Constellation Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Brands Bundle

Constellation Brands' diverse portfolio presents a fascinating case study in strategic product management. Understanding where their brands fall within the BCG Matrix—whether as Stars, Cash Cows, Dogs, or Question Marks—is crucial for informed decision-making. Purchase the full BCG Matrix to gain a comprehensive understanding of their product landscape and unlock actionable insights for growth and resource allocation.

Stars

Modelo Especial stands out as a Star within Constellation Brands' portfolio. It achieved the distinction of being the top-selling beer in the U.S. by dollar sales, a remarkable feat indicating strong market penetration and consumer preference.

The brand's performance is further bolstered by an impressive 11% volume increase in Q1 2025, showcasing its sustained momentum. This growth solidifies its leadership in the high-end beer segment and positions it as a critical engine for Constellation Brands' financial success.

Despite broader economic challenges, Modelo Especial's enduring consumer appeal and market dominance in a growing premium beer landscape firmly place it in the Star category, promising continued high returns.

Pacifico beer is a shining example of a Star in Constellation Brands' portfolio. Its depletion growth was impressive, reaching 17% in fiscal 2024 and accelerating to 21% in the first quarter of fiscal 2025. This strong performance has propelled Pacifico past the significant milestone of selling over 20 million cases.

Constellation Brands recognizes Pacifico's immense potential and is actively investing in its development and long-term growth. The brand's consistent double-digit growth in crucial markets underscores its position as a high-performing asset with ample room for further expansion and market penetration.

Modelo Chelada has experienced remarkable expansion, tripling its volume in the past five years. In fiscal year 2024, it achieved an impressive 30% depletion growth.

As a brand that has reached 20 million cases, Modelo Chelada holds a commanding position in the chelada market. It captures over 67% of the dollar share within this segment.

This robust growth within a burgeoning niche firmly establishes Modelo Chelada as a Star in Constellation Brands' portfolio.

Modelo Oro

Modelo Oro has quickly established itself as a Star within Constellation Brands' portfolio, demonstrating impressive growth in the U.S. high-end beer market. In its first fiscal year of 2024, it achieved a remarkable sales volume of 3.5 million cases.

This rapid market penetration highlights Modelo Oro's strong performance and its contribution to the expansion of the premium beer segment. The brand's success is a testament to its ability to capitalize on increasing consumer demand for more flavorful beer options, backed by the established equity of the Modelo brand.

- Market Share Gain: Modelo Oro was a significant share gainer in the U.S. high-end beer segment during fiscal 2024.

- Sales Volume: It reached 3.5 million cases in its inaugural year.

- Category Growth: Its rapid adoption contributes to the premium beer category's overall growth.

- Brand Leverage: It effectively uses the Modelo brand's equity to attract consumers seeking flavorful choices.

Corona Cero

Corona Cero, the non-alcoholic version of the popular Corona beer, is experiencing remarkable growth. In 2024, it achieved triple-digit growth, signaling strong market traction.

This surge is partly fueled by strategic marketing, including its role as an official sponsor of the Paris 2024 Olympics. This high-profile association aims to capture a broad audience and reinforce the brand's visibility.

The expansion of Corona Cero aligns perfectly with the growing consumer preference for wellness and reduced alcohol consumption. This trend is reshaping the beverage industry, and Corona Cero is well-positioned to benefit from it.

- Triple-digit growth in 2024

- Paris 2024 Olympics sponsorship

- Capitalizes on wellness and low/no-alcohol trend

- Expands Corona's market reach

Modelo Especial continues its reign as a top-tier Star for Constellation Brands. In fiscal year 2024, it not only maintained its position as the U.S. beer category's top seller by dollar sales but also achieved an impressive 11% volume growth in the first quarter of fiscal 2025. This sustained momentum solidifies its dominance in the high-end segment and highlights its consistent ability to drive significant revenue.

Pacifico is a strong performer, demonstrating robust growth. Fiscal 2024 saw a 17% depletion growth, which accelerated to 21% in Q1 fiscal 2025, pushing sales past 20 million cases. Constellation Brands' strategic investment in Pacifico underscores its potential for continued expansion and market penetration.

Modelo Chelada has experienced explosive growth, tripling its volume over the last five years and achieving 30% depletion growth in fiscal 2024. Holding over 67% of the dollar share in its segment and reaching 20 million cases, it's a clear Star in a rapidly expanding niche.

Modelo Oro has rapidly ascended to Star status, capturing 3.5 million cases in its debut fiscal year 2024. This rapid market penetration in the U.S. high-end beer segment is a testament to its strong performance and ability to leverage the established Modelo brand equity.

Corona Cero is a rapidly growing Star, achieving triple-digit growth in 2024. Its sponsorship of the Paris 2024 Olympics amplifies its visibility, capitalizing on the increasing consumer demand for wellness and low/no-alcohol options.

| Brand | Category | Fiscal 2024 Performance | Q1 Fiscal 2025 Performance | Key Highlights |

|---|---|---|---|---|

| Modelo Especial | High-End Beer | Top U.S. beer by dollar sales | 11% volume growth | Sustained market leadership, strong revenue driver |

| Pacifico | Beer | 17% depletion growth, 20M+ cases sold | 21% depletion growth | Accelerating growth, strategic investment target |

| Modelo Chelada | Chelada | 30% depletion growth | N/A | 3x volume growth in 5 years, 67%+ dollar share |

| Modelo Oro | High-End Beer | 3.5M cases sold | N/A | Rapid market penetration, leverages brand equity |

| Corona Cero | Non-Alcoholic Beer | Triple-digit growth | N/A | Olympics sponsorship, capitalizes on wellness trend |

What is included in the product

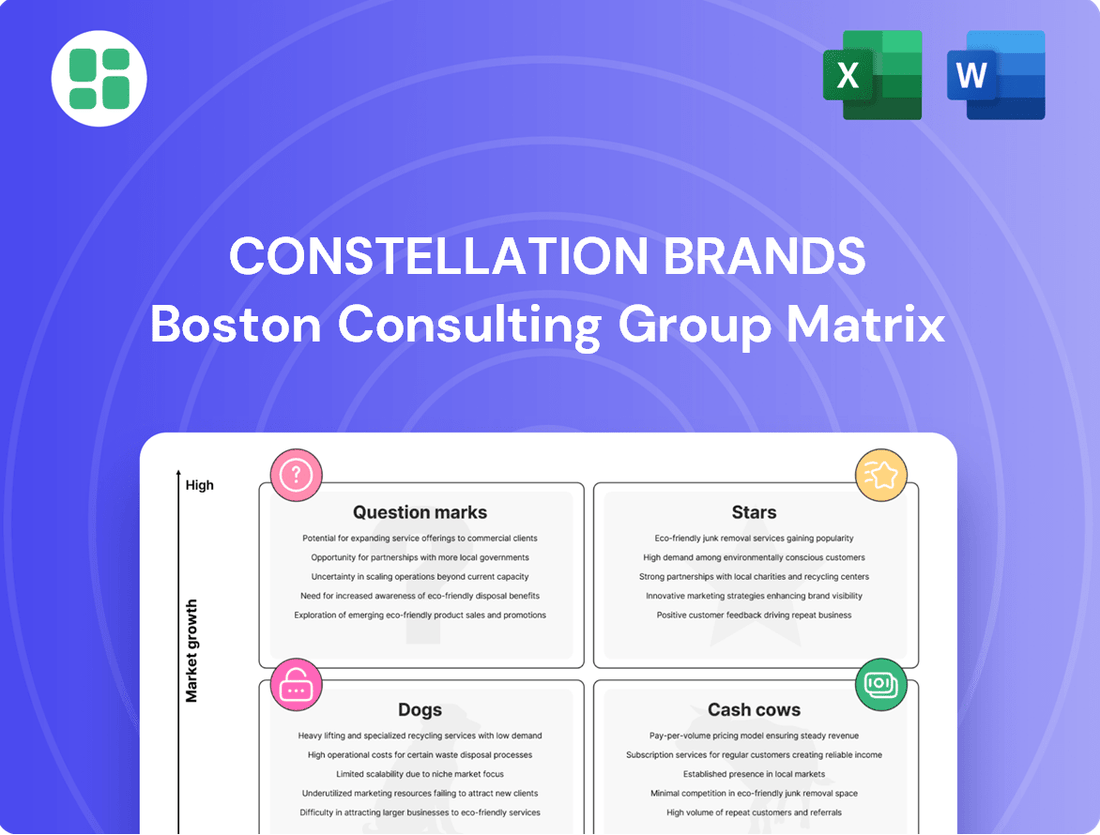

This BCG Matrix analysis highlights Constellation Brands' portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights on investment, holding, or divesting each business unit.

The Constellation Brands BCG Matrix provides a clear, one-page overview, relieving the pain of uncertainty by strategically placing each business unit in its correct quadrant.

Cash Cows

Corona Extra Beer, a key player in Constellation Brands' portfolio, solidifies its status as a Cash Cow. As of May 2025, it holds the impressive title of the world's most valuable beer brand and ranks as the third-highest premium beer brand in the United States.

Despite a modest depletion increase of nearly 1% in fiscal year 2024, Corona Extra's enduring market leadership and consistent, high brand valuation translate into significant and reliable cash flow for Constellation Brands. This mature market dominance makes it a vital, profit-generating asset.

Kim Crawford Wines stands as a prime example of a Cash Cow for Constellation Brands. It’s the top-selling Sauvignon Blanc in the United States, a testament to its strong brand recognition and market dominance in a mature segment of the wine industry.

This brand consistently generates substantial cash flow for Constellation Brands. Despite potential volume fluctuations in the wine market, Kim Crawford's established leadership and premium perception ensure a reliable revenue stream, making it a valuable, high-market-share asset within Constellation's diverse wine portfolio.

Robert Mondavi Winery stands as a cornerstone within Constellation Brands' portfolio, firmly positioned as a Cash Cow. This iconic Napa Valley brand represents a strategic retention, reflecting Constellation's commitment to the higher-end wine market.

Despite broader industry headwinds, Robert Mondavi Winery maintains a strong, established presence and significant market share within the premium wine segment. Its consistent performance underpins its Cash Cow status.

The winery reliably generates substantial revenue and contributes meaningfully to Constellation Brands' overall profitability, particularly within the lucrative luxury wine category. For instance, Constellation Brands reported a 6.2% increase in its Wine and Spirits segment sales for the fiscal year ended February 29, 2024, with premium brands like Robert Mondavi playing a key role in this growth.

Ruffino Estates and Prosecco

Ruffino Estates and its Prosecco offerings are considered Cash Cows for Constellation Brands. These Italian producers are key assets within the company's premium wine segment, benefiting from Prosecco's sustained popularity.

Ruffino's established brand and significant market share in mature European wine markets generate consistent, reliable cash flows for Constellation. This stability is characteristic of a Cash Cow, providing a dependable revenue stream.

- Ruffino's strong brand recognition in established markets

- Prosecco's continued consumer demand

- Contribution of steady cash flow to Constellation Brands

- High market share in premium wine niches

Casa Noble Tequila

Casa Noble Tequila, a distinguished award-winning craft spirit, is a key asset within Constellation Brands' premium spirits division. Its strong presence in the premium tequila market indicates a significant market share within this specific, high-growth segment.

The brand consistently delivers robust cash flows, solidifying its position as a valuable Cash Cow for Constellation Brands. For instance, Constellation Brands reported a 10% increase in net sales for its total spirits portfolio in fiscal year 2024, with premium brands like Casa Noble driving much of this growth.

- Brand Strength: Casa Noble is recognized for its premium quality and craft production.

- Market Position: It holds a strong market share in the rapidly expanding premium tequila category.

- Financial Contribution: The brand is a consistent generator of substantial cash flow for Constellation Brands.

- Portfolio Value: Its success contributes significantly to the overall valuation of Constellation Brands' spirits business.

Brands like Corona Extra, Kim Crawford Wines, Robert Mondavi Winery, Ruffino Estates, and Casa Noble Tequila are Constellation Brands' Cash Cows. These established brands dominate mature markets, generating consistent and substantial cash flow with minimal investment. Their high market share and strong brand recognition in premium segments make them reliable profit engines for the company.

For fiscal year 2024, Constellation Brands saw a 6.2% increase in its Wine and Spirits segment sales, with premium brands like Robert Mondavi contributing significantly. The total spirits portfolio experienced a 10% net sales increase in the same period, with premium offerings such as Casa Noble Tequila driving this growth. Corona Extra, the world's most valuable beer brand, continues to be a powerhouse, showing a nearly 1% depletion increase in fiscal year 2024, underscoring its stable cash generation.

| Brand | Category | Status | Key Financial Contribution | Market Position |

| Corona Extra Beer | Beer | Cash Cow | High, reliable cash flow | World's most valuable beer brand, 3rd highest premium beer in US |

| Kim Crawford Wines | Wine | Cash Cow | Substantial cash flow | Top-selling Sauvignon Blanc in the US |

| Robert Mondavi Winery | Wine | Cash Cow | Substantial revenue and profitability | Strong presence in premium wine segment |

| Ruffino Estates | Wine | Cash Cow | Consistent, reliable cash flows | High market share in premium wine niches, strong in European markets |

| Casa Noble Tequila | Spirits | Cash Cow | Robust cash flows | Strong market share in premium tequila category |

What You’re Viewing Is Included

Constellation Brands BCG Matrix

The Constellation Brands BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, offering you a ready-to-use report for immediate business planning.

What you see here is the final, professional-grade Constellation Brands BCG Matrix report that will be delivered to you upon completion of your purchase. This meticulously crafted document is precisely what you will download, ensuring no surprises and providing you with an analysis-ready file for your strategic needs.

This preview showcases the actual Constellation Brands BCG Matrix document you will acquire once you complete your purchase. The file is instantly downloadable and fully editable, allowing you to seamlessly integrate this market-backed analysis into your presentations or internal strategy discussions.

Dogs

Woodbridge by Robert Mondavi, a once prominent name, was divested by Constellation Brands in June 2025. This strategic move firmly places it in the Dog category of the BCG Matrix, indicating its position in a low-growth, low-market-share segment.

The mainstream wine market, where Woodbridge primarily operated, has faced significant headwinds, contributing to its diminished growth prospects. Constellation Brands' decision to divest underscores a broader strategy to streamline its portfolio and focus on higher-performing assets, a common practice when managing brands classified as Dogs.

Meiomi Wines, a brand previously held by Constellation Brands, was slated for divestiture to The Wine Group in June 2025. This move strongly suggests Meiomi was classified as a Dog within Constellation's strategic framework.

Brands categorized as Dogs typically exhibit low market share and slow growth, requiring significant investment for minimal returns. Constellation's focus on premiumizing its wine portfolio made brands like Meiomi, which likely didn't align with this high-growth, high-margin strategy, candidates for divestment.

Robert Mondavi Private Selection, a brand aimed at a broader consumer base, was part of Constellation Brands' recent divestiture. This move suggests the brand was not meeting the company's objectives for high growth or significant market share within its premiumization strategy.

The sale of Robert Mondavi Private Selection aligns with Constellation Brands' ongoing strategy to shed 'Dog' products, allowing the company to focus resources on more promising segments of its portfolio.

Cook's California Champagne

Cook's California Champagne, a brand historically associated with Constellation Brands, was divested in June 2025. This strategic move clearly positions Cook's as a Dog within Constellation's portfolio, signifying its low market share and operating within a low-growth segment.

The divestiture aligns with Constellation Brands' broader strategy to pivot towards higher-margin, premium beverage categories. In 2024, Constellation Brands reported net sales of $10.05 billion, with a strategic emphasis on its wine and spirits portfolio, particularly its premium offerings which have shown consistent growth.

- Divested in June 2025

- Low market share and low market growth

- Strategic shift by Constellation Brands towards premium products

- Represents a classic 'Dog' in the BCG Matrix

SIMI Wines

SIMI Wines, previously a component of Constellation Brands' diverse portfolio, was divested in 2025. This strategic sale indicates that SIMI likely occupied a position as a .

The divestment suggests SIMI Wines experienced a low market share coupled with stagnant growth. Such performance metrics are characteristic of brands that are no longer aligned with the company's growth objectives, prompting their classification as .

Constellation Brands' decision to sell SIMI Wines reflects a broader strategy of portfolio optimization. By shedding underperforming or slow-growth assets, the company aims to reallocate resources towards more promising opportunities, a common practice for brands identified as .

- SIMI Wines Divested: Sold by Constellation Brands in 2025.

- Market Position: Likely held a low market share within Constellation's portfolio.

- Growth Trajectory: Experienced stagnant growth, characteristic of .

- Strategic Rationale: Sale represents an exit from an underperforming asset.

Brands like Woodbridge by Robert Mondavi, Meiomi Wines, Robert Mondavi Private Selection, and Cook's California Champagne were divested by Constellation Brands in 2025. These brands, characterized by low market share and slow growth in a competitive mainstream wine market, were strategically classified as Dogs within the BCG Matrix. This divestment reflects Constellation's pivot towards its premium portfolio, aligning with their 2024 net sales of $10.05 billion and a focus on higher-margin segments.

| Brand | Divestment Year | BCG Category | Strategic Rationale |

|---|---|---|---|

| Woodbridge by Robert Mondavi | 2025 | Dog | Low growth, low market share |

| Meiomi Wines | 2025 | Dog | Not aligned with premiumization strategy |

| Robert Mondavi Private Selection | 2025 | Dog | Underperforming in premium focus |

| Cook's California Champagne | 2025 | Dog | Low market share in low-growth segment |

Question Marks

Fresca Mixed, a spirits-based ready-to-drink cocktail, represents Constellation Brands' entry into the rapidly expanding RTD market. This segment saw robust growth in 2023 and projections for 2024 indicate continued strong consumer demand for convenient, pre-mixed beverages.

As a newer entrant, Fresca Mixed currently occupies a relatively small market share within Constellation Brands' portfolio. This positions it as a Question Mark in the BCG matrix, necessitating substantial investment in marketing and distribution to increase brand awareness and capture a larger piece of the growing RTD pie.

Hiyo, an organic, non-alcoholic social tonic, represents a strategic investment for Constellation Brands, tapping into the surging consumer preference for wellness and alcohol-free options. This aligns with a significant market trend, as the global non-alcoholic beverage market is projected to reach $1.9 trillion by 2027, growing at a CAGR of 5.7%.

Within Constellation's diverse portfolio, Hiyo currently holds a nascent market share, classifying it as a potential 'Question Mark' in the BCG matrix. This category signifies high growth potential but requires significant investment to capture market share.

The company's commitment to Hiyo necessitates robust marketing and distribution strategies to foster brand awareness and expand its reach. This investment is crucial for Hiyo to transition from a question mark to a future star performer in Constellation's beverage lineup.

Sea Smoke Wines, acquired by Constellation Brands in May 2024, is positioned as a Question Mark within the BCG matrix. Despite its premium Santa Barbara County origins and high quality, its market share is still developing under Constellation's ownership, especially within the rapidly expanding luxury wine sector.

This integration into a larger portfolio necessitates strategic investment to capitalize on its potential for growth in the high-end market. The luxury wine segment, which saw a 15% increase in sales in 2023 according to Wine Spectator, presents a fertile ground for Sea Smoke to expand its presence.

Lingua Franca Wines

Lingua Franca, a premium winery in Oregon's Willamette Valley, represents Constellation Brands' strategic move into the high-growth, regional wine market. While it operates in a desirable segment, its current market share within Constellation's portfolio is relatively small, classifying it as a Question Mark in the BCG Matrix.

To elevate Lingua Franca from a Question Mark to a Star, Constellation Brands needs to invest heavily. This includes expanding distribution channels and significantly boosting brand awareness. For context, the premium wine segment in the US saw continued growth through 2023, with Oregon wines, particularly Pinot Noir, showing strong consumer interest.

- Lingua Franca's Position: Question Mark in Constellation Brands' BCG Matrix due to low market share in a high-growth segment.

- Growth Opportunity: The premium and regional wine market, especially in areas like the Willamette Valley, continues to attract consumer demand.

- Investment Needs: Success hinges on substantial investment in distribution networks and marketing to increase brand visibility.

- Market Context: Oregon's wine region, known for its Pinot Noir, is a key area of focus for premium wine growth.

Modelo Aguas Frescas

Modelo Aguas Frescas, though demonstrating strong initial traction as the leading new flavored malt beverage (FMB) in its test markets, is still in its nascent stages for Constellation Brands. This product is positioned within a rapidly expanding FMB segment, but its future success hinges on achieving substantial market penetration beyond its current test successes.

The product's current status places it firmly in the Question Mark category of the BCG matrix. This designation reflects its high growth potential within a dynamic market, but also underscores the need for ongoing strategic investment and wider consumer acceptance to solidify its market position.

- High Growth Potential: Operates in the high-growth FMB category.

- Market Penetration Needed: Requires expansion beyond test market success.

- Strategic Investment: Continued funding is crucial for growth.

- Emerging Product: Still a relatively new offering for Constellation Brands.

Question Marks in Constellation Brands' portfolio represent products with high growth potential but low current market share. These brands require significant investment to capture market share and transition into Stars.

Examples include Fresca Mixed, Hiyo, Sea Smoke Wines, Lingua Franca, and Modelo Aguas Frescas. These products are in burgeoning market segments like ready-to-drink cocktails, non-alcoholic beverages, and premium wines.

The success of these Question Marks hinges on strategic marketing, expanded distribution, and continued financial backing. For instance, the non-alcoholic beverage market is projected for robust growth, highlighting the opportunity for brands like Hiyo.

Constellation Brands is actively investing in these areas, aiming to capitalize on consumer trends and solidify their position in high-potential markets. The company's strategic acquisitions and product launches in 2024 underscore this focus.

BCG Matrix Data Sources

Our Constellation Brands BCG Matrix is informed by comprehensive market data, including company financial reports, industry growth projections, and competitor analysis to provide strategic clarity.