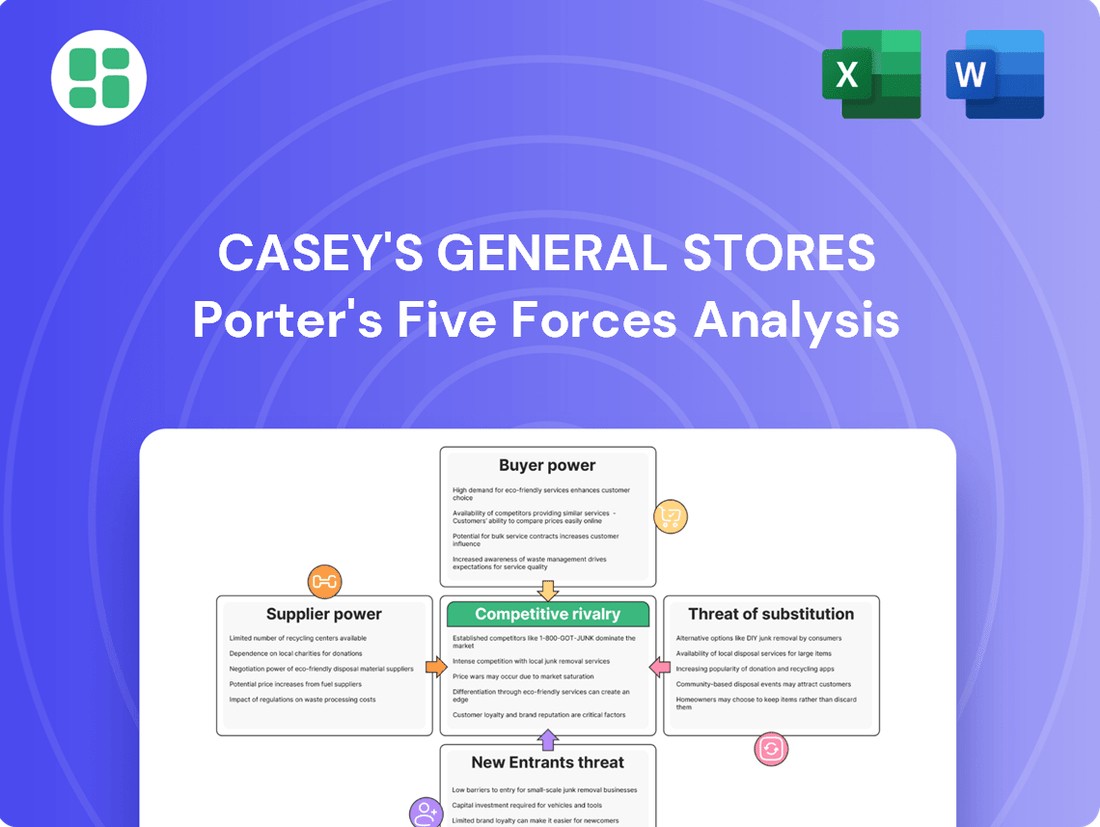

Casey's General Stores Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

Casey's General Stores navigates a landscape shaped by moderate buyer power and the ever-present threat of substitutes, particularly from larger grocery chains and convenience stores. Their unique fuel and food offerings create a competitive edge, but understanding the intensity of these forces is crucial for sustained success.

The complete report reveals the real forces shaping Casey's General Stores’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Casey's General Stores benefits from a diverse supplier base, sourcing essential products like fuel, groceries, and prepared foods from numerous vendors. This broad network is crucial for mitigating the bargaining power of any single supplier.

The company's strategy ensures that no single supplier accounts for more than 15% of its total procurement. This diversification significantly reduces Casey's reliance on any one entity, thereby strengthening its position at the negotiation table and limiting the suppliers' ability to dictate terms.

Casey's General Stores cultivates long-term supplier relationships, often securing agreements with durations averaging 3 to 5 years. These enduring partnerships are crucial for maintaining a stable supply chain and predictable costs, especially for key categories like fuel and private-label food products. For instance, in fiscal year 2024, Casey's reported that approximately 75% of its fuel purchases were covered by contracts with major distributors, offering a degree of insulation from immediate price volatility.

Casey's General Stores leverages integrated supply chain technology, including collaborative inventory management systems. This tech integration streamlines operations and fosters stronger supplier relationships, potentially increasing supplier bargaining power. For instance, in fiscal year 2024, Casey's reported a 9.1% increase in same-store sales, highlighting efficient inventory flow, which could make it harder to switch suppliers without disruption.

Fuel Market Dynamics

The bargaining power of fuel suppliers for Casey's General Stores is generally moderate. While Casey's relies on regional distributors, the broader fuel market exhibits steady growth, with global production of petroleum and other liquid fuels anticipated to rise in 2025. This stable supply environment can temper the leverage of individual suppliers.

However, specific regional supply constraints or disruptions could temporarily increase supplier power. For instance, if a major refinery in a key Casey's operating region experiences an outage, the remaining suppliers in that area might gain more pricing influence.

- Global Fuel Production Growth: Projections indicate an increase in global petroleum and liquid fuels production for 2025, suggesting a generally robust supply.

- Regional Dependence: Casey's reliance on regional petroleum distributors means that localized supply dynamics can still impact supplier bargaining power.

- Market Volatility: Fluctuations in crude oil prices, geopolitical events, and refining capacity can introduce temporary shifts in supplier leverage.

Food and Beverage Supplier Landscape

The bargaining power of suppliers in the food and beverage sector for convenience stores like Casey's is evolving. Major food brands are increasingly focusing on the convenience store channel, often through mergers and acquisitions. This trend is a positive development for Casey's, as it broadens the pool of potential suppliers.

With more large food manufacturers entering the convenience store market, Casey's can expect a wider selection of ingredients and finished products. This increased competition among suppliers can lead to more favorable pricing and better terms for Casey's, ultimately strengthening its position in negotiating supply agreements.

- Increased Supplier Competition: The growing interest from major food brands in the convenience channel intensifies competition among suppliers, potentially leading to better pricing for Casey's.

- Diversified Product Offerings: A larger number of food manufacturers entering the space provides Casey's with a broader range of ingredients and prepared food options.

- Potential for Favorable Terms: The enhanced supplier landscape can translate into more advantageous contracts and supply chain efficiencies for Casey's.

Casey's General Stores benefits from a diverse supplier base, which limits the bargaining power of individual suppliers. The company's strategy of not having any single supplier exceed 15% of total procurement significantly reduces its dependence on any one entity, strengthening its negotiation position.

For fiscal year 2024, Casey's reported that approximately 75% of its fuel purchases were secured through contracts with major distributors. This contractual approach provides a degree of insulation from immediate price volatility, effectively capping the bargaining power of fuel suppliers.

The increasing focus of major food brands on the convenience store channel is a positive development for Casey's, as it broadens the supplier pool and intensifies competition. This enhanced competition among food suppliers can lead to more favorable pricing and terms for Casey's, thereby diminishing supplier leverage.

| Supplier Category | Impact on Bargaining Power | Casey's Mitigation Strategy | Fiscal Year 2024 Data Point |

|---|---|---|---|

| Fuel | Moderate, influenced by regional supply dynamics and market volatility | Long-term contracts with major distributors (averaging 3-5 years) | ~75% of fuel purchases covered by contracts |

| Food & Beverage | Decreasing due to increased competition from major brands entering the convenience channel | Diversification of supplier base and leveraging increased supplier competition for better terms | Not specified, but implied by the trend of major brands entering the channel |

| General Merchandise | Varies based on product specificity and availability | Broad sourcing network and strategic partnerships | Not specified |

What is included in the product

This analysis uncovers the competitive landscape for Casey's General Stores, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the convenience store and gas station industry.

Quickly identify and address competitive threats by visualizing Casey's General Stores' Porter's Five Forces with a user-friendly dashboard.

Customers Bargaining Power

Casey's General Stores enjoys significant customer loyalty, boasting a retention rate of 68.3% and repeat customers visiting an average of 3.7 times weekly. This strong loyalty is largely attributed to its convenience-focused business model, particularly impactful in smaller communities where Casey's often becomes a primary hub for daily needs.

Customers at Casey's General Stores are indeed sensitive to price, even though they appreciate the convenience offered. For instance, a significant 67% of global consumers are willing to switch brands if they find a lower price. This means Casey's needs to carefully consider its pricing strategy, particularly for its popular prepared food items.

The perception of value is also crucial. In 2024, a notable 72% of consumers now consider convenience stores like Casey's as a practical alternative to traditional quick-service restaurants, largely driven by the value proposition they offer. This trend highlights an opportunity for Casey's to leverage its convenience factor while remaining competitive on price.

Customers now expect convenience stores to offer foodservice comparable to quick-service restaurants, driving a rise in made-to-order purchases. This means Casey's investment in items like pizza and improved coffee means customers are comparing them against established QSRs, raising the bar for quality and variety.

Impact of Digital and Loyalty Programs

The growing prevalence of digital and contactless payment methods, coupled with sophisticated loyalty programs, significantly shapes customer expectations and behavior. Casey's General Stores leverages this trend with its robust Casey's Rewards program, boasting over 9 million members as of early 2024. This extensive membership base highlights how personalized offers and digital interaction can foster deeper customer loyalty and encourage increased spending.

However, this digital engagement also heightens customer expectations for seamless, personalized experiences. The bargaining power of customers is amplified as they can readily compare offerings and switch to competitors who provide superior digital convenience and more compelling loyalty benefits. This necessitates continuous investment by Casey's in its digital infrastructure and reward offerings to maintain a competitive edge and mitigate the potential for customer attrition.

- Digital Adoption: Over 9 million Casey's Rewards members highlight the importance of digital engagement.

- Customer Expectations: Customers now expect personalized rewards and seamless digital experiences.

- Loyalty Impact: Effective loyalty programs can drive incremental spend and strengthen customer retention.

- Competitive Landscape: The ease of switching to competitors with better digital offerings increases customer bargaining power.

Rural Market Niche

Casey's strategic focus on small towns and rural communities often means fewer direct competitors for its customers. This limited competition in their chosen niches can significantly reduce the bargaining power of these customers, as convenient alternatives are often scarce. For instance, in many of the approximately 2,400 towns where Casey's operates, it may be one of the few, if not the only, major convenience store option.

This reduced customer bargaining power is a key advantage for Casey's. In 2024, Casey's continued to emphasize its rural and suburban market penetration, a strategy that inherently limits customer options. This allows Casey's to maintain more stable pricing and margins in these less competitive environments, contributing to their overall financial performance.

- Limited Competition: Casey's operates in approximately 2,400 locations, many of which are in rural or small-town settings with fewer direct convenience store competitors.

- Reduced Customer Options: In these niche markets, customers have fewer alternative places to purchase convenience items, gasoline, and prepared foods, thereby lowering their bargaining power.

- Pricing Stability: The limited availability of substitutes allows Casey's to experience greater stability in its pricing strategies and potentially higher profit margins in these areas.

- Strategic Advantage: This focus on underserved markets is a core element of Casey's business model, directly mitigating the threat of powerful buyers.

Casey's General Stores benefits from a reduced bargaining power of customers, particularly in the smaller communities it serves. With operations in approximately 2,400 locations, many of these are in rural or suburban areas where direct convenience store competition is limited. This scarcity of alternatives means customers have fewer options for essential purchases, lessening their ability to negotiate prices or demand significant concessions.

In 2024, this strategic positioning continues to be a key advantage. By focusing on markets with fewer substitutes, Casey's can maintain more consistent pricing and margins. For example, in towns where Casey's is the primary convenience provider, customers are less likely to switch due to price alone, as comparable options are scarce.

| Factor | Impact on Customer Bargaining Power | Casey's Strategic Advantage |

|---|---|---|

| Limited Competition in Niche Markets | Lowers customer ability to negotiate or switch | Allows for stable pricing and margins |

| Few Direct Substitutes in Rural Areas | Reduces customer price sensitivity | Strengthens brand loyalty and repeat business |

| Primary Convenience Hub Status | Customers rely on Casey's for daily needs | Creates a captive audience for various product categories |

Same Document Delivered

Casey's General Stores Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis for Casey's General Stores delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the convenience store and gas station industry. This detailed report provides actionable insights into the strategic positioning and future outlook of Casey's.

Rivalry Among Competitors

The convenience store market is a bustling arena, projected to hit $957.16 billion by 2025, showing a robust 8.4% compound annual growth rate. This expansion, while promising, fuels intense competition.

Within this dynamic landscape, Casey's General Stores faces a fragmented market. Numerous local, regional, and national competitors, such as industry giants 7-Eleven, Circle K, and Murphy USA, are all vying for a piece of this expanding pie, making rivalry a significant force.

Leading convenience store chains, including Casey's, are actively pursuing aggressive expansion. This includes both building new locations and acquiring existing ones, which significantly heats up the competition.

Casey's demonstrated this trend by acquiring 235 stores in fiscal year 2025. Furthermore, the company has set a target to add roughly 270 stores in 2025, directly increasing the number of competitors in the market and intensifying rivalry.

Foodservice is no longer just an add-on for convenience stores; it's a central battleground. Casey's has leaned into this, making its pizza and made-to-order items a significant draw, directly challenging quick-service restaurants. This focus is vital as the convenience store landscape sees more players emphasizing prepared food offerings.

Technological Advancements and Customer Experience

Technological advancements are intensifying competitive rivalry within the convenience store sector. Innovations like AI-powered inventory management and personalized customer offers, exemplified by Casey's ongoing investment in its loyalty program, are becoming key differentiators. These technologies directly impact customer experience, with automated checkout systems also emerging as a competitive factor.

Stores that successfully integrate these technological solutions can carve out a significant competitive edge. For instance, the drive towards enhanced customer experience through digital platforms and seamless in-store technology is a critical battleground. This focus on innovation and customer-centric tech is reshaping how convenience stores compete, pushing others to adapt or risk falling behind.

- AI in Inventory Management: Reduces stockouts and waste, improving operational efficiency.

- Personalized Offers: Increases customer loyalty and basket size through targeted promotions.

- Automated Checkout: Speeds up the transaction process, enhancing customer convenience.

- Loyalty Programs: Drive repeat business and provide valuable customer data for further personalization.

Regional Concentration vs. National Presence

Casey's General Stores enjoys a robust presence, particularly in the Midwest and parts of the South. However, this regional strength means it faces intense competition from rivals with wider national distribution or dominant positions in other geographic areas. For instance, while Casey's operated over 2,700 stores as of early 2024, national convenience store chains like 7-Eleven have a significantly larger global footprint, creating a different competitive dynamic in markets where they overlap.

The intensity of rivalry is not uniform across all locations. In areas where Casey's has a high concentration of stores, competition might be more localized and focused on specific neighborhood dynamics. Conversely, in markets where Casey's is less established, it contends with competitors who may already have strong brand loyalty and established supply chains.

- Regional Strength vs. National Reach: Casey's strong Midwestern and Southern presence contrasts with competitors possessing broader national or even international footprints, leading to varied competitive pressures.

- Market Saturation: The level of competition intensifies in specific geographic markets where Casey's has a high store density, leading to more direct rivalry for local customers.

- Competitor Diversification: Rivals may compete not just on convenience items but also on fuel offerings, grocery selections, or restaurant concepts, creating a multifaceted competitive landscape.

- Market Share Dynamics: While Casey's holds a significant share in its core regions, national players like Circle K or national grocery chains with convenience formats can exert considerable pressure in overlapping territories.

Competitive rivalry is a significant force for Casey's General Stores, amplified by the convenience store industry's projected growth to $957.16 billion by 2025. The market is fragmented, with major players like 7-Eleven and Circle K, alongside numerous regional and local operators, all vying for market share. Casey's expansion efforts, including acquiring 235 stores in fiscal year 2025 and targeting approximately 270 new stores in 2025, directly increase this competitive pressure.

The battleground extends to foodservice, where Casey's pizza and made-to-order items compete directly with quick-service restaurants, a trend mirrored by many rivals enhancing their prepared food offerings. Technological advancements, such as AI-powered inventory and personalized offers through loyalty programs, are also key differentiators, with Casey's investing in these areas to maintain a competitive edge.

Casey's strong regional presence in the Midwest and South faces competition from national chains like 7-Eleven, which boasts a much larger global footprint, creating varied competitive dynamics. In markets with high Casey's store density, rivalry becomes more localized and intense, as competitors vie for neighborhood customers.

| Competitor | Store Count (Approx. Early 2024) | Key Competitive Strategy |

|---|---|---|

| Casey's General Stores | 2,700+ | Regional strength, foodservice focus, loyalty program investment |

| 7-Eleven | ~77,000 (Global) | Extensive global footprint, diverse product offerings |

| Circle K | ~13,000 (North America) | Broad market presence, fuel and convenience focus |

| Murphy USA | ~1,700 | Focus on fuel and convenience, often located near Walmart |

SSubstitutes Threaten

Supermarkets and larger grocery chains present a substantial threat of substitutes for Casey's General Stores, particularly for core grocery and general merchandise items. These larger retailers often boast a broader product assortment and can leverage economies of scale to offer more competitive pricing, making them attractive for consumers conducting more extensive shopping trips. For instance, in 2024, the average US supermarket boasted over 30,000 SKUs, significantly more than a typical convenience store.

The threat of substitutes for Casey's prepared food offerings is significant, primarily from quick-service restaurants (QSRs) and traditional fast-food chains. These competitors offer a wide array of convenient, ready-to-eat meals that directly compete with Casey's pizza, sandwiches, and breakfast items. For instance, McDonald's McCafé and breakfast menu, or Subway's sandwich options, represent readily available alternatives for consumers seeking a quick meal on the go.

As the foodservice landscape evolves, the distinction between convenience stores and QSRs continues to diminish. Many fast-food chains are expanding their hours and locations, making them accessible at times and places where a convenience store might also operate. This blurring of lines means customers increasingly perceive QSRs as direct substitutes for the hot meal solutions Casey's provides, especially during peak meal times.

The burgeoning e-commerce landscape, especially within the grocery and convenience sectors, poses a significant substitute threat to Casey's General Stores. Online delivery services offer consumers a convenient alternative, particularly for everyday items. For instance, in 2024, the online grocery market continued its robust growth, with a significant portion of consumers indicating a preference for delivery over in-store pickup for routine purchases, a trend that directly impacts brick-and-mortar retailers.

This shift means consumers can bypass physical stores for many of their needs, from snacks to beverages. Data from late 2023 and early 2024 shows that while speed is a factor, cost-effectiveness in delivery is increasingly influencing consumer choices, putting pressure on traditional retailers to compete with online pricing and delivery models. This can erode impulse purchases, a key revenue driver for convenience stores like Casey's.

Alternative Fuel Sources and Electric Vehicles

The growing adoption of electric vehicles (EVs) presents a notable substitute threat to Casey's General Stores' core fuel business. As consumers increasingly opt for EVs, the demand for traditional gasoline and diesel is projected to decline over the long term.

By 2024, the global EV market is experiencing robust growth, with sales expected to reach new heights. This shift necessitates convenience stores like Casey's to re-evaluate their revenue streams and consider integrating services that cater to EV owners, such as charging infrastructure.

- EV Market Growth: Projections indicate continued strong sales growth for EVs globally through 2024 and beyond, directly impacting traditional fuel consumption.

- Infrastructure Investment: Convenience store chains are exploring investments in EV charging stations to adapt to changing consumer preferences and maintain foot traffic.

- Diversification Needs: Casey's may need to diversify its product and service offerings beyond fuel to mitigate the long-term impact of this substitute threat.

Home Cooking and Meal Preparation

Home cooking and meal preparation present a significant threat to Casey's General Stores' prepared food offerings. As economic pressures mount, consumers are increasingly looking for ways to save money, making the cost-effectiveness of preparing meals at home a compelling alternative to purchasing convenience foods.

The growing adoption of GLP-1 drugs, which can lead to reduced appetite and altered food consumption patterns, also plays a role. Individuals using these medications may find themselves eating less overall, further incentivizing home cooking over impulse purchases of prepared meals from convenience stores.

- Economic Sensitivity: Consumers are more likely to cook at home when facing budget constraints.

- Health and Wellness Trends: The desire for healthier, portion-controlled meals often drives home preparation.

- Time vs. Cost Calculation: While convenience is a draw, the perceived cost savings of home cooking can outweigh the time investment for many.

The threat of substitutes for Casey's General Stores is multifaceted, impacting both its fuel and prepared food segments. Consumers have a growing number of alternatives for their daily needs, from groceries to quick meals, and even fuel. This necessitates a strategic approach to maintaining customer loyalty and revenue streams.

Supermarkets and large grocery chains offer a wider selection and often better pricing for general merchandise and food items, directly competing with Casey's. Similarly, quick-service restaurants (QSRs) provide convenient meal solutions that rival Casey's prepared food offerings. Even the shift towards electric vehicles (EVs) presents a long-term substitute threat to Casey's primary fuel business.

The rise of online grocery shopping and delivery services further amplifies the substitute threat, offering unparalleled convenience and often competitive pricing for everyday items. This evolving consumer behavior demands that Casey's continually adapt its strategy to remain relevant and competitive in the face of these diverse alternatives.

| Substitute Category | Key Competitors/Examples | Impact on Casey's | 2024 Data/Trend |

|---|---|---|---|

| Grocery & General Merchandise | Supermarkets (e.g., Kroger, Walmart Supercenters) | Loss of basket share for non-fuel items; price sensitivity | US supermarkets averaged over 30,000 SKUs in 2024. |

| Prepared Foods | QSRs (e.g., McDonald's, Subway), Fast-Casual Restaurants | Direct competition for breakfast, lunch, and dinner occasions | Continued growth in QSR market share for convenient meals. |

| Fuel | Electric Vehicles (EVs) | Long-term decline in gasoline demand | Global EV sales projected for significant growth through 2024. |

| Convenience & Delivery | Online Grocery Platforms (e.g., Instacart), Meal Kit Services | Erosion of impulse purchases; convenience redefined | Online grocery market continued robust growth in 2024. |

Entrants Threaten

The threat of new entrants for Casey's General Stores is significantly mitigated by the high capital investment required to establish a presence in the convenience store sector. Launching a chain necessitates substantial outlays for prime real estate, store construction, stocking diverse inventory, and implementing modern point-of-sale and inventory management systems. For instance, the average cost to build a new convenience store can range from $1 million to $3 million, depending on size and location, making it a considerable hurdle for aspiring competitors.

Established players like Casey's General Stores benefit from deeply entrenched distribution networks and robust supply chain relationships. These existing ties with suppliers and logistics providers are difficult and costly for newcomers to replicate. For instance, Casey's extensive network of over 2,500 stores across 16 states relies on sophisticated, proprietary distribution infrastructure that took years to develop and optimize.

Building a comparable distribution system from the ground up would require substantial capital investment and time, presenting a significant barrier to entry. New entrants would struggle to achieve the same economies of scale and efficiency that Casey's currently enjoys through its integrated operations, making it challenging to compete on cost or product availability.

Casey's General Stores enjoys significant brand loyalty in its core rural and small-town markets, creating a substantial barrier for potential new entrants. This loyalty, built over years of consistent service and community integration, means new competitors face an uphill battle in capturing customer attention and market share. For instance, Casey's reported over $16.0 billion in revenue for fiscal year 2024, demonstrating its established customer base.

Regulatory Hurdles and Compliance Costs

The convenience store sector, especially those selling fuel and tobacco, faces significant regulatory oversight and associated compliance expenses. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to enforce strict regulations on tobacco products, including marketing and sales restrictions, which can add substantial operational costs for any new player.

New entrants must contend with these intricate regulatory landscapes, which may include limitations on specific product categories or sales practices. These compliance burdens can significantly increase the capital and operational expenditure required to establish and maintain a presence, thereby raising the barrier to entry.

Key regulatory considerations for new entrants in 2024 and beyond include:

- Federal and State Environmental Regulations: Compliance with environmental standards for fuel storage and dispensing, such as those managed by the EPA, involves ongoing monitoring and potential upgrades.

- Tobacco Sales Regulations: Adherence to age verification laws, flavor bans (where applicable), and marketing restrictions imposed by bodies like the FDA.

- Alcohol and Lottery Licensing: Obtaining and maintaining licenses for selling alcohol and lottery tickets often involves rigorous background checks and fees.

- Food Safety Standards: For stores offering prepared foods, compliance with health department regulations is paramount.

Economies of Scale and Operational Efficiency

The threat of new entrants for Casey's General Stores is somewhat mitigated by significant economies of scale. Large, established chains like Casey's leverage their size for better purchasing power, more efficient marketing campaigns, and streamlined operations. For instance, in 2024, Casey's reported over $14 billion in revenue, a testament to its operational scale.

New competitors entering the market would find it difficult to replicate these cost advantages. Without the same volume, they would likely face higher per-unit costs for inventory, marketing, and distribution. This makes it challenging for newcomers to compete effectively on price and achieve comparable profit margins.

- Economies of Scale: Casey's, with its extensive network of over 2,500 stores as of early 2024, benefits from substantial purchasing power, reducing the cost of goods sold.

- Operational Efficiency: Centralized distribution and optimized logistics contribute to lower operating expenses per store compared to smaller, independent operators.

- Marketing Reach: A larger customer base allows for more impactful and cost-effective marketing efforts, building brand recognition that new entrants would struggle to match.

- Capital Investment: Establishing a competitive footprint requires significant capital for store development, inventory, and technology, creating a high barrier to entry.

The threat of new entrants for Casey's General Stores is low due to substantial capital requirements for real estate, inventory, and technology, with new store builds costing millions. Established distribution networks and supplier relationships are difficult and expensive for newcomers to replicate, as Casey's proprietary infrastructure took years to optimize. Furthermore, significant brand loyalty in its operating regions and stringent regulatory compliance, particularly concerning fuel and tobacco sales, create considerable barriers for any new player attempting to enter the market.

| Barrier Type | Description | Impact on New Entrants | Example for Casey's (2024 Data) |

|---|---|---|---|

| Capital Requirements | High costs for property, inventory, and technology. | Significant financial hurdle. | Average new store cost: $1M-$3M. |

| Distribution & Supply Chain | Existing, optimized networks are hard to duplicate. | Difficulty achieving scale and efficiency. | Over 2,500 stores rely on proprietary infrastructure. |

| Brand Loyalty | Established customer trust and community integration. | Challenging to capture market share. | Revenue of over $16.0 billion in FY24. |

| Regulatory Environment | Compliance costs and restrictions (e.g., tobacco, fuel). | Increases operational complexity and expense. | FDA regulations on tobacco sales. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Casey's General Stores is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports. We also incorporate data from trade publications and competitor announcements to gain a comprehensive understanding of the competitive landscape.