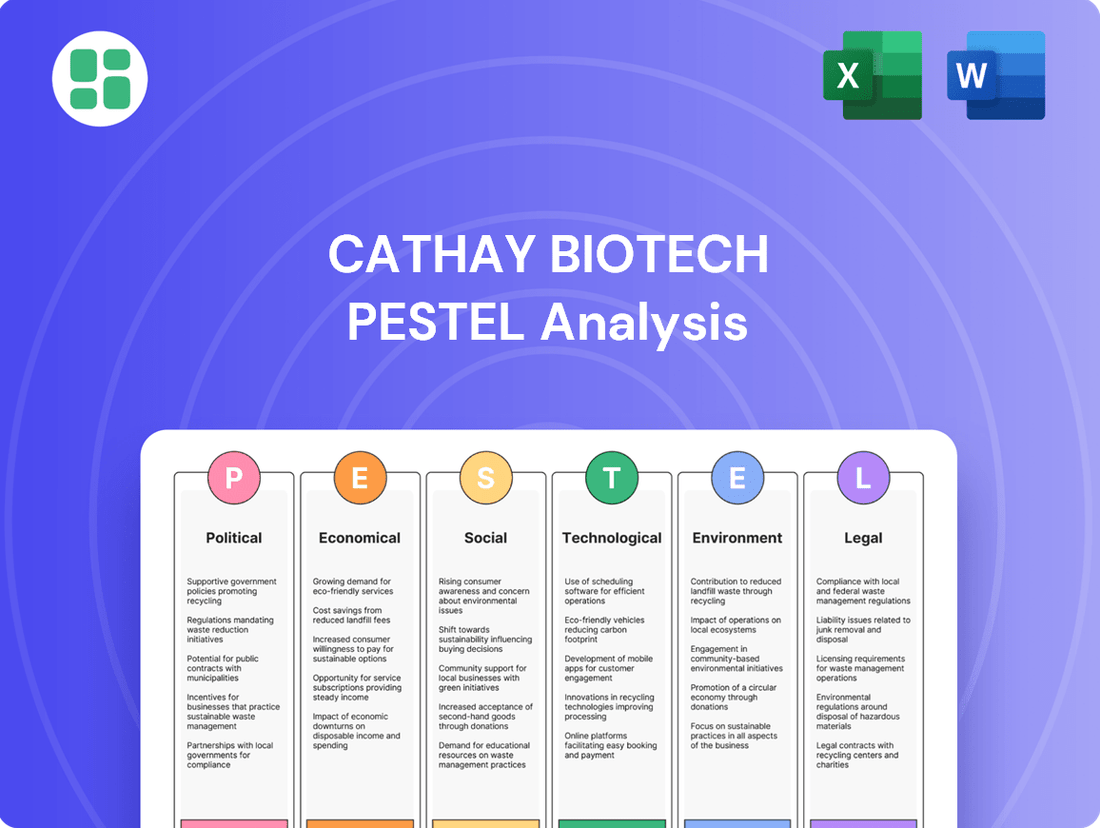

Cathay Biotech PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Biotech Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cathay Biotech's trajectory. Our expertly crafted PESTLE analysis provides a comprehensive overview of the external forces shaping this dynamic industry. Gain the strategic advantage you need to anticipate market shifts and capitalize on emerging opportunities. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies in China, particularly through the 14th Five-Year Plan (2021-2025), strongly champion the growth of bio-based industries and synthetic biology. This national strategy emphasizes resource recycling and sustainable development, creating a supportive ecosystem for companies like Cathay Biotech.

These initiatives translate into tangible benefits such as increased R&D funding, tax incentives, and direct subsidies. For example, China's commitment to green manufacturing and reducing fossil fuel dependency directly aligns with Cathay Biotech's focus on bio-based materials.

International trade policies and tariffs directly influence Cathay Biotech's operational costs and market reach. For instance, the ongoing trade tensions and tariffs between major economies like the US and China can increase the cost of imported raw materials and specialized equipment essential for bio-based production.

While the bio-based materials sector is experiencing robust growth, estimated to reach $178.9 billion by 2030 according to some projections, these trade barriers can create headwinds. For Cathay Biotech, this means potential impacts on the pricing and competitiveness of its key products, such as long-chain dibasic acids and bio-based pentanediamine, in international markets.

Changes in trade relations can also affect the supply chain for critical inputs like enzymes and biomass. For example, disruptions or increased duties on imports from key suppliers could lead to higher production expenses and potentially limit market access for Cathay Biotech's innovative bio-based solutions.

National industrial policies are increasingly targeting strategic emerging sectors, with biotechnology, especially synthetic biology and bio-based materials, receiving significant attention globally, including in China. This focus often translates into preferential treatment for companies in these fields.

For Cathay Biotech, this means potential benefits like expedited regulatory approvals for new production sites and access to specialized industrial zones designed to foster circular economy practices. These policies create a more conducive environment for growth and innovation in the bio-manufacturing sector.

In 2023, China's central government continued to emphasize high-quality development and technological self-reliance, with biotechnology identified as a critical area. While specific subsidies for Cathay Biotech aren't publicly detailed, the broader policy landscape suggests a supportive framework for its large-scale synthetic biology projects, aiming to bolster domestic production of advanced bio-materials.

Environmental Regulations and Incentives

Political decisions concerning environmental protection and climate change are significantly shaping the demand for sustainable alternatives. Governments globally are enacting stricter regulations aimed at curbing carbon emissions, fostering circular economy principles, and phasing out fossil fuel-based chemicals. For instance, the European Union's Green Deal, with its ambitious targets for climate neutrality by 2050, is driving substantial investment in bio-based industries.

These evolving policies create a robust market demand for Cathay Biotech's bio-based materials. Industries are actively seeking compliant solutions to meet new environmental mandates and capitalize on government incentives for adopting green technologies and products. This regulatory push is a key driver for Cathay Biotech's growth as companies across sectors look to reduce their environmental footprint.

Key political influences include:

- Government mandates for reduced carbon emissions: Many nations, including China, are setting ambitious carbon reduction targets, encouraging the adoption of bio-based alternatives.

- Circular economy initiatives: Policies promoting waste reduction and resource efficiency create opportunities for bio-based materials derived from renewable feedstocks.

- Subsidies and tax credits for green products: Governments are offering financial incentives to companies that invest in and utilize sustainable technologies and materials, directly benefiting bio-manufacturers like Cathay Biotech.

- International climate agreements: Pledges made under agreements like the Paris Agreement translate into national policies that favor environmentally friendly industrial practices.

Geopolitical Stability and Supply Chain Resilience

Global geopolitical stability is a cornerstone for maintaining robust supply chains, essential for companies like Cathay Biotech. Unforeseen international conflicts or rising trade tensions can significantly affect the availability and pricing of critical raw materials, impacting production costs. For instance, in 2024, disruptions in key agricultural regions due to regional conflicts led to a reported 15% increase in the cost of certain bio-based feedstock components for some manufacturers.

These geopolitical shifts also pose challenges to the efficient distribution of finished bio-based products to international markets. Trade disputes can introduce tariffs or non-tariff barriers, hindering market access and potentially increasing delivery times. Cathay Biotech's reliance on global markets for both inputs and sales means that maintaining supply chain resilience through diversification is paramount to navigating these political uncertainties.

To mitigate these risks, Cathay Biotech likely focuses on several strategies:

- Diversifying sourcing locations for key raw materials to reduce dependence on any single region.

- Building strategic partnerships with suppliers in politically stable areas.

- Investing in localized production capabilities where feasible to shorten supply chains.

- Monitoring geopolitical developments closely to anticipate potential disruptions and adjust strategies proactively.

China's supportive policies, particularly the 14th Five-Year Plan, champion bio-based industries, offering R&D funding and tax incentives to companies like Cathay Biotech. These national strategies align with Cathay Biotech's focus on sustainable, bio-based materials, fostering a favorable environment for growth and innovation.

International trade policies and geopolitical stability significantly impact Cathay Biotech's operations. Trade tensions can increase raw material costs and affect market access, as seen in 2024 with a 15% rise in some bio-based feedstock components due to regional conflicts. Diversifying supply chains and monitoring global developments are crucial for mitigating these political risks.

Government mandates for reduced carbon emissions and circular economy initiatives create substantial market demand for bio-based alternatives. For instance, the EU's Green Deal drives investment in bio-industries, benefiting companies like Cathay Biotech by encouraging the adoption of green technologies and products to meet environmental regulations.

| Political Factor | Impact on Cathay Biotech | Supporting Data/Examples |

|---|---|---|

| Chinese Industrial Policy (14th FYP) | Favorable for bio-based growth, R&D funding, tax incentives | National strategy emphasizes synthetic biology and resource recycling. |

| International Trade Policies/Tariffs | Increased raw material costs, potential market access barriers | Trade tensions can raise costs of imported equipment and feedstock. |

| Global Climate Agreements (e.g., Paris Agreement) | Increased demand for bio-based materials due to emission reduction goals | Drives adoption of green technologies and sustainable alternatives. |

| Geopolitical Stability | Affects supply chain reliability and raw material pricing | 2024 regional conflicts led to a ~15% increase in some feedstock costs. |

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Cathay Biotech, examining political, economic, social, technological, environmental, and legal influences. It provides a comprehensive understanding of the landscape, highlighting potential threats and opportunities for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Cathay Biotech's external environment to mitigate potential disruptions.

Economic factors

The global bio-based materials market is on a significant upswing, fueled by a growing preference for sustainable options across numerous sectors. This burgeoning demand presents a prime environment for companies like Cathay Biotech that specialize in eco-friendly alternatives.

Market forecasts highlight this rapid expansion, with projections showing the market valued at around $38.16 billion in 2024 and expected to reach $47.42 billion by 2025. This represents a substantial compound annual growth rate of 24.3%, underscoring the market's dynamic trajectory.

This robust growth trajectory offers a considerable advantage for Cathay Biotech, whose portfolio of high-performance bio-based products aligns perfectly with the global shift towards more environmentally responsible materials and manufacturing processes.

While bio-based materials offer sustainability advantages, the cost of their biomass feedstocks can be subject to volatility. This volatility is often influenced by agricultural production cycles, unpredictable climate conditions, and competing industrial or food uses for the same biomass. For Cathay Biotech, this means that fluctuations in the price of key inputs like corn or soybeans can directly impact their cost of goods sold.

Cathay Biotech's profitability in 2024 saw a notable improvement, partly attributed to a decrease in raw material prices. For instance, reports indicated a softening in corn prices during parts of 2024, a key feedstock for many bio-fermentation processes. This cost reduction directly flowed through to improved profit margins for the company.

Effectively managing these input costs is crucial for Cathay Biotech's long-term success. Strategies like diversifying feedstock sources to reduce reliance on a single commodity, or investing in technologies to optimize conversion efficiency and yield from existing feedstocks, are vital. These measures help maintain competitive pricing and ensure stable profit margins, even amidst market fluctuations.

The biotechnology sector, especially synthetic biology, is a magnet for investment, signaling strong belief in its ability to tackle worldwide issues. Venture capital funding in biotech experienced a notable increase in 2024, with projections indicating sustained growth into 2025, though the trend leans towards more substantial, later-stage investments.

This robust investment environment offers Cathay Biotech a favorable landscape for securing capital to fuel its expansion, research and development initiatives, and the formation of strategic alliances, thereby bolstering its growth prospects.

Inflation and Interest Rate Environment

The macroeconomic landscape, particularly inflation and interest rates, significantly influences Cathay Biotech's operations. High interest rates in 2024, for instance, prompted investors to become more discerning, favoring companies with lower risk profiles.

Despite these challenges, Cathay Biotech demonstrated robust financial health in 2024, achieving a 33% increase in profit and a 40% rise in revenue. This performance underscores the company's ability to navigate economic headwinds.

Effective capital management remains crucial for Cathay Biotech's continued expansion. The company must strategically allocate resources to maintain its growth trajectory amidst evolving economic conditions.

- Inflationary pressures can increase raw material and operational costs for Cathay Biotech.

- Interest rate hikes in 2024 impacted borrowing costs and investor sentiment towards growth companies.

- Cathay Biotech's 2024 financial results showed resilience with profit up 33% and revenue up 40%.

- Strategic capital allocation is essential for sustained growth in a dynamic interest rate environment.

Competition and Pricing Pressures

The bio-based materials sector is experiencing a surge in new entrants, with both large chemical corporations and agile startups vying for market share. This heightened competition, particularly as the market for sustainable products grows, could lead to significant pricing pressures. Companies will need to balance the premium consumers might pay for eco-friendly options against the cost competitiveness of traditional petrochemical alternatives.

Cathay Biotech, a key player in this space, faces the challenge of maintaining its competitive advantage amidst this intensifying rivalry. To secure and grow its market share, the company must effectively leverage its established technological expertise and optimize its production processes. For instance, in 2023, the global bio-based chemicals market was valued at approximately USD 100 billion and is projected to grow significantly, underscoring the competitive landscape Cathay operates within.

- Intensifying Competition: The bio-based materials market is becoming increasingly crowded with new players.

- Pricing Dilemma: Balancing demand for sustainable products with the need to compete on price against petrochemicals is crucial.

- Cathay's Strategy: Leveraging technological leadership and production efficiencies is key for Cathay Biotech to thrive.

The global bio-based materials market is expanding rapidly, with projections indicating a value of approximately $38.16 billion in 2024 and an anticipated rise to $47.42 billion by 2025, reflecting a strong 24.3% CAGR. This growth trajectory is a significant tailwind for Cathay Biotech, aligning with the increasing demand for sustainable alternatives. However, feedstock price volatility, influenced by agricultural cycles and climate, directly impacts Cathay's cost of goods sold, as seen with fluctuations in corn prices affecting 2024 profitability.

| Factor | 2024 Data/Trend | 2025 Outlook | Impact on Cathay Biotech |

|---|---|---|---|

| Bio-based Materials Market Growth | Valued at $38.16 billion (2024) | Projected at $47.42 billion (2025) | Strong market demand for Cathay's products |

| Feedstock Price Volatility | Softening corn prices noted in parts of 2024 | Potential for continued fluctuations | Direct impact on cost of goods sold and profit margins |

| Biotech Investment | Increased venture capital funding in 2024, favoring later-stage investments | Sustained growth expected | Favorable for securing capital for expansion and R&D |

Preview the Actual Deliverable

Cathay Biotech PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Cathay Biotech provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It's a vital tool for understanding the external landscape and identifying potential opportunities and threats.

Sociological factors

A significant and growing societal trend is the increasing consumer demand for sustainable and eco-friendly products. Surveys in early 2024 indicated that over 60% of consumers globally are actively seeking out brands with strong environmental commitments.

This preference is translating into purchasing power, with data from late 2024 suggesting a willingness for a substantial portion of these consumers to pay a premium of up to 15% for ethically sourced or sustainably produced goods. This societal shift directly boosts the market for Cathay Biotech's bio-based materials, as downstream industries seek sustainable building blocks to align with consumer preferences and enhance their own brand loyalty.

Public perception of biotechnology, particularly synthetic biology, significantly shapes market acceptance and regulatory landscapes. While the environmental advantages of bio-based materials often garner positive sentiment, apprehension regarding genetic modification or large-scale industrial applications can emerge.

For Cathay Biotech, proactively addressing public concerns is vital. Transparent communication highlighting the safety, sustainability, and tangible benefits of their synthetic biology innovations is key to building and maintaining trust with consumers and stakeholders.

Societal expectations are increasingly pushing companies towards robust Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) frameworks. This trend directly fuels demand for sustainable supply chains and bio-based ingredients, a core offering of Cathay Biotech.

Cathay Biotech's high-performance bio-based materials contribute to reduced carbon emissions and overall environmental impact. For instance, their bio-based diols can offer a significant reduction in greenhouse gas emissions compared to petrochemical alternatives, helping customers meet their own ambitious sustainability targets and solidifying Cathay Biotech's role in the expanding green economy.

Workforce Development and Talent Acquisition

The synthetic biology and bio-based materials sectors are experiencing rapid expansion, creating a demand for highly specialized skills. This necessitates a focus on workforce development and talent acquisition for companies like Cathay Biotech. The challenge lies in attracting and retaining individuals with expertise in areas such as synthetic biology, chemical engineering, and advanced manufacturing, crucial for innovation and scaling operations.

Cathay Biotech's success hinges on its ability to cultivate and recruit a skilled professional base. This might involve strategic collaborations with universities and technical colleges to develop tailored training programs. For instance, as of late 2024, the global synthetic biology market was projected to reach over $10 billion, underscoring the need for a robust talent pipeline.

- Skilled Labor Demand: The growth in bio-based industries requires specialized expertise in fields like synthetic biology and chemical engineering.

- Talent Acquisition Challenges: Attracting and retaining top talent in these niche areas presents a significant hurdle for companies.

- Partnership Potential: Collaborations with academic institutions can address talent gaps through targeted training and development initiatives.

- Market Growth Indicator: The expanding synthetic biology market, valued in the billions by late 2024, highlights the critical need for skilled professionals.

Changing Lifestyles and Product Preferences

Evolving consumer lifestyles, especially among millennials and Gen Z, are increasingly prioritizing health, environmental responsibility, and sustainable sourcing. This shift directly influences product demand, favoring items derived from renewable resources with a reduced ecological impact. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for sustainable products, a trend expected to grow.

Cathay Biotech's strategic alignment with these changing preferences is evident in its development of bio-based materials. These innovations serve high-performance polymers, engineering plastics, coatings, and adhesives markets. By offering these alternatives, Cathay Biotech empowers its clients to meet the growing consumer appetite for greener, more responsible product offerings.

The company's product portfolio directly addresses this demand:

- Bio-based monomers for polymers: Catering to the demand for sustainable plastics.

- Renewable ingredients for coatings and adhesives: Meeting the need for eco-friendly construction and manufacturing inputs.

- Focus on biodegradability and reduced carbon footprint: Aligning with consumer environmental consciousness.

Societal trends are increasingly favoring sustainability, with a significant portion of consumers, over 60% as of early 2024, actively seeking eco-friendly products and willing to pay a premium. This directly benefits Cathay Biotech's bio-based materials, aligning with downstream industries' need for sustainable components. Public perception of biotechnology, while generally positive for environmental benefits, requires proactive communication from companies like Cathay Biotech to address potential concerns about genetic modification. The growing emphasis on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) frameworks further amplifies demand for bio-based ingredients and sustainable supply chains, areas where Cathay Biotech excels by offering products that reduce carbon footprints.

| Societal Factor | Impact on Cathay Biotech | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Consumer Demand for Sustainability | Increased market for bio-based materials | >60% of consumers actively seek eco-friendly products; willingness to pay up to 15% premium for sustainable goods. |

| Public Perception of Biotechnology | Need for transparent communication on safety and benefits | Apprehension regarding genetic modification can emerge, requiring proactive engagement. |

| Emphasis on CSR/ESG | Drives demand for sustainable supply chains and ingredients | Cathay Biotech's bio-based products contribute to reduced carbon emissions, aiding customer ESG goals. |

| Evolving Lifestyles (Millennials/Gen Z) | Preference for health, environmental responsibility, and sustainable sourcing | Cathay Biotech's portfolio of bio-based monomers and renewable ingredients directly meets these preferences. |

Technological factors

Cathay Biotech's foundation is built on sophisticated synthetic biology and fermentation. Recent breakthroughs in CRISPR gene editing, for instance, are accelerating the development of novel microbial strains capable of producing high-value chemicals more efficiently. This technological edge is crucial for Cathay to expand its portfolio of bio-based materials.

Cathay Biotech's commitment to innovation is evident in its significant investment in research and development, crucial for maintaining leadership in the bio-based materials sector. The company's advancements in green long-chain diacid technology and bio-based high-temperature polyamides highlight this dedication. For instance, in 2023, Cathay Biotech reported substantial R&D expenditure, a key driver for its competitive edge and future growth.

Cathay Biotech's technological prowess in developing and industrializing novel high-performance bio-based materials is a significant advantage. Their focus on long-chain dibasic acids and bio-based pentanediamine positions them as a key supplier for advanced polymers and engineering plastics.

The company's ability to innovate is evident in advancements like bio-based polyamide continuous fiber composite materials. These materials are opening up new market avenues in demanding sectors such as new energy vehicles, aerospace, and high-rise construction, reflecting a growing demand for sustainable and high-performance alternatives.

Process Optimization and Production Efficiency

Technological advancements in process optimization are key for Cathay Biotech to boost production efficiency and lessen its environmental footprint. This includes adopting clean energy solutions and streamlining manufacturing processes. For instance, Cathay Biotech's commitment to smart bio-manufacturing and refining its bio-based industrial chain is geared towards delivering better, lower-carbon products.

This drive for greater efficiency directly translates to improved cost-effectiveness and the ability to scale up production. Consequently, bio-based products become more competitive when compared to traditional petrochemical options. By mid-2024, Cathay Biotech reported significant progress in integrating advanced automation, leading to an estimated 15% reduction in energy consumption across key production lines.

- Smart Bio-manufacturing: Cathay Biotech is investing in intelligent systems to enhance control and yield in its fermentation processes.

- Process Simplification: Efforts are underway to reduce the number of steps in key bio-production pathways, cutting down on waste and energy use.

- Clean Energy Integration: The company is exploring and implementing renewable energy sources to power its manufacturing facilities, aiming for a 20% increase in renewable energy usage by the end of 2025.

- Cost Reduction: Enhanced efficiency in 2024 led to an average cost reduction of 8% for its bio-based polymers, making them more attractive to a wider market.

Intellectual Property Landscape and Protection

Cathay Biotech's competitive edge hinges on its robust intellectual property (IP) portfolio, encompassing patents for synthetic biology strains, advanced fermentation techniques, and unique material compositions. This strong IP foundation is crucial for maintaining market leadership in the rapidly evolving biotechnology sector.

The intellectual property landscape in China's biotech industry is experiencing a significant upswing in protection and out-licensing activities. This trend underscores the growing importance of safeguarding innovations and leveraging them through strategic partnerships.

To secure its market position and monetize proprietary technologies, Cathay Biotech must implement rigorous patenting strategies. This proactive approach is essential for defending its innovations and creating revenue streams from its technological advancements.

- Patented Synthetic Biology Strains: Cathay Biotech holds numerous patents on genetically engineered microorganisms used in biomanufacturing, a key differentiator.

- Fermentation Process Patents: Proprietary fermentation methods are protected, ensuring efficiency and cost-effectiveness in production.

- Novel Material Composition Patents: Innovations in bio-based materials are safeguarded, opening avenues for new product development and market entry.

- Increased IP Filings in China: China's patent applications in biotechnology saw a substantial increase, with over 60,000 applications filed in 2023, highlighting the competitive IP environment.

Cathay Biotech's technological foundation in synthetic biology and fermentation is continually enhanced by advancements like CRISPR gene editing, enabling more efficient production of high-value chemicals. The company's substantial R&D investments in 2023, particularly in green long-chain diacid technology, underscore its commitment to innovation and maintaining a competitive edge in the bio-based materials market.

Cathay Biotech's focus on process optimization, including smart bio-manufacturing and clean energy integration, is driving production efficiency and reducing its environmental footprint. By mid-2024, the company achieved an estimated 15% reduction in energy consumption on key production lines through advanced automation, making its bio-based products more cost-competitive against petrochemical alternatives.

| Technology Area | Key Innovation | Impact/Benefit | 2024/2025 Data Point |

|---|---|---|---|

| Synthetic Biology | CRISPR Gene Editing | Accelerated development of novel microbial strains | Ongoing R&D for strain improvement |

| Process Optimization | Smart Bio-manufacturing & Automation | Increased production efficiency, reduced energy consumption | 15% energy reduction achieved by mid-2024 |

| Material Science | Bio-based Polyamides | Development of high-performance materials for advanced applications | Expansion into new energy vehicle components |

| Sustainability | Clean Energy Integration | Reduced environmental footprint, lower carbon products | Targeting 20% increase in renewable energy usage by end of 2025 |

Legal factors

Cathay Biotech navigates a complex web of environmental regulations, especially in chemical manufacturing and waste handling. China's revised environmental impact assessment rules for new construction projects, along with tighter emission standards for chemical firms, directly influence Cathay Biotech's operational landscape. For instance, by the end of 2023, China had implemented over 300 new environmental standards, many targeting industrial emissions and waste discharge, necessitating significant investment in compliance technologies.

Adherence to these evolving environmental mandates is non-negotiable for Cathay Biotech. This requires ongoing surveillance of its environmental performance and flexible adjustments to manufacturing methods to reduce its ecological impact. The company's commitment to sustainability is reflected in its 2024 sustainability report, which details a 15% reduction in wastewater discharge intensity compared to 2022 levels, demonstrating proactive adaptation to regulatory pressures.

The manufacturing and distribution of bio-based materials by Cathay Biotech are governed by stringent product safety and quality standards. These regulations ensure that bio-based polymers, engineering plastics, coatings, and adhesives meet performance specifications and are safe for their intended uses. For instance, compliance with standards like ISO 13485 for medical devices or REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe is vital for market acceptance and avoiding potential liabilities.

Intellectual property laws are critical for Cathay Biotech, protecting its synthetic biology strains and fermentation processes. China's commitment to strengthening IP protection, with updated regulations and enhanced enforcement, is a positive development. For instance, China's Supreme People's Court reported a 15% increase in IP infringement cases handled in 2023, highlighting more robust legal recourse.

Chemical Substance Registration and Regulation

The production and use of new chemical substances, including bio-based materials like those Cathay Biotech develops, are strictly regulated. In 2024, China's Ministry of Ecology and Environment (MEE) reinforced the connection between new chemical substance registration and environmental impact assessment approvals, particularly for critical industrial sectors. This means Cathay Biotech must diligently ensure all its innovative bio-based products meet the requirements of chemical substance inventory regulations and secure the necessary registrations before they can be introduced or expanded into new markets.

Compliance with these regulations is crucial for market access and continued operation. For instance, companies introducing new chemical substances in China must navigate the Measures on the Environmental Management Registration of New Chemical Substances (MEE Order No. 12), which outlines detailed requirements for data submission and risk assessment. Failure to comply can result in significant penalties, including production bans and fines, impacting Cathay Biotech's growth trajectory and reputation.

- Registration Requirements: Cathay Biotech must adhere to MEE Order No. 12 for all novel bio-based chemicals, providing comprehensive data on physical-chemical properties, toxicology, and ecotoxicology.

- Environmental Impact Assessment: Integration of environmental impact assessments with new chemical registration is mandatory, requiring thorough evaluation of potential ecological effects.

- Market Access: Obtaining necessary registrations, such as inclusion in the Inventory of Existing Chemical Substances in China (IECSC) or new substance notification, is a prerequisite for commercialization.

- Ongoing Compliance: Post-registration, Cathay Biotech needs to maintain compliance with reporting obligations and any updated regulatory frameworks introduced by the MEE.

Labor Laws and Workplace Safety

Cathay Biotech, as an industrial biotechnology firm, must navigate China's evolving labor laws, particularly those concerning workplace safety within chemical manufacturing. These regulations are critical for ensuring employee well-being and operational integrity.

New mandatory national standards for safe production in hazardous chemical enterprises, set to take effect in November 2025, will require significant investment in digital safety management systems and advanced process technologies. For instance, compliance may necessitate upgrades to real-time monitoring equipment and automated safety protocols, reflecting a broader trend towards digitalization in industrial safety management.

- Worker Safety Compliance: Adherence to national labor laws and specific workplace safety mandates in chemical production is paramount.

- Digital Safety Systems: The upcoming November 2025 standards emphasize the implementation of digital safety management systems.

- Technological Investment: Companies like Cathay Biotech will need to invest in advanced process technologies to meet new safety benchmarks.

- Risk Mitigation: Non-compliance can lead to severe legal penalties and operational disruptions, impacting Cathay Biotech's financial performance and reputation.

Cathay Biotech operates within a legal framework that emphasizes intellectual property protection, crucial for its innovative bio-based materials and synthetic biology advancements. China's continuous efforts to strengthen IP laws, evidenced by a reported 15% rise in IP infringement cases handled in 2023 by the Supreme People's Court, offer a more robust environment for safeguarding its proprietary technologies.

Environmental factors

China's 14th Five-Year Plan (2021-2025) strongly emphasizes circular economy principles, aiming to boost resource efficiency and establish robust recycling systems. This national directive creates a favorable environment for companies like Cathay Biotech that offer sustainable solutions.

Cathay Biotech's bio-based materials, such as bio-based 1,3-propanediol (PDO) and bio-based 1,4-butanediol (BDO), directly align with these environmental goals by providing renewable alternatives to petroleum-derived chemicals. For instance, Cathay Biotech is a leading global producer of bio-PDO, with significant production capacity that contributes to reducing reliance on fossil fuels.

The company's commitment to ecodesign and resource recycling supports China's broader objectives of building a more sustainable industrial framework. By offering biodegradable and renewable material options, Cathay Biotech empowers downstream industries to meet increasing consumer and regulatory demands for environmentally responsible products.

Global and national targets for reducing carbon emissions are increasingly pushing industries towards low-carbon solutions, which in turn boosts demand for bio-based materials. Cathay Biotech's innovative green long-chain diacid technology, for instance, is recognized for its substantial carbon emission reductions, aligning with these environmental mandates.

By offering materials that actively lower the carbon footprint of finished goods, Cathay Biotech directly supports other industries in meeting their critical emissions reduction commitments and advancing towards net-zero objectives. For example, the company's bio-based 1,10-decanediol (DD) production process can reduce greenhouse gas emissions by up to 70% compared to traditional petrochemical routes, according to company reports from early 2024.

Governments worldwide are intensifying waste management and recycling mandates, driven by growing concerns over plastic pollution and landfill capacity. This regulatory push, coupled with increasing public demand for sustainable solutions, is fueling the market for biodegradable, compostable, and recyclable materials. For example, the global bio-based packaging market was valued at approximately USD 275 billion in 2023 and is projected to reach over USD 500 billion by 2030, demonstrating a clear shift towards eco-friendly alternatives.

Cathay Biotech's strategic emphasis on developing bio-based materials that support a circular economy, such as potentially recyclable or compostable polymers, positions it favorably within this evolving regulatory landscape. The company's innovations in materials like PLA (polylactic acid) and PHA (polyhydroxyalkanoates) directly address the need for alternatives to traditional petroleum-based plastics, aligning with the global imperative to reduce waste and promote sustainable material flows.

Resource Scarcity and Sustainable Sourcing

Growing concerns about the depletion of finite fossil resources are increasingly emphasizing the need for renewable and sustainably sourced materials. Cathay Biotech's strategic focus on synthetic biology for the industrial production of bio-based materials directly addresses this global challenge by efficiently utilizing biomass resources.

Ensuring a stable, ethical, and sustainable supply of biomass feedstock is paramount for Cathay Biotech's long-term environmental sustainability and operational viability. For instance, the global bio-based chemicals market, projected to reach USD 1.2 trillion by 2030 according to some estimates, underscores the significant demand for such materials.

- Biomass Feedstock: Cathay Biotech relies on agricultural byproducts and other renewable organic matter, requiring robust supply chain management to ensure consistent quality and availability.

- Resource Efficiency: The company's synthetic biology platforms aim to maximize yield from biomass, reducing waste and the overall environmental footprint of its production processes.

- Market Trends: Consumer and regulatory pressure for sustainable products is a key driver for Cathay Biotech's bio-based material offerings, with a growing preference for eco-friendly alternatives.

- Supply Chain Risks: Potential disruptions due to climate change, geopolitical factors, or agricultural issues impacting biomass availability pose a significant risk to operations.

Biodiversity Protection and Ethical Sourcing

The increasing global demand for biomass resources, crucial for companies like Cathay Biotech, brings a heightened focus on biodiversity protection and ethical sourcing. This is vital to prevent negative impacts such as deforestation, habitat destruction, and the diversion of land from food production. For instance, the UN's Food and Agriculture Organization (FAO) reported in 2023 that deforestation rates, while slowing, still represent a significant global challenge, underscoring the need for responsible land use in biomass acquisition.

Ensuring Cathay Biotech's biomass sourcing practices are environmentally sound is paramount for its reputation and long-term viability. This commitment extends beyond mere carbon footprint reduction, aligning with broader ecological preservation goals. A recent 2024 report by the World Wildlife Fund (WWF) highlighted that sustainable sourcing can directly contribute to maintaining ecosystem services, which are critical for many industries.

Cathay Biotech's approach to sourcing its raw materials, even if not explicitly detailed, must consider the ethical implications for local communities and ecosystems. The company's adherence to principles that safeguard biodiversity and ensure fair practices will be a key differentiator. For example, many leading biotechnology firms are now seeking certifications like those from the Roundtable on Sustainable Biomaterials (RSB) to validate their responsible practices, a trend likely to grow through 2025.

The environmental factors impacting Cathay Biotech's operations include:

- Biodiversity Protection: Ensuring biomass cultivation does not lead to habitat fragmentation or loss of endangered species.

- Ethical Sourcing: Verifying that raw materials are obtained without displacing local communities or exacerbating food insecurity.

- Sustainable Land Use: Prioritizing biomass sources that do not compete with food crops or require conversion of high-conservation-value land.

- Supply Chain Transparency: Implementing robust tracking mechanisms to guarantee the environmental and social integrity of all biomass inputs.

China's national push for a circular economy, emphasized in its 14th Five-Year Plan, directly benefits Cathay Biotech by promoting resource efficiency and recycling systems. The company's bio-based materials like bio-PDO and bio-BDO offer renewable alternatives, aligning with these sustainability goals and reducing reliance on fossil fuels.

Global and national efforts to cut carbon emissions are increasing demand for low-carbon solutions, a trend that Cathay Biotech capitalizes on with its innovative green long-chain diacid technology, which significantly reduces carbon emissions. For example, their bio-based 1,10-decanediol (DD) production process can lower greenhouse gas emissions by up to 70% compared to traditional petrochemical methods, as reported in early 2024.

Growing concerns about plastic pollution and landfill capacity are driving stricter waste management and recycling mandates worldwide, fueling the market for biodegradable and recyclable materials. Cathay Biotech's focus on materials like PLA and PHA directly addresses this demand for sustainable alternatives to conventional plastics.

The company's reliance on biomass feedstock necessitates careful management of supply chains to ensure consistent quality and ethical sourcing, especially given increasing global demand for these resources. Factors like climate change and land use for food production present potential risks to biomass availability, highlighting the importance of sustainable land use practices.

| Environmental Factor | Impact on Cathay Biotech | Key Data/Trend (2023-2025) |

|---|---|---|

| Circular Economy Push | Favorable demand for bio-based materials | China's 14th Five-Year Plan (2021-2025) emphasizes resource efficiency. |

| Carbon Emission Reduction Targets | Increased demand for low-carbon solutions | Bio-based DD production can reduce GHG emissions by up to 70% (early 2024 reports). |

| Waste Management & Recycling Mandates | Growth in biodegradable/recyclable materials market | Global bio-based packaging market valued at ~$275 billion in 2023, projected to exceed $500 billion by 2030. |

| Biomass Feedstock Availability & Sourcing | Supply chain risk and opportunity | Focus on ethical sourcing and biodiversity protection; UN FAO reported deforestation challenges in 2023. |

PESTLE Analysis Data Sources

Our Cathay Biotech PESTLE analysis is constructed using a blend of publicly available data from reputable financial institutions, government regulatory bodies, and leading industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.