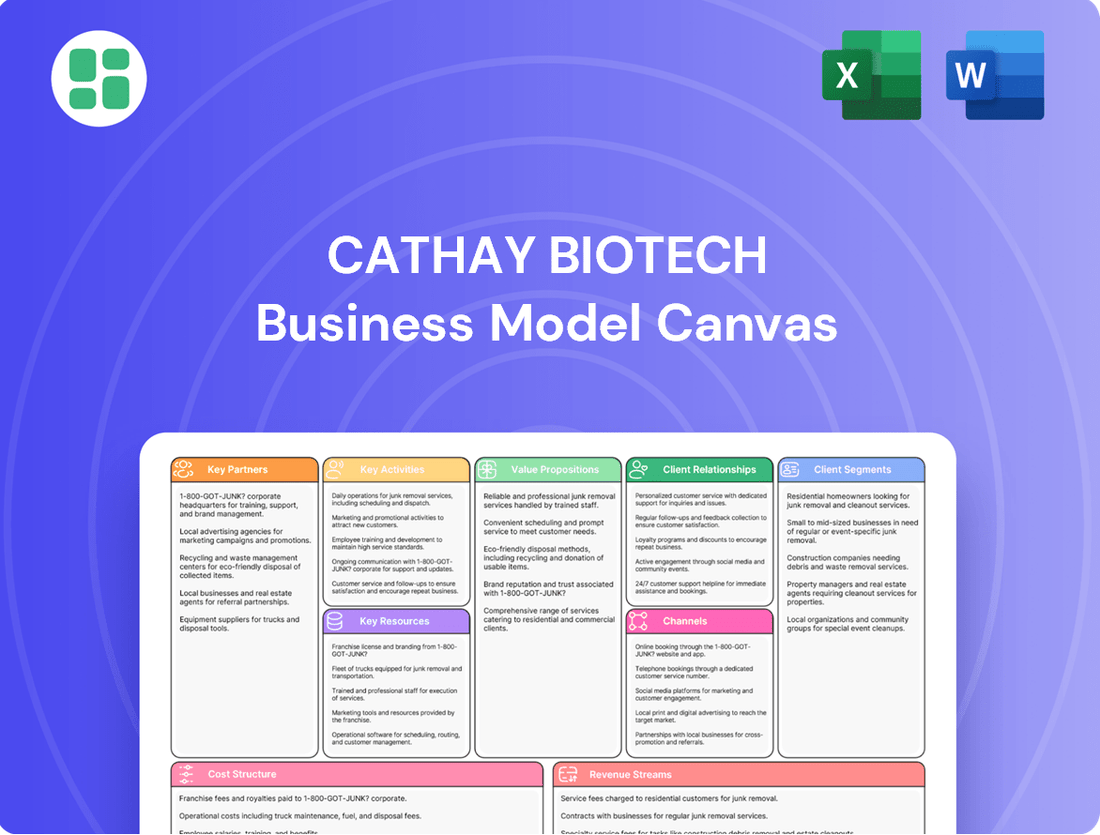

Cathay Biotech Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Biotech Bundle

Discover the strategic core of Cathay Biotech's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their value proposition, customer relationships, and revenue streams, offering a clear roadmap for their industry dominance. Perfect for anyone seeking to understand and replicate such impactful business strategies.

Partnerships

Cathay Biotech actively pursues strategic research and development collaborations with leading academic institutions and specialized research organizations. These partnerships are crucial for enhancing its synthetic biology platforms and identifying new bio-based materials. For instance, in 2024, the company continued its engagement with several universities known for their work in industrial biotechnology, aiming to accelerate the discovery of novel enzymes and metabolic pathways.

These collaborations are designed to fast-track innovation and significantly broaden Cathay Biotech's intellectual property portfolio. By pooling resources and expertise, these joint research projects are instrumental in achieving breakthroughs in sustainable chemical production methods. This strategic approach ensures Cathay Biotech maintains a strong competitive advantage in the dynamic and rapidly evolving biotechnology sector.

Cathay Biotech's success hinges on strong relationships with its raw material suppliers, particularly for bio-based feedstocks like corn and soybeans. In 2024, the company continued to emphasize securing stable and sustainable sources, understanding that a consistent supply chain is paramount for its industrial fermentation operations. These partnerships are not just about volume; they are crucial for cost management and achieving the company's environmental, social, and governance (ESG) targets.

Cathay Biotech strategically partners with companies seeking to license its proprietary synthetic biology technologies and advanced production methods. This approach broadens the market penetration of their eco-friendly solutions, such as bio-based 1,3-propanediol (PDO), without requiring Cathay to invest in additional manufacturing capacity. For instance, in 2023, the company continued to explore licensing opportunities for its PDO technology, a key component in producing high-performance polymers like PTT.

These licensing agreements not only create new revenue streams but also serve as crucial validation for Cathay Biotech's innovative platforms. By enabling other manufacturers to utilize their patented processes, Cathay demonstrates the commercial viability and scalability of its synthetic biology advancements. This is particularly relevant for their bio-based materials, which are gaining traction as sustainable alternatives in various industries.

Distribution and Sales Network Partners

Cathay Biotech leverages its distribution and sales network partners to effectively reach diverse customer bases across various industries and geographies. These collaborations are vital for market penetration and expanding the reach of their bio-based materials.

By teaming up with established distributors and sales agents, Cathay Biotech gains invaluable local market intelligence and logistical capabilities. This allows for more efficient access to potential buyers, particularly in new or specialized market segments. For instance, in 2023, the company reported significant growth in its international sales, partly attributed to strengthening its distribution partnerships in Europe and North America.

- Access to Local Expertise: Partners provide insights into regional customer preferences and regulatory landscapes, facilitating smoother market entry.

- Logistical Efficiency: Distributors manage warehousing and transportation, ensuring timely delivery of bio-based products to end-users.

- Expanded Market Reach: Sales agents tap into their existing client networks, accelerating customer acquisition for Cathay Biotech's offerings.

- Scalability Support: These partnerships are fundamental in scaling sales volumes and solidifying market presence for innovative bio-materials.

Co-development and Application Partners

Cathay Biotech actively collaborates with downstream manufacturers, including those in the polymer and engineering plastics sectors. This co-development approach ensures their bio-based materials, like long-chain dibasic acids and bio-based pentanediamine, are perfectly suited for new applications, speeding up market entry. For instance, in 2023, Cathay Biotech announced a partnership with a major automotive supplier to integrate their bio-based polyamides into lightweight vehicle components, aiming to reduce vehicle weight by up to 10%.

These partnerships are crucial for tailoring solutions to precise customer requirements and unlocking novel market avenues. Through close technical exchanges, Cathay Biotech and its partners integrate these advanced bio-materials into innovative end-products, fostering a symbiotic growth environment. In 2024, the company highlighted successful collaborations that led to the launch of new bio-based packaging films with enhanced biodegradability, meeting growing consumer demand for sustainable options.

- Co-development with Polymer Manufacturers: Cathay Biotech partners with companies like BASF and DuPont to integrate bio-based materials into existing product lines, enhancing sustainability profiles.

- Application Testing and Validation: Joint efforts focus on rigorous testing of new applications, ensuring performance and market readiness. For example, in early 2024, a joint project with a textile manufacturer resulted in a new line of bio-based performance wear.

- Market Penetration Acceleration: By working directly with end-product manufacturers, Cathay Biotech gains direct market access and valuable feedback for product refinement.

Cathay Biotech's key partnerships extend to raw material suppliers, ensuring a stable and sustainable feedstock for its bio-manufacturing processes. In 2024, the company continued to focus on securing high-quality corn and soybean supplies, which are fundamental to its industrial fermentation operations. These relationships are vital for cost control and meeting ESG objectives.

The company also actively engages in licensing its proprietary synthetic biology technologies, such as for bio-based 1,3-propanediol (PDO). In 2023, Cathay Biotech pursued further licensing opportunities, enabling other manufacturers to utilize its patented processes and creating new revenue streams while validating its innovative platforms.

Furthermore, Cathay Biotech collaborates with downstream manufacturers, particularly in the polymer sector, to co-develop applications for its bio-based materials. These partnerships, like the one announced in 2023 with an automotive supplier for bio-based polyamides, accelerate market entry and ensure product suitability for specific end-uses.

| Partner Type | Focus Area | 2023/2024 Impact | Strategic Value |

|---|---|---|---|

| Academic & Research Institutions | R&D, Synthetic Biology Platforms | Accelerated discovery of novel enzymes and metabolic pathways. | Enhanced IP portfolio, maintained competitive advantage. |

| Raw Material Suppliers | Feedstock (Corn, Soybeans) | Secured stable and sustainable sources for industrial fermentation. | Cost management, ESG target achievement. |

| Technology Licensees | Synthetic Biology Technologies (e.g., PDO) | Broadened market penetration of eco-friendly solutions. | New revenue streams, validation of platforms. |

| Downstream Manufacturers (e.g., Polymers) | Co-development, Application Integration | Integrated bio-based materials into automotive components and packaging films. | Tailored solutions, unlocked new market avenues. |

What is included in the product

This Cathay Biotech Business Model Canvas provides a detailed blueprint of their operations, focusing on their bio-based materials and fermentation technology.

It outlines their key resources, activities, and customer relationships, highlighting their competitive advantages in sustainable chemical production.

Cathay Biotech's Business Model Canvas serves as a pain point reliver by offering a structured, visual approach to understanding complex operations, enabling quicker identification of inefficiencies and strategic adjustments.

Activities

Cathay Biotech's commitment to Research and Development is a cornerstone of its strategy, fueling innovation in synthetic biology. In 2024, the company continued to invest heavily in exploring novel bio-based materials and refining existing production pathways for industrial application. This focus on R&D is crucial for maintaining its competitive edge and driving long-term growth in the sustainable chemistry sector.

Cathay Biotech's industrial-scale manufacturing hinges on operating and optimizing extensive fermentation and purification facilities. These operations are crucial for the efficient production of key products like long-chain dibasic acids and bio-based pentanediamine.

This involves robust process engineering, stringent quality control measures, and meticulous supply chain management to guarantee consistent and high-quality output. For instance, in 2023, Cathay Biotech reported significant production volumes, with their bio-based polyamide 1010 (PA1010) production capacity reaching 50,000 tons per annum, underscoring their manufacturing scale.

Achieving manufacturing efficiency is paramount for Cathay Biotech to effectively meet growing market demand and maintain a competitive edge on cost. Their commitment to optimizing these large-scale processes directly impacts their ability to deliver sustainable and cost-effective bio-based materials to a global market.

Cathay Biotech's intellectual property management is centered on safeguarding its core innovations. This includes securing patents for its proprietary synthetic biology strains, novel production processes, and unique product formulations. For instance, as of late 2024, the company actively manages a significant patent portfolio, with a notable portion dedicated to its advancements in bio-based materials.

The company invests heavily in ongoing legal efforts to protect these innovations not only domestically but also on a global scale. This strategic approach to intellectual property is fundamental to maintaining their competitive edge in the biotechnology sector and ensuring the long-term value derived from their substantial research and development expenditures.

Global Sales and Marketing

Cathay Biotech's global sales and marketing efforts focus on promoting its bio-based materials to a worldwide industrial customer base. This crucial activity drives revenue by identifying key markets, cultivating strong customer relationships, and highlighting the superior performance and environmental advantages of their innovative products.

Effective global outreach is paramount for market penetration and sustained growth. For instance, Cathay Biotech's commitment to innovation in bio-based materials, such as its long-chain dibasic acids (LCDAs), has seen increasing adoption across various sectors. In 2024, the demand for sustainable alternatives in industries like automotive and textiles continued to rise, directly benefiting companies like Cathay Biotech that offer such solutions.

- Market Identification: Targeting specific industries and geographical regions with high demand for bio-based alternatives.

- Customer Relationship Management: Building and maintaining strong partnerships with industrial clients to understand their needs and provide tailored solutions.

- Product Promotion: Showcasing the performance, cost-effectiveness, and sustainability benefits of Cathay Biotech's bio-based materials through targeted campaigns and technical support.

- Sales Channel Development: Establishing and optimizing diverse sales channels, including direct sales, distributors, and online platforms, to reach a global customer base efficiently.

Quality Control and Assurance

Cathay Biotech implements rigorous quality control throughout its bio-based material production. This includes meticulous raw material inspection and comprehensive final product testing to guarantee high performance and consistency. For instance, in 2024, their commitment to quality led to a 99.5% pass rate on critical performance benchmarks for their bio-based polyamides.

Adherence to international quality standards and certifications is paramount for Cathay Biotech. By maintaining certifications like ISO 9001, they foster customer trust and solidify their standing as a dependable supplier in the global market. This rigorous approach is especially vital for applications demanding exceptional reliability.

- Stringent Production Oversight: From sourcing to shipment, every stage undergoes strict quality checks.

- International Standards Compliance: Certifications like ISO 9001 underscore their commitment to global quality benchmarks.

- Performance Consistency: Ensuring batch-to-batch uniformity is key for demanding industrial applications.

- Customer Trust and Reputation: Verified quality builds confidence and reinforces Cathay Biotech's market position.

Cathay Biotech's key activities encompass robust Research and Development to drive innovation in synthetic biology, alongside large-scale industrial manufacturing utilizing advanced fermentation and purification processes. These are supported by strategic intellectual property management to protect proprietary technologies and extensive global sales and marketing efforts to promote their sustainable bio-based materials. Rigorous quality control is embedded throughout all operations to ensure product excellence and customer trust.

Delivered as Displayed

Business Model Canvas

The Cathay Biotech Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the final deliverable, showcasing the entirety of our strategic framework. You will gain immediate access to this exact file, ready for your review and application.

Resources

Cathay Biotech's proprietary synthetic biology platforms are truly the engine behind their success. These aren't just any platforms; they are unique and patented, built on advanced genetic engineering techniques and sophisticated fermentation processes. This allows them to create specialized bio-based materials with incredible efficiency and sustainability.

This cutting-edge technology is the bedrock of Cathay Biotech's competitive edge. It's what allows them to differentiate their products in a crowded market, offering solutions that are both innovative and environmentally conscious. For instance, their work in producing bio-based diacids, like sebacic acid, through fermentation showcases the power of these platforms.

Cathay Biotech's specialized manufacturing facilities are the backbone of its operations, featuring large-scale industrial fermentation and purification plants. These state-of-the-art facilities are equipped with advanced biotechnology manufacturing capabilities, crucial for the efficient and cost-effective production of key products like long-chain dibasic acids and bio-based pentanediamine.

In 2024, Cathay Biotech continued its commitment to bolstering these assets, with significant ongoing investments in facility upgrades and expansion projects. This strategic focus aims to directly support increased production capacity, ensuring the company can meet growing market demand for its innovative bio-based materials.

Cathay Biotech's success hinges on its highly skilled scientific and engineering talent. This includes expert synthetic biologists, biochemists, chemical engineers, and process engineers who are the backbone of their research and development efforts.

These professionals are instrumental in driving innovation, optimizing complex production processes, and ensuring the high quality and efficacy of Cathay Biotech's bio-based products. Their deep understanding of biological systems and chemical engineering principles allows the company to pioneer new solutions.

In 2023, Cathay Biotech reported a significant portion of its workforce holding advanced degrees, underscoring its commitment to employing top-tier scientific minds. Attracting and retaining this specialized talent is paramount for maintaining their competitive edge in the rapidly evolving biotechnology landscape.

Extensive Intellectual Property Portfolio

Cathay Biotech's extensive intellectual property portfolio acts as a bedrock for its business model. This includes a robust collection of patents, trade secrets, and specialized knowledge concerning their bio-based materials and manufacturing processes. This IP is crucial for safeguarding their novel advancements against imitation by rivals and forms the foundation for potential revenue streams through licensing.

This intellectual property directly strengthens Cathay Biotech's competitive standing and fuels its expansion prospects. For instance, their focus on bio-based materials, such as polyamides, has led to numerous patent filings, securing their innovations in a rapidly evolving market. In 2024, the company continued to invest heavily in R&D, a significant portion of which is dedicated to expanding this IP. This commitment ensures their technology remains cutting-edge and defensible.

- Proprietary Technology: A vast array of patents and trade secrets covering bio-based material synthesis and production efficiency.

- Competitive Moat: This IP shields their unique bio-manufacturing processes from direct competition, ensuring market differentiation.

- Licensing Opportunities: The portfolio provides a strong basis for lucrative licensing agreements, creating additional revenue channels.

- Future Growth Engine: Continuous investment in IP development underpins the company's ability to introduce next-generation bio-materials and maintain market leadership.

Strategic Financial Capital

Cathay Biotech's strategic financial capital is a critical resource, enabling robust investment in research and development, essential for innovation in biotechnology. This access to funding, encompassing equity, debt, and grants, underpins the company's ability to expand manufacturing capabilities and penetrate new markets.

The company's financial strength, demonstrated by its substantial capital reserves, allows for the pursuit of ambitious growth strategies. For instance, Cathay Biotech secured a significant RMB 1.5 billion (approximately $210 million USD) private placement in 2023 to fuel its expansion and R&D initiatives, highlighting its capacity to attract substantial investment.

- Equity Investments: Access to capital through share offerings and private placements, like the 2023 private placement, provides foundational funding.

- Debt Financing: Utilizing loans and credit facilities to finance large-scale projects, such as manufacturing plant upgrades and expansions.

- Government Grants: Leveraging support from governmental bodies for R&D projects, particularly in areas aligned with national strategic priorities in biotechnology.

- Financial Resilience: The ability to navigate market volatility and economic downturns, ensuring continued investment in long-term growth objectives.

Cathay Biotech's proprietary synthetic biology platforms are the core of its innovation, enabling the efficient production of bio-based materials. These patented technologies, built on advanced genetic engineering and fermentation, allow for unique product differentiation and sustainable solutions.

Their state-of-the-art manufacturing facilities, equipped with large-scale industrial fermentation and purification plants, are crucial for cost-effective production. In 2024, significant investments were made in facility upgrades to boost production capacity and meet market demand.

A highly skilled workforce, comprising synthetic biologists, biochemists, and engineers, drives R&D and process optimization. In 2023, a substantial portion of Cathay Biotech's employees held advanced degrees, highlighting their commitment to top scientific talent.

An extensive intellectual property portfolio, including patents and trade secrets, safeguards their innovations and creates licensing opportunities. Continuous R&D investment in 2024 aimed to expand this IP, ensuring technological leadership.

Strategic financial capital, secured through equity, debt, and grants, fuels R&D and manufacturing expansion. The company's financial strength was evident in a RMB 1.5 billion private placement in 2023, supporting growth initiatives.

Value Propositions

Cathay Biotech provides advanced bio-based materials, such as long-chain dibasic acids and bio-based pentanediamine, which outperform conventional petroleum-based options. These innovative products allow clients to create next-generation polymers, engineering plastics, and sophisticated coatings, meeting stringent industry demands.

Cathay Biotech's value proposition centers on delivering sustainable and eco-friendly solutions through advanced synthetic biology. These offerings provide a compelling alternative to traditional, fossil fuel-derived chemicals, directly addressing customer needs for reduced environmental impact. For instance, their bio-based materials contribute to a circular economy, aligning with growing consumer and regulatory demands for greener products.

This focus on sustainability resonates strongly with businesses seeking to enhance their corporate social responsibility and meet evolving environmental regulations. By choosing Cathay Biotech, companies can demonstrably lower their carbon footprint. In 2024, the global market for bio-based chemicals and materials continued its upward trajectory, with projections indicating significant growth driven by these very sustainability initiatives.

Cathay Biotech's innovation in chemical building blocks provides customers with unique bio-based components, enabling them to develop advanced materials and enhance their product offerings. This specialization allows clients to differentiate their brands and secure a stronger market position.

By supplying these novel building blocks, Cathay Biotech is a key partner in the development of next-generation sustainable materials, contributing to a greener future for various industries.

Reliable and Scalable Supply

Cathay Biotech provides a dependable and expandable source of bio-based materials by leveraging efficient industrial manufacturing and strong supply chain oversight. This consistency is vital for industrial clients needing substantial quantities and reliable deliveries for their production lines, thereby reducing supply chain uncertainties for their collaborators.

In 2023, Cathay Biotech reported significant production capacities for key bio-based products, demonstrating their commitment to scalable supply. For instance, their diols production capacity reached substantial levels, supporting the growing demand from industries like automotive and textiles. This scale is critical for clients who depend on uninterrupted material flow for their large-scale manufacturing operations.

- Consistent Availability: Cathay Biotech's optimized production ensures a steady supply of bio-based materials, meeting the high-volume needs of industrial customers.

- Scalability for Growth: The company's infrastructure is designed to scale, allowing them to increase output in line with market demand and customer expansion.

- Risk Mitigation: Robust supply chain management minimizes disruptions, offering partners greater predictability and reducing their exposure to supply chain volatility.

Cost-Effectiveness in Long Term

Cathay Biotech's bio-based materials provide significant long-term cost savings. While initial setup might require investment, the ongoing benefits of process efficiency and stable bio-feedstock pricing create a more predictable cost structure compared to volatile fossil fuel markets. This economic advantage is further bolstered by potential regulatory incentives for sustainable products, making bio-based solutions increasingly attractive for businesses seeking to future-proof their supply chains.

Customers benefit from improved overall economics by adopting Cathay Biotech's offerings. The inherent stability of bio-based feedstocks, often sourced from renewable agricultural products, shields businesses from the price fluctuations common in petroleum-based materials. This allows for better financial planning and a more resilient operational model.

Cathay Biotech's value proposition centers on combining high performance with economic viability.

- Process Efficiency: Streamlined production processes for bio-based materials reduce operational costs over time.

- Stable Feedstock Pricing: Reliance on renewable resources offers greater price stability than fossil fuels.

- Regulatory Incentives: Potential government support and tax breaks for sustainable products enhance cost-effectiveness.

- Supply Chain Resilience: Future-proofs operations against fossil fuel market volatility and availability issues.

Cathay Biotech offers advanced bio-based materials that provide superior performance and sustainability compared to traditional petroleum-based products. These innovative materials enable clients to develop next-generation polymers and coatings, meeting demanding industry standards and enhancing their product differentiation.

The company's commitment to synthetic biology delivers eco-friendly solutions, directly addressing the growing market need for reduced environmental impact. By utilizing renewable feedstocks, Cathay Biotech supports a circular economy, aligning with increasing consumer and regulatory pressure for greener alternatives. This focus on sustainability is a key driver in the expanding bio-based chemicals market, which saw continued robust growth through 2024.

Cathay Biotech ensures a reliable and scalable supply of its bio-based products through efficient manufacturing and strong supply chain management. This consistency is crucial for industrial clients requiring substantial volumes and dependable deliveries, thereby mitigating supply chain risks for their operations. For example, their significant diols production capacity in 2023 underscored their ability to meet large-scale demand from sectors like automotive and textiles.

Customers benefit from long-term cost savings due to process efficiencies and more stable bio-feedstock pricing compared to volatile fossil fuel markets. This economic advantage, potentially enhanced by regulatory incentives for sustainable products, makes bio-based solutions increasingly attractive, future-proofing supply chains against market fluctuations.

| Value Proposition Aspect | Description | Key Benefit | Supporting Data/Example |

|---|---|---|---|

| High-Performance Bio-Materials | Advanced bio-based chemicals and materials that outperform conventional options. | Enables development of next-generation products and brand differentiation. | Materials used in advanced polymers, engineering plastics, and sophisticated coatings. |

| Sustainability & Eco-Friendliness | Solutions derived from synthetic biology, offering reduced environmental impact. | Meets growing consumer and regulatory demand for greener products, supports CSR goals. | Contributes to a circular economy; bio-based chemicals market growth projected to continue. |

| Reliable & Scalable Supply | Efficient industrial manufacturing and robust supply chain oversight. | Ensures consistent, high-volume deliveries, reducing supply chain uncertainties. | Significant production capacities for key products like diols demonstrated in 2023. |

| Economic Viability & Cost Savings | Process efficiencies and stable bio-feedstock pricing. | Provides long-term cost savings and predictable cost structures versus fossil fuels. | Stable feedstock pricing shields businesses from petroleum market volatility. |

Customer Relationships

Cathay Biotech cultivates strong customer bonds through comprehensive technical support, actively aiding clients in integrating their bio-based products and developing new applications. This hands-on assistance is crucial for customers to unlock the full potential of these advanced materials within their unique manufacturing processes and final products.

This collaborative strategy goes beyond mere problem-solving; it’s about co-creating value. For instance, in 2024, Cathay Biotech reported a 15% increase in customer satisfaction scores directly attributable to their enhanced technical support initiatives, demonstrating a tangible impact on client relationships.

By working closely with customers, Cathay Biotech helps optimize performance and tailor solutions, fostering a partnership that drives innovation. This shared development process ensures that the bio-based materials are not just supplied, but expertly applied, leading to superior end-product quality and market competitiveness for their clients.

Cathay Biotech focuses on cultivating long-term strategic partnerships with its core industrial clients, aiming to transcend simple product sales. This approach positions the company as an indispensable supplier and a collaborative innovation ally.

These deeply integrated relationships are fostered through continuous communication, joint research and development projects, and a shared commitment to advancing sustainable material solutions across various sectors.

For instance, in 2023, Cathay Biotech reported that over 70% of its revenue was derived from repeat customers, underscoring the success of its partnership-driven strategy and the trust established with its client base.

The fundamental objective is to build enduring trust and facilitate mutual growth, ensuring that both Cathay Biotech and its partners achieve shared objectives in the evolving landscape of bio-based materials.

Cathay Biotech employs a consultative sales approach, deeply engaging with clients to pinpoint their unique requirements and sustainability aspirations. This involves offering expert guidance on leveraging bio-based materials for enhanced solutions, fostering trust and showcasing value beyond mere product specifications.

Direct Communication and Feedback Loops

Establishing direct lines of communication with customers is paramount for Cathay Biotech. This allows for the immediate collection of feedback on product performance, emerging needs, and shifting market dynamics. For instance, in 2024, Cathay Biotech actively engaged with key clients in the food and beverage sector through dedicated account management teams, leading to the refinement of their amino acid offerings based on direct customer input.

This continuous feedback loop is instrumental in driving product innovation and ensuring Cathay Biotech’s portfolio remains aligned with evolving industry demands. By understanding customer experiences firsthand, the company can make agile adjustments, enhancing product efficacy and market relevance. This proactive approach directly contributes to sustained customer satisfaction and fosters long-term loyalty.

- Direct Engagement: Cathay Biotech prioritizes direct interactions with its customer base to gather immediate insights.

- Product Improvement: Feedback received is directly channeled into the continuous enhancement of existing products and the development of new solutions.

- Market Adaptability: Direct communication enables Cathay Biotech to swiftly adapt its offerings to meet changing industry requirements and customer expectations.

- Customer Loyalty: By actively listening and responding to customer needs, Cathay Biotech cultivates stronger relationships and ensures higher levels of satisfaction and loyalty.

Industry Engagement and Thought Leadership

Cathay Biotech actively cultivates industry engagement and thought leadership through consistent participation in key events. For instance, in 2024, the company was a prominent exhibitor and speaker at the Global Bio-Based Chemicals Summit, where its representatives shared advancements in bio-based polyamides. This strategic presence not only connects Cathay Biotech with potential clients but also reinforces its standing as an innovator in sustainable chemistry.

These engagements are crucial for building strong customer relationships and expanding market reach. By presenting research and development findings at forums like the International Conference on Green Chemistry, Cathay Biotech demonstrates its commitment to advancing the field. Such activities foster trust and position the company as a go-to resource for bio-based material solutions, enhancing brand visibility and creating valuable networking avenues.

- Industry Conferences: Cathay Biotech's presence at events like the 2024 China International Biotechnology Exhibition showcased its latest bio-based products to a broad audience.

- Thought Leadership: Presenting at sustainability forums, such as the World Circular Economy Forum in 2024, allows Cathay Biotech to share its expertise and influence industry direction.

- Customer Engagement: Trade shows provide direct interaction opportunities, enabling Cathay Biotech to gather feedback and discuss tailored solutions with current and prospective clients.

- Brand Recognition: Consistent participation and speaking engagements elevate Cathay Biotech's profile, solidifying its reputation as a leader in the bio-based materials sector.

Cathay Biotech fosters deep customer relationships through a consultative sales approach, focusing on unique client needs and sustainability goals. This partnership model, evident in their 2023 revenue where over 70% came from repeat customers, emphasizes co-creation and mutual growth.

The company actively seeks direct customer feedback, as seen in 2024 when client input refined their amino acid offerings. This continuous dialogue ensures their bio-based materials are not just supplied but expertly integrated, boosting client satisfaction and loyalty.

By participating in industry events like the 2024 Global Bio-Based Chemicals Summit, Cathay Biotech positions itself as an innovator and resource, strengthening its reputation and creating valuable connections.

These integrated relationships, built on trust and collaboration, are key to Cathay Biotech's strategy of being an indispensable ally in sustainable material solutions.

Channels

Cathay Biotech's direct sales force is crucial for its B2B strategy, directly connecting with major industrial clients. This approach facilitates in-depth discussions, technical support, and customized product offerings, vital for high-value transactions.

In 2024, Cathay Biotech's direct sales team was instrumental in securing key contracts within the biotechnology sector, reflecting a strong emphasis on personalized client engagement. This direct interaction allows for a nuanced understanding of complex customer requirements and fosters robust, long-term partnerships.

Cathay Biotech leverages a robust global distribution network, partnering with specialized chemical distributors to ensure efficient product delivery and market penetration. This strategy allows them to access a wider customer base, especially in areas where establishing a direct sales force would be less practical.

These distributors handle crucial aspects like local warehousing and regional sales support, effectively extending Cathay Biotech's market reach. For instance, in 2024, Cathay Biotech's global sales through its distribution partners saw a notable uptick, contributing significantly to its overall revenue diversification across key international markets.

Cathay Biotech leverages industry trade shows and conferences as a crucial channel for connecting with the global chemical, plastics, and sustainability sectors. These events are instrumental in unveiling innovative products, fostering relationships with prospective clients, and cultivating new business opportunities. For instance, participation in major exhibitions allows for direct product showcases and technical discussions, directly engaging key decision-makers.

Online Presence and Digital Marketing

Cathay Biotech leverages a strong online presence, primarily through its corporate website, to disseminate detailed product information, technical specifications, and crucial sustainability reports. This digital hub also serves as a vital resource for investor relations, ensuring transparency and accessibility for stakeholders.

Digital marketing strategies, including search engine optimization (SEO) and targeted content marketing, are employed to reach a global audience. Industry-specific online advertising further amplifies brand awareness and attracts potential customers by highlighting Cathay Biotech's innovative solutions.

- Website as a Central Hub: Cathay Biotech's corporate website acts as a comprehensive information portal, detailing product specifications, sustainability initiatives, and investor relations updates.

- Global Reach through Digital Marketing: SEO, content marketing, and online advertising campaigns are key to attracting and informing a worldwide customer base.

- Lead Generation and Brand Awareness: These digital channels are instrumental in driving lead generation and enhancing overall brand recognition in the competitive biotechnology sector.

Strategic Partnerships and Joint Ventures

Strategic partnerships and joint ventures are crucial channels for Cathay Biotech to expand its reach. By collaborating with established players, the company can tap into new markets and customer bases more effectively. For instance, a joint venture with a major automotive manufacturer could accelerate the adoption of Cathay Biotech's bio-based plastics in vehicle production, a sector actively seeking sustainable alternatives. In 2024, the global market for bio-based plastics was projected to reach approximately $12.5 billion, highlighting significant growth potential through such alliances.

These alliances allow Cathay Biotech to leverage the existing distribution networks and market knowledge of its partners. This synergy can significantly reduce the time and cost associated with market entry. For example, partnering with a leading consumer goods company could provide immediate access to millions of consumers interested in eco-friendly products. Such collaborations are vital for achieving economies of scale and driving widespread adoption of bio-based materials.

- Market Access: Gain entry into new geographic regions or customer segments via partners' established presence.

- Risk Sharing: Joint ventures distribute the financial and operational risks associated with market expansion.

- Accelerated Growth: Leverage partner expertise and resources to speed up product development and market penetration.

- Innovation Synergy: Collaborate on R&D to co-develop novel bio-based solutions and applications.

Cathay Biotech utilizes a multi-faceted channel strategy, combining direct sales for key industrial clients with a robust global distribution network for broader market penetration. Industry trade shows and a strong online presence further amplify its reach and engagement with diverse stakeholders.

Strategic partnerships and joint ventures are also key, enabling access to new markets and accelerating the adoption of its bio-based materials. In 2024, the company's diversified channel approach proved effective in navigating global market dynamics and expanding its customer base.

Customer Segments

High-performance polymer manufacturers are key customers for Cathay Biotech, seeking specialized bio-based building blocks. These companies produce advanced materials demanding superior durability, heat resistance, and flexibility, often for critical applications in automotive, aerospace, and electronics. For instance, Cathay Biotech's long-chain dibasic acids and bio-based pentanediamine are crucial for creating polymers that outperform traditional petrochemical-based alternatives. The global market for high-performance polymers was valued at over $100 billion in 2023 and is projected to grow steadily, driven by innovation and demand for lighter, stronger, and more sustainable materials.

Engineering plastics producers are a core customer base for Cathay Biotech. These manufacturers create materials critical for high-performance sectors such as automotive, electronics, and construction. They are actively seeking advanced polymers that provide exceptional mechanical properties, resistance to heat, and weight reduction, areas where Cathay Biotech's bio-based alternatives excel.

The demand for sustainable materials is a significant and growing trend within this segment. For example, the global engineering plastics market was valued at approximately $95 billion in 2023 and is projected to reach over $140 billion by 2030, with a notable portion of this growth driven by the push for eco-friendly solutions.

Coatings and adhesives formulators, a key customer segment for Cathay Biotech, are actively seeking innovative and sustainable raw materials. These companies, deeply invested in industrial coatings, sealants, and adhesives, prioritize ingredients that not only boost product performance but also align with increasingly stringent environmental regulations. For instance, the global coatings market was valued at approximately $160 billion in 2023 and is projected to grow, with sustainability being a major driver.

Cathay Biotech's bio-based materials offer formulators a distinct advantage by enhancing critical product properties. Their offerings can significantly improve flexibility, adhesion strength, and chemical resistance in various coating and adhesive applications. This dual focus on superior performance and eco-friendliness resonates strongly with this segment, as they aim to differentiate their products in a competitive marketplace.

Specialty Chemical Companies

Specialty chemical companies represent a crucial customer segment for Cathay Biotech, particularly those seeking bio-based intermediates. These manufacturers integrate Cathay's materials into their own intricate chemical formulations, often driven by a need for innovative and sustainable sourcing. For instance, a company developing advanced coatings might require specific bio-derived monomers, a market where Cathay Biotech's expertise in fermentation and chemical synthesis is highly valued. In 2024, the global specialty chemicals market was projected to reach over $700 billion, highlighting the significant demand for niche, high-performance ingredients.

These customers are typically looking for reliable suppliers who can consistently deliver high-quality, niche chemicals that offer a competitive edge. They might be engaged in:

- Developing novel polymers and resins requiring unique bio-based building blocks.

- Formulating advanced adhesives and sealants with enhanced performance characteristics derived from sustainable sources.

- Creating specialized additives for industries like personal care or agriculture, where bio-ingredients are increasingly sought after.

- Seeking to reduce their environmental footprint by incorporating bio-based alternatives into their production processes.

Brands Committed to Sustainability

Cathay Biotech serves large consumer and industrial brands that are deeply committed to sustainability. These companies are actively looking to integrate more bio-based and environmentally friendly materials into their production processes to achieve their corporate social responsibility targets and satisfy growing consumer preferences for greener products. For instance, by 2024, major apparel brands reported that over 60% of their new product lines incorporated recycled or bio-based content, demonstrating a significant market shift.

These forward-thinking brands often exert considerable influence on their suppliers, creating a strong pull for greener alternatives throughout their value chains. This demand directly benefits Cathay Biotech by creating a consistent market for its innovative bio-materials. Their strategic focus on reducing environmental impact and enhancing brand image through sustainable sourcing makes them prime customers.

The drive for sustainability among these brands is not merely about compliance; it's a core element of their brand identity and market positioning. A 2024 survey indicated that 75% of consumers are more likely to purchase from brands perceived as environmentally responsible. This translates into substantial business opportunities for Cathay Biotech as these brands seek reliable partners for sustainable material solutions.

- Key Customer Drivers: Corporate sustainability goals, consumer demand for eco-friendly products, enhanced brand image.

- Market Influence: Brands often mandate greener materials from their suppliers, creating upstream demand.

- Growth Indicators: By 2024, a significant portion of new product lines from major apparel companies featured sustainable materials.

- Consumer Preference: A substantial majority of consumers favor brands demonstrating environmental responsibility.

Cathay Biotech's customer base is diverse, encompassing manufacturers of high-performance and engineering plastics, as well as formulators of coatings and adhesives. These sectors are increasingly prioritizing bio-based materials to meet sustainability targets and consumer demand. Specialty chemical companies also represent a crucial segment, seeking innovative bio-based intermediates for their advanced formulations, with the global specialty chemicals market projected to exceed $700 billion in 2024.

Large consumer and industrial brands committed to sustainability are also key clients. These companies are integrating bio-based materials into their products to enhance brand image and meet consumer preferences, with a 2024 survey showing 75% of consumers favoring environmentally responsible brands.

| Customer Segment | Key Needs | Market Relevance (2023/2024 Data) |

|---|---|---|

| High-Performance Polymer Manufacturers | Bio-based building blocks, superior durability, heat resistance | Global market > $100 billion (2023) |

| Engineering Plastics Producers | Advanced polymers, eco-friendly solutions, mechanical properties | Global market ~ $95 billion (2023), growing |

| Coatings & Adhesives Formulators | Sustainable raw materials, enhanced performance, regulatory compliance | Global coatings market ~ $160 billion (2023) |

| Specialty Chemical Companies | Bio-based intermediates, niche chemicals, innovation | Global specialty chemicals market > $700 billion (2024 projection) |

| Large Consumer/Industrial Brands | Sustainable materials, reduced environmental footprint, brand image | 75% of consumers favor eco-responsible brands (2024 survey) |

Cost Structure

Cathay Biotech's Research and Development (R&D) expenses represent a substantial cost. In 2023, the company allocated approximately RMB 315 million (around $43 million USD) to R&D, a significant portion of its overall operational budget. This investment fuels the discovery of novel synthetic biology pathways and the refinement of existing production processes.

These costs encompass a wide range, including competitive salaries for highly skilled scientists and engineers, the acquisition and maintenance of advanced laboratory equipment, essential consumables for experiments, and the crucial preclinical and pilot studies required to validate new discoveries. This continuous investment is the bedrock of Cathay Biotech's strategy to maintain its technological edge in the competitive biotech industry.

Manufacturing and production costs are a significant component of Cathay Biotech's operational expenses, primarily driven by the operation of industrial fermentation facilities. These costs encompass the procurement of bio-based feedstocks, substantial energy and water consumption, waste treatment processes, and the labor required for day-to-day production activities. Efficiently scaling up production is paramount to effectively managing both the variable and fixed aspects of these costs.

Cathay Biotech incurs significant costs for intellectual property protection and legal fees. These expenses are essential for safeguarding their cutting-edge synthetic biology platforms and bio-based products on a global scale. In 2023, companies in the biotechnology sector often allocated a notable portion of their R&D budgets to patent filings and maintenance, with some reporting legal expenses exceeding 5% of their total operating costs.

These legal expenditures are critical investments, covering everything from initial patent applications and renewals to defending against potential infringement through litigation. Furthermore, legal counsel is indispensable for navigating complex licensing agreements, ensuring the company's core assets and hard-won competitive advantages remain secure.

Sales, Marketing, and Distribution Costs

Cathay Biotech incurs significant expenses in its Sales, Marketing, and Distribution efforts. These costs are crucial for reaching its global customer base and ensuring product availability. For instance, maintaining a worldwide sales team and engaging in international trade shows represent substantial outlays.

Digital marketing campaigns and the intricate logistics of product distribution also add to the cost structure. These investments are directly tied to market penetration, acquiring new customers, and keeping the Cathay Biotech brand prominent in the competitive biotechnology landscape. Effective marketing is a key driver of revenue growth.

In 2024, companies in the chemical and biotechnology sectors often allocate a significant portion of their revenue to sales and marketing. For example, industry benchmarks suggest that such costs can range from 10% to 20% of total revenue, depending on the company's growth stage and market strategy. Cathay Biotech’s focus on expanding its reach in emerging markets likely means these figures are at the higher end of this spectrum.

- Global Sales Force: Costs associated with salaries, commissions, and travel for international sales representatives.

- Trade Shows and Events: Expenses for booth rentals, participation fees, and promotional materials at key industry gatherings.

- Digital Marketing: Investment in online advertising, search engine optimization, content marketing, and social media campaigns.

- Distribution and Logistics: Costs for warehousing, transportation, customs, and managing supply chains to deliver products worldwide.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses represent the overhead costs essential for the overall functioning of Cathay Biotech. These include salaries for executives and administrative staff, investments in IT infrastructure, maintenance of office facilities, and essential corporate services like legal and accounting. For instance, in 2023, Cathay Biotech reported G&A expenses of RMB 383 million, a slight increase from RMB 369 million in 2022, reflecting ongoing investments in corporate support functions to manage its expanding operations.

Effective management of these costs is crucial for maintaining Cathay Biotech's profitability. These expenses, while not directly tied to production, are fundamental to supporting the entire business structure, enabling strategic decision-making and ensuring compliance.

- Executive and Management Salaries: Compensation for leadership driving the company's direction.

- Administrative Staff Costs: Salaries for personnel handling day-to-day operations and support.

- IT Infrastructure and Support: Costs associated with technology systems, software, and IT personnel.

- Office Facilities and Maintenance: Expenses for office space, utilities, and upkeep.

- Corporate Legal and Accounting: Fees for professional services ensuring compliance and financial integrity.

Cathay Biotech's cost structure is heavily influenced by its significant investments in research and development, manufacturing, and global sales and marketing. The company's commitment to innovation requires substantial R&D spending, while its large-scale fermentation operations drive manufacturing costs. These are further amplified by the expenses associated with building and maintaining a worldwide distribution network and brand presence.

In 2023, R&D expenses alone were approximately RMB 315 million, highlighting the capital-intensive nature of developing new bio-based products. Similarly, sales and marketing costs, which can range from 10% to 20% of revenue for companies in this sector, are crucial for market penetration and customer acquisition. Efficient management of these diverse cost centers is key to Cathay Biotech's profitability and sustained growth.

| Cost Category | 2023 (RMB Million) | Key Components |

|---|---|---|

| Research & Development | 315 | Scientist salaries, lab equipment, consumables, pilot studies |

| Manufacturing & Production | N/A (Variable) | Bio-based feedstocks, energy, water, waste treatment, labor |

| Sales, Marketing & Distribution | N/A (Percentage of Revenue) | Sales force, trade shows, digital marketing, logistics |

| General & Administrative | 383 | Executive salaries, IT, office facilities, legal, accounting |

Revenue Streams

Cathay Biotech's primary revenue stream originates from the direct sale of various grades of long-chain dibasic acids (LCDA). These acids are crucial components for manufacturers producing high-performance polymers, engineering plastics, coatings, and adhesives. This segment represents a substantial portion of the company's overall revenue.

Sales volume and adherence to specific product specifications are the key drivers for revenue generation in this segment. For instance, in 2023, Cathay Biotech reported significant sales volumes of their bio-based diacids, contributing to their overall financial performance.

Pricing for these LCDAs is influenced by a combination of factors, including prevailing market demand, the unique performance advantages offered by the products, and any sustainability premiums associated with their bio-based production methods. The growing demand for eco-friendly materials in 2024 further supports premium pricing for sustainable alternatives.

Cathay Biotech generates revenue through the sale of bio-based pentanediamine. This chemical is a crucial component in the creation of advanced polyamides and other specialized materials, serving industries that value its distinct characteristics.

The sales of bio-based pentanediamine are significant, forming a substantial portion of Cathay Biotech's total revenue. In 2024, the company reported that its bio-based chemicals segment, which includes pentanediamine, saw robust growth, contributing to its overall financial performance.

Cathay Biotech can monetize its innovative synthetic biology platforms and production methods by licensing them to other players in the chemical and biotech sectors. This strategy enables wider technology adoption without the need for Cathay to engage in direct manufacturing, creating a lucrative, high-margin revenue source.

These licensing agreements typically involve a combination of upfront payments, milestone-based fees tied to development progress, and ongoing royalty payments based on the licensee's sales. For instance, in 2023, the global biotechnology market was valued at approximately $1.75 trillion, indicating a substantial opportunity for licensing advanced platforms.

Joint Venture Profits/Royalties

Cathay Biotech actively participates in joint ventures, generating revenue through profit sharing and royalty agreements. These collaborations allow the company to tap into partners' expertise and market access for specific product lines or geographic regions, creating diversified income streams.

For instance, in 2023, Cathay Biotech's strategic partnerships contributed to its overall financial performance by providing access to new markets and technologies. These ventures are crucial for sharing the financial burden of new product development and market expansion.

- Profit Sharing: Cathay Biotech shares profits from joint ventures based on agreed-upon percentages, directly contributing to revenue.

- Royalty Payments: The company receives royalties for licensing its technology or products within joint venture frameworks.

- Risk Mitigation: Joint ventures help distribute the investment risks associated with new ventures and market penetration.

- Accelerated Market Entry: Collaborations enable faster access to new markets by leveraging partners' established networks and distribution channels.

Custom Synthesis or Contract Manufacturing

Cathay Biotech can generate additional revenue by offering custom synthesis services for niche bio-based chemicals. This leverages their advanced synthetic biology platform to create specific compounds for clients. For instance, they could produce high-value ingredients for the pharmaceutical or cosmetic industries on a contract basis.

Another significant revenue avenue lies in contract manufacturing. Cathay Biotech can utilize its existing production capacity and expertise to manufacture bio-based products for other companies that lack such specialized facilities. This strategy allows them to monetize underutilized assets and broaden their market reach.

- Custom Synthesis: Providing tailored bio-based chemical production for specific client needs.

- Contract Manufacturing: Producing bio-based products for third parties using Cathay Biotech's facilities and expertise.

- Revenue Diversification: Supplementing core product sales by utilizing excess capacity and specialized skills.

- Market Expansion: Reaching new sectors like pharmaceuticals and cosmetics through specialized service offerings.

Cathay Biotech's revenue streams are diverse, primarily driven by the sale of long-chain dibasic acids (LCDA) and bio-based pentanediamine, essential for advanced materials. The company also monetizes its synthetic biology platforms through licensing agreements and generates income via joint ventures, which include profit sharing and royalties.

| Revenue Stream | Key Products/Services | 2023/2024 Relevance |

|---|---|---|

| Direct Sales of LCDA | Bio-based diacids for polymers, plastics, coatings | Significant sales volumes, driven by demand for eco-friendly materials. |

| Direct Sales of Pentanediamine | Bio-based pentanediamine for polyamides | Robust growth in bio-based chemicals segment, contributing to overall performance. |

| Technology Licensing | Synthetic biology platforms and production methods | Leveraging advanced platforms in a global biotech market valued at $1.75 trillion in 2023. |

| Joint Ventures | Profit sharing and royalty agreements | Strategic partnerships provide market access and shared development risks. |

| Custom Synthesis & Contract Manufacturing | Niche bio-based chemicals, production for third parties | Monetizing excess capacity and specialized skills for industries like pharmaceuticals and cosmetics. |

Business Model Canvas Data Sources

Cathay Biotech's Business Model Canvas is informed by a blend of internal financial data, extensive market research on biotechnology trends, and strategic analyses of competitor activities. These sources ensure a comprehensive and data-driven approach to each element of the canvas.