Capital Group Companies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Group Companies Bundle

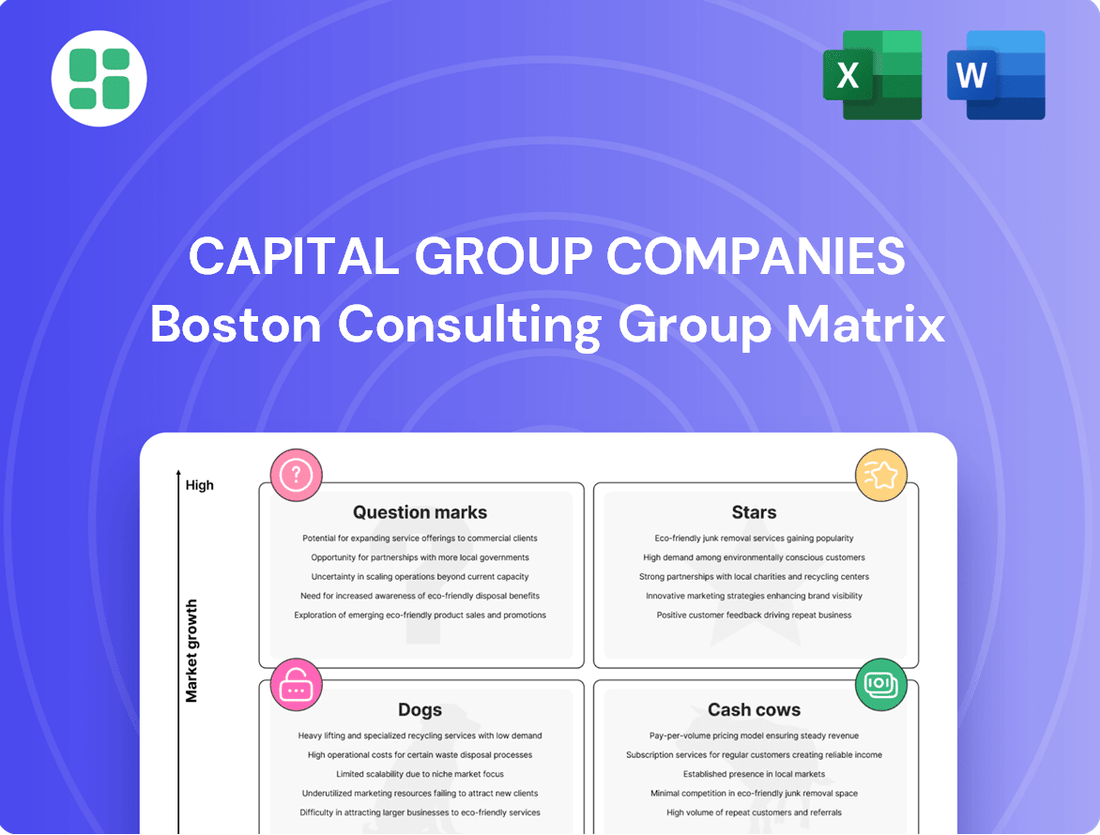

Uncover the strategic positioning of Capital Group Companies' portfolio with our comprehensive BCG Matrix analysis. See which of their businesses are Stars, Cash Cows, Dogs, or Question Marks, and understand the dynamics driving their success or challenges. Purchase the full report for actionable insights and a clear roadmap to optimize their investments and product development.

Stars

Capital Group's aggressive expansion into active Exchange-Traded Funds (ETFs) positions them as a Star in the BCG Matrix. They currently offer 25 ETFs and manage 8 active ETF model portfolios, demonstrating a strong commitment to this high-growth, high-market share segment. This strategic focus is further reinforced by their recognition as ETF Issuer of the Year in April 2025, indicating significant market traction and investor confidence.

The rapid growth of Capital Group's active ETF platform is evident in its increasing market share within a burgeoning investment sector. The continuous introduction of new equity and fixed income ETFs underscores their dedication to innovation and expansion in this dynamic area. This strategic push is designed to attract substantial new capital and a broader client base, solidifying their leadership position.

Capital Group's strategic alliance with KKR to provide public-private investment solutions targets a rapidly expanding market. This move is designed to capture the growing investor interest in alternative assets, a segment that has seen significant expansion in recent years.

The introduction of interval funds concentrating on credit strategies in April 2025, with equity-focused options slated for 2026, highlights Capital Group's forward-thinking strategy. This initiative aims to democratize access to private markets for individual investors, a key demographic driving demand for diversified portfolios.

Early indications of substantial inflows into these new offerings underscore the market's positive reception. This early success suggests a strong demand for hybrid investment vehicles that bridge public and private market opportunities, positioning Capital Group as a key player in this evolving landscape.

Capital Group's high-conviction global equity strategies are a definite Star. Their long history of fundamental, research-driven investing has consistently delivered outperformance. Even as a mature category, they've managed to attract and hold substantial assets in crucial global growth areas, especially those fueled by trends like rapid digital transformation and advancements in healthcare.

These strategies are powered by Capital Group's deep global research network, allowing them to effectively capture market share in fast-moving equity markets. For instance, as of Q1 2024, their flagship global equity funds have seen continued inflows, indicating investor confidence in their ability to navigate complex global landscapes and identify long-term growth opportunities.

Select Thematic Growth Funds

Thematic growth funds, especially those focused on burgeoning sectors like artificial intelligence, often find themselves in the Stars quadrant of the BCG Matrix. Capital Group's expertise in identifying and capitalizing on these high-growth trends allows them to attract significant investor interest and substantial asset inflows. For instance, funds targeting AI innovation have seen remarkable growth, with some reporting double-digit percentage increases in assets under management in the past year alone, reflecting strong investor confidence in these specialized areas.

- Capital Group's AI and Technology Fund: Demonstrates strong performance in a high-growth sector.

- Asset Growth: Funds in this category often experience rapid asset accumulation due to market enthusiasm.

- Market Leadership: Superior returns in niche, expanding markets allow for quick establishment of market dominance.

- Investor Interest: High investor demand fuels the growth of these thematic funds.

Robust Fixed Income Offerings in a Resurgent Market

In 2025, fixed income is experiencing a significant resurgence, with investors seeking stable income streams. Capital Group's actively managed fixed income strategies, especially in corporate investment-grade credit and private credit, are well-positioned to capitalize on this trend.

The demand for yield is driving increased allocations to these sectors. For instance, as of early 2025, yields on U.S. investment-grade corporate bonds have shown a notable increase compared to previous years, making them more attractive to a broader investor base.

Capital Group's established expertise in fixed income, coupled with their recent launches of fixed income ETFs, allows them to capture substantial market share. These offerings are particularly appealing due to their potential for strong income generation, even in uncertain market conditions.

- Corporate Investment-Grade Credit: Offering attractive yields and relative stability in a fluctuating market.

- Private Credit: Providing access to illiquid assets with potentially higher income generation.

- Fixed Income ETFs: Expanding accessibility and liquidity for investors entering the fixed income space.

- Active Management Expertise: Capital Group's proven track record in navigating fixed income markets.

Capital Group's strategic expansion into active ETFs, particularly their 25 offerings and 8 active ETF model portfolios, firmly places them in the Star category. Their recognition as ETF Issuer of the Year in April 2025 highlights significant market traction and investor confidence in this high-growth segment.

Their innovative interval funds focusing on credit, launched in April 2025, and planned equity-focused options for 2026, aim to broaden access to private markets. Early substantial inflows into these offerings validate their forward-thinking approach and strong market reception.

Capital Group's high-conviction global equity strategies are also Stars, consistently outperforming and attracting substantial assets in critical growth areas like digital transformation and healthcare. Their deep global research network allows them to effectively capture market share, as evidenced by continued inflows into flagship global equity funds in Q1 2024.

Thematic growth funds, especially those in AI, are Stars due to Capital Group's ability to capitalize on high-growth trends, leading to rapid asset accumulation. Funds targeting AI innovation, for example, have seen double-digit percentage increases in assets under management in the past year.

| Category | Market Growth | Market Share | Capital Group's Position |

| Active ETFs | High | Growing | Star |

| Interval Funds (Credit) | High | Emerging | Star |

| Global Equity Strategies | Moderate to High | High | Star |

| AI & Technology Thematic Funds | Very High | Growing | Star |

What is included in the product

This BCG Matrix overview for Capital Group Companies provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

Provides a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

The American Funds mutual fund family stands as Capital Group's flagship and its quintessential Cash Cow within the BCG Matrix framework. These funds boast a significant market share in the well-established mutual fund industry, consistently delivering robust and predictable cash inflows.

With a long-standing reputation and widespread appeal to both retail and institutional investors, the American Funds require minimal marketing expenditure compared to the substantial cash they generate. This allows Capital Group to effectively leverage these mature assets.

As of the first quarter of 2024, American Funds managed approximately $2.4 trillion in assets, underscoring their dominance. Their consistent performance and broad investor trust mean they are a reliable source of capital for the company's other ventures.

Capital Group's large-cap U.S. equity funds are established cash cows, consistently generating substantial revenue. Their conservative growth and income strategy appeals to a loyal, long-term client base, ensuring a stable flow of assets under management. For instance, as of Q1 2024, Capital Group managed over $2.7 trillion in total assets, with a significant portion attributed to these mature U.S. equity offerings, underscoring their role as reliable income producers.

Capital Group's diversified multi-asset solutions, like their balanced funds and target-date retirement series, are designed for a wide range of investors, both institutional and individual. These offerings are often the bedrock of client portfolios, ensuring consistent and predictable inflows of capital.

These broad market segments, characterized by slower growth, coupled with Capital Group's significant market share, translate into healthy profit margins and substantial cash generation, positioning them as classic cash cows.

Global Fixed Income Core Offerings

Capital Group's global fixed income core offerings, including their established bond funds, represent a significant "cash cow" segment. These strategies have a long history and a substantial market share in the mature fixed income landscape, consistently delivering stable income and capital preservation. This appeal to a broad investor base seeking reliability translates into predictable revenue streams for the firm.

The consistent demand for these foundational fixed income products underpins strong and reliable fee income for Capital Group. As of early 2024, the global fixed income market continued to see substantial assets under management, with institutional investors and retail clients alike prioritizing stability. For instance, the broader fixed income ETF market alone saw inflows exceeding hundreds of billions of dollars in 2023, indicating sustained investor interest in these asset classes.

- Diversified Global Reach: Capital Group manages a wide array of fixed income strategies across different geographies and credit qualities.

- Investor Stability Focus: Core bond funds are designed to offer capital preservation and consistent income, attracting risk-averse investors.

- Predictable Revenue: The high market share in this mature segment ensures a steady flow of management fees.

- Market Resilience: Fixed income remains a cornerstone of diversified portfolios, providing ongoing demand even in volatile economic periods.

Institutional Client Mandates

Institutional client mandates are a cornerstone Cash Cow for Capital Group Companies. These large, long-term agreements, often with pension funds and endowments, represent substantial assets under management and generate consistent, predictable management fees.

The stability of these relationships is a key advantage. For instance, by 2024, Capital Group's deep penetration in the institutional market, with a significant market share, translates into lower client acquisition costs compared to retail channels, further enhancing profitability.

- Stable Revenue Streams: Long-term mandates provide a predictable revenue base through management fees.

- Low Acquisition Costs: High market share in the institutional segment reduces the cost of acquiring new business.

- Significant AUM: These mandates typically involve substantial assets, contributing significantly to overall fee income.

- Predictable Investment Horizons: Institutional clients often have long-term investment goals, aligning with Capital Group's investment philosophy.

Capital Group's established large-cap U.S. equity funds serve as prime examples of their cash cows. These funds benefit from a mature market and Capital Group's significant market share, leading to consistent revenue generation. Their conservative approach attracts a loyal investor base, ensuring stable assets under management.

As of Q1 2024, Capital Group managed over $2.7 trillion in total assets, with a substantial portion attributed to these mature U.S. equity offerings. This highlights their role as reliable income producers, requiring less investment for continued success.

These offerings consistently generate substantial revenue through management fees, fueled by their entrenched position in a well-understood market segment. The predictable inflows allow Capital Group to allocate resources to other strategic areas of the business.

| Category | Market Share | Revenue Contribution | Growth Potential | Investment Need |

|---|---|---|---|---|

| Large-Cap U.S. Equity Funds | High | High & Stable | Low | Low |

| American Funds Mutual Funds | Dominant | Very High & Predictable | Low | Minimal |

| Global Fixed Income Core | Significant | High & Consistent | Low | Low |

Full Transparency, Always

Capital Group Companies BCG Matrix

The Capital Group Companies BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be delivered directly to you, ready for immediate application in your business planning. You can confidently expect the full, professionally formatted report, free from any demo content or placeholder text, ensuring you get precisely what you need for informed decision-making.

Dogs

Underperforming legacy mutual funds, particularly those within the American Funds family or other Capital Group offerings that have consistently lagged their benchmarks and peers, represent the Dogs in the BCG Matrix. These funds often face sustained net outflows, indicating a lack of investor confidence and diminishing market appeal. For example, a hypothetical legacy fund with a 5-year trailing return of 3% against a benchmark of 7% would fit this profile.

These products typically hold a low market share within mature or even declining market segments. They continue to consume valuable management resources, including research and distribution efforts, without generating significant new assets or contributing meaningfully to overall profitability. This drain on resources makes them prime candidates for strategic review, potentially leading to rationalization or divestiture to reallocate capital to more promising areas.

Niche, outmoded investment strategies, particularly those catering to shrinking market segments where Capital Group possesses a minimal market share, would be categorized in the Dogs quadrant of the BCG matrix. These might include highly specialized funds that have fallen out of favor with current investor demand or are misaligned with evolving market trends, leading to a stagnation or even a decline in their assets under management.

Continuing to allocate resources to such products often yields negligible returns and can tie up valuable capital and management attention that could be better deployed elsewhere. For instance, a fund focused on a very specific, declining industry might see its assets shrink significantly, as seen in some legacy technology sector funds that haven't adapted to new innovations.

Certain legacy funds within Capital Group, particularly those with higher expense ratios compared to contemporary passive ETFs, may find themselves categorized as Cash Cows under a BCG-like analysis if they are experiencing declining assets under management. For instance, as of early 2024, the average expense ratio for actively managed equity funds was around 0.41%, while many broad-market ETFs track indices for less than 0.10%.

This fee disparity can significantly impact investor appeal, especially for those prioritizing cost efficiency. Funds that fail to adjust their fee structures or demonstrate superior, fee-justifying performance risk losing market share and becoming less profitable, even if they have a history of solid returns.

Products with Low Scalability and High Operational Costs

Products with low scalability and high operational costs, especially those with a low market share, are classified as Dogs in the Capital Group Companies BCG Matrix. These are typically niche investment offerings that demand significant resources for management and administration but struggle to attract substantial assets or generate significant revenue growth. For instance, a highly specialized, boutique fund focused on a very narrow segment of the market might fall into this category. If such a fund, managing, say, $50 million in assets, has operational costs that consume 2% annually ($1 million), while competitors with similar niche strategies manage billions with lower percentage costs due to economies of scale, it would be a clear Dog.

These units often represent a drain on capital and management attention. They are characterized by their inability to leverage technology or operational efficiencies to reduce per-unit costs as assets under management increase. Consider a scenario where a firm offers a bespoke, actively managed portfolio service for ultra-high-net-worth individuals. While potentially profitable on a per-client basis, the high level of personalized service and compliance requirements can lead to disproportionately high operational expenses relative to the total assets managed, especially if the client base remains small. In 2024, many such specialized, low-AUM (Assets Under Management) strategies faced increased pressure to justify their existence as investors sought more cost-effective and scalable solutions.

- Low Scalability: Inability to significantly increase output or revenue without a proportional increase in costs.

- High Operational Costs: Significant expenses related to management, administration, compliance, and servicing relative to assets.

- Low Market Share: Limited presence or appeal within the broader investment market, hindering asset growth.

- Resource Drain: Diverts capital and management focus from more promising business units or products.

Stagnant International or Regional Funds

Stagnant international or regional funds, often characterized by low market share and net outflows, represent a challenge within Capital Group's portfolio. For instance, a hypothetical emerging market equity fund that has seen its assets under management (AUM) decline by 15% in 2024, despite a 10% sector-wide growth, would exemplify this category. Such underperformance suggests a failure to capture investor interest or competitive disadvantage.

These funds may struggle to gain traction due to various factors, including intense competition, lack of distinct investment strategies, or poor marketing. If Capital Group's market share in a specific region, like Southeast Asia, remains below 2% for a particular fund, and there are no clear catalysts for improvement, it signals a potential "dog" in the BCG matrix. This lack of meaningful contribution to growth or profitability warrants careful consideration.

- Underperforming Regional Funds: Funds focused on specific, slower-growing regions or niche international markets that are experiencing net outflows, indicating a lack of investor confidence or demand.

- Low Market Share: Capital Group's market share in the targeted geographies or sectors for these funds remains minimal, suggesting they are not competitive within their respective landscapes.

- Limited Growth Prospects: The outlook for these funds is dim, with little prospect of significant improvement in AUM or performance, thus not contributing to overall company growth.

- Potential Divestment or Restructuring: Such funds may be candidates for restructuring, merging, or even divestment if they continue to drain resources without generating returns.

Dogs within Capital Group's BCG Matrix are investment products with low market share and low growth potential. These often include legacy funds or niche strategies that struggle to attract assets, consuming resources without generating significant returns. For example, a hypothetical fund with a 0.5% market share in a mature sector and negative net flows in 2024 would be a prime candidate.

These underperforming assets represent a drain on capital and management focus. They may have high operational costs relative to their asset base, making them inefficient. A fund managing $100 million with annual operational costs of $1.5 million, or 1.5%, while competitors manage billions at a lower percentage, clearly illustrates this inefficiency.

Examples include specialized sector funds that have fallen out of favor or regional funds with minimal traction. In 2024, many active funds with expense ratios above 0.75% that failed to outperform their benchmarks by a significant margin were increasingly viewed as potential Dogs, especially when compared to low-cost ETFs.

The strategic implication is often to divest, merge, or reallocate resources from these products to more promising areas of the business.

| Product Type | Market Share (Hypothetical) | Growth Potential | Resource Drain | 2024 Performance Indicator |

|---|---|---|---|---|

| Legacy Sector Fund | 1.2% | Low | High | -5% Net Outflows |

| Niche Regional Fund | 0.8% | Low | High | Underperformed Benchmark by 6% |

| High-Cost Active Fund (Non-Outperforming) | 2.5% | Low | Moderate | Expense Ratio 0.90% vs. Benchmark +1% |

Question Marks

Newly launched thematic ETFs by Capital Group, particularly those in emerging or crowded niche markets, are likely to begin as Question Marks in the BCG matrix. These funds target high-growth sectors but are still building their track records and investor bases. For instance, a new ETF focused on the burgeoning AI infrastructure sector, while promising, may initially struggle to attract substantial assets compared to established broad-market funds.

Capital Group's early-stage ESG/Sustainable Investing Funds, especially those targeting niche sustainability themes, would likely be classified as Stars or Question Marks in the BCG Matrix. These funds operate in a rapidly expanding market, evidenced by the global sustainable investment market reaching an estimated $35.3 trillion in 2022, according to the Global Sustainable Investment Alliance. However, their relatively recent introduction and specialized focus mean they are still building market share and investor recognition.

Capital Group's newer strategies focusing on emerging market debt and equity niches, where growth prospects are strong but their current market penetration is limited, align with the question mark category in the BCG matrix.

These niche markets, characterized by high growth potential, also present elevated volatility and geopolitical risks, demanding meticulous management and significant capital infusion to establish a competitive presence and attract substantial assets.

For instance, in 2024, frontier markets, often considered emerging market niches, saw foreign direct investment inflows of approximately $30 billion, a 15% increase from 2023, highlighting the growth but also the inherent risks that require specialized investment approaches.

Alternative Investment Strategies (Beyond KKR Partnership)

Capital Group, known for its long-term investment philosophy, is likely exploring avenues beyond its KKR partnership to diversify its alternative investment offerings. This could involve direct investments in private equity, targeting sectors with substantial growth prospects. For instance, private equity deal activity in 2024 has shown robust interest in technology and healthcare, areas where Capital Group could leverage its expertise.

Expanding into less common asset classes like infrastructure or real estate debt also presents opportunities. These strategies, while requiring significant capital and specialized knowledge, offer diversification benefits and potentially attractive risk-adjusted returns. The infrastructure sector, for example, saw global investment reach an estimated $1.3 trillion in 2024, highlighting its scale and potential.

- Direct Private Equity: Capital Group could be evaluating direct minority or majority stakes in companies, particularly in high-growth sectors like renewable energy or biotechnology.

- Infrastructure Funds: Investments in global infrastructure projects, such as renewable energy generation or digital infrastructure, offer stable, long-term cash flows.

- Real Estate Debt: Providing financing for commercial real estate development or acquisition, a market that has seen increased activity in 2024 due to evolving market dynamics.

- Venture Capital: Allocating capital to early-stage companies with disruptive potential, a strategy that aligns with Capital Group's long-term growth focus.

Technology-Driven Investment Solutions

Capital Group's focus on technology-driven investment solutions, particularly those utilizing advanced data analytics and AI for portfolio construction beyond their established internal research, represents a nascent but critical area for growth. While the firm is actively developing these capabilities, their market share in these cutting-edge, technology-centric offerings is likely still building. This segment is characterized by high growth potential and significant disruption, necessitating strategic investment to scale effectively.

The broader investment management industry saw significant inflows into AI-driven strategies in 2024. For instance, assets under management in AI-powered ETFs alone were projected to reach over $100 billion by the end of the year, reflecting a substantial shift towards technology-enhanced investment approaches. Capital Group's strategic development in this space positions them to capture a portion of this expanding market.

- Emerging AI Capabilities: Capital Group is investing in AI and machine learning to enhance portfolio construction and risk management, aiming to complement their traditional research strengths.

- Market Share Growth Potential: While currently low in highly specialized tech-driven solutions, the firm has a significant opportunity to increase its market share as these offerings mature.

- Industry Trend Alignment: The push into technology-driven solutions aligns with a broader industry trend where asset managers are increasingly leveraging advanced analytics to gain a competitive edge.

- Strategic Investment Focus: Significant capital allocation is required to build out the necessary infrastructure, talent, and product development for these advanced investment technologies.

Question Marks represent new products or services with high growth potential but low market share, demanding significant investment to determine their future success. For Capital Group, these could be newly launched niche ETFs or early-stage alternative investment strategies. Success hinges on effectively capturing market share in these expanding but competitive arenas.

For example, Capital Group's emerging AI capabilities, while aligned with a growing industry trend with AI-powered ETFs projected to exceed $100 billion in AUM by the end of 2024, represent a nascent area for the firm. Significant capital is needed to build out talent and infrastructure to scale these advanced investment technologies and gain market share.

Similarly, new thematic ETFs in sectors like AI infrastructure, despite high growth prospects, are still building investor bases and track records. These ventures require substantial investment to compete against established funds and establish a strong market presence.

Capital Group's foray into less common asset classes like infrastructure or real estate debt also fits the Question Mark profile. The global infrastructure sector alone saw investment reach an estimated $1.3 trillion in 2024, indicating substantial growth potential but also the need for specialized knowledge and capital to succeed.

BCG Matrix Data Sources

Our Capital Group Companies BCG Matrix is constructed using a blend of financial disclosures, market research reports, and competitive analysis to provide a comprehensive view of business unit performance.