Carahsoft SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carahsoft Bundle

Carahsoft's strategic partnerships and deep understanding of government procurement are significant strengths, positioning them well in a lucrative market. However, their reliance on these specific channels presents a potential vulnerability if market dynamics shift unexpectedly.

Want the full story behind Carahsoft's competitive advantages, potential threats, and opportunities for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market research.

Strengths

Carahsoft's strength lies in its role as a master government aggregator, boasting over 220 contract vehicles. This includes key agreements like GSA MAS and NASA SEWP, which are crucial for public sector IT procurement.

These numerous contract vehicles significantly simplify the acquisition process for government agencies seeking IT solutions. This streamlined approach helps reduce sales cycles and administrative overhead for both Carahsoft's vendor partners and its public sector clients.

Carahsoft’s strength lies in its extensive partner ecosystem, encompassing thousands of technology vendors, resellers, and system integrators. This network includes major players like Adobe, Salesforce, ServiceNow, and Microsoft, providing government clients with a broad spectrum of advanced IT solutions.

This robust network is a significant advantage, enabling Carahsoft to deliver specialized and diverse offerings to the public sector. For instance, in 2023, Carahsoft continued to expand its portfolio, onboarding numerous new technology partners to meet evolving government IT needs.

Carahsoft's strength lies in its profound understanding of the government IT landscape, including intricate procurement processes and crucial compliance standards like FedRAMP. This specialized knowledge is a key differentiator, allowing them to effectively bridge the gap between technology providers and federal agencies. Their focus on emerging technologies such as artificial intelligence and cybersecurity directly addresses key federal initiatives projected for 2025 and beyond.

Strong Focus on Emerging Technologies

Carahsoft demonstrates a significant strength by concentrating its efforts on emerging technologies like Artificial Intelligence, cybersecurity, cloud computing, and zero trust architectures. This strategic focus aligns directly with key government IT spending priorities for fiscal year 2025. For instance, the U.S. government's proposed budget for FY2025 continues to emphasize investments in advanced technologies to enhance national security and modernize federal systems, with cybersecurity and AI consistently ranking as top priorities.

This proactive engagement with cutting-edge technology sectors positions Carahsoft to effectively meet the evolving needs of its government clients. As federal agencies increasingly seek innovative solutions to complex challenges, Carahsoft's expertise in these critical areas allows it to serve as a vital partner in their digital transformation journeys. The demand for these technologies is substantial, with cybersecurity spending alone projected to grow significantly in the federal sector over the next few years.

- Alignment with Federal IT Priorities: Carahsoft's focus on AI, cybersecurity, cloud, and zero trust directly mirrors the stated spending objectives for federal IT in FY2025.

- Capitalizing on Demand: This specialization allows Carahsoft to capture a larger share of the growing market for these advanced government solutions.

- Contribution to Modernization: By promoting and distributing these technologies, Carahsoft actively supports the modernization of government infrastructure and capabilities.

Proven Track Record and Market Recognition

Carahsoft has built a robust reputation through its consistent high performance, evidenced by its inclusion on the Inc. 5000 list for 17 consecutive years. This remarkable achievement, coupled with over $16 billion in revenue for 2023, highlights a stable and growing market presence. The company's numerous industry accolades further validate its leadership and consistent delivery of value in the government IT landscape.

This sustained success translates into significant trust from its stakeholders.

- Proven Performance: 17 consecutive years on the Inc. 5000 list.

- Financial Strength: Exceeded $16 billion in revenue in 2023.

- Market Leadership: Numerous industry awards and recognition.

- Client Trust: Strong track record builds confidence with partners and public sector clients.

Carahsoft's extensive network of over 220 contract vehicles, including key agreements like GSA MAS and NASA SEWP, streamlines IT procurement for government agencies. This simplifies the acquisition process, reducing sales cycles and administrative burdens for both vendors and clients.

Its vast partner ecosystem, featuring thousands of technology vendors like Adobe, Salesforce, ServiceNow, and Microsoft, ensures a broad range of advanced IT solutions are available to the public sector. This allows Carahsoft to cater to diverse and specialized government IT requirements.

Carahsoft excels in understanding the complex government IT landscape, including procurement processes and compliance standards like FedRAMP. Their focus on emerging technologies such as AI and cybersecurity aligns with critical federal initiatives for 2025 and beyond.

| Strength Area | Description | Supporting Data |

|---|---|---|

| Contract Vehicles | Master government aggregator with over 220 contract vehicles. | Includes GSA MAS, NASA SEWP. |

| Partner Ecosystem | Extensive network of technology vendors, resellers, and system integrators. | Thousands of partners including Adobe, Salesforce, ServiceNow, Microsoft. |

| Market Expertise | Deep understanding of government IT procurement and compliance. | Focus on AI, cybersecurity, cloud, zero trust aligning with FY2025 priorities. |

| Performance & Reputation | Consistent high performance and market leadership. | 17 consecutive years on Inc. 5000; over $16 billion revenue in 2023. |

What is included in the product

Delivers a strategic overview of Carahsoft’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Simplifies complex government contracting challenges by clearly outlining Carahsoft's strengths, weaknesses, opportunities, and threats.

Weaknesses

Carahsoft's significant reliance on government contracts makes it vulnerable to the unpredictable nature of public sector spending. Changes in administration, shifting political priorities, or economic downturns can lead to abrupt budget cuts or delays in funding, directly impacting Carahsoft's revenue streams. For instance, the FY 2025 budget discussions highlighted potential reductions in certain technology modernization programs for some federal agencies, creating a degree of uncertainty for providers like Carahsoft.

Carahsoft's deep involvement in the government sector exposes it to significant regulatory and compliance risks. Navigating complex procurement laws and cybersecurity mandates such as CMMC and FedRAMP requires constant vigilance and adaptation. Failure to comply can result in severe penalties, loss of valuable contracts, and damage to its reputation.

The FBI's recent activity at Carahsoft's headquarters, reportedly linked to an investigation of a former business partner, underscores these vulnerabilities. Such events highlight the critical importance of robust compliance frameworks and due diligence in managing third-party relationships within the government contracting landscape.

Carahsoft's reliance on a few major technology vendors presents a significant weakness. If a key partner like Microsoft or Amazon Web Services were to alter its government contracting strategy or develop direct sales channels, Carahsoft's access to critical products could be jeopardized, potentially impacting its market position. For instance, in 2023, a substantial portion of Carahsoft's revenue was derived from reselling solutions from a limited number of large cloud and software providers, highlighting this dependency.

Intense Competition in the Government IT Market

The government IT solutions sector is exceptionally crowded, with numerous large and small contractors actively pursuing federal, state, and local contracts. Carahsoft contends with other government IT resellers, the direct sales channels of major technology firms, and system integrators, all of which can impact its profit margins and market standing. For instance, the federal IT market alone was projected to reach over $150 billion in 2024, showcasing the sheer scale of competition.

Furthermore, the government's ongoing initiatives to direct a greater portion of contract opportunities towards small businesses intensify the competitive environment. This dynamic means Carahsoft must continually differentiate its offerings and value proposition to secure and maintain its market share against a broad range of players.

- High number of government IT contractors

- Competition from direct sales and system integrators

- Government focus on small business set-asides

- Pressure on margins and market share

Potential for Supply Chain Disruptions

Carahsoft's position as an IT solutions aggregator places it within a complex, multi-layered supply chain. This inherent structure makes it vulnerable to external shocks. For instance, the global semiconductor shortage that significantly impacted the tech industry throughout 2021 and 2022, with lingering effects into 2023 and projections for continued tightness in certain segments through 2024, directly affects the availability of hardware Carahsoft distributes.

These disruptions can translate into tangible delivery delays for government agencies relying on Carahsoft for critical IT infrastructure and software. Such delays can stall vital government projects, impacting operational efficiency and potentially straining relationships with both the technology vendors Carahsoft partners with and the government clients it serves. The inability to meet delivery timelines, a common challenge in 2023 for many IT resellers, could erode client trust.

- Vulnerability to Semiconductor Shortages: Ongoing global chip supply constraints, impacting availability and pricing of essential hardware components, directly affect Carahsoft's ability to fulfill orders promptly.

- Software Licensing Complexity: Changes or disruptions in software vendor licensing models or availability can create integration challenges and delays in delivering comprehensive solutions to government entities.

- Impact on Government Project Timelines: Delays in hardware or software delivery due to supply chain issues can lead to missed deadlines for critical government IT projects, potentially incurring penalties or damaging Carahsoft's reputation for reliability.

- Vendor and Customer Relationship Strain: Persistent supply chain problems can put pressure on Carahsoft's relationships with both its technology partners and its government clients, who expect consistent and timely delivery of IT solutions.

Carahsoft's concentrated revenue stream from government contracts presents a significant vulnerability. Fluctuations in public sector spending, influenced by political shifts or economic downturns, can directly impact its financial performance. For example, the FY 2025 budget discussions indicated potential reductions in certain federal technology modernization programs, creating uncertainty for providers like Carahsoft.

The company's deep entanglement with government regulations, including cybersecurity mandates like CMMC and FedRAMP, exposes it to substantial compliance risks. Non-adherence can lead to severe penalties and contract loss. The FBI's recent inquiry into a former business partner at Carahsoft's headquarters highlights the critical need for robust compliance and due diligence in managing third-party relationships.

Reliance on a limited number of major technology vendors, such as Microsoft and Amazon Web Services, poses another weakness. A shift in these partners' government sales strategies could jeopardize Carahsoft's access to essential products. In 2023, a substantial portion of Carahsoft's revenue was tied to reselling solutions from a few key cloud and software providers, underscoring this dependency.

The highly competitive government IT solutions market, with numerous resellers, direct sales channels, and system integrators, puts pressure on Carahsoft's margins and market share. The federal IT market alone was projected to exceed $150 billion in 2024, illustrating the intense competition. Government initiatives favoring small businesses further intensify this landscape.

Carahsoft's role as an IT solutions aggregator makes it susceptible to supply chain disruptions, such as the ongoing global semiconductor shortages that affected the tech industry through 2023 and into 2024. These shortages can cause delivery delays for government agencies, potentially stalling critical projects and straining relationships with vendors and clients.

| Weakness Category | Specific Issue | Impact on Carahsoft | Example/Data Point (2023-2024) |

|---|---|---|---|

| Revenue Concentration | Heavy reliance on government contracts | Vulnerability to public sector spending fluctuations | FY 2025 budget discussions hinted at potential tech program cuts. |

| Regulatory & Compliance | Navigating complex government IT procurement laws | Risk of penalties, contract loss, and reputational damage | FBI inquiry into a former partner underscores compliance importance. |

| Vendor Dependency | Dependence on a few major tech vendors | Risk of product access disruption if vendors change strategy | Significant 2023 revenue linked to a small number of large software/cloud providers. |

| Market Competition | Crowded government IT solutions sector | Pressure on profit margins and market share | Federal IT market projected over $150 billion in 2024; small business set-asides increase competition. |

| Supply Chain Vulnerability | Susceptibility to global supply chain shocks | Potential for delivery delays, impacting project timelines | Ongoing semiconductor shortages affecting hardware availability through 2024. |

Preview Before You Purchase

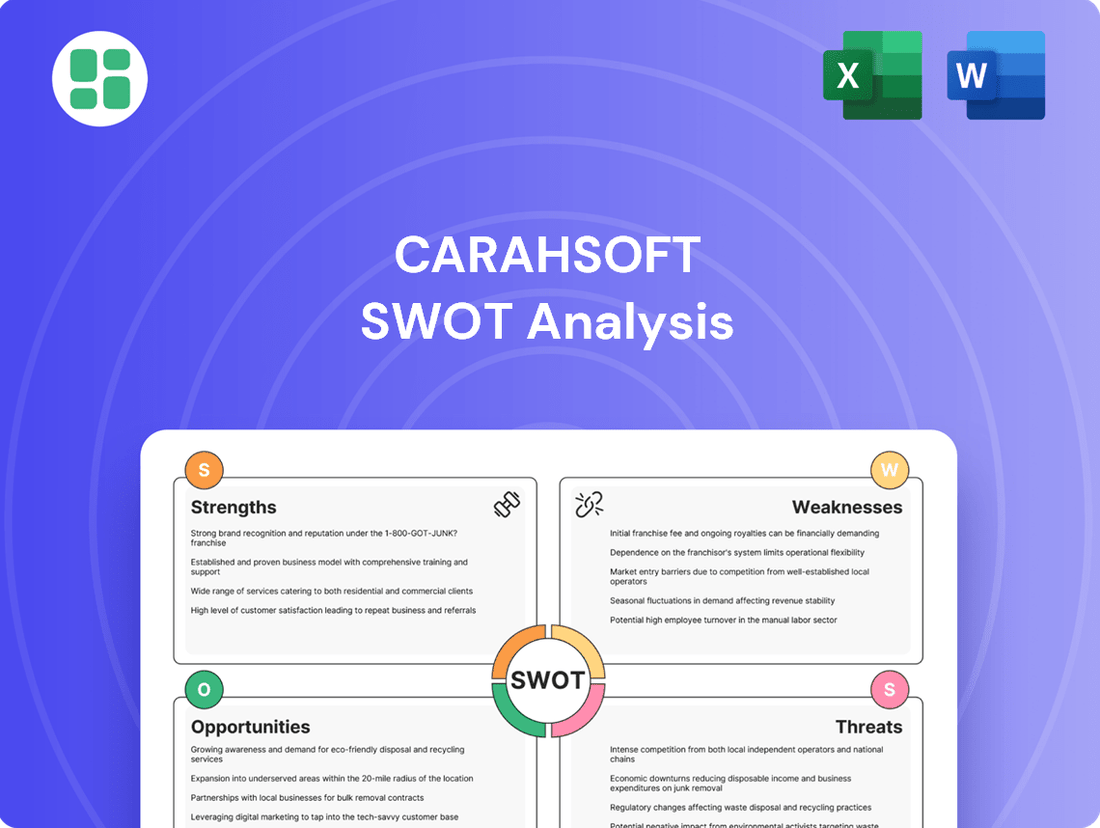

Carahsoft SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of Carahsoft's Strengths, Weaknesses, Opportunities, and Threats. You'll gain actionable insights to inform your strategic decisions.

Opportunities

Government IT spending is on a significant upward trajectory. Federal civilian IT spending is anticipated to reach $76.8 billion in fiscal year 2025, marking an 8.1% increase from FY2023 levels. This growth is driven by substantial investments in critical areas like cybersecurity, artificial intelligence, and the modernization of IT infrastructure across numerous government agencies.

Carahsoft is well-positioned to capitalize on these trends. The company's established expertise and extensive partner ecosystem enable it to effectively serve agencies focused on upgrading outdated systems and bolstering their digital capabilities. This presents a prime opportunity for Carahsoft to expand its market share as the demand for advanced IT solutions within the federal government continues to rise.

Cybersecurity budgets for civilian agencies are projected to climb by 15% between FY2023 and FY2025, reaching an estimated $13 billion in FY2025, with a strong emphasis on Zero Trust Strategy and CISA initiatives. This surge in government spending creates a substantial runway for Carahsoft to expand its offerings in critical security solutions.

The government's commitment to advancing artificial intelligence is further evidenced by approximately $300 million in mandatory funding allocated for AI risk management. Carahsoft's established presence and key partnerships within the cybersecurity and emerging AI sectors position it to capitalize on this growing demand, driving significant market share gains.

Carahsoft’s reach extends beyond the federal government into the state, local, education, and healthcare (SLEDH) sectors, which are actively pursuing digital transformation and greater IT investment. These markets are prioritizing enhanced citizen services, modernized public health infrastructure, and advancements in educational technology, creating significant expansion opportunities for Carahsoft.

For instance, state and local governments are projected to spend over $140 billion on IT in 2024, with a notable portion allocated to cloud services and cybersecurity, areas where Carahsoft excels. The healthcare sector's increasing adoption of telehealth and electronic health records, coupled with the education sector's focus on edtech, further solidifies these markets as fertile ground for Carahsoft's tailored solutions.

Leveraging Digital Transformation and Cloud Adoption

Government agencies are accelerating their digital transformation journeys, with a significant push towards cloud-native solutions to enhance service delivery and operational efficiency. For instance, the U.S. government's cloud spending was projected to reach over $100 billion by 2025, highlighting the scale of this opportunity.

Carahsoft is strategically positioned to capitalize on this trend by offering FedRAMP-authorized cloud solutions and digital experience platforms. This focus directly addresses the public sector's need for secure, scalable, and modern IT infrastructure, creating a strong demand for Carahsoft's offerings.

- Increased Demand for Cloud Services: Government agencies are prioritizing cloud adoption for agility and cost savings, driving market growth.

- Digital Transformation Initiatives: Federal agencies are investing heavily in modernizing IT systems to improve citizen services and internal processes.

- Carahsoft's FedRAMP Expertise: The company's specialization in FedRAMP-authorized solutions aligns perfectly with government security requirements.

Strategic Acquisitions and New Partnerships

Carahsoft's strategy to enhance its market standing and service portfolio involves actively seeking out strategic acquisitions of smaller, specialized IT companies. This approach allows for the rapid integration of new technologies and capabilities, bolstering its competitive edge.

Forging new partnerships with innovative technology providers is also a key opportunity. This collaborative strategy grants Carahsoft access to cutting-edge solutions and expands its footprint within specialized government IT sectors. For instance, its recent collaborations with Spendwell.AI and its presence on the AWS Marketplace for Zero Trust initiatives underscore this ongoing strategic direction.

- Strategic Acquisitions: Targeting specialized IT firms to quickly gain new technologies and market share.

- New Partnerships: Collaborating with innovative tech companies to expand service offerings and reach.

- Market Expansion: Leveraging acquisitions and partnerships to penetrate niche government IT segments.

- Capability Integration: Seamlessly incorporating new functionalities through strategic alliances and buyouts.

Carahsoft is poised to benefit from the government's increasing focus on cloud services and digital transformation, with federal cloud spending projected to exceed $100 billion by 2025. Its expertise in FedRAMP-authorized solutions directly addresses agency needs for secure, modern IT infrastructure.

The company can also leverage strategic acquisitions and new partnerships to integrate cutting-edge technologies and expand its reach into specialized government IT segments. For instance, collaborations in Zero Trust initiatives highlight this strategic growth avenue.

The state, local, education, and healthcare (SLEDH) sectors represent another significant opportunity, with projected IT spending over $140 billion in 2024, particularly in cloud and cybersecurity. Carahsoft's tailored solutions are well-suited to address the digital transformation priorities within these markets.

| Opportunity Area | Key Driver | Carahsoft's Advantage |

|---|---|---|

| Government Cloud Adoption | Federal cloud spending over $100B by 2025 | FedRAMP expertise, secure solutions |

| Digital Transformation | Modernizing IT for better citizen services | Partner ecosystem, specialized offerings |

| Cybersecurity Investment | 15% budget increase for civilian agencies (FY23-FY25) | Zero Trust, CISA initiative alignment |

| AI Integration | $300M AI risk management funding | Partnerships in emerging AI sectors |

| SLEDH Market Growth | >$140B IT spending in 2024 | Tailored solutions for education, healthcare |

Threats

Budgetary constraints remain a significant threat for Carahsoft. While overall government IT spending is projected to grow, specific agency budget decreases or the continuation of continuing resolutions, which temporarily fund government operations, can introduce uncertainty. These factors can lead to unpredictable shifts in government IT spending priorities, directly impacting Carahsoft's business.

Political shifts also pose a considerable risk. A change in administration or unexpected economic downturns could trigger budget cuts or reallocations. For instance, if a new administration prioritizes different areas or faces fiscal challenges, it might reduce funding for IT initiatives that Carahsoft relies on, potentially impacting projected revenue streams.

Heightened scrutiny on government contractors, particularly concerning subcontracting practices and regulatory adherence, presents a significant threat. Carahsoft, like its peers, faces potential substantial fines, suspension from crucial contract vehicles, or severe reputational damage if found non-compliant, even indirectly through its partners.

Ongoing investigations and the FBI's raid at Carahsoft's headquarters in Reston, Virginia, directly underscore this heightened risk environment. Such events signal increased enforcement focus, demanding rigorous internal controls and transparent operations to mitigate potential legal and financial repercussions.

The escalating sophistication of cyber threats presents a significant challenge for Carahsoft. As government mandates like CMMC 2.0 become more stringent, the company and its partners must continuously update their solutions and ensure rigorous compliance. This ongoing adaptation demands substantial investment in security technologies and expertise.

Failure to stay ahead of evolving cyber threats and complex regulatory requirements could result in data breaches, impacting Carahsoft's reputation and potentially leading to a loss of crucial government contracts. For instance, the U.S. government's cybersecurity spending is projected to reach $30 billion in 2025, highlighting the critical importance of robust security postures.

Disruptive Technologies and Business Models

The relentless march of technological advancement, especially in artificial intelligence and cloud computing, poses a significant threat. New business models or direct sales approaches by tech giants could emerge, potentially circumventing established aggregators like Carahsoft.

The rise of advanced procurement platforms and AI-powered procurement tools presents a direct challenge to Carahsoft's traditional intermediary role. For instance, the global AI market was valued at over $200 billion in 2023 and is projected to grow significantly, indicating the increasing integration of AI into business processes, including procurement.

Carahsoft's business model relies on its ability to navigate complex government procurement landscapes. If new, more efficient digital procurement systems gain widespread adoption, particularly within government agencies, Carahsoft's value proposition could be diminished, necessitating a strategic pivot.

Key areas of concern include:

- Emergence of AI-driven procurement: Tools that automate supplier discovery and contract negotiation could reduce reliance on traditional resellers.

- Direct-to-government sales by manufacturers: Major technology providers might leverage AI to streamline their own government sales channels, bypassing intermediaries.

- Shifts in government purchasing behavior: Increased adoption of cloud-based, self-service procurement portals could alter how government entities acquire technology solutions.

Vendor Consolidation and Direct Sales Channels

Vendor consolidation presents a significant threat. As major technology providers merge or strengthen their direct sales capabilities, their need for intermediaries like Carahsoft could diminish. This trend could pressure Carahsoft's margins and potentially weaken its relationships with key manufacturers, impacting its ability to aggregate and distribute solutions effectively.

For instance, the cybersecurity sector, a key area for Carahsoft, has seen notable consolidation. In 2023, several mid-sized security firms were acquired by larger players, who may then prioritize their own direct government outreach. This shift could reduce the volume of business flowing through aggregation partners.

The increasing preference for direct-to-government sales by technology vendors poses another challenge. If vendors opt to bypass aggregators and build out their own federal sales teams, Carahsoft's role as a primary channel partner could be undermined. This could lead to:

- Reduced revenue streams from decreased reliance on aggregators.

- Lowered profit margins due to direct competition or vendor price adjustments.

- Potential loss of exclusive distribution agreements with critical technology providers.

The increasing sophistication of cyber threats demands continuous investment in security, with U.S. government cybersecurity spending projected to reach $30 billion in 2025. The rapid advancement of AI and cloud computing also presents a threat, as tech giants may adopt direct sales models, potentially bypassing intermediaries like Carahsoft. Emerging AI-driven procurement tools and a shift towards self-service government portals could further diminish Carahsoft's traditional role.

Vendor consolidation, particularly in sectors like cybersecurity where mid-sized firms were acquired in 2023, poses a risk. Larger entities may prioritize direct government outreach, reducing business for aggregators. This trend could impact Carahsoft's margins and relationships with key manufacturers.

The preference for direct-to-government sales by technology vendors is another significant threat. As vendors build their own federal sales teams, Carahsoft's intermediary role could be undermined, leading to reduced revenue streams and potentially lower profit margins. This could also result in the loss of exclusive distribution agreements with critical technology providers.

SWOT Analysis Data Sources

This Carahsoft SWOT analysis is built upon a foundation of credible data, including their public financial filings, comprehensive market intelligence reports, and expert evaluations from industry analysts to provide a thorough and accurate strategic overview.