Caterpillar SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caterpillar Bundle

Caterpillar's robust brand recognition and extensive dealer network are significant strengths, but a reliance on cyclical industries presents a key vulnerability. Discover the complete picture behind Caterpillar's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Caterpillar stands as the undisputed global leader in construction and mining equipment, a position reinforced by its highly respected brand, synonymous with durability and performance. This market dominance is further solidified by an expansive dealer network, reaching roughly 190 countries with over 2,800 service points, ensuring robust customer support and fostering enduring loyalty.

Caterpillar boasts an incredibly broad range of products and services, covering everything from heavy machinery for construction and mining to engines for power generation and transportation. This extensive offering is a significant strength, as it allows them to serve a wide array of industries.

This diversification isn't just about product variety; it extends to their financial services and insurance offerings as well. By providing these alongside their core products, Caterpillar creates multiple avenues for revenue and helps cushion the impact of any slowdowns in specific sectors. For instance, their equipment financing arm plays a crucial role in facilitating sales and generating income, especially during periods of economic uncertainty.

In the first quarter of 2024, Caterpillar reported sales and revenues of $13.4 billion, demonstrating the scale of their operations across these diverse segments. This wide net helps ensure financial stability, as a downturn in one area is often offset by strength in another, a testament to the strategic advantage of their diversified business model.

Caterpillar consistently demonstrates robust financial performance, a key strength. The company has a proven ability to generate sustainable revenue and profits, even amidst fluctuating market conditions. For instance, in the first quarter of 2024, Caterpillar reported sales and revenues of $13.44 billion, a slight decrease from the previous year, but managed to achieve an impressive operating profit margin of 17.3%.

Furthermore, Caterpillar excels in returning capital to its shareholders. The company has a long-standing commitment to rewarding investors, evidenced by its 55 consecutive years of dividend payments. In 2023 alone, Caterpillar returned $7.4 billion to shareholders through dividends and share repurchases, underscoring its financial discipline and shareholder-centric approach.

Commitment to Innovation and Technology

Caterpillar stands out as an early adopter of digitalization, channeling substantial investments into research and development to integrate cutting-edge technologies into its offerings. This commitment fuels the development of advanced solutions that enhance customer value and operational efficiency.

The company actively leverages data from its vast network of over 1.5 million connected assets. This wealth of information provides actionable insights, driving improvements in machine productivity and paving the way for innovations in automation, electrification, and alternative fuel compatibility, aligning with a future focused on sustainability.

- Digitalization Leader: Caterpillar is at the forefront of adopting digital technologies in the heavy equipment sector.

- Data-Driven Insights: Over 1.5 million connected assets provide real-time data for enhanced performance and predictive maintenance.

- Future-Forward Solutions: Significant R&D investment targets automation, electrification, and alternative fuels for sustainability.

Extensive Global Dealer Network and Customer Relationships

Caterpillar's extensive global dealer network is a cornerstone of its competitive strength, facilitating sales, distribution, and vital after-sales support. This network, comprising over 175 dealers worldwide as of early 2024, ensures localized service and parts availability, a critical factor for customers operating in diverse and often remote locations.

These strong, long-standing relationships with dealers and end-customers translate into deep market penetration and a significant competitive advantage. Caterpillar's ability to maintain close ties fosters customer loyalty and provides invaluable feedback for product development and service enhancements.

- Global Reach: Over 175 independent dealers across more than 190 countries.

- Customer Proximity: Localized sales, service, and parts support ensures uptime for customers.

- Market Leadership: Strong relationships contribute to market share and customer satisfaction.

- Service Excellence: Dealers provide essential maintenance, repair, and training, reinforcing brand reputation.

Caterpillar's brand recognition is exceptional, built on decades of delivering reliable and durable equipment, a significant advantage in a competitive market. This strong brand equity fosters customer trust and loyalty, which is crucial for repeat business and market share retention.

The company's broad product portfolio, encompassing construction, mining, and energy solutions, provides a diversified revenue stream. This wide range allows Caterpillar to cater to numerous industries, mitigating risks associated with downturns in any single sector. For example, in Q1 2024, sales and revenues reached $13.4 billion, showcasing the breadth of their operations.

Caterpillar's financial services arm is a key strength, facilitating equipment sales through financing and insurance. This integrated approach not only boosts sales but also generates additional revenue, as seen in their consistent profitability and shareholder returns, with $7.4 billion returned in 2023.

The company's commitment to digitalization and investing in R&D, particularly in automation and electrification, positions it well for future growth and sustainability trends. Leveraging data from over 1.5 million connected assets provides valuable insights for product improvement and innovation.

| Strength | Description | Supporting Data |

|---|---|---|

| Brand Recognition | Globally recognized for durability and performance. | Synonymous with quality in heavy equipment. |

| Product Diversification | Extensive range of equipment and services across multiple industries. | Serves construction, mining, energy, and transportation sectors. |

| Financial Services | Facilitates sales and generates revenue through financing and insurance. | Returned $7.4 billion to shareholders in 2023. |

| Digitalization & Innovation | Leading in adopting new technologies like automation and electrification. | Utilizes data from over 1.5 million connected assets. |

What is included in the product

Offers a full breakdown of Caterpillar’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, organized framework to identify and address potential business challenges, turning complex strategic thinking into actionable insights.

Weaknesses

Caterpillar's significant reliance on the construction and mining sectors, both highly sensitive to economic cycles, presents a notable weakness. When these industries experience slowdowns, demand for Caterpillar's heavy machinery naturally dips.

This cyclicality directly affects Caterpillar's financial performance. For instance, the company reported a decrease in sales volumes in Q1 2025, a clear indicator of how economic headwinds in its core markets can impact revenue and profitability.

Caterpillar's business model inherently demands significant capital investment. In 2023, the company reported capital expenditures of $3.5 billion, reflecting ongoing investments in manufacturing capabilities and product development. This high level of spending, while necessary for maintaining its competitive edge, can strain financial flexibility, particularly when market demand softens.

The substantial upfront and ongoing costs associated with research and development, maintaining extensive manufacturing facilities, and managing a global distribution network contribute to elevated operating expenses. These costs can make Caterpillar susceptible to profitability pressures, especially during economic downturns when sales volumes decrease, potentially leading to issues like overcapacity and the accumulation of excess inventory.

Caterpillar's reliance on a vast network of external suppliers for raw materials and manufactured components, a cornerstone of its global sourcing strategy, inherently introduces vulnerabilities. Disruptions stemming from geopolitical instability, trade disputes, or natural disasters can significantly impact its ability to procure essential inputs.

The ongoing challenges with semiconductor component availability, a critical element in modern machinery, directly affect Caterpillar's production schedules and overall operational efficiency. For instance, the global chip shortage experienced throughout 2021-2023 led to production delays across various industries, including heavy equipment manufacturing.

Furthermore, the imposition of increased tariffs on imported goods can escalate production costs, potentially squeezing profit margins and necessitating price adjustments for end products. This dynamic adds another layer of complexity to managing its supply chain and maintaining competitive pricing in a fluctuating global market.

Geographic Concentration in North America

Despite Caterpillar's global presence, its significant reliance on North America for sales presents a notable weakness. In the first quarter of 2024, for instance, the company reported that its Construction Industries segment, a major revenue driver, saw its strongest performance in North America, underscoring this concentration.

This heavy dependence on a single geographic region, primarily the U.S. and Canada, exposes Caterpillar to greater vulnerability from regional economic downturns or shifts in demand. If the North American market experiences a slowdown, Caterpillar's overall financial performance could be disproportionately impacted compared to competitors with more balanced global revenue streams.

This geographic concentration means that localized market disruptions, such as trade policy changes or specific industry slowdowns within North America, can have a more pronounced effect on Caterpillar's profitability and operational stability.

- Regional Economic Sensitivity: A slowdown in the North American economy directly impacts Caterpillar's sales and revenue more than a company with a truly global, diversified customer base.

- Vulnerability to Policy Changes: Trade policies or regulatory shifts specific to North America can have a magnified negative effect on Caterpillar's operations.

- Limited Buffer Against Localized Downturns: Unlike more diversified competitors, Caterpillar has less of a cushion if its primary market faces significant challenges.

Impact of Economic and Political Instability

Caterpillar's extensive global footprint, while a strength, also exposes it to significant economic and political instability. Fluctuations in currency exchange rates, for instance, can directly impact reported earnings and the cost of goods sold. The company experienced this when the US dollar strengthened significantly against major currencies in late 2024, affecting international sales translation.

Trade disputes and protectionist policies present another considerable weakness. Tariffs, like those implemented in early 2025 on certain imported components, can increase manufacturing costs and affect pricing competitiveness, potentially dampening demand for Caterpillar's heavy machinery in affected markets. These disruptions can ripple through the supply chain, leading to production delays and increased operational expenses.

Changes in government policies and regulations across different operating regions also pose a risk. New environmental standards or shifts in infrastructure spending priorities, for example, could necessitate costly adjustments to product lines or reduce market opportunities. The unpredictability of these policy shifts makes long-term strategic planning more challenging.

- Currency Volatility: A strong US dollar in late 2024 negatively impacted translated foreign earnings.

- Trade Tensions: Tariffs in early 2025 increased input costs and affected market access.

- Regulatory Uncertainty: Evolving environmental regulations require ongoing adaptation and investment.

Caterpillar's heavy reliance on the cyclical construction and mining industries makes it vulnerable to economic downturns. When these sectors slow, demand for its machinery naturally falls, impacting sales. For example, Q1 2025 saw decreased sales volumes, highlighting this sensitivity.

The company's substantial capital expenditure, such as the $3.5 billion in 2023, while necessary for innovation and capacity, can strain financial flexibility during market slumps. High operating expenses from R&D and manufacturing also pressure profitability when sales decline.

Supply chain disruptions, particularly concerning critical components like semiconductors, pose a significant operational risk. The global chip shortage experienced through 2021-2023 directly impacted production schedules across industries, including heavy equipment.

Geopolitical instability and trade disputes can escalate production costs through tariffs, affecting profit margins and pricing. Furthermore, Caterpillar's significant sales concentration in North America exposes it to amplified risks from regional economic slowdowns or policy shifts.

What You See Is What You Get

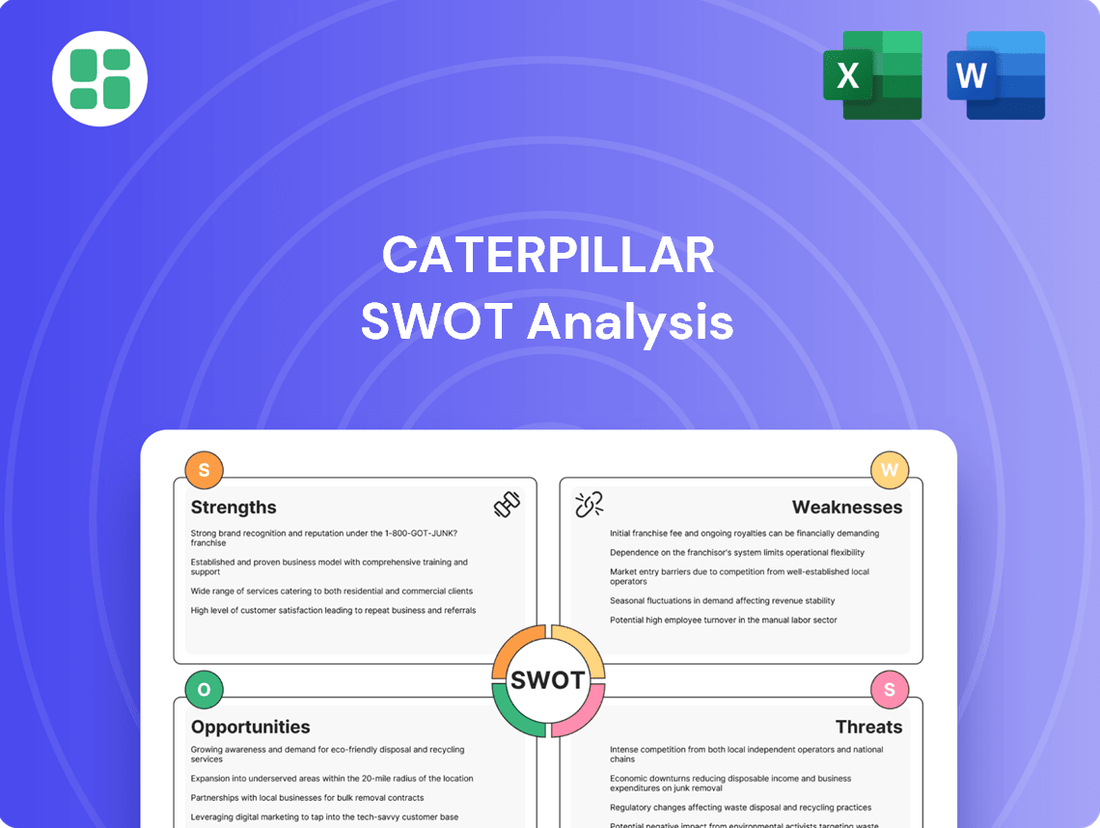

Caterpillar SWOT Analysis

The preview you see is the actual Caterpillar SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the exact professional quality report you expect.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, offering comprehensive insights into Caterpillar's strategic position, becomes available immediately after checkout.

Opportunities

Emerging markets present a significant avenue for growth, fueled by ongoing urbanization and industrialization. For instance, in 2024, infrastructure spending in many developing Asian economies is projected to see robust increases, creating substantial demand for heavy machinery.

Caterpillar's established global footprint and strong brand recognition position it to effectively tap into these burgeoning markets. This expansion can serve as a crucial counterweight to any deceleration observed in more established, mature economies, thereby broadening the company's overall customer reach and revenue streams.

The increasing global call for sustainability, focusing on lower emissions, better fuel economy, and alternative fuel options, is a significant growth avenue for Caterpillar. This trend directly aligns with the company's strategic direction towards cleaner energy and more efficient operations.

Caterpillar is strategically positioned to capitalize on this by broadening its range of electric, hybrid, and autonomous machinery. For instance, the company has been actively developing and launching electric versions of its popular equipment, such as the R1700 XE electric underground loader, demonstrating a tangible commitment to this opportunity.

Furthermore, investments in digital technologies like telematics and advanced data analytics offer a dual benefit: enhancing operational efficiency for customers and creating new service-based revenue streams. Caterpillar's Cat Connect services already provide valuable insights, and further development in this area can solidify its leadership in providing data-driven sustainable solutions.

Caterpillar is seeing significant opportunities in the power generation market, especially with the surging demand for large reciprocating engines to power data centers. This trend is a key growth driver, offering a robust alternative to cyclical construction and mining sectors.

In 2024, the global data center market is projected to reach over $300 billion, with continued expansion expected. Caterpillar's strong position in providing reliable power solutions for these critical facilities is a major advantage.

Furthermore, potential government investments in infrastructure, including energy grids and digital networks, could further boost demand for Caterpillar's power generation equipment, offering diversification and sustained revenue streams.

Aftermarket Services and Remanufacturing Growth

Caterpillar's focus on expanding its aftermarket services, encompassing parts, maintenance, and remanufacturing, offers a robust avenue for generating consistent, recurring revenue. This strategic push also deepens customer loyalty by providing comprehensive lifecycle support for their equipment.

The company's dedication to the principles of a circular economy is a key growth driver. By increasing sales of remanufactured products and efficiently recovering valuable materials from end-of-life equipment, Caterpillar not only meets its sustainability targets but also boosts its operational efficiency and profitability.

- Recurring Revenue Growth: Aftermarket services are projected to become an increasingly significant portion of Caterpillar's revenue. In 2023, services revenue reached $16.1 billion, a notable increase from previous years, highlighting the growing importance of this segment.

- Circular Economy Impact: Caterpillar's remanufacturing operations, such as Cat Reman, are central to this strategy. The company aims to recover and reuse more components, reducing waste and the need for new raw materials, which directly supports environmental goals and cost savings.

- Customer Retention: By offering a complete suite of services, from parts availability to expert maintenance and remanufacturing solutions, Caterpillar strengthens its relationships with customers, ensuring they rely on Cat products and services throughout the equipment's lifespan.

Strategic Acquisitions and Partnerships

Caterpillar's strategic acquisitions and partnerships present a significant opportunity to bolster its capabilities. By acquiring complementary businesses or forming alliances, the company can rapidly expand its product portfolio and gain access to new geographic markets. For instance, in the first half of 2024, Caterpillar completed several small acquisitions aimed at enhancing its digital solutions and services, which are crucial for the evolving construction and mining industries.

These collaborations are vital for integrating cutting-edge technologies, such as advanced robotics and AI-driven predictive maintenance, directly into Caterpillar's existing offerings. This allows the company to stay ahead of technological shifts and meet the increasing demand for smarter, more efficient equipment. Such moves are critical for maintaining a competitive edge in a market that is rapidly embracing digital transformation.

The ability to strategically acquire and partner can significantly strengthen Caterpillar's overall market position.

- Enhanced Product Offerings: Acquisitions can bring in new product lines or technologies that complement existing ones, such as adding specialized demolition equipment or advanced telematics systems.

- Expanded Market Reach: Partnerships can open doors to new regions or customer segments, leveraging the partner's established presence.

- Technology Integration: Collaborations facilitate the swift adoption of new technologies, like autonomous vehicle systems or sustainable power solutions, crucial for future growth.

- Competitive Advantage: By quickly adapting to industry changes through strategic moves, Caterpillar can solidify its leadership position against competitors.

Expanding into emerging markets, particularly those undergoing significant urbanization and infrastructure development, presents a substantial growth opportunity for Caterpillar. The company's robust global presence and brand strength are key assets in capturing this demand. Furthermore, the global shift towards sustainability, emphasizing lower emissions and fuel efficiency, aligns perfectly with Caterpillar's product development in electric, hybrid, and autonomous machinery.

The power generation sector, especially the demand for large reciprocating engines to support data center expansion, offers a strong alternative revenue stream. Caterpillar's aftermarket services, including parts, maintenance, and remanufacturing, are also crucial for building recurring revenue and enhancing customer loyalty. Strategic acquisitions and partnerships allow Caterpillar to quickly integrate new technologies and expand its market reach, ensuring it remains competitive in a rapidly evolving industry.

| Opportunity Area | Key Drivers | Caterpillar's Position |

|---|---|---|

| Emerging Markets | Urbanization, Infrastructure Spending | Established Global Footprint, Brand Recognition |

| Sustainability & Electrification | Demand for Lower Emissions, Fuel Efficiency | Development of Electric, Hybrid, Autonomous Machinery |

| Power Generation (Data Centers) | Growth in Data Center Industry | Reliable Power Solutions for Critical Facilities |

| Aftermarket Services & Remanufacturing | Recurring Revenue, Customer Loyalty | Comprehensive Lifecycle Support, Circular Economy Focus |

| Strategic Acquisitions & Partnerships | Technology Integration, Market Expansion | Access to New Capabilities and Geographies |

Threats

Caterpillar operates in a highly competitive landscape, facing strong rivals such as Komatsu, Volvo Construction Equipment, and John Deere. These competitors, particularly those with a significant presence in emerging markets, can leverage lower production costs or specialized product offerings to gain an edge.

This intense rivalry often translates into significant pricing pressure, forcing Caterpillar to carefully manage its margins. In 2023, the global heavy equipment market experienced fluctuations, with demand in certain sectors impacted by economic slowdowns, further intensifying the battle for market share.

Caterpillar's substantial revenue is closely tied to the health of the global economy. A significant economic downturn, like the potential weakness anticipated for 2025, directly translates to lower demand for construction and mining equipment. This can severely impact Caterpillar's sales volumes and overall profitability.

Market instability, characterized by volatile commodity prices or geopolitical uncertainty, further exacerbates these risks. Such conditions can lead to reduced capital expenditure by Caterpillar's customers, directly affecting order pipelines. The company may also face challenges with inventory management, potentially requiring costly write-downs if demand falters unexpectedly.

Caterpillar faces significant threats from evolving regulatory landscapes, particularly concerning environmental standards and emissions. For instance, in 2024, the company, like many in the heavy machinery sector, is navigating stricter emissions targets in key markets such as the European Union and North America. These regulations often necessitate substantial investments in research and development for cleaner technologies and may increase operational compliance costs.

The growing global emphasis on sustainability translates into intensified scrutiny of Caterpillar's environmental footprint. Failure to adapt to these increasingly stringent regulations could result in higher compliance expenses, potential legal challenges, and a need for ongoing capital allocation towards greener equipment development. This could potentially affect profit margins and require strategic adjustments to product portfolios to meet future market demands and regulatory expectations.

Supply Chain Disruptions and Trade Tensions

Ongoing global trade disruptions, including tariffs and geopolitical tensions, remain a significant threat to Caterpillar's intricate global supply chain. These factors can directly impact the cost of raw materials and components, potentially leading to price increases for customers and reduced profit margins for Caterpillar. For instance, in 2023, the company continued to navigate the effects of various trade disputes, which influenced its material costs and logistics planning.

These trade tensions can also result in parts shortages and logistical hurdles, directly affecting Caterpillar's production schedules and its capacity to fulfill customer orders promptly. Such disruptions can lead to project delays for Caterpillar's clients, potentially damaging customer relationships and impacting future sales. The company's reliance on a global network of suppliers means it is particularly susceptible to these international trade dynamics.

- Increased Material Costs: Tariffs and trade restrictions can directly inflate the cost of steel, aluminum, and other essential materials used in manufacturing heavy equipment.

- Supply Chain Volatility: Geopolitical events can lead to unpredictable disruptions in the flow of parts and finished goods, impacting delivery times and operational efficiency.

- Reduced Demand: Trade tensions can slow global economic growth, which in turn can dampen demand for construction and mining equipment, Caterpillar's core products.

Fluctuations in Commodity Prices and Customer Demand

Fluctuations in commodity prices directly impact Caterpillar's customer base, particularly in the mining and energy sectors. When prices for commodities like iron ore, copper, or oil drop significantly, it can deter investment in new equipment or expansion projects. For instance, a sharp decline in oil prices in late 2023 and early 2024 could certainly temper demand for heavy machinery in the energy exploration and production segments.

This volatility creates unpredictable revenue streams for Caterpillar. A downturn in commodity markets can lead to reduced orders for excavators, loaders, and other heavy equipment. Conversely, a commodity price boom might spur demand, but the inherent instability makes long-term financial planning challenging for both Caterpillar and its customers.

Consider these points:

- Customer Investment Tied to Commodity Prices: Mining and energy companies' capital expenditure decisions are heavily influenced by the profitability derived from commodity prices.

- Demand Instability: A sudden drop in, say, copper prices could lead to a slowdown in orders for mining equipment, impacting Caterpillar's sales volumes.

- Revenue Stream Uncertainty: The cyclical nature of commodity markets means Caterpillar's revenue can be subject to sharp swings, affecting financial forecasting and investment strategies.

Caterpillar faces significant threats from intense competition, particularly from rivals like Komatsu and Volvo, who can leverage lower costs in emerging markets. This competition leads to pricing pressure, impacting Caterpillar's profit margins, especially as global economic slowdowns in 2023 and anticipated weakness in 2025 reduce demand for heavy equipment.

Evolving environmental regulations, such as stricter emissions targets in the EU and North America in 2024, necessitate costly R&D investments in cleaner technologies. Failure to adapt can lead to higher compliance costs and potential legal issues. Furthermore, global trade disruptions, including tariffs and geopolitical tensions, continue to affect Caterpillar's supply chain, increasing material costs and potentially causing parts shortages and delivery delays, as seen with ongoing trade disputes impacting material costs in 2023.

Fluctuations in commodity prices also pose a threat, as downturns in sectors like mining and energy, driven by lower commodity prices in late 2023 and early 2024, can significantly reduce customer investment in new equipment. This volatility creates unpredictable revenue streams for Caterpillar, making long-term financial planning challenging.

| Threat Category | Specific Threat | Impact on Caterpillar | Example/Data Point |

|---|---|---|---|

| Competition | Intense Rivalry | Pricing pressure, margin erosion | Competitors like Komatsu and Volvo gain market share in emerging markets. |

| Economic Factors | Global Economic Slowdown | Reduced demand for equipment, lower sales volumes | Anticipated economic weakness in 2025 impacting construction and mining sectors. |

| Regulatory Environment | Stricter Environmental Standards | Increased R&D costs, compliance expenses | Navigating stricter emissions targets in EU and North America in 2024. |

| Supply Chain & Trade | Trade Disruptions & Tariffs | Higher material costs, supply chain volatility | Impact of trade disputes on material costs and logistics planning in 2023. |

| Commodity Prices | Price Volatility | Reduced customer investment, unpredictable revenue | Downturns in oil and copper prices affecting demand for mining and energy equipment. |

SWOT Analysis Data Sources

This Caterpillar SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and insights from industry experts and analysts to ensure a thorough and accurate assessment.