Carahsoft PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carahsoft Bundle

Carahsoft operates within a dynamic environment shaped by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying both opportunities and potential threats. Our PESTLE analysis delves deep into these factors, offering a comprehensive view of the external influences impacting Carahsoft's operations and future trajectory. Gain a critical edge in understanding Carahsoft's market position and unlock actionable intelligence by purchasing the full analysis today.

Political factors

Government spending on IT solutions is the bedrock of Carahsoft's revenue. For fiscal year 2024, the US federal government allocated over $110 billion to IT, with projections for FY2025 indicating continued strong investment, particularly in areas like cloud computing and cybersecurity, which directly benefit Carahsoft's portfolio.

Changes in administration can significantly alter the landscape. A new presidential administration often brings revised IT modernization priorities and budget allocations, potentially impacting the types of solutions agencies seek and Carahsoft's strategic focus for the upcoming years.

The growing emphasis on cybersecurity and national security directly benefits Carahsoft by positioning them as a key provider of secure IT solutions for the government. New mandates, such as the proposed Federal Acquisition Regulation (FAR) Cybersecurity requirements, and the push for Zero Trust architectures, are creating substantial demand for compliant technologies that Carahsoft aggregates and delivers.

Carahsoft's active involvement in government cybersecurity initiatives, including participation in events and strategic partnerships focused on securing federal systems, underscores their alignment with these critical national security priorities. For instance, their presence at events like the annual Billington CyberSecurity Summit demonstrates their commitment to addressing the evolving threat landscape faced by government agencies.

Government-wide digital transformation initiatives, such as the Biden-Harris administration's push for cloud-first strategies and AI adoption, directly benefit Carahsoft. These efforts, aiming to modernize IT infrastructure and enhance citizen services, represent a significant market opportunity. For instance, the U.S. General Services Administration (GSA) has been actively promoting cloud adoption, with federal agencies increasingly migrating workloads to cloud environments.

Agencies are prioritizing investments in advanced technologies to boost efficiency and operational effectiveness. This trend is evident in the growing federal spending on IT modernization, with projections indicating continued robust growth through 2025. Carahsoft's position as a master aggregator is crucial here, enabling them to connect government entities with the necessary vendor solutions to meet these evolving technological demands.

Procurement Policies and Contract Vehicles

Changes in federal procurement policies, such as those aimed at streamlining acquisition processes and increasing competition, directly impact Carahsoft's role as a government IT reseller. The Biden-Harris Administration's focus on reducing compliance burdens and enhancing cybersecurity standards for federal contractors, as seen in initiatives like the Cybersecurity Maturity Model Certification (CMMC), shapes the operational environment.

Carahsoft's strategic reliance on established contract vehicles like the General Services Administration (GSA) Multiple Award Schedule (MAS) and NASA Solutions for Enterprise-Wide Procurement (SEWP) is fundamental to its business model. These vehicles provide access to government agencies and streamline the purchasing process for IT solutions. For instance, the GSA MAS program facilitated over $77 billion in sales across all categories in fiscal year 2023, highlighting the significant market access these vehicles offer.

- Federal Procurement Policy Shifts: Government directives to reduce acquisition lead times and encourage the use of commercial off-the-shelf (COTS) software influence how Carahsoft partners with vendors and serves its agency clients.

- Contract Vehicle Importance: Carahsoft's success is intrinsically linked to its ability to leverage and manage a diverse portfolio of government-wide acquisition contracts (GWACs) and schedule contracts, which are critical for market penetration.

- Cybersecurity Mandates: Evolving cybersecurity requirements for government IT systems necessitate that Carahsoft and its vendor partners maintain rigorous compliance, impacting product offerings and sales strategies.

- Budgetary Allocations: Federal IT spending, projected to reach approximately $125 billion in fiscal year 2024 according to industry analysis, underscores the substantial market opportunity influenced by procurement policies.

Geopolitical Landscape and Global Conflicts

The current geopolitical climate, marked by ongoing conflicts and escalating tensions with nations like China, significantly shapes government spending. These global dynamics directly influence priorities, channeling substantial investment into defense and intelligence sectors. This increased focus on national security creates a fertile ground for companies like Carahsoft, which provide specialized technology solutions.

Carahsoft is well-positioned to capitalize on the growing demand for advanced technologies in national security. This demand spans critical areas such as geospatial intelligence, space technology, and secure communication systems. The company's leadership recognizes these complex geopolitical shifts as presenting significant, albeit challenging, opportunities for growth and market expansion.

- Increased Defense Budgets: Global defense spending reached an estimated $2.44 trillion in 2023, a 9% increase from 2022, driven by ongoing conflicts and heightened geopolitical tensions.

- Technology Investment: The US Department of Defense, for example, requested $135 billion for research, development, testing, and evaluation (RDT&E) in its FY2024 budget, signaling a strong emphasis on technological advancement.

- Cybersecurity Focus: Nations are prioritizing cybersecurity, with government spending on cybersecurity solutions projected to reach $163.8 billion globally in 2024, up from $155.7 billion in 2023.

- Space Sector Growth: Government investment in space technology, including satellite communications and intelligence gathering, is also on the rise, with global space economy revenues projected to grow significantly in the coming years.

Government IT spending remains a primary driver for Carahsoft, with the US federal government's IT budget projected to exceed $110 billion for FY2024 and likely see continued robust investment in FY2025, particularly in cloud and cybersecurity sectors. Shifts in administration can alter IT modernization priorities and budget allocations, directly impacting the demand for Carahsoft's offerings.

The increasing emphasis on national security and cybersecurity mandates, such as the push for Zero Trust architectures, creates substantial demand for compliant technologies that Carahsoft aggregates. Government-wide digital transformation initiatives, including cloud-first strategies and AI adoption, further expand the market opportunity for Carahsoft's solutions.

| Factor | Description | Impact on Carahsoft |

|---|---|---|

| Government IT Spending | US Federal IT budget projected over $110 billion for FY2024, with continued strong investment in FY2025. | Directly fuels Carahsoft's revenue through IT solution sales. |

| Cybersecurity Mandates | Increased focus on Zero Trust, secure communication, and data protection. | Drives demand for Carahsoft's cybersecurity solutions and partnerships. |

| Digital Transformation | Government push for cloud adoption, AI integration, and modernization of services. | Opens new avenues for Carahsoft to provide advanced technology solutions. |

| Procurement Policy | Streamlining acquisition processes and reducing compliance burdens. | Influences Carahsoft's operational efficiency and vendor relationships. |

What is included in the product

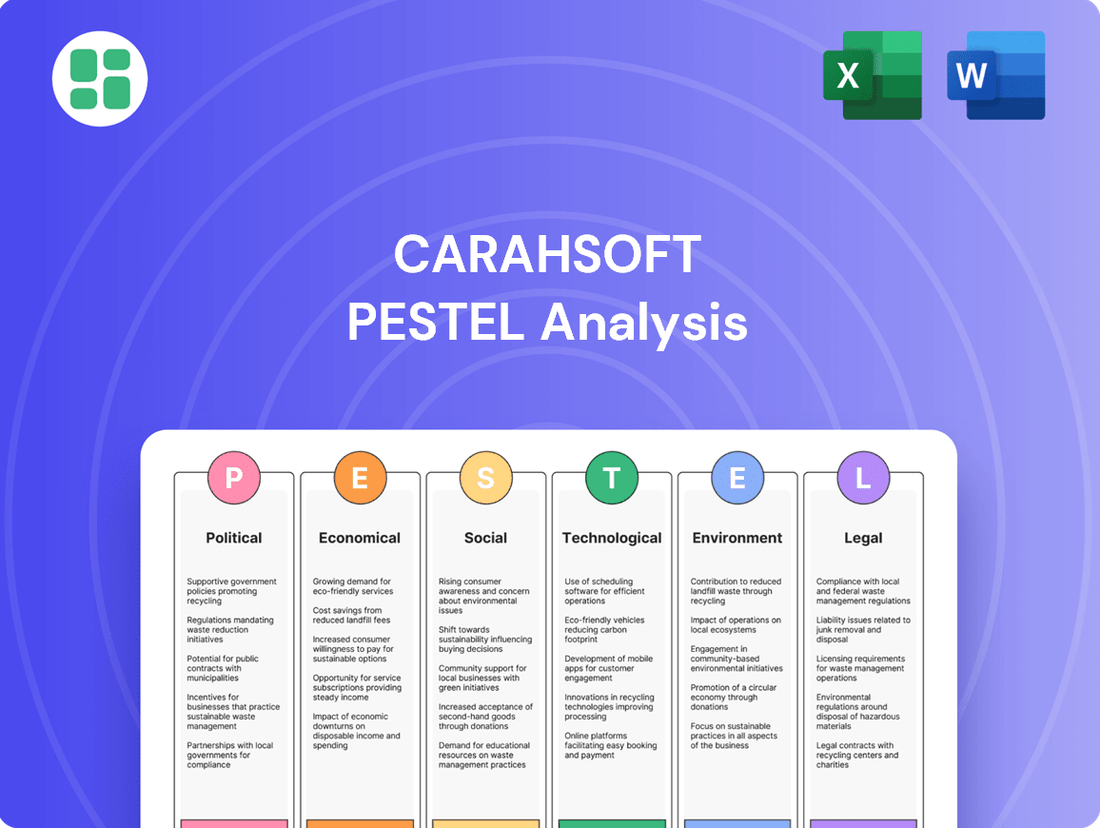

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Carahsoft across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities within Carahsoft's operating landscape.

Carahsoft's PESTLE analysis provides a clear, summarized version of external factors, making it easy to reference during meetings and presentations to alleviate the pain of information overload.

Economic factors

The federal budget deficit is a significant economic factor for Carahsoft. Projections indicate the deficit will widen in fiscal year 2025, impacting the overall availability of government funds for IT procurement. This necessitates careful financial planning for companies like Carahsoft.

Government spending patterns, especially concerning technology, remain a key driver. While IT investments, particularly in cybersecurity and artificial intelligence, are expected to continue strong, broader economic pressures could introduce volatility. These pressures might manifest as budget fluctuations or reliance on continuing resolutions, affecting the predictability of contract awards.

Rising inflation and higher interest rates in 2024 and early 2025 directly impact Carahsoft's operational costs and those of its vendor partners, potentially increasing the price of technology solutions. This economic environment can also constrain government agencies' budgets, affecting their purchasing power for new technologies.

Carahsoft's Vice President for Innovative & Intelligence Solutions has highlighted these economic shifts as critical market influencers, noting that increased borrowing costs can dampen investment in long-term technology projects. For instance, the US Federal Reserve's interest rate decisions throughout 2024, aiming to curb inflation, directly shape the cost of capital for both Carahsoft and its clients.

The overall economic stability and growth trajectory in the U.S. and globally significantly impact government agencies' confidence and capacity to fund new IT initiatives. A robust economy generally translates to more consistent federal IT spending, a positive indicator for Carahsoft's business model.

For instance, the U.S. GDP growth rate was projected to be around 2.3% in 2024, signaling a healthy economic environment conducive to government investment. Conversely, economic downturns or recessions often prompt agencies to adopt more conservative spending patterns, potentially slowing down the procurement of new technologies.

Competition in the Government IT Market

The government IT market is a dynamic arena, featuring established giants and nimble startups vying for contracts. This intense competition necessitates strategic differentiation, which Carahsoft addresses by acting as a crucial bridge for new vendors navigating complex government procurement processes.

The General Services Administration (GSA) is actively working to streamline compliance, a move designed to foster greater competition. By reducing regulatory hurdles, the GSA aims to open doors for a broader spectrum of companies, including those historically underserved, to participate in government IT projects. For instance, in fiscal year 2023, the GSA awarded over $75 billion in IT contracts, highlighting the significant opportunity for market entrants.

Carahsoft's core strategy involves empowering these emerging vendors with the knowledge and tools needed to meet stringent government requirements. This includes understanding federal acquisition regulations and cybersecurity mandates, thereby enabling them to effectively compete against larger, more experienced prime contractors. This support is vital as the government increasingly seeks innovative solutions from a diverse vendor base.

- Market Dynamics: The government IT sector is characterized by a mix of large prime contractors and a growing number of specialized startups.

- GSA Initiatives: The GSA's efforts to reduce compliance burdens are projected to increase the number of participating small and medium-sized businesses in federal IT procurement.

- Carahsoft's Role: Carahsoft facilitates market entry for new technology vendors by simplifying government contracting complexities and compliance requirements.

- Market Opportunity: With federal IT spending projected to reach over $170 billion in 2024, the competitive landscape offers substantial opportunities for well-prepared vendors.

Private Sector IT Spending Trends

While Carahsoft primarily serves the public sector, understanding private sector IT spending provides valuable context. Significant growth in private sector IT investment, particularly in software, cloud computing, and artificial intelligence, signals the increasing maturity and availability of these technologies. These advancements often pave the way for government adoption, as the private sector drives innovation and develops robust solutions.

Global IT spending is anticipated to see robust growth in 2025, with projections indicating a substantial increase driven by key areas. Specifically, investments in software and data center systems are expected to be major contributors to this expansion. This trend suggests a dynamic market where cutting-edge IT capabilities are being developed, creating opportunities for government agencies to leverage these innovations.

- Projected global IT spending growth in 2025: Expected to rise significantly, fueled by private sector investments.

- Key growth drivers: Software and data center systems are leading the charge in private sector IT expenditure.

- Technology maturity: Increased private sector adoption of cloud and AI indicates the readiness of these technologies for broader application, including government use.

- Innovation pipeline: Private sector spending creates a pipeline of advanced IT solutions that can be adapted for public sector needs.

The federal budget deficit is a significant economic factor for Carahsoft. Projections indicate the deficit will widen in fiscal year 2025, impacting the overall availability of government funds for IT procurement. This necessitates careful financial planning for companies like Carahsoft.

Government spending patterns, especially concerning technology, remain a key driver. While IT investments, particularly in cybersecurity and artificial intelligence, are expected to continue strong, broader economic pressures could introduce volatility. These pressures might manifest as budget fluctuations or reliance on continuing resolutions, affecting the predictability of contract awards.

Rising inflation and higher interest rates in 2024 and early 2025 directly impact Carahsoft's operational costs and those of its vendor partners, potentially increasing the price of technology solutions. This economic environment can also constrain government agencies' budgets, affecting their purchasing power for new technologies.

Carahsoft's Vice President for Innovative & Intelligence Solutions has highlighted these economic shifts as critical market influencers, noting that increased borrowing costs can dampen investment in long-term technology projects. For instance, the US Federal Reserve's interest rate decisions throughout 2024, aiming to curb inflation, directly shape the cost of capital for both Carahsoft and its clients.

The overall economic stability and growth trajectory in the U.S. and globally significantly impact government agencies' confidence and capacity to fund new IT initiatives. A robust economy generally translates to more consistent federal IT spending, a positive indicator for Carahsoft's business model.

For instance, the U.S. GDP growth rate was projected to be around 2.3% in 2024, signaling a healthy economic environment conducive to government investment. Conversely, economic downturns or recessions often prompt agencies to adopt more conservative spending patterns, potentially slowing down the procurement of new technologies.

The government IT market is a dynamic arena, featuring established giants and nimble startups vying for contracts. This intense competition necessitates strategic differentiation, which Carahsoft addresses by acting as a crucial bridge for new vendors navigating complex government procurement processes.

The General Services Administration (GSA) is actively working to streamline compliance, a move designed to foster greater competition. By reducing regulatory hurdles, the GSA aims to open doors for a broader spectrum of companies, including those historically underserved, to participate in government IT projects. For instance, in fiscal year 2023, the GSA awarded over $75 billion in IT contracts, highlighting the significant opportunity for market entrants.

Carahsoft's core strategy involves empowering these emerging vendors with the knowledge and tools needed to meet stringent government requirements. This includes understanding federal acquisition regulations and cybersecurity mandates, thereby enabling them to effectively compete against larger, more experienced prime contractors. This support is vital as the government increasingly seeks innovative solutions from a diverse vendor base.

- Market Dynamics: The government IT sector is characterized by a mix of large prime contractors and a growing number of specialized startups.

- GSA Initiatives: The GSA's efforts to reduce compliance burdens are projected to increase the number of participating small and medium-sized businesses in federal IT procurement.

- Carahsoft's Role: Carahsoft facilitates market entry for new technology vendors by simplifying government contracting complexities and compliance requirements.

- Market Opportunity: With federal IT spending projected to reach over $170 billion in 2024, the competitive landscape offers substantial opportunities for well-prepared vendors.

While Carahsoft primarily serves the public sector, understanding private sector IT spending provides valuable context. Significant growth in private sector IT investment, particularly in software, cloud computing, and artificial intelligence, signals the increasing maturity and availability of these technologies. These advancements often pave the way for government adoption, as the private sector drives innovation and develops robust solutions.

Global IT spending is anticipated to see robust growth in 2025, with projections indicating a substantial increase driven by key areas. Specifically, investments in software and data center systems are expected to be major contributors to this expansion. This trend suggests a dynamic market where cutting-edge IT capabilities are being developed, creating opportunities for government agencies to leverage these innovations.

- Projected global IT spending growth in 2025: Expected to rise significantly, fueled by private sector investments.

- Key growth drivers: Software and data center systems are leading the charge in private sector IT expenditure.

- Technology maturity: Increased private sector adoption of cloud and AI indicates the readiness of these technologies for broader application, including government use.

- Innovation pipeline: Private sector spending creates a pipeline of advanced IT solutions that can be adapted for public sector needs.

Economic factors like the federal deficit and inflation directly influence government IT budgets, potentially impacting contract availability and pricing for Carahsoft. While federal IT spending remains robust, projected at over $170 billion for 2024, economic pressures can introduce volatility. Higher interest rates, for example, increase operational costs for Carahsoft and its partners, and can constrain agency purchasing power.

| Economic Factor | Impact on Carahsoft | Relevant Data (2024-2025) |

|---|---|---|

| Federal Budget Deficit | Potential reduction in available government IT funds | Projected widening deficit in FY2025 |

| Inflation & Interest Rates | Increased operational costs, reduced agency purchasing power | Continued elevated interest rates in early 2025; Fed rate decisions in 2024 |

| GDP Growth | Influences government confidence and IT spending capacity | U.S. GDP growth projected around 2.3% for 2024 |

| Private Sector IT Spending | Drives technology maturity and innovation pipeline | Robust global IT spending growth anticipated in 2025, led by software and data centers |

What You See Is What You Get

Carahsoft PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Carahsoft PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and market position.

Sociological factors

Citizens now demand digital government services that are as seamless and efficient as their private sector counterparts. This expectation, amplified by widespread digital adoption, pushes agencies towards modernizing their IT infrastructure and focusing on user experience. For instance, a 2024 Pew Research Center survey found that 73% of Americans believe government agencies should offer online options for most services they provide.

This growing public demand directly fuels investment in customer experience (CX) and engagement technologies. Carahsoft, by partnering with leading technology providers, is well-positioned to support government agencies in meeting these expectations. The drive to improve service delivery and foster constituent trust is a significant catalyst for government IT modernization initiatives.

The digital literacy and evolving skill sets within the government workforce directly influence how effectively new IT solutions are adopted and utilized. For instance, a 2024 survey indicated that while many federal employees expressed comfort with basic digital tools, a significant portion reported needing more advanced training in areas like data analytics and cybersecurity. This gap necessitates IT solutions that are intuitive and come with robust, accessible training programs.

Recognizing this, agencies are actively investing in upskilling their federal workforce, with substantial budgets allocated in 2024 for training in emerging technologies such as artificial intelligence and cloud computing. Carahsoft plays a crucial role here, not just by supplying the technology but also by offering comprehensive training modules and support resources that bridge these skill gaps and ensure successful implementation.

Demographic shifts, like the increasing diversity in age and language across the United States, directly impact the demand for government digital services. For instance, the U.S. Census Bureau reported that in 2023, over 67 million Americans spoke a language other than English at home, highlighting a critical need for multilingual accessibility in government platforms. This necessitates inclusive technology solutions that cater to a broad spectrum of citizen needs, ensuring all individuals can access essential information and services.

Carahsoft plays a role in addressing these evolving citizen requirements by supporting modernization efforts that enhance accessibility. Their partnerships often focus on providing solutions that leverage advanced technologies, such as AI-powered chatbots and virtual assistants. These tools are designed to offer readily available information and streamline citizen engagement, making government services more efficient and user-friendly for an increasingly diverse populace.

Public Perception of Government Technology

Public perception of government technology significantly shapes policy and funding decisions. When citizens view government IT as inefficient, insecure, or lacking transparency, it can lead to reduced trust and a demand for better solutions. For instance, a 2023 Pew Research Center survey indicated that a majority of Americans still express concerns about the security of their personal data when interacting with government digital services.

High-profile cyber incidents, such as data breaches affecting federal agencies, can further erode public confidence, amplifying the call for robust and secure IT infrastructure. This public pressure often translates into legislative action and increased budgetary allocation towards cybersecurity and efficient digital service delivery. The U.S. government's Cybersecurity Executive Order 14028, issued in 2021, reflects this growing emphasis on secure federal technology.

Carahsoft's business model directly addresses these public concerns by specializing in providing secure, compliant, and efficient technology solutions to government entities. Their partnerships with leading IT vendors offering advanced cybersecurity, cloud computing, and data management capabilities position them to meet the evolving demands for trustworthy government technology. In 2023, Carahsoft reported significant growth, partly driven by agencies seeking to upgrade their IT systems to meet stringent security and performance standards.

- Public Trust: Over 60% of Americans express concerns about government data security (Pew Research, 2023).

- Cybersecurity Focus: Executive Order 14028 mandates enhanced federal cybersecurity measures.

- Market Demand: Carahsoft's growth in 2023 highlights agency investment in secure and efficient IT.

- Carahsoft's Role: Facilitates access to compliant and advanced technology solutions for government.

Remote Work and Hybrid Models

The enduring trend of remote and hybrid work arrangements within government bodies significantly fuels the need for advanced collaborative tools, robust secure access, and scalable cloud-based infrastructure. This shift is reshaping how public sector employees operate and interact.

Carahsoft, a key government IT solutions aggregator, is well-positioned to capitalize on this sociological factor. Their curated portfolio directly addresses the requirements of a distributed workforce, offering secure IT solutions essential for enabling telework and ensuring the continuity of public sector operations. For instance, the U.S. government's continued investment in digital transformation initiatives, projected to reach billions in 2024 and 2025, underscores this demand.

- Increased Demand for Collaboration Software: Government agencies are actively seeking platforms that facilitate seamless communication and project management for remote teams.

- Focus on Cybersecurity for Remote Access: Ensuring secure connections and data protection for employees working outside traditional office environments is paramount.

- Cloud Adoption for Flexibility: Agencies are increasingly migrating services to the cloud to support flexible work models and enhance accessibility.

- Employee Productivity and Well-being: Societal expectations and the proven benefits of hybrid models are pushing agencies to adopt policies that support these arrangements.

Public demand for accessible, user-friendly digital government services continues to rise, with a significant majority of Americans expecting online options for most government interactions. This trend, highlighted by a 2024 Pew Research survey showing 73% of Americans favoring online government services, directly influences IT modernization efforts and the adoption of customer experience technologies.

The evolving digital literacy of the government workforce necessitates intuitive IT solutions and robust training. Federal agencies are investing heavily in upskilling employees in areas like AI and cloud computing, with significant training budgets allocated for 2024 to bridge skill gaps and ensure effective technology implementation.

Demographic shifts, including a growing non-English speaking population, underscore the need for multilingual and inclusive government digital services. Over 67 million Americans spoke a language other than English at home in 2023, emphasizing the demand for accessible platforms and AI-powered tools to serve a diverse populace.

Public trust in government technology is heavily influenced by perceptions of security and efficiency. Concerns about data security, as noted in a 2023 Pew Research survey where over 60% of Americans expressed worries, coupled with high-profile cyber incidents, drive legislative action and increased investment in cybersecurity measures, as exemplified by Executive Order 14028.

Technological factors

The rapid ascent of Artificial Intelligence (AI), especially generative AI, is fundamentally reshaping how government agencies operate, marking it as a significant investment frontier. Many agencies are prioritizing the secure implementation of AI to streamline processes, boost efficiency, and elevate citizen-facing services.

For instance, the U.S. government has earmarked substantial funding for AI initiatives. In 2024, federal agencies are projected to spend billions on AI technologies, with a significant portion directed towards generative AI solutions aimed at enhancing data analysis and automating tasks. Carahsoft is instrumental in this transition, acting as a crucial bridge between government entities and leading AI providers, thereby fostering the responsible integration of these transformative technologies.

Cloud computing is a critical driver for federal agencies, with a strong push to accelerate adoption and refine spending. This strategic imperative means agencies are increasingly looking for solutions that can seamlessly integrate across different cloud environments.

The trend towards multi-cloud strategies is prominent, necessitating technology providers to offer flexibility, robust scalability, and stringent security measures. For instance, the U.S. government's cloud spending was projected to reach $100 billion by 2025, highlighting the scale of this transition.

Carahsoft's role in this landscape is significant, particularly through its broad portfolio of FedRAMP-authorized cloud solutions. Their ability to support diverse cloud technologies directly addresses the government's demand for secure, adaptable, and cost-effective cloud infrastructure.

The cybersecurity landscape is constantly shifting, pushing for advanced solutions like Zero Trust architectures. This approach assumes no user or device can be trusted by default, requiring strict verification for every access attempt. This is crucial for protecting sensitive government data and critical infrastructure from escalating threats.

Government agencies are actively bolstering their defenses. In 2024, federal agencies are prioritizing secure software supply chains and robust identity management systems, aligning with mandates to enhance data protection and national resilience. These efforts are directly driven by the increasing sophistication of cyberattacks.

Carahsoft plays a vital role in this ecosystem by providing essential cybersecurity technologies to government entities. Their offerings support these critical mandates, enabling agencies to implement advanced security controls and strengthen their overall resilience strategies against emerging cyber threats.

5G and Advanced Connectivity

The widespread adoption of 5G and advanced wireless technologies is a significant technological driver, particularly for government agencies. These advancements are revolutionizing how public sector entities communicate and operate, especially in areas like mission-critical services and the development of autonomous systems. For instance, by mid-2024, 5G network coverage is expected to reach over 70% of major urban areas in the US, enabling faster data transfer and lower latency crucial for real-time applications.

Carahsoft is strategically positioned to capitalize on this trend by facilitating access to these cutting-edge solutions for government clients. Their partnerships with leading technology providers allow them to offer integrated 5G and edge computing capabilities. This directly supports government modernization efforts, improving operational efficiency and communication resilience. The global edge computing market, which complements 5G, was projected to reach over $60 billion by 2024, highlighting the substantial opportunity.

The implications for Carahsoft include:

- Enhanced Public Sector Operations: 5G enables faster, more reliable communications for emergency services, defense, and public safety, improving response times and situational awareness.

- Autonomous Systems Enablement: The low latency and high bandwidth of 5G are critical for the deployment and management of autonomous vehicles, drones, and other connected systems used by government agencies.

- Edge Computing Integration: Carahsoft's role in bringing edge computing solutions alongside 5G allows for localized data processing, reducing reliance on centralized data centers and improving the performance of real-time applications.

- Market Growth Opportunities: The ongoing expansion of 5G infrastructure and its integration into government IT strategies presents a significant growth avenue for Carahsoft and its technology partners.

Data Analytics and Digital Transformation Tools

Government agencies are awash in data, and the sheer volume is only growing. This surge necessitates sophisticated data analytics and digital transformation tools to make sense of it all. For instance, in 2024, federal agencies continued to invest heavily in cloud computing and data management solutions, with a significant portion of IT budgets allocated to these areas.

These tools are crucial for improving how government operates. By leveraging data and artificial intelligence (AI), agencies can streamline processes, make more informed decisions, and offer greater transparency to the public. A 2025 report indicated that agencies using advanced analytics saw an average of 15% improvement in operational efficiency in key areas.

Carahsoft plays a vital role by offering solutions that help these agencies not only organize their vast digital information but also extract meaningful insights. This enables better resource allocation and more effective service delivery.

- Data Volume Growth: Government data generation is projected to increase by over 20% annually through 2026, demanding robust analytics.

- AI Adoption: A 2025 survey found that 60% of federal agencies are actively exploring or implementing AI for decision support.

- Efficiency Gains: Early adopters of digital transformation tools reported an average 10% reduction in processing times for citizen requests.

- Carahsoft's Role: The company provides access to leading platforms for data warehousing, AI-driven insights, and cybersecurity to protect this sensitive information.

The technological landscape is rapidly evolving, with advancements like Artificial Intelligence (AI) and cloud computing becoming central to government modernization efforts. Agencies are increasingly investing in these areas to improve efficiency and citizen services. For example, federal agencies are projected to spend billions on AI in 2024, with a focus on generative AI for task automation and data analysis.

The push towards multi-cloud strategies and enhanced cybersecurity, including Zero Trust architectures, is also a significant trend. By mid-2024, 5G network coverage is expected to reach over 70% of major US urban areas, enabling faster communications and supporting autonomous systems. Carahsoft plays a crucial role by providing access to these advanced, secure technologies for government clients, facilitating their digital transformation.

Government agencies are grappling with massive data growth, driving demand for sophisticated analytics and AI tools. A 2025 report indicated that agencies using advanced analytics saw an average 15% improvement in operational efficiency. Carahsoft's offerings support agencies in managing this data and extracting valuable insights, with a 2025 survey finding 60% of federal agencies exploring AI for decision support.

| Technology Trend | 2024/2025 Projection/Data | Impact on Government Operations | Carahsoft's Role |

| AI & Generative AI | Billions in federal spending projected for 2024 | Streamlining processes, enhancing data analysis, automation | Facilitates secure implementation of AI solutions |

| Cloud Computing | US government cloud spending projected to reach $100 billion by 2025 | Accelerated adoption, multi-cloud strategies, scalability | Provides FedRAMP-authorized cloud solutions |

| Cybersecurity (Zero Trust) | Federal agencies prioritizing secure software supply chains in 2024 | Protecting sensitive data, enhancing resilience against threats | Offers advanced cybersecurity technologies |

| 5G & Edge Computing | 5G coverage expected in over 70% of major US urban areas by mid-2024 | Revolutionizing communication, enabling autonomous systems | Facilitates access to 5G and edge computing capabilities |

| Data Analytics & Digital Transformation | Average 15% operational efficiency improvement reported by analytics users (2025 report) | Making sense of data, improving decision-making, resource allocation | Provides platforms for data warehousing and AI insights |

Legal factors

Carahsoft's business is significantly shaped by the Federal Acquisition Regulations (FAR) and other procurement laws that govern how government bodies purchase IT solutions. These regulations are crucial for Carahsoft's role as a major reseller of technology to the public sector.

New regulatory proposals, such as the FAR CUI Rule, are introducing stricter cybersecurity, training, and incident reporting mandates for all federal contractors. For instance, the CUI rule aims to standardize the handling of controlled unclassified information, impacting how Carahsoft and its partners manage sensitive data.

Carahsoft must continuously adapt its operations and ensure its partners adhere to these evolving legal frameworks. Compliance with these changes is vital to maintaining its position as a trusted government IT solutions provider.

Navigating the complex landscape of government data security is paramount for Carahsoft. Regulations such as the Federal Information Security Management Act (FISMA), Federal Risk and Authorization Management Program (FedRAMP), and the Cybersecurity Maturity Model Certification (CMMC) dictate stringent requirements for protecting sensitive information. Compliance ensures that Carahsoft and its technology partners meet the high bar set for government systems, fostering trust and enabling participation in federal contracts.

These frameworks are not merely bureaucratic hurdles; they are essential for safeguarding national security and citizen data. For instance, FedRAMP authorization, a rigorous process involving security assessments and continuous monitoring, is a prerequisite for many cloud service providers seeking to do business with federal agencies. Carahsoft's role in guiding vendors through these certifications is crucial, as evidenced by the growing number of FedRAMP-authorized solutions available through their channels.

Navigating intellectual property and software licensing is critical for Carahsoft in the IT sector. As a master aggregator, Carahsoft must meticulously manage diverse vendor agreements, ensuring government clients receive compliant solutions. This involves understanding complex licensing terms to avoid legal pitfalls.

The General Services Administration (GSA) is actively working to standardize software contract terms. This initiative, ongoing into 2024 and 2025, aims to enhance license flexibility for federal agencies, potentially streamlining procurement and usage for solutions Carahsoft distributes.

Supply Chain Security Regulations

Heightened concerns regarding the security of IT supply chains, particularly within government procurement, have spurred the development of new regulations and increased oversight. For instance, the Biden administration's Executive Order 14036, issued in 2021, emphasizes the need for a secure and resilient supply chain, impacting how federal agencies acquire technology. This has led to interagency efforts to evaluate and mitigate significant supply chain risks associated with information and communications technology (ICT).

Carahurst is positioned to assist government agencies in navigating these complex requirements. By ensuring the integrity of software and hardware supply chains, Carahurst addresses the critical need for secure technology solutions. The company's role is vital in helping federal entities comply with evolving security mandates, such as those stemming from the Secure Software Development Framework (SSDF) initiative, which aims to enhance software security throughout its lifecycle.

Key aspects of these evolving regulations include:

- Mandated risk assessments: Federal agencies are increasingly required to conduct thorough risk assessments of their ICT supply chains.

- Software bill of materials (SBOM): The demand for transparency through SBOMs is growing, allowing for better understanding of software components and their origins.

- Vendor vetting and compliance: Stricter protocols are being implemented for vetting vendors and ensuring their compliance with security standards.

- Resilience and mitigation strategies: Regulations focus on building resilience against disruptions and developing strategies to mitigate identified supply chain vulnerabilities.

International Cybersecurity Laws and Directives

While Carahsoft's core business centers on the U.S. public sector, international cybersecurity regulations like the EU's NIS2 Directive, DORA, and the Cyber Resilience Act (CRA) can still have a ripple effect. These directives, aiming to bolster digital resilience across member states, often set high benchmarks for security and data protection. For instance, NIS2, which came into effect in January 2023, expands the scope of cybersecurity requirements to a broader range of critical entities.

These evolving international standards can indirectly influence Carahsoft's global vendor partners. As vendors adapt their products and services to meet stringent extraterritorial requirements, these enhanced features and best practices may eventually align with or even exceed emerging U.S. government cybersecurity mandates. This creates a dynamic where international compliance can proactively shape the product landscape relevant to U.S. federal agencies.

- NIS2 Directive: Expanded scope to cover more sectors, increasing compliance demands for vendors operating in or serving the EU.

- DORA (Digital Operational Resilience Act): Focuses on the resilience of financial entities, impacting technology providers in that sector.

- CRA (Cyber Resilience Act): Sets cybersecurity requirements for products with digital elements, potentially influencing the design of software and hardware offered by Carahsoft's partners.

Carahsoft's operations are heavily influenced by government procurement laws like the Federal Acquisition Regulations (FAR). These rules dictate how federal agencies acquire IT solutions, making compliance paramount for Carahsoft as a major reseller. The increasing focus on cybersecurity, exemplified by the FAR CUI Rule, mandates stricter data handling and incident reporting for contractors, impacting Carahsoft and its partners.

New mandates like the CMMC are also shaping the landscape, requiring specific cybersecurity practices for defense contractors. For instance, CMMC Level 1 compliance, which became a requirement for many DoD contracts in late 2023 and early 2024, necessitates basic cybersecurity hygiene. Carahsoft's ability to offer compliant solutions is key to its continued success in this market.

The legal framework surrounding government IT procurement is constantly evolving, with a significant emphasis on supply chain security. Executive Order 14036, focusing on supply chain resilience, has spurred initiatives like the Secure Software Development Framework (SSDF). This means vendors must demonstrate robust security practices throughout their software development lifecycle, a critical factor for Carahsoft's vendor vetting process. The increasing demand for Software Bills of Materials (SBOMs) in 2024 further enhances transparency and risk assessment.

International regulations like the EU's NIS2 Directive and the Cyber Resilience Act (CRA) are also indirectly impacting Carahsoft. As vendors adapt to these extraterritorial requirements, their enhanced security features often align with or exceed U.S. government mandates, creating a proactive compliance environment. For example, the NIS2 Directive, which expanded its scope in January 2023, sets a higher bar for cybersecurity across more sectors.

Environmental factors

Government agencies are increasingly prioritizing sustainability in their IT procurement, with a significant push towards 'Green IT' initiatives. This trend is driven by a desire to reduce energy consumption and minimize carbon footprints across federal operations. For instance, the Biden-Harris Administration's Federal Sustainability Plan aims for a 100% clean energy federal government by 2030, directly impacting IT purchasing decisions.

Agencies are actively seeking IT solutions that demonstrate energy efficiency and support broader environmental goals, influencing vendor selection. This includes a growing preference for hardware with reduced power consumption and cloud services that consolidate physical data centers, thereby lowering environmental impact. Carahsoft can leverage this by showcasing IT solutions from its partners that align with these sustainability mandates and highlight vendors with robust environmental, social, and governance (ESG) commitments.

Government mandates for energy efficiency are increasingly shaping the procurement of IT infrastructure, including data center hardware and cloud services. For instance, the U.S. government's Federal Data Center Consolidation Initiative and subsequent energy efficiency targets, such as those outlined by the Department of Energy, directly influence agency spending. This pushes demand towards technologies that minimize power consumption, impacting what Carahsoft's partners can offer.

This trend drives demand for more efficient technologies, potentially influencing Carahsoft's product catalog and strategic partnerships. As agencies prioritize reducing their carbon footprint and operational expenses, solutions offering higher performance per watt become more attractive. Carahsoft can capitalize on this by highlighting and promoting energy-efficient solutions from its vendor ecosystem to environmentally conscious government clients.

The escalating generation of electronic waste, or e-waste, poses significant environmental challenges and drives stricter regulations around the disposal and recycling of IT hardware. Globally, e-waste is projected to reach 74.7 million metric tons by 2030, a substantial increase from 53.6 million metric tons in 2019, according to the Global E-waste Monitor 2020. While Carahsoft's core business is IT procurement, understanding these environmental pressures is crucial.

Carahsoft, by facilitating the acquisition of IT solutions, indirectly influences the entire IT product lifecycle. Aligning with government mandates and promoting vendors with robust e-waste management and circular economy principles can enhance Carahsoft's standing. This could involve highlighting partners who offer certified recycling services or implement product take-back programs, thereby supporting responsible end-of-life solutions for government agencies.

Climate Action Plans of Government Agencies

Many government agencies are actively developing and implementing comprehensive climate action plans. These plans often include specific targets for reducing greenhouse gas emissions stemming from their IT operations, influencing procurement decisions.

This focus on environmental impact can translate into a preference for cloud-based solutions over traditional on-premise infrastructure, as cloud services often offer greater energy efficiency. Agencies are also increasingly looking to partner with vendors who can demonstrate a clear commitment to sustainability and reducing their environmental footprint.

For instance, the U.S. General Services Administration (GSA) aims to reduce federal government emissions by 50% by 2030, a target that directly impacts IT procurement. Carahsoft's portfolio, which includes solutions supporting remote work, cloud migration, and optimized data center operations, directly aligns with these governmental climate objectives. By helping agencies reduce their physical IT footprint and associated energy consumption, Carahsoft can position itself as a key partner in achieving these critical environmental goals.

- Government IT Emissions Reduction Targets: Many agencies are working towards specific emission reduction goals, with some aiming for substantial cuts by 2030.

- Cloud Adoption for Sustainability: Climate action plans often encourage migration to cloud environments due to their potential for energy efficiency and reduced physical infrastructure.

- Vendor Sustainability Commitments: Procurement processes are increasingly factoring in a vendor's demonstrated efforts to minimize their environmental impact.

Supply Chain Environmental Impact

The environmental impact of the IT supply chain, from the raw materials used in manufacturing to the logistics of delivery, is under increasing scrutiny. This includes everything from the energy consumed during production to the carbon emissions generated by shipping. For instance, the electronics industry's carbon footprint is substantial, with manufacturing processes alone accounting for a significant portion of global emissions.

While Carahsoft operates as an aggregator, its awareness of its partners' environmental practices is becoming crucial, particularly for government procurement. Agencies are increasingly prioritizing vendors with demonstrable commitments to ethical sourcing and sustainable manufacturing processes. A 2024 survey indicated that over 60% of government IT decision-makers consider a vendor's sustainability practices when making purchasing choices.

Carahsoft's position as a key facilitator in the government IT ecosystem means that partnering with technology vendors who actively reduce their environmental footprint is advantageous. This includes vendors who invest in renewable energy for data centers, implement eco-friendly packaging, and prioritize energy-efficient product designs. For example, some leading hardware manufacturers have set ambitious targets for reducing e-waste and increasing the use of recycled materials in their products by 2025.

- Growing Government Demand for Sustainable IT: Over 60% of government IT decision-makers factor sustainability into procurement.

- IT Supply Chain's Carbon Footprint: Manufacturing and logistics contribute significantly to global emissions.

- Vendor Responsibility: Carahsoft's partners are increasingly expected to demonstrate ethical sourcing and sustainable manufacturing.

- Industry Targets: Many tech companies are aiming to reduce e-waste and increase recycled material content by 2025.

Government agencies are increasingly prioritizing sustainability, with a strong push towards 'Green IT' to reduce energy consumption and carbon footprints. For instance, the Biden-Harris Administration's Federal Sustainability Plan targets a 100% clean energy federal government by 2030, directly influencing IT procurement decisions and favoring energy-efficient solutions.

This focus drives demand for technologies that minimize power consumption, impacting the types of IT infrastructure and cloud services agencies procure. Carahsoft can leverage this by showcasing IT solutions from its partners that align with these sustainability mandates and highlight vendors with robust environmental, social, and governance (ESG) commitments.

The escalating generation of electronic waste (e-waste) is a significant environmental challenge, leading to stricter regulations on IT hardware disposal and recycling. Globally, e-waste is projected to reach 74.7 million metric tons by 2030, underscoring the need for responsible end-of-life solutions.

Carahsoft's role in IT procurement means it can influence the IT product lifecycle by promoting partners with strong e-waste management and circular economy principles, such as those offering certified recycling or take-back programs.

| Environmental Factor | Impact on Government IT Procurement | Carahsoft Opportunity |

|---|---|---|

| Sustainability Mandates | Agencies prioritize 'Green IT' and clean energy, aiming for reduced carbon footprints. | Showcase energy-efficient solutions and ESG-committed partners. |

| Energy Efficiency | Demand for lower power consumption in hardware and cloud services. | Highlight vendors with high performance-per-watt solutions. |

| E-waste Management | Increasing regulations on disposal and recycling of IT hardware. | Promote partners with certified recycling and take-back programs. |

| Climate Action Plans | Agencies setting emission reduction targets, favoring cloud and efficient IT. | Position as a partner in achieving climate goals through IT solutions. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Carahsoft is built upon a robust foundation of data from leading government agencies, reputable industry associations, and comprehensive market research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.