Carahsoft Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carahsoft Bundle

Carahsoft navigates a complex landscape shaped by intense buyer power and the constant threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp their competitive positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Carahsoft’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Carahsoft's reliance on a broad range of technology vendors, many providing unique or proprietary IT solutions for the government, directly influences supplier bargaining power. If a handful of major suppliers control essential software or hardware, their leverage over Carahsoft grows significantly.

This concentration of power enables these dominant vendors to impose terms, pricing, and distribution strategies, potentially squeezing Carahsoft's profit margins and limiting its operational agility. For instance, a critical cybersecurity software provider holding a substantial market share in government contracts could dictate unfavorable terms to Carahsoft, its reseller.

While Carahsoft functions as an aggregator, the process of switching away from a major technology partner can impose substantial financial and operational burdens. These costs often encompass the complexities of re-negotiating existing contract vehicles, the necessity of retraining sales and technical personnel, and the strategic realignment of marketing initiatives to reflect new partnerships.

These elevated switching costs for Carahsoft inherently strengthen the bargaining power of its key technology suppliers. As the aggregator faces greater hurdles in changing partners, its reliance on established relationships with these suppliers increases, giving those suppliers more leverage in negotiations.

Carahsoft's role as a 'Master Government Aggregator' is pivotal for technology vendors seeking to penetrate the public sector. By consolidating access to federal, state, and local government agencies, Carahsoft simplifies a complex sales landscape for its partners.

For many technology companies, Carahsoft is not just a channel but a primary conduit for substantial government revenue. This reliance on Carahsoft's established network and contract vehicles can diminish the bargaining power of individual suppliers to Carahsoft, as vendors depend on this aggregated access to reach government clients effectively.

Threat of Forward Integration by Suppliers

Large technology vendors often have the financial muscle and established direct sales channels to approach government agencies independently. This capability allows them to bypass intermediaries like Carahsoft, thereby strengthening their position. For instance, major cloud providers or software developers might leverage existing relationships or develop specialized government outreach programs.

The threat of suppliers pursuing forward integration, meaning they could sell directly to government clients, directly impacts Carahsoft. If a significant vendor decides to establish its own direct sales force for government contracts, it could erode Carahsoft's revenue streams. This is a common concern in the IT distribution space where manufacturers can, in theory, disintermediate resellers.

- Supplier Direct Sales Capability: Major technology companies, such as Microsoft or Amazon Web Services, have the resources to build dedicated government sales teams.

- Deterrent Factors for Suppliers: Carahsoft's expertise in navigating complex government procurement processes and its extensive network of contract vehicles, like GSA Schedules, present a significant barrier to entry for direct sales by suppliers.

- Carahsoft's Value Proposition: The aggregator's deep understanding of agency needs and compliance requirements makes it difficult for suppliers to replicate this specialized service efficiently on their own.

Uniqueness and Criticality of Supplier Inputs

The specialized IT solutions Carahsoft sources, particularly in cybersecurity and cloud services, are often mission-critical for government clients. These inputs, especially those meeting stringent compliance standards like FedRAMP, can be difficult for agencies to replicate independently. This uniqueness and essentiality grant significant bargaining power to Carahsoft's technology partners.

Carahsoft's business model relies on aggregating these unique and critical solutions. The inherent value and often proprietary nature of the underlying technologies empower the suppliers who offer them. For instance, a government agency's need for a specific, FedRAMP-authorized cybersecurity platform directly translates to leverage for the provider of that platform in negotiations with Carahsoft.

- Mission-Critical Inputs: Carahsoft deals with IT solutions vital for government operations, making these inputs highly valuable.

- Supplier Leverage: The uniqueness and difficulty in replicating these specialized solutions strengthen suppliers' negotiating positions.

- Compliance Requirements: Adherence to standards like FedRAMP further solidifies the power of suppliers offering compliant technologies.

Carahsoft's reliance on specialized, mission-critical IT solutions, often with unique government certifications like FedRAMP, significantly bolsters supplier bargaining power. These essential, hard-to-replicate technologies give vendors considerable leverage in negotiations with Carahsoft, as agencies depend on these specific offerings. For example, a provider of a highly sought-after, FedRAMP-authorized cloud security solution can command favorable terms due to its indispensable nature in government IT infrastructure.

The bargaining power of Carahsoft's suppliers is amplified by the potential for forward integration, where vendors might bypass Carahsoft to sell directly to government agencies. While Carahsoft's expertise in navigating complex government procurement is a deterrent, major players like Microsoft or Amazon Web Services can leverage their resources and existing relationships to establish direct government sales channels, potentially impacting Carahsoft's revenue.

Switching costs for Carahsoft when changing technology partners are substantial, involving contract renegotiations, retraining, and strategic realignments. These hurdles reinforce the leverage of existing key suppliers, making it more difficult for Carahsoft to diversify its offerings or negotiate aggressively from a position of reduced dependence. In 2024, the IT resale market continues to see this dynamic play out, with specialized software providers holding strong positions.

What is included in the product

This analysis dissects Carahsoft's competitive environment by examining supplier power, buyer bargaining, new entrant threats, substitute products, and the intensity of rivalry within the government IT solutions market.

Carahsoft's Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding competitive pressures.

Customers Bargaining Power

Carahsoft's customer base, primarily comprising government agencies, educational institutions, and healthcare organizations, wields significant bargaining power. These entities operate under stringent regulatory frameworks and often utilize large, consolidated procurement contracts. For instance, in 2024, many federal IT procurement vehicles, like NASA SEWP, saw substantial spending, indicating the scale at which these consolidated contracts operate, thereby amplifying buyer influence.

Public sector clients, including government agencies, are acutely aware of their budget constraints, often funded by taxpayer dollars. This makes them highly price-sensitive, as they are obligated to secure the most cost-effective solutions available. For instance, in 2024, many federal agencies faced tighter budgets, increasing the pressure on vendors like Carahsoft to offer competitive pricing and demonstrate tangible value.

This inherent price sensitivity translates directly into significant bargaining power for these customers. They can readily compare offerings and negotiate aggressively to ensure they are getting the best possible deal, often leveraging multiple bids to drive down costs. Carahsoft's success hinges on its ability to consistently prove the efficiency and cost-effectiveness of its aggregated software and IT solutions to satisfy these demanding requirements.

Government agencies have numerous ways to buy IT solutions, not just through Carahsoft. They can go directly to the tech companies themselves or work with other big government contractors and system integrators. This means agencies have options, and if Carahsoft's prices or terms aren't appealing, they can easily look elsewhere, giving them significant leverage.

For instance, in 2023, the U.S. federal government's IT spending reached an estimated $140 billion, with a substantial portion flowing through various contract vehicles and direct purchases, highlighting the competitive landscape Carahsoft operates within.

Carahsoft's strategy to counter this involves offering specialized knowledge and a wide array of pre-negotiated contract vehicles. This makes it easier for agencies to procure necessary solutions efficiently, thereby building loyalty and reducing the incentive to explore every alternative channel.

Volume of Purchases and Long-Term Contracts

The substantial volume and multi-year duration of government contracts grant customers significant bargaining power. These long-term agreements represent a predictable and large revenue stream for aggregators like Carahsoft, enabling clients to negotiate favorable terms, pricing, and service level agreements. Carahsoft's business model is intrinsically tied to its ability to secure and retain these major government commitments.

For instance, in fiscal year 2023, Carahsoft reported over $15 billion in revenue, largely driven by its extensive portfolio of government contracts. This scale underscores the leverage customers wield; a single large contract can represent a significant portion of Carahsoft's annual business. The potential for recurring revenue from these contracts means customers can effectively demand concessions in exchange for continued commitment.

- Government contracts often involve massive purchase volumes, directly impacting an aggregator's revenue stability.

- The multi-year nature of these agreements allows customers to leverage future business for present-day favorable terms.

- Carahsoft's reliance on these large-scale agreements inherently strengthens the bargaining power of its government clients.

Demand for Specialized and Compliant Solutions

Government agencies are increasingly demanding IT solutions tailored to specific needs, especially in cybersecurity and cloud computing. This specialization, coupled with strict compliance requirements like FedRAMP and CMMC, gives these customers significant leverage. They can dictate terms by exclusively engaging vendors that meet these stringent criteria.

Carahsoft capitalizes on this by offering a curated portfolio of solutions that adhere to these complex regulatory landscapes. For instance, in 2024, the U.S. government continued to prioritize cybersecurity spending, with agencies like the Department of Defense allocating substantial budgets towards compliant technologies.

- Specialized Needs: Government entities require highly specific IT functionalities to address unique operational challenges.

- Compliance as a Barrier: Certifications like FedRAMP and CMMC act as significant entry barriers, empowering compliant vendors.

- Customer Leverage: Agencies can exert considerable power by selecting only those providers who meet their rigorous compliance standards.

- Carahsoft's Role: Carahsoft facilitates access to these compliant solutions, acting as a key aggregator for government IT procurement.

Carahsoft's primary customers, government agencies, educational institutions, and healthcare organizations, possess substantial bargaining power due to their consolidated procurement and price sensitivity. In 2024, the significant spending on federal IT procurement vehicles underscored the scale of these buyers, amplifying their influence. These public sector entities are highly focused on cost-effectiveness, often facing tighter budgets, which compels them to negotiate aggressively for the best value. This means Carahsoft must consistently demonstrate the efficiency and cost benefits of its aggregated solutions to meet these demanding requirements.

| Customer Segment | Key Bargaining Power Factors | 2024/2023 Data Point |

|---|---|---|

| Government Agencies | Consolidated procurement, price sensitivity, regulatory compliance needs | Federal IT spending estimated at $140 billion in 2023. |

| Educational Institutions | Budget constraints, bulk purchasing, comparison shopping | Many universities focused on cost-saving IT initiatives in 2024. |

| Healthcare Organizations | Strict compliance (HIPAA), specialized IT needs, volume purchasing | Increased demand for secure, compliant cloud solutions in 2024. |

What You See Is What You Get

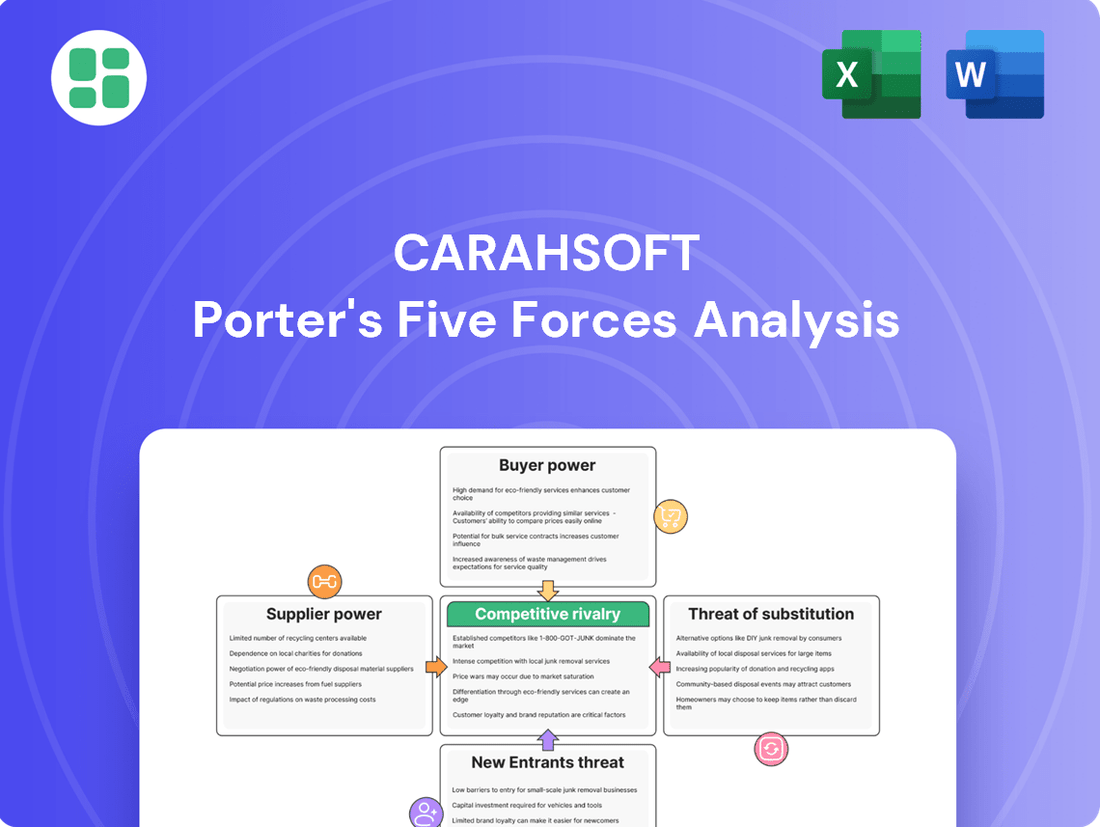

Carahsoft Porter's Five Forces Analysis

This preview showcases the complete Carahsoft Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its market. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently expect to download this exact, ready-to-use report upon completing your transaction.

Rivalry Among Competitors

The government IT solutions arena is a crowded space, with a broad range of companies vying for contracts. Carahsoft, a significant entity, finds itself in direct competition with major players such as SHI, Accenture, Deloitte Consulting, and World Wide Technology. This diverse competitive landscape, populated by both large prime contractors and specialized firms, significantly heightens the rivalry for market dominance.

While federal IT spending remains a significant and generally steady market, fluctuations in growth rates or increased scrutiny on expenditures can intensify competition. For instance, in fiscal year 2023, U.S. federal government IT spending was projected to reach approximately $120 billion, a slight increase from previous years, but this growth can attract more vendors.

The government's strategic push towards digital transformation, artificial intelligence (AI), and enhanced cybersecurity measures presents substantial new contract avenues. However, these high-demand areas also draw a larger pool of competitors, making the pursuit of these lucrative government contracts exceptionally competitive.

Carahsoft stands out by acting as a Master Government Aggregator, leveraging its extensive network of contract vehicles and deep understanding of government procurement processes. This unique approach allows them to offer a broad range of solutions to public sector clients. For instance, in 2023, Carahsoft reported over $16 billion in revenue, showcasing the scale of their operations and the effectiveness of their model in capturing government IT spending.

While Carahsoft's model is robust, rivals can carve out their own niches. Some competitors might focus on forging exclusive partnerships with cutting-edge technology providers or specializing in specific government sectors, like defense or healthcare. Others may emphasize highly responsive customer support or tailored implementation services to win business. The ongoing challenge for Carahsoft is to continuously reinforce its distinct value proposition against these varied competitive strategies.

Switching Costs for Customers

While government agencies often face hurdles in switching vendors due to ingrained processes and integration complexities, the switching costs between different software aggregators themselves might not be excessively high. This means that if a competitor presents a more attractive price point, a wider array of functionalities, or demonstrably better customer support, agencies might indeed explore changing providers. For instance, in 2024, the federal IT procurement landscape saw continued emphasis on cost-effectiveness and modern solutions, making vendor loyalty less of a barrier if compelling alternatives emerge.

This dynamic directly fuels competitive pressure among aggregator providers. They are incentivized to continuously innovate and offer superior value propositions to retain existing clients and attract new ones. Carahsoft, operating within this environment, must remain vigilant about its pricing, service offerings, and technological advancements to counter potential client attrition. The ability for agencies to relatively easily switch aggregators, even with the broader context of government procurement, keeps the competitive intensity elevated.

- Lower Switching Costs: Agencies can potentially switch between aggregators without the extensive re-procurement processes associated with changing prime contractors.

- Competitive Pricing Pressure: The ease of switching encourages aggregators to offer competitive pricing to retain government contracts.

- Focus on Value Proposition: Providers must constantly demonstrate superior value through price, features, and support to minimize client churn.

- Impact on Market Dynamics: This factor contributes to a more dynamic market where providers must actively compete for agency business.

High Fixed Costs and Strategic Stakes

The government IT aggregation sector is characterized by substantial fixed costs. These include the expenses of managing numerous contract vehicles, ensuring robust compliance, and supporting a large, specialized sales force. For instance, maintaining the necessary certifications and infrastructure to bid on federal contracts can run into millions of dollars annually.

The high strategic value placed on government contracts compels companies to compete fiercely, often on price. This aggressive stance is driven by the need to maximize the utilization of their significant fixed assets and preserve their market standing. In 2024, many government IT contractors reported increased pressure on profit margins due to this competitive dynamic.

- High Fixed Costs: Significant investment in contract vehicles, compliance, and sales infrastructure.

- Strategic Importance: Government contracts are crucial for asset utilization and market presence.

- Price Competition: Companies often compete aggressively on price to secure and retain contracts.

- Margin Pressure: This rivalry can lead to reduced profitability for players in the space.

The competitive rivalry within the government IT solutions market is intense. Carahsoft faces formidable opponents like SHI, Accenture, Deloitte, and World Wide Technology, all vying for significant federal IT spending, which was projected to be around $120 billion in fiscal year 2023. This crowded field, encompassing large prime contractors and specialized firms, intensifies the battle for market share, especially in high-demand areas like AI and cybersecurity.

| Competitor | Key Strengths | 2023 Estimated Revenue (Govt IT Focus) |

|---|---|---|

| Carahsoft | Master Government Aggregator, extensive contract vehicles, procurement expertise | $16+ billion |

| SHI | Broad IT solutions, strong commercial and public sector presence | Undisclosed specific to govt IT, but overall revenue significant |

| Accenture | Consulting, digital transformation, cloud services | Undisclosed specific to govt IT, but overall revenue significant |

| Deloitte Consulting | Consulting, cybersecurity, cloud migration | Undisclosed specific to govt IT, but overall revenue significant |

| World Wide Technology | Technology solutions, integration services | Undisclosed specific to govt IT, but overall revenue significant |

SSubstitutes Threaten

Government agencies directly procuring IT products and services represent a significant substitute threat for Carahsoft. This bypasses the need for an aggregator like Carahsoft, especially if agencies possess strong internal procurement expertise and direct vendor relationships. For instance, some federal agencies might leverage their scale and existing contracts to negotiate directly with major technology providers, potentially seeing a cost benefit.

Government agencies may choose to build their own IT solutions in-house, bypassing external providers for specific needs. This internal development, while often constrained by budget and skilled personnel availability, acts as a substitute for relying on external aggregation services, especially for bespoke or mission-critical systems.

The threat of in-house IT development is tempered by the persistent challenge of talent shortages within government IT departments. For instance, in 2023, the U.S. government faced significant gaps in cybersecurity and cloud computing expertise, making large-scale internal solution development difficult.

General IT consulting firms and large system integrators present a significant threat as substitutes for Carahsoft. These entities can offer end-to-end solutions, from initial procurement and complex system integration to ongoing IT management, directly challenging Carahsoft's aggregated approach. For example, in 2024, the IT consulting market was valued at over $400 billion globally, with major players like Accenture and Deloitte providing a broad spectrum of services that could bypass the need for Carahsoft's reseller model.

These integrated service providers often bundle diverse IT solutions, presenting government agencies with a streamlined, single point of contact. This consolidated offering can be highly attractive, directly competing with Carahsoft's strength in aggregating multiple technology partners. Many of these system integrators are also strategic partners for Carahsoft, but their ability to deliver comprehensive, managed IT services independently makes them a potent substitute.

Adoption of Open Source Software and Public Cloud Marketplaces

The growing adoption of open-source software by government agencies presents a significant threat of substitution for Carahsoft. As more public sector organizations embrace open-source alternatives, their need for proprietary commercial software, which Carahsoft aggregates, diminishes. This shift can lead to reduced demand for Carahsoft's core offerings.

Furthermore, the expansion of public cloud marketplaces, like the AWS Marketplace for Public Sector, directly impacts Carahsoft's role as an aggregator. These platforms enable government agencies to procure a range of IT solutions, including software and cloud services, directly from providers. This disintermediation bypasses traditional resellers and aggregators for specific IT needs, potentially eroding Carahsoft's market share for those transactions.

- Open Source Adoption: Government IT spending on open-source solutions is projected to grow, with some reports indicating double-digit annual growth rates in specific segments by 2024.

- Cloud Marketplace Growth: Public sector cloud spending continues to rise, with marketplaces facilitating a significant portion of these procurements, offering agencies more direct purchasing avenues.

- Direct Procurement Trends: Agencies are increasingly empowered to source solutions directly, especially for cloud-based services and commodity software, reducing reliance on traditional aggregation models.

Legacy Systems and Delayed Modernization

The persistent reliance on aging legacy IT systems within government agencies presents a significant threat of substitution for modern solutions like those Carahsoft offers. These entrenched systems, even if inefficient, can deter agencies from adopting newer technologies due to the perceived complexity and cost of migration. For example, a 2024 report indicated that over 60% of federal agencies still utilize systems that are at least 15 years old, highlighting the inertia.

Agencies grappling with budget limitations or the sheer difficulty of transitioning away from established, albeit outdated, infrastructure may opt to extend the life of their current systems. This decision effectively acts as a substitute, deferring or diminishing the demand for innovative, aggregated IT solutions. The cost of replacing or significantly upgrading these legacy platforms can be prohibitive, making incremental maintenance a more attractive, albeit less effective, alternative.

- Legacy System Inertia: Government agencies often prioritize stability and familiarity, making them hesitant to adopt new technologies that require extensive training and integration.

- Budgetary Constraints: Limited IT budgets can force agencies to choose between maintaining legacy systems and investing in potentially disruptive but more advanced solutions.

- Migration Challenges: The technical hurdles and risks associated with migrating critical data and operations from legacy systems can be a major deterrent.

- Cost of Modernization: The significant upfront investment required for new software, hardware, and implementation services can make legacy systems appear more cost-effective in the short term.

The threat of substitutes for Carahsoft is multifaceted, stemming from direct procurement by government agencies, in-house IT development, and the rise of integrated IT consulting firms. Agencies with strong internal procurement capabilities or existing vendor relationships can bypass aggregators, potentially realizing cost savings. For example, in 2024, the global IT consulting market exceeded $400 billion, with major players offering comprehensive solutions that can directly compete with Carahsoft's reseller model.

The increasing adoption of open-source software and the growth of public cloud marketplaces also present significant substitution threats. These trends allow agencies to procure IT solutions more directly, reducing their reliance on traditional aggregation services. By 2024, government IT spending on open-source solutions was projected for robust growth, with specific segments expected to see double-digit annual increases.

Furthermore, the inertia of aging legacy IT systems within government agencies acts as a substitute for modern solutions. Agencies hesitant to undertake costly and complex migrations may opt to maintain older systems, thereby deferring demand for newer technologies. A 2024 report indicated that over 60% of federal agencies still operate systems that are at least 15 years old, underscoring this challenge.

Entrants Threaten

The government IT market presents formidable barriers for new entrants due to stringent regulatory and compliance demands. Navigating requirements like FedRAMP, Cybersecurity Maturity Model Certification (CMMC), and specific government contract vehicle prerequisites involves substantial time, investment, and expertise, making it difficult for newcomers to establish a foothold.

Achieving these certifications is a costly and time-consuming endeavor, with FedRAMP authorization alone potentially costing hundreds of thousands of dollars and taking over a year to complete. This high compliance threshold significantly deters potential competitors, protecting established players.

Carahsoft's extensive experience and existing infrastructure in managing these complex compliance frameworks represent a critical competitive advantage. Their established processes and proven track record in meeting government IT security and operational standards create a robust barrier against new market entrants.

Accessing crucial government-wide acquisition contracts (GWACs) and GSA schedules is paramount for any company aiming to serve the public sector. The process of securing these essential contract vehicles is notoriously lengthy and demanding, creating a significant barrier for newcomers.

New entrants often find it incredibly difficult to obtain the necessary contract vehicles, which are frequently already secured by established companies like Carahsoft. This situation effectively restricts their ability to enter and compete within the public sector market, as Carahsoft itself holds over 220 such contract vehicles, giving it a substantial advantage.

Breaking into the government IT sector, particularly as a reseller like Carahsoft, demands more than just offering products. It hinges on deep, established relationships with both technology manufacturers and government clients. These connections aren't built overnight; they're forged through years of consistent performance, reliability, and a strong reputation within the GovCon community. For instance, Carahsoft's extensive network means they can often secure favorable terms from vendors and have direct lines to key decision-makers within agencies.

Newcomers face a significant hurdle here. They lack the pre-existing trust and credibility that Carahsoft has painstakingly cultivated. Without these long-standing ties, it's challenging to attract major technology partners or convince government agencies to take a chance on an unknown entity. Carahsoft's leadership, for example, is frequently cited and recognized within the government contracting landscape, providing an immediate advantage in securing new business.

Significant Capital Investment Requirements

Establishing a comprehensive government IT aggregation business like Carahsoft requires significant capital. This includes substantial upfront investment in legal and compliance frameworks, specialized sales and marketing infrastructure for the public sector, and the resources to cultivate and manage a broad partner ecosystem. For instance, building out a robust cybersecurity compliance program alone can cost hundreds of thousands of dollars annually.

These high initial capital demands act as a considerable barrier, effectively deterring many potential new entrants. The sheer scale of investment needed to compete effectively in the government IT procurement space is a major deterrent, limiting the number of companies that can realistically enter and challenge established players.

- High initial investment: Significant capital is needed for legal, compliance, sales, and marketing infrastructure tailored to the government sector.

- Partner ecosystem development: Resources are required to build and maintain relationships with a wide array of technology partners.

- Regulatory compliance costs: Meeting stringent government regulations and certifications adds substantial ongoing expenses.

- Deterrent to new entrants: The substantial financial outlay required discourages new companies from entering the market.

Scarcity of Specialized Talent and Expertise

The government IT sector demands a rare combination of advanced technological skills and a deep understanding of complex public sector procurement. This makes it exceptionally difficult and costly for new companies to attract and retain the specialized talent needed to compete effectively.

Carahsoft, as a well-established player, benefits from a workforce possessing this unique blend of expertise, including navigating federal acquisition regulations and understanding agency-specific needs. For instance, in 2024, the demand for cybersecurity professionals with government clearance remained exceptionally high, with average salaries for cleared individuals often exceeding market rates by 15-25%.

- Specialized Skillset: Government IT requires knowledge of federal procurement alongside technical proficiency.

- Talent Acquisition Challenge: Recruiting and retaining individuals with this dual expertise is a significant hurdle.

- Cost of Expertise: The scarcity drives up compensation, making it an expensive proposition for new entrants.

- Carahsoft's Advantage: Existing deep institutional knowledge and specialized workforce create a competitive barrier.

The threat of new entrants in the government IT market is significantly low, largely due to the substantial barriers to entry that protect established players like Carahsoft. These barriers are multifaceted, encompassing high capital requirements, complex regulatory hurdles, and the necessity of cultivating deep, long-standing relationships within the public sector ecosystem.

Newcomers face immense challenges in securing government-wide acquisition contracts (GWACs) and GSA schedules, which are essential for participating in public sector procurement. Carahsoft's extensive portfolio of over 220 such contract vehicles provides a critical competitive advantage, effectively limiting market access for new companies.

Furthermore, the demand for specialized talent with a unique blend of technical expertise and knowledge of federal procurement processes creates another significant hurdle. In 2024, the market for cleared cybersecurity professionals saw average salaries increase by 15-25% compared to uncleared roles, highlighting the high cost of acquiring necessary expertise.

| Barrier Type | Description | Impact on New Entrants | Carahsoft's Position | 2024 Data Point |

| Regulatory Compliance | FedRAMP, CMMC, and other government certifications | High cost and time investment, deterring new entrants | Established processes and proven track record | FedRAMP authorization can exceed $100,000 and take over a year |

| Contract Vehicles | Securing GWACs and GSA schedules | Lengthy and demanding process, difficult for newcomers | Holds over 220 contract vehicles | N/A (specific number of new contracts secured in 2024 not publicly available) |

| Relationship Building | Establishing trust with vendors and government agencies | Requires years of consistent performance and reputation | Extensive network and established credibility | Carahsoft's leadership frequently recognized in GovCon landscape |

| Capital Investment | Legal, compliance, sales, and marketing infrastructure | Significant upfront costs create a major deterrent | Robust infrastructure and partner ecosystem | Annual cybersecurity compliance programs can cost hundreds of thousands of dollars |

| Talent Acquisition | Hiring specialized IT professionals with government clearance | High demand and cost for dual expertise | Existing deep institutional knowledge and specialized workforce | Cleared cybersecurity professionals' salaries up 15-25% in 2024 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages data from Carahsoft's extensive government contracting databases, public company filings, and industry-specific market research reports. This comprehensive approach ensures a robust understanding of competitive dynamics within the public sector IT market.