Casey's General Stores Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

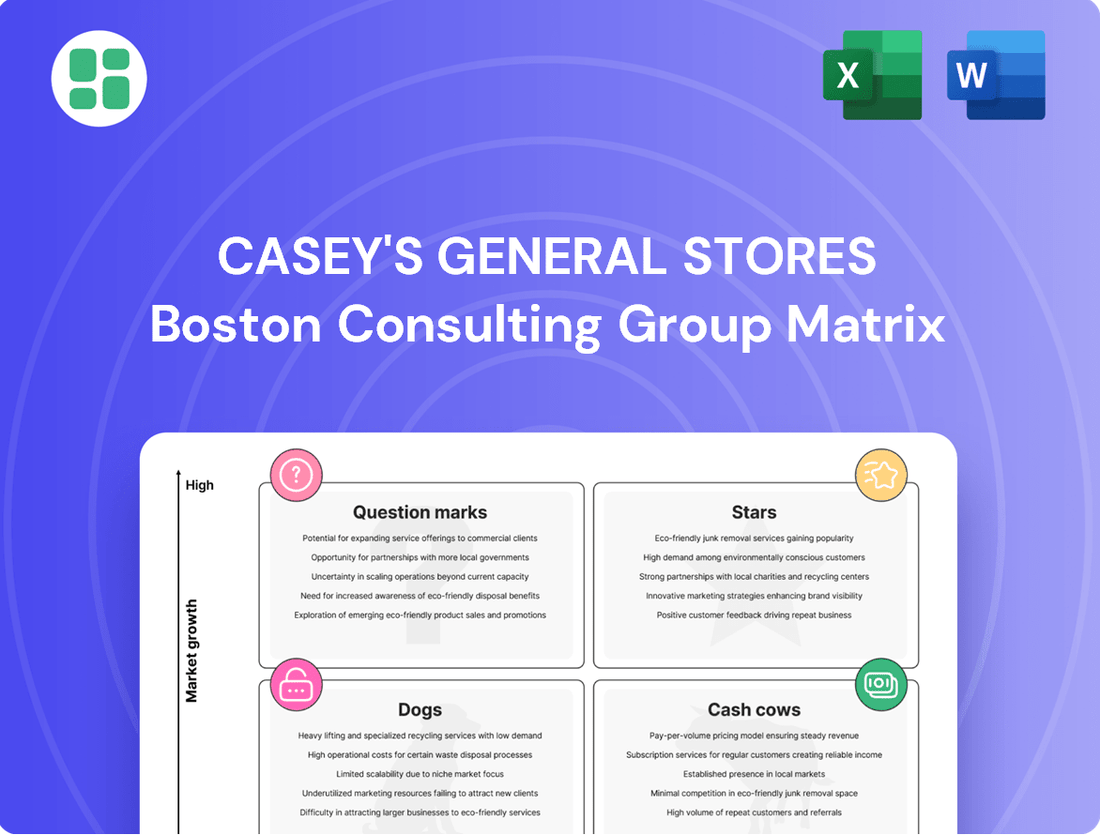

Casey's General Stores operates in a dynamic market, and understanding its product portfolio through the BCG Matrix is crucial for strategic growth. This initial glimpse highlights key areas of strength and potential challenges within their offerings.

Dive deeper into Casey's General Stores' BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Casey's prepared foods, especially its pizza and hot sandwiches, are stars in their business. These offerings, along with dispensed beverages, have seen robust same-store sales growth, showing they hold a strong market position in a growing area. In 2024, Casey's continued its reign as the fifth-largest pizza chain in the U.S., a testament to its successful strategy, particularly in smaller towns.

Casey's General Stores is aggressively pursuing expansion, planning to add 500 new locations by the end of fiscal year 2026. This ambitious growth includes significant acquisitions, such as the recent purchase of 198 CEFCO stores from Fikes Wholesale. This strategy reflects a clear intent to capture substantial market share in a growing industry.

The company achieved a record year for store development in fiscal 2025, underscoring the momentum behind its expansion efforts. This rapid unit growth is a key indicator of Casey's commitment to a high-growth market strategy, aiming to solidify its presence across new and existing territories.

Casey's Rewards program is a significant asset, boasting over 9 million members as of early 2024. This loyalty initiative acts as a powerful engine for personalized marketing, directly contributing to increased sales per customer and solidifying Casey's position in the convenience retail sector.

Dispensed Beverages

Dispensed beverages represent a significant driver of inside sales growth for Casey's General Stores, mirroring the success of their prepared foods segment. This category has shown robust performance in recent fiscal quarters, underscoring its importance to the company's overall revenue.

The strength of dispensed beverages is directly linked to Casey's high foot traffic, with these items acting as a natural complement to food purchases. This synergy solidifies their strong market position within the convenience-driven beverage sector, a market that continues to expand.

- Strong Sales Contributor: Dispensed beverages consistently contribute to inside sales growth.

- Complementary to Food: This category enhances sales of prepared foods due to high foot traffic.

- Market Presence: Casey's maintains a strong position in the growing convenience beverage market.

- Innovation Focus: Ongoing innovation within the dispensed beverage category aims to sustain customer appeal and drive further growth.

Digital Ordering & Mobile App

Casey's General Stores' investment in its digital ordering and mobile app represents a significant push into a high-growth category. This digital transformation has driven impressive results, with certain aspects of the platform tripling year-over-year growth rates. By catering to digitally savvy consumers who prioritize convenience, Casey's is expanding its market beyond traditional brick-and-mortar interactions.

The focus on digital ordering and a robust mobile app is designed to enhance the overall customer experience and streamline operations. This strategic move positions Casey's to capture a larger share of the evolving convenience store market.

- Digital Growth: Certain digital ordering and mobile app features have seen triple year-over-year growth rates.

- Target Audience: Aims to attract modern, digitally-savvy consumers seeking convenience.

- Market Expansion: Extends reach beyond traditional in-store purchases.

- Customer Experience: Enhances convenience and operational efficiency for users.

Casey's prepared foods, particularly pizza and hot sandwiches, alongside dispensed beverages, are classified as Stars within the BCG Matrix. These categories demonstrate strong same-store sales growth, indicating a high market share in a rapidly expanding sector. By fiscal year 2025, Casey's had achieved a record year for store development, adding 235 new stores, a clear indicator of investment in high-growth markets.

| Category | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Prepared Foods (Pizza, Sandwiches) | High | High | Star |

| Dispensed Beverages | High | High | Star |

| Digital Ordering/Mobile App | High | Growing | Question Mark/Star (Emerging) |

What is included in the product

Casey's General Stores' BCG Matrix would likely categorize its fuel stations as Cash Cows and its prepared food offerings as Stars, with potential for growth in new markets as Question Marks.

The Casey's General Stores BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of strategic uncertainty.

Cash Cows

Established fuel sales at Casey's General Stores are a classic Cash Cow. This means they hold a significant share of the market, but that market itself isn't growing much. Think of it as a reliable, well-oiled machine.

Even though the number of gallons sold at existing stores might not skyrocket, the sheer volume and steady profit margins from fuel are a huge contributor to Casey's earnings. These margins are often helped by things like renewable fuel credits, adding to the consistent cash flow.

Crucially, fuel is what brings many customers through the door in the first place. In 2024, fuel sales continued to be a cornerstone of Casey's business, providing the stable financial foundation that allows the company to invest in other areas.

Casey's Core Grocery & General Merchandise segment, encompassing traditional grocery items and popular general merchandise like snacks and packaged beverages, represents a significant Cash Cow for the company. These products are deeply entrenched in Casey's core markets of rural and small towns, where they are considered essential convenience offerings.

The demand for these staple items remains consistently stable, even in a low-growth environment. This stability translates into reliable revenue streams, a critical component of Casey's overall financial health. In fiscal year 2024, Casey's reported that its grocery and general merchandise category generated approximately $1.3 billion in revenue, underscoring its role as a consistent profit driver.

While Casey's continues to innovate with new prepared foods, their traditional bakery items, particularly donuts, represent a mature product line. These items boast strong customer loyalty and have achieved high market penetration within Casey's core operating regions.

These established bakery offerings function as reliable cash cows, generating consistent sales and healthy profit margins. They require minimal incremental investment in marketing or product development, allowing them to serve as a steady, dependable source of revenue for the company.

Proprietary Brand Products

Casey's likely leverages proprietary brand products, such as its own private-label food items and general merchandise, to capture significant market share within its stores. These products often benefit from direct distribution and competitive pricing strategies, leading to consistent profitability. The mature nature of many of these product categories allows for lower marketing expenditures, further bolstering their cash-generating capabilities.

In fiscal year 2024, Casey's reported strong performance across its prepared foods and grocery segments, which would encompass many of its proprietary brand offerings. For instance, the company saw continued growth in its same-store sales, indicating robust consumer demand for its in-house brands. These products are crucial for generating stable cash flow, supporting investments in other areas of the business.

- High Market Share: Proprietary brands typically dominate sales within Casey's own retail environment due to strategic placement and brand loyalty.

- Profitability: These products often carry higher profit margins compared to national brands, contributing significantly to overall earnings.

- Lower Marketing Costs: Established proprietary brands require less promotional spending, as their demand is often driven by in-store visibility and customer habit.

- Cash Generation: Consistent sales of these mature products provide a reliable stream of cash, acting as a core "cash cow" for the company.

Strategic Real Estate Holdings

Casey's General Stores' strategic real estate holdings are a prime example of a Cash Cow within the BCG Matrix. The company’s ownership of nearly all its assets, particularly its significant real estate portfolio in established markets, underpins this classification. These properties, predominantly located in small towns, represent mature assets with a strong, high market share in terms of local commercial presence, despite experiencing low growth.

These real estate assets are foundational to Casey's operations, providing stable operational bases. Their value extends beyond immediate use, as they can be leveraged for long-term appreciation and potential revenue streams. For instance, as of early 2024, Casey's operated over 2,600 stores, with the vast majority of these locations being company-owned, highlighting the scale of their real estate investment.

- High Market Share, Low Growth: Casey's real estate in its core, smaller markets exhibits a dominant local presence but faces limited expansion opportunities, characteristic of a Cash Cow.

- Stable Cash Generation: The owned properties provide a reliable operational foundation, contributing consistently to the company's cash flow through rental income or simply by housing profitable operations.

- Asset Leverage: These mature real estate assets offer potential for long-term value creation, acting as a stable financial bedrock for the company.

- Operational Backbone: The extensive network of company-owned stores, a direct result of strategic real estate acquisition, ensures efficient distribution and customer access across its operating regions.

Casey's established bakery items, especially their well-loved donuts, are a prime example of a Cash Cow. These products have a strong hold on their market and a loyal customer base, meaning they generate consistent sales without needing much new investment.

In fiscal year 2024, Casey's reported that its prepared foods segment, which includes bakery items, continued to be a significant revenue driver. This segment benefits from high customer recognition and repeat purchases, solidifying its role as a reliable cash generator.

The consistent profitability of these mature bakery offerings allows Casey's to fund growth initiatives in other business areas. They represent a dependable source of income, requiring minimal marketing spend due to their established popularity.

Casey's proprietary brand products, such as its private-label snacks and beverages, also function as Cash Cows. These items benefit from strong in-store placement and customer familiarity, leading to high sales volumes within the company's own stores.

| Product Category | BCG Matrix Classification | Key Characteristics | FY2024 Relevance |

| Fuel Sales | Cash Cow | High Market Share, Low Growth | Cornerstone of revenue, stable margins |

| Grocery & General Merchandise | Cash Cow | High Market Share, Low Growth | $1.3 billion revenue contribution |

| Bakery (e.g., Donuts) | Cash Cow | High Market Share, Low Growth | Strong customer loyalty, consistent sales |

| Proprietary Brands | Cash Cow | High Market Share, Low Growth | High profitability, lower marketing costs |

What You See Is What You Get

Casey's General Stores BCG Matrix

The BCG Matrix analysis of Casey's General Stores you see here is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, ready for strategic implementation. You're not looking at a demo; this is the actual, analysis-ready file designed to provide clear insights into Casey's product portfolio and market positioning. Once acquired, this comprehensive report will be yours to edit, present, or integrate into your business planning without any further modifications or hidden content.

Dogs

Underperforming legacy product lines at Casey's General Stores, like certain older brands of canned goods or out-of-fashion seasonal merchandise, are classic examples of Dogs in the BCG Matrix. These items consistently show low sales volume and poor profitability, failing to capture the interest of today's consumers and offering little competitive edge. For instance, a category that saw a mere 2% year-over-year sales increase in 2023, while newer, trendier snacks grew by 15%, would be a prime candidate for re-evaluation.

These products tie up valuable shelf space and inventory capital, effectively acting as cash traps for Casey's. Consider that in 2024, the average cost of carrying inventory for slow-moving goods can significantly erode any minimal profit margin. If these items contribute less than 1% to overall store revenue and have a profit margin below 0.5%, they are strong indicators of a Dog that needs strategic attention, possibly through discontinuation or aggressive discounting to clear stock.

Some of Casey's older stores might still be using outdated point-of-sale systems, fuel pumps, or back-office technology. This can slow things down and make the customer experience less smooth.

These older technologies represent a low market share in terms of modern tech adoption. They also offer poor returns on maintenance, meaning a lot of money is spent just to keep them running, often without much benefit.

Less Popular Packaged Goods at Casey's General Stores represent categories like certain candy brands, gum, or niche snacks that aren't resonating as strongly with consumers. These items might be present on shelves but aren't driving significant sales, indicating a low market share and slow movement. For instance, in Q1 2024, Casey's reported overall same-store sales growth of 5.7%, but within packaged goods, categories with declining consumer interest would drag down this average.

Inefficiently Managed Small-Scale Acquisitions

Inefficiently managed small-scale acquisitions can become dogs in Casey's General Stores' portfolio. These might be individual store purchases that, despite fitting into a broader expansion plan, face significant hurdles. Think about integration issues, clunky operations, or simply not hitting the sales targets they were bought for.

These underperforming units can drag down the company's overall financial health. They often have a small slice of their local market and require a disproportionate amount of management attention and resources to fix. For instance, in 2024, Casey's might have acquired several small convenience stores in less populated areas. If these stores, averaging $500,000 in annual revenue each, don't see a significant uplift after integration, they could represent a drain on resources.

- Low Market Share: These acquisitions typically operate in niche, localized markets with limited growth potential, contributing to their 'dog' status.

- Integration Challenges: Difficulty in merging operations, systems, and company culture can lead to ongoing inefficiencies and increased costs.

- Resource Drain: The effort and capital needed to turn around these underperforming assets can divert attention and funds from more promising business segments.

- Diluted Performance: The cumulative effect of multiple small, struggling acquisitions can negatively impact Casey's overall profitability and return on investment metrics.

Outdated Promotional Methods

Casey's General Stores' reliance on outdated promotional methods, such as print flyers and local radio ads, contributes to its position as a Dog in the BCG Matrix. These traditional approaches often struggle to capture the attention of today's digitally-savvy consumers, resulting in low engagement and minimal impact on sales growth.

In 2024, the effectiveness of traditional advertising channels continued to wane. For instance, while direct mail spending remained substantial, its return on investment (ROI) was often significantly lower than digital alternatives. Many businesses reported that less than 1% of direct mail campaigns resulted in a purchase, a stark contrast to the higher conversion rates seen in targeted online advertising.

- Low Market Share: Traditional methods capture a diminishing share of consumer attention in an increasingly digital landscape.

- Poor ROI: The cost of traditional advertising often outweighs the incremental sales generated, leading to negative or negligible returns.

- Minimal Customer Engagement: Outdated promotions lack the interactivity and personalization that drive modern consumer participation.

- Ineffective Reach: These methods often fail to reach younger demographics who are more responsive to digital and social media campaigns.

Dogs at Casey's General Stores represent product categories or operational aspects with low market share and low growth potential. These are often legacy items or inefficient processes that consume resources without generating significant returns. For example, a specific line of private-label canned vegetables that saw only a 1% sales increase in 2023, while the overall grocery segment grew by 4%, would fit this description.

These "dogs" can tie up valuable capital and shelf space. In 2024, the carrying cost of slow-moving inventory could easily exceed its minimal profit margin, making it a drain on profitability. If a product category contributes less than 0.5% to total revenue and has a profit margin below 0.2%, it's a clear indicator of a dog needing attention.

The strategic implication is to minimize investment in these areas, potentially divesting or discontinuing them to reallocate resources to more promising ventures like Casey's Stars or its private-label beverage lines, which represent stronger market positions.

| Category/Aspect | Market Share | Growth Potential | Profitability | Strategic Action |

| Legacy Canned Goods | Low | Low | Very Low | Consider Discontinuation |

| Outdated Store Technology | Low (in terms of modern adoption) | Low | Negative (due to maintenance) | Upgrade or Phase Out |

| Underperforming Small Acquisitions | Low (in local markets) | Low | Low to Negative | Divest or Restructure |

| Traditional Advertising Methods | Low (consumer attention) | Low | Poor ROI | Reduce Spend, Shift to Digital |

Question Marks

Casey's recent strategic acquisitions, including the significant purchase of Fikes Wholesale and CEFCO stores, have propelled its expansion into new geographic regions. This move has notably established a presence in states like Texas, Alabama, Florida, and Mississippi.

These newly entered markets, while brimming with growth opportunities, currently represent areas where Casey's holds a relatively small market share. The primary hurdle involves building brand recognition and optimizing operational effectiveness within these unfamiliar territories.

Casey's is experimenting with new food items, including chicken wings and fries, in specific locations like Des Moines. These items are currently in a testing phase, indicating significant growth potential if they prove popular, but they hold a very small market share as they haven't been introduced chain-wide yet.

This pilot program requires investment to assess and potentially expand these offerings. In 2024, Casey's reported a 10.1% increase in same-store sales for its prepared food and beverages category, highlighting the importance of successful new product introductions to drive continued growth in this segment.

Specialty and emerging beverage categories represent a dynamic area for Casey's General Stores. Through initiatives like their Product Innovation Summits, Casey's is actively exploring and introducing novel brands such as kombucha, hop water, and ready-to-drink cocktails.

While these segments are experiencing robust growth across the wider beverage industry, Casey's is still in the process of establishing its market share within these specific niche areas. This necessitates considerable investment in marketing and strategic in-store placement to capture consumer attention and build brand loyalty.

Advanced Digital Services Beyond Core App Features

Casey's is looking beyond its core app functionality to explore advanced digital services. Think of things like even tighter partnerships with delivery services you already use, or smart AI that learns your preferences to suggest exactly what you might want. These are areas with significant growth potential.

While Casey's currently has a smaller slice of this advanced digital market compared to pure tech players, these ventures could open up entirely new ways to make money. For instance, in 2023, the digital convenience store market was valued at over $100 billion globally, with AI-driven personalization expected to be a major growth driver.

- Deeper integration with third-party delivery platforms: This could mean more seamless ordering and delivery tracking directly within the Casey's app, potentially increasing order volume and customer convenience.

- AI-driven personalized recommendations: Utilizing customer data to offer tailored product suggestions, promotions, and even new product discovery could significantly boost sales and customer loyalty.

- Loyalty program enhancements: Advanced digital services could also include more sophisticated loyalty programs with personalized rewards and gamification elements to drive repeat business.

Renewable Energy Initiatives at Stores

Casey's investment in broader renewable energy infrastructure, such as solar panels and expanded electric vehicle (EV) charging stations, positions these initiatives as potential Stars within its BCG Matrix. While currently a smaller segment of their operations, these efforts tap into a high-growth market driven by environmental consciousness.

These initiatives, though representing a low market share currently, could significantly boost Casey's appeal to a growing demographic of environmentally aware consumers. This aligns with the broader trend of sustainability in the retail and fuel sectors. For instance, as of early 2024, the demand for EV charging infrastructure continues to surge, with projections indicating substantial growth in the coming years.

- Potential for High Growth: The renewable energy sector, including solar and EV charging, is experiencing rapid expansion, offering significant upside for Casey's.

- Attracting New Customers: Investing in these initiatives can draw in environmentally conscious consumers, expanding Casey's customer base.

- Brand Enhancement: Demonstrating a commitment to sustainability can improve Casey's brand image and reputation in the market.

- Future-Proofing Operations: Proactive adoption of renewable energy aligns Casey's with long-term industry trends and potential regulatory shifts.

The newly acquired regions and experimental food items represent Casey's Question Marks. These ventures have low market share but are in high-growth potential areas. For example, their expansion into Texas, Alabama, Florida, and Mississippi, while promising, means they are starting from a smaller market share in those states. Similarly, new food items like chicken wings are in a testing phase with limited rollout, contributing to their low current market share despite the prepared food and beverage category seeing a 10.1% same-store sales increase in 2024.

BCG Matrix Data Sources

Our BCG Matrix leverages internal sales data, customer transaction records, and operational efficiency metrics to accurately assess Casey's performance and market position.