Constellation Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Brands Bundle

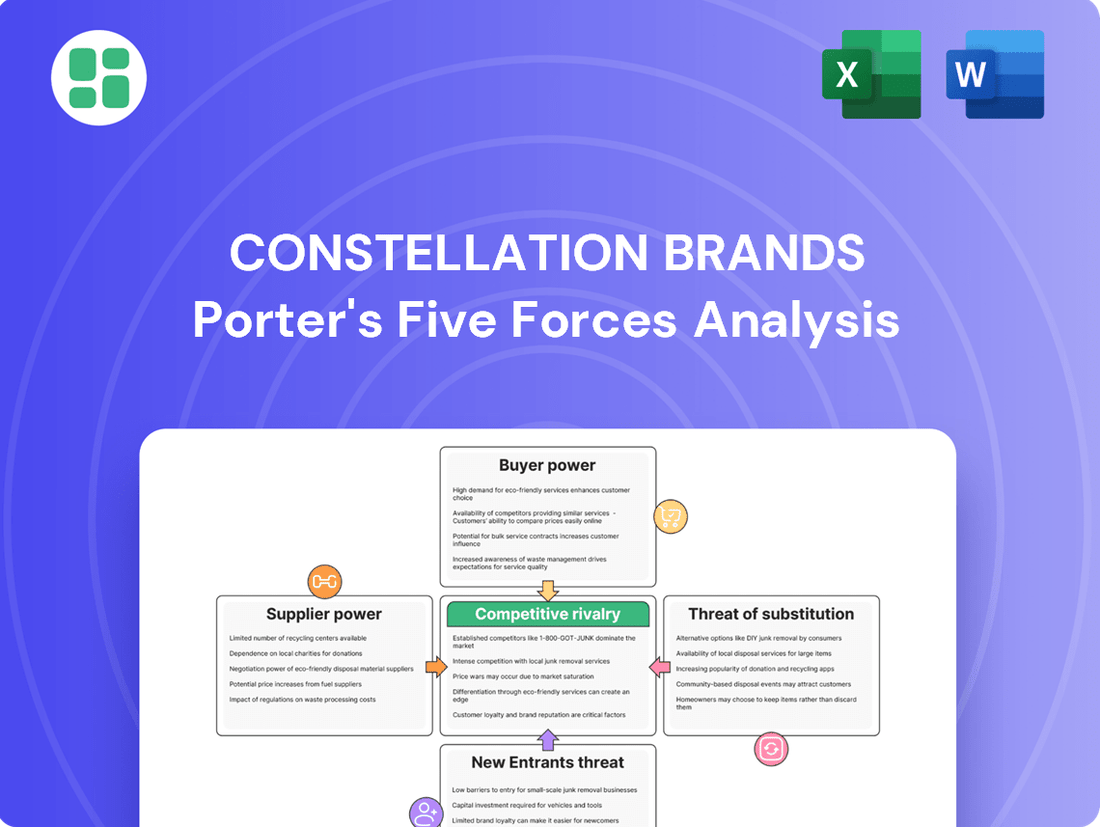

Constellation Brands navigates a dynamic beverage alcohol market, facing moderate buyer power from retailers and consumers, while the threat of new entrants is somewhat mitigated by high capital requirements and established brand loyalty.

The complete report reveals the real forces shaping Constellation Brands’s industry—from supplier influence to substitute threats. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Constellation Brands, operating within the food and beverage sector, contends with persistent increases in the cost of raw materials and packaging. For instance, in fiscal year 2024, the company noted that inflationary pressures continued to affect its cost of goods sold, impacting categories like beer and wine where key inputs such as barley, grapes, and glass are crucial.

The availability and pricing of these essential components are frequently disrupted by global events, including geopolitical tensions and labor market challenges. These factors amplify the bargaining power of suppliers, as Constellation Brands must secure consistent and cost-efficient sources for its production needs, such as the glass bottles used for its extensive portfolio of beverages.

To mitigate these impacts and safeguard its profit margins, Constellation Brands actively pursues strategies to identify and cultivate relationships with more cost-effective and dependable suppliers. This proactive approach is vital for maintaining competitive pricing and ensuring product availability in a dynamic market environment.

The bargaining power of suppliers for Constellation Brands can be substantial when critical, high-quality inputs, like specific grape varietals or unique brewing components, are controlled by a limited number of suppliers. While precise data on Constellation's raw material supplier concentration isn't publicly detailed, the beverage industry broadly sees suppliers of specialized ingredients wielding significant influence. For instance, in 2024, the global wine grape market saw price fluctuations for premium varietals, directly impacting producers like Constellation.

Switching suppliers for critical components, such as specialized glass bottles or unique fermentation yeasts, can incur significant costs for Constellation Brands. These expenses may include retooling manufacturing lines, implementing new quality assurance protocols, and managing potential disruptions to their extensive production schedules. These switching costs effectively increase the bargaining power of their current suppliers.

Constellation Brands’ vast operational scale and deeply integrated supply chains mean that supplier transitions are complex and resource-intensive. For instance, securing new suppliers for their wine or beer production requires rigorous vetting to ensure consistent quality and volume, which takes considerable time and investment, further solidifying supplier leverage.

Supplier's Ability to Forward Integrate

Suppliers who can integrate forward into beverage production or distribution wield considerable power over Constellation Brands. This means a supplier could potentially start making their own beer, wine, or spirits, or take over the channels used to sell them. For instance, a major hops supplier might consider investing in brewing facilities.

While raw material suppliers typically don't have this capability, significant packaging firms or providers of unique ingredients might consider forward integration. This possibility acts as a strong motivator for Constellation Brands to cultivate robust and cooperative relationships with its vital suppliers. In 2023, the global beverage market saw significant consolidation, increasing the potential leverage of larger suppliers.

- Supplier Forward Integration Threat

- Impact on Constellation Brands

- Strategic Importance of Supplier Relations

- Market Trends Favoring Supplier Leverage

Importance of Constellation Brands to Suppliers

Constellation Brands' substantial purchasing volume significantly impacts its suppliers, making them reliant on the company's business. For instance, in 2023, Constellation Brands reported net sales of $10.0 billion, indicating the sheer scale of its procurement needs. This large order volume can diminish a supplier's leverage, as losing Constellation as a customer would represent a considerable revenue loss for many.

However, the bargaining power of suppliers is not solely dictated by Constellation's size. If a supplier offers a unique or difficult-to-source component essential for Constellation's products, their power remains robust. This is particularly true for specialized ingredients or packaging materials that have few alternative providers.

- Constellation's 2023 net sales reached $10.0 billion, highlighting its significant purchasing power.

- Suppliers who provide specialized or scarce inputs retain considerable bargaining power, irrespective of Constellation's market share.

- The loss of Constellation Brands as a major client would be financially detrimental to many of its suppliers.

Suppliers hold significant bargaining power when they provide unique or difficult-to-source inputs crucial for Constellation Brands' products, such as specific grape varietals or specialized brewing components. While Constellation's substantial purchasing volume, evidenced by its $10.0 billion in net sales in 2023, can reduce supplier reliance, the scarcity of certain inputs can still empower suppliers. This dynamic is amplified by market trends like consolidation, which can increase the leverage of larger suppliers.

| Factor | Impact on Constellation Brands | Supporting Data/Context |

| Supplier Concentration for Key Inputs | High power for suppliers of unique or scarce materials. | Limited public data on specific supplier concentration, but industry trends suggest influence for specialized ingredients. 2024 saw price fluctuations for premium wine grapes. |

| Switching Costs | Increases supplier leverage due to expense and complexity of changing providers. | Costs include retooling, new quality assurance, and potential production disruptions. |

| Supplier Forward Integration Threat | Potential for suppliers to enter Constellation's markets increases their leverage. | While less common for raw materials, significant packaging or ingredient firms might consider it. 2023 market consolidation enhanced potential supplier leverage. |

| Constellation's Purchasing Power | Diminishes supplier power when Constellation is a major customer. | Constellation's 2023 net sales of $10.0 billion indicate significant buying influence. |

What is included in the product

This analysis delves into the competitive forces shaping Constellation Brands' operating environment, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the beverage alcohol industry.

Instantly assess Constellation Brands' competitive landscape to identify and mitigate threats from rivals, new entrants, and substitute products.

Customers Bargaining Power

Constellation Brands faces significant bargaining power from its large retail and distributor customers. These major players, like national supermarket chains and large beverage distributors, buy in massive quantities. In 2023, for instance, the top 10 retail chains in the U.S. controlled a substantial portion of grocery sales, giving them considerable leverage over suppliers like Constellation Brands.

Constellation Brands operates in a market where customers, including both retailers and end consumers, can exhibit significant price sensitivity. Even with a focus on premium offerings, economic headwinds and ongoing inflation, trends prominent in 2024 and projected into 2025, can amplify this sensitivity. Consumers are increasingly seeking what's termed 'affordable luxury,' meaning they are more likely to scrutinize price points and explore value-driven options if Constellation Brands attempts to pass on increased costs.

Retailers, a key customer segment for Constellation Brands, face a vast landscape of beverage alcohol options. This abundance of choice, encompassing established competitors and emerging craft brands, significantly empowers them.

The sheer volume of alternatives means retailers can easily switch suppliers if Constellation's offerings or pricing are not competitive. For instance, the ready-to-drink (RTD) segment alone saw significant growth, with market research indicating a compound annual growth rate (CAGR) of over 10% in recent years leading up to 2024, presenting a direct challenge to traditional beverage categories.

This readily available supply of substitute products allows customers to exert considerable pressure on Constellation Brands, demanding favorable pricing, promotional support, and continuous product innovation to secure shelf space and meet evolving consumer preferences.

Low Switching Costs for Customers

For retailers and distributors, the cost of switching from Constellation Brands' products to those of competitors is minimal. They can easily adjust their inventory management systems to delist one brand and onboard another, meaning they aren't heavily invested in specific Constellation offerings. This flexibility significantly enhances their leverage.

This ease of substitution directly translates to increased bargaining power for customers, including both large retail chains and individual consumers. They are not bound to Constellation Brands, allowing them to seek out better pricing or more favorable terms from alternative suppliers. For instance, in the beer segment, retailers can readily stock craft beers or import brands if Constellation's pricing or product mix becomes less attractive.

Consumers at the point of sale also experience low switching costs. The decision to purchase one beer, wine, or spirits brand over another often comes down to immediate price, promotion, or personal preference, rather than a significant commitment to a particular brand's ecosystem. This consumer behavior reinforces the bargaining power of the entire customer base.

- Low Switching Costs: Retailers and distributors can easily shift inventory between Constellation Brands and competitors.

- Customer Leverage: This ease of substitution empowers customers to negotiate better terms or seek lower prices.

- Consumer Choice: Individual consumers face minimal barriers when choosing between Constellation Brands and alternative beverage options at the point of purchase.

Customer Information and Transparency

Customers, especially large retail chains, wield significant bargaining power due to increased transparency. Online platforms and readily available market data allow retailers to easily compare pricing, product availability, and terms from multiple beverage alcohol suppliers, including Constellation Brands. This heightened awareness empowers them to negotiate more aggressively for favorable deals and terms.

- Informed Negotiation: Retailers can leverage price comparison tools and industry reports to benchmark supplier offerings, strengthening their negotiating position.

- Supplier Competition: The ease of comparing suppliers intensifies competition, forcing companies like Constellation Brands to offer competitive pricing and terms.

- Impact on Margins: Increased customer bargaining power can directly impact Constellation Brands' profit margins if they cannot differentiate their products or services effectively. For example, in 2023, the average gross profit margin for alcoholic beverage distributors in the US hovered around 20-25%, a figure heavily influenced by retailer negotiations.

Constellation Brands' customers, particularly large retailers and distributors, possess substantial bargaining power. This is driven by their significant purchasing volume and the wide array of available beverage alcohol options. In 2024, the consolidation within the retail sector means fewer, larger players control a greater share of the market, amplifying their negotiation leverage. For instance, the top five U.S. grocery retailers accounted for over 45% of industry sales in early 2024, giving them immense sway over suppliers.

| Customer Segment | Key Drivers of Bargaining Power | Impact on Constellation Brands |

|---|---|---|

| Large Retail Chains | High purchase volume, numerous supplier alternatives, price sensitivity | Pressure on pricing, demand for promotional support, potential for reduced shelf space |

| Distributors | Consolidation, ability to switch suppliers easily, inventory management efficiency | Negotiation of favorable terms, impact on distribution agreements |

| End Consumers | Low switching costs, brand loyalty variations, price and promotion sensitivity | Influence on product demand, need for consistent value proposition |

Full Version Awaits

Constellation Brands Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Constellation Brands, detailing the competitive landscape and strategic positioning of the company within the beverage alcohol industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights without any alterations or placeholders.

Rivalry Among Competitors

The beverage alcohol sector is intensely competitive, with Constellation Brands navigating a landscape populated by formidable global players. Giants such as Anheuser-Busch InBev, Diageo, Molson Coors, Heineken, and Pernod Ricard command substantial market share through their vast distribution capabilities, massive marketing investments, and broad product assortments.

Despite Constellation Brands' impressive performance, notably its beer division where Modelo Especial achieved the distinction of becoming the top beer brand by U.S. dollar sales in fiscal year 2024, the competitive pressures remain significant. These established competitors continuously innovate and expand their offerings, intensifying the rivalry across all segments of the market.

Constellation Brands benefits significantly from established brand loyalty, particularly with its premium imported beers like Corona and Modelo, and its portfolio of fine wines and spirits. This strong brand equity allows them to command premium pricing and fosters repeat purchases, creating a substantial competitive moat.

However, the beverage alcohol industry is dynamic. In 2024, Constellation Brands and its competitors face evolving consumer tastes, with a notable trend towards premiumization and a growing demand for non-alcoholic alternatives across wine and spirits. This necessitates ongoing investment in product innovation and marketing to maintain differentiation and capture market share.

The overall beverage alcohol market, especially wine and spirits, saw volume decreases in 2024, though value experienced slight growth. This maturity means companies are fighting harder for existing customers, increasing rivalry.

Constellation Brands' wine and spirits segment has felt these pressures, leading them to adjust their fiscal 2024 forecast to anticipate a decline in organic net sales. This situation amplifies the competitive landscape.

High Fixed Costs and Exit Barriers

The beverage alcohol industry, including companies like Constellation Brands, is characterized by significant fixed costs. These include substantial investments in production facilities, warehousing, distribution networks, and extensive marketing campaigns. For example, building and maintaining breweries or wineries requires millions of dollars in capital expenditure.

These high fixed costs, combined with specialized assets and the considerable brand equity that takes years to build, create formidable exit barriers. Companies find it difficult and costly to divest or repurpose these specialized assets, often forcing them to continue operating even when market conditions are unfavorable. This can lead to intense competition as firms strive to maintain sales volume and capacity utilization.

- Significant Capital Outlay: The beverage alcohol sector demands large upfront investments in manufacturing plants, sophisticated bottling lines, and extensive supply chain infrastructure.

- Brand Building Expenses: Marketing and advertising budgets are crucial for establishing and maintaining brand recognition, representing a substantial ongoing fixed cost.

- Specialized Assets: Production equipment and aging facilities for spirits or wine are highly specialized, making them difficult to repurpose or sell, thus increasing exit barriers.

- Capacity Utilization Pressure: High fixed costs incentivize companies to operate at or near full capacity, which can fuel aggressive pricing and promotional strategies to gain market share.

Strategic Acquisitions and Innovation

Constellation Brands has a history of leveraging strategic acquisitions and product innovation to fortify its market standing. A prime example is their divestiture of mainstream wine assets in 2021, a move designed to sharpen their focus on higher-margin, premium beverage categories. This strategic pivot highlights a commitment to portfolio optimization.

Competitors are actively pursuing similar growth avenues. Many are expanding their offerings into ready-to-drink (RTD) beverages, low- and no-alcohol options, and are experimenting with novel flavor profiles to capture evolving consumer preferences. This widespread adoption of innovation keeps the competitive arena highly fluid.

- Strategic Acquisitions: Constellation Brands' acquisition of brands like The Prisoner Wine Company for $285 million in 2017 demonstrates a strategy of acquiring premium assets.

- Divestitures for Focus: The sale of its Canadian wine and spirits portfolio for $1.03 billion in 2020 allowed for greater concentration on its U.S. beer and spirits business.

- Industry Trend in RTDs: The U.S. spirits-based RTD market saw significant growth, with sales increasing by 41.1% in 2023, according to IWSR Drinks Market Analysis, indicating a key area of competitive focus.

- Innovation in Low/No Alcohol: The global low and no-alcohol market is projected to reach $35.1 billion by 2025, presenting a substantial innovation opportunity for all players.

The competitive rivalry within the beverage alcohol industry is fierce, with Constellation Brands facing off against global powerhouses like Anheuser-Busch InBev and Diageo. Despite Constellation's success, such as Modelo Especial becoming the top U.S. beer brand by dollar sales in fiscal 2024, competitors constantly innovate and expand their portfolios, intensifying market competition.

The industry's high fixed costs, including manufacturing and marketing, coupled with strong brand equity, create significant barriers to exit. This often compels companies to maintain sales volumes, leading to aggressive strategies and further fueling rivalry, especially as the market grapples with shifting consumer preferences towards premiumization and non-alcoholic options.

Constellation Brands has strategically divested mainstream wine assets and acquired premium brands to focus on higher-margin categories, a move mirrored by competitors expanding into RTDs and low/no-alcohol segments. The U.S. spirits-based RTD market alone saw a 41.1% sales increase in 2023, underscoring this competitive innovation race.

SSubstitutes Threaten

The burgeoning non-alcoholic beverage market presents a substantial threat of substitutes for Constellation Brands. Consumers, increasingly health-conscious and mindful of moderation, are driving significant growth in non-alcoholic beer, wine, and spirits.

In 2023, the U.S. market for these alternatives surpassed $565 million. Projections indicate a robust compound annual growth rate of 17% through 2028, signaling a powerful shift away from traditional alcoholic options, especially among younger consumers like Gen Z.

The burgeoning popularity of ready-to-drink (RTD) beverages, including hard seltzers and spirit-based cocktails, poses a significant threat of substitution for Constellation Brands. This category has experienced explosive growth, with the U.S. hard seltzer market alone valued at approximately $6 billion in 2023, and projected to continue its upward trajectory. Consumers are drawn to the convenience, variety of flavors, and often lower calorie counts offered by these alternatives, directly impacting traditional beer and wine consumption occasions.

The increasing legalization and social acceptance of recreational cannabis in various regions, including many US states and Canada, pose a growing, albeit indirect, substitute threat to alcoholic beverages. Consumers looking for relaxation or social experiences might choose cannabis-infused products over alcohol, altering traditional consumption patterns. For instance, in 2023, the legal cannabis market in the U.S. was valued at approximately $30 billion, indicating a significant and expanding consumer base.

Furthermore, the emergence of new weight-loss drugs, such as Ozempic and Wegovy, is also dampening general food and drink consumption, which naturally includes alcohol. As these medications gain traction for appetite suppression and metabolic effects, individuals may reduce their intake of various beverages, including alcoholic ones, impacting overall demand for Constellation Brands' core products.

Shift in Consumer Lifestyles and Health Consciousness

A significant societal shift towards moderation and healthier living is directly impacting the beverage alcohol industry. Consumers are increasingly choosing to reduce their overall alcohol consumption or select lower-alcohol-by-volume (ABV) alternatives, driven by growing health awareness and economic prudence. This evolving preference represents a substantial threat of substitution for traditional alcoholic beverages, as consumers actively seek out non-alcoholic or reduced-alcohol options.

This trend is evidenced by the growing market for non-alcoholic beers, wines, and spirits. For instance, the global non-alcoholic beverage market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating a clear consumer pivot. Within this, the non-alcoholic beer segment alone saw significant growth, with some reports indicating double-digit increases in sales in recent years. This demonstrates that consumers are not just cutting back but actively replacing traditional alcoholic drinks with alternatives that align with their lifestyle choices.

- Growing Health Consciousness: Consumers are prioritizing well-being, leading to a reduction in alcohol intake.

- Rise of Low-ABV and Non-Alcoholic Options: The market for alternatives like non-alcoholic beer and spirits is expanding rapidly.

- Economic Factors: In some cases, consumers may opt for less expensive non-alcoholic beverages as a substitute.

- Shifting Social Norms: Mindful drinking and moderation are becoming more socially accepted, further encouraging substitution.

Availability of Other Beverage Categories

Consumers have a vast selection of non-alcoholic beverages for hydration and social events. Categories like soft drinks, juices, coffee, and specialty teas compete for consumer attention and occasions, particularly as individuals seek alternatives to alcoholic beverages.

While these non-alcoholic options don't replicate the 'buzz' of alcohol, they directly contend for share of stomach and influence consumer choices for drinking occasions. For instance, the global non-alcoholic beverage market was valued at approximately USD 1.1 trillion in 2023 and is projected to grow, indicating a significant competitive landscape for Constellation Brands.

- Market Share Competition: Non-alcoholic beverages vie for consumer spending that could otherwise go towards alcoholic drinks.

- Health and Wellness Trends: Growing consumer interest in health and wellness fuels demand for non-alcoholic alternatives, impacting alcohol consumption occasions.

- Occasion Diversification: Consumers increasingly seek diverse beverage options for various social and personal occasions, broadening the competitive set beyond traditional alcohol.

The threat of substitutes for Constellation Brands is significant, driven by evolving consumer preferences and a widening array of alternatives. The increasing focus on health and wellness, coupled with a desire for moderation, is pushing consumers towards non-alcoholic and lower-alcohol-by-volume (ABV) options. This shift is not just a trend but a fundamental change in consumption habits, directly impacting the demand for traditional alcoholic beverages.

The market for non-alcoholic beverages is expanding rapidly, offering consumers a diverse range of choices for various occasions. For example, the U.S. non-alcoholic beer market alone was valued at over $565 million in 2023 and is projected to grow at a compound annual growth rate of 17% through 2028. This growth signifies a direct substitution for traditional beer consumption.

Ready-to-drink (RTD) beverages, including hard seltzers and spirit-based cocktails, also represent a substantial substitute. The U.S. hard seltzer market, valued at approximately $6 billion in 2023, offers convenience and flavor variety that appeals to consumers seeking alternatives to beer and wine. Furthermore, the growing acceptance and market size of legal cannabis, estimated at $30 billion in the U.S. in 2023, presents an indirect but notable substitute for relaxation and social occasions traditionally associated with alcohol.

| Substitute Category | 2023 Market Value (Approx.) | Projected Growth Driver |

| Non-Alcoholic Beverages (Overall) | USD 1.1 Trillion (Global) | Health consciousness, moderation |

| Non-Alcoholic Beer (U.S.) | $565 Million | Health, taste parity, variety |

| Hard Seltzers (U.S.) | $6 Billion | Convenience, low-calorie, flavor |

| Legal Cannabis (U.S.) | $30 Billion | Relaxation, social, alternative experience |

Entrants Threaten

Entering the beverage alcohol industry at a scale rivaling Constellation Brands demands immense capital. Significant investments are needed for state-of-the-art production facilities, including breweries, wineries, and distilleries, alongside establishing robust distribution networks. For instance, building a new brewery can easily cost tens to hundreds of millions of dollars, a substantial hurdle for aspiring competitors.

Constellation Brands enjoys a formidable advantage due to its portfolio of iconic brands, such as Corona and Modelo, which have cemented deep consumer loyalty over many years. This established brand equity makes it incredibly difficult for newcomers to gain traction.

New entrants would need to invest heavily in marketing and advertising, potentially billions of dollars, to even begin to rival the brand recognition Constellation Brands already possesses. For instance, Constellation Brands' beer division alone generated over $5.2 billion in net sales in fiscal year 2024, showcasing the scale of their market presence.

Securing effective distribution channels and gaining shelf space in competitive retail environments presents a significant barrier for new beverage alcohol companies. Established players like Constellation Brands leverage their extensive networks and existing agreements, making it challenging for newcomers to achieve widespread market access. For instance, in 2024, Constellation Brands continued to benefit from its strong relationships with major retailers across the U.S., a key factor in its market dominance.

Stringent Regulatory Environment

The alcoholic beverage industry is a minefield of regulations, making it tough for newcomers. Think licensing, production rules, advertising limits, and taxes at every level of government. For instance, in 2024, the Alcohol and Tobacco Tax and Trade Bureau (TTB) continued to oversee a vast array of federal regulations impacting production and distribution.

This intricate web of laws demands significant legal and compliance know-how, acting as a substantial hurdle for any aspiring entrant. Companies must invest heavily in understanding and adhering to these complex requirements.

- Complex Licensing: Obtaining federal, state, and local licenses can be a lengthy and costly process.

- Production Standards: Strict quality control and manufacturing guidelines must be met.

- Marketing Restrictions: Advertising and promotional activities are often heavily regulated.

- Taxation: Excise taxes and other levies add to the financial burden for new players.

Economies of Scale and Experience Curve

Existing giants like Constellation Brands leverage substantial economies of scale in production, sourcing, and distribution. This translates to lower per-unit costs that new entrants find difficult to replicate quickly, creating an immediate disadvantage.

The experience curve further solidifies the position of incumbents. Through years of operation, companies like Constellation Brands have honed their processes, leading to greater efficiency and cost savings that are hard for newcomers to match from the outset.

- Economies of Scale: Constellation Brands benefits from purchasing power in raw materials and efficient logistics networks, reducing overall production costs.

- Experience Curve Advantages: Decades of operational refinement allow for optimized manufacturing techniques and supply chain management, lowering unit expenses.

- Cost Disadvantage for Newcomers: Start-up companies lack the established infrastructure and volume to achieve comparable cost efficiencies, making their initial pricing less competitive.

The threat of new entrants for Constellation Brands is relatively low due to substantial capital requirements, strong brand loyalty, and extensive distribution networks. New competitors face significant hurdles in matching Constellation's established market presence and brand equity, especially given the billions invested in marketing and brand building by incumbents. The regulatory landscape further complicates entry, demanding considerable legal and compliance resources.

| Barrier to Entry | Impact on New Entrants | Constellation Brands' Advantage |

|---|---|---|

| Capital Requirements | High investment needed for facilities and distribution. | Established infrastructure and economies of scale. |

| Brand Loyalty | Difficult to build recognition against established brands. | Iconic brands like Corona and Modelo command deep consumer loyalty. |

| Distribution Channels | Gaining shelf space and access is challenging. | Extensive existing networks and retailer relationships. |

| Regulatory Environment | Complex licensing, production, and marketing rules. | Experience in navigating and complying with regulations. |

Porter's Five Forces Analysis Data Sources

Our Constellation Brands Porter's Five Forces analysis is built upon a foundation of comprehensive data, including the company's annual reports, SEC filings, and industry-specific market research from firms like IBISWorld. We also incorporate insights from financial news outlets and analyst reports to capture current market dynamics and competitive pressures.