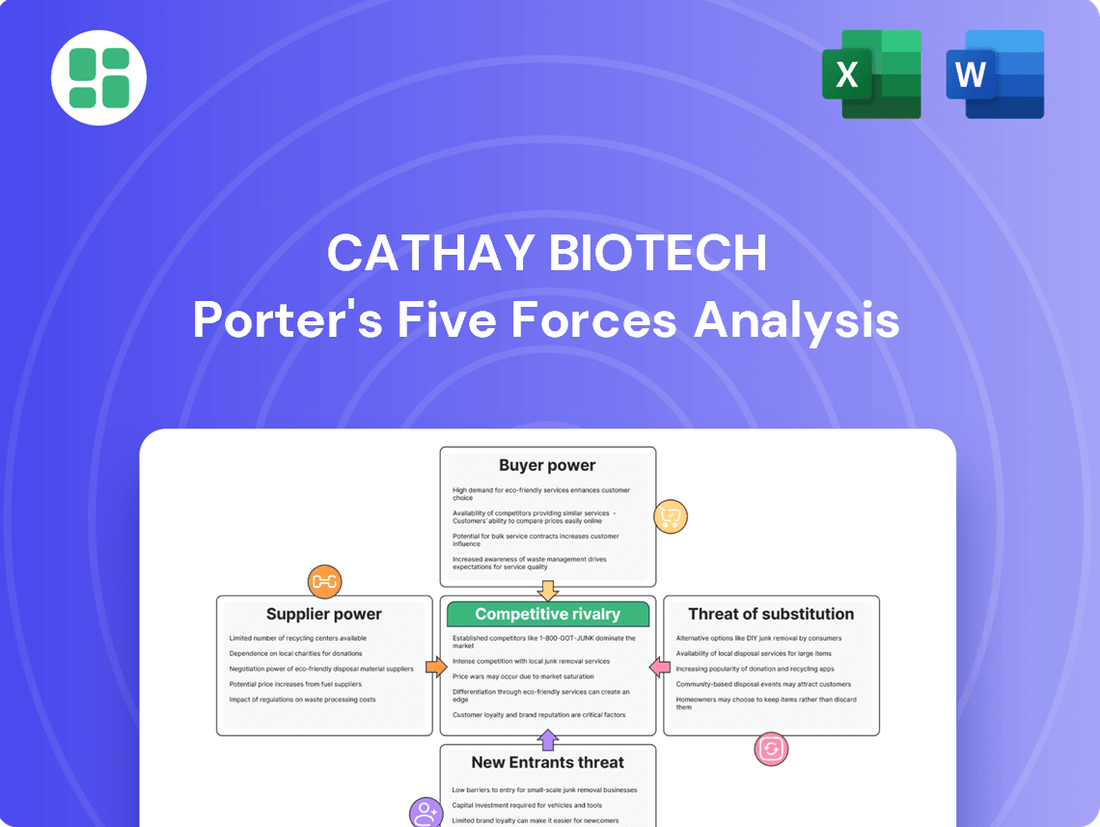

Cathay Biotech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Biotech Bundle

Cathay Biotech navigates a landscape shaped by moderate buyer power and intense rivalry, with the threat of substitutes presenting a significant challenge.

The full Porter's Five Forces analysis unlocks a comprehensive understanding of these dynamics, revealing the true competitive intensity and strategic levers available to Cathay Biotech.

Ready to move beyond the basics? Get a full strategic breakdown of Cathay Biotech’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Cathay Biotech's reliance on specialized biological feedstocks and enzymes for its synthetic biology operations positions certain suppliers with considerable bargaining power. These inputs are often unique or proprietary, meaning Cathay Biotech may have limited alternatives, giving these suppliers significant leverage. For instance, access to specific microbial strains or patented enzyme technologies could dictate input costs and ensure consistent supply chains.

The availability of key biological inputs is a crucial factor in Cathay Biotech’s operational costs and competitive positioning. If essential raw materials, like specialized microbial strains or unique fermentation substrates, are scarce or concentrated in the hands of a limited number of suppliers, these suppliers gain significant leverage. This leverage allows them to dictate higher prices and more stringent terms, directly impacting Cathay Biotech's production expenses and profit margins.

Switching bio-reactant suppliers can be a costly and time-consuming endeavor for Cathay Biotech. The process often requires significant investment in re-engineering existing production lines and rigorous re-validation of new materials, potentially leading to costly production interruptions. For instance, in the biopharmaceutical industry, the cost of switching a critical raw material supplier can range from tens of thousands to millions of dollars, including validation studies and potential regulatory hurdles.

Supplier Concentration and Integration Threat

When the market for crucial biological inputs is dominated by a small number of major suppliers, their bargaining power naturally escalates as Cathay Biotech faces fewer viable alternatives. This concentration can lead to less favorable pricing and supply terms for Cathay. For instance, in the specialty enzyme market, which is vital for many bio-based material processes, a few global players often control a significant share of production.

The risk of these key suppliers deciding to integrate forward into the manufacturing of bio-based materials themselves poses a substantial threat. Such a move would directly compete with Cathay Biotech, potentially limiting Cathay's access to essential inputs or forcing it to contend with its own suppliers as rivals. This vertical integration by suppliers can drastically reshape the competitive landscape and Cathay's strategic options.

- Supplier Concentration: Markets for specialized biological inputs, like certain fermentation strains or rare enzymes, can be highly concentrated. For example, as of early 2024, the global market for specific probiotic strains used in industrial biotechnology is estimated to be dominated by less than five major companies.

- Forward Integration Threat: Suppliers with strong R&D capabilities might leverage their expertise to move into producing finished bio-based materials, thereby cutting out companies like Cathay Biotech or becoming a direct competitor. This is a growing concern in sectors where raw material processing and final product manufacturing are closely linked.

- Impact on Cathay Biotech: Increased supplier power translates to higher input costs for Cathay Biotech, potentially squeezing profit margins. It also introduces supply chain vulnerabilities if a dominant supplier experiences production issues or decides to prioritize other customers.

Intellectual Property of Biological Inputs

Suppliers who possess patents or proprietary technology for crucial biological inputs, such as specific genetic sequences or fermentation processes, can exert significant influence over pricing and supply terms. Cathay Biotech's dependence on these patented inputs directly amplifies the bargaining power of its suppliers, as they control the fundamental components necessary for its bio-based manufacturing.

- Patented inputs: Suppliers holding patents on essential biological materials or processes can command higher prices.

- Proprietary technology: Exclusive access to unique fermentation strains or genetic modifications provides suppliers leverage.

- Reliance on innovation: Cathay Biotech's need for cutting-edge biological inputs makes it susceptible to supplier control.

- Market exclusivity: If only a few suppliers offer patented, high-performance biological inputs, their bargaining power is substantial.

The bargaining power of suppliers for Cathay Biotech is significant due to the specialized nature of biological feedstocks and proprietary enzymes. These inputs are often unique, limiting Cathay Biotech's alternatives and giving suppliers considerable leverage over pricing and terms. For example, access to specific microbial strains or patented enzyme technologies can dictate input costs and ensure supply chain continuity, as seen in the biopharmaceutical industry where switching critical raw material suppliers can cost millions.

| Factor | Impact on Cathay Biotech | Example Data (Early 2024) |

|---|---|---|

| Supplier Concentration | Higher input costs, supply chain vulnerabilities | Global market for specific probiotic strains dominated by < 5 major companies. |

| Proprietary Technology/Patents | Increased input costs, dependence on innovation | Suppliers holding patents on essential biological materials can command higher prices. |

| Switching Costs | Potential production interruptions, significant re-engineering investment | Switching costs in biopharma can range from tens of thousands to millions of dollars. |

| Forward Integration Threat | Direct competition, reduced access to inputs | Growing concern in sectors where raw material processing and final product manufacturing are closely linked. |

What is included in the product

This analysis uncovers the competitive landscape for Cathay Biotech, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its market position.

Easily identify and mitigate competitive threats by visualizing Cathay Biotech's Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Cathay Biotech's customer base is concentrated within specific industrial sectors, including polymers, engineering plastics, coatings, and adhesives. This concentration means that if a few major players dominate these markets, they hold considerable sway over Cathay Biotech.

These large customers can leverage their purchasing power to negotiate for lower prices, demand customized product specifications, and dictate favorable payment terms. Such pressure directly impacts Cathay Biotech's profitability by squeezing margins.

For instance, in the global engineering plastics market, which Cathay Biotech serves, the top 10 players accounted for over 60% of the market share in 2023, highlighting the potential for customer concentration to be a significant factor.

Cathay Biotech's long-chain dibasic acids and bio-based pentanediamine stand out due to their innovative nature and unique performance advantages, especially in sustainability. These highly differentiated bio-based materials, crucial for many customer end-products, significantly reduce customer bargaining power by limiting readily available comparable alternatives.

Customers face substantial hurdles when considering a switch from traditional petroleum-based or existing bio-based materials to those offered by Cathay Biotech. These challenges include the need for extensive re-formulation of their products, significant investment in new or modified manufacturing equipment, and rigorous re-qualification processes to meet industry standards.

For instance, the chemical industry often requires extensive testing and validation, which can take months or even years, before a new material can be integrated into production lines. This lengthy and costly process effectively raises the switching costs for customers. In 2024, the average cost for a major industrial product reformulation due to new material integration was estimated to be in the millions of dollars, depending on the complexity of the product and the regulatory environment.

These high switching costs directly diminish the bargaining power of customers. When it is expensive and time-consuming to change suppliers, customers are less inclined to frequently seek out alternative material providers, thereby strengthening Cathay Biotech's position.

Availability of Alternative Building Blocks

Customers can easily switch to petroleum-based chemical building blocks or other bio-based alternatives offered by Cathay Biotech's competitors. This availability of substitutes directly impacts Cathay Biotech's ability to dictate terms. For instance, the global market for bio-based chemicals, excluding biofuels, was projected to reach approximately $100 billion by 2024, indicating a significant competitive landscape with numerous alternative suppliers.

The ease with which customers can find functionally similar products from other companies weakens their bargaining power. If these alternatives are priced competitively or offer comparable performance, customers are less reliant on Cathay Biotech. In 2023, the price of crude oil, a key input for traditional chemical building blocks, fluctuated, making the cost-competitiveness of bio-based alternatives a dynamic factor influencing customer choices.

- Substitutability: Customers can opt for petroleum-derived chemicals or other bio-based alternatives.

- Cost-Effectiveness: The price and performance of alternatives directly influence customer switching decisions.

- Market Growth: The expanding bio-based chemical market (estimated over $100 billion by 2024) signifies increased competition and more alternatives for customers.

- Input Volatility: Fluctuations in raw material costs, like crude oil in 2023, can shift the cost advantage between traditional and bio-based products, impacting customer leverage.

Threat of Backward Integration by Customers

Large industrial customers, like major chemical or material manufacturers, may evaluate developing their own bio-based production facilities if Cathay Biotech’s offerings prove essential and profitable. This potential for backward integration significantly amplifies their leverage, enabling them to negotiate more favorable pricing or even threaten to produce the materials in-house. For instance, a significant portion of Cathay Biotech's revenue could be concentrated among a few key clients, making them vulnerable to such demands.

- Customer Dependence: If a substantial percentage of Cathay Biotech's sales are to a limited number of large customers, these clients gain considerable bargaining power.

- Profitability Pressure: Attractive margins on Cathay Biotech's bio-based materials could incentivize customers to explore in-house production, thereby pressuring Cathay's pricing strategies.

- Strategic Importance: When Cathay Biotech's products become critical components in a customer's value chain, the customer's threat of backward integration becomes more potent.

While Cathay Biotech's innovative bio-based materials offer unique advantages, the bargaining power of its customers is influenced by several factors. The concentration of customers in specific industrial sectors, like engineering plastics, gives large buyers significant leverage, as seen with the top 10 players holding over 60% of that market share in 2023. However, the high switching costs associated with reformulating products and re-qualifying materials, estimated to cost millions of dollars in 2024, significantly reduce this power. The availability of substitutes, supported by a global bio-based chemical market projected to exceed $100 billion by 2024, presents a counterbalancing force.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Context |

|---|---|---|

| Customer Concentration | Increases power | Top 10 players held >60% of engineering plastics market share in 2023. |

| Switching Costs | Decreases power | Product reformulation costs estimated in millions of dollars in 2024. |

| Availability of Substitutes | Increases power | Global bio-based chemical market projected >$100 billion by 2024. |

| Threat of Backward Integration | Increases power | Potential for large clients to develop in-house production if margins are attractive. |

Same Document Delivered

Cathay Biotech Porter's Five Forces Analysis

This preview showcases the complete Cathay Biotech Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within the biotechnology sector. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning needs.

Rivalry Among Competitors

The competitive landscape for bio-based materials is characterized by a mix of established chemical giants and agile biotech startups. Companies like BASF and Dow are increasingly investing in bio-based alternatives, leveraging their scale and existing distribution networks. This dual presence of large, diversified players and specialized, innovative firms means rivalry is significant.

The sheer number and size of these producers directly impact competitive intensity. For instance, as of early 2024, major players are reporting substantial growth in their bio-based product segments. DuPont's bio-based polymers division, for example, has seen double-digit growth, indicating strong market demand and intense competition to capture market share. This can lead to price pressures and a greater need for differentiation through product performance and sustainability claims.

The bio-based materials market generally exhibits robust growth, which tends to temper competitive rivalry. As new demand emerges, companies like Cathay Biotech can focus on expansion rather than aggressively contesting existing market share. For instance, the global bio-based chemicals market was valued at approximately USD 105.2 billion in 2023 and is projected to grow substantially.

However, the intensity of competition can fluctuate depending on the specific segments within the broader bio-based materials industry where Cathay Biotech operates. Segments experiencing slower growth or higher maturity might see more intense rivalry as companies vie for a larger piece of a more static market.

Cathay Biotech distinguishes itself by focusing on high-performance bio-based products, a strategy that leverages synthetic biology to create superior materials. This focus on unique and advanced product performance directly reduces head-to-head price competition with rivals, enabling the company to command premium pricing. For instance, in 2024, Cathay Biotech reported significant growth in its specialty bio-based polymers segment, a key area where product differentiation is paramount.

Exit Barriers in Biotechnology Manufacturing

The biotechnology manufacturing sector faces substantial exit barriers, primarily due to the immense capital required for specialized fermentation facilities and advanced equipment. For instance, establishing a single biopharmaceutical manufacturing plant can easily cost hundreds of millions of dollars, with some exceeding the billion-dollar mark, making it incredibly difficult for companies to recoup their investment if they decide to leave the market.

Furthermore, the lengthy and complex research and development cycles, coupled with stringent regulatory compliance like FDA approvals, create a high degree of sunk costs. Companies invest years and significant funds into developing and validating their processes. These factors mean that even when market conditions are unfavorable, many firms are compelled to remain operational, intensifying competitive rivalry as they strive to maintain market share and cover their fixed costs.

- High Capital Investment: Specialized fermentation and purification equipment represent significant upfront costs, often running into hundreds of millions of dollars per facility.

- R&D and Regulatory Hurdles: Extensive investment in research, clinical trials, and navigating complex regulatory pathways (e.g., FDA, EMA) creates substantial sunk costs, making exit financially prohibitive.

- Specialized Workforce: The need for highly skilled personnel in areas like molecular biology, process engineering, and quality assurance adds to operational complexity and exit difficulty.

- Long Product Lifecycles: Once a product is established, the process of replacing it with a new one is lengthy, encouraging incumbent firms to persevere through market fluctuations.

Innovation Pace and Intellectual Property

The competitive landscape in synthetic biology and bio-based materials is intensely shaped by the relentless pace of innovation. Companies are constantly striving to develop novel processes and proprietary products, which directly influences their market standing. For instance, Cathay Biotech's focus on developing advanced fermentation technologies and unique product lines allows it to differentiate itself, thereby mitigating direct competition from less innovative players.

A robust intellectual property (IP) portfolio acts as a significant competitive advantage. Companies that secure patents for their novel technologies and products, like Cathay Biotech, can create barriers to entry and command premium pricing. This emphasis on IP protection is crucial in a sector where technological advancements can quickly render existing methods obsolete. As of early 2024, the global synthetic biology market was projected to reach over $13 billion, underscoring the value placed on innovative solutions.

- Innovation as a Differentiator: Companies like Cathay Biotech leverage continuous R&D to create unique bio-based materials and synthetic biology processes, setting them apart from competitors.

- Intellectual Property Strength: A strong patent portfolio is a key driver of competitive advantage, protecting proprietary technologies and enabling market leadership.

- Market Growth and IP Value: The expanding synthetic biology market, valued in the billions, highlights the significant economic importance of innovation and IP in this sector.

The competitive rivalry within the bio-based materials sector is substantial, driven by both large, established chemical companies and nimble biotech startups. Companies like BASF and Dow are actively expanding their bio-based offerings, utilizing their significant scale and distribution networks. This dynamic means that Cathay Biotech faces competition from players with deep pockets and market reach.

The intensity of this rivalry is amplified by the rapid innovation occurring in synthetic biology. Companies are in a race to develop novel processes and proprietary products, with intellectual property playing a crucial role in securing market advantage. For example, Cathay Biotech's investment in advanced fermentation technologies and unique product lines, supported by a strong IP portfolio, is key to differentiating itself and mitigating direct competition.

While the overall growth of the bio-based market can temper rivalry, specific segments might experience heightened competition. As of early 2024, segments with slower growth or higher maturity can see more aggressive competition as firms fight for existing market share. The global bio-based chemicals market was valued at approximately USD 105.2 billion in 2023, indicating a large and growing arena where competition is a constant factor.

High exit barriers, including massive capital investment in specialized facilities and lengthy R&D cycles with stringent regulatory requirements, compel companies to remain operational even in challenging conditions. This persistence further intensifies competition, as firms strive to cover their substantial fixed costs and maintain their market presence.

SSubstitutes Threaten

The primary substitutes for Cathay Biotech's bio-based long-chain dibasic acids and pentanediamine are their petroleum-derived counterparts. These traditional chemicals are often well-established in the market and can be more cost-effective, especially when oil prices are low. For instance, in 2024, the price of crude oil fluctuated, impacting the cost competitiveness of petroleum-based chemicals against bio-based alternatives.

Customers weigh substitutes by considering their cost, how well they perform, and their environmental impact. For instance, if petroleum-based alternatives provide comparable performance at a lower price point, or if new bio-based options emerge offering a superior cost-performance balance, the threat of substitutes for Cathay Biotech's products intensifies.

This competitive pressure could compel Cathay Biotech to re-evaluate its pricing strategies to remain competitive. As of early 2024, the bio-based chemical market is experiencing significant growth, with companies like Cathay Biotech aiming to capture market share by offering sustainable solutions, but the cost-competitiveness against established petrochemicals remains a key factor for adoption.

Customer preference for sustainability is increasingly influencing purchasing decisions, creating a significant shift away from traditional petroleum-based products. This growing environmental consciousness, coupled with corporate sustainability targets, directly benefits bio-based alternatives like those offered by Cathay Biotech.

For instance, the global market for bio-based chemicals was valued at over $100 billion in 2023 and is projected to grow substantially, indicating a strong consumer and industry pull towards greener solutions. This trend significantly reduces the threat posed by conventional, less sustainable substitutes for Cathay Biotech’s bio-based materials.

Regulatory Landscape and Environmental Policies

Government regulations and policies play a crucial role in shaping the threat of substitutes for Cathay Biotech. For instance, policies that promote bio-based products or penalize petroleum-based ones directly influence the cost-competitiveness and market acceptance of alternatives. As of 2024, many governments worldwide are actively implementing incentives and mandates to encourage the adoption of sustainable materials, thereby reducing the attractiveness of traditional, non-bio-based substitutes.

Favorable policies for bio-based materials can significantly diminish the threat from conventional alternatives. This creates a more conducive market environment for companies like Cathay Biotech, which specialize in bio-based solutions. For example, tax credits for using bio-based feedstocks or subsidies for green manufacturing processes can make Cathay Biotech's products more competitive against petroleum-derived counterparts.

- Government incentives for bio-based materials: Many nations are offering tax breaks and grants to companies investing in bio-manufacturing, making bio-alternatives more cost-effective.

- Carbon pricing mechanisms: The increasing implementation of carbon taxes or emissions trading schemes makes petroleum-based products more expensive, enhancing the relative appeal of bio-based substitutes.

- Mandates for sustainable sourcing: Some industries are facing regulatory pressure or voluntary commitments to increase their use of renewable and biodegradable materials, directly impacting the demand for conventional substitutes.

Emergence of Other Bio-Based Substitutes

The threat of substitutes is amplified by the ongoing development of alternative bio-based chemicals and materials by competing biotechnology firms. These emerging substitutes aim to fulfill similar market needs, potentially impacting Cathay Biotech's existing product lines. For instance, advancements in synthetic biology could lead to novel production methods for compounds currently manufactured by Cathay Biotech.

The swift pace of innovation within the biotechnology sector means that new bio-based substitutes can appear rapidly, posing a persistent challenge. These substitutes might offer distinct advantages, such as improved performance characteristics or more competitive pricing structures. For example, research into enzymatic synthesis could yield cost-effective alternatives to fermentation-based processes used by Cathay Biotech.

- Emerging Bio-Based Alternatives: Competitors are actively developing bio-based chemicals and materials that can replace petroleum-derived products, directly challenging Cathay Biotech's market share.

- Innovation in Biotechnology: Rapid advancements in areas like synthetic biology and enzyme engineering create a dynamic landscape where new, potentially superior, bio-based substitutes can emerge quickly.

- Cost and Performance Advantages: New substitutes may offer lower production costs or enhanced performance features, making them more attractive to customers and increasing pressure on Cathay Biotech to adapt.

The threat of substitutes for Cathay Biotech's bio-based products is moderate but growing. While petroleum-derived chemicals remain a significant alternative, increasing customer preference for sustainability and supportive government policies are diminishing their appeal. For instance, the global bio-based chemicals market was valued at over $100 billion in 2023, signaling a strong shift. However, the cost-competitiveness against fluctuating oil prices, as seen in 2024, continues to be a key factor.

Innovation in biotechnology also presents a dynamic threat, with new bio-based substitutes emerging rapidly. These can offer improved performance or cost advantages, pressuring Cathay Biotech to continuously innovate. For example, advancements in enzymatic synthesis could provide more efficient production methods compared to current fermentation processes.

| Substitute Type | Key Characteristics | Impact on Cathay Biotech | 2024 Considerations |

|---|---|---|---|

| Petroleum-derived chemicals | Lower cost (especially at low oil prices), established market | Moderate threat, price sensitive | Oil price volatility impacts cost competitiveness |

| Emerging bio-based alternatives | Potentially superior performance, competitive pricing | Growing threat, requires continuous innovation | Rapid advancements in synthetic biology and enzyme engineering |

Entrants Threaten

Establishing industrial-scale biomanufacturing facilities, particularly for synthetic biology and fermentation, demands significant capital investment. This includes substantial outlays for cutting-edge research and development, as well as the construction and equipping of advanced production infrastructure. For instance, setting up a new fermentation plant can easily run into hundreds of millions of dollars, a figure that presents a formidable financial barrier.

This high financial hurdle effectively deters many potential new entrants from entering the biomanufacturing sector. Only entities with substantial financial backing and access to significant capital can even consider undertaking such an endeavor. This capital intensity means that the threat of new entrants is relatively low, as the upfront costs are simply too high for most to overcome.

Developing advanced bio-based materials, such as those pioneered by Cathay Biotech, requires substantial investment in research and development. This includes deep scientific knowledge in areas like synthetic biology and metabolic engineering, which are not easily replicated by newcomers.

The lengthy development cycles and the need for highly specialized expertise create a significant barrier to entry. For instance, bringing a new bio-based chemical to market can take many years and millions of dollars in R&D, a hurdle that deters many potential competitors.

Cathay Biotech's robust intellectual property portfolio, likely encompassing numerous patents on proprietary strains and fermentation processes, presents a significant barrier to new entrants. This strong IP protection makes it both difficult and expensive for competitors to replicate Cathay's unique bio-based molecules and production methods without risking legal action. For instance, in 2023, the global biotechnology market saw significant investment in R&D, with companies filing thousands of new patents, highlighting the critical role of IP in this competitive landscape.

Regulatory Hurdles and Certification Processes

New entrants in industrial biotechnology, like Cathay Biotech, face significant regulatory hurdles. Navigating complex frameworks for environmental permits, safety assessments, and product certifications is a major barrier. For instance, in 2024, the average time for obtaining key industrial biotechnology approvals in major markets like the EU and US often extended beyond 18-24 months, involving substantial upfront investment in compliance and specialized legal/scientific expertise. This lengthy and costly process effectively deters many potential competitors, safeguarding established players.

These regulatory processes are not merely procedural; they demand deep scientific understanding and substantial financial resources. Companies must invest heavily in research and development to meet stringent safety and efficacy standards, often requiring extensive testing and documentation. The capital expenditure associated with demonstrating compliance can be prohibitive for smaller or less-funded entrants, creating a high barrier to entry and protecting the market share of companies like Cathay Biotech that have already invested in these areas.

Key aspects of these regulatory challenges include:

- Environmental Impact Assessments: Ensuring new bio-processes meet strict environmental discharge and waste management regulations.

- Product Safety and Efficacy Approvals: Obtaining certifications for products used in food, feed, or pharmaceutical applications, requiring rigorous testing.

- Intellectual Property Protection: Navigating patent landscapes and ensuring new entrants do not infringe on existing bio-patents, which are prevalent in this sector.

- Containment and Biosafety Protocols: Adhering to strict guidelines for handling genetically modified organisms (GMOs) or novel biological materials.

Access to Distribution Channels and Customer Relationships

Securing reliable distribution channels and cultivating deep, trusting relationships with industrial clients in sectors like polymers, plastics, coatings, and adhesives is a time-consuming and resource-intensive endeavor. Newcomers face a substantial hurdle in quickly penetrating these established networks and earning the requisite customer confidence.

For instance, in the specialty chemicals market, where Cathay Biotech operates, building these relationships can take years. A 2024 industry report indicated that over 70% of B2B purchasing decisions in these sectors are influenced by existing supplier trust and established supply chain reliability, making it difficult for new entrants to displace incumbents.

- Distribution Channel Access: New entrants often lack the established logistics and sales networks required to efficiently reach key industrial customers.

- Customer Relationship Building: Developing the necessary trust and loyalty with industrial buyers in specialized markets like polymers and coatings is a lengthy process.

- Incumbent Advantage: Existing players benefit from long-standing partnerships and a proven track record, which new entrants struggle to replicate quickly.

The threat of new entrants in the industrial biotechnology sector, where Cathay Biotech operates, is generally low due to substantial barriers. These include immense capital requirements for R&D and manufacturing, often in the hundreds of millions of dollars for a single fermentation plant. Furthermore, the need for highly specialized scientific expertise and lengthy development cycles for novel bio-based materials, which can take years and millions in R&D, deters many potential competitors.

Porter's Five Forces Analysis Data Sources

Our Cathay Biotech Porter's Five Forces analysis is built upon a foundation of robust data, including Cathay Biotech's annual reports, investor presentations, and official company disclosures. We supplement this with industry-specific market research reports and analyses from reputable financial data providers.