Caterpillar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caterpillar Bundle

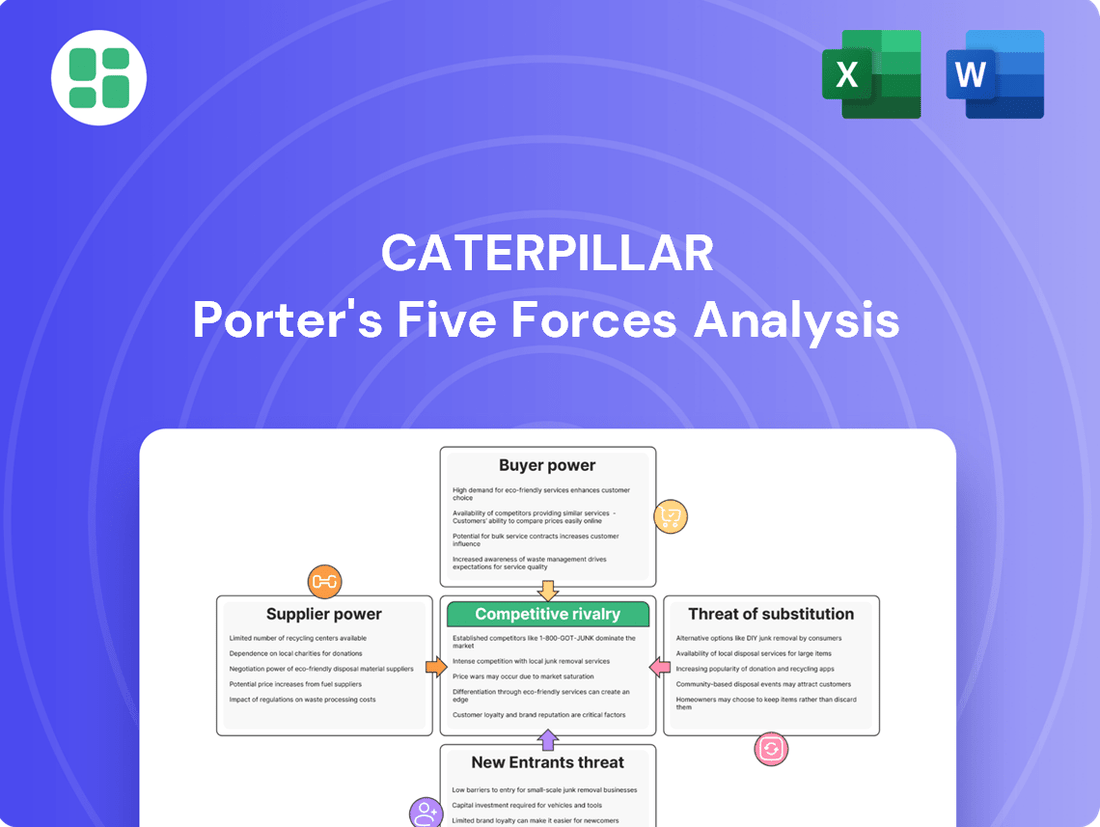

Caterpillar operates in a highly competitive heavy machinery market, facing significant bargaining power from both suppliers and buyers. The threat of new entrants is moderate, while the threat of substitutes is relatively low due to the specialized nature of their products.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Caterpillar’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Caterpillar's reliance on specialized components, such as advanced engine technology and sophisticated hydraulic systems, places significant bargaining power in the hands of its suppliers. These suppliers, often possessing proprietary technology or operating in niche markets, face limited competition for their unique offerings. For instance, a supplier of a highly integrated electronic control module for Caterpillar's excavators might have considerable leverage due to the complexity of its product and the extensive testing and integration required by Caterpillar.

The high switching costs associated with changing suppliers for these critical parts further empower them. Caterpillar would need to undertake substantial research and development, re-engineer existing equipment, and potentially retool manufacturing facilities to accommodate a new component. This process is not only time-consuming but also incurs significant capital expenditure, making Caterpillar hesitant to switch, thereby strengthening the supplier's negotiating position.

For standardized raw materials like steel and rubber, Caterpillar's substantial purchasing power and worldwide sourcing approach effectively lessen supplier influence. In 2024, Caterpillar's immense scale allows for negotiation of better pricing and payment terms, as they represent a significant portion of many suppliers' business.

Recent global events, including geopolitical tensions and pandemic-related lockdowns, have significantly exposed the fragility of intricate supply chains. This has, in turn, temporarily bolstered the bargaining power of suppliers experiencing production bottlenecks or facing considerable logistical hurdles. For instance, during 2021 and early 2022, shortages of critical components like semiconductors and raw materials led to extended lead times and increased costs for many manufacturers, including those in the heavy equipment sector.

While Caterpillar has made strides in diversifying its supplier base to mitigate such risks, unforeseen disruptions can still temporarily tip the scales in favor of suppliers who can guarantee timely delivery, even if it means commanding higher prices. This was evident in the automotive industry, where a lack of chips led to production cuts, demonstrating how a single component shortage can empower a few key suppliers.

Consequently, Caterpillar's strategy increasingly involves robust risk management protocols and sophisticated inventory planning. This includes building strategic reserves of key components and exploring alternative sourcing options to maintain production continuity and control costs, even when facing external supply chain pressures.

Investment in R&D and Vertical Integration

Caterpillar’s significant investment in research and development (R&D), exceeding $30 billion over the last two decades, is a key strategy to mitigate supplier bargaining power. This investment fosters proprietary technologies, reducing the necessity for external sourcing of critical innovations.

Furthermore, Caterpillar’s exploration of backward vertical integration, where strategically advantageous, can bring essential manufacturing processes in-house. This move directly diminishes the leverage of external suppliers by internalizing certain production stages.

- R&D Investment: Over $30 billion invested in the past 20 years.

- Proprietary Technologies: Developed through R&D, reducing reliance on external suppliers.

- Vertical Integration: Strategic backward integration to control critical manufacturing processes.

Supplier Importance to Caterpillar's Innovation

As Caterpillar (CAT) pushes forward with cutting-edge technologies such as automation, electrification, and alternative fuels, its reliance on specialized technology suppliers intensifies. This strategic dependency grants these innovative suppliers significant bargaining power, as their unique contributions are essential for Caterpillar to remain competitive and satisfy customer needs for greener, more efficient machinery.

For instance, in 2024, Caterpillar continued its significant investments in electrification, aiming to have 40% of its equipment sales be electric or hybrid by 2027. This necessitates strong partnerships with battery technology and electric drivetrain providers, who can command higher prices or favorable terms due to their critical role in achieving these ambitious goals.

- Critical Component Dependency: Suppliers of specialized components for advanced systems like autonomous navigation or advanced battery management systems hold considerable sway.

- Innovation Collaboration: Companies providing proprietary software or unique material science solutions for next-generation equipment are vital partners, increasing their leverage.

- Limited Alternatives: The scarcity of suppliers with proven expertise in niche, high-tech areas for heavy machinery means Caterpillar has fewer viable alternatives, strengthening supplier negotiation power.

Suppliers of highly specialized components, particularly those related to Caterpillar's push into electrification and automation, wield significant bargaining power. This is due to the proprietary nature of their technology and the limited number of qualified alternative providers in 2024.

Caterpillar's substantial investment in R&D, exceeding $30 billion over two decades, aims to develop in-house expertise and reduce reliance on external suppliers for critical innovations.

However, the company's strategic focus on electrification, with a goal of 40% of equipment sales being electric or hybrid by 2027, creates a dependency on battery and electric drivetrain suppliers, who can leverage this demand.

While Caterpillar benefits from scale for commodity materials, the specialized technology sector presents a different dynamic where innovation and unique capabilities empower suppliers.

| Factor | Impact on Suppliers | Caterpillar's Mitigation Strategy |

| Specialized Technology Dependence | High leverage for suppliers of advanced components (e.g., electric drivetrains) | R&D investment, strategic partnerships |

| Switching Costs | High for Caterpillar due to re-engineering and integration | Supplier relationship management, long-term contracts |

| Commodity Materials | Low leverage due to Caterpillar's purchasing power and global sourcing | Leveraging scale for price negotiation |

| Supply Chain Disruptions (2021-2024) | Temporary increase in power for suppliers facing bottlenecks | Diversifying supplier base, strategic inventory |

What is included in the product

This analysis unpacks the five competitive forces shaping Caterpillar's industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify and quantify competitive threats with a dynamic Porter's Five Forces model, allowing for proactive strategy adjustments.

Customers Bargaining Power

Caterpillar's bargaining power of customers is notably high when dealing with large corporate and government clients. These major buyers, including significant mining corporations, construction firms, and government agencies, frequently procure equipment in substantial volumes.

This high-volume purchasing capability grants these clients considerable leverage. They can effectively negotiate for competitive pricing, attractive financing arrangements, and tailored equipment solutions to meet their specific operational needs.

Caterpillar's dependence on securing these large-scale contracts means that these key customers hold significant influence during price and term negotiations, impacting Caterpillar's profit margins and sales strategies.

Smaller construction companies and individual contractors generally hold moderate bargaining power. Their individual purchase volumes are typically lower, limiting their ability to negotiate significant price breaks on their own. However, the sheer number of these smaller entities represents a substantial portion of Caterpillar's customer base, giving them collective influence.

These customers can leverage the competitive landscape, as they have choices among various equipment manufacturers and dealers. Caterpillar's strategy to counter this involves its robust dealer network, which provides accessible service and support, and its financing arm, Cat Financial. These offerings are designed to foster customer loyalty and make Caterpillar equipment a more attractive option, even for smaller buyers.

Caterpillar effectively manages customer bargaining power by cultivating a robust brand image, emphasizing superior product quality, and leveraging its expansive global dealer network. This network is crucial for delivering essential aftermarket parts, maintenance, and support, thereby solidifying customer reliance.

The significant costs involved in integrating new machinery into existing fleets, coupled with the extended operational life of Caterpillar equipment, naturally cultivate strong customer loyalty. This loyalty diminishes the inclination for customers to switch to competitors based solely on price considerations.

Customer Price Sensitivity and Cyclical Demand

Customer price sensitivity is a significant factor for Caterpillar, particularly given the cyclical nature of the heavy equipment industry. When the economy slows or commodity prices dip, customers become more cautious, directly influencing their willingness to pay premium prices for new machinery. This heightened sensitivity allows them to exert greater leverage in negotiations, often pushing for discounts or delaying capital expenditures until market conditions improve.

The impact of this price sensitivity is magnified during economic downturns. For example, in 2023, while Caterpillar reported strong revenues, the demand for certain equipment lines can fluctuate significantly based on global infrastructure project pipelines and mining activity. When these sectors experience a slowdown, customers are more inclined to seek out deals or extend the life of their existing fleets, thereby reducing immediate sales opportunities for Caterpillar and putting downward pressure on pricing power.

- Cyclical Demand: The heavy equipment sector is intrinsically tied to economic cycles, meaning demand for Caterpillar's products rises and falls with global economic health.

- Price Sensitivity: Customers' purchasing decisions are heavily influenced by economic conditions, commodity prices, and government infrastructure spending, leading to greater price negotiation power during downturns.

- Impact on Sales: Increased price sensitivity can result in lower sales volumes and reduced profitability for Caterpillar as customers delay purchases or demand lower prices.

Demand for Sustainable and Tech-Enabled Solutions

Customers are increasingly vocal about their desire for equipment that is not only powerful but also environmentally friendly and technologically advanced. This means a growing demand for fuel-efficient machinery, electric and hybrid options, and even autonomous capabilities, all integrated with digital tools for better management and performance tracking.

This shift in customer preference significantly boosts their bargaining power. When a substantial portion of Caterpillar's customer base prioritizes sustainability and tech integration, it compels the company to invest heavily in research and development to meet these evolving needs. For instance, Caterpillar's 2024 product updates are heavily featuring enhanced telematics and connectivity options, directly responding to this demand.

- Increased Demand for Sustainability: Growing customer emphasis on reducing emissions and operational costs drives the need for eco-friendly machinery.

- Technological Integration: Customers expect advanced digital solutions, autonomous features, and connectivity to improve efficiency and data-driven decision-making.

- Influence on Product Development: This demand directly shapes Caterpillar's innovation pipeline, pushing for the development of electric, hybrid, and smart equipment.

- Pricing Power for Manufacturers: Companies that successfully deliver on these advanced features can command premium pricing, but failure to adapt can lead to competitive disadvantage.

Caterpillar's customers, particularly large corporations and governments, wield significant bargaining power due to their substantial purchase volumes. This allows them to negotiate favorable pricing, financing, and customized solutions, directly impacting Caterpillar's profitability and strategic decisions.

Smaller buyers, while individually less influential, collectively represent a large customer base. Caterpillar mitigates their bargaining power through its extensive dealer network, offering crucial after-sales support and financing options like Cat Financial, fostering loyalty and reducing price-based switching.

Customer price sensitivity, amplified during economic downturns, further enhances their negotiation leverage. For example, in 2023, global economic shifts influenced customer willingness to pay premium prices, impacting Caterpillar's sales strategies.

The growing demand for environmentally friendly and technologically advanced equipment also strengthens customer bargaining power. Caterpillar's 2024 product updates, featuring enhanced telematics and connectivity, reflect this customer-driven push for innovation.

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Large Corporate & Government Clients | High | High-volume purchases, negotiation of pricing, financing, and tailored solutions |

| Small & Medium Businesses/Individual Contractors | Moderate (collectively High) | Lower individual volume, but significant collective influence; leverage competitive landscape |

| All Customers | Influenced by Economic Cycles | Price sensitivity during downturns, demand for sustainable and tech-advanced equipment |

Preview the Actual Deliverable

Caterpillar Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Caterpillar's competitive landscape through a detailed Porter's Five Forces analysis, covering the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

The heavy equipment industry is a battleground, with giants like Komatsu, Volvo Construction Equipment, Hitachi Construction Machinery, and John Deere constantly vying for dominance. These established global players offer product lines that mirror Caterpillar's, creating a fierce contest for market share, particularly in developed economies.

This intense rivalry compels Caterpillar to remain on the cutting edge of innovation, constantly seeking ways to distinguish its products and services. For instance, in 2023, Komatsu reported net sales of ¥3,068.8 billion (approximately $21 billion USD), showcasing the significant financial muscle of its competitors.

Caterpillar operates in an industry with substantial fixed costs, including massive investments in manufacturing plants, research and development, and a complex global supply chain. For instance, Caterpillar’s capital expenditures were approximately $3.5 billion in 2023, reflecting ongoing investments in its operational infrastructure. These high upfront expenses mean companies must achieve high sales volumes to spread costs and become profitable, fostering intense competition to capture market share.

The significant capital required for specialized machinery and facilities creates formidable exit barriers. Companies are often reluctant to abandon these investments, even during downturns, leading them to compete aggressively for existing business rather than cutting losses and leaving the market. This dynamic ensures that established players, like Caterpillar, face persistent rivalry from both domestic and international competitors striving for capacity utilization.

Competitive rivalry in heavy machinery is intense, with companies differentiating not just on core product features but heavily on technology, operational efficiency, and long-term durability. This is particularly true for Caterpillar, where innovation in areas like fuel efficiency and autonomous operation plays a significant role in attracting and retaining customers.

Crucially, aftermarket support and services represent a major battleground. Caterpillar's vast and well-established dealer network provides unparalleled access to parts, maintenance, and repair services. This comprehensive support system is a key differentiator, fostering strong customer loyalty and generating substantial recurring revenue, as evidenced by Caterpillar's significant aftermarket sales, which often represent a substantial portion of their total revenue.

Emergence of Chinese Competitors

Chinese manufacturers such as SANY and XCMG are rapidly increasing their global market share, primarily by offering more affordable construction equipment. This competitive pressure is particularly felt in emerging markets where price sensitivity is high. For instance, by the end of 2023, SANY's international sales saw significant growth, contributing to a more competitive global landscape.

These Chinese firms are not just competing on price; they are also investing heavily in research and development, including advanced electric vehicle technology for their construction fleets. This strategic move, exemplified by XCMG’s unveiling of new electric excavators and loaders in early 2024, directly challenges established players like Caterpillar by offering technologically advanced, albeit often lower-priced, alternatives. This aggressive expansion into export markets puts additional pressure on pricing strategies and market share for incumbent companies.

- Market Share Growth: Chinese manufacturers like SANY and XCMG have seen substantial growth in their share of the global construction equipment market, particularly in regions like Asia and Africa.

- Price Competitiveness: These competitors often undercut established brands by 15-25% on comparable equipment, making them a significant threat in cost-conscious markets.

- Technological Advancement: Companies like XCMG are actively developing and deploying electric and alternative-fuel construction machinery, mirroring and sometimes exceeding the pace of Western competitors in certain segments.

- Export Market Penetration: Aggressive export strategies are allowing Chinese brands to gain a foothold in markets traditionally dominated by North American and European manufacturers.

Slowdown in Key Markets and Regional Dynamics

A projected mild decline in global construction and mining equipment sales for 2025 across several key markets intensifies competitive rivalry. Companies are increasingly fighting for a reduced number of new orders, creating a more challenging sales environment.

While certain emerging markets are demonstrating growth, the overall market dynamics in developed regions are characterized by heightened competition. This forces companies like Caterpillar to battle more aggressively for each potential sale, impacting pricing and market share.

- Market Slowdown: Projections indicate a mild decline in global construction and mining equipment sales in 2025 for some regions.

- Intensified Competition: Companies are increasingly competing for a smaller pool of new orders.

- Regional Disparities: Growth in emerging markets contrasts with intensified competition in developed regions.

The heavy equipment sector is fiercely competitive, with established global players like Komatsu and Volvo, alongside growing Chinese manufacturers such as SANY and XCMG, constantly vying for market share. This rivalry is amplified by high fixed costs and substantial exit barriers, compelling companies to compete aggressively for sales volumes to maintain profitability.

Chinese brands, in particular, are making significant inroads by offering price-competitive alternatives and investing heavily in advanced technologies like electric powertrains, as seen with XCMG's new electric equipment launches in early 2024. This strategy directly challenges incumbents in cost-sensitive markets.

The competitive landscape is further intensified by a projected mild decline in global equipment sales for 2025, forcing companies to fight harder for fewer new orders, especially in developed markets.

Caterpillar differentiates itself through its robust aftermarket support and extensive dealer network, a crucial factor in customer loyalty and recurring revenue, while simultaneously needing to innovate in areas like fuel efficiency and autonomous operation to stay ahead.

| Competitor | Approximate 2023 Net Sales (USD Billions) | Key Competitive Strategy |

|---|---|---|

| Komatsu | 21.0 | Product mirroring, innovation, financial strength |

| Volvo Construction Equipment | N/A (Part of Volvo Group) | Product mirroring, innovation |

| SANY | N/A (Significant growth in international sales) | Price competitiveness, R&D investment, export market penetration |

| XCMG | N/A (Aggressive export strategy, electric vehicle development) | Price competitiveness, technological advancement (electric), export market penetration |

SSubstitutes Threaten

The rental market presents a significant threat to Caterpillar's new equipment sales. For instance, in 2024, the global equipment rental market was projected to reach over $115 billion, indicating a substantial alternative for businesses needing machinery without the commitment of ownership. This is particularly attractive for smaller contractors or those with intermittent project needs, as it bypasses the substantial upfront capital investment and ongoing maintenance expenses associated with purchasing new Caterpillar machinery.

Furthermore, the thriving used equipment market acts as another potent substitute. In 2024, the used construction equipment market continued to demonstrate resilience, offering a more budget-friendly option for many buyers. This availability of pre-owned machinery, often in good working condition, directly competes with new sales by providing a lower-cost entry point for accessing essential equipment, thereby potentially dampening demand for brand-new Caterpillar products.

While direct substitutes for heavy machinery are typically limited, emerging technologies pose a potential threat. For instance, advancements in drone technology and sophisticated data analytics could diminish the reliance on traditional surveying or exploration equipment in sectors like mining. This shift might reduce demand for certain Caterpillar products.

Furthermore, the rise of modular construction methods could fundamentally alter the types of equipment required on job sites. Innovations in automation and artificial intelligence are also reshaping operational workflows, potentially leading to a decreased need for certain manual labor-intensive machinery.

The increasing push for sustainability and lower emissions is accelerating the development and adoption of electric and hybrid construction and mining machinery. This trend presents a significant threat of substitution, as companies that can offer more advanced or economically viable alternative-fuel equipment could draw customers away from Caterpillar's established diesel-powered lines.

While Caterpillar is investing heavily in electrification, as evidenced by their 2024 announcements regarding expanded electric equipment offerings and battery technology development, other manufacturers are also making strides. For example, Komatsu has been actively showcasing its electric excavator prototypes and aims for a significant portion of its equipment to be electric or hybrid by 2030, directly challenging Caterpillar's market share in this evolving segment.

Shift to Lighter, More Agile Equipment

The construction industry is seeing a trend towards lighter, more agile equipment, and even robotic solutions, which could serve as substitutes for some of Caterpillar's heavier machinery. This shift is particularly noticeable in urban environments with space constraints or for specialized projects requiring precision. For example, the market for compact construction equipment, including mini excavators and skid steers, has shown consistent growth, with global revenues projected to reach over $20 billion by 2027.

Advancements in automation and robotics are also presenting a potential substitution threat. Autonomous or remotely operated systems can perform tasks like demolition, excavation, and material handling, potentially reducing the need for traditional manned heavy equipment in certain scenarios. The global construction robotics market was valued at approximately $1.7 billion in 2023 and is expected to grow significantly, indicating a growing acceptance of these technologies.

- Urbanization driving demand for compact equipment: Increased urban development projects often necessitate smaller, more maneuverable machinery.

- Robotics in construction: Autonomous systems can perform repetitive or dangerous tasks, offering an alternative to conventional equipment.

- Specialized project needs: Niche applications may favor lighter, more adaptable tools over large, general-purpose machines.

- Technological advancements: Innovations in battery technology and electric powertrains are making smaller, more efficient equipment viable substitutes.

Focus on Services over Ownership

The shift towards 'power-by-the-hour' service agreements, rather than outright equipment ownership, presents a significant threat of substitution for Caterpillar. Customers increasingly prefer access to machinery and its operational output without the burden of ownership, maintenance, and depreciation. This evolving preference directly challenges Caterpillar's traditional sales model.

This trend is amplified by competitors offering flexible, usage-based leasing and comprehensive maintenance packages. For instance, in 2024, the global equipment rental market was valued at over $100 billion, with service-based models showing robust growth. This indicates a substantial portion of the market is moving away from capital expenditure on machinery.

- Growing Service-Based Models: Competitors are increasingly offering 'power-by-the-hour' or full-service solutions, directly substituting the need for customers to purchase and maintain their own heavy equipment.

- Market Size of Equipment Rental: The global equipment rental market exceeded $100 billion in 2024, highlighting the significant demand for access over ownership.

- Impact on Traditional Sales: A strong customer preference for these service models can directly reduce Caterpillar's sales volume of new equipment.

The threat of substitutes for Caterpillar is multifaceted, encompassing the rental market, used equipment, and emerging technologies. The substantial global equipment rental market, projected to exceed $115 billion in 2024, offers a compelling alternative to purchasing new machinery, especially for businesses with variable needs. Similarly, the robust used equipment market provides a more affordable entry point, directly impacting demand for new units.

Technological advancements also present a substitution threat. Innovations in drone technology and data analytics could reduce reliance on traditional surveying equipment, while modular construction and automation may decrease the need for certain heavy machinery. Furthermore, the accelerating shift towards electric and hybrid alternatives, with competitors like Komatsu actively developing and promoting these technologies, poses a direct challenge to Caterpillar's established diesel-powered offerings.

The industry is also seeing a rise in lighter, more agile equipment and robotics, which can substitute for some of Caterpillar's larger machinery, particularly in urban settings or for specialized tasks. The global construction robotics market, valued at approximately $1.7 billion in 2023, underscores the growing acceptance of these automated solutions.

The increasing popularity of service-based models, such as 'power-by-the-hour,' further substitutes for outright equipment ownership. With the global equipment rental market valued over $100 billion in 2024, these flexible, usage-based arrangements are gaining traction, potentially reducing Caterpillar's new equipment sales volume.

Entrants Threaten

The heavy equipment manufacturing sector presents a formidable barrier to entry, primarily due to the staggering capital requirements. Establishing state-of-the-art manufacturing plants, investing in cutting-edge research and development, and building a comprehensive global sales and service infrastructure demand billions of dollars. For instance, setting up a new, fully operational heavy machinery manufacturing facility can easily cost upwards of $1 billion, a sum that deters most potential newcomers.

Caterpillar leverages substantial economies of scale across its operations, from manufacturing and component sourcing to its extensive global distribution network. This scale allows Caterpillar to spread fixed costs over a larger output, significantly reducing its per-unit cost. For instance, in 2023, Caterpillar reported revenues of $67.1 billion, a testament to its vast production capacity and market reach.

New entrants face a formidable barrier in matching Caterpillar's cost efficiencies. To achieve comparable per-unit costs, a new competitor would need to invest heavily in production facilities and global supply chains, requiring immense upfront capital and time to build volume. This makes it exceptionally challenging for new players to compete on price against an established, scaled giant like Caterpillar, thus acting as a strong deterrent.

Caterpillar's formidable brand loyalty, cultivated over decades, presents a significant barrier to new entrants. This loyalty is deeply intertwined with its vast, established dealer network, which offers crucial sales, service, and parts support globally. For instance, in 2023, Caterpillar reported revenues of $67.1 billion, underscoring the scale and reach of its operations, a scale that new competitors would struggle to replicate.

Technological Complexity and R&D Investment

The design, engineering, and manufacturing of advanced construction and mining equipment demand substantial technological sophistication. This complexity necessitates significant, ongoing investment in research and development, especially as automation, electrification, and digital integration become paramount. For instance, Caterpillar's commitment to R&D is evident in its substantial capital expenditures, which in 2023 alone were reported to be in the billions, focusing on these very areas to maintain its competitive edge.

New companies entering the heavy equipment sector must possess or swiftly acquire this advanced expertise to produce competitive offerings. The high barrier to entry is amplified by the need for proprietary technology and efficient production processes, which take years and considerable capital to develop. Without this, a new entrant would struggle to match the performance, reliability, and efficiency that customers expect from established players.

Consider these key aspects:

- High R&D Costs: Developing cutting-edge machinery, such as autonomous mining haul trucks or electric excavators, requires substantial upfront investment in specialized engineering talent and advanced manufacturing capabilities.

- Intellectual Property: Established firms hold numerous patents protecting their core technologies, creating a significant hurdle for newcomers seeking to innovate without infringing on existing IP.

- Talent Acquisition: Attracting and retaining highly skilled engineers and technicians experienced in complex machinery design and advanced manufacturing is a competitive and costly endeavor.

Regulatory Hurdles and Environmental Standards

The heavy machinery industry, including Caterpillar's sector, faces significant regulatory hurdles. Stringent environmental regulations, safety standards, and emissions controls are in place globally. For instance, in 2024, the European Union continued to implement stricter emissions standards for off-road machinery, impacting engine design and manufacturing processes.

These complex and evolving requirements add substantial cost and technical expertise demands for any new entrant. Navigating these regulations, especially in developed markets like North America and Europe, requires considerable investment in research, development, and compliance infrastructure. This effectively raises the barrier to entry, making it more challenging for smaller or less capitalized firms to compete.

- Environmental Regulations: Continued tightening of emissions standards (e.g., Tier 4 Final in the US, Stage V in Europe) necessitate advanced engine technologies, increasing R&D and manufacturing costs for new entrants.

- Safety Standards: Compliance with rigorous international safety certifications and operational standards requires significant upfront investment in product design and testing.

- Global Compliance Complexity: New entrants must manage a patchwork of differing regulations across various key markets, adding operational complexity and cost.

The threat of new entrants in the heavy equipment manufacturing sector, where Caterpillar operates, is considerably low. This is largely due to the immense capital required to establish operations, with new manufacturing facilities costing upwards of $1 billion. Furthermore, the established brand loyalty and extensive global dealer networks of companies like Caterpillar present significant hurdles for newcomers attempting to gain market traction.

New entrants must also overcome substantial technological sophistication and navigate complex global regulatory landscapes, which demand significant investment in R&D and compliance. For instance, in 2024, stricter emissions standards continued to be implemented across major markets, increasing the cost and technical expertise required for compliance. This combination of high capital needs, established brand equity, technological barriers, and regulatory complexities effectively deters most potential new competitors.

| Barrier to Entry | Impact on New Entrants | Supporting Data (Illustrative) |

|---|---|---|

| Capital Requirements | Extremely High | New plant setup can exceed $1 billion. |

| Economies of Scale | Significant Advantage for Incumbents | Caterpillar's 2023 revenue of $67.1 billion reflects vast production scale. |

| Brand Loyalty & Dealer Network | Formidable | Decades of cultivation, essential for sales and service. |

| Technological Sophistication & R&D | High | Billions invested by Caterpillar in areas like electrification and automation. |

| Regulatory Compliance | Challenging & Costly | Stricter emissions standards (e.g., EU Stage V) require advanced engine tech. |

Porter's Five Forces Analysis Data Sources

Our Caterpillar Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Caterpillar's official annual reports, investor presentations, and SEC filings. We also incorporate insights from reputable industry analysis firms, macroeconomic data providers, and global economic indicators to capture the full competitive landscape.