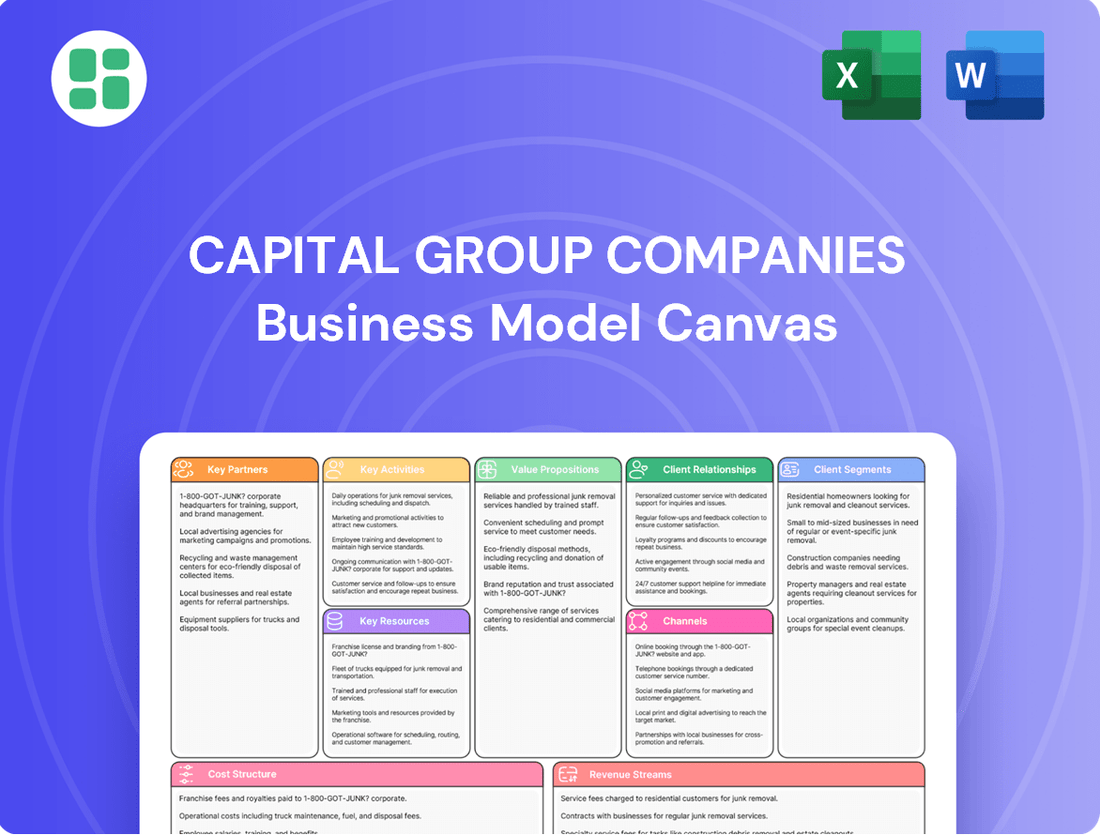

Capital Group Companies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Group Companies Bundle

Unlock the strategic blueprint of Capital Group Companies with its comprehensive Business Model Canvas. This detailed breakdown reveals how they attract and retain clients, manage key resources, and generate revenue in the competitive investment management sector. Discover the core components that drive their long-term success and market positioning.

Partnerships

Capital Group heavily relies on independent financial advisors and wealth management firms as key partners. These relationships are vital for distributing Capital Group's American Funds and other investment products to a broad base of individual investors.

In 2024, the financial advisory sector continued its robust growth, with many firms actively seeking high-quality investment solutions to meet client demand. Capital Group's established reputation and diverse product suite make it an attractive partner for these advisors.

To support these crucial alliances, Capital Group offers advisors comprehensive resources. These include in-depth market research, educational materials, and digital tools designed to enhance client engagement and drive business growth for the advisors themselves.

Capital Group collaborates with institutional consultants who guide major organizations like pension funds, endowments, and foundations. These partnerships are crucial for accessing significant assets under management and winning mandates to oversee intricate investment portfolios.

In 2024, institutional consultants played a vital role in directing billions in assets. For instance, firms like Mercer and Willis Towers Watson, prominent institutional consultants, advised on trillions in assets globally, influencing investment decisions for many large entities that are potential clients for Capital Group.

These consultants perform thorough due diligence on investment managers, making their endorsement a significant factor in securing new business. Their recommendations can directly translate into substantial inflows for asset management firms.

Capital Group's strategic alliances, notably its exclusive collaboration with KKR, are pivotal in expanding its investment offerings. This partnership focuses on creating innovative solutions, such as public-private market funds, which democratize access to alternative investments.

The alliance with KKR, a leading global investment firm, aims to bridge the gap for individual investors and financial advisors seeking exposure to private markets. This strategic move diversifies Capital Group's product suite, providing enhanced opportunities for portfolio growth.

Technology and Data Providers

Capital Group collaborates with technology and data providers to sharpen its research, trading, and client service operations. These partnerships grant access to advanced market analysis, risk management, and digital client engagement tools. For instance, in 2024, the firm continued to invest in data analytics platforms to process vast market information, aiming to identify alpha-generating opportunities more effectively.

The integration of artificial intelligence is a key focus for addressing complex data challenges. By leveraging AI, Capital Group seeks to enhance predictive modeling and automate data interpretation, improving the speed and accuracy of investment decisions. This strategic alignment with tech innovators is crucial for maintaining a competitive edge in the rapidly evolving financial landscape.

- Enhanced Research: Access to real-time market data and advanced analytics tools from providers like Bloomberg and Refinitiv fuels deeper investment insights.

- Trading Efficiency: Partnerships with trading technology firms streamline execution and reduce transaction costs, crucial for performance.

- Client Experience: Collaborations with digital platforms improve client onboarding, reporting, and communication, fostering stronger relationships.

- AI Integration: Focusing on AI solutions for data analysis and risk assessment, with significant investment anticipated in 2024 to leverage machine learning for predictive insights.

Custodians and Fund Service Providers

Capital Group, as a significant player in investment management, leans heavily on custodians for the secure holding of client assets. These relationships are fundamental to safeguarding the trillions of dollars under management. For instance, in 2023, major custodians like BNY Mellon and State Street reported record levels of assets under custody, reflecting the scale of operations for firms like Capital Group.

Beyond safekeeping, Capital Group partners with a spectrum of fund service providers. These entities offer crucial administrative and operational support, encompassing functions like fund accounting, transfer agency services, and compliance monitoring. This outsourcing allows Capital Group to maintain operational efficiency across its vast product suite.

These strategic alliances are critical for the compliant and seamless operation of Capital Group's investment products. They underpin the back-office infrastructure, ensuring adherence to complex regulatory frameworks worldwide. For example, the Investment Company Institute reported that in 2023, the U.S. mutual fund industry managed over $27 trillion in assets, highlighting the critical role of service providers in managing such volumes.

- Custodianship: Securing and safeguarding client assets, a core function for trust and compliance.

- Fund Administration: Handling accounting, NAV calculation, and regulatory reporting for investment vehicles.

- Transfer Agency: Managing shareholder records, transactions, and distributions.

- Operational Support: Providing essential services that enable the efficient functioning of investment products.

Capital Group's key partnerships extend to technology and data providers, crucial for enhancing research, trading, and client service. In 2024, the firm continued to invest in advanced data analytics platforms to process vast market information, aiming for more effective alpha generation.

These collaborations are vital for integrating artificial intelligence to tackle complex data challenges, improving predictive modeling and automating data interpretation for faster, more accurate investment decisions. This focus on AI integration is a significant driver for maintaining a competitive edge.

Partnering with custodians like BNY Mellon and State Street is fundamental for safeguarding the trillions of dollars under management, ensuring trust and compliance. Furthermore, alliances with fund service providers handle essential administrative functions like fund accounting and regulatory reporting, enabling operational efficiency across a diverse product suite.

| Partner Type | Key Role | 2024 Focus/Impact |

| Financial Advisors & Wealth Managers | Distribution of investment products | Continued robust growth, seeking high-quality solutions |

| Institutional Consultants | Access to significant assets, mandates for portfolios | Advised on trillions globally, influencing large entity investments |

| KKR | Product innovation, access to alternative investments | Developing public-private market funds |

| Technology & Data Providers | Research, trading, client service enhancement | AI integration for predictive modeling, data analysis |

| Custodians | Safeguarding client assets | Maintaining trust and compliance for trillions under management |

| Fund Service Providers | Administrative and operational support | Ensuring efficiency and compliance for investment products |

What is included in the product

A detailed Business Model Canvas for Capital Group Companies, outlining their client-centric approach to investment management and long-term wealth creation.

This model emphasizes their diverse customer segments, multi-channel distribution, and core value proposition of providing specialized investment solutions.

The Capital Group Companies Business Model Canvas offers a structured approach to dissecting complex investment strategies, thereby alleviating the pain point of information overload.

It provides a clear, visual representation of their diversified investment operations, simplifying the understanding of their value proposition and customer segments.

Activities

Capital Group's central function revolves around in-depth fundamental investment research and hands-on portfolio management for various asset classes like stocks, bonds, and blended strategies. This involves proprietary analysis, direct engagement with companies through visits, and a collaborative team structure to pinpoint enduring investment prospects.

The firm's distinctive 'Capital System' underpins a disciplined, research-centric approach to active management. As of early 2024, Capital Group manages trillions in assets, a testament to the effectiveness of their long-standing research-driven strategy.

Capital Group is actively expanding its product offerings to cater to changing investor demands. In 2024, the company continued its strategy of launching new investment vehicles, including actively managed Exchange-Traded Funds (ETFs) and public-private interval funds. This focus on innovation involves pinpointing unmet market needs and creating unique investment structures that reflect Capital Group's enduring investment principles.

A key aspect of this product development is the introduction of new equity ETFs. For instance, Capital Group launched new U.S. Growth and U.S. Value Equity ETFs in 2024, providing investors with more specialized options within the U.S. equity market. These launches demonstrate a commitment to evolving the portfolio to meet contemporary investment objectives.

Capital Group's client servicing and relationship management is a cornerstone, focusing on nurturing connections with individual investors, financial advisors, and large institutional clients. This dedication to client satisfaction is evident in their consistent efforts to provide high-quality support and resources.

The firm actively engages in offering educational materials and personalized assistance, aiming to foster long-term client loyalty and retention. In 2024, for instance, Capital Group continued to emphasize proactive communication and tailored advice, a strategy that has historically contributed to their strong client base.

Furthermore, Capital Group provides a suite of specialized tools and market insights designed to empower financial professionals. These resources are crucial for advisors seeking to enhance their own client relationships and investment strategies, reflecting the firm's commitment to supporting the entire financial ecosystem.

Global Market Analysis and Outlook Generation

Capital Group's key activity involves rigorous global market analysis, producing forward-looking insights like their annual Investment Outlook and Capital Market Assumptions. These reports, often released in late 2023 and early 2024, provide crucial perspectives on economic trends and potential asset class performance, guiding investors and advisors.

These publications are instrumental in helping clients and financial professionals navigate complex markets. For instance, their 2024 Capital Market Assumptions might project a moderate growth environment with inflation gradually moderating, influencing strategic asset allocation decisions for the year ahead.

- Global Economic Trends: Analyzing factors like geopolitical shifts and technological advancements impacting various regions.

- Asset Class Performance Projections: Estimating potential returns and risks for equities, fixed income, and alternatives.

- Investment Theme Identification: Spotting emerging opportunities driven by demographic changes or innovation.

- Data-Driven Outlooks: Utilizing extensive quantitative research to support forecasts and strategic recommendations.

Compliance and Risk Management

Capital Group's commitment to compliance and risk management is central to its operations in the heavily regulated financial sector. In 2024, the firm continued to invest heavily in systems and personnel to navigate a complex global regulatory landscape, which includes adhering to rules from bodies like the SEC, FCA, and others. This proactive approach ensures they meet diverse international standards and maintain the highest levels of integrity.

Key activities include the rigorous implementation of internal controls designed to safeguard client assets and prevent operational failures. Capital Group actively monitors various investment risks, such as market volatility and credit risk, as well as operational risks like cybersecurity threats and process errors. This continuous oversight is critical for protecting the firm and its clients.

The paramount importance of client trust and regulatory adherence drives these extensive efforts. For instance, in 2024, financial institutions globally faced increased scrutiny regarding data privacy and anti-money laundering (AML) regulations, areas where Capital Group maintains robust protocols. Their dedication to these principles underpins their long-standing reputation.

- Adherence to Global Regulations: Capital Group actively monitors and complies with evolving financial regulations across all operating jurisdictions, a critical function in 2024 given increased global regulatory focus.

- Robust Internal Controls: Implementing and continuously refining internal control frameworks to mitigate operational and financial risks, ensuring the integrity of all business processes.

- Risk Monitoring and Mitigation: Ongoing assessment and management of investment risks, including market, credit, and liquidity risks, alongside proactive identification and mitigation of operational vulnerabilities.

- Client Trust and Integrity: Maintaining client confidence through unwavering commitment to regulatory compliance and ethical business practices, a cornerstone of Capital Group's strategy.

Capital Group's core activities center on deep fundamental research and active portfolio management across diverse asset classes. This includes proprietary analysis, direct company engagement, and a collaborative approach to identify long-term investment opportunities.

The firm also focuses on expanding its product suite, launching new investment vehicles like actively managed ETFs and public-private interval funds in 2024 to meet evolving investor needs. This innovation is guided by their enduring investment principles.

Client servicing and relationship management are paramount, with a focus on providing high-quality support, educational materials, and personalized advice to individual investors, financial advisors, and institutions.

Furthermore, Capital Group produces forward-looking market insights and data-driven outlooks, such as their annual Investment Outlook and Capital Market Assumptions, to guide clients through complex market environments.

| Key Activity | Description | 2024 Focus/Data |

| Investment Research & Management | Proprietary analysis, active portfolio management, company engagement. | Managed trillions in assets, emphasizing a research-centric approach. |

| Product Development | Launching new investment vehicles, including ETFs and interval funds. | Introduced new U.S. Growth and U.S. Value Equity ETFs. |

| Client Servicing | Providing support, education, and personalized advice. | Emphasized proactive communication and tailored advice for client retention. |

| Market Insights | Global economic analysis and asset class performance projections. | Released 2024 Capital Market Assumptions guiding strategic asset allocation. |

Full Version Awaits

Business Model Canvas

The Capital Group Companies Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis and strategic framework that will be yours, complete with all sections and details. Once your order is processed, you'll gain full access to this identical, ready-to-use document, allowing you to immediately leverage its insights for your business planning.

Resources

Capital Group's cornerstone is its extensive network of seasoned investment professionals. This includes portfolio managers, research analysts, and ESG specialists, all contributing their deep expertise.

The firm's investment philosophy hinges on their collective knowledge, long tenures, and a collaborative spirit that fuels its fundamental research approach. This human capital is undeniably a critical resource.

Remarkably, the average portfolio manager at Capital Group boasts 25 years of investment experience. This extensive track record speaks volumes about the depth of knowledge and stability within their investment teams.

Capital Group Companies' proprietary research and data infrastructure form a cornerstone of their business model. They invest heavily in advanced analytical tools and cultivate a global network for information gathering, enabling them to uncover unique investment insights. This robust backbone supports their high-conviction investment approach.

This extensive data infrastructure, honed over decades, allows Capital Group to process vast amounts of information, identifying trends and opportunities that might elude others. For instance, their commitment to research is reflected in the significant resources dedicated to their analyst teams, who are empowered by sophisticated data platforms.

Capital Group Companies leverages its exceptionally strong brand reputation, particularly through the highly regarded American Funds mutual fund family. This established trust is a cornerstone for attracting and retaining clients in the highly competitive investment management sector. For instance, as of the first quarter of 2024, American Funds managed over $2.4 trillion in assets, a testament to its enduring client loyalty and market presence.

Substantial Assets Under Management (AUM)

Capital Group's substantial assets under management (AUM) are a cornerstone of its business model, reaching over $3.0 trillion in equity and fixed income as of June 30, 2025. This impressive scale translates directly into significant market influence and robust financial stability.

The sheer volume of AUM empowers Capital Group to make substantial investments in critical areas like cutting-edge research, advanced technology, and top-tier talent. This continuous investment is vital for maintaining and strengthening its competitive edge in the financial industry.

- Scale and Market Influence: Over $3.0 trillion in AUM as of June 30, 2025, provides significant leverage in financial markets.

- Financial Stability: A large AUM base ensures a stable financial foundation for operations and growth.

- Investment Capacity: Enables substantial allocation to research, technology, and talent development.

- Competitive Advantage: Reinforces Capital Group's position through continuous innovation and operational excellence.

Advanced Technology and Digital Platforms

Capital Group Companies leverages advanced technology and digital platforms as a core resource to drive innovation and efficiency. This commitment fuels enhanced investment research, streamlined trading operations, and more personalized client interactions. For instance, in 2024, the firm continued to invest heavily in artificial intelligence and machine learning to refine its data analysis capabilities, aiming to identify market trends and investment opportunities with greater precision.

These digital investments extend to client-facing portals, providing investors and financial professionals with intuitive access to portfolio information, market insights, and personalized reporting. By optimizing both internal processes and external services through technology, Capital Group aims to deliver superior value and maintain a competitive edge in the dynamic financial landscape.

- AI-Driven Research: Integration of AI for advanced data analysis and predictive modeling.

- Digital Client Portals: Enhanced online platforms for investor and advisor engagement.

- Operational Efficiency: Technology adoption to streamline trading, back-office functions, and data management.

- Cybersecurity Investments: Continued focus on robust security measures to protect client data and assets.

Capital Group's key resources are its people, proprietary research, strong brand, massive assets under management, and advanced technology. The firm’s investment professionals, averaging 25 years of experience, are central to its collaborative research approach. Their substantial assets under management, exceeding $3.0 trillion as of June 30, 2025, underpin financial stability and allow for significant investments in innovation.

| Resource | Description | Key Data Point (as of latest available) |

|---|---|---|

| Human Capital | Experienced investment professionals | Average portfolio manager experience: 25 years |

| Proprietary Research & Data | Advanced analytical tools and global information network | Continuous investment in AI and machine learning capabilities (2024) |

| Brand Reputation | Trust built through American Funds | American Funds AUM over $2.4 trillion (Q1 2024) |

| Assets Under Management (AUM) | Scale and market influence | Over $3.0 trillion in equity and fixed income (June 30, 2025) |

| Technology & Digital Platforms | Innovation and efficiency drivers | Continued heavy investment in AI/ML for data analysis (2024) |

Value Propositions

Capital Group's core value proposition centers on achieving superior, consistent long-term investment performance. This unwavering focus is built upon a foundation of disciplined, research-intensive active management, meticulously designed to weather diverse market cycles over extended horizons. The firm's philosophy actively encourages staying invested, prioritizing client objectives for the long haul.

Capital Group’s value proposition hinges on its deep, proprietary fundamental research, powered by a global team of investment professionals. This extensive analysis aims to identify undervalued companies and mitigate risks by unearthing unique market insights.

Their integrated approach also thoughtfully incorporates financially material Environmental, Social, and Governance (ESG) factors into their investment decisions. For instance, in 2024, Capital Group’s commitment to fundamental research was evident in their active engagement with companies on ESG matters, aligning with growing investor demand for sustainable practices.

Capital Group Companies provides a broad spectrum of investment options, encompassing equities, fixed income, and multi-asset strategies, catering to diverse client needs. This extensive offering, including mutual funds and actively managed ETFs, empowers investors to construct portfolios aligned with their unique financial goals and risk tolerance.

The firm actively utilizes the ETF structure, emphasizing its benefits of transparency and tax efficiency for investors. As of early 2024, Capital Group managed over $2.7 trillion in assets, underscoring the scale and reach of its diversified solutions.

Stability, Experience, and Trust

Capital Group's long history, originating in 1931, instills a profound sense of stability and deep experience in its investment management. This enduring presence, coupled with a consistent investment philosophy, cultivates trust among clients who value a reliable partner for achieving their financial aspirations.

The firm's commitment to continuity is evident in its well-defined leadership transition plans, ensuring a smooth handover of expertise and strategic direction. This focus on longevity reassures investors that their financial future is managed by seasoned professionals dedicated to long-term success.

- Founded: 1931

- Assets Under Management (as of Q1 2024): Over $2.7 trillion

- Key Focus: Long-term investment growth and client trust

- Management Philosophy: Emphasizes stability and consistent approach

Integrated ESG Considerations

Capital Group's commitment to integrated ESG considerations is a cornerstone of their investment philosophy. This means they don't just look at financial returns; they also scrutinize environmental, social, and governance factors to understand the full picture of a company's long-term viability. This holistic view is crucial in today's market, where sustainability is increasingly linked to financial performance.

By weaving ESG into their core investment process, Capital Group aims to uncover potential risks that others might miss and identify opportunities for growth that are aligned with sustainable practices. This proactive approach is designed to enhance long-term value creation for their clients, reflecting a growing global trend. For instance, in 2024, assets under management in sustainable funds continued to climb, with many investors actively seeking out firms that prioritize ESG principles.

- Dedicated ESG Expertise: Capital Group maintains a specialized ESG team, underscoring their commitment to in-depth analysis in this critical area.

- Proprietary Research: The firm leverages its own research capabilities to identify and assess ESG factors, ensuring a unique and informed perspective.

- Risk Mitigation and Opportunity Identification: Integrating ESG helps in spotting potential business risks and uncovering new avenues for value creation that are sustainable over time.

- Alignment with Investor Demand: This approach directly addresses the increasing investor preference for sustainable and responsible investment strategies in 2024 and beyond.

Capital Group's value proposition is built on delivering consistent, long-term investment performance through disciplined, research-driven active management. They prioritize client objectives by encouraging sustained investment through market cycles.

Their deep, proprietary fundamental research, conducted by a global team, aims to uncover undervalued companies and mitigate risks. This is further enhanced by integrating financially material ESG factors, as seen in their 2024 engagements with companies on sustainability practices, aligning with growing investor demand.

Capital Group offers a wide array of investment options, including equities, fixed income, and multi-asset strategies, available through mutual funds and actively managed ETFs. This extensive range allows investors to tailor portfolios to their specific financial goals and risk profiles.

| Value Proposition Component | Description | Supporting Fact/Data |

|---|---|---|

| Long-Term Investment Performance | Focus on superior and consistent results over extended periods. | Founded in 1931, emphasizing enduring investment philosophy. |

| Proprietary Fundamental Research | Deep analysis by a global team to identify undervalued assets and manage risk. | Actively engages with companies on ESG matters in 2024. |

| Diversified Investment Offerings | Broad range of asset classes and fund structures to meet varied client needs. | Manages over $2.7 trillion in assets as of Q1 2024, offering mutual funds and ETFs. |

| Integrated ESG Approach | Incorporation of environmental, social, and governance factors into investment decisions. | Dedicated ESG team and proprietary research for assessing sustainability factors. |

Customer Relationships

Capital Group excels in customer relationships through dedicated relationship management for institutional clients and crucial financial advisor alliances. These teams deliver personalized service and strategic guidance, focusing on understanding and addressing intricate investment requirements. Their approach fosters deep, enduring partnerships built on trust and tailored support.

Capital Group offers robust support and educational resources to financial advisors, including practice management insights and market outlooks. This commitment helps advisors grow their businesses and better serve clients, strengthening the firm's relationships within the advisor community.

Their Pathways to Growth study, for instance, provides actionable strategies for advisors. In 2024, continued emphasis on these resources aims to equip advisors with the knowledge and tools necessary to navigate evolving market landscapes and client needs.

Capital Group Companies offers robust digital and online services, allowing clients to effortlessly manage their accounts, research fund performance, and access market insights. This commitment to digital accessibility enhances convenience and empowers clients with self-service capabilities.

In 2024, Capital Group saw continued strong engagement across its digital platforms, reflecting a growing preference for online account management and information access among its diverse client base. The company reported that over 70% of client interactions were initiated through digital channels.

These comprehensive online portals provide immediate access to account updates, crucial tax resources, and a wealth of investment information, streamlining the client experience and fostering greater financial literacy.

Proactive Communication and Thought Leadership

Capital Group actively shares its expertise through regular investment outlooks and capital market assumptions, keeping clients and the broader market informed. This commitment to thought leadership ensures stakeholders are up-to-date on market dynamics and Capital Group's strategic viewpoints. For instance, in early 2024, their outlooks highlighted a cautious optimism for global equities, anticipating moderate growth despite persistent inflation concerns.

The firm leverages research reports to provide in-depth analysis, further solidifying its position as a trusted source of financial intelligence. These reports often delve into specific sectors or macroeconomic trends, offering actionable insights for investors. Their Q1 2024 report on emerging markets, for example, identified specific opportunities in technology and renewable energy sectors, supported by data showing significant investment inflows.

Webinars serve as a crucial channel for disseminating these valuable insights directly to clients and interested parties. These interactive sessions allow for real-time engagement and clarification of complex market scenarios. In April 2024, a webinar discussing the impact of central bank policy shifts saw over 5,000 attendees, demonstrating the demand for Capital Group's expert commentary.

- Proactive Market Insights: Regular publication of investment outlooks and capital market assumptions.

- In-depth Research: Dissemination of detailed research reports on market trends and opportunities.

- Client Engagement: Utilization of webinars to share perspectives and foster dialogue.

- Thought Leadership: Establishing the firm as a go-to source for financial intelligence.

Retirement Plan Participant Engagement

Capital Group actively engages retirement plan participants through initiatives like ICanRetire®. This program is designed to boost engagement and improve financial outcomes for individuals saving for retirement.

Their commitment extends beyond asset management, focusing on actively supporting participants in reaching their retirement objectives. This approach aims to foster a stronger connection with plan members.

- ICanRetire® Program: A key offering designed to enhance participant engagement and financial well-being.

- Expanded Access: The program has broadened its reach, making its services available to small businesses.

- Focus on Outcomes: Capital Group emphasizes improving the actual retirement readiness of individuals.

- Commitment to Support: Demonstrates a dedication to helping participants achieve their long-term financial goals.

Capital Group cultivates strong customer relationships through dedicated relationship managers for institutional clients and vital partnerships with financial advisors. These relationships are built on personalized service, strategic guidance, and a deep understanding of client needs, fostering trust and enduring collaborations. The firm's commitment to empowering financial advisors with practice management tools and market insights, as seen in their 2024 Pathways to Growth initiatives, further strengthens these crucial alliances.

Channels

Independent financial advisors are a cornerstone distribution channel for Capital Group, acting as trusted intermediaries who recommend the firm's mutual funds and investment solutions to their individual and small business clientele. This vital network enables Capital Group to tap into a diverse investor base, reaching individuals across a wide spectrum of financial situations and wealth levels. In 2024, the independent advisor channel continued to be a significant driver of asset gathering for many asset managers, with many firms reporting substantial inflows through these relationships.

Capital Group leverages extensive relationships with major wirehouses and independent broker-dealers to distribute its American Funds and other investment products. These channels provide access to a vast network of financial advisors and their affluent client bases, facilitating broad market penetration. For instance, in 2024, many of these large platforms continued to emphasize ESG investing, with intermediaries playing a critical role in client adoption of sustainable strategies.

Capital Group employs a dedicated institutional sales team to directly engage with large investors like pension funds, endowments, and sovereign wealth funds. This direct channel fosters deep relationships and allows for the development of highly customized investment solutions tailored to the specific needs of these sophisticated clients.

This consultative sales approach is crucial for securing and retaining substantial assets under management (AUM). In 2023, institutional clients were a cornerstone of Capital Group's business, contributing significantly to their overall AUM, which stood at over $2.7 trillion as of December 31, 2023.

Online Platforms and Digital Presence

Capital Group leverages sophisticated online platforms to provide clients with seamless access to their account details, comprehensive fund performance data, market insights, and a wealth of educational resources. This digital ecosystem is crucial for investor engagement and support, even if it doesn't represent a direct sales channel for every offering.

The company is actively enhancing its digital user experience. For instance, in 2024, Capital Group continued its rollout of modernized online account interfaces, aiming to simplify navigation and improve information accessibility for its diverse investor base.

- Enhanced Digital Accessibility: Capital Group's online portals offer 24/7 access to account management, fund performance tracking, and research.

- Investor Education Hub: The platforms feature extensive educational content, including articles, webinars, and market commentary, supporting informed decision-making.

- Digital Experience Upgrades: In 2024, the company focused on improving the user interface and experience of its online platforms to better serve its clients.

Retirement Plan Providers and Consultants

Capital Group leverages retirement plan providers and consultants as a crucial channel to distribute its investment solutions within employer-sponsored retirement plans, like 401(k)s. This strategic partnership grants access to a vast pool of individuals actively saving for their future.

In 2024, Capital Group continued to enhance its offerings for the small and mid-sized retirement plan market, recognizing its significant growth potential. For instance, the company's focus on digital tools and personalized advice aims to streamline the participant experience.

- Partnerships: Collaborates with leading retirement plan administrators and financial advisors.

- Market Reach: Accesses millions of employees through workplace retirement savings programs.

- Product Integration: Offers Capital Group's diverse investment funds as options within 401(k) and other retirement vehicles.

- Growth Focus: Expanding services and technology for small and mid-sized employer plans.

Capital Group utilizes a multi-faceted channel strategy to reach diverse investor segments. Independent financial advisors and large broker-dealers serve as key intermediaries, distributing mutual funds and investment solutions to individual and affluent clients. The firm also directly engages institutional investors, such as pension funds and endowments, with tailored strategies. Furthermore, Capital Group partners with retirement plan providers to offer investment options within employer-sponsored plans, tapping into a broad base of retirement savers.

| Channel | Key Intermediaries/Methods | Target Audience | 2024 Focus/Trend |

|---|---|---|---|

| Independent Financial Advisors | Direct relationships, advisor networks | Individual investors, small businesses | Continued significant driver of asset gathering |

| Wirehouses & Independent Broker-Dealers | Large financial advisory networks | Affluent clients, retail investors | Emphasis on ESG investing adoption |

| Institutional Sales | Direct engagement by sales teams | Pension funds, endowments, sovereign wealth funds | Developing customized solutions |

| Retirement Plan Providers | Partnerships with plan administrators | Employees in employer-sponsored plans | Enhancing offerings for small/mid-sized plans, digital tools |

| Digital Platforms | Online portals, mobile apps | All client types | Improving user experience, account access, educational resources |

Customer Segments

Individual investors represent a significant customer base for Capital Group, primarily engaging with their offerings through financial advisors. These investors are looking for expert guidance to manage their personal savings, retirement accounts, and funds earmarked for future goals like college education.

The American Funds, a flagship product line, caters to this segment by providing diversified investment solutions across U.S. and international markets. This approach allows individual investors to gain broad market exposure without the need for extensive personal research or direct trading.

In 2024, the trend of individuals relying on financial advisors for investment decisions continued, with many seeking to navigate market volatility and achieve long-term financial security. Capital Group's focus on advisor-driven distribution ensures these investors have access to professionally managed portfolios designed for sustained growth.

Institutional investors, including pension funds, endowments, foundations, and insurance companies, represent a key customer segment for Capital Group. These entities possess significant asset pools and demand highly specialized investment management services. As of 2024, Capital Group manages over $3.0 trillion for a vast array of these institutional clients.

These sophisticated investors often engage Capital Group's expertise through financial consultants or cultivate direct, long-term relationships to access customized investment strategies designed to meet their unique objectives and risk appetites.

Capital Group serves employers who sponsor retirement plans like 401(k)s and 403(b)s, along with the individuals participating in these plans. These employers are looking for reliable investment vehicles and support to help their employees save for retirement and generate income. As of 2024, Capital Group continues to enhance its retirement plan service offerings, aiming to provide robust investment solutions and educational resources to meet the evolving needs of plan sponsors and participants.

High-Net-Worth Individuals and Family Offices

High-net-worth individuals and family offices are a key customer segment, demanding tailored investment approaches and highly personalized service. Capital Group caters to these sophisticated clients, often through dedicated financial advisors, but also offers direct engagement via its private client services.

These clients typically have complex financial needs that go beyond traditional asset classes, frequently requiring access to multi-asset portfolios and alternative investment solutions. For instance, in 2024, the global private banking sector saw continued strong demand for alternative investments, with reports indicating that high-net-worth individuals allocated, on average, 15-20% of their portfolios to these strategies.

- Bespoke Investment Strategies: Customized portfolios designed to meet specific risk tolerance and return objectives.

- Personalized Service: Dedicated relationship managers and access to specialized expertise.

- Multi-Asset and Alternative Solutions: Investment opportunities in private equity, hedge funds, real estate, and other non-traditional assets.

- Direct Engagement: Some clients may bypass intermediaries and work directly with Capital Group's private client teams.

Financial Professionals (Advisors, RIAs, Consultants)

Financial professionals, including advisors and consultants, are a crucial customer segment for Capital Group, acting as both direct purchasers and key influencers of their investment products. The firm dedicates significant resources to equipping these professionals with essential tools, in-depth research, and valuable market insights to facilitate their client recommendations.

Capital Group’s commitment to this segment is underscored by initiatives like their 2024 Advisor Benchmark Survey, which directly addresses the needs and perspectives of financial advisors. This survey likely provides data on advisor sentiment, product preferences, and challenges, informing Capital Group's product development and service offerings.

- Key Influencers: Financial professionals are pivotal in channeling Capital Group's products to end-investors.

- Support Investment: Capital Group actively invests in providing financial professionals with robust tools and research.

- 2024 Advisor Benchmark Survey: This initiative highlights Capital Group's focus on understanding and serving this critical segment.

- Data-Driven Insights: The survey aims to gather data that informs Capital Group's strategies for supporting financial advisors.

Capital Group serves a diverse customer base, ranging from individual investors seeking guidance through financial advisors to large institutional entities like pension funds and endowments. The firm also caters to employers sponsoring retirement plans and high-net-worth individuals and family offices requiring specialized investment solutions.

In 2024, the emphasis on personalized investment strategies and access to alternative assets remained a key driver for high-net-worth clients, with many allocating a significant portion of their portfolios to these areas. Financial professionals are also a critical segment, with Capital Group actively providing them with research and tools, as evidenced by their 2024 Advisor Benchmark Survey.

| Customer Segment | Key Characteristics | 2024 Focus/Trends |

| Individual Investors | Seek guidance via advisors, focus on retirement and long-term goals. | Continued reliance on advisors for market volatility navigation. |

| Institutional Investors | Pension funds, endowments, foundations, insurance companies; large asset pools. | Managed over $3.0 trillion in 2024 for diverse institutional clients. |

| Employers/Retirement Plans | Sponsor 401(k)s, 403(b)s; seek reliable investment vehicles for employees. | Enhancing retirement service offerings and educational resources. |

| High-Net-Worth/Family Offices | Demand tailored approaches, personalized service, complex needs. | Strong demand for alternative investments (15-20% allocation in 2024). |

| Financial Professionals | Advisors, consultants; key influencers and purchasers of products. | Focus on providing tools, research; 2024 Advisor Benchmark Survey. |

Cost Structure

Employee compensation and benefits represent a substantial cost for Capital Group Companies. This category encompasses salaries, bonuses, health insurance, retirement plans, and other incentives for their extensive global workforce, which includes investment professionals, researchers, sales personnel, and administrative staff. In 2024, the competitive landscape for top talent in the financial sector means significant investment in attracting and retaining skilled individuals.

Capital Group Companies allocates significant capital to technology and infrastructure, a critical component of their operational model. These investments encompass sophisticated proprietary research platforms, advanced trading systems, robust cybersecurity measures, and user-friendly client-facing digital tools. For instance, in 2024, financial services firms globally continued to ramp up spending on AI and machine learning, with estimates suggesting the market for AI in financial services could reach over $25 billion by 2026, a trend Capital Group is undoubtedly participating in to enhance data analysis and maintain a competitive edge.

Capital Group's significant investment in marketing and distribution, particularly for its American Funds, represents a substantial cost. This includes extensive advertising campaigns targeting both financial advisors and institutional investors, aiming to build brand recognition and product awareness.

The company allocates considerable resources to developing and disseminating educational materials and hosting events. These initiatives are crucial for informing potential clients and reinforcing Capital Group's expertise in investment management.

A key component of their marketing spend is dedicated to supporting financial advisors in their efforts to acquire new clients. This often involves co-marketing initiatives and providing sales support, which are vital for expanding the advisor network and, consequently, asset flows.

Regulatory Compliance and Legal Costs

Operating within the global financial services sector, Capital Group Companies faces substantial expenditures on regulatory compliance and legal matters. These costs are driven by the need to adhere to a complex web of national and international laws, including strict SEC filing and disclosure requirements. In 2024, the financial services industry, as a whole, saw compliance costs continue to rise, with many firms allocating significant portions of their budgets to legal teams and compliance officers.

Maintaining robust compliance frameworks is not merely a cost but a critical investment to safeguard against legal penalties and reputational damage. For instance, fines for non-compliance in the financial sector can be exceptionally high, underscoring the importance of proactive adherence. The sheer volume of regulatory updates and the need for continuous training for staff add to this ongoing expense.

Key cost drivers within this category include:

- Legal counsel fees for advice on evolving regulations and dispute resolution.

- Costs associated with internal compliance staff and technology solutions for monitoring and reporting.

- Expenses related to external audits and certifications to verify adherence to standards.

- Fees for regulatory filings and necessary disclosures to governmental bodies.

Research and Data Subscriptions

Capital Group dedicates substantial resources to its research and data subscriptions, a crucial element in sustaining its fundamental research edge. These ongoing costs are essential for acquiring comprehensive market data, subscribing to specialized research platforms, and utilizing advanced analytical tools. For instance, in 2024, the financial data and analytics sector saw significant growth, with market research firms like Gartner and Forrester reporting increased spending by investment firms on data and analytics solutions to gain competitive insights.

These subscriptions are not merely operational expenses; they are foundational to Capital Group's ability to inform its investment decisions and cultivate proprietary insights that differentiate its strategies. The investment in these data feeds directly supports the deep dives into companies and markets that are characteristic of their approach. The increasing complexity and volume of financial data mean that staying ahead requires continuous investment in these information channels.

The growing importance of Environmental, Social, and Governance (ESG) factors presents another significant cost center. Engaging with ESG data, which often involves specialized providers and sophisticated analytical frameworks, requires considerable investment. For example, the demand for ESG data and ratings has surged, leading to higher subscription costs for firms seeking to integrate these considerations into their investment processes. This investment is critical for meeting client demand and regulatory expectations in 2024 and beyond.

- Market Data Subscriptions: Costs associated with Bloomberg Terminal, Refinitiv Eikon, and other real-time data providers.

- Research Platforms: Investment in access to specialized equity research, economic forecasts, and industry-specific analysis.

- Analytical Tools: Expenditure on software and platforms for quantitative analysis, portfolio construction, and risk management.

- ESG Data Providers: Outlays for ESG ratings, scores, and data sets from firms like MSCI, Sustainalytics, and S&P Global.

The cost structure of Capital Group Companies is largely driven by its extensive global operations, talent acquisition, and technological investments. Key expenses include employee compensation, advanced technology infrastructure, marketing and distribution efforts, regulatory compliance, and the procurement of market data and ESG information.

These costs are essential for maintaining their competitive edge in the asset management industry. For instance, in 2024, the firm's commitment to proprietary research and sophisticated trading systems, coupled with increasing regulatory burdens and the growing demand for ESG data, significantly shaped its expenditure patterns.

The company's investment in attracting and retaining top financial talent, particularly in specialized research and investment roles, represents a substantial ongoing cost. Furthermore, the continuous need for cutting-edge technology, including AI and machine learning capabilities, adds to the operational expenditure.

| Cost Category | Description | 2024 Significance |

| Employee Compensation & Benefits | Salaries, bonuses, health, retirement for global workforce. | Major cost driver due to competitive talent market. |

| Technology & Infrastructure | Proprietary research platforms, trading systems, cybersecurity. | Significant investment in AI/ML and digital tools. |

| Marketing & Distribution | Advertising, advisor support, educational materials. | Crucial for brand building and asset gathering. |

| Regulatory Compliance & Legal | Adherence to complex national/international laws. | Rising costs due to evolving regulations and penalties. |

| Data & Research Subscriptions | Market data (e.g., Bloomberg), ESG data, analytical tools. | Essential for informed investment decisions and ESG integration. |

Revenue Streams

Capital Group's main way of making money comes from asset management fees. These fees are a small percentage of the total money they manage for clients, known as assets under management, or AUM. This setup means Capital Group does better when their clients' investments grow and perform well.

As of June 30, 2025, Capital Group was overseeing more than $3.0 trillion in assets. This substantial AUM base directly translates into significant revenue from these management fees, highlighting the scale of their operations.

Capital Group generates revenue through a variety of fund administration and service fees. These fees are tied to the management of its extensive range of mutual funds, exchange-traded funds (ETFs), and other investment products. For instance, in 2023, the asset management industry, where Capital Group operates, saw significant fee income, with total U.S. fund industry assets reaching over $27 trillion.

These fees are essential for covering the operational costs of managing these investment vehicles, including meticulous record-keeping and dedicated shareholder servicing. Such operational efficiency and client support directly contribute to the firm's overall profitability, ensuring the smooth functioning of its investment offerings.

Capital Group may charge performance fees for specific, often institutional or specialized, investment strategies. These fees are typically calculated as a percentage of profits earned beyond a predetermined benchmark or hurdle rate. For instance, a hedge fund strategy might have a 2% management fee and a 20% performance fee on returns exceeding 8% annually.

This fee structure directly links Capital Group's compensation to the success of its investment management, strongly aligning its interests with those of its clients. The primary goal is to incentivize the firm to achieve and sustain superior long-term investment performance for its investors.

Advisory Fees for Separate Accounts

Capital Group earns advisory fees from clients who opt for separately managed accounts or customized investment mandates. These fees are calculated as a percentage of the total assets under management, directly correlating with the bespoke investment strategies and dedicated service offered.

This revenue stream is particularly significant for high-net-worth individuals and institutional investors seeking tailored financial solutions. For instance, in 2024, a substantial portion of Capital Group’s revenue is expected to originate from these specialized advisory relationships, reflecting the ongoing demand for personalized wealth management.

- Fee Structure: Typically a percentage of Assets Under Management (AUM).

- Clientele: High-net-worth individuals and institutional investors.

- Service: Personalized investment management and customized mandates.

- Revenue Driver: Reflects the value of tailored financial advice and dedicated portfolio management.

New Product Category Revenue (e.g., Interval Funds)

Capital Group's strategic expansion into new product categories, exemplified by their partnership with KKR for public-private interval funds, directly generates novel revenue streams. This initiative broadens their investment solutions, catering to the increasing investor appetite for alternative assets. The initial launch of these interval funds occurred in April 2025, marking a significant step in diversifying their revenue base.

These new offerings are designed to capture market share in a growing segment of alternative investments. By collaborating with established players like KKR, Capital Group leverages expertise and market access to accelerate revenue generation from these innovative products. The success of these interval funds will contribute directly to the firm's top-line growth.

- New Product Revenue: Interval Funds (Public-Private)

- Partnership: KKR

- Launch Date: April 2025

- Market Focus: Alternative Investments

Capital Group's revenue is primarily driven by asset management fees, calculated as a percentage of the total assets they manage. This model directly links their earnings to investment performance and the overall growth of their clients' portfolios.

As of June 30, 2025, Capital Group managed over $3.0 trillion in assets, underscoring the substantial revenue generated from these fees. This vast AUM base is a testament to their scale and market presence.

In addition to management fees, Capital Group earns revenue from a variety of fund administration and service fees associated with its broad range of investment products. The asset management industry in 2023 saw significant fee income, with U.S. fund industry assets exceeding $27 trillion.

Performance fees are also a component of their revenue, typically charged on specific strategies where Capital Group earns a percentage of profits above a benchmark. This structure incentivizes superior investment outcomes for clients.

Advisory fees from separately managed accounts and customized mandates represent another key revenue stream, particularly for high-net-worth and institutional clients. In 2024, these specialized advisory relationships are expected to contribute significantly to Capital Group’s overall revenue.

| Revenue Stream | Primary Mechanism | Key Client Segment | 2024/2025 Data Point |

|---|---|---|---|

| Asset Management Fees | Percentage of AUM | All investors | $3.0 trillion+ AUM (June 30, 2025) |

| Fund Administration & Service Fees | Fees on mutual funds, ETFs, etc. | All investors | Industry AUM over $27 trillion (2023) |

| Performance Fees | Percentage of profits above benchmark | Institutional, specialized strategies | Common in hedge fund-like strategies |

| Advisory Fees | Percentage of AUM for tailored solutions | High-net-worth, institutional | Significant contributor in 2024 |

Business Model Canvas Data Sources

The Capital Group Companies Business Model Canvas is built upon a foundation of comprehensive financial disclosures, internal operational data, and extensive market research. These sources provide the granular detail necessary to accurately map out revenue streams, cost structures, and key activities.