Constellation Brands SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Brands Bundle

Constellation Brands boasts a powerful portfolio of leading brands, a significant strength in the competitive beverage alcohol market. However, navigating evolving consumer preferences and potential regulatory shifts presents key challenges.

Want the full story behind Constellation Brands' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Constellation Brands commands a formidable presence in the U.S. imported beer sector, anchored by highly recognizable brands such as Modelo Especial and Corona. Modelo Especial has ascended to become the top-selling beer in the United States based on dollar sales, a key driver of the company's impressive financial results.

This powerful beer collection consistently outpaces the broader beer market and the entire beverage alcohol industry in both volume and dollar sales growth. For instance, in fiscal year 2024, Constellation Brands reported a significant increase in its beer segment's net sales, further solidifying its market leadership.

Constellation Brands has successfully shifted its focus to premiumization, concentrating on high-margin brands in beer, wine, and spirits. This strategic move taps into growing consumer demand for superior quality, enabling the company to capture more profitable market share. For instance, by divesting lower-priced wine brands, Constellation is prioritizing those priced at $15 and above, demonstrating a clear commitment to this premium strategy.

Constellation Brands boasts a robust financial performance, notably driven by its thriving beer segment. This division has consistently delivered impressive revenue and operating income growth, underscoring its market strength.

For the first quarter of Fiscal Year 2025, the company reported a significant 15% year-over-year increase in net sales, totaling $2.3 billion. This strong showing led Constellation Brands to reaffirm its full-year fiscal 2025 guidance, signaling continued confidence in its trajectory.

The company's capacity to generate substantial free cash flow is another key strength, bolstering its financial resilience. This financial flexibility allows for strategic reinvestment, further solidifying its market position and operational capabilities.

Strategic Investments in Capacity and Distribution

Constellation Brands is making significant strides in bolstering its beer business. To meet the escalating demand for its popular brands, the company has earmarked a substantial $4 billion over the next five years. This capital infusion is primarily directed towards expanding brewery capacity in Mexico, ensuring a robust supply chain for the future.

This strategic investment is crucial for supporting aggressive distribution expansion efforts. Constellation Brands aims to secure hundreds of thousands of new points of distribution for its flagship brands, particularly Modelo Especial. This focus on capacity and distribution is designed to capitalize on market growth and solidify its leading position.

- Brewery Expansion: $4 billion investment over five years in Mexico to increase beer production capacity.

- Distribution Growth: Targeting hundreds of thousands of new distribution points for key brands like Modelo Especial.

- Demand Fulfillment: Ensuring the company can meet and exceed current and projected consumer demand for its beer portfolio.

Commitment to ESG and Sustainability Initiatives

Constellation Brands has deeply integrated an Environmental, Social, and Governance (ESG) strategy across its operations, prioritizing environmental care, social fairness, and promoting responsible product use. This commitment is further underscored by specific, forward-looking goals. For instance, by fiscal year 2025, the company aims for significant achievements in water restoration, reducing greenhouse gas emissions, and implementing circular packaging solutions, showcasing a tangible dedication to sustainable business practices.

The company's ESG framework is not just aspirational but is backed by concrete targets that align with global sustainability efforts. These include ambitious objectives for the fiscal year 2025, such as:

- Water Restoration: Aims to restore 100% of the water used in its operations, particularly in water-stressed regions.

- Greenhouse Gas Emissions Reduction: Targets a substantial decrease in Scope 1 and Scope 2 emissions.

- Circular Packaging: Focuses on increasing the recycled content in its packaging and improving recyclability.

Constellation Brands' beer portfolio, led by brands like Modelo Especial and Corona, dominates the U.S. imported beer market. Modelo Especial's status as the top-selling beer by dollar sales in the U.S. is a testament to the company's brand strength and market penetration.

The company's strategic focus on premiumization, evident in its divestment of lower-priced wine brands and concentration on offerings above $15, is driving significant margin expansion and capturing a more valuable segment of the market.

Constellation Brands demonstrates robust financial health, with its beer segment consistently delivering strong revenue and operating income growth, as highlighted by a 15% year-over-year net sales increase to $2.3 billion in Q1 FY2025.

A substantial $4 billion investment over five years is being directed towards expanding brewery capacity in Mexico, ensuring the company can meet the escalating demand for its popular beer brands and support aggressive distribution expansion.

What is included in the product

Delivers a strategic overview of Constellation Brands’s internal and external business factors, highlighting its strong brand portfolio and market position while noting potential challenges in evolving consumer preferences and competitive pressures.

Offers a clear breakdown of Constellation Brands' internal capabilities and external market forces, simplifying complex strategic challenges.

Weaknesses

Constellation Brands' wine and spirits segment is a notable weakness, grappling with declining revenues. This underperformance led to a significant non-cash goodwill impairment loss of up to $2.5 billion in fiscal 2025, highlighting the severity of the challenges.

Despite strategic shifts toward premium products, this division continues to face headwinds. Difficult market conditions and ongoing destocking by U.S. wholesalers are hindering its recovery and growth prospects.

Constellation Brands faces significant vulnerability to widespread economic downturns. Factors like increasing joblessness and persistent inflation directly dampen consumer spending power, which can slow the demand for their diverse portfolio of beverages.

These macroeconomic pressures have already been felt, particularly within the wine and spirits categories. While the beer segment has shown resilience, these broader economic headwinds pose a risk of moderating its growth trajectory as well.

Constellation Brands' significant reliance on imported Mexican beer brands, such as Corona and Modelo, presents a notable weakness. This dependence makes the company susceptible to disruptions from potential U.S.-Mexico trade disputes or tariffs, which could directly impact their cost of goods sold and sales volumes.

For instance, in fiscal year 2024, Constellation Brands reported that its Beer Segment, largely driven by these Mexican imports, accounted for approximately 70% of its total net sales. Any adverse policy changes could therefore have a substantial effect on the company's overall financial performance and market position.

Intense Competition in the Broader Alcohol Market

The beverage alcohol industry is a crowded space, and Constellation Brands feels this pressure from all sides. They're up against massive global players, but also a surge of smaller, nimble craft breweries and distilleries that are constantly innovating. This means Constellation has to keep investing heavily in new products and marketing just to stay in the game and keep their brands fresh in consumers' minds.

This intense competition means Constellation Brands needs to be sharp. For instance, in the fiscal year 2024, the company reported net sales of $9.36 billion, a slight increase from the previous year, but maintaining growth in such a competitive environment requires constant strategic adjustments. The sheer number of competitors, from established giants to emerging craft brands, creates a dynamic market where market share gains are hard-won and require sustained effort.

- Intense Competition: Constellation Brands operates in a highly competitive beverage alcohol market.

- Pressure from All Sides: Facing competition from both large multinational corporations and numerous independent craft producers.

- Need for Continuous Innovation: The fragmented landscape demands ongoing investment in new products and marketing to maintain market share and brand relevance.

- Fiscal Year 2024 Performance: The company reported net sales of $9.36 billion, highlighting the challenge of growth amidst strong competition.

Limited Scope 3 Emissions Targets

Constellation Brands faces a challenge with its greenhouse gas emissions targets. While the company has made environmental commitments, its current goals for Scope 1 and 2 emissions don't fully align with the ambitious 1.5°C target set by the Paris Agreement. This means there's room for improvement in directly reducing the company's own operational footprint.

The larger issue lies in Scope 3 emissions, which represent over 95% of Constellation Brands' total carbon impact. These are emissions that occur in the company's value chain, such as from suppliers and the use of its products. Currently, comprehensive targets for these crucial Scope 3 emissions are still under development, highlighting a significant gap in its overall climate strategy and a potential area of weakness in addressing its full environmental impact.

The company's wine and spirits segment is a significant area of weakness, evidenced by declining revenues. This underperformance contributed to a substantial non-cash goodwill impairment loss of up to $2.5 billion reported in fiscal year 2025, underscoring the challenges within this division.

Despite efforts to pivot towards premium offerings, this segment continues to struggle against difficult market conditions and ongoing destocking by U.S. wholesalers, impeding its ability to achieve robust growth.

Constellation Brands' heavy reliance on imported Mexican beer brands, such as Corona and Modelo, represents a notable vulnerability. This dependence exposes the company to risks associated with potential U.S.-Mexico trade disputes or tariffs, which could adversely affect its cost of goods sold and overall sales volumes.

In fiscal year 2024, the Beer Segment, primarily fueled by these imports, constituted approximately 70% of Constellation Brands' total net sales, highlighting the significant financial impact any adverse policy changes could have.

Preview Before You Purchase

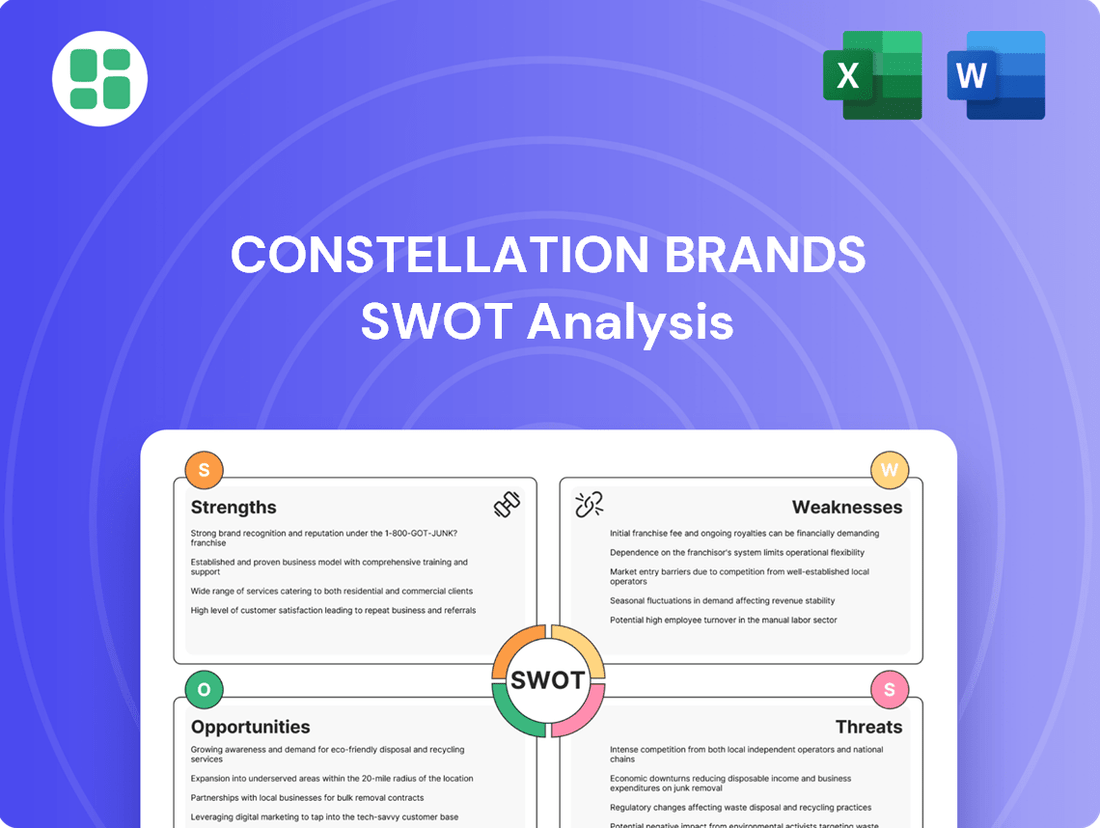

Constellation Brands SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Constellation Brands SWOT analysis, providing a clear understanding of its strategic positioning. Purchase unlocks the full, detailed report.

Opportunities

The shift towards premiumization in alcoholic beverages is a major opportunity for Constellation Brands. Consumers are increasingly seeking higher-quality products and are willing to pay a premium for them. This trend directly aligns with Constellation's strategy of focusing on its premium beer, wine, and spirits brands.

Constellation Brands is well-positioned to benefit from this premiumization trend. For instance, in fiscal year 2024, the company's beer division, which includes premium brands like Modelo and Corona, continued to show strong performance, contributing significantly to revenue growth. This demonstrates their ability to capture market share from consumers seeking a better drinking experience and willing to spend more.

Constellation Brands is actively pursuing innovation and product diversification to capture evolving consumer preferences. For instance, their investment in flavored beer variants, such as Corona Sunbrew Citrus Cerveza, aims to attract a broader audience seeking refreshing and accessible options. This strategic move aligns with the growing demand for innovative beverage experiences.

Furthermore, collaborations in the ultra-premium spirits segment, like their partnership with Metallica's Blackened American Whiskey, demonstrate a commitment to tapping into niche markets and high-growth categories. This diversification strategy allows Constellation Brands to cater to a wider spectrum of tastes and maintain its competitive edge in a dynamic beverage landscape.

Constellation Brands has a significant opportunity to bolster its beer segment by expanding distribution for its flagship brands, especially Modelo Especial, into new or less developed retail channels. This strategic move aims to capture a larger market share and drive incremental volume growth.

The company is actively pursuing this by increasing points of distribution, a strategy that has historically proven effective for leading beverage brands. For instance, in fiscal year 2024, Constellation Brands saw its beer portfolio achieve a 5.4% comparable basis net sales increase, demonstrating the success of such expansion efforts.

Strategic Mergers, Acquisitions, and Divestitures

Constellation Brands actively optimizes its portfolio through strategic mergers, acquisitions, and divestitures. This approach allows the company to divest underperforming assets while acquiring brands that align with its premiumization strategy, demonstrating agility in adapting to market shifts. For instance, in fiscal year 2024, Constellation completed the sale of its Canadian wine business for $1.03 billion, a move aimed at focusing resources on its core beer and spirits portfolio.

This strategic maneuvering enhances shareholder value by concentrating on high-growth areas. The company's commitment to portfolio management is evident in its ongoing efforts to refine its brand offerings and market presence.

- Portfolio Optimization: Actively shedding underperforming assets and acquiring complementary brands.

- Premiumization Strategy: Focusing on brands that align with higher-value market segments.

- Adaptability: Demonstrating agility in response to evolving market trends and consumer preferences.

- Shareholder Value Enhancement: Strategic M&A and divestitures are geared towards improving overall financial performance.

Leveraging Strong Brand Loyalty and Marketing

Constellation Brands can capitalize on the deep-seated loyalty for its flagship beer brands, Modelo and Corona, by implementing highly focused marketing initiatives. These campaigns will aim to strengthen the emotional bonds consumers have with these popular labels, ensuring sustained demand even when economic conditions are less favorable.

By adapting its marketing strategies to evolving consumer purchasing channels, Constellation Brands can effectively maintain its market presence. For instance, in the fiscal year ending February 2024, Constellation Brands reported a 7% increase in net sales for its beer segment, underscoring the continued strength of its core brands.

- Targeted Digital Campaigns: Focus on social media and digital platforms to engage consumers with content that reinforces brand heritage and lifestyle associations.

- Experiential Marketing: Invest in events and sponsorships that allow consumers to interact directly with the brands, fostering deeper connections.

- Channel-Specific Promotions: Develop tailored promotions for on-premise (bars, restaurants) and off-premise (retail) channels to meet diverse consumer needs.

- Data-Driven Insights: Utilize consumer data to personalize marketing messages and offers, enhancing relevance and driving purchase intent.

Constellation Brands has a significant opportunity to expand its market reach by leveraging the growing demand for ready-to-drink (RTD) beverages and exploring new product categories. For instance, in fiscal year 2024, the company saw continued growth in its spirits portfolio, indicating potential for further expansion into adjacent categories. This adaptability allows them to tap into emerging consumer trends and maintain relevance.

The company can also capitalize on the increasing consumer interest in health and wellness by developing or acquiring brands that offer lower-alcohol or non-alcoholic options. This strategic pivot aligns with broader societal shifts and opens up new revenue streams. For example, the growing popularity of non-alcoholic beers presents a clear avenue for innovation and market penetration.

Furthermore, Constellation Brands can enhance its competitive position through strategic acquisitions and partnerships in high-growth international markets. Expanding its global footprint allows the company to diversify revenue streams and mitigate risks associated with reliance on a single market. Their ongoing evaluation of potential M&A targets underscores this commitment to strategic growth.

The company's strong financial position, evidenced by its consistent revenue growth and profitability in fiscal year 2024, provides a solid foundation for pursuing these opportunities. This financial strength enables significant investment in innovation, marketing, and strategic acquisitions to drive future expansion.

Threats

A significant threat to Constellation Brands stems from evolving consumer tastes, especially within younger demographics like Gen Z. This generation is demonstrating a reduced inclination towards alcohol consumption compared to previous cohorts.

The growing popularity of cannabis-based alternatives and a broader societal emphasis on health and wellness present a considerable challenge, potentially dampening demand for traditional alcoholic beverages. For instance, in 2023, the U.S. legal cannabis market was valued at approximately $30 billion, indicating a substantial alternative spending category.

Constellation Brands faces a significant threat from intensified competition, as the beverage alcohol landscape is increasingly crowded. Beyond traditional rivals, a surge of independent craft breweries, distilleries, and wineries are capturing consumer attention, particularly in premium and craft segments. For instance, the U.S. craft beer market, while maturing, still represents a substantial segment where smaller, nimble operations can swiftly adapt to evolving tastes and carve out market share, directly challenging Constellation's established brands.

Constellation Brands' significant reliance on imports from Mexico, particularly for its beer portfolio, presents a notable regulatory risk. The potential imposition of tariffs by governments, such as those seen in past trade disputes, could directly inflate the cost of goods sold. For instance, if new tariffs were enacted, the company might face increased expenses that could compress its healthy operating margins, which stood at 26.7% for the beer segment in fiscal year 2024.

Such tariffs could force Constellation Brands to absorb the costs, impacting profitability, or pass them on to consumers. Price increases, even if necessary, risk alienating price-sensitive customers and could erode market share against competitors with less exposure to import-related tariffs. This dynamic directly threatens the company's competitive positioning and its ability to maintain its strong performance in the U.S. market.

Economic Downturns and Reduced Consumer Spending

Adverse macroeconomic conditions, such as sustained inflation or a potential recession, pose a significant threat by curtailing consumer discretionary spending. This could pressure Constellation Brands' premium offerings as consumers gravitate towards more budget-friendly alcohol options.

For instance, if economic uncertainty persists through 2024 and into 2025, consumers might trade down from Constellation's higher-priced brands to more accessible alternatives. This shift directly impacts sales volumes and profit margins for their premium beer, wine, and spirits portfolio.

- Economic Sensitivity: Constellation Brands' premium portfolio is vulnerable to economic downturns that reduce disposable income.

- Consumer Behavior Shift: A recessionary environment could drive consumers towards value-oriented alcoholic beverages, impacting Constellation's market share.

- Profit Margin Pressure: Reduced demand for premium products and increased competition from value brands could compress Constellation's profitability.

Supply Chain Disruptions and Agricultural Vulnerabilities

Constellation Brands, deeply rooted in agriculture, faces significant threats from climate change. Extreme weather events like droughts and floods can devastate crop yields, directly impacting the availability and cost of key ingredients for their beverages. For instance, the 2023 California drought, a continuation of multi-year dry spells, significantly strained water resources essential for grape cultivation, a critical component for their wine portfolio.

These agricultural vulnerabilities translate into supply chain instability. Reduced crop yields can lead to increased input costs as competition for scarce resources intensifies, potentially squeezing Constellation Brands' profit margins. Furthermore, shortages in raw materials could result in inventory gaps, affecting their ability to meet consumer demand and potentially leading to lost sales opportunities.

The company's reliance on specific agricultural regions makes it susceptible to localized climate impacts. For example, disruptions in hop production, vital for their beer segment, due to unseasonal weather patterns in key growing areas, could have a ripple effect across their product lines.

- Climate-related events pose a direct threat to Constellation Brands' agricultural inputs.

- Supply chain disruptions can lead to increased costs and inventory shortages.

- Water scarcity in key growing regions, like California, impacts grape yields for their wine business.

Constellation Brands faces a significant threat from the evolving preferences of younger consumers, particularly Gen Z, who show a declining interest in alcohol. This trend is further amplified by the growing appeal of cannabis alternatives and a societal shift towards health and wellness, which collectively pose a challenge to traditional beverage alcohol sales. The U.S. legal cannabis market's substantial valuation, approximately $30 billion in 2023, underscores the significant alternative spending power diverting from alcoholic beverages.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Constellation Brands' official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a well-rounded view of the company's performance and its operating environment.