Carahsoft Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carahsoft Bundle

Explore the intricate workings of Carahsoft's market dominance with our comprehensive Business Model Canvas. This detailed breakdown illuminates their strategic partnerships, customer segments, and revenue streams, offering a clear roadmap to their success.

Unlock the full strategic blueprint behind Carahsoft's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Carahsoft's key partnerships with technology vendors are foundational to its business model, enabling it to offer a broad spectrum of IT solutions to government agencies. These vendors, ranging from major software developers to hardware manufacturers and cloud service providers, are essential for Carahsoft's ability to curate a comprehensive product catalog.

These vendor relationships are mutually beneficial; while Carahsoft leverages their offerings, the vendors gain a specialized channel to the complex and lucrative public sector market. In 2023, Carahsoft reported facilitating over $16 billion in government IT sales, a testament to the strength and reach of these vendor partnerships.

Carahsoft's success is significantly amplified by its extensive network of value-added resellers (VARs) and system integrators (SIs). These partners are crucial in extending Carahsoft's market presence and delivering complex solutions to government and enterprise clients.

In 2024, Carahsoft continued to foster these relationships, enabling VARs and SIs to utilize Carahsoft's established contract vehicles and master aggregator status. This allows them to efficiently procure and implement technology solutions, streamlining the procurement process for end-users.

This strategic collaboration not only expands Carahsoft's customer reach but also bolsters its solution delivery capabilities. By leveraging the specialized expertise of SIs and the market access of VARs, Carahsoft ensures that its technology offerings are effectively deployed and integrated into client environments.

Government agencies, while primarily customers for Carahsoft, also function as indirect partners. This partnership stems from the long-term, strategic nature of their engagements and the critical need for compliance within the public sector. Carahsoft actively collaborates with these agencies to deeply understand their changing IT requirements, ensuring vendor solutions are precisely aligned to meet public sector demands.

This close working relationship allows Carahsoft to aggregate and tailor vendor offerings to meet the specific, often complex, needs of government entities. For instance, in 2024, Carahsoft continued its role in facilitating the adoption of cloud solutions and cybersecurity tools across various federal departments, a testament to these strategic, albeit indirect, partnerships.

Contract Vehicle Holders

Carahsoft's business model heavily relies on its relationships with Contract Vehicle Holders, which are crucial for navigating the government procurement landscape. These partnerships, often involving entities holding General Services Administration (GSA) Schedules or specific agency contracts, streamline the sales process for public sector clients.

By leveraging these pre-negotiated contract vehicles, Carahsoft can offer government agencies a faster, more compliant way to acquire technology solutions. This access directly translates into accelerated sales cycles, as the foundational elements of a purchase are already in place. For instance, in 2024, Carahsoft continued to expand its portfolio of government-wide acquisition contracts (GWACs) and other contract vehicles, facilitating billions in government IT spending.

- GSA Schedules: Carahsoft holds numerous GSA Schedules, allowing federal agencies to purchase services and products directly.

- Agency-Specific Contracts: Partnerships often include agreements tailored to the unique procurement needs of specific government departments.

- Streamlined Procurement: These vehicles reduce administrative burden and compliance hurdles for government buyers.

- Accelerated Sales: Access to established contracts significantly shortens the time from initial contact to final sale.

Industry Associations and Alliances

Engaging with key industry associations and alliances is crucial for Carahsoft to maintain its position as a master aggregator. These relationships provide invaluable insights into market trends, upcoming regulatory shifts, and the latest technological advancements impacting the government IT sector. For instance, active participation in groups like the ACT-IAC (American Council for Technology and Industry Advisory Council) allows Carahsoft to directly influence and understand policy discussions that shape procurement landscapes.

These affiliations also serve as powerful networking conduits, fostering connections with both technology vendors and government agencies. By being an active member, Carahsoft enhances its credibility and visibility within the government IT ecosystem, reinforcing its reputation as a trusted partner. This strategic engagement is particularly vital in a dynamic market where understanding agency needs and vendor capabilities is paramount.

Furthermore, partnerships with these bodies contribute significantly to Carahsoft's thought leadership and market intelligence. This allows them to proactively identify opportunities and challenges, thereby supporting their role in aggregating solutions for government clients. For example, insights gained from industry forums often inform Carahsoft's strategic decisions regarding which emerging technologies to prioritize and how to best present them to the public sector.

- Industry Association Engagement: Carahsoft's participation in associations like ACT-IAC and AFCEA (Armed Forces Communications and Electronics Association) provides direct access to market intelligence and policy influencers.

- Networking and Reputation: These alliances facilitate crucial networking opportunities, enhancing Carahsoft's standing as a key intermediary in the government IT procurement process.

- Market Trend and Technology Insights: Staying abreast of market trends and emerging technologies through these partnerships is fundamental to Carahsoft's strategy as a master aggregator, ensuring they offer relevant and cutting-edge solutions.

Carahsoft's key partnerships are the bedrock of its success, primarily with technology vendors who provide the products it distributes. These vendor relationships are crucial for its master aggregator role, allowing it to offer a vast catalog of IT solutions. In 2023, Carahsoft facilitated over $16 billion in government IT sales, highlighting the significant impact of these vendor alliances.

Furthermore, Carahsoft's network of value-added resellers (VARs) and system integrators (SIs) extends its market reach and enhances solution delivery capabilities. These partners leverage Carahsoft's established contracts to efficiently serve government clients. In 2024, this collaborative approach continued to streamline technology procurement for public sector entities.

Carahsoft also strategically partners with contract vehicle holders, such as those with GSA Schedules, to navigate government procurement. These partnerships accelerate sales by providing compliant purchasing pathways. By expanding its portfolio of government-wide acquisition contracts (GWACs) in 2024, Carahsoft further solidified its position in facilitating billions in government IT spending.

Engaging with industry associations like ACT-IAC and AFCEA provides Carahsoft with vital market intelligence and policy insights. These affiliations enhance its credibility and networking within the government IT sector, enabling it to stay ahead of market trends and technological advancements. This strategic engagement is key to its role as a master aggregator.

| Type of Partner | Role in Carahsoft's Model | Key Benefit | 2023/2024 Data Point |

| Technology Vendors | Product/Solution Providers | Comprehensive IT catalog | Facilitated $16B+ in Gov IT sales (2023) |

| VARs & SIs | Market Reach & Solution Delivery | Extended market presence, specialized expertise | Enabled efficient procurement in 2024 |

| Contract Vehicle Holders | Procurement Navigation | Streamlined, compliant sales process | Expanded GWAC portfolio (2024) |

| Industry Associations | Market Intelligence & Networking | Policy insights, trend identification | Active participation in ACT-IAC, AFCEA |

What is included in the product

A detailed Carahsoft Business Model Canvas outlining its unique government contracting approach, focusing on its role as a reseller and aggregator for technology solutions.

This model emphasizes Carahsoft's key partners, customer segments within the public sector, and the value proposition of simplifying technology procurement for government agencies.

Carahsoft's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex government IT solutions, simplifying procurement for agencies.

Activities

Carahsoft's key activity centers on expertly managing a vast portfolio of government contract vehicles, including GSA Schedules and various agency-specific contracts. This meticulous management ensures strict compliance and simplifies the complex procurement process for both vendors and government agencies.

Their proficiency in navigating and administering these contracts is a critical competitive advantage, enabling efficient and effective government technology transactions. For instance, in fiscal year 2023, Carahsoft reported over $16 billion in revenue, a testament to their success in managing these complex governmental relationships.

Carahsoft's core activity is acting as a master aggregator, bringing together a wide array of IT solutions from many different technology providers. They focus on carefully selecting and consolidating these offerings to make them readily available. This process includes bringing new technologies into their portfolio and managing the supply chain to ensure smooth delivery to their customers.

By consolidating these diverse IT products and services, Carahsoft significantly streamlines the procurement journey for government agencies. This aggregation allows these entities to acquire a broad spectrum of technology needs from a single, trusted partner, simplifying complex purchasing processes and saving valuable time and resources.

In 2024, Carahsoft continued to solidify its position as a leading government IT solutions provider, distributing a vast portfolio of products and services. Their aggregation model is crucial for government agencies looking to access cutting-edge technology efficiently, a strategy that has proven effective in navigating complex procurement landscapes.

Carahsoft's Sales and Marketing Support is a cornerstone of its value proposition, offering technology vendors a specialized pathway into the government, education, and healthcare markets. This support encompasses crucial activities like lead generation, collaborative marketing initiatives, and active participation in industry events, all designed to connect vendors with their target public sector audiences. For instance, in 2023, Carahsoft's extensive outreach efforts directly contributed to over $1.5 billion in government contract awards for its partners, demonstrating the tangible impact of their specialized market access and sales engagement strategies.

Public Sector Expertise and Consulting

Carahsoft's key activities include offering specialized expertise in public sector IT procurement and compliance. They guide vendors through market entry and advise agencies on adopting the best solutions. This consulting aspect elevates Carahsoft beyond a simple distributor, establishing them as a valuable partner.

This advisory role is critical for navigating the complex government contracting landscape. For instance, in 2024, federal IT spending was projected to reach over $140 billion, with a significant portion allocated to software and services. Carahsoft’s ability to streamline procurement processes for both vendors seeking to access this market and agencies seeking efficient acquisition is a core function.

- Expert Guidance: Carahsoft provides deep knowledge of government contracting regulations and best practices.

- Market Access: They help technology vendors understand and penetrate the public sector market.

- Solution Adoption: Carahsoft assists government agencies in identifying and procuring the most suitable IT solutions.

- Compliance Assurance: Their expertise ensures adherence to federal procurement rules and standards.

Logistics and Fulfillment

Carahsoft's logistics and fulfillment operations are central to its business model, focusing on the efficient delivery of IT products and services to government clients. This involves meticulous order processing, secure shipping, and ensuring the timely arrival of often complex technology solutions. For instance, in 2024, Carahsoft reported handling millions of transactions annually, underscoring the scale of their fulfillment capabilities.

The company's expertise in managing the supply chain for government IT ensures that agencies receive the necessary equipment and software without delay. This streamlined process is crucial for supporting large-scale government IT deployments and maintaining high levels of customer satisfaction. Their ability to navigate government procurement regulations adds another layer of complexity to their logistics, which they manage effectively.

- Order Processing: Streamlining the intake and validation of government IT orders.

- Inventory Management: Maintaining optimal stock levels for a wide range of IT products.

- Shipping and Delivery: Ensuring secure and timely dispatch and receipt of goods to government sites.

- Reverse Logistics: Managing returns and exchanges efficiently.

Carahsoft's key activities revolve around its role as a master aggregator and expert navigator of government IT procurement. They meticulously manage a vast portfolio of government contract vehicles, simplifying the acquisition process for agencies and vendors alike. This includes extensive sales and marketing support, offering specialized market access and compliance assurance for technology partners aiming to serve the public sector.

Their operations are further defined by efficient logistics and fulfillment, ensuring the timely and secure delivery of IT solutions. Carahsoft's expertise in public sector IT procurement and compliance acts as a critical advisory function, guiding both vendors and agencies through complex regulations and solution adoption.

| Key Activity | Description | Impact/Data Point (2023/2024) |

|---|---|---|

| Contract Vehicle Management | Expertly managing GSA Schedules and agency-specific contracts. | Facilitated over $16 billion in revenue in FY2023. |

| Aggregation & Distribution | Consolidating and making a wide array of IT solutions readily available. | Streamlines procurement for government agencies seeking diverse technology needs. |

| Sales & Marketing Support | Providing specialized market access, lead generation, and collaborative marketing. | Contributed to over $1.5 billion in government contract awards for partners in 2023. |

| Procurement & Compliance Expertise | Guiding vendors and agencies through complex government contracting. | Assists in navigating a federal IT market projected to exceed $140 billion in 2024. |

| Logistics & Fulfillment | Efficient processing, secure shipping, and timely delivery of IT products. | Handles millions of transactions annually, ensuring smooth IT deployments. |

Delivered as Displayed

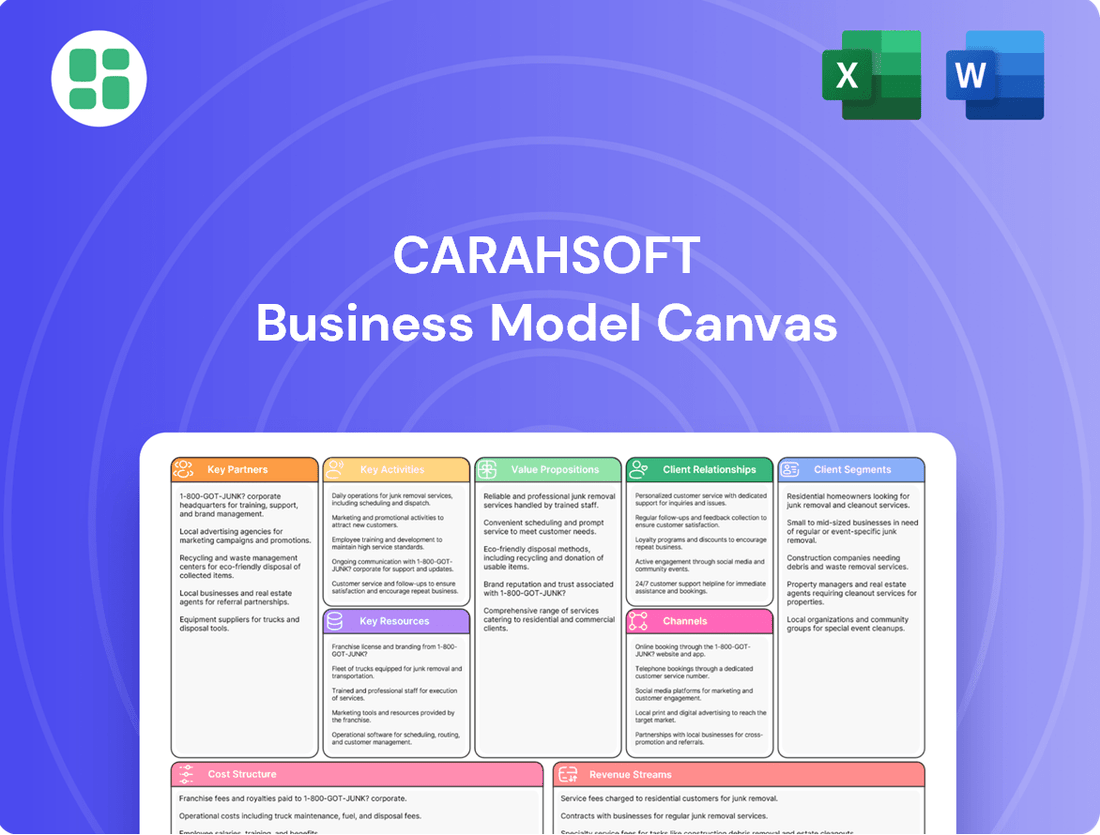

Business Model Canvas

The Carahsoft Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This ensures full transparency and allows you to see the exact structure, content, and professional formatting before committing. Upon completion of your order, you will gain immediate access to this complete, ready-to-use Business Model Canvas, identical to the preview provided.

Resources

Carahsoft's extensive portfolio of government contract vehicles, including GSA Schedules, SEWP, and ITES-3S, is a cornerstone of its business model. These pre-negotiated agreements offer government agencies a swift and compliant route to acquire technology solutions, significantly simplifying the procurement process.

These contract vehicles act as a substantial competitive advantage, presenting a high barrier to entry for other companies seeking to serve the public sector. In 2023 alone, Carahsoft facilitated over $16 billion in sales through these channels, underscoring their critical role in enabling billions in revenue and market access.

Carahsoft's extensive vendor and partner network is a foundational element of its business model, acting as a significant intellectual and relational asset. This vast ecosystem of technology providers, resellers, and system integrators is crucial for delivering a broad spectrum of IT solutions to the public sector.

These deep-rooted relationships enable Carahsoft to offer a comprehensive suite of products and services, effectively extending its market reach and competitive advantage. The sheer breadth and depth of this network are exceptionally difficult for competitors to replicate, creating a strong competitive moat.

For instance, in 2024, Carahsoft continued to expand its partnerships, representing over 1,000 technology vendors, including major players like Microsoft, Amazon Web Services, and Google Cloud. This allows them to provide government agencies with access to cutting-edge solutions across cloud computing, cybersecurity, and data analytics.

Carahsoft's public sector IT expertise is a cornerstone of its business model. This collective knowledge, honed through years of experience in government IT procurement and understanding agency-specific needs, allows them to offer unparalleled guidance. For instance, their team's familiarity with the nuances of the Federal Acquisition Regulation (FAR) and the specific requirements of agencies like the Department of Defense and the General Services Administration (GSA) is critical for navigating these complex markets.

This deep understanding of government regulations and agency needs translates directly into Carahsoft's ability to provide specialized advice and effectively manage intricate sales cycles. Their human capital, therefore, represents a significant competitive advantage, enabling them to bridge the gap between technology providers and public sector clients. In 2023, Carahsoft reported over $16 billion in sales, a testament to their proficiency in this specialized area.

Robust IT Infrastructure and Platforms

Carahsoft’s robust IT infrastructure is the backbone of its operations, enabling efficient management of complex government procurement processes. This includes advanced platforms for order processing, inventory tracking, and customer relationship management (CRM). For instance, in 2023, Carahsoft processed over $16 billion in sales, a testament to the scalability and reliability of its IT systems.

These technological assets are crucial for data analytics, providing insights that drive strategic decisions and support scalable growth. Marketing automation tools further enhance customer engagement and streamline outreach efforts. By facilitating seamless interactions across the entire value chain, from vendor partnerships to end-user delivery, Carahsoft ensures operational excellence.

- Advanced IT Systems: Crucial for managing high-volume government contracts and ensuring data integrity.

- Scalable Platforms: Support growth and efficient processing of over $16 billion in sales annually.

- CRM and Marketing Automation: Enhance customer engagement and streamline business development efforts.

- Value Chain Integration: Facilitate seamless operations from vendor sourcing to end-user delivery.

Financial Capital and Credit Lines

Carahsoft's business model hinges on robust financial capital and access to substantial credit lines. This financial muscle is crucial for navigating the complexities of large-scale government contracts, which often involve extended payment cycles. Their ability to manage inventory and invest in growth initiatives is directly tied to this financial strength.

The company's financial capacity enables it to effectively act as a master aggregator. This means they can absorb the financial demands of managing multiple vendors and fulfilling diverse government needs, especially when dealing with payment terms that can stretch for 30 to 90 days or even longer. For instance, in 2024, many government agencies continued to operate with these standard payment terms, underscoring the need for Carahsoft's financial resilience.

- Financial Strength: Enables management of long payment cycles typical in government contracting.

- Credit Lines: Provide liquidity to cover operational expenses and inventory needs.

- Investment Capacity: Supports strategic growth initiatives and expansion of service offerings.

- Aggregator Role: Underpinned by the financial ability to manage diverse vendor relationships and contract fulfillment.

Carahsoft's key resources are multifaceted, encompassing its extensive government contract vehicles, a vast network of technology vendors and partners, deep public sector IT expertise, robust IT infrastructure, and strong financial capital. These elements collectively form the foundation of its market leadership.

The company's contract vehicles, such as GSA Schedules and SEWP, are critical enablers, facilitating billions in annual sales and creating significant barriers to entry for competitors. In 2023, Carahsoft reported over $16 billion in sales, a clear indicator of the effectiveness of these resources.

Its expansive partner ecosystem, representing over 1,000 technology vendors including major players like Microsoft and AWS in 2024, allows for a comprehensive offering of cutting-edge solutions. This, combined with specialized knowledge of government procurement, positions Carahsoft as an indispensable partner for public sector agencies.

| Key Resource | Description | 2023/2024 Impact |

|---|---|---|

| Government Contract Vehicles | Pre-negotiated agreements simplifying government procurement. | Facilitated over $16 billion in sales in 2023. |

| Vendor & Partner Network | Relationships with over 1,000 technology providers. | Enables access to a broad spectrum of IT solutions, including cloud and cybersecurity. |

| Public Sector IT Expertise | Deep understanding of government procurement and agency needs. | Crucial for navigating complex sales cycles and regulatory environments. |

| IT Infrastructure | Advanced systems for order processing, CRM, and data analytics. | Supports efficient operations and scalable growth, processing billions in sales. |

| Financial Capital | Access to credit lines and financial strength. | Manages extended payment cycles and supports strategic investments. |

Value Propositions

Carahsoft offers technology vendors a direct pathway into the vast public sector, covering federal, state, and local governments, as well as education and healthcare sectors. This access is crucial for vendors looking to expand their reach beyond the commercial market.

By utilizing Carahsoft's established contract vehicles, such as NASA SEWP V and NIH CIO-SP3, technology companies can bypass the lengthy and often challenging process of securing their own government contracts. In 2023 alone, Carahsoft facilitated over $15 billion in sales, highlighting their significant market penetration.

Furthermore, Carahsoft provides specialized sales and marketing expertise tailored to government procurement. This support helps vendors understand and navigate the unique requirements of public sector sales, significantly reducing the time and resources needed to become government-ready and accelerate revenue generation.

Government agencies can streamline their acquisition processes with Carahsoft, ensuring compliance and efficiency. In 2024, the U.S. federal government’s IT spending was projected to reach over $130 billion, highlighting the need for simplified procurement pathways.

Through Carahsoft, agencies gain a single, reliable channel to access a broad spectrum of advanced IT solutions from numerous technology providers. This consolidated approach simplifies vendor management and speeds up the acquisition of necessary technologies.

This model significantly reduces administrative burdens for government entities, allowing them to focus on mission-critical objectives rather than complex procurement logistics. Agencies can confidently secure the most suitable technologies, meeting their specific requirements with ease.

Resellers and system integrators can significantly broaden their service portfolios and market reach by aligning with Carahsoft. This strategic alliance grants them access to Carahsoft's robust contract vehicles, including key government purchasing agreements, and its established network of technology vendors.

Through this partnership, resellers and SIs gain the ability to bid on and secure larger, more lucrative government contracts that might otherwise be inaccessible due to procurement complexities or scale requirements. For instance, Carahsoft's role in facilitating access to the NASA SEWP contract, a significant vehicle for IT solutions in the public sector, allows partners to tap into billions of dollars in annual spending.

This collaboration directly boosts their competitive standing within the public sector landscape. By leveraging Carahsoft's established presence and contracting advantages, partners can offer more comprehensive solutions and improve their service delivery capabilities, ultimately winning more business and driving revenue growth.

Expertise in Government IT Compliance and Regulations

Carahsoft's expertise in government IT compliance and regulations is a cornerstone of its value proposition. They navigate the complex web of federal, state, and local IT procurement laws, ensuring vendors and government agencies meet all necessary standards. This specialized knowledge is crucial for successful public sector sales.

For instance, in 2024, government IT spending is projected to reach hundreds of billions of dollars, with compliance being a non-negotiable aspect of any contract. Carahsoft's understanding of frameworks like FISMA, FedRAMP, and Section 508 directly addresses these critical needs.

- Mitigates Risk: Carahsoft's compliance expertise reduces legal and financial risks for all parties involved in government IT transactions.

- Facilitates Procurement: Their deep understanding of regulations streamlines the often-arduous government procurement process for technology solutions.

- Ensures Security Standards: Carahsoft helps vendors meet stringent government cybersecurity and data protection requirements.

- Builds Trust: By guaranteeing compliance, Carahsoft fosters confidence and reliability in the government IT marketplace.

Streamlined Sales and Marketing for Public Sector

Carahsoft offers a unique value proposition by providing specialized sales and marketing services designed exclusively for the public sector. This focus is crucial because government procurement processes and market dynamics differ significantly from those in commercial sectors.

Their approach includes highly targeted campaigns and lead generation strategies that resonate with government agencies. By employing dedicated sales teams with deep understanding of public sector needs, Carahsoft helps vendors navigate this complex landscape effectively.

This specialized support enables technology providers to efficiently penetrate and expand their footprint within government markets. For instance, in 2024, Carahsoft facilitated over $15 billion in sales for its partners, demonstrating their efficacy in optimizing public sector sales efforts.

- Targeted Public Sector Engagement: Carahsoft's expertise lies in understanding and executing sales and marketing strategies tailored for government agencies, a niche often challenging for vendors to master independently.

- Efficient Market Penetration: They provide vendors with the necessary tools and channels to efficiently reach and engage public sector decision-makers, streamlining the often-complex government sales cycle.

- Growth Acceleration: By leveraging Carahsoft's established relationships and market knowledge, technology companies can accelerate their growth within the public sector, achieving significant market share.

- Optimized Sales Efforts: Vendors benefit from optimized sales efforts, reducing the burden of building and managing a dedicated public sector sales force from scratch, thereby improving ROI.

Carahsoft acts as a vital bridge, connecting technology vendors to the extensive public sector market, including federal, state, and local governments, as well as educational and healthcare institutions. This offers vendors a clear path to expand beyond commercial sales.

By leveraging Carahsoft's existing government contracts, such as NASA SEWP V, companies can bypass the lengthy and complex process of obtaining their own contracts. For example, in 2023, Carahsoft facilitated over $15 billion in sales for its technology partners.

Furthermore, Carahsoft provides specialized sales and marketing support tailored to government procurement, helping vendors navigate unique requirements and accelerate revenue. This expertise is critical in a market where U.S. federal IT spending was projected to exceed $130 billion in 2024.

Carahsoft simplifies the acquisition process for government agencies, ensuring compliance and efficiency. This allows agencies to access a wide range of advanced IT solutions through a single, reliable channel, reducing administrative burdens and speeding up technology adoption.

| Value Proposition | Target Audience | Key Benefit | Supporting Data/Fact |

|---|---|---|---|

| Public Sector Market Access | Technology Vendors | Direct pathway to government contracts and sales opportunities. | Facilitated over $15 billion in sales in 2023. |

| Streamlined Procurement | Government Agencies | Efficient and compliant acquisition of IT solutions. | U.S. federal IT spending projected over $130 billion in 2024. |

| Contract Vehicle Utilization | Resellers & SIs | Access to significant government contracts and expanded market reach. | Access to contracts like NASA SEWP V. |

| Compliance Expertise | Vendors & Agencies | Mitigation of legal/financial risks and adherence to regulations. | Navigates complex regulations like FISMA and FedRAMP. |

Customer Relationships

Carahsoft’s dedicated account management is a cornerstone of its business model, ensuring personalized support for both technology vendors and government agencies. These specialized teams act as a single point of contact, streamlining communication and building trust.

For instance, Carahsoft’s commitment to dedicated account management is reflected in its consistent growth. In fiscal year 2023, Carahsoft reported over $16 billion in sales, a testament to the strong relationships cultivated through this approach, facilitating complex government procurement processes.

Carahsoft cultivates long-term strategic partnerships, a necessity given the often multi-year nature of government IT procurement cycles. These enduring relationships are built on a foundation of trust and consistent value delivery.

The company actively adapts to the evolving needs of its government clients and technology partners, offering continuous support and solutions. This proactive engagement fosters mutual growth and ensures Carahsoft remains a stable, reliable vendor in the public sector IT landscape.

For instance, in fiscal year 2023, Carahsoft's focus on these deep relationships contributed to its continued strong performance, securing significant contract renewals and expanding its footprint within federal agencies.

Carahsoft truly shines with its consultative and advisory approach, acting as a trusted guide for both technology vendors and government agencies. They don't just move products; they offer expert advice, helping clients navigate the complexities of the public sector IT landscape. This advisory role is crucial for agencies making significant IT investments, ensuring they get the best solutions for their needs.

This strategy positions Carahsoft as more than a reseller; they are a strategic partner. For instance, in 2024, Carahsoft facilitated over $16 billion in government IT sales, a testament to their ability to connect the right solutions with the right agencies through this hands-on guidance. Their deep understanding of government procurement processes and technology trends allows them to provide invaluable insights, fostering informed decision-making and maximizing the value of IT expenditures for their public sector customers.

Training and Enablement Programs

Carahsoft prioritizes robust customer relationships through comprehensive training and enablement programs. These initiatives ensure partners and government agencies can effectively leverage Carahsoft's solutions, fostering deeper engagement and long-term loyalty.

- Product Training: Carahsoft offers detailed training on its extensive portfolio of software and hardware solutions, equipping users with the knowledge to maximize their investment.

- Regulatory Updates: Keeping pace with evolving government mandates and compliance requirements is crucial. Carahsoft’s programs provide timely information on these changes, ensuring government clients remain compliant.

- Best Practices for IT Adoption: Beyond product specifics, Carahsoft shares best practices for successful IT implementation and adoption within government environments, driving efficiency and value.

- Partner Enablement: For its reseller partners, Carahsoft provides specialized training to enhance their sales and technical capabilities, strengthening the entire ecosystem.

Customer Feedback and Continuous Improvement

Carahsoft prioritizes customer feedback to enhance its aggregated solutions, ensuring they meet evolving government IT needs. In 2024, they continued to refine their processes based on direct input, aiming to streamline procurement and support. This focus on improvement is vital for maintaining Carahsoft's position as a trusted technology provider.

They actively engage customers through various channels to gather insights and address concerns. This proactive approach allows Carahsoft to adapt its offerings, making sure its aggregated solutions remain highly relevant and effective in the dynamic government sector. For instance, feedback on user experience with new software integrations directly informs updates.

- Customer Feedback Integration: Carahsoft actively solicits and integrates customer feedback to continuously refine its service offerings and adapt to market demands.

- Regular Communication Channels: Established channels ensure the capture of insights, addressing of concerns, and relevance of aggregated solutions.

- Strengthening Customer Ties: This commitment to improvement fosters stronger customer relationships and enhances market responsiveness.

- 2024 Focus: Continued refinement of procurement and support processes based on direct customer input in 2024.

Carahsoft's customer relationships are built on dedicated account management and a consultative approach, positioning them as a strategic partner rather than just a reseller. This focus on deep engagement and continuous support fosters long-term loyalty and ensures they meet the evolving needs of government agencies and technology vendors.

Their commitment to training and incorporating customer feedback further solidifies these relationships, making them a trusted provider in the public sector IT landscape. For instance, in 2024, Carahsoft facilitated over $16 billion in government IT sales, underscoring the effectiveness of their relationship-centric model.

| Customer Relationship Aspect | Description | Impact/Example (2024 Data) |

|---|---|---|

| Dedicated Account Management | Single point of contact, personalized support | Streamlined communication, built trust, facilitated $16B+ in sales |

| Consultative Approach | Expert advice, navigating IT complexities | Positioned as strategic partner, informed IT investments |

| Training & Enablement | Product knowledge, best practices, partner capabilities | Enhanced customer and partner effectiveness |

| Customer Feedback Integration | Continuous refinement of solutions and processes | Improved procurement and support, maintained relevance |

Channels

Carahsoft’s direct sales force is a cornerstone of its business model, comprising a substantial team of specialists deeply versed in government IT procurement processes. This dedicated force cultivates vital relationships with key agency stakeholders, enabling direct engagement with government customers and vendor partners alike.

This direct channel is particularly crucial for Carahsoft, as it facilitates the complex sales cycles often encountered in the public sector, where trust and established relationships are paramount for closing deals. For instance, in 2023, Carahsoft reported over $15 billion in revenue, a significant portion of which is attributed to the effectiveness of its direct sales approach in navigating the intricate landscape of government contracting.

Carahsoft leverages its online portals and e-commerce platforms to offer a streamlined procurement experience for government agencies. These digital channels allow agencies to easily browse, select, and purchase a vast catalog of IT solutions, enhancing convenience and efficiency. For instance, in 2023, Carahsoft reported significant growth in its online sales, reflecting the increasing reliance on these platforms for government IT acquisition.

Carahsoft's Partner Reseller Network is a cornerstone of its go-to-market strategy, effectively extending its reach across the government and public sector landscape. By partnering with numerous value-added resellers (VARs) and system integrators (SIs), Carahsoft taps into specialized market segments and geographic regions, enabling broader customer access.

This indirect channel is crucial for amplifying market penetration. For instance, in 2024, Carahsoft reported significant growth driven by its robust partner ecosystem, with reseller partners contributing to a substantial portion of its overall sales. These partnerships allow for localized support and tailored solutions, which are vital for government procurement processes.

Government Contract Vehicles (as a channel)

Government contract vehicles are a cornerstone of Carahsoft's distribution strategy, acting as direct conduits to federal, state, and local government agencies. By being listed on numerous vehicles, Carahsoft significantly streamlines the purchasing process for these entities, which are often mandated or strongly prefer to buy through these established agreements. This pre-vetting process inherently legitimizes Carahsoft's offerings and makes them readily accessible for government procurement.

Carahsoft's extensive portfolio of contract vehicles provides a critical pathway for technology vendors to reach the public sector. For instance, the General Services Administration (GSA) Schedule is a widely utilized vehicle, and Carahsoft's presence on multiple GSA Schedules allows them to serve a broad range of agency needs. In 2024, government IT spending is projected to reach significant figures, with agencies increasingly leveraging contract vehicles for efficient acquisition of necessary technologies.

- GSA Schedules: Offer a broad range of IT products and services, simplifying procurement for federal agencies.

- NASA SEWP (Solutions for Enterprise-Wide Procurement): A government-wide acquisition contract (GWAC) specifically for IT products and services.

- CIO-CS (Chief Information Officer - Commodities and Services): Another GWAC that provides a wide array of IT commodities and services.

- State and Local Government Contracts: Carahsoft also participates in numerous cooperative purchasing programs and state-specific contracts, expanding its reach beyond the federal government.

Industry Events, Conferences, and Webinars

Carahsoft leverages industry events, conferences, and webinars as key channels for engaging the government IT sector. These platforms are vital for marketing, generating leads, and fostering crucial relationships within this specialized market.

By actively participating in and hosting these events, Carahsoft can effectively showcase its latest solutions and demonstrate its expertise. This direct engagement allows for meaningful interaction with potential customers and partners, solidifying Carahsoft's position as a thought leader.

In 2024, Carahsoft continued its robust presence at major government IT conferences. For instance, their participation in events like the annual AFCEA TechNet Cyber showcased their commitment to addressing critical cybersecurity challenges for government agencies. Such events often attract thousands of attendees, providing significant visibility and lead generation opportunities.

- Showcasing Solutions: Carahsoft uses these forums to present new technologies and services relevant to government needs.

- Lead Generation: Events provide a direct avenue for identifying and capturing potential customer interest.

- Relationship Building: Face-to-face or virtual interactions at conferences strengthen ties with clients and partners.

- Thought Leadership: Presenting at or hosting webinars establishes Carahsoft as an authority in government IT solutions.

Carahsoft utilizes a multi-channel approach to reach its government and public sector clientele. These channels include direct sales, a robust partner reseller network, government contract vehicles, and engagement through industry events and digital platforms. This diversified strategy ensures broad market coverage and caters to various procurement preferences within the public sector.

The partner reseller network is particularly vital, enabling Carahsoft to access niche markets and provide localized support. In 2024, this network played a significant role in driving sales growth, demonstrating its effectiveness in expanding Carahsoft's reach. By leveraging value-added resellers and system integrators, Carahsoft effectively amplifies its market penetration and offers tailored solutions.

Government contract vehicles serve as essential conduits, streamlining the procurement process for agencies. Carahsoft's presence on key vehicles like GSA Schedules and NASA SEWP facilitates efficient acquisition of IT solutions. As government IT spending continues to rise, these contract vehicles are critical for accessing the market. For example, in 2024, government agencies are projected to spend billions on IT, with contract vehicles being a preferred procurement method.

| Channel | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Direct Sales | Specialized team engaging directly with government agencies. | Builds strong relationships and navigates complex procurement. | Continues to be a primary driver of significant revenue. |

| Partner Reseller Network | Collaboration with VARs and SIs. | Extends market reach and provides specialized solutions. | Contributed significantly to 2024 sales growth. |

| Government Contract Vehicles | Access via GSA Schedules, NASA SEWP, etc. | Streamlines procurement for government entities. | Crucial for accessing billions in projected 2024 government IT spend. |

| Industry Events & Digital Engagement | Conferences, webinars, online portals. | Marketing, lead generation, and thought leadership. | Essential for showcasing solutions and building brand presence in 2024. |

Customer Segments

Federal Government Agencies represent a cornerstone customer segment for Carahsoft, encompassing all branches and departments of the U.S. federal government. This vast market demands IT solutions that meet stringent compliance and procurement requirements.

Carahsoft facilitates access to these critical agencies by offering compliant procurement vehicles and a broad portfolio of aggregated technologies. In fiscal year 2023, Carahsoft reported over $16 billion in revenue, with a significant portion derived from its federal government contracts, underscoring the segment's importance.

State and local government agencies represent a significant portion of Carahsoft's customer base, encompassing thousands of entities from individual counties and cities to entire state governments across the United States. These agencies have distinct procurement processes, often involving complex bidding and contract requirements that differ from federal agencies. For instance, in 2023, state and local governments in the U.S. spent an estimated $2.9 trillion on goods and services, with IT spending being a substantial component.

Carahsoft tailors its approach to meet these varied needs by leveraging a wide array of contract vehicles and cooperative purchasing agreements. This allows them to efficiently serve diverse regional and local bodies, ensuring compliance with specific state and local regulations. This adaptability is crucial for broadening market coverage and solidifying their nationwide presence within the public sector.

Education Institutions, encompassing K-12 school districts, colleges, and universities, represent a significant customer segment for technology solutions. These institutions require robust IT infrastructure, specialized software for learning management and administration, and essential services to support research activities.

Carahsoft plays a crucial role by offering customized technology solutions and expert procurement assistance specifically designed for the education sector. This support helps educational bodies navigate complex acquisition processes and acquire the technology needed for their digital transformation initiatives, enhancing both teaching and administrative functions.

The education technology market is substantial and growing. For instance, in 2024, global EdTech spending was projected to reach over $300 billion, with a significant portion directed towards cloud services, software, and hardware for institutions. Carahsoft's ability to provide these solutions through government contracts and cooperative purchasing agreements makes them a key partner for schools and universities looking to modernize their operations and improve educational outcomes.

Healthcare Organizations (Public Sector)

Public sector healthcare organizations, including government hospitals, clinics, and health departments, represent a crucial customer segment with stringent IT requirements driven by regulation and the need for secure patient data management. Carahsoft facilitates their access to compliant and advanced technology solutions, enhancing patient care and operational workflows. For instance, in 2024, the U.S. Department of Health and Human Services (HHS) continued to invest heavily in modernizing its IT infrastructure to improve public health services and data security.

These organizations prioritize solutions that meet rigorous security and privacy mandates, such as HIPAA compliance. Carahsoft's role is to bridge the gap between these needs and available government-contracted IT vendors. The U.S. federal government's cybersecurity spending, a significant portion of which supports healthcare IT, was projected to reach over $120 billion in 2024, highlighting the importance of secure solutions for this sector.

- Focus on Public Sector Healthcare: Serving government hospitals, clinics, and health departments with critical, regulated IT needs.

- Carahsoft's Role: Enabling acquisition of compliant and secure IT solutions for patient care, data management, and efficiency.

- Specialized Requirements: Addressing unique security and privacy considerations essential for public health data.

Technology Vendors (as customers/partners)

Technology vendors view Carahsoft as a vital partner, essentially a customer of their services. They leverage Carahsoft's established presence and expertise to navigate the complex public sector landscape. This includes gaining access to government contracts and benefiting from specialized sales and marketing efforts tailored for this market.

Carahsoft's value proposition for these vendors lies in its ability to aggregate demand and provide deep understanding of government procurement processes. In 2023, Carahsoft reported over $16 billion in sales, a significant portion of which was driven by its technology vendor partnerships, highlighting the substantial revenue these vendors generate through Carahsoft's platform.

- Market Access: Vendors purchase Carahsoft's ability to connect them with federal, state, and local government agencies.

- Contract Vehicle Management: Carahsoft manages the intricacies of government contracts, simplifying the process for vendors.

- Sales and Marketing Support: Vendors rely on Carahsoft's dedicated public sector sales force and marketing initiatives to drive adoption of their technologies.

Carahsoft's customer segments are primarily within the public sector, including federal, state, and local government agencies, as well as educational institutions and public sector healthcare organizations. These entities require specialized IT solutions that adhere to strict procurement regulations and compliance standards.

The company also serves technology vendors who utilize Carahsoft as a channel to access and sell to these government and education markets. This partnership model allows vendors to leverage Carahsoft's expertise in navigating complex government contracting and sales processes.

| Customer Segment | Key Characteristics | Carahsoft's Value Proposition |

|---|---|---|

| Federal Government Agencies | Stringent compliance, complex procurement | Compliant procurement vehicles, broad technology portfolio |

| State and Local Governments | Varied procurement processes, regional needs | Diverse contract vehicles, cooperative purchasing agreements |

| Education Institutions | IT infrastructure, learning software, research support | Customized solutions, procurement assistance |

| Public Sector Healthcare | HIPAA compliance, secure data management | Secure, compliant IT solutions for patient care |

| Technology Vendors | Market access, contract management | Public sector sales and marketing expertise |

Cost Structure

Carahsoft's cost structure heavily relies on its sales and marketing efforts, a critical component for engaging the public sector. A substantial portion of their expenses goes towards supporting a specialized sales force, which is key to navigating the complexities of government procurement.

Extensive marketing campaigns, designed to reach government agencies and prime contractors, also represent a significant cost. These efforts are vital for building brand awareness and generating leads within their target market.

Furthermore, Carahsoft invests considerably in participating in industry events and conferences. These engagements are crucial for networking, showcasing their offerings, and fostering relationships with both potential customers and technology partners, driving their lead generation and customer acquisition strategies.

Carahsoft's significant personnel costs stem from its need for highly skilled individuals. This includes experienced sales professionals adept at navigating government procurement, contract specialists who manage complex agreements, and technical support staff ensuring seamless product delivery.

The company invests heavily in recruiting and retaining talent with specialized government IT expertise, a crucial factor for its success in serving public sector clients. This focus on specialized human capital is a primary driver of their operational expenditures.

In 2024, Carahsoft reported a substantial portion of its operating expenses allocated to personnel. While exact figures vary, industry benchmarks for technology resellers with similar government focus often see personnel costs representing upwards of 40-50% of total operating expenses, reflecting the human capital-intensive nature of their business model.

Carahsoft's operational and administrative overheads are substantial, encompassing expenses for office spaces, robust IT infrastructure, and essential legal and compliance functions. These costs are fundamental to their role as a master aggregator, ensuring efficient and lawful operations.

In 2024, managing these overheads effectively is paramount for profitability. For instance, IT infrastructure, including cloud services and software licenses, can represent a significant portion of these costs, especially for a company managing numerous complex government contracts.

Technology and Platform Development/Maintenance

Carahsoft's cost structure heavily features investment in and ongoing maintenance of its proprietary IT platforms. This includes their e-commerce portals and crucial internal systems that manage everything from order processing to customer relationships and data analytics. These technological outlays are essential for Carahsoft to scale its operations efficiently and maintain a competitive edge in the government IT marketplace.

The company's commitment to continuous updates for these systems is vital. This ensures they can effectively support a broad and ever-changing portfolio of technology products and services offered to government agencies. For instance, in 2024, significant resources were allocated to enhancing cybersecurity features within their platforms, a direct response to evolving government mandates and threats.

- Platform Development: Ongoing investment in proprietary e-commerce and internal systems.

- Maintenance Costs: Expenses related to keeping IT infrastructure updated and secure.

- Scalability & Efficiency: Technological investments directly support operational growth and streamlined processes.

- Product Portfolio Support: Costs associated with adapting systems for a diverse and expanding range of technology offerings.

Contract Vehicle Management and Compliance Costs

Carahsoft incurs significant expenses managing and complying with a multitude of government contract vehicles. These costs encompass legal counsel for contract review and negotiation, administrative staff dedicated to contract administration, and the necessary resources for ongoing compliance monitoring. For instance, in 2024, the U.S. government awarded over $700 billion in prime contracts, highlighting the sheer volume of vehicle management required.

Maintaining rigorous adherence to federal acquisition regulations, such as the Federal Acquisition Regulation (FAR), is a critical and unavoidable expenditure. Non-compliance can lead to severe financial penalties, contract termination, and damage to Carahsoft's reputation, making proactive compliance a foundational cost of doing business in the public sector.

- Legal fees for contract negotiation and review.

- Administrative overhead for contract management and reporting.

- Costs associated with ensuring ongoing regulatory compliance (e.g., FAR, ITAR).

- Potential penalties or fines for non-compliance.

Carahsoft's cost structure is heavily influenced by its extensive sales and marketing efforts, particularly within the public sector. Significant investments are made in a specialized sales force adept at navigating government procurement processes and in broad marketing campaigns to build brand awareness and generate leads.

Personnel costs are a major component, reflecting the need for skilled sales professionals, contract specialists, and technical support staff with government IT expertise. In 2024, personnel costs often represented 40-50% of operating expenses for similar technology resellers focused on the public sector.

Technological investments in proprietary e-commerce platforms and internal systems are crucial for operational efficiency and scalability, with cybersecurity enhancements being a key focus in 2024. Additionally, managing numerous government contract vehicles and ensuring compliance with regulations like the Federal Acquisition Regulation (FAR) incurs substantial legal, administrative, and compliance-related expenses.

| Cost Category | Key Drivers | 2024 Relevance |

| Sales & Marketing | Specialized sales force, government-focused campaigns, industry events | Essential for lead generation and customer acquisition in the public sector. |

| Personnel Costs | Skilled sales, contracts, and technical staff; government IT expertise recruitment | A significant portion of operating expenses, often 40-50% for similar companies. |

| Technology Investment | Proprietary e-commerce platforms, internal systems, cybersecurity upgrades | Vital for operational efficiency, scalability, and supporting a diverse product portfolio. |

| Contract Management & Compliance | Legal counsel, contract administration staff, regulatory adherence (e.g., FAR) | A foundational cost of doing business in the public sector to avoid penalties and maintain reputation. |

Revenue Streams

Carahsoft's main way of making money comes from commissions and margins on IT products and services. They sell these to government, education, and healthcare clients, earning a percentage of each sale.

In 2024, Carahsoft continued to leverage its aggregation model, generating revenue across a wide array of technology solutions. This approach allows them to capture value from a diverse range of vendor partnerships and customer needs within the public sector.

Carahsoft generates revenue through value-added service fees, offering technology vendors specialized support beyond basic sales. These services can include enhanced marketing initiatives, tailored training programs, and in-depth integration assistance. These fees represent an additional income stream, complementing their primary sales commissions and highlighting the unique expertise Carahsoft brings to the public sector market.

Carahsoft may collect fees from its vendor partners for the service of facilitating access to and managing specific government contract vehicles. This revenue acknowledges the substantial effort Carahsoft invests in navigating intricate government procurement processes and ensuring compliance.

These fees essentially monetize Carahsoft's specialized knowledge and operational capacity in securing and maintaining these vital government contracts, which is a significant value proposition for their vendor ecosystem.

Referral Fees/Co-Marketing Funds from Vendors

Carahsoft leverages its deep understanding of the public sector to secure referral fees and co-marketing funds from technology vendors. These arrangements are essentially vendor investments in Carahsoft's proven ability to reach and engage government agencies, driving sales and market penetration for their solutions.

This revenue stream is a critical component of Carahsoft's business model, aligning the interests of both Carahsoft and its vendor partners. By sharing in the success of promoting and selling specific technologies to the government, both parties are incentivized to maximize market reach and achieve joint objectives. For instance, in 2024, a significant portion of Carahsoft's revenue growth was attributed to these strategic vendor partnerships, reflecting the increasing reliance of government agencies on specialized IT solutions.

- Vendor Investment: Funds received from vendors for lead generation and sales support.

- Market Penetration: Drives deeper adoption of vendor solutions within the public sector.

- Incentive Alignment: Creates a shared success model between Carahsoft and its partners.

- Specialized Capabilities: Capitalizes on Carahsoft's unique government sales and marketing expertise.

Professional Services and Consulting

While Carahsoft is renowned as a technology aggregator, they also generate revenue through professional services and consulting. This segment focuses on providing specialized expertise to government agencies, particularly concerning IT strategy, implementation, and compliance within complex public sector environments.

These offerings leverage Carahsoft's deep understanding of government procurement processes and technology needs. For instance, in 2024, Carahsoft’s commitment to supporting federal IT modernization efforts through expert guidance likely contributed to this revenue stream, complementing their core distribution business.

- Specialized IT Strategy: Offering guidance on technology roadmaps and digital transformation for government entities.

- Implementation Support: Assisting agencies with the deployment and integration of procured technology solutions.

- Compliance Consulting: Advising on regulatory adherence and security standards relevant to government IT projects.

Carahsoft's revenue streams are diverse, primarily driven by commissions and margins on IT product sales to government, education, and healthcare sectors. They also earn through value-added service fees, offering vendors specialized marketing and training, and potentially receive fees for managing government contract vehicles. In 2024, these diverse revenue streams, including vendor investments for market penetration and specialized IT consulting, demonstrated Carahsoft's robust aggregation and service model within the public sector.

| Revenue Stream | Description | 2024 Focus/Impact |

| Commissions & Margins | Percentage earned on IT product and service sales. | Core revenue driver, reflecting broad technology portfolio sales. |

| Value-Added Service Fees | Fees for enhanced vendor support (marketing, training). | Supplements sales, highlighting specialized expertise. |

| Contract Vehicle Management Fees | Fees for facilitating and managing government contracts. | Monetizes expertise in navigating complex procurement. |

| Vendor Investment/Co-Marketing | Funds from vendors for lead generation and sales support. | Drives market penetration and aligns partner interests. |

| Professional Services & Consulting | Fees for IT strategy, implementation, and compliance advice. | Supports federal IT modernization efforts with expert guidance. |

Business Model Canvas Data Sources

The Carahsoft Business Model Canvas leverages a combination of government procurement data, market intelligence reports, and internal sales analytics. These sources provide a comprehensive view of customer segments, value propositions, and revenue streams within the public sector IT market.