Capital Group Companies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Group Companies Bundle

Discover how political stability, economic fluctuations, and evolving social trends are shaping Capital Group Companies's strategic landscape. Our PESTLE analysis provides a critical overview of these external forces. Download the full version to gain actionable intelligence and refine your investment strategy.

Political factors

Government and regulatory bodies globally are increasing their scrutiny of the investment management sector. This heightened oversight stems from a desire to ensure market stability, safeguard investors, and mitigate systemic risks. For Capital Group, this means a dynamic regulatory landscape that demands constant adaptation. For instance, the U.S. Securities and Exchange Commission (SEC) proposed new rules in 2024 aimed at enhancing transparency and competition in the asset management industry, which could affect how firms like Capital Group structure their fees and services.

Navigating these evolving policies, which span disclosure requirements, trading practices, and product distribution, presents both challenges and opportunities. Capital Group must remain agile to comply with varying international regulations, potentially impacting operational costs and strategic decision-making. The European Union's ongoing review of its MiFID II framework, for example, continues to shape market conduct and reporting standards across member states, influencing cross-border business operations.

Global political tensions, including ongoing conflicts in Eastern Europe and the Middle East, continue to create significant market volatility. These geopolitical events directly impact investor sentiment and capital flows, as seen in the fluctuations of global equity markets throughout 2024.

Capital Group, operating as a worldwide investment manager, must actively navigate the risks posed by political instability. This includes managing exposure to regions affected by sanctions, trade disputes, and evolving international relations, all of which can influence the performance of its extensive investment portfolios.

For instance, the protracted trade tensions between major economic blocs, which intensified in late 2023 and continued into 2024, have led to increased uncertainty for multinational corporations and, by extension, their investors. This environment necessitates robust risk management strategies to safeguard portfolio value.

Changes in corporate tax rates significantly impact Capital Group's investment strategies. For instance, a reduction in the U.S. federal corporate tax rate from 35% to 21% in 2017 boosted corporate earnings, influencing equity valuations. As of early 2025, discussions around potential adjustments to these rates in major economies continue, requiring Capital Group to recalibrate its portfolio allocations and tax-efficient product structuring.

Government Spending and Fiscal Policies

Government fiscal decisions significantly impact economic growth and inflation. For instance, the U.S. federal budget deficit was projected to reach $1.8 trillion in 2024, a substantial figure that can influence interest rates and investment climates. Capital Group must analyze how increased infrastructure spending or potential stimulus packages might create opportunities in sectors like construction and materials, while also considering the inflationary pressures these policies could introduce.

Fiscal policies directly affect the availability of capital and the cost of borrowing, crucial elements for Capital Group's investment strategies. A widening budget deficit, as seen with the projected U.S. deficit, might lead to higher government borrowing, potentially crowding out private investment or driving up yields on government bonds. This necessitates a careful evaluation of debt markets and an understanding of how fiscal expansion or contraction could benefit or hinder specific asset classes.

- Infrastructure Spending: Governments globally are increasing infrastructure investment. For example, the EU's NextGenerationEU recovery fund allocates significant portions to green and digital transitions, potentially boosting related industries.

- Budget Deficits: High budget deficits can signal future tax increases or spending cuts, impacting corporate profitability and consumer spending power.

- Stimulus Packages: Targeted stimulus can provide short-term boosts to specific sectors, but broad stimulus can fuel inflation, affecting purchasing power and investment returns.

- Fiscal Policy Shifts: Anticipating shifts in government spending priorities, such as a move towards defense or renewable energy, is key for identifying long-term investment trends.

International Trade Agreements and Protectionism

The evolving landscape of international trade agreements and the resurgence of protectionist policies significantly influence global supply chains and corporate profitability. For Capital Group, understanding shifts in trade dynamics, such as the renegotiation of existing agreements or the imposition of new tariffs, is crucial for assessing portfolio company performance and identifying cross-border investment opportunities. For instance, the World Trade Organization (WTO) reported that trade restrictions imposed by G20 economies increased by 15% in the first half of 2024 compared to the same period in 2023, directly impacting companies reliant on international trade.

Capital Group must proactively analyze how these trade tensions affect the companies within its diverse portfolios. This includes evaluating the resilience of supply chains, the potential for increased operating costs due to tariffs, and the impact on market access for export-oriented businesses. Adjusting global investment allocations based on these trade assessments can help mitigate risks and capitalize on emerging opportunities in a more fragmented global trade environment.

- Trade Policy Shifts: Monitoring changes in trade agreements and the imposition of tariffs by major economies, such as the United States and China, impacts market access and input costs for multinational corporations.

- Supply Chain Vulnerability: Protectionist measures can disrupt established global supply chains, forcing companies to re-evaluate sourcing strategies and potentially leading to higher operational expenses.

- Investment Opportunities: While protectionism can create headwinds, it can also foster new investment opportunities in domestic production or in countries benefiting from trade diversion.

Governments worldwide are increasingly focused on financial market stability and investor protection, leading to stricter regulations. For Capital Group, this means adapting to evolving rules on transparency, fees, and trading practices, as seen with proposed SEC changes in 2024. These regulatory shifts, including updates to frameworks like MiFID II in Europe, necessitate continuous compliance efforts and can influence operational costs and strategic planning for international firms.

Geopolitical instability, marked by ongoing conflicts and rising trade tensions, creates market volatility and impacts investor sentiment. Capital Group must manage risks associated with sanctions, trade disputes, and shifting international relations that can affect its global investment portfolios, as evidenced by increased trade restrictions among G20 economies in early 2024.

Fiscal policies, including government spending and tax rate adjustments, significantly influence economic growth, inflation, and investment climates. For example, the projected U.S. federal deficit of $1.8 trillion for 2024 highlights how fiscal decisions can affect interest rates and create sector-specific opportunities, such as in infrastructure, while also posing inflationary risks.

Changes in corporate tax rates, like the ongoing discussions around potential adjustments in major economies as of early 2025, directly impact investment strategies and portfolio valuations. Capital Group needs to recalibrate asset allocations and tax-efficient product structuring in response to these fiscal policy shifts.

What is included in the product

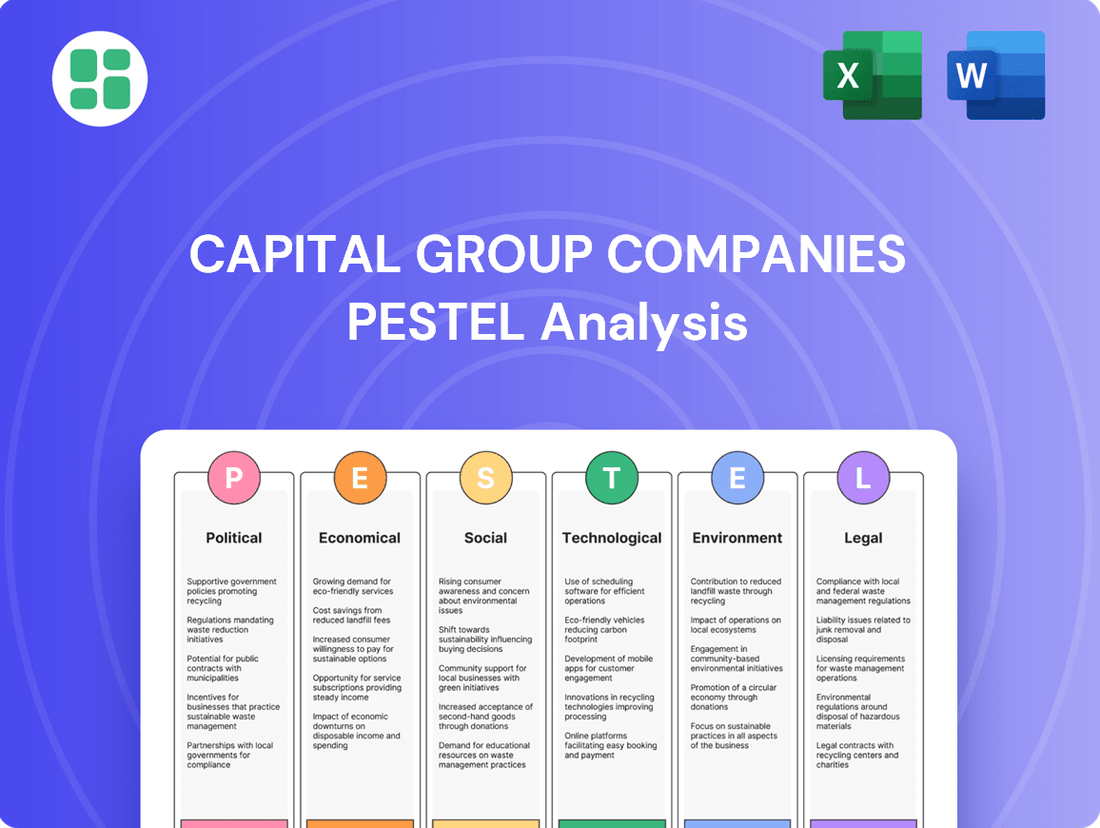

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Capital Group Companies, providing a strategic overview of the external landscape.

It aims to equip stakeholders with actionable insights into market dynamics and potential strategic advantages or challenges.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting Capital Group Companies.

Helps support discussions on external risk and market positioning during planning sessions by offering a structured PESTLE framework for Capital Group Companies.

Economic factors

Monetary policy decisions by central banks, like the Federal Reserve and the European Central Bank, significantly impact borrowing costs and investment returns. For instance, the Federal Reserve maintained its benchmark interest rate in the 3.75%-4.00% range through early 2024, a move that affects the attractiveness of fixed-income investments.

Capital Group's diverse investment strategies, especially those in fixed income and multi-asset classes, are highly sensitive to these interest rate adjustments. Changes in rates directly influence bond yields and equity valuations, necessitating agile portfolio management to navigate duration risk and capitalize on market opportunities for clients.

The potential for interest rate hikes in late 2024 or 2025, driven by persistent inflation concerns, could increase the cost of capital for businesses and impact the pricing of financial assets. This environment demands robust risk management and a deep understanding of macroeconomic trends to ensure Capital Group's strategies remain resilient and effective.

Persistent inflation, as seen with the US Consumer Price Index (CPI) peaking at 9.1% year-over-year in June 2022 and moderating to around 3.4% by April 2024, significantly erodes purchasing power and impacts investment strategies. Capital Group must consider assets like real estate and commodities, which historically offer some protection against rising prices.

Conversely, the risk of deflation, where prices fall, can lead to reduced consumer spending and business investment, potentially impacting asset valuations negatively. For instance, the Bank of Japan has grappled with deflationary concerns for decades, highlighting the challenges of stimulating an economy with falling prices.

Navigating these opposing forces requires a nuanced approach, favoring assets that can maintain or increase their real value. In 2024, while inflation has eased from its peaks, the Federal Reserve's target of 2% remains a key benchmark, and any deviation, either higher or lower, will necessitate strategic portfolio adjustments for Capital Group.

The global economy's trajectory significantly influences Capital Group's investment strategies. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight acceleration from 3.1% in 2023, highlighting areas of potential expansion. Conversely, any signs of a global recession, such as a widespread contraction in manufacturing output or a sharp decline in consumer confidence, would prompt Capital Group to re-evaluate asset allocations, potentially shifting towards more defensive assets.

Capital Group's investment decisions are directly tied to its ability to forecast economic expansions and contractions accurately. By analyzing data like the World Bank's GDP growth forecasts, which indicated varied regional performance in 2024 with emerging markets generally outpacing advanced economies, Capital Group can identify promising investment opportunities. This foresight allows them to position portfolios to capitalize on robust growth in certain sectors or geographies while mitigating risks associated with economic slowdowns elsewhere.

Market Volatility and Investor Confidence

Periods of heightened market volatility, often fueled by economic uncertainty or unforeseen global events, can significantly test investment strategies and sway investor sentiment. For instance, the S&P 500 experienced a notable surge in volatility in early 2024, with several days seeing swings exceeding 1%, reflecting ongoing inflation concerns and geopolitical tensions.

Capital Group, with its established long-term investment philosophy, is tasked with navigating clients through these turbulent times. This involves reinforcing the value of disciplined investing, such as maintaining asset allocation and avoiding emotional trading decisions, while diligently managing portfolio risk and ensuring adequate liquidity to meet potential client needs.

Investor confidence is a crucial barometer, and sharp market downturns can erode it quickly. Following the market corrections seen in late 2023, investor sentiment surveys indicated a cautious outlook, with many individuals expressing concerns about potential recessions.

- Market Volatility Indicators: The VIX (CBOE Volatility Index) provides a real-time measure of expected market volatility. In early 2024, the VIX fluctuated between the 15-20 range, indicating moderate but present market uncertainty.

- Investor Sentiment Data: Surveys like the AAII Investor Sentiment Survey reveal shifts in individual investor outlook. In Q1 2024, the percentage of bullish investors saw a dip, while bearish sentiment edged higher, reflecting cautiousness.

- Capital Group's Long-Term Performance: While specific short-term performance figures fluctuate, Capital Group's historical data demonstrates resilience across various market cycles, often outperforming benchmarks over extended periods.

Currency Exchange Rate Movements

For a global investment manager like Capital Group, currency exchange rate movements are a critical consideration. When Capital Group invests in international markets, the value of those investments in the investor's home currency can be significantly altered by fluctuations in exchange rates. For instance, if a US-based investor holds European stocks, a strengthening Euro against the US Dollar would increase the USD value of those holdings, and vice versa.

Managing this currency exposure is paramount for optimizing global returns. In 2024, for example, the US Dollar experienced periods of both strength and weakness against major currencies like the Euro and Japanese Yen, directly impacting the realized returns for international investors. The IMF's projections for 2025 suggest continued volatility, making currency hedging strategies a key component of portfolio management.

- Impact on International Returns: Fluctuations directly affect the value of foreign assets when converted back to the investor's base currency, potentially boosting or diminishing gains.

- Currency Hedging Importance: Strategies to mitigate currency risk are essential for stabilizing portfolio performance and protecting against adverse exchange rate movements.

- 2024/2025 Market Context: The US Dollar's performance against currencies like the EUR and JPY in 2024 highlighted the tangible impact of exchange rate volatility on global investment portfolios, a trend expected to persist into 2025.

Monetary policy, particularly interest rate decisions by central banks like the Federal Reserve, directly influences borrowing costs and investment returns. The Fed's decision to hold rates steady in the 3.75%-4.00% range through early 2024 made fixed-income investments more appealing, impacting Capital Group's strategies.

Inflationary pressures remain a key economic factor, with the US CPI moderating to around 3.4% by April 2024 from its 2022 peak. This persistent inflation necessitates strategies that can preserve purchasing power, such as investments in real estate and commodities, which Capital Group actively considers.

Global economic growth projections, such as the IMF's forecast of 3.2% for 2024, guide Capital Group's asset allocation decisions. Identifying regions with robust expansion, like emerging markets which generally outpaced advanced economies in 2024, allows for strategic positioning to capitalize on growth opportunities.

Market volatility, exemplified by the S&P 500's daily swings exceeding 1% in early 2024 due to inflation and geopolitical concerns, underscores the need for disciplined investing. Capital Group emphasizes maintaining asset allocation and managing risk to navigate these turbulent periods effectively.

| Economic Factor | Key Data Point (2024/2025) | Impact on Capital Group |

|---|---|---|

| Interest Rates | Federal Reserve target range: 3.75%-4.00% (early 2024) | Influences bond yields and borrowing costs, affecting fixed-income and equity valuations. |

| Inflation | US CPI: ~3.4% (April 2024) | Requires strategies to preserve purchasing power; influences asset class attractiveness. |

| Global Growth | IMF projection: 3.2% (2024) | Guides asset allocation, identifying opportunities in faster-growing regions. |

| Market Volatility | VIX range: 15-20 (early 2024) | Necessitates disciplined investing and robust risk management. |

What You See Is What You Get

Capital Group Companies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Capital Group Companies covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand the strategic landscape and potential challenges or opportunities facing Capital Group.

Sociological factors

The global demographic landscape is a significant factor for Capital Group. Developed nations, like Japan and much of Europe, are experiencing aging populations, which directly impacts savings rates and retirement planning needs. For instance, by 2030, it's projected that over 20% of the population in the European Union will be 65 or older.

Conversely, emerging markets, particularly in Africa and parts of Asia, are characterized by rapidly growing, younger populations. This creates a different set of demands, focusing on wealth accumulation and early-stage investment products. Nigeria, for example, has a median age of around 18, indicating a vast pool of potential future investors.

Capital Group must adapt its product suite to these divergent trends. This includes developing robust retirement solutions for aging clients and innovative intergenerational wealth transfer strategies to cater to families managing assets across multiple generations. The company's ability to serve both the steady demand for income generation from older clients and the growth-oriented needs of younger demographics will be crucial for sustained success.

Investor preferences are shifting, with a significant portion of the market now prioritizing Environmental, Social, and Governance (ESG) criteria. This trend is not just a niche interest; by the end of 2023, ESG assets under management globally were projected to reach over $50 trillion, indicating a substantial reallocation of capital.

Concurrently, the long-standing debate between passive and active investment strategies continues to shape the landscape. While passive investing, often through ETFs, saw continued inflows in 2024, many investors are also re-evaluating the potential alpha generation offered by active management, especially in volatile market conditions.

For Capital Group, this necessitates a dual approach: embedding robust ESG integration into their core investment research and product offerings, and clearly communicating the enduring benefits of their active, research-intensive methodology to capture investor confidence amidst evolving preferences.

Financial literacy remains a significant differentiator, with a notable portion of the population struggling to grasp complex investment concepts. For instance, a 2024 survey indicated that only 57% of U.S. adults could answer three basic financial literacy questions correctly. This gap directly impacts how investment products are understood and adopted, creating a clear need for improved educational outreach.

Capital Group must therefore intensify its digital engagement, offering intuitive platforms that demystify investing. By providing readily accessible, bite-sized educational content, the firm can empower a wider audience. This approach is crucial as digital channels are increasingly the primary source for financial information, with a significant percentage of investors, especially younger demographics, relying on online resources for research and decision-making.

Workforce Trends and Talent Acquisition

The financial sector is grappling with significant challenges in attracting and keeping skilled professionals, especially in high-demand fields like data analytics, artificial intelligence, and green finance. This competition for talent is intensifying as the industry evolves. For instance, a 2024 report indicated a 15% year-over-year increase in demand for AI specialists within financial services.

Capital Group needs to prioritize robust talent development programs and cultivate an appealing workplace environment to secure the necessary expertise. Adapting to flexible and hybrid work arrangements is also crucial for retaining employees and attracting new talent in the post-pandemic landscape. Companies that offer strong professional growth opportunities and a positive culture are better positioned to succeed.

- Talent Gap: Shortages persist in specialized financial roles, impacting innovation and service delivery.

- Competitive Landscape: Financial firms compete with tech companies for data science and AI talent.

- Retention Strategies: Investing in employee development and flexible work models is key to keeping top performers.

- Future Skills: Demand for expertise in sustainable finance and digital transformation continues to rise.

Societal Trust in Financial Institutions

Societal trust in financial institutions is a critical barometer for Capital Group Companies. Recent years have seen shifts in this trust, influenced by factors like the 2008 financial crisis and ongoing debates about corporate accountability. A 2024 survey indicated that while trust in established firms like Capital Group remains relatively stable, a significant portion of the public expresses skepticism towards the broader financial sector, with only 45% of respondents reporting high confidence.

Capital Group's long history and commitment to client-centricity are vital assets in this environment. Maintaining a reputation for integrity and transparency is paramount for retaining existing clients and attracting new ones. For instance, Capital Group's consistent focus on long-term investment strategies and client education has historically fostered a strong sense of reliability, which is crucial for navigating periods of economic uncertainty.

The company's ability to demonstrate ethical conduct and robust risk management practices directly impacts public perception. In 2023, financial institutions faced increased scrutiny regarding their environmental, social, and governance (ESG) performance, with investors increasingly prioritizing firms that align with societal values. Capital Group's proactive approach to ESG reporting and sustainable investment practices can therefore bolster its societal trust.

- Public Confidence: A 2024 survey revealed that only 45% of the public expressed high confidence in the financial services industry.

- Reputation Management: Capital Group's long-standing emphasis on integrity and transparency is key to maintaining client loyalty.

- ESG Influence: Increased investor focus on ESG factors in 2023 highlights the importance of ethical corporate behavior in building societal trust.

Societal trust in financial institutions is a critical barometer for Capital Group Companies, with a 2024 survey indicating only 45% of the public expressed high confidence in the financial services industry. Capital Group's long-standing emphasis on integrity and transparency is key to maintaining client loyalty, particularly as increased investor focus on ESG factors in 2023 highlights the importance of ethical corporate behavior in building societal trust.

The company's ability to demonstrate ethical conduct and robust risk management practices directly impacts public perception, reinforcing the need for proactive ESG reporting and sustainable investment practices to bolster societal trust. This focus is essential for navigating periods of economic uncertainty and maintaining client relationships.

| Societal Trust Factor | 2024 Data/Trend | Capital Group's Response/Implication |

|---|---|---|

| Public Confidence in Financial Services | 45% high confidence (2024 Survey) | Reinforces need for transparency and integrity. |

| Reputation and Client Loyalty | Long-standing emphasis on integrity and transparency | Key asset for retaining and attracting clients. |

| ESG Influence on Trust | Increased investor focus (2023) | Proactive ESG reporting and sustainable practices bolster trust. |

Technological factors

The financial services landscape is being fundamentally altered by the rapid expansion of FinTech. Robo-advisors, digital payment systems, and online investment platforms are not just changing how clients interact with financial institutions but also how these institutions operate internally. This digital shift is crucial for Capital Group to maintain its competitive edge.

Embracing digital transformation is no longer optional; it's essential for Capital Group to elevate client experiences and optimize operational workflows. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, underscoring the urgency for established players to adapt to these agile competitors.

As Capital Group's operations and client interactions become more digital, cybersecurity threats are a significant concern. The increasing volume of online financial transactions and sensitive client data makes the company a prime target for cyberattacks. For instance, in 2024, the financial services sector experienced a notable rise in ransomware attacks, with some reports indicating a 70% increase compared to the previous year, highlighting the persistent danger.

To counter these escalating risks, Capital Group must maintain substantial investments in advanced cybersecurity measures. This includes not only technological defenses but also ongoing employee training to prevent social engineering tactics. Adherence to evolving data privacy regulations, such as GDPR and CCPA, is also paramount, ensuring the protection of client information and upholding the company's reputation for trustworthiness. Failure to do so can result in significant financial penalties and reputational damage.

Capital Group can significantly enhance its investment strategies by integrating AI, machine learning, and big data analytics. These technologies allow for deeper market analysis and identification of subtle trends that traditional methods might miss. For instance, in 2024, many leading asset managers reported substantial improvements in portfolio performance and risk mitigation through AI-driven insights, with some seeing a 5-10% uplift in alpha generation.

By leveraging these advanced tools, Capital Group can refine its fundamental research, uncovering new investment opportunities and improving operational efficiency. Big data analytics, in particular, can process vast datasets from diverse sources, providing a more comprehensive view of companies and markets. This data-driven approach is becoming crucial for staying competitive, as firms that adopt these technologies are better positioned to adapt to evolving market dynamics.

Automation of Operations and Back-Office Functions

Automation technologies are revolutionizing back-office operations, promising significant efficiency gains and cost reductions for firms like Capital Group. By automating tasks such as trade processing, reconciliation, and compliance reporting, companies can drastically minimize human error. This shift allows for the redeployment of valuable human capital towards more strategic, higher-value activities, ultimately bolstering operational resilience.

The financial services industry is increasingly embracing automation. For instance, a 2024 report indicated that 65% of financial institutions are investing in AI and automation to streamline back-office functions. This trend is driven by the potential to reduce operational costs by up to 30% while simultaneously improving accuracy. Capital Group can leverage these advancements to enhance its competitive edge.

- Increased Efficiency: Automation can process transactions and data reconciliation at speeds far exceeding manual capabilities, leading to faster settlement times and improved client service.

- Reduced Operational Costs: By automating repetitive tasks, Capital Group can lower labor costs associated with back-office functions.

- Minimized Human Error: Automated systems reduce the likelihood of mistakes in data entry, trade execution, and compliance reporting, enhancing data integrity.

- Enhanced Compliance and Reporting: Automation can ensure consistent and accurate generation of regulatory reports, mitigating compliance risks.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) continue to present transformative possibilities for the asset management sector. These technologies offer enhanced transparency and can significantly reduce settlement times, potentially cutting down on operational costs and improving efficiency. For Capital Group, staying abreast of these advancements is crucial for future-proofing its operations and exploring innovative solutions.

The potential impact on transaction costs is substantial. By streamlining processes and removing intermediaries, blockchain could lead to more cost-effective transactions for Capital Group and its clients. Exploring pilot programs will allow the company to gauge the practical benefits and security enhancements these technologies can bring to its existing infrastructure.

- Blockchain adoption in finance is projected to grow significantly, with some estimates suggesting the global market could reach hundreds of billions of dollars by the late 2020s.

- DLT can reduce trade settlement times from days to minutes, a considerable improvement for high-volume trading environments.

- The use of smart contracts on blockchain platforms can automate compliance and reporting, further reducing manual effort and potential errors.

The integration of advanced technologies like AI, machine learning, and big data analytics presents a significant opportunity for Capital Group to refine its investment strategies. These tools enable deeper market analysis and the identification of subtle trends often missed by traditional methods. For example, in 2024, many leading asset managers reported substantial improvements in portfolio performance and risk mitigation through AI-driven insights, with some seeing a 5-10% uplift in alpha generation.

Automation is revolutionizing back-office operations, promising substantial efficiency gains and cost reductions for firms like Capital Group. By automating tasks such as trade processing and compliance reporting, companies can drastically minimize human error and redeploy human capital toward more strategic activities. A 2024 report indicated that 65% of financial institutions are investing in AI and automation to streamline back-office functions, aiming to reduce operational costs by up to 30%.

Blockchain and Distributed Ledger Technology (DLT) offer transformative possibilities for asset management, enhancing transparency and reducing settlement times. By streamlining processes and removing intermediaries, blockchain could lead to more cost-effective transactions for Capital Group and its clients. DLT can reduce trade settlement times from days to minutes, a considerable improvement for high-volume trading environments.

| Technology | Impact on Capital Group | Key Data/Trend (2024/2025) |

|---|---|---|

| AI & Machine Learning | Enhanced investment strategies, improved portfolio performance, risk mitigation | 5-10% uplift in alpha generation reported by AI-adopting asset managers |

| Automation | Increased operational efficiency, reduced costs, minimized human error | 65% of financial institutions investing in AI/automation for back-office; potential 30% cost reduction |

| Blockchain & DLT | Greater transparency, reduced settlement times, cost-effective transactions | Settlement times reduced from days to minutes; projected market growth into hundreds of billions by late 2020s |

Legal factors

Capital Group navigates a stringent global regulatory landscape, with key oversight from bodies like the U.S. Securities and Exchange Commission (SEC), the UK's Financial Conduct Authority (FCA), and Europe's Markets in Financial Instruments Directive II (MiFID II). These regulations dictate everything from product disclosure and investor protection to trading practices and capital requirements.

Compliance with these evolving rules is not merely a legal obligation but a critical operational imperative. For instance, MiFID II's implementation in 2018 brought significant changes to transparency and trading costs across European financial markets, impacting how firms like Capital Group conduct business and report transactions. Failure to comply can result in substantial fines, reputational damage, and the potential loss of operating licenses, underscoring the need for robust compliance infrastructure.

Capital Group, like all financial institutions, must navigate stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These laws mandate rigorous client identity verification and ongoing transaction monitoring to thwart illicit financial activities, a crucial legal imperative in 2024 and beyond.

To comply, Capital Group has invested significantly in robust internal controls and thorough due diligence processes. These efforts are essential for meeting evolving legal obligations, including adapting to new regulatory guidance issued by bodies like the Financial Action Task Force (FATF), which continues to refine global AML/KYC standards.

Global data protection laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly impact Capital Group. These regulations mandate strict protocols for how client data is gathered, stored, processed, and secured. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Capital Group must maintain robust data governance frameworks to ensure adherence to these evolving legal landscapes. This involves investing in advanced cybersecurity measures and transparent data handling policies to safeguard client information and maintain trust. Non-compliance risks not only financial repercussions but also severe damage to its reputation within the financial services industry.

Litigation Risks and Class-Action Lawsuits

As a prominent investment manager, Capital Group is exposed to litigation risks, particularly concerning investment performance, potential misrepresentations to clients, or operational shortcomings. These risks can manifest as class-action lawsuits, which can be costly and damaging to reputation. For instance, the financial services industry, in general, saw a significant number of securities class actions filed in 2023, with filings increasing by 15% compared to 2022, according to Cornerstone Research.

To navigate these challenges, Capital Group must maintain rigorous risk management protocols, ensure transparent and accurate client communications, and retain strong legal expertise. Proactive compliance and a commitment to ethical conduct are paramount in minimizing the likelihood and impact of legal disputes.

- Litigation Exposure: Capital Group, like other large asset managers, faces potential lawsuits related to investment outcomes, client disclosures, and operational integrity.

- Class-Action Threats: The possibility of class-action lawsuits, often stemming from perceived performance failures or misleading information, poses a significant legal risk.

- Mitigation Strategies: Robust risk management, clear client communication, and expert legal counsel are crucial for defending against and minimizing the impact of litigation.

- Industry Trends: The broader financial sector experienced an uptick in securities class actions in 2023, highlighting the persistent legal environment faced by firms like Capital Group.

Cross-Border Regulatory Harmonization and Fragmentation

The global financial landscape is marked by a dynamic tension between efforts to harmonize regulations and persistent fragmentation. This creates significant complexities for multinational firms like Capital Group, requiring constant adaptation of compliance strategies to ensure seamless cross-border operations while respecting diverse local requirements.

Navigating these inconsistencies is crucial for maintaining operational efficiency and market access. For instance, differing data privacy laws, such as the EU's GDPR versus regulations in other jurisdictions, necessitate tailored approaches to client data management. Capital Group must continuously monitor and adjust its internal policies to align with these evolving legal frameworks.

- Regulatory Divergence: In 2024, the Financial Stability Board highlighted ongoing divergence in prudential regulations for crypto-assets across major economies, impacting how firms like Capital Group manage digital asset investments.

- Harmonization Efforts: Initiatives like the Basel III framework aim for global banking standards, but implementation timelines and interpretations vary by country, presenting a challenge for capital adequacy assessments.

- Cross-Border Data Flows: Restrictions on cross-border data transfer, such as those seen in India and China, directly affect Capital Group's ability to centralize data analytics and client relationship management.

- Compliance Costs: The International Monetary Fund estimated in 2025 that compliance costs for financial institutions operating in multiple jurisdictions can represent a significant portion of operational expenses, directly impacting profitability.

Capital Group operates under a complex web of global regulations, including those from the SEC, FCA, and MiFID II, which govern investor protection and trading practices. Compliance with these rules, like MiFID II's 2018 transparency mandates, is essential to avoid fines and reputational damage.

The company must adhere to strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, necessitating thorough client verification and transaction monitoring, a critical focus in 2024. Data protection laws like GDPR and CCPA also impose significant requirements on client data handling, with GDPR fines potentially reaching 4% of global annual revenue.

Capital Group faces litigation risks, with securities class action filings increasing by 15% in 2023, underscoring the need for robust risk management and transparent communication. Furthermore, regulatory divergence across jurisdictions, as noted by the Financial Stability Board regarding crypto-assets in 2024, adds complexity to cross-border operations.

| Regulation Area | Key Legislation/Body | Impact on Capital Group | 2023/2024 Data Point |

|---|---|---|---|

| Investor Protection & Trading | SEC, FCA, MiFID II | Dictates disclosure, trading practices, capital requirements. | MiFID II implementation significantly altered European market transparency. |

| Financial Crime Prevention | AML, KYC, FATF | Mandates client verification and transaction monitoring. | FATF continues to refine global AML/KYC standards. |

| Data Privacy | GDPR, CCPA | Governs client data collection, storage, and security. | GDPR fines can reach up to 4% of global annual revenue. |

| Litigation | Securities Law | Exposure to lawsuits regarding performance and disclosures. | Securities class action filings rose 15% in 2023. |

| Cross-Border Compliance | Varying National Laws | Requires adaptation to diverse local requirements. | FSB noted regulatory divergence for crypto-assets in 2024. |

Environmental factors

Climate change presents both significant risks and emerging opportunities for Capital Group's investment portfolios. Physical risks, like increased frequency of extreme weather events, could devalue assets in vulnerable sectors, while transition risks, such as regulatory changes or shifts to low-carbon technologies, necessitate portfolio adjustments. For instance, the global investment in clean energy reached an estimated $1.7 trillion in 2023, signaling a massive shift.

Capital Group must proactively assess these climate-related impacts across its diverse holdings. Identifying companies that are resilient to physical risks and those poised to benefit from the transition to a low-carbon economy is crucial. The sustainable investing market is rapidly expanding, with global sustainable fund assets projected to reach $50 trillion by 2025, offering substantial growth potential for investors positioned correctly.

Investor appetite for Environmental, Social, and Governance (ESG) considerations continues to surge. In 2024, global sustainable investment assets are projected to exceed $50 trillion, reflecting a significant shift in capital allocation. This growing demand pressures asset managers like Capital Group to not only integrate ESG factors into their investment processes but also to offer products that cater to this preference.

To meet these evolving expectations, Capital Group must bolster its ESG research infrastructure and ensure transparent reporting on its sustainability initiatives. Developing investment strategies and products that genuinely align with ESG principles is no longer optional but a strategic imperative to attract and retain capital in this increasingly conscious market.

Growing worries about resource scarcity, such as water shortages and the availability of rare earth minerals, directly affect companies Capital Group invests in. For instance, the International Energy Agency reported in 2024 that demand for critical minerals like lithium and cobalt, essential for EVs and renewable energy technologies, is projected to surge by 400% to 600% by 2040, potentially leading to price volatility and supply constraints.

Climate-related events, like extreme weather, are increasingly disrupting global supply chains. A 2024 report by the World Economic Forum highlighted that supply chain disruptions cost the global economy an estimated $1.3 trillion in 2023 alone, a figure expected to rise as climate impacts intensify, impacting operational stability and profitability for many businesses.

Understanding and analyzing these environmental shifts is therefore paramount for building resilient long-term investment portfolios. Companies that proactively manage their resource dependencies and adapt to climate-induced supply chain risks are better positioned for sustained success.

Regulatory Pressure for Sustainable Finance

Governments worldwide are stepping up regulations to encourage sustainable finance. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants to disclose sustainability-related information. Capital Group needs to ensure its reporting and investment strategies align with these evolving environmental mandates to maintain compliance and investor trust.

These regulatory shifts are impacting investment strategies significantly. By mid-2024, many asset managers were enhancing their ESG integration processes to meet stricter disclosure requirements and investor demand for sustainable options. Capital Group's adaptation to these environmental regulations will be crucial for its long-term competitiveness.

The push for sustainable finance is also evident in the growth of green finance frameworks. The International Capital Market Association's Green Bond Principles, updated in 2023, provide a benchmark for issuing green bonds. Capital Group's engagement with such frameworks will demonstrate its commitment to environmentally responsible financial practices.

Key regulatory developments impacting Capital Group include:

- Mandatory ESG disclosures: Regulations like the EU's SFDR and upcoming SEC climate disclosure rules in the US are compelling companies and asset managers to report on environmental, social, and governance factors.

- Green bond standards: The increasing adoption of standardized green bond frameworks helps channel capital towards environmentally beneficial projects, requiring careful adherence for issuers and investors.

- Climate risk integration: Regulators are increasingly expecting financial institutions to integrate climate-related risks into their risk management frameworks and investment decisions.

- Sustainable investment product labeling: Initiatives to label sustainable investment products aim to prevent greenwashing and ensure transparency for investors, influencing how Capital Group markets its offerings.

Reputational Risk and Environmental Impact

Public perception of Capital Group's environmental stewardship is a critical factor influencing its brand image and its capacity to attract both clients and top talent. Negative environmental impacts, even indirectly through investment portfolios, can lead to significant reputational damage.

Capital Group needs to actively manage its own operational environmental footprint, aiming for reduced emissions and waste. Furthermore, its investment decisions must demonstrably align with sustainable practices to proactively mitigate reputational risks associated with environmental concerns.

- Brand Value: A strong environmental record can enhance brand loyalty; conversely, environmental missteps can erode trust. For instance, in 2024, a significant portion of investors indicated that a company's ESG (Environmental, Social, and Governance) performance influences their investment decisions.

- Talent Acquisition: Younger generations, in particular, prioritize working for organizations with a clear commitment to environmental responsibility. Studies in 2024 showed a marked preference for employers with robust sustainability initiatives.

- Investment Screening: Capital Group's investment strategies must consider the environmental impact of the companies it invests in. This includes scrutinizing industries with high carbon footprints or those involved in environmentally damaging practices.

Capital Group must navigate increasing regulatory pressures focused on environmental sustainability. Mandatory ESG disclosures, such as the EU's SFDR, and evolving climate risk integration expectations require robust data management and transparent reporting. The global push for green finance frameworks, like the updated Green Bond Principles from 2023, also necessitates alignment with environmentally responsible practices.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Capital Group Companies is built on a robust foundation of data from leading financial institutions like the IMF and World Bank, alongside reports from reputable market research firms and government regulatory bodies. We meticulously gather insights on political stability, economic forecasts, technological advancements, environmental policies, and social trends to provide a comprehensive view.