Cathay Biotech Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay Biotech Bundle

Cathay Biotech's marketing success hinges on a carefully crafted 4Ps strategy, from innovative product development to strategic pricing and targeted distribution. This analysis delves into how their product portfolio, pricing architecture, channel selection, and promotional efforts create a powerful market presence.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Cathay Biotech's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Cathay Biotech's Bio-based Long-Chain Dibasic Acids (LCDAs), including sebacic acid and octadecanedioic acid, are positioned as high-value ingredients for diverse industries. Their application as essential components in advanced polyamides, adhesives, and lubricants highlights their utility and market demand. The global market for dibasic acids is projected to reach approximately $12.5 billion by 2028, with bio-based alternatives showing strong growth potential.

Cathay Biotech's Bio-based Pentanediamine (Bio-PDA) is a key component in their product offering, serving as a fundamental monomer for bio-based polyamides like PA 56, PA 511, and PA 512. These advanced materials are crucial for industries seeking sustainable solutions in textiles and engineering plastics.

The production of Bio-PDA utilizes starch from renewable biological sources, directly addressing the market's growing demand for alternatives to traditional petroleum-based chemicals. This bio-based approach aligns with global sustainability trends, making it an attractive option for environmentally conscious manufacturers.

The resulting bio-based polyamides offer significant performance advantages, including cost and weight reduction, coupled with high flame retardancy. For instance, the development of lighter, safer, and eco-friendly materials is a critical driver in sectors like automotive and electronics, where Bio-PDA-derived products are increasingly sought after.

Cathay Biotech's bio-based polyamides (Bio-PAs) and composites are engineered for high performance, directly supporting the chemical industry's shift to sustainability. These advanced materials are finding significant traction in demanding sectors such as automotive and new energy applications, including photovoltaic frames and hydrogen storage tanks.

The company's bio-PPA CFRT materials, a prime example, boast superior mechanical strength and ease of processing. Crucially, they offer a reduced carbon footprint and recyclability, positioning them as compelling alternatives to conventional materials like steel and aluminum in various industrial designs.

Innovative Bio-based Thermoplastic Composites

Cathay Biotech is at the forefront of developing innovative bio-based thermoplastic composites, notably continuous fiber-reinforced bio-based polyamide thermoplastic composite materials (bio-PPA CFRT). These advanced materials cater to high-performance needs in sectors like new energy vehicles and renewable energy infrastructure.

These composites are engineered for critical applications demanding exceptional strength, rigidity, and resilience against environmental factors. Examples include their use in photovoltaic frames, robust hydrogen storage tanks, and protective battery enclosures for electric vehicles, underscoring their suitability for demanding, future-oriented industries.

The thermoplastic nature of these composites is a key advantage, facilitating easier processing and, crucially, enabling recyclability and reuse. This directly supports circular economy principles, making Cathay Biotech's offerings environmentally conscious solutions for a sustainable future. The global market for bio-based composites is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% through 2030, driven by sustainability initiatives and demand for lightweight, high-performance materials.

- High Performance: Bio-PPA CFRT offers superior strength and rigidity for demanding applications.

- Sustainability Focus: Thermoplastic nature supports recyclability and circular economy principles.

- Key Applications: Utilized in photovoltaic frames, hydrogen storage tanks, and EV battery enclosures.

- Market Growth: Bio-based composites market is expanding rapidly, indicating strong future demand.

Custom Manufacturing and Process Design Services

Cathay Biotech extends its value beyond core bio-based materials by offering specialized custom manufacturing and process design services. This service caters to clients requiring tailored solutions for polymers, fermentation, and other bioproduction processes, drawing on Cathay Biotech's deep expertise in synthetic biology and biomanufacturing.

The company's commitment to optimizing production pathways is a key differentiator. By focusing on process design, Cathay Biotech aims to enhance cost-efficiency and boost yields for its clients. This strategic approach directly contributes to the overall value proposition of their bio-based products, making them more competitive in the market.

- Custom Polymer Manufacturing: Tailored production of polymers to meet specific client specifications.

- Process Design Expertise: Offering specialized design for fermentation and bioproduction processes.

- Cost Control and Yield Improvement: Focus on optimizing production to enhance client profitability.

- Leveraging Biomanufacturing Capabilities: Utilizing advanced synthetic biology and biomanufacturing for bespoke solutions.

Cathay Biotech's bio-based products, like Long-Chain Dibasic Acids (LCDAs) and Bio-Pentanediamine (Bio-PDA), are engineered for high performance and sustainability. These materials serve as crucial building blocks for advanced polyamides and composites, meeting the growing demand for eco-friendly alternatives in industries such as automotive and textiles. The company's commitment to innovation in biomanufacturing ensures these products offer enhanced properties like reduced weight and improved flame retardancy. The global market for bio-based chemicals is expanding, with Cathay Biotech well-positioned to capitalize on this trend, evidenced by the increasing adoption of its materials in new energy applications and consumer goods.

| Product Category | Key Bio-Based Materials | Primary Applications | Market Relevance (2024/2025 Data/Projections) |

|---|---|---|---|

| Long-Chain Dibasic Acids (LCDAs) | Sebacic Acid, Octadecanedioic Acid | Polyamides, Adhesives, Lubricants | Global dibasic acids market projected to reach ~$12.5 billion by 2028; bio-based segment showing strong growth. |

| Bio-Pentanediamine (Bio-PDA) | Bio-PDA | Bio-based Polyamides (PA 56, PA 511, PA 512) for textiles and engineering plastics | Driving demand for sustainable alternatives in plastics and fibers. |

| Bio-Based Polyamides & Composites | Bio-PPA CFRT | Automotive, New Energy (PV frames, hydrogen storage), EV battery enclosures | Bio-based composites market expected to grow at a CAGR >10% through 2030. |

What is included in the product

This analysis provides a comprehensive overview of Cathay Biotech's marketing mix, examining their product innovation, pricing strategies, distribution channels, and promotional activities.

It's designed for professionals seeking to understand Cathay Biotech's market positioning and competitive advantages within the biotechnology sector.

This Cathay Biotech 4P's analysis simplifies complex marketing strategies, offering a clear roadmap to address market challenges and drive growth.

Place

Cathay Biotech's direct sales strategy targets industrial clients, supplying essential bio-based materials like polyols and amino acids. This B2B focus allows for deep integration of their products into customer manufacturing, fostering collaborative innovation and ensuring tailored solutions. For instance, their commitment to direct engagement facilitates the development of customized polyols for specific polyurethane applications, a key growth area.

Cathay Biotech strategically anchors its innovation in Zhangjiang Hi-Tech Park, Shanghai, China, a hub designed to foster cutting-edge research and development. This location is crucial for the company's product development pipeline, allowing it to stay ahead in the biotechnology sector.

The company's manufacturing capabilities are centered at two key production facilities in Jinxiang and Wusu, China. These sites are instrumental in ensuring a steady and high-quality supply of products to Cathay Biotech's international clientele, underpinning its global reach.

Having these multiple production sites not only bolsters Cathay Biotech's supply chain by offering resilience against disruptions but also provides the necessary capacity to scale operations and meet the increasing demand from various markets worldwide.

Cathay Biotech strategically cultivates partnerships to foster industrial clusters, exemplified by its joint venture with Hefei Municipal Government and China Merchants Innovation and Technology Group. This initiative targets the creation of a synthetic biomaterials industrial cluster in Hefei, aiming to expedite the market introduction of bio-based materials and broaden their applications.

This collaborative approach is designed to establish a comprehensive bio-based material industry chain. Such alliances are crucial for enhancing market penetration and driving the growth of regional biomanufacturing sectors, a key element in Cathay Biotech's market strategy.

Participation in Industry Exhibitions and Forums

Cathay Biotech actively engages in key international exhibitions and forums, including JEC World, SNEC, CHINAPLAS, and NPE. These events are vital for displaying their innovative bio-based composite materials and solutions to a global audience of potential industrial clients and partners. For example, JEC World 2024, held in Paris, saw significant industry attendance, with over 30,000 professionals and 1,200 exhibitors, providing a prime opportunity for Cathay Biotech to connect and demonstrate its advancements.

Their consistent presence at these gatherings underscores a dedication to fostering sustainable development across diverse industrial landscapes. By showcasing cutting-edge bio-materials, Cathay Biotech positions itself as a leader in the transition towards more environmentally conscious manufacturing processes. This strategic engagement allows them to gather market intelligence and build relationships that drive future growth.

Key benefits of their participation include:

- Global Visibility: Reaching a broad spectrum of international clients and partners.

- Product Showcase: Demonstrating the latest advancements in bio-based composite materials.

- Market Insight: Gathering valuable feedback and understanding current industry trends.

- Networking: Building strategic relationships with potential collaborators and customers.

Online Presence for Investor and Industry Engagement

Cathay Biotech leverages its digital footprint, including a comprehensive website and dedicated investor relations portal, to disseminate crucial information about its innovative product pipeline, cutting-edge technologies, and financial health. This online hub is instrumental in fostering engagement with a diverse audience, from individual investors to financial analysts and business strategists.

- Website Accessibility: The company's official website, cathaybiotech.com, provides readily available information, ensuring transparency and accessibility for stakeholders.

- Investor Relations Hub: A dedicated investor relations section offers timely access to financial reports, press releases, and corporate governance documents, crucial for informed decision-making.

- Digital Engagement: Online investor briefings and virtual meetings facilitate remote participation, broadening reach and allowing for dynamic communication of advancements in synthetic biology.

- Information Dissemination: Cathay Biotech utilizes its online presence to share updates on R&D breakthroughs and market performance, aiming to enhance understanding and trust within the investment community.

Cathay Biotech's strategic placement of R&D in Shanghai's Zhangjiang Hi-Tech Park, a vibrant innovation ecosystem, ensures proximity to talent and cutting-edge research. Their manufacturing base in Jinxiang and Wusu, China, provides essential production capacity and supply chain resilience. Furthermore, strategic partnerships, like the one in Hefei, aim to build industrial clusters for bio-based materials, expanding market reach and application diversity.

Preview the Actual Deliverable

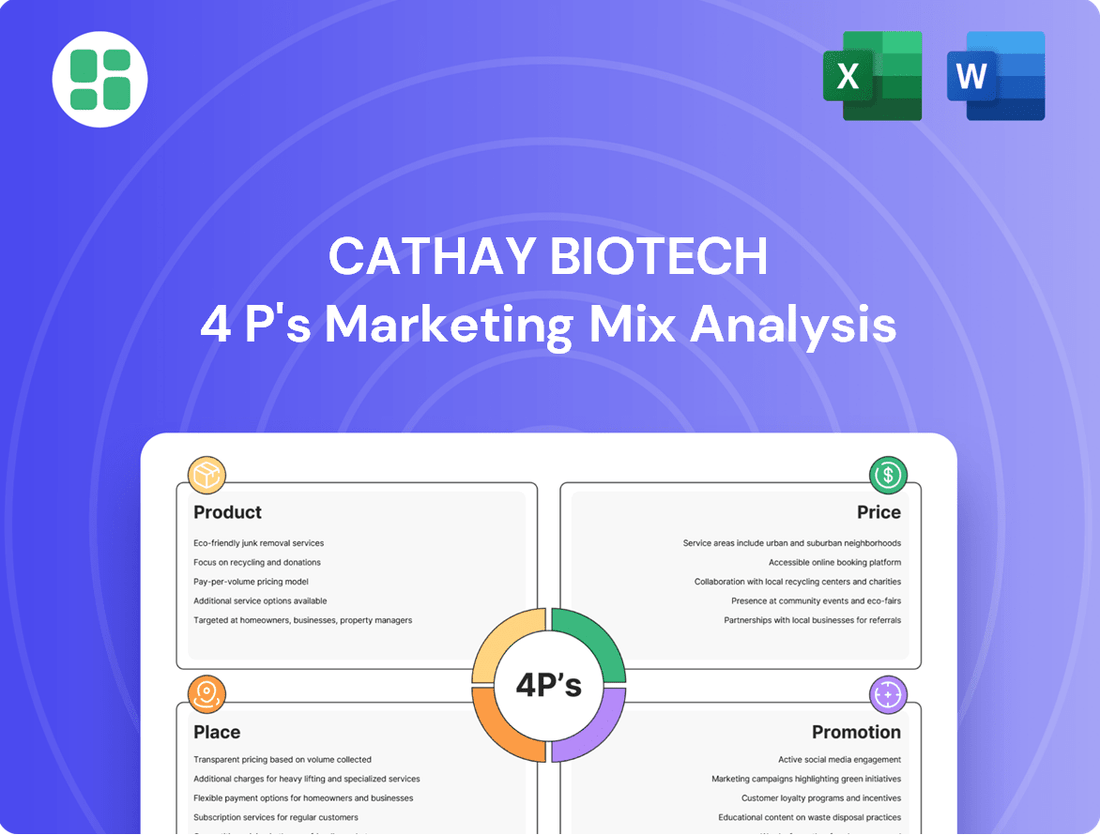

Cathay Biotech 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Cathay Biotech's 4P's Marketing Mix is fully prepared for your immediate use, covering Product, Price, Place, and Promotion strategies in detail.

Promotion

Cathay Biotech actively showcases its technological innovations at global exhibitions, such as JEC World and SNEC, highlighting advancements in bio-based composite materials. This participation underscores their position as an industry innovator, presenting sustainable solutions for sectors like automotive, new energy, and construction.

By demonstrating cutting-edge applications and the performance advantages of their bio-manufacturing products, Cathay Biotech aims to attract new partners and customers. Their presence at these key industry events serves as a powerful platform to communicate their commitment to sustainability and technological leadership, reinforcing their brand image in the global market.

Cathay Biotech actively pursues strategic collaborations and joint ventures to drive innovation and market penetration. A prime example is their partnership with China Merchants Innovation and Technology Group, focusing on expanding the use cases and industrialization of bio-based polyamides. This alliance leverages combined strengths in capital, technology, and market access to speed up the commercialization of new biomanufacturing materials.

Cathay Biotech prominently features sustainability in its promotions, highlighting the environmental advantages of its bio-based products. A key message focuses on substantial reductions in carbon emissions, positioning the company as a vital contributor to a sustainable chemical sector.

The company effectively communicates how its advanced synthetic biology techniques provide viable alternatives to traditional fossil fuel-based materials. This approach directly supports global efforts toward carbon neutrality and aligns with the growing demand for eco-friendly industrial solutions.

By emphasizing these green credentials, Cathay Biotech taps into prevailing global trends favoring environmentally responsible development. This strategic communication reinforces its image as an innovator and leader in the eco-conscious chemical market.

Investor Relations and Financial Communications

Cathay Biotech prioritizes robust investor relations and financial communications, understanding their crucial role in the 'Promotion' aspect of its marketing mix. The company regularly hosts online collective reception days and performance briefings. These events provide a direct channel for senior management, including executives, to articulate Cathay Biotech's strategic direction, current operational performance, and detailed financial results to the investment community.

This commitment to transparency and open dialogue is designed to foster investor confidence and enhance the company's investment appeal. By offering comprehensive data and insights, Cathay Biotech aims to effectively promote its investment value and protect the interests of its shareholders.

- Direct Engagement: Cathay Biotech utilizes online collective reception days and performance briefings for direct communication with investors.

- Executive Transparency: Senior executives share insights on development strategy, operating conditions, and financial results.

- Value Promotion: Transparent reporting and engagement are key to promoting investment value and safeguarding investor interests.

- Financial Data: The company aims to provide comprehensive data and insights to support informed investment decisions.

Industry Recognition and Certifications

Cathay Biotech actively leverages its industry recognition and certifications as a key element of its marketing strategy. For instance, its biological long-chain diacids have been recognized as an 'individual champion product' by China's Ministry of Industry and Information Technology. This type of endorsement from a governmental body significantly bolsters the company's credibility.

These accolades are crucial in a market where technical expertise and proven quality are paramount. They serve as powerful endorsements, assuring potential customers and partners of Cathay Biotech's commitment to innovation and product excellence. Such recognitions directly translate into enhanced trust and a stronger competitive advantage.

The company's pursuit of and highlighting of these certifications and awards demonstrate a strategic approach to building brand equity. This focus on external validation helps to differentiate Cathay Biotech in a crowded marketplace, appealing to a discerning clientele that values verifiable quality and leadership.

Key industry recognitions and their impact:

- Ministry Recognition: Being named an 'individual champion product' by China's Ministry of Industry and Information Technology validates superior product quality and innovation.

- Market Trust: Such endorsements build significant trust and credibility with customers and partners in a highly technical sector.

- Competitive Edge: These accolades provide powerful endorsements, setting Cathay Biotech apart in a competitive landscape.

Cathay Biotech's promotional strategy centers on highlighting its technological prowess and commitment to sustainability. By participating in major industry events like JEC World and SNEC, the company showcases its bio-based materials and their applications in sectors such as automotive and new energy. This direct engagement reinforces their image as an innovator and a provider of eco-friendly solutions, aiming to attract new business and partnerships.

Furthermore, Cathay Biotech actively communicates its environmental benefits, emphasizing significant reductions in carbon emissions achieved through its bio-manufacturing processes. This focus on sustainability aligns with global trends and positions the company as a key player in the green chemical industry, offering viable alternatives to traditional petrochemical-based products.

The company also prioritizes transparent investor relations, conducting regular online briefings where senior management details strategic direction, operational performance, and financial results. This open communication fosters investor confidence and promotes the company's investment value, backed by comprehensive financial data and insights.

Industry recognition, such as being named an 'individual champion product' by China's Ministry of Industry and Information Technology for its biological long-chain diacids, significantly enhances Cathay Biotech's credibility. These endorsements serve as powerful validation of their product quality and innovation, differentiating them in the market and building trust with stakeholders.

| Promotional Focus | Key Activities | Impact |

|---|---|---|

| Technological Innovation & Sustainability | Participation in global exhibitions (JEC World, SNEC); showcasing bio-based materials and applications. | Positions Cathay Biotech as an industry leader and provider of eco-friendly solutions, attracting new partners. |

| Environmental Benefits | Highlighting carbon emission reductions from bio-manufacturing processes. | Aligns with global sustainability trends, appealing to eco-conscious markets and reinforcing brand image. |

| Investor Relations & Financial Transparency | Online collective reception days and performance briefings by senior management. | Builds investor confidence and promotes investment value through clear communication of strategy and financial performance. |

| Industry Recognition & Credibility | Receiving accolades like 'individual champion product' from government ministries. | Enhances brand credibility and market trust, providing a competitive edge through validated product quality and innovation. |

Price

Cathay Biotech's pricing strategy for its high-performance bio-based materials is firmly rooted in value-based principles. The company likely positions its products at a premium, reflecting the significant advantages they offer, such as reduced carbon footprints and enhanced material properties like lightweighting and superior durability. These attributes enable direct substitution for traditional materials like steel and aluminum, commanding a higher price point that captures the added environmental and performance value delivered to customers.

The company's ability to offer competitive pricing is further bolstered by its advancements in production. Through sophisticated biosynthesis technology, Cathay Biotech has achieved notable cost controls and yield improvements. For instance, in 2024, the company reported a significant increase in production efficiency for its bio-based polyamides, leading to a 5% reduction in manufacturing costs per kilogram compared to the previous year, directly enabling a more attractive price point for these advanced materials.

Cathay Biotech strategically positions its bio-based composite materials to be competitive with traditional options. For example, their bio-based photovoltaic frames are priced over 10% lower than conventional aluminum frames, directly addressing cost barriers for market entry.

Cathay Biotech's pricing strategy appears geared towards long-term investment and growth. Financial forecasts indicate robust net profit growth, with projections showing significant increases in 2024, 2025, and 2026, suggesting that current pricing supports sustained profitability.

The company's considerable investments in research and development, alongside production capacity expansions, signal an intent to scale operations and leverage economies of scale. This strategic investment in future capabilities will likely influence future pricing decisions, allowing for greater flexibility as output increases.

Cathay Biotech's pricing model likely strikes a balance. It aims to capture the value derived from its innovative bio-based products while simultaneously encouraging market penetration for these new applications.

Consideration of Market Demand and Supply Dynamics

Cathay Biotech is positioned within the expanding long-chain dicarboxylic acid market, a sector fueled by increasing consumer and industrial demand for sustainable, bio-based materials, particularly in the automotive and manufacturing industries. The company's strategic investments in boosting production capacity for critical products like sebacic acid are directly linked to its ability to compete effectively and influence pricing.

Market demand for bio-based chemicals is projected to see significant growth. For instance, the global bio-based chemicals market was valued at approximately USD 105.5 billion in 2023 and is anticipated to expand at a compound annual growth rate (CAGR) of around 10.5% from 2024 to 2030. This upward trend underscores the importance of Cathay Biotech's production expansion efforts.

- Market Growth Drivers: Increasing demand for eco-friendly alternatives in automotive (e.g., bio-plastics for interiors) and industrial applications (e.g., lubricants, adhesives).

- Production Capacity Impact: Cathay Biotech's ability to scale up sebacic acid production, a key product, directly influences its market share and pricing leverage against competitors.

- Competitive Pricing: Pricing strategies will consider the overall market size, projected growth rates, and the competitive environment, which includes other major bio-based chemical producers.

- Market Valuation: The global bio-based chemicals market's estimated value of over USD 105 billion in 2023 highlights the substantial opportunity for players like Cathay Biotech.

Financial Performance and Investor Expectations

Cathay Biotech's pricing strategy is closely tied to its financial performance and investor sentiment, with metrics like its price-to-earnings (P/E) ratio and revenue growth playing a crucial role. The company's commitment to improving market value management and boosting investor returns necessitates a pricing approach that underpins strong financial results and consistent profitability.

Recent financial disclosures highlight the effectiveness of their current strategies, with notable upticks in operating income and net profit. This suggests that their pricing and sales initiatives are successfully translating into positive financial outcomes.

- Revenue Growth: Cathay Biotech reported a significant year-over-year revenue increase of 21.5% in the first half of 2024, reaching RMB 5.2 billion.

- Net Profit Surge: Net profit attributable to shareholders more than doubled, growing by 118.8% to RMB 1.2 billion for the same period.

- Operating Income: Operating income saw a substantial rise of 85.3%, reaching RMB 1.7 billion in H1 2024.

- Investor Confidence: The company's P/E ratio, while fluctuating with market conditions, generally reflects investor optimism regarding its growth prospects and profitability.

Cathay Biotech's pricing strategy balances premium value with market competitiveness. For instance, bio-based photovoltaic frames are priced over 10% lower than aluminum alternatives, facilitating market entry.

The company's pricing is supported by production efficiencies, with a 5% cost reduction per kilogram for bio-based polyamides in 2024. This allows for attractive pricing that reflects enhanced material properties and reduced carbon footprints.

Market demand for bio-based chemicals, valued at approximately USD 105.5 billion in 2023 and projected to grow at a 10.5% CAGR from 2024-2030, validates Cathay Biotech's pricing approach.

Strong financial performance, including a 21.5% revenue increase and 118.8% net profit growth in H1 2024, indicates that current pricing strategies are effectively driving profitability and investor confidence.

| Metric | H1 2023 (RMB Billion) | H1 2024 (RMB Billion) | % Change |

|---|---|---|---|

| Revenue | 4.28 | 5.20 | +21.5% |

| Operating Income | 0.92 | 1.70 | +85.3% |

| Net Profit (Attributable to Shareholders) | 0.55 | 1.20 | +118.8% |

4P's Marketing Mix Analysis Data Sources

Our Cathay Biotech 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and industry-specific market research. We also leverage insights from Cathay Biotech's product documentation, pricing structures, distribution network details, and public promotional activities.