Casey's General Stores SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

Casey's General Stores boasts strong brand recognition and a loyal customer base, particularly in its Midwestern stronghold. However, it faces increasing competition from larger chains and evolving consumer preferences.

Want the full story behind Casey's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Casey's General Stores boasts an impressive reach into rural markets, with a significant 72% of its locations situated in small towns and the countryside. This strategic positioning often makes Casey's the go-to convenience and fuel stop in these areas, significantly reducing head-to-head competition from larger rivals.

This focus on underserved communities allows Casey's to thrive even in places with very small populations, demonstrating its ability to achieve profitability in towns as small as 400 residents.

Casey's boasts a robust prepared food program, notably its made-from-scratch pizza, which has positioned it as the fifth-largest pizza chain nationwide. This commitment to foodservice, encompassing items like hot sandwiches and bakery goods, is a key driver of inside sales, with new offerings like chicken wings and fries currently in pilot phases.

Casey's has a robust history of expanding its presence through both building new stores and acquiring existing ones. This strategy is exemplified by its significant move in fiscal year 2025, which included the acquisition of 198 CEFCO stores, marking its largest transaction to date.

The company has set an ambitious goal to incorporate around 500 new locations by the conclusion of its current three-year strategic plan in fiscal year 2026. This aggressive expansion plan highlights Casey's dedication to increasing its market reach and accessibility for customers.

This dual approach to growth, combining organic development with strategic acquisitions, offers considerable flexibility. It allows Casey's to capitalize on opportunities as they arise, supported by a solid financial position, ensuring sustained expansion and market share gains.

Strong Financial Performance and Liquidity

Casey's General Stores demonstrated exceptional financial strength in fiscal year 2025, achieving a record net income of $546.5 million and an impressive EBITDA of $1.2 billion. This robust performance underscores the company's operational efficiency and market positioning.

The company's revenue saw a healthy increase of 7.2% in fiscal 2025, reaching $15.9 billion, which highlights its sustained growth trajectory. This consistent revenue expansion is a testament to the effectiveness of Casey's business strategy and its ability to capture market share.

Casey's maintains a solid financial foundation, evidenced by $1.2 billion in available liquidity as of April 2025. This strong liquidity position provides ample flexibility to pursue strategic growth opportunities and continue rewarding shareholders through dividend increases.

- Record Fiscal Year 2025 Performance: Net income of $546.5 million and EBITDA of $1.2 billion.

- Consistent Revenue Growth: 7.2% revenue increase to $15.9 billion in fiscal 2025.

- Strong Liquidity Position: $1.2 billion in available liquidity as of April 2025.

- Financial Flexibility: Supports growth initiatives and dividend increases.

Effective Loyalty Program and Customer Engagement

Casey's boasts a robust loyalty program, Casey's Rewards, which had amassed over 9 million members by the end of fiscal year 2025. This significant membership base underscores the company's success in fostering customer retention and driving engagement.

The program's effectiveness lies in its ability to deliver personalized promotions and targeted offers, thereby enriching the customer experience and stimulating sales. This data-driven approach allows Casey's to tailor its offerings to individual preferences.

Leveraging insights gleaned from its extensive member base, Casey's is well-positioned to offer relevant products at competitive price points. This strategic advantage helps maintain customer satisfaction and encourages repeat business.

- Over 9 million Casey's Rewards members by year-end fiscal 2025

- Personalized promotions and targeted offerings enhance customer experience

- Leverages guest insights for relevant product selection and competitive pricing

Casey's strong financial performance in fiscal year 2025, with $546.5 million in net income and $1.2 billion in EBITDA, provides a solid foundation for continued growth and shareholder returns. The company's revenue increased by 7.2% to $15.9 billion in the same period, demonstrating its ability to expand its market presence effectively. With $1.2 billion in available liquidity as of April 2025, Casey's possesses significant financial flexibility to pursue strategic acquisitions and organic growth initiatives.

| Financial Metric | Fiscal Year 2025 |

|---|---|

| Net Income | $546.5 million |

| EBITDA | $1.2 billion |

| Revenue Growth | 7.2% |

| Total Revenue | $15.9 billion |

| Available Liquidity (April 2025) | $1.2 billion |

What is included in the product

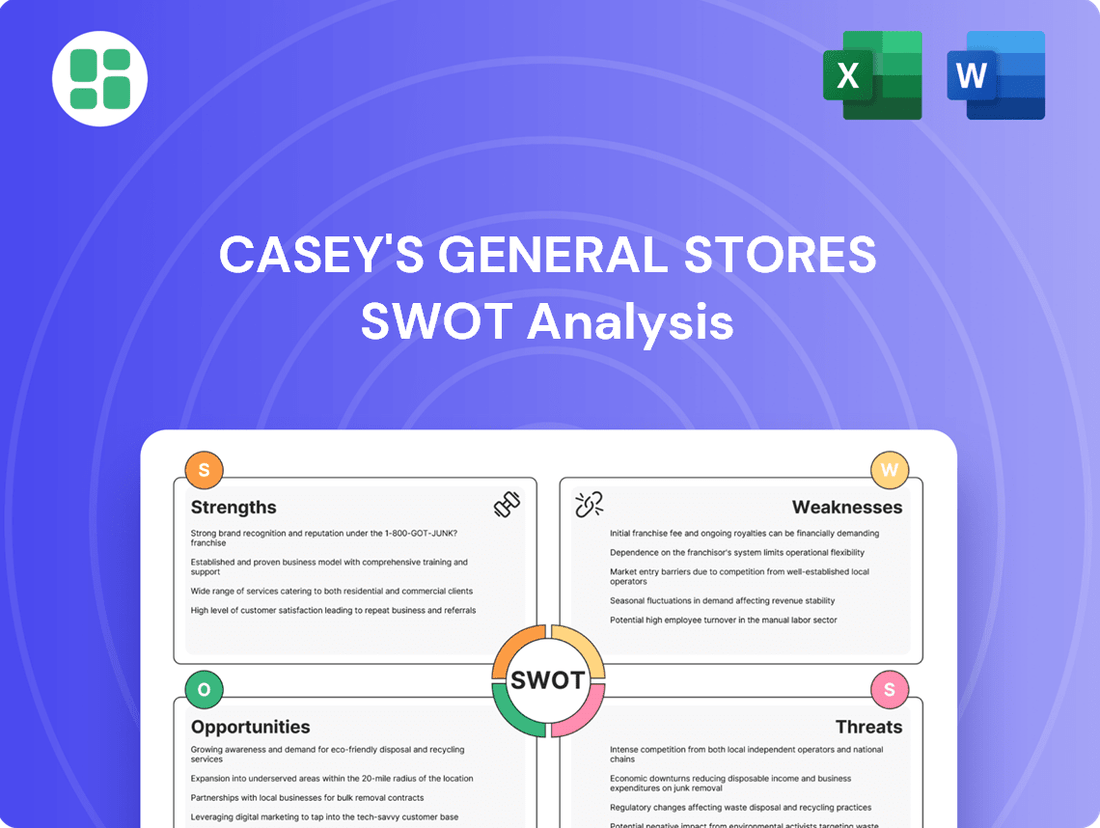

Offers a full breakdown of Casey's General Stores’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable SWOT analysis to identify and address Casey's General Stores' challenges and leverage its strengths for improved performance.

Weaknesses

Casey's General Stores' geographic concentration in the Midwestern and Southern United States, with a strong historical presence in states like Iowa, Missouri, and Illinois, presents a significant weakness. This regional focus means the company is more vulnerable to localized economic downturns or adverse weather events that could disproportionately impact sales and operations compared to a more geographically dispersed competitor.

While Casey's has been expanding, notably into Texas, a substantial portion of its existing store base remains concentrated in these core Midwestern and Southern regions. This concentration risk could lead to greater volatility in earnings if regional economic conditions deteriorate, as seen in past periods of agricultural stress affecting the Midwest.

Despite Casey's strategic push to grow inside sales, the company's revenue remains heavily tied to fuel. In fiscal year 2024, fuel sales constituted a substantial portion of their overall revenue, leaving them vulnerable to the unpredictable swings in global oil prices and fuel margins. This dependence means that events impacting crude oil markets or geopolitical instability can directly affect fuel gross profit, posing a challenge to consistent profitability.

Casey's General Stores operates in a highly competitive sector, facing pressure from established convenience store rivals like 7-Eleven and Murphy USA, as well as broader retailers such as Walmart and traditional supermarkets. These competitors often leverage lower price points and a wider selection of goods, directly challenging Casey's value proposition.

The increasing presence of formidable players like Buc-ee's in key growth areas, notably Texas, further escalates the competitive intensity. This influx necessitates ongoing strategic adjustments for Casey's to effectively vie for customer attention and loyalty.

To retain and grow its market share, Casey's must prioritize continuous innovation and clear differentiation. This includes refining its product offerings, enhancing customer experience, and potentially exploring new service models to stand out against a diverse and aggressive competitive set.

Operational Complexity of Fresh Food Offerings

While Casey's prepared foods are a significant draw, the sheer scale of its fresh food program, spanning almost 2,900 locations, presents substantial operational hurdles. Managing a consistent supply chain, precise inventory control, and rigorous food safety standards across such a broad footprint, particularly in more remote locations, is inherently complex.

Ensuring that items like their popular pizza and freshly baked goods maintain uniform quality and freshness throughout this extensive network requires meticulous planning and execution. This complexity is further amplified by the need for efficient procurement and distribution systems to effectively manage potential waste and maintain product integrity.

- Supply Chain Strain: Coordinating fresh food deliveries to nearly 2,900 stores, many in rural areas, strains logistics and increases the risk of stockouts or spoilage.

- Inventory Management Challenges: Balancing demand for perishable items across a wide store base requires sophisticated inventory systems to minimize waste and ensure availability.

- Food Safety Compliance: Maintaining consistent food safety protocols across thousands of employees and diverse store environments is a constant operational challenge.

Labor Acquisition and Retention Challenges

Casey's, like many in the convenience store sector, grapples with significant labor acquisition and retention issues. This is a top concern for operators, impacting operational efficiency. For instance, the U.S. Bureau of Labor Statistics reported that the leisure and hospitality sector, which includes convenience stores, experienced a quit rate of 4.6% in early 2024, indicating ongoing workforce instability.

Wage inflation and a competitive labor market directly translate to higher operating expenses for Casey's. This can strain profitability and, if not managed, lead to service disruptions due to understaffing. Reports from industry surveys in late 2023 and early 2024 consistently highlighted increased labor costs as a primary challenge for convenience store chains.

While Casey's has introduced initiatives to improve its workforce situation, the fundamental challenge persists across the industry. These ongoing difficulties necessitate continuous investment in employee benefits, training, and competitive compensation to attract and keep the necessary staff.

- Industry-wide Labor Shortage: Convenience store operators consistently cite hiring and retention as a major hurdle.

- Impact of Wage Inflation: Rising wages increase operating costs, potentially affecting margins and service levels.

- Staffing Level Risks: Inadequate staffing can lead to reduced service quality and operational inefficiencies.

- Casey's Mitigation Efforts: The company is actively implementing programs to address these labor challenges, though it remains an industry-wide concern.

Casey's reliance on fuel sales, which represented a significant portion of its revenue in fiscal year 2024, exposes it to the volatility of global oil prices and fluctuating fuel margins. This dependency means that external factors impacting crude oil markets can directly affect the company's profitability, creating a challenge for consistent earnings.

The company faces intense competition from established convenience store chains like 7-Eleven and Murphy USA, as well as large retailers such as Walmart and traditional supermarkets, which often compete on price and product variety. Furthermore, the growing presence of competitors like Buc-ee's in key markets like Texas adds to this competitive pressure, requiring Casey's to continuously innovate and differentiate its offerings to maintain market share.

Managing the operational complexities of a vast fresh food program across nearly 2,900 locations presents a significant weakness. This includes ensuring consistent supply chains, precise inventory management to minimize waste, and maintaining rigorous food safety standards throughout its extensive network, especially in more remote areas.

Labor acquisition and retention remain a critical challenge for Casey's, mirroring broader industry trends. The leisure and hospitality sector, including convenience stores, saw a quit rate of 4.6% in early 2024, indicating ongoing workforce instability. This, coupled with wage inflation, directly increases operating expenses and risks service disruptions due to understaffing, impacting overall efficiency.

Full Version Awaits

Casey's General Stores SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Casey's General Stores. This comprehensive report details their Strengths, Weaknesses, Opportunities, and Threats. The complete version, offering in-depth insights and actionable strategies, becomes available immediately after checkout.

Opportunities

Casey's has a clear strategy to grow its store count, focusing on areas that are currently underserved, especially in rural communities. This approach taps into a significant growth opportunity by reaching customers where larger competitors might have a limited presence.

The company has set an ambitious goal to open around 500 new locations by the end of fiscal year 2026. This expansion will be achieved through both acquiring existing stores and building new ones, strategically increasing their market share.

By establishing a strong foothold in these less-served markets, Casey's can solidify its position as a vital community resource. This expansion directly supports their objective of capturing new customers and building brand loyalty in areas ripe for development.

Casey's has a substantial opportunity to grow its prepared food segment. By adding more menu choices, featuring temporary specials, and venturing into new areas like chicken wings and fries, they can significantly boost sales. This aligns with a broader trend where convenience stores are increasingly becoming go-to spots for meals.

Upgrading kitchen equipment and broadening the food and drink selection, perhaps with healthier snacks and higher-end beverages, can draw in more customers. For example, in fiscal year 2024, Casey's reported that its prepared foods and beverages category saw a 6.4% increase in same-store sales, highlighting the potential for further growth through innovation and investment in this area.

Casey's General Stores can significantly boost its operational efficiency and customer satisfaction by embracing advanced technologies. Think about implementing mobile ordering systems, which saw a 25% increase in adoption for similar convenience store chains in 2024, and frictionless checkout options. These advancements directly address the need for speed and convenience that today's consumers expect.

Introducing new digital tools within the stores themselves offers another avenue for improvement. These tools can streamline tasks for employees, leading to faster service for customers. For instance, digital inventory management systems, projected to grow by 15% in the retail sector by the end of 2025, can reduce stockouts and overstock situations.

Furthermore, leveraging AI for inventory management and data analytics presents a powerful opportunity. This can lead to smarter product selection based on real-time sales data and more efficient supply chain operations. In 2024, retailers using AI for inventory saw an average reduction in waste by 10%, a tangible benefit for Casey's bottom line.

Integration of Electric Vehicle (EV) Charging Stations

As the automotive landscape rapidly electrifies, Casey's has a significant opportunity to integrate electric vehicle (EV) charging stations into its existing, widespread fuel infrastructure. This strategic move would not only solidify Casey's position as a crucial travel stop but also tap into a growing demographic of EV owners. By 2025, the global EV market is projected to reach over 30 million vehicles, presenting a substantial customer base ready for convenient charging solutions.

This adaptation allows Casey's to proactively address shifting consumer preferences and maintain its relevance in the evolving transportation sector. Beyond simply offering a new amenity, investing in EV charging infrastructure presents a clear path to diversifying revenue streams. This diversification moves the company beyond its traditional reliance on gasoline and diesel sales, creating new income avenues.

- Market Growth: The global EV market is expected to exceed 30 million units by 2025, indicating a substantial and growing customer base for charging services.

- Revenue Diversification: Integrating EV charging stations offers a new revenue stream, reducing dependence on traditional fuel sales.

- Customer Attraction: Providing EV charging can attract a new segment of environmentally conscious consumers to Casey's locations.

- Infrastructure Synergy: Leveraging existing fuel station footprints minimizes the capital investment required for new charging infrastructure.

Strategic Product Innovation and Partnerships

Casey's commitment to strategic product innovation, highlighted by its annual Innovation Summit, provides a clear avenue to introduce novel and distinctive merchandise. This focus allows for a dynamic diversification of their product selection, potentially offering exclusive items that can attract new customer segments.

Forming partnerships with emerging suppliers and broadening their private label portfolio presents a significant opportunity to distinguish Casey's from rivals. This strategy directly addresses the growing consumer desire for greater variety and enhanced product quality, fostering brand loyalty.

The company's proactive approach to innovation is poised to unlock unforeseen convenience experiences for its patrons. For instance, in fiscal year 2024, Casey's reported a 9.2% increase in same-store sales for its prepared foods and drinks, demonstrating the positive impact of product enhancements and strategic offerings.

- Diversification: Introduce unique products via the Innovation Summit to broaden merchandise appeal.

- Differentiation: Expand private label and collaborate with new suppliers to stand out from competitors.

- Consumer Demand: Meet evolving customer preferences for variety and quality through innovative offerings.

Casey's has a significant opportunity to expand its store footprint, particularly in underserved rural markets where it can establish itself as a primary convenience provider. The company's aggressive expansion plan, aiming for approximately 500 new locations by fiscal year 2026, positions it to capture market share in areas with less competition.

The prepared food and beverage segment offers substantial growth potential, as evidenced by a 6.4% same-store sales increase in this category during fiscal year 2024. By enhancing menu options and investing in kitchen upgrades, Casey's can further capitalize on the trend of consumers seeking convenient meal solutions.

Leveraging technology, such as mobile ordering systems which saw a 25% adoption increase in the convenience sector in 2024, can streamline operations and improve customer experience. Furthermore, integrating EV charging stations by 2025, when the global EV market is projected to exceed 30 million vehicles, presents a strategic avenue for revenue diversification and attracting a growing customer base.

Strategic product innovation, supported by initiatives like the annual Innovation Summit, allows Casey's to differentiate itself and meet evolving consumer demand for variety and quality. Expanding private label offerings and partnering with new suppliers can further enhance this differentiation, as seen in the 9.2% increase in same-store sales for prepared foods and drinks in fiscal year 2024 due to product enhancements.

| Opportunity Area | Key Initiative/Trend | Supporting Data/Projection |

|---|---|---|

| Store Expansion | Targeting underserved rural markets | Aiming for ~500 new locations by FY2026 |

| Prepared Foods & Beverages | Menu innovation & kitchen upgrades | 6.4% same-store sales growth in FY2024 |

| Technology Integration | Mobile ordering, EV charging | 25% mobile order adoption increase (2024); 30M+ global EVs by 2025 |

| Product Innovation | Private label expansion, partnerships | 9.2% same-store sales growth in prepared foods/drinks (FY2024) |

Threats

Casey's significant reliance on fuel sales, which constituted a substantial portion of its revenue in fiscal year 2024, makes it particularly vulnerable to the unpredictable swings in crude oil prices. This exposure can directly impact profitability, especially when combined with fluctuating fuel margins.

Geopolitical events and disruptions within the global supply chain, as seen with recent international conflicts and shipping challenges in 2024, can amplify these price volatilities. These external factors can create unpredictable cost pressures and affect the company's ability to maintain stable profit margins.

While Casey's actively works on margin optimization strategies, prolonged periods of compressed margins or extreme price volatility remain a persistent threat. For instance, in Q1 2025, the average retail gasoline margin was reported to be around $0.25 per gallon, a figure that can be significantly eroded by rapid increases in wholesale costs.

Casey's General Stores is facing a more complex competitive environment than just other convenience stores. We're seeing dollar stores, fast-food chains, and even supermarkets beefing up their convenience and ready-to-eat food selections. This broadens the competitive field considerably.

This wider array of competitors puts pressure on Casey's. It can affect how they price their products, how many customers walk through the door, and ultimately, their share of the market. This is especially true in areas with a higher population density.

For instance, in 2024, the convenience store sector, while robust, is seeing increased overlap with QSRs and grocery's prepared foods. Casey's needs to highlight what makes them stand out. Their strategy of focusing on prepared foods, especially pizza, has been a key differentiator, contributing to their strong performance, with same-store sales for prepared foods often outperforming other categories.

Economic uncertainties, such as persistent inflation and the specter of recession, pose a significant threat by potentially curbing consumer spending. This could particularly impact Casey's General Stores' higher-margin prepared foods and other discretionary purchases, as households tighten their budgets. For instance, a sustained inflation rate above 4% in 2024 could force consumers to prioritize essentials over convenience items.

Furthermore, shifts in consumer behavior driven by economic pressures could directly affect Casey's fuel and in-store sales. Consumers might opt for more fuel-efficient vehicles or reduce non-essential travel, leading to lower fuel volumes. A recent survey indicated that 65% of consumers plan to cut back on discretionary spending in the face of rising costs, a trend that could disproportionately affect impulse purchases, a crucial revenue stream for convenience retailers.

Changing Consumer Preferences and Health Trends

Consumers are increasingly seeking healthier food choices, fresh ingredients, and products with simpler, more transparent labels. This trend is a significant challenge for convenience stores like Casey's, which have historically relied on more traditional, less health-focused offerings. For instance, a 2024 survey indicated that over 60% of consumers actively look for healthier options when shopping for groceries and prepared foods.

Casey's has been working to expand its prepared food selections, including healthier options. However, a very rapid acceleration in consumer demand for, say, plant-based meals or organic produce could necessitate substantial and quick overhauls of their product lines and how they source them. This agility is crucial in a market where preferences can shift swiftly.

If Casey's cannot keep pace with these evolving tastes and demands for healthier, cleaner-label products, they risk alienating a growing segment of their customer base. This could lead to a noticeable dip in sales and a weakening of customer loyalty, impacting their competitive position in the convenience store sector.

Key considerations for Casey's include:

- Shifting consumer priorities towards wellness and natural ingredients.

- The need for agile supply chain adjustments to accommodate new product demands.

- Potential for market share erosion if health-conscious trends are not met effectively.

- The opportunity to differentiate by proactively embracing and leading in healthier convenience food options.

Regulatory and Environmental Compliance Costs

The convenience store and fuel retail sectors face significant threats from evolving regulatory and environmental compliance costs. For instance, stricter EPA regulations on underground storage tanks, which became more stringent in recent years, necessitate costly upgrades and ongoing monitoring for businesses like Casey's General Stores. Failure to comply can result in substantial fines and operational disruptions.

Furthermore, changes in product sales regulations, particularly concerning tobacco and vaping products, directly impact revenue streams and increase operational complexity. The U.S. Food and Drug Administration's (FDA) ongoing scrutiny and potential new rulings on vapor product flavors, as seen with proposed federal menthol bans in 2024, could significantly restrict or eliminate profitable product categories for retailers. These shifts demand continuous investment in compliance infrastructure and product portfolio adjustments.

Adapting to this dynamic regulatory landscape requires proactive engagement and financial commitment. For example, states have increasingly implemented stricter environmental standards for fuel dispensing and vapor recovery systems, adding to the capital expenditures for station maintenance. Casey's, like its peers, must allocate resources to stay ahead of these mandates, which could involve investments in advanced emission control technologies or new point-of-sale systems to manage restricted product sales.

Key compliance areas impacting Casey's and similar businesses include:

- Environmental Regulations: Compliance with EPA and state-level rules for fuel storage, leak detection, and emissions control, which saw increased enforcement activity in 2023-2024.

- Product Sales Restrictions: Adherence to evolving FDA regulations on tobacco and vaping products, including potential flavor bans and marketing restrictions, impacting a significant portion of convenience store sales.

- Labor and Wage Laws: Staying compliant with minimum wage increases and labor laws, which vary by state and can impact operating expenses, with many states raising minimum wages in 2024.

Casey's susceptibility to volatile fuel prices remains a significant threat, directly impacting its profitability, especially with fuel sales comprising a substantial revenue portion. Geopolitical events and supply chain disruptions further exacerbate these price swings, creating unpredictable cost pressures and potentially squeezing already tight fuel margins, which averaged around $0.25 per gallon in Q1 2025.

The competitive landscape is intensifying, with dollar stores, fast-food chains, and supermarkets expanding their convenience and prepared food offerings, challenging Casey's market share. This broadens competition beyond traditional convenience stores, putting pressure on pricing and customer traffic, particularly in denser markets where prepared food sales are crucial for differentiation.

Economic uncertainties, including inflation and recession fears, threaten consumer spending, potentially impacting Casey's higher-margin prepared foods and discretionary items. A sustained inflation rate above 4% in 2024, for example, could drive consumers to prioritize essentials, reducing impulse purchases vital to convenience retailers.

Evolving consumer preferences toward healthier, natural ingredients present a challenge, as Casey's historically focused on less health-conscious offerings. Failure to adapt quickly to demands for plant-based or organic options could lead to market share erosion and decreased customer loyalty, especially as over 60% of consumers actively seek healthier choices.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Casey's publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.