Capital Group Companies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Group Companies Bundle

The Capital Group Companies operates within a dynamic financial services landscape, facing significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success.

The complete report reveals the real forces shaping Capital Group Companies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Capital Group's reliance on specialized investment research and data from providers like Bloomberg, Refinitiv, and FactSet grants these suppliers a moderate bargaining power. While numerous vendors exist, the unique datasets and advanced analytics offered by some are crucial for Capital Group's sophisticated investment strategies.

The investment management sector, especially for firms like Capital Group that prioritize deep fundamental research, relies on a finite number of highly skilled professionals. This scarcity of top-tier portfolio managers, analysts, and researchers means these individuals hold considerable sway when it comes to negotiating their compensation and benefits packages.

The ongoing difficulty in both attracting and keeping these elite professionals intensifies competition among firms. This talent war directly influences operating expenses and a company's ability to execute its strategic plans effectively.

For instance, in 2024, the average compensation for a senior investment analyst in the US could range significantly, with top performers in major financial hubs potentially earning well over $200,000 annually, plus substantial bonuses. This high cost of talent is a direct reflection of their bargaining power.

Capital Group, a titan in asset management, relies heavily on sophisticated technology for its operations. This includes everything from executing trades and managing vast portfolios to assessing risk and generating client reports. The need for cutting-edge software is paramount for maintaining efficiency and a competitive edge in the financial world.

While the software market is broad, specialized FinTech solutions, particularly those leveraging AI and machine learning, are becoming indispensable. These advanced tools are crucial for optimizing performance and driving innovation. As of 2024, the global FinTech market is projected to reach over $3.1 trillion, highlighting the significant investment and reliance on these technology providers.

The increasing integration of artificial intelligence into financial services means that asset managers like Capital Group will likely see their dependence on these specialized technology providers grow. This growing reliance could consequently enhance the bargaining power of these critical software and AI solution vendors, especially those offering unique or proprietary capabilities.

Custodial and Fund Administration Services

Custodial and fund administration services are critical for investment firms like Capital Group, handling asset safekeeping, trade settlement, and essential back-office operations. The specialized nature of these services, coupled with stringent regulatory requirements and the imperative for secure, uninterrupted operations, makes switching providers a significant undertaking. This complexity and the associated switching costs grant established, reputable custodians considerable leverage.

The bargaining power of these suppliers is generally moderate to high. For instance, as of late 2024, major global custodians like BNY Mellon and State Street continue to dominate the market, managing trillions in assets under custody. Their extensive infrastructure, deep regulatory expertise, and established client relationships create high barriers to entry and make it challenging for firms to migrate services without substantial disruption and expense. The ongoing trend towards digitalization and standardization in fund administration, while potentially simplifying some processes, also reinforces the need for robust, proven technological solutions, further benefiting incumbent providers.

- High Switching Costs: The integration of custodial and fund administration services into a firm's core operations means that changing providers involves significant data migration, system reconfigurations, and retraining, leading to substantial costs and operational risks.

- Regulatory Compliance Expertise: Custodians possess deep knowledge of complex global financial regulations, which is essential for investment firms. This specialized knowledge is not easily replicated, strengthening the suppliers' position.

- Market Concentration: A few large global custodians hold a significant share of the market, limiting the number of viable alternatives for large investment managers and thus increasing their bargaining power.

- Service Complexity and Security: The critical nature of asset safekeeping and transaction processing demands highly secure and reliable systems, which only a few well-established providers can consistently offer, reinforcing their strong supplier position.

Regulatory and Compliance Expertise

Suppliers offering specialized regulatory and compliance expertise, including legal services and technology solutions, wield significant bargaining power over Capital Group. This is particularly true given the dynamic global regulatory environment. For instance, the Securities and Exchange Commission (SEC) continually introduces new rules impacting asset managers, necessitating constant adaptation. In 2024, the financial industry faced ongoing scrutiny regarding anti-money laundering (AML) regulations, further amplifying the need for specialized knowledge.

The demand for up-to-date compliance solutions is high, as failing to adhere to these complex mandates can result in substantial financial penalties and reputational damage. This creates a situation where Capital Group must rely on these expert suppliers to maintain operational integrity. The ability of these suppliers to provide niche, current knowledge makes their services indispensable, thus strengthening their position in negotiations.

- Regulatory Burden: Financial firms like Capital Group must navigate an increasing number of global regulations.

- Expertise Demand: Specialized legal and compliance consultants are essential for staying current.

- Compliance Technology: Providers of AML and other compliance software are critical for operational efficiency.

- Risk of Non-Compliance: Penalties for regulatory breaches can be severe, underscoring the value of supplier expertise.

The bargaining power of suppliers for Capital Group is influenced by the concentration of providers offering critical, specialized services. For data and research, while numerous vendors exist, the unique datasets and advanced analytics from providers like Bloomberg and Refinitiv are crucial, giving them moderate to high power. Similarly, the scarcity of top-tier investment talent means highly skilled professionals can command significant compensation, reflecting their strong bargaining position. The reliance on specialized FinTech solutions, particularly those leveraging AI, also grants these vendors increased leverage due to growing dependence and market expansion, with the global FinTech market projected to exceed $3.1 trillion in 2024.

| Supplier Category | Key Providers | Bargaining Power Level | Key Factors Influencing Power |

|---|---|---|---|

| Data & Research | Bloomberg, Refinitiv, FactSet | Moderate to High | Unique datasets, advanced analytics, reliance for sophisticated strategies |

| Talent (Investment Professionals) | N/A (Individual Professionals) | High | Scarcity of top-tier talent, high demand, intense competition for talent |

| FinTech Solutions (AI/ML) | Various specialized vendors | Growing (Moderate to High) | Increasing reliance on advanced tech, market growth ($3.1T+ projected for FinTech in 2024), proprietary capabilities |

| Custodial & Fund Administration | BNY Mellon, State Street | Moderate to High | High switching costs, regulatory expertise, market concentration, service complexity & security |

| Regulatory & Compliance Expertise | Legal firms, compliance tech providers | High | Complex and dynamic regulatory environment, need for specialized knowledge, risk of non-compliance penalties |

What is included in the product

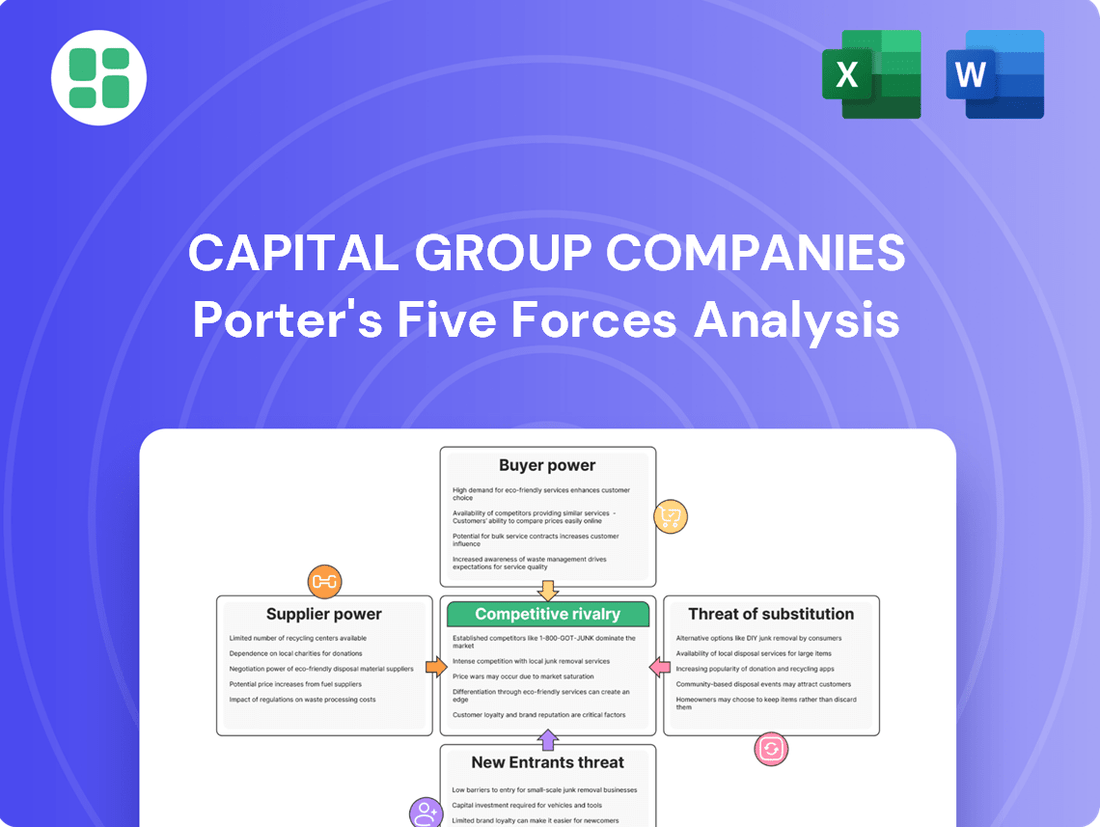

This analysis dissects the competitive landscape for Capital Group Companies, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes.

Instantly visualize competitive intensity with a dynamic, interactive dashboard, transforming complex Porter's Five Forces analysis into actionable insights for strategic planning.

Customers Bargaining Power

Customers today enjoy a vast selection of investment avenues, moving well beyond traditional actively managed mutual funds. Options like low-cost Exchange Traded Funds (ETFs), passively managed index funds, and increasingly popular robo-advisors offer compelling alternatives. In 2024, passive funds continued to attract substantial assets, with global passive AUM projected to reach $15 trillion by year-end, according to industry reports.

This proliferation of substitutes directly impacts firms like Capital Group. The widespread availability and lower expense ratios of passive investment vehicles, which saw net inflows of over $1 trillion globally in 2023, compel active managers to demonstrate superior performance to justify their fees. This dynamic significantly strengthens the bargaining power of investors, who can readily switch to more cost-effective solutions if active management fails to deliver added value.

Investors are more watchful of fees than ever, with lower expense ratios often dictating a move towards passive investments and robo-advisors. This trend, known as fee compression, puts significant pressure on active fund managers to consistently outperform benchmarks and justify their fees. For a firm like Capital Group, this means a constant need to deliver compelling risk-adjusted returns to keep assets under management, especially in areas where active management has historically lagged.

Capital Group's institutional clients, such as large pension funds and endowments, often manage billions of dollars. These sophisticated investors have dedicated teams capable of rigorous due diligence, which naturally enhances their negotiating leverage regarding fees and service customization. Their ability to easily shift assets to competitors or bring management in-house grants them considerable power.

Transparency and Information Access

The digital revolution has dramatically shifted the balance of power toward customers, especially in the financial services sector. Investors now have immediate access to a wealth of data, including fund performance, fee structures, and manager track records. This transparency allows for effortless comparison of Capital Group's products with those of its rivals, creating a more discerning and demanding clientele.

This heightened transparency means asset managers like Capital Group must consistently demonstrate their unique value. For instance, by mid-2024, the average expense ratio for actively managed equity mutual funds in the US hovered around 0.70%, according to industry reports. Clients can easily scrutinize whether Capital Group's fees align with the performance and services offered, making it crucial for the company to articulate its competitive advantages clearly and effectively.

- Unprecedented Information Access: Digital platforms provide investors with real-time data on fund performance, fees, and manager expertise, enabling direct comparisons.

- Informed and Demanding Clientele: Easy access to information empowers customers to make more sophisticated choices, increasing pressure on asset managers to deliver superior value.

- Value Proposition Scrutiny: Capital Group must continuously justify its fees and performance against a backdrop of readily available competitor data.

- Retention Through Communication: Maintaining client trust and assets hinges on transparent communication and a clear demonstration of ongoing value delivery.

Switching Costs (Varying)

For individual investors, particularly those utilizing defined contribution plans like 401(k)s that feature American Funds, the perceived cost of switching between comparable mutual funds or to exchange-traded funds (ETFs) is generally considered low. This ease of transition limits their bargaining power.

However, for substantial institutional mandates or intricate multi-asset solutions, the process of switching providers can incur considerable operational hurdles, potential tax ramifications, and administrative burdens. These factors can somewhat constrain the bargaining power of these larger clients.

The introduction of hybrid public-private investment solutions, such as those potentially offered by Capital Group in collaboration with KKR, may introduce novel switching considerations for investors, potentially altering the existing dynamics of customer power.

- Low Perceived Switching Costs for Retail Investors: Individual investors in 401(k)s with American Funds can often move assets between similar funds or to ETFs with minimal friction, reducing their leverage.

- High Switching Costs for Institutional Clients: Large institutional mandates face significant operational, tax, and administrative complexities when changing investment managers, thereby increasing switching costs and reducing customer power in this segment.

- Emerging Switching Dynamics: New investment structures, like hybrid public-private solutions, could introduce new factors influencing the ease or difficulty of switching, potentially impacting customer bargaining power.

The bargaining power of customers in the asset management industry, particularly for firms like Capital Group, is significantly amplified by the widespread availability of information and the increasing ease of switching investment vehicles. In 2024, investors have access to a wealth of data, making it simple to compare fees, performance, and services across various providers, including low-cost ETFs and robo-advisors.

This transparency forces active managers to demonstrate clear value to retain assets. For instance, the average expense ratio for actively managed equity mutual funds in the US remained around 0.70% in mid-2024, a figure clients can easily benchmark against passive alternatives. Consequently, Capital Group must continually justify its fees through superior risk-adjusted returns to counteract the pressure from cost-conscious investors.

While individual investors may face low switching costs, large institutional clients often encounter higher hurdles, such as operational complexities and potential tax implications, which can temper their bargaining power. However, the overall trend favors customers due to readily available alternatives and a heightened awareness of value.

| Factor | Impact on Bargaining Power | 2024 Context |

|---|---|---|

| Information Availability | Increases power | Real-time data on performance and fees readily accessible. |

| Availability of Substitutes | Increases power | Proliferation of ETFs and robo-advisors offering lower costs. |

| Switching Costs (Retail) | Low, limits power | Easy to move between similar funds or to ETFs. |

| Switching Costs (Institutional) | High, can limit power | Operational, tax, and administrative complexities. |

| Fee Sensitivity | Increases power | Pressure on active managers to justify fees against passive options. |

Preview the Actual Deliverable

Capital Group Companies Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Capital Group Companies, offering a thorough examination of competitive forces within the asset management industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises or placeholder content. This detailed analysis is ready for your immediate use, providing valuable strategic insights into Capital Group's competitive landscape.

Rivalry Among Competitors

The asset management landscape is incredibly crowded, featuring many large and diverse players all competing fiercely. While giants like BlackRock, Vanguard, Fidelity, and State Street, alongside Capital Group, command significant portions of the market, numerous other firms are also actively seeking clients. This fragmentation means that Capital Group faces rivals across a broad spectrum of investment types, from traditional stocks and bonds to newer alternative investments.

This intense rivalry isn't confined to just one area of finance. Competition spans various asset classes, including equities, fixed income, and alternative investments, and targets different customer groups, from large institutional investors to individual retail clients. For instance, as of early 2024, BlackRock managed over $10 trillion in assets, highlighting the sheer scale of the competition Capital Group navigates.

To stay ahead, firms like Capital Group are continuously innovating and broadening their offerings. This includes developing new products and expanding into areas such as private credit and evergreen funds, which are designed to attract and retain clients in this dynamic market. This constant push for new solutions ensures that the competitive pressure remains high across the board.

The increasing popularity of passive investing, especially Exchange Traded Funds (ETFs), significantly heightens competition for Capital Group. As of late 2024, passive funds continue to attract substantial inflows, putting pressure on active managers to justify their fees through superior performance. This shift challenges firms like Capital Group, traditionally known for active management, to adapt or risk losing market share.

The financial services industry faces a dynamic regulatory environment, with new Securities and Exchange Commission (SEC) rules and compliance deadlines in 2024 and beyond presenting significant operational challenges and costs. For instance, the SEC's finalized rules on cybersecurity risk management, effective in late 2023 and with compliance phases extending into 2024, require substantial investment in systems and personnel across all firms.

These compliance burdens, while potentially acting as a barrier for new entrants, intensify competition among existing players. Established firms like Capital Group must allocate considerable resources to meet these evolving requirements, which can divert capital from crucial areas such as product development or efforts to lower management fees. This creates a competitive dynamic where efficiency in regulatory navigation becomes a key differentiator.

Technological Advancements and AI Adoption

The investment management landscape is being dramatically reshaped by the swift integration of artificial intelligence (AI) and machine learning. Firms that master these technologies are seeing substantial gains in areas like investment research, personalized client outreach, and operational streamlining. For instance, by the end of 2024, many leading asset managers are projected to have increased their AI spending by over 20% to gain a competitive edge.

This technological arms race means that companies like Capital Group must consistently invest in digital transformation to avoid falling behind. Those that effectively leverage AI can unlock significant advantages, potentially creating a wider performance gap compared to slower adopters. The ability to process vast datasets for predictive analytics and automate routine tasks is becoming a critical differentiator in the market.

- AI in Investment: AI is enhancing portfolio construction and risk management, leading to potentially higher alpha generation.

- Distribution Channels: Personalized digital marketing powered by AI is improving client acquisition and retention rates.

- Operational Efficiency: Automation of back-office functions through AI is reducing costs and increasing processing speed.

- Competitive Imperative: Continuous investment in AI is no longer optional but essential for survival and growth in the asset management sector.

Brand Reputation and Long-Term Performance

In the investment management sector, where trust is paramount, a strong brand reputation and a history of consistent long-term performance are key advantages. Capital Group, through its well-regarded American Funds, has cultivated significant client loyalty over decades.

This established trust provides a buffer against intense competitive pressures. However, the firm faces ongoing challenges in maintaining superior performance, especially during market downturns. Competitors frequently emerge with strategies that yield short-term gains or introduce novel investment products, constantly testing Capital Group's market position.

For instance, in 2023, while many active managers struggled, Capital Group's American Funds maintained strong inflows, with over $30 billion in net new assets, demonstrating the enduring power of its brand and performance narrative. This contrasts with industry-wide outflows experienced by some peers.

- Brand Trust: Capital Group's American Funds brand is a significant asset, built on a long history of investment management.

- Performance Pressure: Sustaining top-tier performance is a continuous challenge, with rivals often achieving temporary outperformance.

- Product Innovation: Competitors' introduction of innovative products creates pressure to adapt and evolve investment offerings.

- Market Volatility: Economic uncertainties and market fluctuations test the resilience of long-term performance claims and client confidence.

Competitive rivalry is a defining characteristic of the asset management industry, with Capital Group facing intense pressure from numerous large and specialized firms. This competition spans all asset classes, from traditional equities and bonds to alternatives, and targets both institutional and retail investors. The sheer scale of major players, such as BlackRock managing over $10 trillion in assets as of early 2024, underscores the magnitude of this rivalry.

The ongoing shift towards passive investing, particularly ETFs, further intensifies competition, challenging active managers like Capital Group to consistently demonstrate value. Furthermore, the rapid integration of AI and machine learning is creating a technological arms race, with firms projected to increase AI spending by over 20% by the end of 2024 to gain an edge.

Capital Group's established brand reputation, exemplified by the strong inflows into its American Funds in 2023, provides a degree of resilience. However, maintaining superior performance against rivals who frequently introduce innovative products or achieve short-term gains remains a constant challenge in this dynamic market.

| Competitor | Assets Under Management (Approx. as of mid-2024) | Key Competitive Aspect |

|---|---|---|

| BlackRock | $10.5 trillion+ | Scale, passive offerings (iShares), broad product suite |

| Vanguard | $9 trillion+ | Low-cost index funds, strong retail brand, client-owned structure |

| Fidelity Investments | $5 trillion+ | Full-service brokerage, active management expertise, digital platforms |

| State Street Global Advisors | $4 trillion+ | Institutional focus, ETF leadership (SPDRs), indexing |

SSubstitutes Threaten

Passive investment vehicles like ETFs and index funds pose a significant threat to Capital Group's core business. These options provide diversified market exposure at a lower cost, directly competing with actively managed mutual funds. In 2023, passive funds saw net inflows of over $1 trillion, a trend that has persisted for years, indicating a growing investor preference for cost-efficiency and simplicity.

Robo-advisors and digital investment platforms are increasingly offering automated, low-cost investment management, directly challenging traditional advisory services. These platforms, leveraging AI, provide accessible and often emotion-free investing, appealing particularly to younger, tech-savvy investors.

While still a smaller segment, the rapid growth of robo-advisors presents a significant threat. For instance, assets under management by robo-advisors in the U.S. were projected to exceed $3 trillion by 2025, indicating their growing market penetration and competitive pressure on established firms like Capital Group.

The rise of direct investing and self-directed brokerage accounts presents a significant threat of substitutes for traditional asset management services. Many individual investors, empowered by readily available online financial data and user-friendly platforms, can now bypass professional managers. For instance, in 2024, the number of retail investors actively trading through online brokerages continued to grow, with many reporting satisfaction with managing their own portfolios, thereby reducing reliance on firms like Capital Group.

Alternative Investments and Private Markets

For sophisticated investors, direct stakes in private equity, private credit, real estate, and other alternative asset classes present a significant substitute for traditional public market investments. These alternatives are attractive because they aim for returns that don't move in lockstep with public markets, offering valuable diversification, especially when interest rates on safer assets are low.

The appeal of these alternatives is substantial. For instance, global private equity fundraising reached approximately $1.2 trillion in 2023, indicating strong investor demand. This trend underscores the competitive pressure on traditional asset managers.

Capital Group is actively responding to this threat. Their strategic partnership with KKR, announced in 2024, is a prime example of this adaptation. This collaboration aims to provide clients with integrated public and private investment opportunities, directly addressing the growing investor appetite for alternative assets.

- Alternative Assets Offer Diversification Private equity, private credit, and real estate are sought for their potential to deliver uncorrelated returns.

- Investor Demand is High Global private equity fundraising hit around $1.2 trillion in 2023, highlighting significant capital allocation to alternatives.

- Capital Group's Strategic Response Partnerships, like the one with KKR, are being formed to offer integrated public-private investment solutions to clients.

Savings Accounts and Fixed-Income Alternatives

For investors who are extremely cautious about risk, or when interest rates are high, traditional savings accounts, Certificates of Deposit (CDs), and other safe fixed-income options can be seen as alternatives to investment funds. These instruments focus on preserving your initial investment and offering a steady, predictable income stream, which is attractive to those who value security above potential growth.

The continued presence of elevated interest rates could further boost the appeal of these safer alternatives. For instance, as of late 2024, the Federal Reserve's target range for the federal funds rate remained significantly higher than in previous years, leading to more competitive yields on savings accounts and CDs. This environment makes the guaranteed return of these products more compelling when compared to the potential volatility of market-based investments.

- Yields on High-Yield Savings Accounts: In late 2024, many high-yield savings accounts offered annual percentage yields (APYs) exceeding 4.5%, a substantial increase from previous years.

- CD Rates: Similarly, 1-year CD rates were often found in the 5% range or higher, providing a locked-in, predictable return.

- Investor Preference Shift: This trend can divert capital away from riskier investment vehicles, particularly from more conservative investors seeking to avoid potential losses.

The increasing accessibility of alternative investments like private equity and real estate presents a significant substitute for traditional mutual funds. These asset classes offer diversification and potentially uncorrelated returns, appealing to investors seeking to enhance portfolio performance. Global private equity fundraising reached approximately $1.2 trillion in 2023, demonstrating robust investor demand for these alternatives.

Entrants Threaten

The investment management industry is a minefield of regulations, demanding rigorous licensing and robust compliance frameworks. For instance, in 2024, firms must adhere to evolving SEC guidelines and stringent anti-money laundering (AML) protocols, which can cost millions to implement and maintain. These substantial upfront and ongoing expenses create a significant barrier for new players seeking to enter the market.

The threat of new entrants for Capital Group Companies is significantly mitigated by the immense capital and deep-seated brand trust required to succeed in the investment management industry. Launching a firm capable of competing requires substantial financial resources to cover operational costs, cutting-edge technology, attracting top-tier talent, and extensive marketing campaigns.

Building a strong brand reputation and a history of consistent performance, particularly in active management, is a multi-decade endeavor. New players face a steep uphill battle against the established trust and significant economies of scale that incumbents like Capital Group have cultivated over many years. For instance, as of early 2024, the average assets under management for the top 10 global asset managers exceeded $5 trillion, a scale that is incredibly difficult for newcomers to replicate quickly.

The financial services industry faces a significant hurdle in talent acquisition and retention, directly impacting new entrants. The scarcity of highly skilled investment professionals, such as portfolio managers and researchers, creates intense competition for top talent. For instance, in 2024, the demand for experienced financial analysts outpaced supply by an estimated 15%, according to industry reports.

New firms struggle to attract seasoned individuals away from established players like Capital Group, which offer robust compensation packages, comprehensive benefits, and clear career progression. This makes building a competitive investment team a formidable challenge for those just entering the market, effectively acting as a barrier to entry.

Established Distribution Channels and Client Relationships

Established firms, such as Capital Group, benefit from deeply entrenched distribution channels and robust client relationships. These networks, built over years, provide access to a broad investor base through financial advisors, broker-dealers, and institutional consultants.

For instance, Capital Group's American Funds brand alone serves millions of investors, a testament to its established presence. New entrants face a formidable challenge in replicating this reach; developing comparable relationships and a substantial client base requires immense capital and considerable time, often exceeding a decade.

While digital platforms offer new avenues, the enduring strength of direct, personal relationships with financial intermediaries and clients continues to act as a significant barrier to entry. In 2023, the U.S. asset management industry saw continued consolidation, with larger firms leveraging their distribution power, making it even harder for smaller, newer players to gain market share.

- Extensive Distribution Networks: Capital Group leverages established relationships with financial advisors and institutions.

- Direct Client Base: A large existing client pool through brands like American Funds presents a barrier.

- Time and Investment: Building similar networks and trust for new entrants is a costly, long-term endeavor.

- Digital vs. Direct: While digital channels exist, established direct relationships remain a powerful competitive advantage.

Technological Investment and Economies of Scale

While financial technology, or FinTech, has democratized access to some financial services, the need for cutting-edge technology, particularly in areas like artificial intelligence and advanced data analytics, necessitates ongoing and substantial investment. For instance, the global FinTech market size was valued at approximately $2.4 trillion in 2023 and is projected to grow significantly, indicating the scale of investment required to remain competitive.

Established players within the financial services industry can capitalize on economies of scale in technology adoption, research and development, and operational efficiencies. This allows them to offer competitive pricing and enhanced services that pose a considerable challenge for smaller, newer entrants to match without substantial capital infusion.

Consider the significant R&D spending by major financial institutions. In 2023, many large banks and investment firms allocated billions of dollars to technology upgrades and innovation, a figure that is expected to increase as AI integration becomes more prevalent. This creates a high barrier to entry, as new firms must not only develop comparable technologies but also achieve the scale to amortize these costs effectively.

- High Technology Investment: Continuous spending on AI, machine learning, and advanced analytics is crucial for innovation and competitiveness in the financial sector.

- Economies of Scale: Large incumbents benefit from lower per-unit costs in technology adoption and operations, enabling more competitive pricing.

- R&D Expenditure: Major financial institutions invested billions in technology in 2023, a trend expected to rise with AI integration, creating a significant barrier for new entrants.

The threat of new entrants for Capital Group is low due to the substantial capital requirements for licensing, compliance, and technology infrastructure. For instance, in 2024, firms must navigate complex SEC regulations and anti-money laundering protocols, demanding significant upfront and ongoing investment.

Brand reputation and a proven track record, especially in active management, are built over decades, making it difficult for newcomers to gain trust. By early 2024, the top 10 global asset managers managed over $5 trillion in assets, highlighting the immense scale new entrants must overcome.

Talent acquisition is another major hurdle, with intense competition for skilled professionals. In 2024, the demand for financial analysts reportedly outstripped supply by 15%, making it challenging for new firms to build competitive teams against established players offering attractive compensation.

Established distribution networks and client relationships, like those Capital Group has cultivated through brands such as American Funds, represent a significant barrier. Developing comparable reach and trust can take over a decade and substantial capital, a challenge amplified by industry consolidation observed in 2023.

| Barrier Type | Description | 2024/2023 Data Point |

| Capital Requirements | Licensing, compliance, technology investment | Adherence to evolving SEC guidelines and AML protocols |

| Brand & Track Record | Building trust and consistent performance | Top 10 global asset managers' AUM exceeded $5 trillion (early 2024) |

| Talent Acquisition | Competition for skilled professionals | 15% estimated gap in financial analyst supply vs. demand (2024) |

| Distribution & Relationships | Access to investors via intermediaries | Industry consolidation in 2023 making market entry harder |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Capital Group Companies is built upon a foundation of diverse data sources, including their official annual reports, investor presentations, and public SEC filings. We also incorporate insights from reputable financial news outlets, industry-specific market research reports, and macroeconomic data to provide a comprehensive view of the competitive landscape.