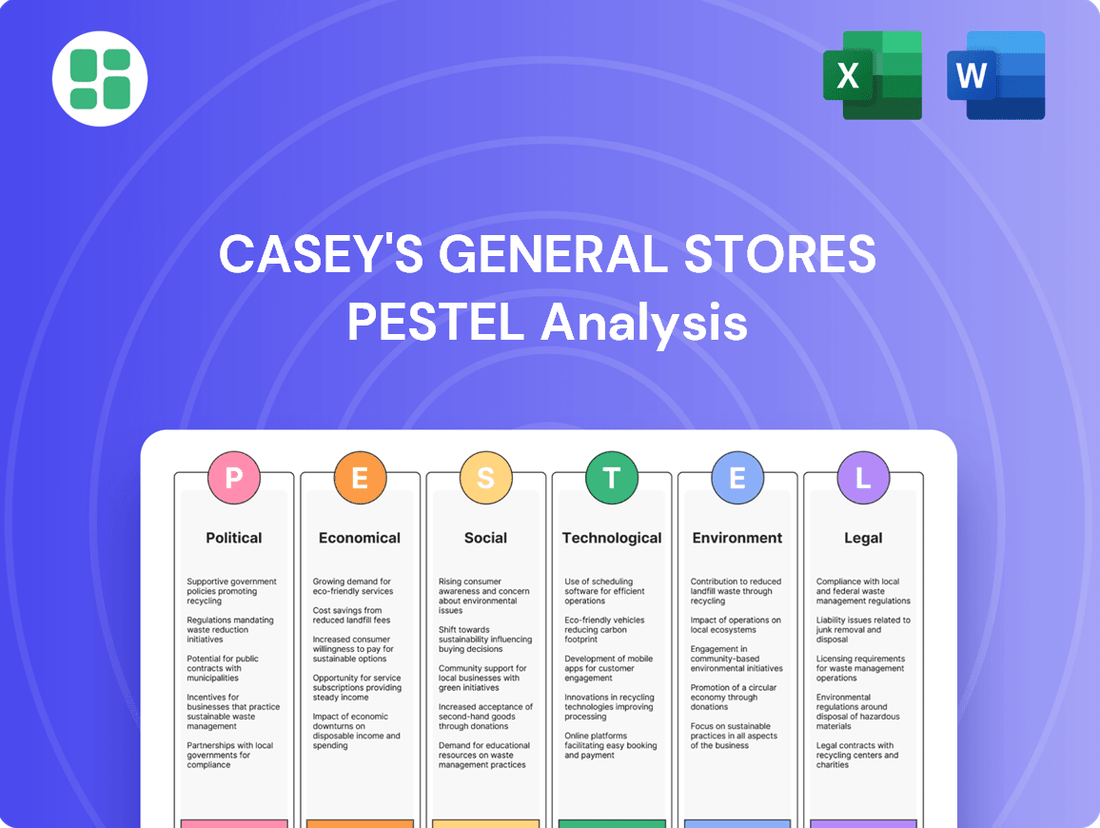

Casey's General Stores PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

Political shifts, economic fluctuations, and evolving social trends all significantly shape Casey's General Stores's operational landscape. Understanding these external forces is crucial for strategic planning and identifying potential opportunities or challenges. Download our comprehensive PESTLE analysis to gain actionable insights into how these factors impact Casey's and empower your own market strategy.

Political factors

Government regulations significantly shape Casey's fuel sales. For instance, the EPA's Renewable Fuel Standard (RFS) mandates the blending of renewable fuels like ethanol, impacting the types of gasoline Casey must offer and potentially affecting its procurement costs. In 2024, the RFS program continued to set volume obligations for renewable fuels, influencing the availability and pricing of traditional gasoline components.

Emissions standards, such as those set by California's Advanced Clean Cars II program, which aims to phase out gasoline-powered vehicle sales by 2035, could indirectly influence consumer demand for traditional fuels over the long term. While Casey's operates in multiple states, awareness of these evolving environmental regulations is key to anticipating future market shifts and ensuring compliance with varying state-level fuel composition requirements.

Fuel taxation policies at federal and state levels directly impact the pump price, a critical factor for Casey's revenue and customer purchasing decisions. For example, the federal gasoline tax has remained at 18.4 cents per gallon since 1993, but many states have adjusted their excise taxes. In 2024, states like Illinois saw continued discussions around fuel tax adjustments, highlighting the dynamic nature of this revenue stream for Casey's.

Casey's ambitious expansion plans, especially into markets like Texas, are directly impacted by local zoning and permitting. These regulations vary significantly from one municipality to another, creating a complex landscape for new store development and acquisitions.

Navigating these diverse rules can slow down the pace of growth and increase associated costs. For instance, a delay in securing permits for a new build or an acquisition in a key growth state could push back projected opening dates, impacting revenue targets.

The company's ability to successfully execute its aggressive growth strategy hinges on its proficiency in managing these local political factors. In 2024, Casey's continued its focus on strategic site selection and development, with an emphasis on streamlining the permitting process to maintain momentum.

Labor laws and minimum wage policies significantly impact Casey's General Stores' operational costs and workforce management. For instance, states like Iowa, Illinois, and Missouri, where Casey's has a strong presence, have seen minimum wage adjustments. As of early 2024, many of these states have minimum wages at or above the federal level, with some considering further increases.

These policies dictate working hours, overtime rules, and unionization rights, all of which directly influence labor expenses and the company's ability to manage its workforce efficiently. While Casey's has focused on improving labor efficiency, rising minimum wages across its operating regions can create upward pressure on overall labor costs, potentially impacting profitability if not managed effectively through productivity gains or pricing strategies.

Strict adherence to these evolving labor regulations is paramount to avoid costly legal disputes and maintain a stable, motivated workforce. Non-compliance can lead to fines, reputational damage, and disruptions in operations, underscoring the importance of robust compliance programs for Casey's.

Food Safety and Health Regulations

Casey's General Stores, a major player in prepared foods like pizza and baked goods, faces significant scrutiny under federal and state food safety and health regulations. These rules mandate strict adherence to practices for food preparation, storage, handling, and accurate labeling, necessitating ongoing staff training and operational diligence. For instance, the U.S. Food and Drug Administration (FDA) continuously updates its Food Code, influencing state-level regulations that Casey's must follow. In 2023, the FDA conducted thousands of inspections, with violations often leading to warning letters and potential recalls, underscoring the importance of compliance.

Failure to meet these rigorous standards can result in substantial financial penalties, damage to Casey's brand reputation, and even temporary or permanent closure of its food service operations. Such non-compliance could directly impact sales and profitability, as seen when foodborne illness outbreaks linked to retail establishments lead to significant revenue loss and consumer trust erosion. For Casey's, maintaining a strong food safety record is paramount to its business continuity and market standing.

Key regulatory areas impacting Casey's include:

- HACCP Implementation: Ensuring Hazard Analysis and Critical Control Points are effectively managed in all food preparation processes.

- Allergen Labeling: Complying with accurate and clear labeling of major food allergens, a requirement reinforced by the Food Allergy Safety, Treatment, Education, and Research Act.

- Temperature Control: Maintaining strict temperature controls for all perishable food items during storage, preparation, and display to prevent bacterial growth.

- Employee Training: Providing regular and comprehensive food safety training for all employees involved in food handling, covering hygiene and safe practices.

Federal Trade Commission (FTC) Oversight on Acquisitions

The Federal Trade Commission (FTC) plays a significant role in Casey's General Stores' expansion plans. As Casey's pursues growth through acquisitions, like the notable purchase of CEFCO stores, these transactions are scrutinized by the FTC to prevent anti-competitive practices. The FTC's oversight ensures that mergers do not unduly harm market competition.

Casey's has navigated this regulatory landscape effectively. The company's strategy of acquiring businesses with minimal geographic overlap has historically streamlined the FTC approval process. This approach has been crucial for facilitating their ongoing expansion efforts, as evidenced by recent deals.

- FTC Review Process: Acquisitions exceeding certain size thresholds, as defined by the Hart-Scott-Rodino Antitrust Improvements Act, automatically trigger an FTC review.

- Market Concentration: The FTC assesses whether an acquisition would substantially lessen competition or tend to create a monopoly in any relevant market.

- Recent Acquisition Example: In 2023, Casey's acquired 44 convenience stores from CEFCO, a transaction that likely underwent FTC scrutiny.

- Regulatory Impact: Favorable FTC decisions allow Casey's to integrate new locations and expand its market reach, directly supporting its growth objectives.

Government regulations significantly influence Casey's fuel sales and operational costs. The Renewable Fuel Standard (RFS) mandates biofuel blending, impacting gasoline procurement, with 2024 volumes continuing this trend. Additionally, evolving emissions standards for vehicles, like California's Advanced Clean Cars II program aiming for an all-electric future by 2035, could gradually shift consumer demand away from traditional fuels, requiring Casey's to anticipate long-term market adjustments.

Fuel taxation policies at federal and state levels directly affect pump prices and Casey's revenue. While the federal gasoline tax has been static at 18.4 cents per gallon since 1993, state excise taxes vary, with ongoing discussions about adjustments in states like Illinois in 2024. These varying tax structures necessitate careful management of pricing strategies across different markets.

Labor laws and minimum wage policies are critical for managing Casey's operational expenses. As of early 2024, states like Iowa and Illinois, where Casey's has a significant presence, have minimum wages at or above federal levels, with potential for further increases. These policies impact payroll costs and workforce management, requiring efficiency gains to offset upward wage pressures.

Antitrust regulations, particularly from the Federal Trade Commission (FTC), scrutinize Casey's expansion through acquisitions, such as the 2023 CEFCO store purchase. The FTC assesses market concentration to prevent anti-competitive practices, with transactions exceeding certain thresholds triggering mandatory reviews under the Hart-Scott-Rodino Act. Casey's strategic approach of acquiring businesses with minimal geographic overlap has historically facilitated smoother FTC approval processes.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting Casey's General Stores, covering political, economic, social, technological, environmental, and legal factors.

It provides actionable insights into how these dynamics present both challenges and strategic opportunities for the company's growth and operational planning.

A PESTLE analysis for Casey's General Stores offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing for strategic discussions and decision-making.

Economic factors

Fluctuations in global oil prices directly impact Casey's General Stores, given that fuel sales represent a significant portion of their revenue. For instance, average gasoline prices in the U.S. saw considerable swings throughout 2024, impacting consumer purchasing power and, consequently, the volume of fuel sold at Casey's locations. This volatility creates a direct link between energy markets and Casey's top-line performance.

Consumer behavior is intrinsically tied to fuel prices. When gas prices rise, consumers tend to reduce non-essential trips, which can decrease impulse purchases of snacks, beverages, and other convenience items inside Casey's stores. Conversely, lower fuel prices often encourage more driving and associated in-store spending. Data from late 2024 indicated a noticeable correlation between regional fuel cost changes and customer traffic patterns at convenience retailers.

Inflationary pressures significantly impact Casey's General Stores, directly affecting the cost of groceries, prepared food ingredients, and other merchandise. For instance, the Consumer Price Index for food away from home saw a notable increase in 2024, putting upward pressure on Casey's ingredient expenses and potentially squeezing gross margins.

Effectively managing procurement costs and strategically adjusting pricing are crucial for Casey's to maintain profitability as input costs rise. The company's success hinges on its ability to absorb or pass on these increased costs to consumers without negatively impacting sales volume, a delicate economic balancing act.

The economic health of the Midwest and South, where Casey's operates, directly impacts consumer spending. For instance, a strong employment rate in these regions, like the 3.9% national unemployment rate reported in April 2024, generally translates to higher disposable income for consumers, benefiting Casey's sales of fuel and its popular prepared food offerings.

Local economic conditions are crucial for Casey's, especially in its small-town locations. When local employment is robust, and wages are stable, residents have more discretionary funds, leading to increased foot traffic and purchases of both convenience items and fuel, which are core to Casey's business model.

Consumer spending power remains a key driver for Casey's, with resilient demand for prepared meals a notable positive. In 2023, Casey's reported a comparable store sales increase of 5.7% in its prepared foods and beverages category, underscoring the strength of this segment even amidst fluctuating economic conditions.

Labor Market Conditions and Wage Inflation

Tight labor markets and rising wage rates present a significant challenge for Casey's General Stores, impacting their ability to staff locations and potentially increasing operational costs. For instance, during 2024, the U.S. unemployment rate hovered near historic lows, often below 4%, which intensifies competition for available workers and drives up wage demands.

In response to these pressures, Casey's has strategically focused on enhancing labor efficiency and reducing same-store labor hours. This approach aims to mitigate the impact of wage inflation, ensuring that operational expenses remain manageable even as labor costs climb. The company's efforts in 2024 and 2025 likely involve optimizing scheduling and leveraging technology to improve productivity per employee.

Attracting and retaining employees, particularly in the rural areas where many Casey's stores are located, remains a persistent economic consideration. This demographic challenge is compounded by broader economic trends that may favor urban employment opportunities or require higher compensation to draw talent to less populated regions. Casey's ongoing success will depend on its ability to offer competitive wages and benefits, alongside a positive work environment, to overcome these geographical hiring hurdles.

- Labor Market Tightness: U.S. unemployment rates in 2024 consistently remained below 4%, indicating a competitive hiring environment.

- Wage Inflation Impact: Rising wages directly increase operating expenses for businesses like Casey's.

- Efficiency Measures: Casey's focus on labor efficiency aims to offset increased wage costs through improved productivity.

- Rural Recruitment Challenges: Sourcing and retaining staff in rural areas presents unique economic and demographic obstacles.

Interest Rates and Financing for Expansion

Changes in interest rates directly influence Casey's General Stores' cost of borrowing, a critical factor for funding new store development and potential acquisitions. For instance, if the Federal Reserve continues its monetary tightening cycle, borrowing costs for Casey's could rise, making expansion projects more expensive.

Despite a robust expansion strategy, Casey's has demonstrated financial resilience. As of the first quarter of 2024, the company reported a strong balance sheet with ample liquidity, providing a solid foundation for continued growth initiatives. This financial health allows them to pursue expansion even in a fluctuating interest rate environment.

However, an increase in interest expenses, even with strong liquidity, can still put pressure on Casey's overall profitability. For example, if Casey's finances a significant acquisition with debt in a higher-rate environment, the increased interest payments would directly reduce net income. This highlights the delicate balance between growth and cost management.

- Impact of Rising Rates: Higher interest rates increase the cost of debt financing for Casey's expansion projects, potentially slowing down new store openings or acquisitions.

- Liquidity Support: Casey's strong liquidity position, evidenced by its healthy cash reserves in early 2024, provides a buffer against rising borrowing costs and supports ongoing growth plans.

- Profitability Pressure: Elevated interest expenses stemming from increased borrowing can negatively impact Casey's net income and overall profitability margins.

Economic growth in Casey's operating regions, particularly the Midwest and South, directly influences consumer spending. For instance, the U.S. GDP growth rate was projected to be around 2.5% for 2024, indicating a generally favorable economic climate that supports higher disposable incomes and increased demand for Casey's offerings.

The company's financial performance is closely tied to consumer purchasing power, which is affected by factors like employment rates and wage growth. With the U.S. unemployment rate hovering near historic lows in 2024, often below 4%, many consumers have more discretionary income, benefiting Casey's sales of fuel and prepared foods.

Casey's must navigate the economic landscape by managing costs and adapting pricing strategies. For example, while consumer spending remained robust, inflation in food costs, as reflected by the CPI for food away from home, saw increases in 2024, requiring careful procurement and pricing to maintain margins.

| Economic Factor | 2024 Data/Trend | Impact on Casey's |

| GDP Growth | Projected ~2.5% | Supports consumer spending and demand. |

| Unemployment Rate | Consistently < 4% | Increases disposable income, boosting sales. |

| Inflation (Food Away From Home) | Notable Increase | Pressures ingredient costs and margins. |

Same Document Delivered

Casey's General Stores PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Casey's General Stores delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into the strategic landscape Casey's operates within.

Sociological factors

Consumers are increasingly prioritizing convenience and quality in their food choices, leading them to view convenience stores as viable options for prepared meals. This shift is transforming these establishments into food service destinations rather than just quick stops.

Casey's strategic emphasis on its prepared food offerings, such as its popular pizza, hot sandwiches, and bakery items, directly taps into this evolving consumer preference. This focus has been a significant driver of inside same-store sales growth for the company, with prepared food sales continuing to be a strong performer.

The company is actively innovating to meet these changing demands, introducing new items like chicken wings and fries to its menu. This continuous product development ensures Casey's remains competitive in the prepared food market.

The increasing consumer focus on wellness is significantly driving demand for healthier and functional beverages, moving beyond sugary sodas. This trend means consumers are actively seeking out options like protein-enriched drinks and enhanced waters. For Casey's, this necessitates ongoing innovation in their product selection to align with these evolving health priorities.

Casey's General Stores thrives by embedding itself within the fabric of small towns, acting as more than just a convenience store but as a community hub. This strategic focus cultivates deep-rooted loyalty, a sociological asset that translates into consistent customer traffic and brand advocacy.

The company's active participation in local events and support for community initiatives, such as sponsoring youth sports teams or contributing to local charities, further solidifies its role as a valued community member. For instance, in 2023, Casey's reported over $7 million in community giving, reinforcing these vital connections.

Importance of Loyalty Programs and Personalization

Customer loyalty programs are a significant sociological factor in the convenience store industry. Casey's General Stores' Casey's Rewards program, boasting over 9 million members, highlights the importance of these initiatives in fostering customer retention and attracting new patrons within a highly competitive market. This level of engagement demonstrates a strong consumer desire for recognition and value.

The strategic use of data gathered from loyalty programs enables personalized promotions and tailored product selections. This approach directly addresses evolving consumer expectations for customized experiences, which in turn drives repeat business and strengthens brand affinity. For instance, personalized offers can significantly increase purchase frequency.

- Customer Loyalty: Programs like Casey's Rewards, with over 9 million members, are vital for building and maintaining a loyal customer base.

- Personalization: Leveraging loyalty data allows for customized promotions and product offerings, enhancing customer satisfaction.

- Competitive Advantage: Effective loyalty strategies differentiate brands and encourage repeat purchases in a crowded market.

Impact of Lifestyle and Convenience Needs

Modern lifestyles increasingly prioritize convenience and speed, making quick-stop retailers like Casey's General Stores exceptionally well-positioned. The demand for immediate gratification and time-saving solutions is a significant sociological trend impacting consumer behavior. Casey's ability to bundle essential services such as fuel, groceries, and ready-to-eat meals addresses this need directly, appealing to busy individuals and families.

This convenience is a powerful draw, directly influencing customer traffic and purchase decisions. For instance, the average American household spent approximately $1,000 on convenience store purchases in 2023, highlighting the economic significance of this lifestyle factor. Casey's integrated model, offering a one-stop shop for various daily necessities, directly taps into this consumer preference.

- Demand for Speed: Consumers are willing to pay a premium for products and services that save them time.

- One-Stop Shopping: The appeal of combining fuel, food, and convenience items in a single visit is a key driver.

- Busy Schedules: Time-poor consumers actively seek out retailers that can fulfill multiple needs efficiently.

- Prepared Food Growth: The market for prepared foods, a core offering at Casey's, continues to expand, driven by convenience needs. In 2024, the convenience store prepared food category is projected to see continued growth, with many chains reporting over 30% of their sales coming from these items.

Sociological factors significantly influence Casey's General Stores' success, particularly the growing demand for convenience and prepared foods. Consumers increasingly view convenience stores as destinations for meals, driving Casey's focus on items like pizza and sandwiches. This trend is supported by data showing a substantial portion of convenience store sales, often over 30%, coming from prepared food categories in 2024.

Community integration is another key sociological element, with Casey's acting as a local hub. Their commitment to community giving, exemplified by over $7 million donated in 2023, fosters strong customer loyalty. This deep connection is reinforced by programs like Casey's Rewards, which boasts over 9 million members, demonstrating the power of personalized engagement in a competitive market.

| Sociological Factor | Casey's Strategy | Impact |

| Demand for Convenience & Prepared Foods | Focus on pizza, sandwiches, bakery items; menu innovation (e.g., wings) | Drives inside same-store sales growth; appeals to busy lifestyles |

| Community Engagement | Sponsorships, local event participation, community giving ($7M+ in 2023) | Builds brand loyalty and advocacy; reinforces community hub image |

| Customer Loyalty Programs | Casey's Rewards (9M+ members); personalized promotions | Enhances customer retention; drives repeat business and data-driven marketing |

Technological factors

Casey's General Stores is actively boosting its digital presence, notably through its mobile app which facilitates online ordering and manages its popular loyalty program. This focus on digital transformation is designed to create a smoother, more personalized experience for customers, making transactions effortless and interactions tailored to individual preferences. In 2023, Casey's reported over 5.5 million loyalty program members, highlighting the significant customer engagement driven by these digital tools.

Artificial intelligence is rapidly transforming the convenience store sector, with companies like Casey's General Stores adopting it to sharpen operations and marketing. This technology is key for tasks like managing stock, forecasting what customers will want, and even predicting buying habits.

Casey's is actively using AI to make its purchasing smoother, keep a close eye on how fresh its food is, cut down on wasted products, and send out special offers that are more likely to appeal to individual customers. For instance, in 2024, many convenience stores reported a significant reduction in spoilage after implementing AI-driven inventory systems, with some seeing decreases of up to 15%.

Casey's is actively enhancing its supply chain through technological investments, partnering with firms like Coupa and Relex Solutions. This strategic move is designed to bring greater transparency to spending and sharpen inventory visibility, crucial for managing its expanding store count and broad product selection.

By modernizing procurement and demand planning, Casey's aims to achieve greater operational efficiency. In 2024, companies prioritizing supply chain visibility saw an average reduction of 15% in stockouts, a key metric for a retailer like Casey's with its diverse convenience store offerings.

Self-Checkout and Frictionless Retail Systems

Self-checkout kiosks and AI-powered frictionless retail systems are increasingly common in convenience stores, aiming to speed up transactions and elevate the customer experience. While Casey's General Stores hasn't publicly detailed specific plans for these technologies, the industry's trajectory points towards their potential to boost efficiency. For instance, by late 2023, major grocery chains reported that self-checkout lanes handled a significant portion of transactions, sometimes exceeding 70% in certain locations, indicating a strong consumer acceptance of these more automated processes.

The integration of these technologies can lead to reduced labor costs and improved throughput, especially during peak hours. Companies like Amazon Go have pioneered 'grab-and-go' technology, allowing customers to simply pick up items and leave, with purchases automatically tallied. This trend suggests a future where convenience store operations could become significantly more streamlined, benefiting both the retailer and the customer through enhanced speed and convenience.

- Industry Adoption: Convenience store operators are exploring self-checkout and frictionless options to improve customer flow.

- Efficiency Gains: These systems can reduce wait times and potentially lower operational staffing needs.

- Customer Experience: Faster transactions and a more seamless shopping journey are key benefits driving adoption.

- Technological Advancements: AI and sensor technology are enabling more sophisticated 'grab-and-go' retail experiences.

Electric Vehicle (EV) Charging Infrastructure

The increasing adoption of electric vehicles (EVs) presents a significant technological shift impacting fuel retailers like Casey's General Stores. While this trend may eventually reduce demand for traditional gasoline, it also creates a new revenue stream opportunity through EV charging infrastructure.

Casey's is proactively addressing this by installing EV charging stations at select locations, signaling a strategic move to adapt to evolving consumer preferences and the future of transportation. This initiative positions them to capture a growing market segment seeking convenient charging solutions while on the go.

The market for EV charging is expanding rapidly. For instance, by the end of 2023, the number of public charging points in the U.S. had surpassed 150,000, a substantial increase from previous years. This growth underscores the necessity for businesses like Casey's to integrate charging capabilities to remain competitive.

- Growing EV Market: By 2025, it's projected that over 3 million EVs will be on U.S. roads, creating a substantial customer base for charging services.

- Infrastructure Investment: The U.S. government's National Electric Vehicle Infrastructure (NEVI) Formula Program is allocating billions to build out a national charging network, incentivizing private sector participation.

- Customer Convenience: Integrating charging stations can enhance customer loyalty and attract new patrons who prioritize the availability of charging amenities alongside convenience store offerings.

Casey's is enhancing its digital infrastructure, notably through its mobile app, which supports online ordering and its loyalty program, boasting over 5.5 million members by 2023. The company is also leveraging artificial intelligence for inventory management and personalized marketing, with AI-driven systems showing potential to reduce product spoilage by up to 15% in similar retail environments by 2024. Investments in supply chain technology, including partnerships with Coupa and Relex Solutions, aim to improve procurement and demand planning, with data from 2024 indicating that enhanced supply chain visibility can reduce stockouts by an average of 15%.

The company is also adapting to the rise of electric vehicles (EVs) by installing charging stations, recognizing the rapid growth in this sector, with over 150,000 public charging points in the U.S. by late 2023. This strategic move anticipates a projected 3 million EVs on U.S. roads by 2025, supported by government initiatives like the NEVI program.

| Technology Area | Casey's Focus/Industry Trend | Impact/Data Point |

|---|---|---|

| Digital Presence & Loyalty | Mobile App, Loyalty Program | 5.5M+ loyalty members (2023) |

| Artificial Intelligence | Inventory, Demand Forecasting, Marketing | Up to 15% spoilage reduction (2024, industry avg.) |

| Supply Chain Management | Procurement, Demand Planning Visibility | 15% reduction in stockouts (2024, industry avg.) |

| EV Infrastructure | EV Charging Stations | 150K+ public charging points (US, late 2023) |

Legal factors

Casey's General Stores operates under a complex web of fuel and environmental regulations, particularly concerning the storage and dispensing of gasoline. These rules, which differ significantly from state to state, mandate ongoing investment in infrastructure upgrades to ensure compliance, such as advanced leak detection systems and vapor recovery units. For instance, the Environmental Protection Agency (EPA) sets national standards, but individual states like Iowa, where Casey's has a strong presence, implement their own specific requirements for underground storage tanks and emissions control.

As a significant employer, Casey's General Stores navigates a dense landscape of labor and employment legislation. These laws cover critical areas such as minimum wage, overtime, workplace safety standards, and anti-discrimination policies. Staying compliant with these federal and state mandates is crucial for preventing costly legal disputes and fostering a positive employee experience. For instance, the increasing prevalence of state-level minimum wage hikes, with many states having already raised their minimum wages in 2024 and further increases anticipated for 2025, directly impacts Casey's operational costs and compensation strategies.

Operating a substantial foodservice operation, like Casey's General Stores, necessitates strict adherence to evolving health department standards and food safety regulations. This includes meticulous attention to food handling protocols, maintaining precise temperature controls for all products, ensuring rigorous sanitation practices across all locations, and implementing robust allergen management programs to protect customers. For instance, in 2024, the FDA's Food Code continues to emphasize these areas, with potential penalties for non-compliance impacting operational continuity and brand trust.

Data Privacy and Consumer Protection Laws

Casey's General Stores' extensive customer data collection through its Casey's Rewards program necessitates strict adherence to data privacy regulations like the California Consumer Privacy Act (CCPA) and similar state-level legislation. Failure to protect this sensitive information and maintain transparent data handling practices poses significant legal risks, including substantial fines and reputational damage.

The company must ensure its data privacy policies are robust and clearly communicated to consumers, a critical factor in maintaining trust. In 2023, data privacy lawsuits against companies averaged over $4 million in settlements, highlighting the financial implications of non-compliance.

- CCPA Compliance: Ensuring all data collection and usage aligns with CCPA requirements, particularly regarding consumer rights to access, delete, and opt-out of data sales.

- State-Specific Laws: Monitoring and adhering to evolving privacy laws in all states where Casey's operates, such as the Virginia Consumer Data Protection Act (VCDPA) and the Colorado Privacy Act (CPA).

- Consumer Trust: Proactive data protection measures are paramount for safeguarding consumer trust, which is directly linked to customer loyalty and engagement with programs like Casey's Rewards.

- Regulatory Penalties: Understanding and mitigating the risk of significant financial penalties, which can be levied for violations of data privacy statutes.

Real Estate and Property Laws for Expansion

Casey's aggressive expansion strategy, which includes opening new locations and acquiring existing ones, means they must closely follow a variety of real estate and property laws. These laws cover everything from zoning regulations that dictate what can be built where, to land use rules, and the specific legal processes for buying property. For instance, in 2024, Casey's announced plans to open approximately 70 new stores, each requiring careful adherence to local land use and zoning ordinances across multiple states.

Thorough legal checks are essential for every property deal. This due diligence helps Casey's ensure they are following all the rules and avoids potential problems down the line related to owning or developing land. In 2023, the company completed 35 acquisitions, underscoring the volume of property transactions requiring meticulous legal review to identify and manage risks.

- Zoning Compliance: Ensuring new store locations meet local zoning requirements for commercial development is paramount, preventing costly delays or project cancellations.

- Land Use Regulations: Adhering to specific land use policies, which can vary significantly by municipality, is crucial for Casey's development plans.

- Property Acquisition Due Diligence: Comprehensive legal reviews of titles, environmental reports, and any existing easements or liens are vital for safe and compliant property purchases.

- Permitting Processes: Navigating the often complex and time-consuming permitting processes for new construction and renovations is a key legal hurdle for expansion.

Casey's must navigate a complex legal environment, including fuel and environmental regulations, labor laws, and food safety standards. The company's expansion efforts also require strict adherence to real estate and property laws, with ongoing compliance a critical factor in operational success and risk mitigation.

Data privacy laws, such as CCPA, are increasingly important, with significant financial penalties for non-compliance. For instance, in 2023, data privacy lawsuits averaged over $4 million in settlements, underscoring the need for robust data protection measures.

Labor laws, including minimum wage increases, directly impact operational costs. Many states saw minimum wage hikes in 2024, with further increases anticipated for 2025.

Casey's announced plans to open approximately 70 new stores in 2024, each requiring adherence to local zoning and land use ordinances.

Environmental factors

Casey's General Stores is making strides in energy efficiency, with initiatives like converting stores to LED lighting and upgrading HVAC and refrigeration systems. These improvements are designed to cut down on energy usage and shrink the company's carbon footprint. For instance, by the end of fiscal year 2024, Casey's had completed LED lighting upgrades in over 1,500 stores, contributing to a notable reduction in electricity consumption.

Casey's General Stores actively employs water conservation methods, such as installing rain-sensing irrigation for landscaping and low-flow fixtures in restrooms and kitchens. These measures are designed to significantly decrease water usage across their retail locations.

In 2023, Casey's reported a notable reduction in water consumption, contributing to their broader environmental stewardship. For instance, their initiative to upgrade to water-efficient restroom fixtures alone is projected to save thousands of gallons annually per store, reflecting a tangible commitment to responsible resource management.

Casey's General Stores actively manages its environmental footprint through robust recycling initiatives. These programs encompass a wide range of materials, including cardboard, pallets, metal, and even light bulbs, at both store and distribution center levels. This commitment extends to reducing paper consumption within their corporate offices, demonstrating a holistic approach to waste reduction.

Sustainable Sourcing and Product Offerings

Casey's is actively engaging with its supply chain to enhance sustainability, a key environmental consideration. A notable commitment involves sourcing 100% cage-free eggs by 2025, contingent on supply availability and affordability.

The company is also broadening its product portfolio to include more environmentally conscious options. This includes offering ethanol-blended fuels and biodiesel, catering to a rising consumer preference for greener alternatives.

- Sustainable Egg Sourcing: Aiming for 100% cage-free eggs by 2025, subject to supply and cost factors.

- Eco-Friendly Fuel Options: Providing ethanol-blended gasoline and biodiesel to meet consumer demand for sustainable transportation fuels.

- Consumer Demand Alignment: Responding to a growing market trend where consumers increasingly prioritize environmentally responsible purchasing decisions.

Climate Change Risk and Disclosure

Casey's General Stores recognizes climate change as a significant risk, anticipating potential shifts in fuel consumption patterns and a rise in environmental regulations. The company is actively disclosing its Scope 1 and Scope 2 greenhouse gas emissions, a crucial step in transparency.

However, influential investor groups are pushing Casey's to adopt ambitious, science-based targets for greenhouse gas reduction, specifically requesting the inclusion of Scope 3 emissions. This push aims to bring Casey's in line with industry best practices and bolster its resilience against escalating climate-related financial risks.

- Disclosure: Casey's reports Scope 1 and Scope 2 emissions.

- Investor Pressure: Investors advocate for science-based targets, including Scope 3.

- Risk Mitigation: Aligning with peers and climate goals can reduce long-term financial exposure.

Casey's General Stores is actively addressing environmental concerns through energy efficiency and water conservation. Initiatives like LED lighting upgrades, completed in over 1,500 stores by fiscal year 2024, and water-saving fixtures are key components of their strategy to reduce their ecological footprint.

The company also focuses on waste reduction through comprehensive recycling programs and is expanding its offerings to include more sustainable products, such as ethanol-blended fuels and biodiesel, aligning with growing consumer preferences for eco-friendly options.

Casey's is responding to investor pressure to enhance its climate change strategy by disclosing Scope 1 and Scope 2 emissions and is being encouraged to set science-based targets that include Scope 3 emissions to mitigate future financial risks.

| Environmental Initiative | Status/Target | Impact/Goal |

|---|---|---|

| LED Lighting Upgrades | Completed in over 1,500 stores (FY24) | Reduced electricity consumption, lower carbon footprint |

| Water Conservation | Low-flow fixtures, rain-sensing irrigation | Significant decrease in water usage |

| Recycling Programs | Cardboard, pallets, metal, light bulbs, paper | Waste reduction across operations |

| Sustainable Sourcing | 100% cage-free eggs by 2025 (subject to availability/cost) | Improved animal welfare and supply chain sustainability |

| Eco-Friendly Fuels | Ethanol-blended gasoline, biodiesel | Meeting consumer demand for greener transportation |

| Emissions Disclosure | Scope 1 and Scope 2 reporting | Increased transparency on greenhouse gas emissions |

PESTLE Analysis Data Sources

Our PESTLE analysis for Casey's General Stores is built on a foundation of official government data, industry-specific market research reports, and reputable economic indicators. We gather insights from consumer spending trends, regulatory updates, and technological advancements to ensure a comprehensive understanding of the external factors impacting Casey's.