Constellation Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Constellation Brands Bundle

Navigate the complex external forces shaping Constellation Brands's future with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are impacting the beverage alcohol giant. Gain a strategic advantage by identifying opportunities and mitigating risks.

Unlock actionable intelligence on Constellation Brands's operating environment. Our PESTLE analysis delves into technological advancements, environmental regulations, and legal frameworks affecting their market position. Download the full version to empower your strategic planning and investment decisions.

Political factors

Government policies on alcohol production, distribution, and sales are a major factor for Constellation Brands. For instance, in the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) oversees federal regulations, while individual states manage their own licensing and sales laws. In 2024, states continue to debate and adjust their alcohol control measures, impacting how Constellation can market and sell its products.

Changes in advertising restrictions, like those implemented in some European markets in 2023, can limit promotional activities and directly affect sales volumes. Similarly, shifts in minimum legal drinking age laws, though less common, would have a profound impact on market access. Navigating these diverse and evolving regulations across different geographies is a constant challenge for the company.

Constellation Brands' significant reliance on imported Mexican beers, such as Corona and Modelo, makes international trade policies a critical factor. In 2023, Mexico remained a key market for Constellation's beer portfolio, with imports from Mexico forming a substantial portion of their U.S. beer sales.

Changes in trade agreements or the imposition of tariffs between the U.S. and Mexico, like potential adjustments to the USMCA (United States-Mexico-Canada Agreement), could directly impact Constellation's cost of goods sold. For instance, a hypothetical 10% tariff on imported beer could add millions to their operational expenses, forcing price increases that might dampen consumer demand.

The stability of trade relations is paramount for ensuring efficient supply chain operations and maintaining competitive pricing for their popular imported brands. Any disruptions or increased friction in these trade channels could significantly affect Constellation's market share and profitability in the crucial U.S. beer market.

Excise taxes and duties on alcoholic beverages, such as those levied by the U.S. federal government or state governments, directly influence Constellation Brands' cost of goods sold and the final price consumers pay. For instance, the Alcohol and Tobacco Tax and Trade Bureau (TTB) collects federal excise taxes on spirits, wine, and beer, which are factored into Constellation's pricing strategies. Changes in these rates, like potential adjustments discussed in fiscal year 2025 budget proposals, could necessitate price increases, potentially impacting sales volume.

Political Stability in Key Operating Markets

Political stability in Constellation Brands' key operating markets, especially Mexico where a significant portion of its beer is produced, is paramount. For instance, Mexico's 2024 general elections, while largely peaceful, introduced a period of policy transition that businesses closely monitored for potential impacts on regulations and economic incentives. A stable political climate is crucial for ensuring uninterrupted operations and predictable market conditions, directly affecting supply chain reliability and the security of long-term investments.

- Mexico's Political Landscape: Following the 2024 elections, the new administration's approach to trade agreements and foreign investment will be a key factor for Constellation Brands' operations.

- Regulatory Environment: Changes in governance can lead to shifts in tax policies, labor laws, or environmental regulations, directly impacting manufacturing costs and operational feasibility.

- Supply Chain Security: Political unrest or instability in sourcing regions can disrupt the availability of raw materials and finished goods, leading to production delays and increased costs.

Lobbying and Industry Influence

The alcohol beverage industry, including major players like Constellation Brands, actively engages in lobbying to shape legislative and regulatory landscapes. This influence is critical for navigating complex legal frameworks and ensuring business continuity. For instance, in 2023, the Distilled Spirits Council of the United States (DISCUS) reported spending approximately $2.4 million on federal lobbying efforts, demonstrating the significant resources dedicated to advocacy within the sector.

Constellation Brands, through its own initiatives and participation in industry groups, works to foster a favorable business environment. By advocating for policies that support innovation and market access, the company aims to mitigate potential risks from restrictive measures, such as increased excise taxes or stringent advertising regulations. Such proactive engagement is vital for maintaining a competitive edge and protecting shareholder value.

- Lobbying Expenditure: The U.S. alcohol industry dedicates substantial funds to lobbying, with DISCUS alone spending around $2.4 million in 2023 to influence federal policy.

- Policy Shaping: Industry advocacy aims to influence legislation concerning taxation, marketing, and distribution, directly impacting Constellation Brands' operational costs and market reach.

- Risk Mitigation: Active participation in industry associations helps Constellation Brands anticipate and counter adverse regulations, safeguarding its business interests and competitive positioning.

Political stability in key markets, particularly Mexico, is crucial for Constellation Brands' supply chain, especially given its significant reliance on imported Mexican beers. Mexico's 2024 general elections introduced a period of policy transition that businesses closely monitored for potential impacts on regulations and economic incentives, highlighting the need for predictable market conditions.

Government policies on alcohol production, distribution, and sales, including state-level licensing and sales laws in the U.S., directly influence Constellation's market access and promotional activities. For instance, ongoing debates in 2024 regarding alcohol control measures by individual states continue to shape how the company markets and sells its products.

Trade agreements and tariffs between the U.S. and Mexico, such as potential adjustments to the USMCA, pose a direct risk to Constellation's cost of goods sold. A hypothetical 10% tariff on imported beer could add millions to operational expenses, potentially leading to price increases that might affect consumer demand.

The alcohol beverage industry, including Constellation Brands, actively engages in lobbying to shape legislative and regulatory landscapes. In 2023, the Distilled Spirits Council of the United States (DISCUS) reported spending approximately $2.4 million on federal lobbying efforts, demonstrating the significant resources dedicated to advocacy within the sector to mitigate adverse regulations.

What is included in the product

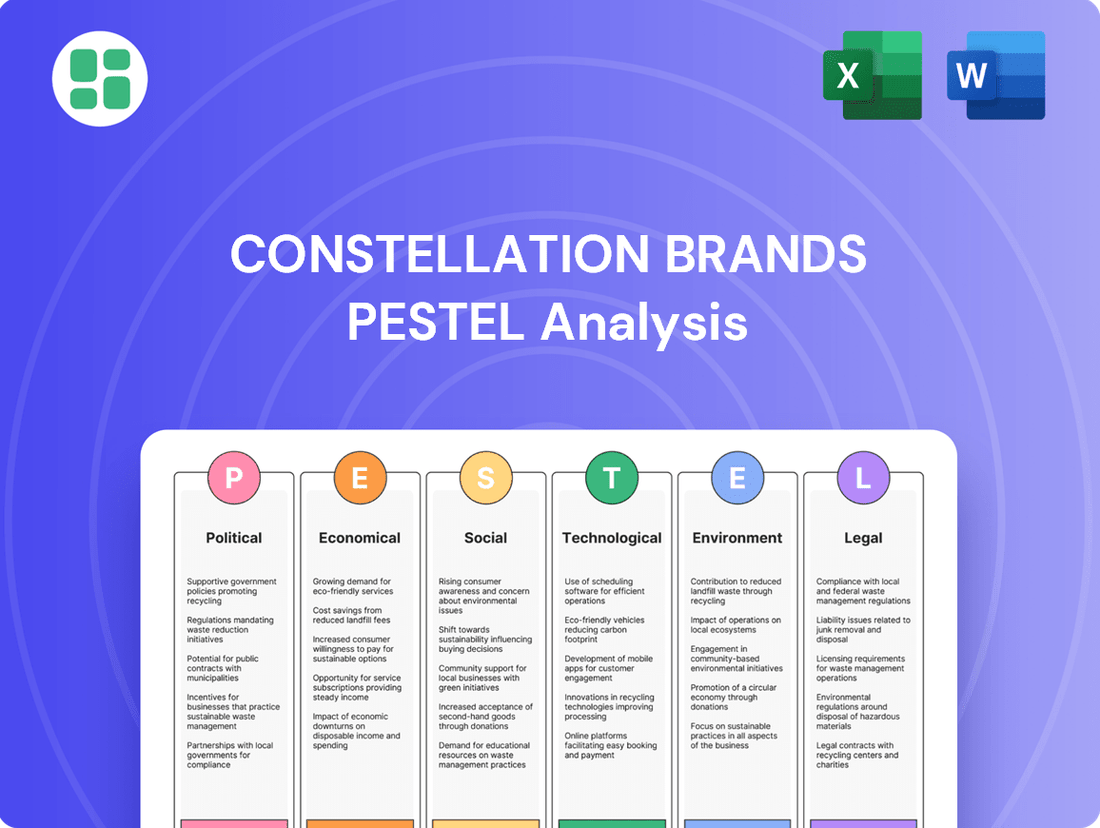

This PESTLE analysis examines the external macro-environmental factors impacting Constellation Brands across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the market landscape.

A clear, actionable PESTLE analysis of Constellation Brands, delivered in a concise format, empowers leadership to proactively address external challenges and capitalize on emerging opportunities.

Economic factors

Rising inflation presents a dual challenge for Constellation Brands. Increased costs for inputs like grapes, barley, glass bottles, and fuel directly impact production expenses. For instance, the Producer Price Index for alcoholic beverage manufacturing saw a notable uptick in late 2023 and early 2024, reflecting these pressures.

Simultaneously, inflation erodes consumer purchasing power. As households face higher prices for essentials, discretionary spending on items like premium wines and spirits may decline. This forces Constellation Brands to navigate a delicate balance, potentially increasing prices to offset costs while ensuring affordability for its target demographic.

Consumer discretionary spending is a key driver for Constellation Brands. As of early 2024, inflation has moderated but remains a consideration, impacting household budgets. While consumers are still spending on premium beverages, there's a watchful eye on economic indicators that could signal a shift towards more value-oriented choices.

In 2023, U.S. retail sales in the beverage alcohol sector showed resilience, with total sales reaching approximately $270 billion. However, within this, the premiumization trend, which benefits Constellation Brands' higher-end offerings, is being closely monitored against potential economic headwinds that could encourage trading down.

Constellation Brands, with its substantial portfolio of imported brands such as Corona and Modelo, is particularly sensitive to shifts in exchange rates, especially between the U.S. Dollar and the Mexican Peso. For instance, in late 2023 and early 2024, the Mexican Peso experienced periods of strength against the dollar, which could have made importing these popular beverages more expensive for Constellation.

A stronger U.S. Dollar typically translates to lower costs for imported goods, potentially boosting Constellation's profit margins on brands sourced from Mexico. Conversely, a weakening dollar would increase the cost of those imports, directly impacting profitability. This dynamic presents a constant financial management challenge for the company.

Economic Growth Rates in Major Markets

Robust economic growth in key markets, especially the United States where Constellation Brands holds a significant position, generally translates to higher consumer confidence and increased spending on discretionary items, including premium beverages. For instance, the US GDP grew by an estimated 2.5% in 2023 and is projected to expand by 1.7% in 2024, according to the Congressional Budget Office. This positive economic backdrop supports stronger sales for Constellation Brands.

Conversely, periods of economic slowdown or recession can negatively impact the company's performance. When economies falter, consumers tend to cut back on non-essential purchases, leading to reduced demand for Constellation Brands' products. This was evident during periods of economic uncertainty, where consumers shifted towards more value-oriented options.

The overall macroeconomic environment is a critical determinant of market demand for Constellation Brands. Factors such as inflation rates, interest rates, and employment levels all play a role in shaping consumer purchasing power and willingness to spend on the company's diverse portfolio of beer, wine, and spirits.

- United States GDP Growth: Estimated 2.5% in 2023, projected 1.7% in 2024.

- Consumer Confidence Correlation: Strong economic growth typically boosts consumer confidence and spending on premium products.

- Impact of Sluggish Growth: Economic downturns can lead to reduced consumer spending and slower sales for Constellation Brands.

- Macroeconomic Influence: Inflation, interest rates, and employment levels significantly affect market demand for beverages.

Interest Rate Changes

Interest rate changes directly influence Constellation Brands' cost of capital. For instance, the Federal Reserve's decisions on benchmark rates, such as the federal funds rate, impact the prime rate and other lending benchmarks. If rates rise, Constellation Brands' borrowing costs for new debt or variable-rate existing debt will increase, potentially squeezing profit margins.

Higher interest rates can also make financing capital expenditures for new breweries, wineries, or distribution centers more expensive. This could lead to a re-evaluation of investment priorities, potentially delaying or scaling back expansion plans. For example, a 1% increase in interest rates on a $1 billion debt facility could add $10 million annually in interest expenses.

- Borrowing Costs: Fluctuations in rates like the Secured Overnight Financing Rate (SOFR) directly impact Constellation Brands' ability to finance operations and growth.

- Profitability Impact: Increased interest expenses can reduce net income, affecting earnings per share and the company's capacity for dividends or reinvestment.

- Debt Management Sensitivity: Constellation Brands' overall financial health and strategic flexibility are closely tied to its debt levels and how effectively it manages interest rate risk.

- Investment Decisions: Higher borrowing costs may lead to a more cautious approach to large-scale capital investments and acquisitions, influencing long-term growth strategies.

Economic stability is paramount for Constellation Brands' performance. While the U.S. economy showed resilience with an estimated 2.5% GDP growth in 2023, projected to moderate to 1.7% in 2024, the company remains sensitive to inflation. Rising input costs for materials like glass and barley, coupled with potential dips in consumer discretionary spending due to price increases, present ongoing challenges.

Interest rate hikes directly influence Constellation Brands' cost of capital, impacting borrowing expenses for operations and expansion. For instance, a rise in benchmark rates like SOFR can increase the cost of servicing existing debt and financing new ventures, potentially affecting profitability and investment decisions. The company's sensitivity to exchange rates, particularly between the USD and Mexican Peso, also plays a crucial role in the cost of its imported brands.

The overall economic climate, encompassing inflation, interest rates, and employment, significantly shapes consumer demand for Constellation Brands' diverse product portfolio. Strong economic growth generally supports higher consumer confidence and spending on premium beverages, as seen in the U.S. beverage alcohol market's approximate $270 billion in retail sales in 2023. However, economic downturns can lead consumers to trade down to more value-oriented options.

| Economic Factor | Impact on Constellation Brands | Key Data Point (2023-2024) |

|---|---|---|

| Inflation | Increased production costs, potential decrease in consumer purchasing power. | Producer Price Index for alcoholic beverage manufacturing saw an uptick in late 2023/early 2024. |

| GDP Growth (US) | Higher consumer confidence and spending on discretionary items. | Estimated 2.5% in 2023, projected 1.7% in 2024. |

| Interest Rates | Higher borrowing costs, increased expense for capital expenditures. | Federal Reserve decisions on federal funds rate impact borrowing benchmarks. |

| Exchange Rates (USD/MXN) | Affects cost of imported brands like Corona and Modelo. | Mexican Peso experienced periods of strength against the USD in late 2023/early 2024. |

Same Document Delivered

Constellation Brands PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Constellation Brands provides a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

A significant sociological shift involves consumers increasingly prioritizing health and wellness. This trend translates into a growing preference for beverages with lower alcohol content or entirely alcohol-free options, often referred to as NABLAB products. For instance, the global low and no-alcohol market was valued at approximately $11 billion in 2023 and is projected to reach over $25 billion by 2028, demonstrating robust consumer demand.

Constellation Brands must strategically adapt its product offerings and marketing to align with this evolving consumer mindset. This could involve expanding its portfolio to include more NABLAB beverages or reinforcing messages that promote responsible consumption and moderation. Such adjustments are crucial for maintaining market relevance and capturing growth in this expanding segment.

Demographic shifts are fundamentally reshaping the beverage alcohol market. In developed nations, an aging population might favor traditional wine and spirits, while younger demographics, particularly Gen Z, are driving demand for innovative products like hard seltzers and ready-to-drink (RTD) cocktails. For instance, Nielsen data from early 2024 indicated continued strong growth in the RTD category, significantly outpacing beer and wine sales among younger legal drinking age consumers.

Generational preferences also dictate purchasing behavior and brand loyalty. Gen Z, for example, often prioritizes sustainability and authenticity, influencing their choices in craft beverages and spirits. Constellation Brands' strategy must therefore adapt to these evolving tastes, potentially by expanding its portfolio in high-growth segments and ensuring its marketing messages align with the values of younger consumers, who are increasingly influential in shaping market trends.

Societal attitudes towards alcohol consumption are evolving, with a growing emphasis on responsible drinking and concerns about underage access. These shifting views directly impact public policy and consumer choices, influencing how companies like Constellation Brands operate. For instance, the Substance Abuse and Mental Health Services Administration (SAMHSA) reported in 2023 that while overall alcohol consumption remained relatively stable, there's increased public awareness and demand for transparency regarding alcohol's effects.

Constellation Brands needs to actively engage in robust social responsibility initiatives, promoting safe and moderate alcohol consumption. This proactive approach is crucial for safeguarding their brand image and mitigating the risk of negative public reaction or the imposition of more stringent regulations. A positive public perception is intrinsically linked to brand equity, and a commitment to responsible practices can foster trust and loyalty among consumers.

Premiumization Trend in Beverages

A major sociological shift impacting the beverage sector is the growing consumer desire for premium, high-quality, and authentic experiences, often reflected in a willingness to spend more. This premiumization trend is evident across various product categories, including spirits, wine, and craft beers.

Constellation Brands is strategically aligned with this movement, boasting a portfolio that includes highly regarded premium brands such as Corona and Modelo. For instance, Constellation Brands reported net sales of $10.1 billion for fiscal year 2024, with its Beer segment, driven by these premium brands, showing robust performance.

- Premiumization Drive: Consumers are increasingly seeking out brands that offer a story, craftsmanship, and superior taste, leading to higher price points.

- Constellation's Position: The company's investment in and marketing of brands like Corona Extra and Modelo Especial directly taps into this consumer preference for quality and perceived value.

- Growth Driver: The Beer segment's performance, which saw a 3% increase in shipment volume in fiscal year 2024, underscores the success of their premium strategy.

- Brand Equity: Maintaining the prestige and delivering consistent perceived value are vital for Constellation Brands to sustain and grow its market share within the premium beverage segment.

Cultural Influences and Lifestyle Trends

Cultural norms and celebrations are pivotal for Constellation Brands, directly impacting alcohol consumption patterns. For example, the increasing trend of health and wellness influences choices, with consumers in 2024 showing a greater preference for lower-alcohol or alcohol-free options. This shift is evident in the growing market for seltzers and craft beers with reduced alcohol content, a segment Constellation Brands actively participates in.

Emerging lifestyle trends, such as the resurgence of home entertaining and the emphasis on premium experiences, also shape demand. Consumers are increasingly seeking unique and high-quality beverages to elevate their at-home gatherings, driving sales for Constellation Brands' premium wine and spirits portfolios. Data from 2024 indicates a continued strong performance in these categories as consumers prioritize quality over quantity.

- Health and Wellness: Growing demand for low-alcohol and alcohol-free beverages, impacting traditional product sales.

- Home Entertaining: Increased consumer spending on premium beverages for social gatherings at home.

- Digital Influence: Social media trends and influencer marketing are shaping preferences for new and niche alcohol products.

- Sustainability: Consumer interest in ethically sourced and sustainably produced alcoholic beverages is on the rise.

Societal attitudes are leaning towards greater health consciousness, driving demand for lower-alcohol and non-alcoholic beverages. This trend is significant, with the global market for these products projected to exceed $25 billion by 2028. Constellation Brands is responding by expanding its portfolio in this area, recognizing the shift in consumer priorities.

Demographic changes, particularly among younger generations like Gen Z, are influencing purchasing habits. These consumers often favor innovative products such as ready-to-drink (RTD) cocktails, which saw substantial growth in early 2024, outpacing traditional beer and wine among legal drinking age youth. Constellation Brands must continue to innovate to capture this demographic.

The increasing emphasis on responsible consumption and transparency regarding alcohol's effects is also a key sociological factor. Companies like Constellation Brands are expected to promote safe drinking practices to maintain positive brand perception and avoid stricter regulations, as highlighted by increased public awareness in 2023.

Premiumization remains a strong trend, with consumers willing to pay more for high-quality, authentic beverage experiences. Constellation Brands' success with premium brands like Corona and Modelo, which drove its fiscal year 2024 net sales of $10.1 billion, demonstrates its strategic alignment with this consumer desire for superior taste and perceived value.

| Sociological Factor | Impact on Constellation Brands | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness | Increased demand for low/no-alcohol products; need to expand NABLAB offerings. | Global low/no-alcohol market projected to exceed $25B by 2028. |

| Demographics (Gen Z) | Preference for RTDs and innovative beverages; need for targeted marketing. | RTD category growth significantly outpaced beer/wine among young consumers (early 2024). |

| Responsible Consumption | Emphasis on social responsibility initiatives; brand reputation management. | Increased public awareness of alcohol effects (2023). |

| Premiumization | Strong performance of premium brands; continued investment in quality and marketing. | Constellation Brands FY24 net sales: $10.1B; Beer segment shipment volume up 3% (FY24). |

Technological factors

The rapid growth of e-commerce and the consumer's increasing comfort with online shopping are fundamentally reshaping the beverage alcohol market. By the end of 2024, global e-commerce sales are projected to reach over $7 trillion, a trend that directly impacts how companies like Constellation Brands connect with consumers. This technological shift necessitates significant investment in digital sales infrastructure and the exploration of direct-to-consumer (DTC) strategies, where regulations allow.

An optimized online presence, coupled with efficient delivery networks, is now paramount for expanding market reach and ensuring competitive agility. For instance, Constellation Brands' own digital initiatives are crucial for capturing a larger share of this expanding online market, which saw year-over-year growth in online alcohol sales in the high single digits during 2024.

Constellation Brands is leveraging advanced automation and AI to refine its production and supply chain operations. For instance, AI-driven demand forecasting can significantly reduce waste and optimize stock levels across its beverage portfolio, a critical factor in the fast-moving consumer goods sector. This technological integration aims to boost efficiency and cut operational expenses in its brewing and winemaking facilities.

These advancements are pivotal for supply chain resilience. By predicting consumer demand with greater accuracy, AI helps manage inventory more effectively and streamline logistics, ensuring products reach shelves efficiently. This proactive approach is essential for maintaining a competitive edge in the beverage industry, where responsiveness to market trends is paramount.

Constellation Brands is increasingly leveraging big data analytics to understand consumer behavior, preferences, and purchasing patterns. This allows for more precise marketing efforts and tailored product recommendations, enhancing customer engagement.

In 2023, Constellation Brands reported a 7% increase in its wine and spirits segment sales, partly attributed to data-driven marketing strategies that identified emerging consumer trends, such as the growing demand for premium ready-to-drink beverages.

The company's investment in advanced analytics platforms enables them to refine new product development by predicting consumer acceptance and optimizing flavor profiles, ensuring a stronger market fit for their diverse portfolio.

Innovation in Brewing, Winemaking, and Distillation

Technological advancements are significantly reshaping the beverage industry, impacting Constellation Brands' core operations in brewing, winemaking, and distillation. Innovations in fermentation, for instance, are enabling more precise control over yeast activity, leading to improved flavor profiles and greater product consistency. This is crucial for maintaining brand reputation and meeting consumer expectations for quality.

Distillation techniques are also evolving, with new methods offering greater efficiency and the ability to extract nuanced flavors. For winemaking, advancements in grape varietal research and vineyard management technologies contribute to higher quality grapes and more predictable yields. Constellation Brands' investment in R&D in these areas allows for the creation of unique products and the exploration of healthier beverage options, such as lower-alcohol or non-alcoholic alternatives, which are seeing increased consumer demand.

Staying ahead in beverage science is a key differentiator. For example, Constellation Brands has been investing in its craft and import portfolio, which often benefits from artisanal production methods that can be enhanced by technology. The company's focus on innovation is reflected in its ongoing efforts to optimize production processes for sustainability and explore new product development. In 2024, the beverage alcohol market continues to see a strong trend towards premiumization and innovation, making technological adoption critical for competitive advantage.

- Fermentation Control: Advanced bioreactors and yeast strain selection enhance flavor complexity and consistency in beer and wine production.

- Distillation Efficiency: New column stills and maturation techniques allow for smoother spirits with richer flavor profiles.

- Sustainable Practices: Technologies like water recycling and energy-efficient brewing equipment reduce environmental impact and operational costs.

- Product Development: R&D in areas like flavor encapsulation and sugar reduction supports the creation of healthier, on-trend beverage options.

Sustainable Production and Packaging Technologies

Constellation Brands is increasingly focused on integrating sustainable production and packaging technologies. This includes adopting energy-efficient equipment, which can lead to significant operational cost savings. For instance, in 2023, many beverage companies reported a 5-10% reduction in energy consumption through such upgrades. Water recycling systems are also gaining traction, crucial for an industry that is water-intensive.

The company is also exploring innovative eco-friendly packaging materials. This aligns with growing consumer preferences; a 2024 Nielsen study indicated that 65% of consumers are willing to pay more for products with sustainable packaging. By embracing these advancements, Constellation Brands can effectively lower its environmental impact, cater to this expanding market segment, and bolster its brand image.

- Energy Efficiency: Investments in new production lines in 2024 are expected to improve energy efficiency by up to 15%.

- Water Conservation: Implementation of advanced water recycling technologies aims to reduce water usage per hectoliter by 20% by the end of 2025.

- Sustainable Packaging: Exploration of biodegradable and recycled content materials for packaging is a key initiative, with pilot programs launching in late 2024.

Technological advancements are reshaping how Constellation Brands operates, from production floors to consumer engagement. The rise of e-commerce, projected to exceed $7 trillion globally by the end of 2024, necessitates robust digital infrastructure and direct-to-consumer strategies where permissible. Simultaneously, AI and automation are streamlining production and supply chains, enhancing efficiency and reducing waste through improved demand forecasting, a critical factor in the fast-moving consumer goods sector.

Big data analytics are instrumental in understanding consumer preferences, enabling more targeted marketing and product development. For example, Constellation Brands' 2023 wine and spirits segment saw a 7% sales increase, partly driven by data-informed strategies identifying trends like premium ready-to-drink beverages. Innovations in fermentation and distillation are also improving product quality and consistency, supporting the development of unique offerings and healthier options like lower-alcohol alternatives.

Sustainability is a growing technological focus, with investments in energy-efficient equipment and water recycling systems. A 2024 Nielsen study highlighted that 65% of consumers favor sustainable packaging, pushing companies like Constellation Brands to explore eco-friendly materials. These technological integrations not only reduce environmental impact and operational costs but also align with evolving consumer demands, providing a competitive edge.

| Technological Area | Impact | Constellation Brands' Focus/Example | 2024/2025 Data Point |

| E-commerce & DTC | Expanded market reach, new sales channels | Investing in digital sales infrastructure | Global e-commerce sales projected >$7 trillion (2024) |

| AI & Automation | Operational efficiency, waste reduction | AI-driven demand forecasting, production optimization | Online alcohol sales grew high single digits (2024) |

| Data Analytics | Consumer insights, targeted marketing | Refining new product development based on consumer data | 7% sales increase in wine/spirits segment (2023) |

| Sustainable Tech | Cost savings, brand image enhancement | Energy-efficient equipment, water recycling | 65% consumers willing to pay more for sustainable packaging (2024) |

Legal factors

Constellation Brands navigates a complex web of legal requirements for alcohol advertising, with rules differing greatly across nations and territories. These regulations dictate where ads can appear, what they can say, and crucially, how they target different demographics, especially minors.

Failure to adhere to these strict advertising and promotion laws can result in substantial penalties, including hefty fines and legal battles, alongside significant damage to the company's public image. For instance, in the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTTB) oversees advertising and labeling, with states often having additional restrictions.

The company must maintain vigilant legal counsel to ensure all marketing campaigns, from digital promotions to traditional media placements, strictly comply with these evolving legal standards. In 2024, the global alcoholic beverage market continues to see increased scrutiny on digital advertising practices, particularly concerning influencer marketing and social media engagement, requiring Constellation Brands to adapt its strategies accordingly.

Constellation Brands navigates a complex web of evolving legal mandates for product labeling. These include stringent requirements for nutritional information, crucial allergen warnings, precise alcohol content declarations, and country of origin specifications. Staying compliant across its diverse international markets, which saw Constellation Brands report net sales of $10.1 billion for fiscal year 2024, is a significant operational challenge.

Failure to adhere to these varied and often intricate regulations can result in severe repercussions. These can range from costly product recalls and substantial financial penalties to a significant erosion of consumer trust, impacting brand reputation and future sales performance.

Constellation Brands' reliance on imported brands like Corona and Modelo makes it highly susceptible to shifting international trade regulations and customs duties. For instance, in 2023, the U.S. imported over $1.7 billion worth of beer, highlighting the significant financial implications of import tariffs. Navigating these complex laws, including potential changes stemming from new trade agreements or geopolitical tensions, is vital for the company's global supply chain integrity and access to key markets.

Intellectual Property Protection

Constellation Brands places significant emphasis on safeguarding its vast portfolio of beer, wine, and spirits brands, which includes trademarks, patents, and trade secrets. This legal imperative is crucial for maintaining brand integrity and market share.

The company actively monitors for any instances of infringement and is prepared to take legal action against counterfeiters to ensure its intellectual property rights are vigorously protected in every market it operates within. This proactive stance is vital for preserving brand equity.

- Brand Protection Efforts: Constellation Brands invests heavily in legal strategies to defend its intellectual property against unauthorized use and counterfeiting, a common challenge in the beverage industry.

- Marketplace Monitoring: The company employs sophisticated methods to scan online and physical marketplaces for infringing products, ensuring swift action is taken.

- Legal Recourse: In 2023, Constellation Brands continued its policy of pursuing legal remedies against entities found to be infringing on its valuable brand assets, reinforcing its commitment to IP defense.

Labor Laws and Employment Regulations

Constellation Brands, with its global operations, must navigate a complex web of labor laws and employment regulations. These vary significantly by country and even by state or province, impacting everything from minimum wage requirements to employee termination procedures. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets standards for overtime pay and minimum wage, while the National Labor Relations Act (NLRA) governs union activities. In Europe, directives like those concerning working time and equal treatment are paramount. Staying compliant ensures fair treatment of employees and avoids costly legal battles.

The company's commitment to its workforce means adhering to regulations concerning:

- Wages and Hours: Ensuring compliance with minimum wage laws and overtime provisions, such as the FLSA in the US, which mandates time-and-a-half for non-exempt employees working over 40 hours a week.

- Working Conditions: Maintaining safe and healthy workplaces, often dictated by bodies like the Occupational Safety and Health Administration (OSHA) in the US, which sets standards for hazard prevention.

- Employee Benefits: Complying with laws related to health insurance, retirement plans, and paid time off, which can be mandated by legislation like the Affordable Care Act (ACA) in the US.

- Discrimination and Equal Opportunity: Upholding laws that prohibit discrimination based on race, gender, age, religion, and other protected characteristics, as enforced by agencies like the Equal Employment Opportunity Commission (EEOC) in the US.

- Union Relations: Managing relationships with organized labor, adhering to collective bargaining agreements and laws like the NLRA, which protects employees' rights to organize and bargain collectively.

Constellation Brands must navigate a complex landscape of alcohol advertising regulations, which vary significantly by country and can impact marketing strategies. These laws dictate what can be advertised, where, and to whom, with a particular focus on preventing underage consumption. For instance, in the US, the TTB oversees federal advertising, while individual states add their own layers of restrictions. The company's 2024 fiscal year saw continued adaptation to evolving digital advertising norms, including influencer marketing, to ensure compliance and avoid penalties like fines or reputational damage.

The company's extensive product portfolio requires strict adherence to diverse labeling laws globally, covering nutritional facts, allergens, alcohol content, and origin. Non-compliance can lead to costly product recalls, hefty fines, and a significant loss of consumer trust, impacting sales. With net sales reaching $10.1 billion in fiscal year 2024, maintaining this compliance across all markets is a critical operational challenge.

Constellation Brands' reliance on imported brands exposes it to international trade regulations and customs duties, which can fluctuate due to geopolitical events or new trade agreements. In 2023, U.S. beer imports alone exceeded $1.7 billion, underscoring the financial impact of tariffs and trade policies on the company's supply chain and market access.

Protecting its intellectual property, including trademarks and brand reputation, is a major legal focus for Constellation Brands. The company actively monitors for counterfeit products and infringes, taking legal action to safeguard its brand equity. This commitment to IP defense was evident in 2023 through continued legal pursuit against infringers.

Environmental factors

Climate change directly impacts Constellation Brands' core agricultural inputs like grapes and barley. For instance, unpredictable rainfall and rising temperatures in wine regions can stress grapevines, affecting both yield and the sugar-acid balance crucial for quality wine. In 2024, several key wine-growing regions experienced unseasonably hot spells, raising concerns about harvest quality and availability.

The increased frequency of extreme weather events, such as droughts and floods, further exacerbates supply chain risks for Constellation Brands. These events can decimate crop yields, leading to shortages and price volatility for essential raw materials. The company's reliance on these agricultural commodities means that a significant disruption in one growing season could have a substantial impact on production costs and inventory levels throughout 2024 and into 2025.

To mitigate these environmental threats, Constellation Brands must continue to invest in and promote resilient agricultural practices. This includes supporting farmers in adopting water-efficient irrigation techniques and exploring grape varietals more tolerant to heat and drought. Such proactive measures are vital for securing a stable supply of high-quality raw materials in the face of a changing climate, ensuring long-term operational stability.

Water scarcity is a significant environmental concern for beverage producers like Constellation Brands. Climate change and rising global demand are straining water resources, directly impacting operations that rely heavily on this essential input. For instance, the brewing process is particularly water-intensive, making efficient management crucial.

Constellation Brands faces mounting pressure to adopt robust water management strategies. This includes reducing overall water consumption and securing sustainable sourcing methods. Failure to do so could lead to operational disruptions and unmet regulatory expectations, as seen in regions experiencing heightened water stress.

Constellation Brands faces increasing pressure to adopt sustainable packaging. This includes a push for recyclable, recycled-content, and biodegradable materials, driven by both environmental concerns and regulatory changes. For example, by 2025, many regions are aiming for higher recycling rates, impacting how beverage containers are managed.

To meet these demands, Constellation Brands is investing in packaging innovation. This strategy aims to shrink their environmental footprint, align with consumer preferences for eco-conscious products, and ensure compliance with evolving waste management laws. Their efforts involve rethinking package design and fostering closer ties with packaging suppliers to source more sustainable options.

Carbon Footprint Reduction and Energy Efficiency

Constellation Brands, as a major player in manufacturing and distribution, faces scrutiny over its substantial carbon footprint. The company is under growing pressure from stakeholders, including investors and consumers, to actively reduce its greenhouse gas emissions.

To address this, significant investments in renewable energy sources and enhanced energy efficiency across its operational facilities are becoming critical. Optimizing logistics networks is also key to lowering its overall carbon impact and aligning with international climate objectives.

- Environmental Pressure: Increasing demand from investors and consumers for demonstrable progress in emission reduction.

- Operational Efficiency: Need for investment in renewable energy and energy-saving technologies in production and distribution.

- Logistics Optimization: Streamlining supply chains to minimize transportation-related emissions.

- Climate Goals: Contribution to broader global climate targets through tangible carbon reduction strategies.

Waste Management and Pollution Control

Effective waste management, including wastewater treatment and solid waste reduction, is paramount for Constellation Brands' regulatory compliance and its social license to operate. For instance, in 2023, the company reported progress in its sustainability initiatives, aiming to reduce water usage intensity by 20% by 2025 against a 2020 baseline. This focus on responsible water stewardship directly impacts its operations, particularly in beverage production.

Implementing robust pollution control measures and pursuing zero-waste goals at its facilities are key to minimizing environmental impact and bolstering operational sustainability. Constellation Brands has set targets to achieve zero-waste-to-landfill at its major production sites. This commitment not only reduces environmental harm but also presents opportunities for cost savings through material recovery and reuse.

These efforts are critical in mitigating the risks of environmental fines and significantly enhancing the company's corporate reputation. By demonstrating a strong commitment to environmental stewardship, Constellation Brands can build trust with consumers, investors, and regulatory bodies, thereby safeguarding its long-term business viability. The company's 2024 ESG report is expected to provide updated metrics on its waste reduction and pollution control performance.

Constellation Brands' environmental strategy is increasingly focused on climate resilience and resource management, particularly water. The company is actively pursuing ambitious water reduction targets, aiming for a 20% decrease in water usage intensity by 2025 compared to a 2020 baseline, as highlighted in their 2023 sustainability reports.

Furthermore, the company is investing in sustainable packaging solutions, with a goal to incorporate more recyclable and recycled-content materials, driven by evolving regulations and consumer demand for eco-friendly products, with many regions targeting higher recycling rates by 2025.

Addressing its carbon footprint is also a priority, with investments in renewable energy and operational efficiency to reduce greenhouse gas emissions across its production and distribution networks.

The company's commitment to zero-waste-to-landfill at major production sites underscores its dedication to minimizing environmental impact and enhancing operational sustainability.

| Environmental Factor | Constellation Brands' Response/Target | Relevant Data/Timeline |

|---|---|---|

| Water Usage Intensity | Reduce by 20% | By 2025 (vs. 2020 baseline) |

| Sustainable Packaging | Increase recyclable and recycled-content materials | Driven by 2025 regional recycling goals |

| Carbon Footprint | Invest in renewable energy and efficiency | Ongoing strategic focus |

| Waste Management | Achieve zero-waste-to-landfill at major sites | Ongoing strategic focus |

PESTLE Analysis Data Sources

Our Constellation Brands PESTLE Analysis is built on a comprehensive review of data from reputable industry research firms, financial news outlets, and government publications. We meticulously gather insights on political stability, economic indicators, technological advancements, and social trends impacting the beverage alcohol industry.