Caterpillar Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caterpillar Bundle

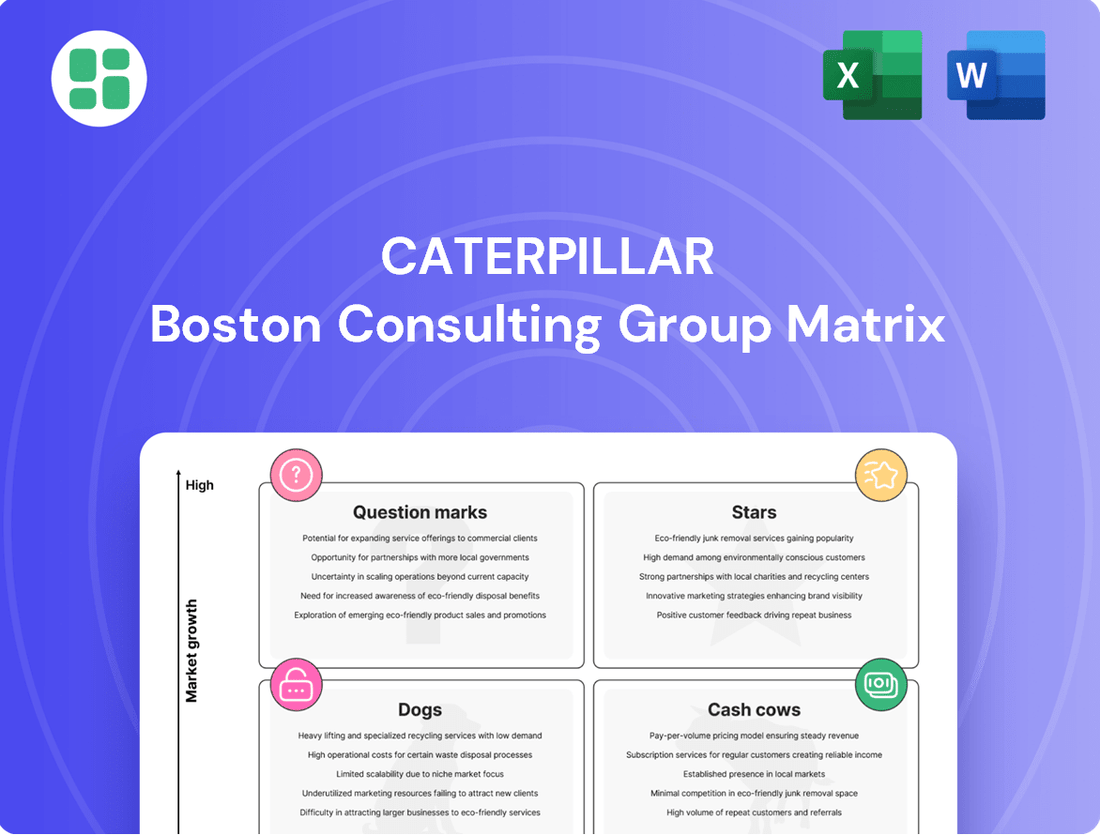

Curious about Caterpillar's product portfolio and market performance? Our BCG Matrix analysis breaks down their offerings into Stars, Cash Cows, Dogs, and Question Marks, revealing their strategic positioning. Don't miss out on the full picture and actionable insights.

Purchase the complete Caterpillar BCG Matrix for a deep dive into each quadrant, complete with data-driven recommendations and a clear roadmap for future investment and product development. Understand where Caterpillar is winning and where it needs to adapt.

This isn't just a chart; it's your key to unlocking Caterpillar's competitive advantage. Get the full BCG Matrix to see their market positioning, identify growth opportunities, and make informed strategic decisions that will drive success.

Stars

Caterpillar is making significant strides in electrified mining and construction equipment, exemplified by their Cat R1700 XE LHD underground loader and smaller electric excavators. These machines are not just concepts; they are being actively showcased at key industry events, demonstrating Caterpillar's commitment to this evolving sector.

The market for electric mining and construction equipment is experiencing a rapid expansion, driven by global decarbonization efforts and a growing demand for sustainable operations. Caterpillar's investment in this area positions them to capitalize on this high-growth segment, aiming to either solidify or increase their market presence.

By developing a diverse range of fuel-flexible and fully electric machinery, Caterpillar is directly addressing customer needs for reduced emissions and enhanced operational sustainability. This strategic focus on electrification is crucial for meeting future regulatory requirements and customer expectations in the coming years.

Caterpillar is actively developing hydrogen-hybrid power solutions, a move that strategically positions them within the burgeoning alternative fuels market for heavy machinery. Their work on new engine platforms, such as the Cat C13D, is a key component of this initiative.

This forward-thinking approach is bolstered by significant external investment, including partial funding from the U.S. Department of Energy, underscoring the perceived potential of this technology. The company's role as a prime contractor in this research and development effort signals a strong commitment to leading the transition towards cleaner power systems in the off-highway sector.

Caterpillar's investment in autonomous mining trucks, like the Cat 777, positions them as a leader in a rapidly expanding market. The aggregates sector, in particular, is seeing significant adoption as companies seek to boost productivity and worker safety.

This advanced technology underscores Caterpillar's strong market share in industrial automation, a field where autonomous systems are becoming indispensable for operational excellence. By 2024, the global autonomous mining market was projected to reach over $10 billion, highlighting the immense growth potential.

Integrated Digital and Connectivity Solutions (CAT Connect)

Caterpillar's CAT Connect suite represents a significant push into the high-growth digital solutions market. This technology leverages connectivity and AI to provide job site productivity enhancements and remote monitoring capabilities, positioning Caterpillar as a leader in smart construction and mining. For instance, Caterpillar reported that its telematics data, a core component of CAT Connect, covered over 1 million assets by the end of 2023, demonstrating the scale of its digital footprint.

These integrated digital and connectivity solutions are designed to boost equipment efficiency, improve safety, and promote sustainability. By offering actionable insights derived from data, CAT Connect helps customers optimize their operations. In 2024, Caterpillar highlighted that customers using its digital services saw an average reduction in unplanned downtime by up to 15%.

- CAT Connect Technology: Focuses on AI-driven insights for job site productivity.

- Remote Monitoring: Enables real-time oversight of equipment performance and health.

- Efficiency Gains: Aims to enhance equipment efficiency, safety, and sustainability.

- Market Position: Solidifies Caterpillar's leadership in leveraging technology for operational excellence in smart construction and mining.

Energy Storage Solutions (ESS) and Charging Infrastructure

Caterpillar's investment in Energy Storage Solutions (ESS) and mobile charging infrastructure, like the MEC500, is a strategic move to bolster the adoption of its electric heavy equipment. This directly addresses the growing demand for reliable power management on job sites, a critical factor for the success of electrified fleets.

The market for robust, scalable power solutions for construction and mining is expanding rapidly. By 2024, the global energy storage market was projected to reach hundreds of billions of dollars, with significant growth driven by industrial applications. Caterpillar's ESS offerings are positioned to capture a substantial share of this burgeoning sector.

- Market Growth: The global energy storage market is experiencing exponential growth, with projections indicating continued expansion through 2030 and beyond.

- Electric Fleet Support: ESS and charging infrastructure are essential enablers for Caterpillar's strategy to transition its customers to electric machinery.

- Job Site Viability: These solutions ensure that electric equipment can operate efficiently and for extended periods on job sites, overcoming range anxiety and charging limitations.

- Competitive Advantage: Caterpillar's early and comprehensive approach to ESS provides a distinct advantage in the evolving landscape of heavy equipment electrification.

Stars in the BCG matrix represent high-growth, high-market-share products or business units. Caterpillar's electrified mining and construction equipment, autonomous trucks, and CAT Connect digital solutions fit this profile. These areas are experiencing rapid market expansion, driven by decarbonization trends, technological advancements, and efficiency demands.

Caterpillar's commitment to electrification, exemplified by machines like the Cat R1700 XE LHD, positions it to capture significant market share in a sector projected for substantial growth. Similarly, the autonomous mining market, valued at over $10 billion by 2024, showcases the high-potential nature of these ventures. The company's digital offerings, like CAT Connect, are also key stars, with telematics data from over a million assets by the end of 2023 indicating strong adoption and market penetration.

| Caterpillar Business Area | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Electrified Equipment | High | Growing | Star |

| Autonomous Mining Trucks | High (>$10B by 2024) | Leading | Star |

| CAT Connect (Digital Solutions) | High | Strong (1M+ assets tracked by end of 2023) | Star |

| Energy Storage Solutions (ESS) | High (Global market in hundreds of billions by 2024) | Emerging | Star |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Visualize your product portfolio to identify underperforming "Dogs" and strategically divest.

Cash Cows

Caterpillar's traditional heavy construction equipment, encompassing excavators, bulldozers, and loaders, stands as a prime example of a Cash Cow. The company holds a robust global market share, projected to be around 16.3% by 2025 in this sector.

Despite operating in a mature market, these established product lines consistently deliver significant and reliable cash flow. This enduring profitability is driven by Caterpillar's strong brand recognition, its vast and efficient dealer network, and a long-standing reputation for producing high-quality, durable machinery.

Caterpillar's large diesel and natural gas engines are a cornerstone of its business, demonstrating enduring market leadership in critical sectors like power generation and transportation. This segment consistently delivers robust profitability and stability, a testament to the company's decades of expertise and the essential nature of reliable power solutions.

Despite operating in markets that may not experience explosive growth, the persistent demand for dependable engines and the lucrative aftermarket services associated with them ensure a steady and substantial cash flow for Caterpillar. For instance, in 2023, Caterpillar reported total revenues of $67.1 billion, with its Power Systems segment, which heavily features these large engines, contributing significantly to this figure.

Caterpillar's conventional mining equipment, despite some recent volume dips, continues to be a powerhouse. This segment, fueled by the essential need for global mineral extraction, generates significant cash flow. The high cost of this machinery, coupled with consistent demand for parts and servicing in ongoing mining projects, solidifies its position as a cash cow for the company.

Parts and Services Division

Caterpillar's Parts and Services division is a classic cash cow within its BCG matrix. This segment thrives on the company's extensive global dealer network and a deeply entrenched aftermarket business, consistently delivering high-margin, recurring revenue. The sheer size of Caterpillar's installed base of machinery fuels demand for essential support, maintenance, and remanufacturing services, effectively extending the life of its products and ensuring continued profitability.

- Recurring Revenue: The parts and services segment provides a stable income stream, less susceptible to the cyclical nature of new equipment sales.

- High Margins: Aftermarket services and parts typically command higher profit margins compared to the sale of new machinery.

- Installed Base Leverage: Caterpillar's vast fleet of machines in operation globally directly translates into a continuous demand for its support offerings.

- Lifecycle Extension: Services like remanufacturing and maintenance not only generate revenue but also enhance customer loyalty and the overall value proposition of Caterpillar products.

Financial Products and Insurance Services

Caterpillar's Financial Products segment acts as a significant Cash Cow, offering crucial financing and insurance services that directly support equipment sales to both customers and dealers. This division provides a stable, recurring revenue stream by leveraging Caterpillar's established customer base and strong brand reputation.

The financial services arm generates additional profits with comparatively low capital intensity when set against the heavy investment required for manufacturing operations. In 2023, Caterpillar's Financial Services segment reported revenues of $3.5 billion, demonstrating its substantial contribution to the company's overall profitability.

- Revenue Generation: The segment provides essential financing and insurance, directly boosting equipment sales and creating a reliable income source.

- Low Capital Intensity: Compared to manufacturing, this division requires less capital investment to generate profits.

- Profitability: In 2023, Financial Services contributed $3.5 billion in revenue, highlighting its role as a profit driver.

- Synergy: It effectively leverages Caterpillar's core machinery business, creating a synergistic relationship that benefits both segments.

Caterpillar's established product lines, like its heavy construction equipment and large engines, are prime examples of Cash Cows. These segments benefit from a strong market presence and consistent demand, ensuring reliable cash flow. The company's Parts and Services division further solidifies its Cash Cow status, leveraging its extensive installed base for high-margin, recurring revenue.

| Segment | Market Position | Cash Flow Contribution | Key Drivers |

| Heavy Construction Equipment | Strong Global Share | High & Reliable | Brand, Dealer Network, Durability |

| Large Engines | Market Leadership | Robust & Stable | Expertise, Essential Demand, Aftermarket |

| Parts & Services | Dominant Aftermarket | High-Margin, Recurring | Installed Base, Dealer Network, Lifecycle Services |

| Financial Products | Synergistic Support | Stable, Profitable | Customer Base, Brand, Low Capital Intensity |

Delivered as Shown

Caterpillar BCG Matrix

The Caterpillar BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered to you without any watermarks or demo content, ready for immediate professional use.

Dogs

Certain older Caterpillar diesel engine models, especially those with lower fuel efficiency and limited adaptability to alternative fuels or stricter emission regulations, could be categorized as Dogs in the BCG Matrix. These legacy products are experiencing a decline in market demand as customers increasingly prioritize cleaner and more efficient power solutions.

For instance, models predating the Tier 4 Final emissions standards, which became fully phased in by 2015 for most heavy-duty engines, often fall into this category. The market shift towards hybrid and electric powertrains, further accelerated by environmental concerns and government incentives, directly impacts the sales volume and profitability of these less competitive engine lines.

These products typically generate low returns and require minimal strategic investment, often being phased out or maintained only for specific niche markets or replacement parts. Caterpillar's strategic focus has been on developing new engine technologies that meet evolving environmental and performance expectations.

Within Caterpillar's BCG Matrix, niche, low-demand specialized equipment often falls into the 'dog' category. These are products catering to very specific industries where the market isn't growing and demand is consistently low. Think of highly customized machinery for a particular manufacturing process or a unique type of construction.

These specialized items might just cover their costs, or even require a bit of cash to maintain, without offering much hope for future expansion. For instance, a report in early 2024 indicated that certain legacy equipment lines, designed for now-declining industries, were showing minimal revenue growth, hovering around 1-2% annually, while still incurring maintenance and support expenses.

Caterpillar might not even be the market leader in these narrow segments. The strategic decision for such products is often to either sell them off, if a buyer can be found, or to significantly reduce the resources invested in them to free up capital for more promising ventures.

Certain segments of Caterpillar's used equipment market are showing declining demand, particularly older models that are expensive to maintain or lack the efficiency features modern customers seek. These 'dogs' in the BCG matrix represent areas where Caterpillar might have a low market share and low growth potential. For instance, older, less fuel-efficient excavators or dozers that require frequent repairs could be facing this challenge.

Small-Scale, Non-Core Product Lines

Within Caterpillar's BCG Matrix, small-scale, non-core product lines would likely fall into the 'Dogs' category. These are typically offerings that don't contribute significantly to overall revenue or market share and operate in mature or declining industries. For instance, if Caterpillar maintained a very niche product line for an outdated industrial application that saw minimal demand and had low growth prospects, it could be classified as a dog.

These segments often represent legacy products that may not align with Caterpillar's current strategic direction, such as its increasing focus on energy efficiency, digital solutions, and sustainability. Such lines might have limited competitive advantage, perhaps due to smaller economies of scale or a lack of ongoing investment in research and development. In 2023, Caterpillar's total revenue was $67.1 billion, and while specific figures for non-core, low-growth product lines are not publicly detailed, any segment significantly underperforming relative to the company's overall growth and investment priorities would fit the dog profile.

- Low Market Share: These product lines typically hold a small percentage of their respective market.

- Low Market Growth: They operate in industries that are not expanding or are experiencing a decline.

- Limited Strategic Importance: They do not align with Caterpillar's core competencies or future strategic objectives.

- Potential Divestment Candidates: Such segments might be considered for divestiture to reallocate resources to more promising areas.

Operations in Geographically Stagnant Markets

In mature or economically stagnant geographic regions, Caterpillar's product lines might find themselves in the dog quadrant of the BCG matrix. This often occurs where infrastructure development has significantly slowed, limiting demand for heavy equipment. For instance, in some parts of Western Europe, where construction activity has seen modest growth, certain older model excavators or dozers might be considered dogs if their market share is low and the overall market isn't expanding.

These situations are characterized by limited growth potential and often lower profitability. Caterpillar might hold a relatively smaller market share in these areas compared to entrenched regional competitors who have a stronger local presence and potentially lower cost structures. For example, in 2024, while global construction equipment sales saw an uptick, specific mature markets in Eastern Europe might have experienced single-digit growth, making it challenging for new or less dominant product lines to gain traction.

- Geographic Stagnation: Mature markets with minimal infrastructure investment.

- Low Market Share: Facing strong competition from established regional players.

- Limited Growth: Product lines generating modest or declining sales and profits.

- Example Scenario: Older excavator models in a European market with less than 3% annual construction growth.

Dogs in Caterpillar's BCG Matrix represent product lines with low market share and low market growth, often generating minimal profits or even losses. These are typically older, less efficient models or niche products catering to declining industries. For example, certain legacy diesel engines that do not meet current emissions standards or specialized equipment for outdated manufacturing processes would fit this description.

Caterpillar's strategic approach to these 'dog' products usually involves minimizing investment, focusing on niche markets for replacement parts, or considering divestiture. The company's overall revenue in 2023 was $67.1 billion, and while specific figures for 'dog' segments aren't broken out, these underperforming lines do not align with Caterpillar's focus on new technologies, energy efficiency, and sustainability.

These products might be phased out to reallocate resources to more promising ventures, such as electric and hybrid powertrains, which are seeing significant market growth. The decision to divest or discontinue these 'dogs' is driven by the need to optimize the product portfolio and improve overall profitability and market competitiveness.

| BCG Category | Market Share | Market Growth | Profitability | Strategic Action |

|---|---|---|---|---|

| Dogs | Low | Low | Low/Negative | Divest, Harvest, Minimal Investment |

Question Marks

Within Caterpillar's BCG Matrix, small-scale electric machines currently reside in the early adoption phase, akin to a Question Mark. While the broader electrification trend is a Star, specific segments like mini excavators and compact loaders are still gaining traction. Despite the high growth potential of the overall electric equipment market, these smaller units often hold a low market share as widespread acceptance and profitability are still developing.

Caterpillar is indeed investing in hydrogen-fueled internal combustion engines, recognizing their substantial future growth prospects. These engines represent a promising area for reducing emissions in heavy machinery.

However, the commercialization phase for hydrogen ICE technology is still in its early stages. This means Caterpillar's current market presence in this specific segment is minimal, and substantial capital will be needed to scale production and establish a dominant market position. For instance, while specific market share data for hydrogen ICE engines in heavy equipment is not yet widely published due to its early stage, the overall global hydrogen fuel cell market, a related technology, was projected to reach around $16.9 billion by 2024, indicating the broader potential of hydrogen solutions.

Caterpillar's expansion of advanced robotics and AI into sectors beyond mining, such as general construction and industrial applications, represents a significant growth opportunity but also carries inherent uncertainties. While these technologies are rapidly advancing, Caterpillar's established market presence in these broader fields is still in its nascent stages.

The company's investment in these areas, including its acquisition of software and AI companies, signals a strategic push. For instance, Caterpillar has been actively developing and deploying AI-powered solutions for site management and equipment optimization, aiming to enhance productivity and safety across various job sites.

The success of these ventures hinges on overcoming challenges like integration complexity, customer adoption rates, and the evolving regulatory landscape for autonomous systems in diverse environments. Caterpillar's 2024 financial reports indicate continued investment in research and development for these advanced technologies, underscoring their perceived future value.

Renewable Energy Power Solutions (beyond traditional gen-sets)

Caterpillar is actively broadening its sustainable energy portfolio, moving beyond traditional generator sets to include solutions like generators powered by renewable fuels and integrated solar power systems. This strategic shift positions them to capitalize on the burgeoning renewable energy sector.

- Market Growth: The global renewable energy market is experiencing robust expansion. For instance, the International Energy Agency (IEA) reported in 2024 that renewable capacity additions are projected to grow by over 10% annually through 2028, reaching nearly 500 gigawatts (GW) in 2024 alone.

- Caterpillar's Position: While Caterpillar has a strong foundation in power generation, its relative market share in providing complete, integrated renewable energy solutions, distinct from its established gen-set business, might still be developing. This suggests a potential "Question Mark" status, requiring focused investment to increase market penetration.

- Strategic Investment: To solidify its position in this high-growth area, Caterpillar will likely need to invest in research and development, strategic partnerships, and potentially acquisitions to enhance its capabilities in areas like battery storage, microgrids, and advanced solar integration.

- Future Potential: The demand for reliable, sustainable power solutions is undeniable. By strategically investing in its renewable energy offerings, Caterpillar can aim to capture significant market share, transforming these "Question Marks" into future "Stars" in its product lineup.

New Digital Service Offerings with Limited Customer Penetration

Caterpillar's investment in new digital service offerings, such as advanced telematics and predictive maintenance for a wider range of equipment, positions them for future growth. However, if these cutting-edge solutions, particularly those tailored for specialized or older machinery, are not yet widely adopted by their customer base, they would be classified as question marks.

This strategic positioning highlights areas with high potential but currently low market share within Caterpillar's digital services portfolio. For instance, while Caterpillar's fleet management solutions are gaining traction, newer offerings like AI-driven optimization for specific construction phases might still be in early adoption stages. In 2023, Caterpillar reported that digital services contributed to a significant portion of their aftermarket revenue growth, indicating the overall strength of this segment, but specific penetration rates for newer services are often proprietary.

- Low Penetration: Newer, specialized digital services may not yet have achieved widespread customer adoption.

- High Potential Growth: These services operate in a growing digital services market, offering significant future upside.

- Investment Required: Continued investment in marketing, education, and product refinement is necessary to move these offerings from question marks to stars.

- Market Uncertainty: The success of these question mark offerings depends on customer acceptance and the ability to demonstrate clear value propositions in niche markets.

Question Marks in Caterpillar's BCG matrix represent products or services with low market share in high-growth industries. These are areas where Caterpillar is investing, but their success is not yet guaranteed. The company needs to carefully decide whether to invest more to gain market share or divest if the potential doesn't materialize. For example, emerging battery-electric vehicle technology for specific heavy-duty applications could be a question mark if adoption rates are still low despite the industry's growth.

| Category | Caterpillar Example | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Emerging battery-electric heavy equipment | High | Low | Requires significant investment to gain share or potential divestment |

| Question Mark | Advanced AI for specialized construction tasks | High | Low | Needs further development and market education to drive adoption |

| Question Mark | Newer digital service offerings for niche markets | High | Low | Success depends on customer acceptance and demonstrating clear ROI |

BCG Matrix Data Sources

Our Caterpillar BCG Matrix is constructed using comprehensive market data, including financial reports, industry analysis, and sales performance metrics to provide a clear strategic overview.