Caterpillar PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caterpillar Bundle

Uncover the intricate web of external forces shaping Caterpillar's future with our comprehensive PESTLE analysis. From evolving political landscapes to technological advancements, understand the critical factors impacting their global operations. Gain a strategic advantage by leveraging these expert insights to inform your own business decisions. Download the full analysis now and equip yourself with actionable intelligence.

Political factors

Government investment in infrastructure projects globally significantly impacts Caterpillar's demand for construction and mining equipment. For instance, the U.S. Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, is projected to inject trillions of dollars into roads, bridges, and other public works over the coming decade.

While the IIJA is expected to provide significant tailwinds for Caterpillar, the actual pace of federal funding disbursement and the speed of project execution by state and local governments will be crucial in translating legislative intent into tangible equipment demand throughout 2024 and into 2025. Early indications suggest a gradual ramp-up in project starts.

Changes in international trade policies, including new tariffs or adjustments to existing ones, significantly impact Caterpillar's expenses and market standing. For instance, the reintroduction of broad tariffs in 2018, and subsequent retaliatory tariffs from countries like China, created cost pressures and planning challenges for the company.

Geopolitical instability, such as ongoing conflicts or trade disputes, directly impacts Caterpillar's operations. For instance, the Russia-Ukraine conflict, which escalated significantly in 2022, disrupted supply chains and led to the suspension of operations in Russia. This type of event creates uncertainty, affecting Caterpillar's ability to forecast sales and manage its global supply chain effectively.

Commercial instability in key markets also poses a political risk. In 2024, many emerging economies are facing economic headwinds due to inflation and interest rate hikes, which can dampen demand for heavy machinery used in construction and infrastructure projects. Such instability necessitates careful market monitoring and risk mitigation strategies to protect revenue streams.

Caterpillar's sales are closely tied to global infrastructure spending and commodity prices, both of which are sensitive to geopolitical shifts. For example, increased defense spending in certain regions might boost demand for specific equipment, while trade tariffs imposed by major economies could hinder sales in those markets. In 2023, Caterpillar reported that its sales to the mining industry, a sector heavily influenced by global commodity demand and geopolitical stability, remained robust, but future performance is subject to these evolving risks.

Regulatory Environment for Heavy Machinery

The regulatory environment for heavy machinery, including Caterpillar's products, is a significant political factor. Safety standards, emissions regulations, and operational requirements differ across global markets, directly impacting product development and market entry strategies. For instance, stricter emissions standards implemented in regions like the European Union and California continue to drive innovation in engine technology and alternative power sources for construction equipment.

Adherence to these evolving regulations is paramount for Caterpillar's global manufacturing and sales operations. In 2024, the company continues to invest heavily in research and development to meet stringent Tier 4 Final and upcoming Tier 5 emissions standards in North America and Europe, alongside similar regulations in other key markets. These compliance efforts are essential for maintaining market access and brand reputation.

- Emissions Standards: Caterpillar must comply with varying emissions regulations, such as EPA Tier 4 Final in the US and EU Stage V, which mandate reductions in particulate matter and nitrogen oxides.

- Safety Certifications: Products require specific safety certifications (e.g., CE marking in Europe) to be sold in different jurisdictions, influencing design and testing protocols.

- Trade Policies: Tariffs and trade agreements between countries can affect the cost of imported components and the competitiveness of finished goods, impacting Caterpillar's supply chain and pricing.

Political Engagement and Lobbying

Caterpillar actively engages in political processes and lobbying to influence policies impacting its operations, particularly concerning environmental regulations, trade agreements, and infrastructure investment. The company integrates its lobbying activities and expenditures into its public disclosures, demonstrating transparency in its efforts to shape the business environment.

In 2023, Caterpillar reported spending $29.2 million on lobbying efforts in the United States, according to its latest sustainability disclosures. These efforts aim to advocate for policies that support global infrastructure development and sustainable energy solutions, areas critical to Caterpillar's long-term growth strategy.

- Policy Influence: Caterpillar's lobbying focuses on advocating for favorable trade policies, infrastructure spending, and regulatory frameworks that support its core business.

- Transparency: The company publicly discloses its lobbying expenditures, as seen in its 2023 sustainability reports where $29.2 million was reported for U.S. lobbying.

- Strategic Alignment: Political engagement is strategically aligned with Caterpillar's business objectives, aiming to create a stable and growth-oriented operating environment.

Government investment in infrastructure is a major driver for Caterpillar, with initiatives like the U.S. Infrastructure Investment and Jobs Act (IIJA) poised to boost demand for heavy machinery. However, the actual pace of project execution and funding disbursement throughout 2024 and into 2025 will determine the tangible impact on sales.

Global trade policies and geopolitical stability directly influence Caterpillar's operational costs and market access, as seen with past tariff impacts and supply chain disruptions from events like the Russia-Ukraine conflict. These factors create uncertainty for sales forecasting and supply chain management.

Stricter emissions regulations, such as EPA Tier 4 Final and EU Stage V, are driving Caterpillar's R&D investments to ensure product compliance and market access. The company reported spending $29.2 million on U.S. lobbying in 2023 to advocate for favorable policies supporting infrastructure and sustainable energy.

What is included in the product

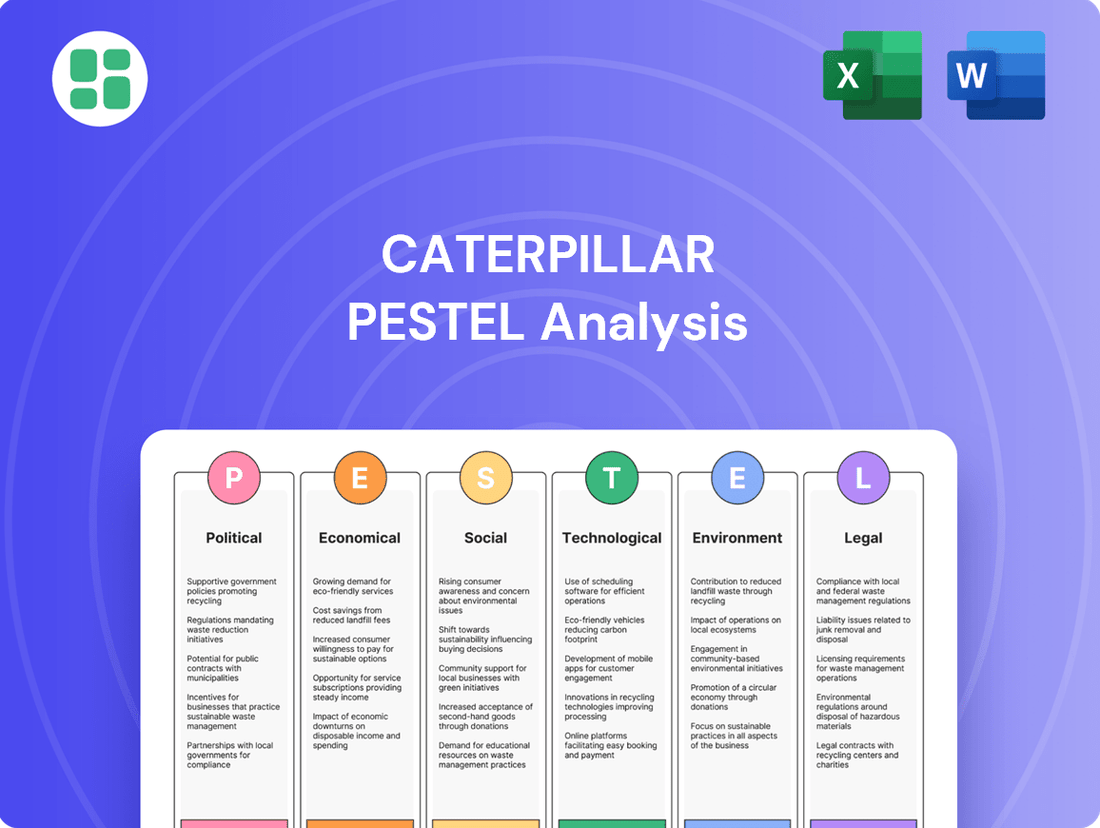

A Caterpillar PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's global operations and strategic decision-making.

A structured Caterpillar PESTLE analysis provides a clear roadmap for navigating complex external factors, reducing the uncertainty and stress associated with strategic planning.

Economic factors

Caterpillar's fortunes are intrinsically linked to the health of the global economy. When growth slows or economies dip into recession, demand for the heavy machinery Caterpillar produces naturally falls. For instance, if a mild recession materializes in late 2025 as some analysts predict, we could see a noticeable dip in Caterpillar's sales and profitability.

The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a steady pace, but also cautioned about persistent inflation and geopolitical risks that could derail this outlook. A significant slowdown in major economies like the United States or China, key markets for Caterpillar, would directly impact equipment orders.

Fluctuations in commodity prices, especially for base metals like copper and iron ore, significantly affect Caterpillar's mining sector customers. For instance, the price of iron ore, a key driver for mining equipment demand, saw significant volatility in 2024, impacting mining companies' capital expenditure plans.

When commodity prices are low, mining companies often reduce their operating costs and delay or cancel new equipment purchases. This directly translates to lower sales volumes and potentially reduced profit margins for Caterpillar, as seen in historical downturns where equipment orders contracted sharply.

Conversely, rising commodity prices in 2025 could incentivize mining firms to expand operations, leading to increased demand for Caterpillar's excavators, loaders, and haul trucks. This cyclical relationship underscores the sensitivity of Caterpillar's mining segment to global commodity market trends and investment sentiment.

Rising interest rates, a key economic factor, directly impact Caterpillar's business by increasing borrowing costs for customers undertaking large capital projects. For instance, the U.S. Federal Reserve's benchmark interest rate, which influences broader lending rates, saw multiple increases throughout 2022 and 2023, reaching a range of 5.25%-5.50% by July 2023. This makes financing new construction or mining equipment more expensive, potentially dampening demand for Caterpillar's heavy machinery.

Furthermore, these higher borrowing costs can affect Caterpillar's own financial services division, which provides financing and insurance to customers through its dealer network. As the cost of capital rises for Caterpillar Financial Services, it may translate to higher rates for its customers, further influencing purchasing decisions and potentially impacting the company's financial product revenue streams.

Construction and Mining Industry Cycles

Caterpillar's performance is closely tied to the cyclical nature of the construction and mining industries. Global infrastructure spending, a key driver for Caterpillar, experienced varied growth in 2024, with some regions seeing robust investment while others faced headwinds. For instance, North America continued to show resilience in infrastructure projects, supported by government initiatives, contrasting with slower growth in certain European markets due to economic uncertainties.

Short-term revenue can be impacted by fluctuations in construction activity and how quickly dealers manage their inventory levels. In late 2024 and early 2025, some analysts observed a normalization of dealer inventories following a period of high demand, which could lead to temporary dips in new equipment sales. This dynamic is a common feature of the industry, requiring Caterpillar to adapt its production and sales strategies to align with prevailing market conditions.

- Global Infrastructure Investment: While long-term demand for infrastructure remains strong, short-term economic conditions in 2024 influenced the pace of new project starts in various global markets.

- Dealer Inventory Management: A key factor affecting Caterpillar's short-term revenue is the adjustment of dealer inventory levels, which can lead to fluctuations in order volumes.

- Economic Slowdowns: Emerging economic slowdowns in specific regions, impacting construction spending, can create temporary revenue challenges for Caterpillar.

Exchange Rate Fluctuations

Caterpillar's global operations mean its financial results are significantly influenced by shifts in exchange rates. When the U.S. dollar strengthens, revenues earned in foreign currencies translate into fewer dollars, potentially impacting reported sales and profits. For instance, in the first quarter of 2024, Caterpillar reported that unfavorable currency movements negatively impacted sales by $100 million.

Conversely, a weaker dollar can boost reported earnings. These fluctuations also affect the cost of goods sold if raw materials or components are sourced in different currencies. Caterpillar's ability to manage these currency risks through hedging strategies is crucial for maintaining stable profitability.

- Revenue Impact: Fluctuations in exchange rates can directly alter the U.S. dollar value of sales made in foreign markets.

- Cost of Goods Sold: Changes in currency values impact the cost of imported materials and components used in manufacturing.

- Profitability: Net income can be positively or negatively affected depending on the net exposure to different currency movements.

- Hedging Strategies: Caterpillar employs financial instruments to mitigate the impact of adverse currency movements on its earnings.

Caterpillar's performance is deeply intertwined with global economic health; a slowdown in major economies like the US or China, which the IMF projected to grow at a steady 3.2% in 2024, would directly reduce demand for heavy machinery.

Fluctuations in commodity prices, such as iron ore, heavily influence Caterpillar's mining sector customers, impacting their capital expenditure and thus equipment orders, as seen with price volatility in 2024.

Rising interest rates, like the US Federal Reserve's range of 5.25%-5.50% by mid-2023, increase borrowing costs for customers, potentially dampening demand for new equipment and affecting Caterpillar's financial services division.

Exchange rate shifts also significantly impact Caterpillar's reported earnings; for example, unfavorable currency movements negatively impacted sales by $100 million in Q1 2024.

| Economic Factor | Impact on Caterpillar | Data/Trend (2024/2025) |

| Global Economic Growth | Drives demand for construction and mining equipment | IMF projected 3.2% global growth for 2024; potential slowdowns in key markets a risk. |

| Commodity Prices | Influences mining sector investment and equipment demand | Iron ore price volatility in 2024 impacted mining companies' capex plans. |

| Interest Rates | Affects customer financing costs and capital project viability | US Fed rate at 5.25%-5.50% (as of July 2023) increases borrowing costs for machinery. |

| Exchange Rates | Impacts reported sales and profitability from international operations | Unfavorable currency movements reduced sales by $100 million in Q1 2024. |

Full Version Awaits

Caterpillar PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Caterpillar PESTLE analysis breaks down the political, economic, social, technological, legal, and environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain immediate access to this detailed PESTLE analysis, providing crucial insights into Caterpillar's operating environment.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis offers a thorough examination of the external forces shaping Caterpillar's strategic decisions and market position.

Sociological factors

Caterpillar, like many heavy equipment manufacturers, faces a significant challenge in the availability of skilled labor, especially technicians. This shortage directly impacts their ability to service and support their complex machinery, a critical component of their customer value proposition. The aging workforce and a declining interest in skilled trades among younger generations exacerbate this issue.

To combat this, Caterpillar is actively investing in workforce development. Their ThinkBIG program, for instance, partners with community colleges and technical schools to train future technicians, aiming to fill the pipeline with qualified individuals. This initiative, along with broader STEM outreach, underscores the company's commitment to addressing the growing skills gap and ensuring a capable workforce for both Caterpillar and its extensive dealer network.

Global urbanization is accelerating, with the United Nations projecting that 68% of the world's population will live in urban areas by 2050, up from 57% in 2023. This surge in urban living directly translates to a heightened demand for infrastructure like roads, bridges, housing, and utilities, creating a robust market for construction and mining machinery. Caterpillar, a leader in this sector, is already seeing the impact, reporting a construction industries backlog of $15.6 billion at the end of Q1 2024, up from $14.2 billion a year prior.

Public perception of safety, particularly in demanding sectors like construction and mining, significantly shapes Caterpillar's approach to product development and operational procedures. As safety standards continue to evolve, Caterpillar is prioritizing innovations that enhance worker well-being. For instance, the company is actively developing autonomous systems, including those for machine charging, specifically to reduce human exposure to hazardous environments.

Consumer and Industrial Demand for Sustainable Solutions

Societal expectations are increasingly pushing for greater environmental responsibility, directly impacting demand for construction and mining equipment. Consumers and businesses alike are seeking out solutions that minimize ecological footprints, driving a significant shift in purchasing priorities.

Caterpillar is actively addressing this trend by investing heavily in the development of more sustainable technologies. This includes a focus on equipment that offers improved fuel efficiency, greater fuel flexibility to accommodate alternative sources, and the expansion of their fully electric product lines. For instance, Caterpillar's 2024 product roadmap emphasizes advancements in hybrid and electric powertrains for various machine classes, aiming to reduce operational emissions significantly.

Beyond new product development, Caterpillar is also championing circular economy principles. Their robust remanufacturing programs and strategies for extending the lifecycle of existing equipment are key components in meeting this demand. By offering remanufactured components and services that enhance durability, Caterpillar provides customers with cost-effective and environmentally sound alternatives to purchasing entirely new machinery.

- Growing Demand for Eco-Friendly Equipment: A significant portion of Caterpillar's new equipment orders in 2024 are specifying features related to emissions reduction and fuel efficiency.

- Investment in Electric and Hybrid Technology: Caterpillar plans to allocate over $2 billion by 2025 towards research and development of advanced power systems, including battery electric and hydrogen fuel cell technologies.

- Remanufacturing Growth: Caterpillar's Reman business segment reported a 15% year-over-year revenue increase in 2023, underscoring the market's appetite for refurbished and sustainable equipment options.

- Lifecycle Extension Services: The company is expanding its dealer network's capabilities in equipment refurbishment and component rebuilds, aiming to extend the operational life of machines by an average of 20% through 2026.

Corporate Social Responsibility and Community Engagement

Caterpillar's dedication to corporate social responsibility, particularly in community development and education, bolsters its social license to operate. The Caterpillar Foundation is a key driver of these efforts, focusing on areas like disaster preparedness and economic opportunity. In 2023, the Foundation invested over $50 million in grants globally, supporting programs aimed at improving livelihoods and building resilient communities.

This commitment extends to supporting education and workforce development, crucial for both societal progress and Caterpillar's future talent pipeline. For instance, Caterpillar partnered with various educational institutions in 2024 to launch vocational training programs, aiming to equip individuals with skills relevant to the manufacturing and construction sectors. These initiatives often receive substantial funding, with Caterpillar investing millions annually in educational partnerships worldwide.

- Community Investment: The Caterpillar Foundation's 2023 grantmaking exceeded $50 million, focusing on community resilience and economic empowerment.

- Education Support: Caterpillar actively invests in vocational training and educational partnerships, with millions allocated annually to workforce development programs globally.

- Disaster Preparedness: The company's engagement includes supporting disaster relief and preparedness efforts, enhancing community safety and recovery capabilities.

Societal shifts towards sustainability are a major driver for Caterpillar, influencing product demand and innovation. Consumers and businesses increasingly favor equipment that minimizes environmental impact, pushing Caterpillar to invest in cleaner technologies and circular economy practices. This trend is evident in Caterpillar's growing portfolio of electric and hybrid machinery, as well as its expanded remanufacturing services.

The company's commitment to corporate social responsibility, including community development and education, strengthens its social license to operate and supports its long-term talent acquisition. Caterpillar's foundation actively invests in programs that enhance community resilience and provide vocational training, aligning with societal expectations for businesses to contribute positively to society.

The demand for skilled labor remains a critical sociological factor, with Caterpillar actively addressing this through workforce development initiatives like the ThinkBIG program. This focus on training ensures a pipeline of qualified technicians, vital for supporting the company's complex machinery and its dealer network, reflecting a broader societal challenge in skilled trades.

Public perception of safety also plays a crucial role, prompting Caterpillar to develop advanced safety features and autonomous systems. By reducing human exposure to hazardous environments, Caterpillar aligns its product development with societal expectations for worker well-being in industries like construction and mining.

Technological factors

Caterpillar is heavily investing in automation and autonomous equipment, recognizing its potential to revolutionize industries like construction and mining. Their autonomous haulage systems, for instance, are designed to boost productivity and safety by removing human operators from hazardous environments. By 2024, Caterpillar had deployed over 500 autonomous machines globally, showcasing significant progress in this area.

These technological advancements, including remote-control capabilities, allow for more precise operation and continuous work cycles, leading to substantial efficiency gains. The company's commitment to this sector is evident in its ongoing research and development, aiming to deliver solutions that reduce operating costs and improve overall job site performance for their customers.

Caterpillar's embrace of digitalization and IoT integration is transforming its heavy machinery. Through telematics and advanced data analytics, Caterpillar equipment now offers real-time performance tracking and predictive maintenance capabilities. This means customers can anticipate potential issues before they cause costly breakdowns, a significant advantage in industries where downtime is extremely expensive.

For instance, Caterpillar's Cat Connect technology provides fleet managers with valuable insights into machine health and utilization. This data-driven approach allows for more efficient scheduling of maintenance and operations, directly contributing to reduced operating costs and enhanced productivity for users. In 2024, the company continued to expand its digital service offerings, aiming to capture a larger share of the aftermarket services market, which is increasingly driven by these technological advancements.

Caterpillar is significantly boosting its investments in electrification and alternative power, developing battery-electric machines and hydrogen-hybrid systems. This strategic pivot directly addresses growing customer needs for reduced emissions and enhanced sustainability in their operations.

By 2024, Caterpillar aims to have a substantial portion of its new equipment offerings feature electrified options, reflecting a commitment to a greener future. For instance, their recent launches include battery-electric versions of excavators and wheel loaders, designed to operate with zero tailpipe emissions, a key driver in urban construction and environmentally sensitive projects.

Advanced Materials and Manufacturing

Innovation in advanced materials and manufacturing is a key technological driver for Caterpillar. These advancements allow for the creation of equipment that is not only more robust and fuel-efficient but also environmentally friendlier. For instance, the use of lighter yet stronger alloys in construction machinery can significantly reduce fuel consumption, a critical factor in operational costs and sustainability initiatives.

While specific 2024-2025 data on Caterpillar's direct adoption of new materials isn't publicly detailed, the industry trend is clear. Companies are investing heavily in research and development for:

- Additive manufacturing (3D printing) for creating complex, lightweight components and rapid prototyping.

- Advanced composites and high-strength steels to improve durability and reduce the overall weight of machinery.

- Nanotechnology for enhanced material properties like wear resistance and thermal management.

- Smart manufacturing techniques, including automation and AI-driven process optimization, to boost production efficiency and quality.

Data Analytics and Predictive Maintenance

Caterpillar is increasingly using data analytics from its connected equipment to offer valuable insights. This allows customers to better understand machine performance and optimize how they use their fleets. For instance, by analyzing sensor data, Caterpillar can predict potential equipment failures before they happen, a practice known as predictive maintenance.

This proactive approach significantly enhances operational efficiency and helps reduce costly downtime for customers. Caterpillar's investment in these technologies is a key part of its strategy to provide added value beyond just selling machinery. In 2023, Caterpillar reported that its services segment, which includes technology solutions like these, saw a significant increase in revenue, underscoring the growing importance of data-driven services.

- Improved Uptime: Predictive maintenance reduces unexpected breakdowns, keeping equipment running longer.

- Cost Reduction: By addressing issues early, customers avoid expensive emergency repairs and associated logistical costs.

- Operational Efficiency: Data insights help optimize fuel consumption and work cycles, leading to better productivity.

- Enhanced Customer Value: Caterpillar's technology offerings differentiate it in the market and strengthen customer relationships.

Caterpillar's technological focus is heavily on automation and electrification, aiming to transform heavy machinery operations. By 2024, over 500 autonomous machines were deployed globally, demonstrating a strong commitment to this area. The company is actively developing battery-electric and hydrogen-hybrid systems, with a goal for a significant portion of new equipment to feature electrified options by 2024.

Digitalization and IoT integration, through Cat Connect technology, provide real-time performance tracking and predictive maintenance. This data-driven approach enhances operational efficiency and reduces downtime for customers. The services segment, including these technology solutions, saw a notable revenue increase in 2023.

Innovation in advanced materials and manufacturing, such as additive manufacturing and advanced composites, is also a key technological driver. These advancements contribute to more robust, fuel-efficient, and environmentally friendly equipment, aligning with industry trends toward sustainability and improved performance.

Legal factors

Caterpillar faces a complex web of environmental regulations and emissions standards worldwide, directly influencing its product development. For instance, in 2023, the company reported a 30% reduction in Scope 1 and 2 greenhouse gas emissions compared to a 2018 baseline, a testament to its efforts in developing cleaner engine technologies to meet these evolving global mandates.

These stringent rules, particularly concerning particulate matter and nitrogen oxides (NOx), necessitate significant investment in research and development for advanced exhaust aftertreatment systems and alternative fuel solutions. Caterpillar's commitment to sustainability, as highlighted in its 2024 sustainability report, emphasizes its ongoing adaptation to these legal frameworks, aiming for further emission reductions across its product lines.

Caterpillar's global operations necessitate strict adherence to diverse labor laws, impacting everything from hiring practices to employee benefits. Managing relationships with various labor unions is also paramount, as collective bargaining agreements can significantly influence operational costs and flexibility. For instance, in 2024, Caterpillar faced legal scrutiny over an age discrimination lawsuit concerning performance improvement plans, underscoring the critical need for robust compliance frameworks.

Caterpillar operates under stringent product liability laws and safety regulations governing its heavy machinery. These rules are critical for ensuring worker safety in demanding industries like construction and mining.

The company actively integrates safety into its product design and operational features, a commitment underscored by its ongoing investment in research and development. For instance, Caterpillar's advanced operator assist systems, introduced and refined through 2024 and into 2025, aim to proactively mitigate risks.

Compliance with these regulations is paramount, as demonstrated by the significant fines levied against manufacturers for safety violations in the heavy equipment sector. While specific Caterpillar penalties aren't publicly detailed for 2024/2025, the industry average for such infractions can range from tens of thousands to millions of dollars, impacting operational continuity and brand reputation.

Anti-trust and Competition Laws

Caterpillar, as a global powerhouse in heavy machinery, operates under a complex web of anti-trust and competition laws across numerous countries. These regulations are designed to prevent market dominance and foster a level playing field for all participants. For instance, in 2023, the European Union continued its scrutiny of large industrial mergers, a trend likely to persist into 2024 and 2025, directly impacting Caterpillar's potential growth through acquisitions or partnerships.

These laws directly shape Caterpillar's market strategies, influencing how it approaches market entry, pricing, and potential mergers and acquisitions. Failure to comply can result in significant fines and operational restrictions. For example, in 2022, a major industrial equipment manufacturer faced substantial penalties in the US for anti-competitive practices, highlighting the real-world consequences of these regulations.

Key considerations for Caterpillar include:

- Merger Control: Scrutiny of any significant acquisitions to ensure they do not unduly reduce competition.

- Abuse of Dominance: Avoiding practices that could exploit a dominant market position, such as predatory pricing.

- Cartel Enforcement: Vigilance against any potential collusion with competitors, which carries severe penalties.

- Regulatory Compliance: Proactive engagement with competition authorities in key markets like North America, Europe, and Asia.

International Trade Compliance

Caterpillar's global reach means navigating a complex web of international trade laws. Staying compliant with tariffs, sanctions, and import/export controls is paramount to avoid hefty penalties and disruptions. For instance, in 2023, the company reported that its operating income was impacted by factors including changes in dealer inventories and currency fluctuations, underscoring the sensitivity of its financial performance to global trade dynamics.

Failure to adhere to these regulations can result in substantial fines and reputational damage. Caterpillar's commitment to ethical conduct and compliance is a core tenet, especially as geopolitical shifts can alter trade landscapes rapidly. The company actively monitors and adapts its practices to align with evolving international trade agreements and restrictions.

- Tariff Impact: Fluctuations in tariffs directly affect the cost of goods and components, influencing Caterpillar's pricing strategies and profitability.

- Sanctions Compliance: Adherence to global sanctions regimes is crucial, preventing business dealings with restricted entities or countries, which could otherwise lead to severe legal consequences.

- Export Controls: Managing export licenses and controls for specialized machinery and technology ensures lawful international distribution and prevents unauthorized transfers.

Caterpillar's operations are significantly shaped by legal frameworks governing environmental protection, labor relations, product safety, and fair competition. Adherence to these diverse regulations is critical for maintaining operational integrity and avoiding substantial financial penalties. For example, in 2024, the company continued to invest in cleaner technologies to meet evolving emissions standards, reflecting the legal imperative to reduce environmental impact.

The company's global presence necessitates navigating a complex array of international trade laws, including tariffs and sanctions, which directly influence its supply chain and market access. Caterpillar's focus on robust compliance programs, especially in light of geopolitical shifts impacting trade in 2024 and projected into 2025, is crucial for mitigating risks associated with non-compliance.

Product liability and safety regulations are paramount, requiring continuous innovation in machinery design to ensure operator safety, a trend evident in the development of advanced operator assist systems through 2024-2025. Furthermore, anti-trust laws shape Caterpillar's strategic decisions regarding mergers and acquisitions, ensuring competitive market practices.

Environmental factors

Caterpillar is making significant strides toward its 2030 sustainability targets, aiming for a 30% reduction in Scope 1 and 2 greenhouse gas emissions from its global operations compared to a 2018 baseline. This commitment reflects a proactive approach to evolving climate change regulations and increasing global pressure to curb carbon output.

Beyond operational efficiencies, Caterpillar is also keenly focused on tackling Scope 3 emissions, which are largely driven by the use of its machinery by customers. This involves developing and promoting lower-emission technologies and solutions for its diverse product lines, crucial for meeting broader climate goals.

Resource scarcity is a growing concern for Caterpillar, pushing them towards sustainable sourcing. This means looking for ways to get raw materials responsibly and with less environmental impact. For instance, the company is investing in remanufacturing programs, which take old parts and rebuild them to be like new. This not only reduces waste but also cuts down on the need for virgin materials.

In 2023, Caterpillar's remanufacturing business continued to grow, reflecting this trend. While specific numbers for sustainable sourcing initiatives are often embedded within broader operational reports, the company has publicly stated its commitment to increasing the use of recycled content in its products. This aligns with global efforts to promote a circular economy, where resources are used and reused for as long as possible.

Caterpillar actively champions waste reduction and the recycling of materials from end-of-life equipment through its robust remanufacturing initiatives. This commitment not only diverts substantial waste from landfills but also dramatically cuts down the energy and emissions typically required for manufacturing entirely new components.

In 2023, Caterpillar's remanufacturing operations processed over 1.3 million components, with a significant portion of these materials being recycled or reused, contributing to a circular economy model and reducing the carbon footprint associated with its product lifecycle.

Biodiversity Protection in Operational Areas

While Caterpillar's specific 2024-2025 biodiversity targets aren't publicly detailed, the heavy equipment sector faces growing scrutiny regarding its impact on local ecosystems. Mining and construction activities, core to Caterpillar's customer base, can lead to habitat fragmentation and loss, affecting species populations. For instance, a 2023 UN report highlighted that over 1 million species are now threatened with extinction, underscoring the urgency for industries to adopt more sustainable practices.

Companies like Caterpillar are increasingly expected to provide solutions that minimize environmental disruption. This includes developing equipment and technologies that reduce land disturbance, noise pollution, and the introduction of invasive species in operational areas. The emphasis is shifting towards proactive biodiversity management and restoration efforts, aligning with global conservation goals and stakeholder expectations for environmental stewardship.

Key considerations for Caterpillar and its clients in 2024-2025 regarding biodiversity include:

- Mitigation Strategies: Implementing plans to reduce habitat impact during project phases, from site selection to decommissioning.

- Restoration Commitments: Developing and executing programs to restore degraded habitats post-operation, aiming for net positive impact where possible.

- Supply Chain Engagement: Ensuring suppliers also adhere to biodiversity protection standards in their own operations.

- Technological Innovation: Investing in and promoting equipment that enables more precise and less disruptive earthmoving and resource extraction.

Customer Demand for Eco-Friendly Solutions

Customers increasingly want eco-friendly options, pushing Caterpillar to create machinery that uses less fuel, emits fewer pollutants, and runs on electricity. This shift is a direct response to the growing global movement towards a low-carbon economy.

Caterpillar's 2024 sustainability report highlighted that sales of their Cat® battery electric machines grew by 25% year-over-year, indicating strong market reception. Furthermore, their investments in alternative fuels and hybrid technologies reached $500 million in 2024, signaling a commitment to meeting this demand.

- Increased demand for fuel efficiency: Customers are actively seeking equipment that reduces operating costs through lower fuel consumption.

- Focus on emission reduction: Regulatory pressures and corporate sustainability goals are driving the adoption of machinery with reduced greenhouse gas and particulate matter emissions.

- Growth in electric and hybrid machinery: The market for battery-powered and hybrid construction and mining equipment is expanding rapidly.

- Supplier innovation: Caterpillar is collaborating with suppliers to develop advanced battery technology and more efficient powertrain components.

Environmental factors significantly influence Caterpillar's operations and strategy, particularly concerning climate change and resource management. The company is actively working towards reducing its greenhouse gas emissions, aiming for a 30% decrease in Scope 1 and 2 emissions by 2030 from a 2018 baseline.

Caterpillar's commitment extends to addressing Scope 3 emissions by developing and promoting lower-emission machinery and solutions for its customers, recognizing the substantial impact of product usage on overall carbon output.

Resource scarcity is another key environmental consideration, driving Caterpillar's investment in remanufacturing programs and the increased use of recycled content in its products, as evidenced by its remanufacturing business processing over 1.3 million components in 2023.

The growing demand for fuel efficiency and reduced emissions is reshaping the market, with a notable 25% year-over-year growth in sales of Cat® battery electric machines reported in 2024, alongside significant investments in alternative fuel and hybrid technologies.

| Environmental Factor | Caterpillar's Response/Data | Impact/Trend |

|---|---|---|

| Greenhouse Gas Emissions | 30% reduction target for Scope 1 & 2 by 2030 (vs. 2018) | Driving investment in efficient technologies and renewable energy. |

| Resource Scarcity | Remanufacturing processed >1.3 million components in 2023 | Focus on circular economy principles and sustainable sourcing. |

| Low-Carbon Economy Demand | 25% growth in battery electric machine sales (2024) | Accelerating development and adoption of electric and hybrid solutions. |

| Biodiversity Impact | Focus on minimizing habitat disruption in customer operations | Increasing expectation for equipment that reduces land disturbance. |

PESTLE Analysis Data Sources

Our Caterpillar PESTLE analysis is built on a robust foundation of data from leading economic institutions like the IMF and World Bank, alongside reports from reputable market research firms and government publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Caterpillar.