Capcom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capcom Bundle

Capcom's success is intricately linked to the ever-shifting global landscape. Our PESTLE analysis dives deep into the political stability, economic fluctuations, and technological advancements that directly impact their operations and future growth. Understand the social and environmental factors that influence consumer behavior and regulatory frameworks, giving you a critical edge.

Gain a comprehensive understanding of the external forces shaping Capcom's strategic decisions. From evolving legal landscapes to the competitive technological environment, our PESTLE analysis provides actionable intelligence. Unlock the full report to equip yourself with the insights needed to anticipate market shifts and capitalize on emerging opportunities.

Political factors

Governments globally, including Japan, are tightening controls on video game content, focusing on violence, gambling-like features such as loot boxes, and age appropriateness. Capcom must adapt to these varied legal frameworks to prevent penalties and market access issues. For example, Japan has specific rules concerning in-game virtual currency and the mechanics of loot boxes, impacting game design and monetization strategies.

The effectiveness of intellectual property (IP) laws and their enforcement in major markets significantly influences Capcom's capacity to safeguard its valuable franchises, such as Resident Evil and Monster Hunter. Strong legal structures are essential for deterring piracy and the unauthorized exploitation of its distinctive characters and game assets, which are critical for its character merchandising and burgeoning eSports ventures.

Capcom's global operations are significantly shaped by international trade policies and evolving geopolitical landscapes. For instance, the ongoing discussions around digital trade agreements and potential tariffs on imported electronics could influence the cost of hardware components and the distribution of physical game copies. In 2023, Japan, Capcom's home base, saw its trade deficit widen, highlighting the sensitivity of its economy to global trade dynamics.

Government Support for Creative Industries

The Japanese government is making a concerted effort to boost its content sector, with a specific focus on video games. The goal is to see the industry's value increase fourfold by 2033, a significant ambition that could translate into tangible benefits for companies like Capcom.

This strategic push might manifest as direct financial incentives, grants for game development projects, or policy changes designed to enhance the working environment and compensation for creative professionals. Such measures could foster a more robust domestic talent pool and a generally more supportive ecosystem for game creators.

- Government Target: Aim to quadruple the value of Japan's content industry by 2033.

- Potential Benefits for Capcom: Access to incentives, development funding, and improved creator conditions.

- Impact on Talent Pool: A stronger domestic talent pool and a more supportive creative ecosystem.

Esports and Gambling Legislation

The regulatory landscape for esports and gambling is a significant political factor for Capcom. As governments worldwide grapple with the intersection of competitive gaming and betting, new laws are emerging. These regulations often target how prize money is distributed and how in-game items, particularly those with real-world monetary value, are monetized. For instance, in 2024, several European nations continued to refine rules around loot boxes and virtual item trading, impacting potential revenue streams for game developers.

Capcom's business model, which includes substantial revenue from in-game purchases and its participation in the esports ecosystem, is directly exposed to these evolving legal frameworks. A stricter stance on loot boxes, akin to gambling regulations, could necessitate significant adjustments to how monetization strategies are implemented in titles like Street Fighter or Resident Evil. This requires a proactive approach to legal compliance and business model adaptation to navigate varying national and regional legislative approaches.

- Evolving Esports Regulations: Governments are increasingly scrutinizing prize pools, player contracts, and event broadcasting rights in esports.

- Gambling Law Impact: Stricter interpretations of gambling laws could affect the legality and taxation of in-game purchases that resemble betting.

- Monetization Adjustments: Capcom may need to modify its in-game monetization strategies, such as loot box mechanics or virtual item sales, to comply with new legislation.

- International Compliance: Navigating diverse legal requirements across different markets presents a complex challenge for global game publishers.

Governments worldwide are increasingly scrutinizing video game content, with a focus on violence, gambling-like features, and age appropriateness. Capcom must navigate these diverse legal frameworks to avoid penalties and maintain market access. For instance, Japan has specific regulations concerning in-game virtual currency and loot box mechanics, directly impacting game design and monetization strategies.

The effectiveness and enforcement of intellectual property laws in key markets are crucial for Capcom to protect its valuable franchises like Resident Evil and Monster Hunter. Robust legal protections are essential to combat piracy and the unauthorized use of its characters, which are vital for merchandising and its growing esports presence.

International trade policies and geopolitical shifts significantly shape Capcom's global operations. Discussions around digital trade and potential tariffs on electronics could affect hardware component costs and physical game distribution. In 2023, Japan's trade deficit widened, underscoring its economy's sensitivity to global trade dynamics.

Japan aims to quadruple its content industry value by 2033, a significant ambition that could benefit companies like Capcom through incentives, development grants, and improved conditions for creative professionals, fostering a stronger domestic talent pool.

| Political Factor | Description | Impact on Capcom | Example/Data Point |

| Content Regulation | Government oversight on game content (violence, loot boxes). | Requires adaptation of game design and monetization. | Japan's specific rules on virtual currency and loot boxes. |

| Intellectual Property (IP) Enforcement | Strength of IP laws and their application. | Crucial for protecting franchises and preventing piracy. | Safeguarding Resident Evil and Monster Hunter for merchandising and esports. |

| Trade Policies & Geopolitics | International trade agreements and global political stability. | Affects hardware costs and game distribution. | Japan's 2023 trade deficit highlights economic sensitivity to global trade. |

| Government Support for Content Industry | National initiatives to boost the creative sector. | Potential for incentives, funding, and improved talent conditions. | Japan's goal to quadruple content industry value by 2033. |

What is included in the product

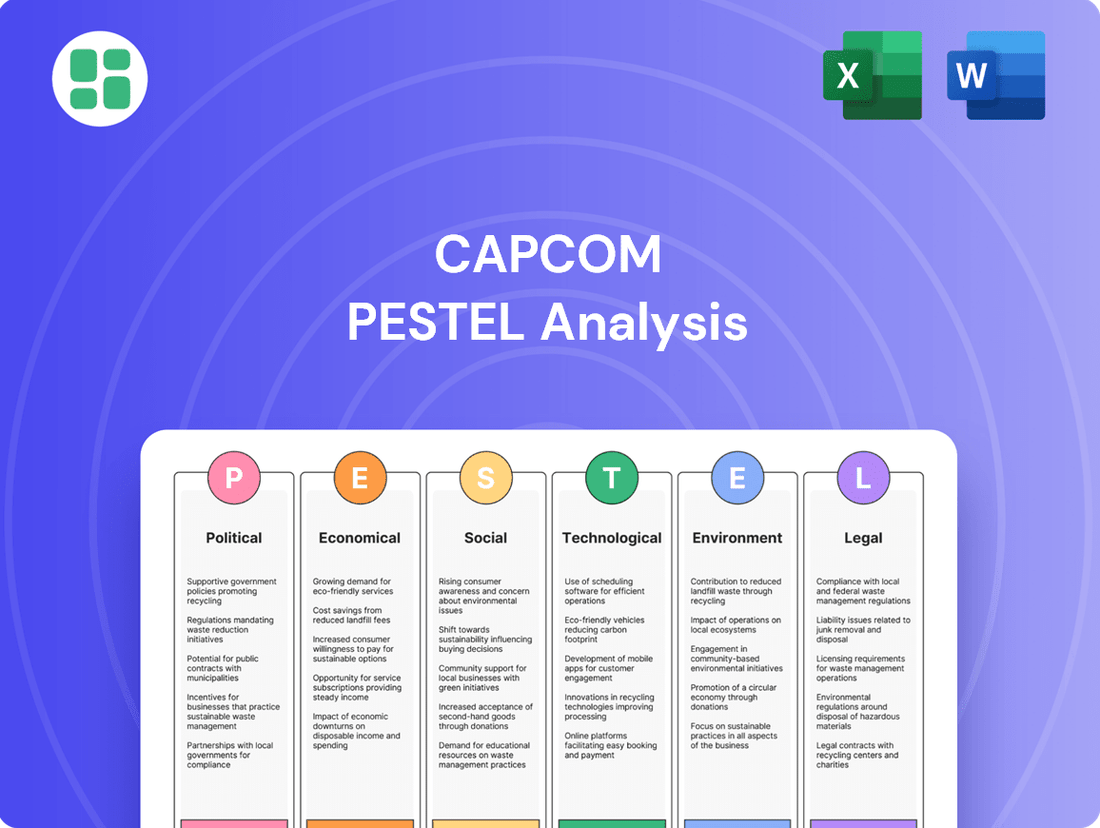

This Capcom PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides actionable insights for strategic decision-making by highlighting key external trends and their implications for Capcom's future growth.

A concise, actionable Capcom PESTLE analysis that highlights key external factors, offering clarity and focus for strategic decision-making and risk mitigation.

Economic factors

The overall health of the global economy significantly impacts consumer spending, especially on discretionary items like video games. When economies are strong, consumers have more disposable income and are more likely to purchase new titles and in-game content. Conversely, during economic slowdowns, discretionary spending often tightens, potentially affecting Capcom's revenue streams from game sales.

The global games industry showed resilience, with projections indicating continued expansion. For 2024, the industry was expected to grow by approximately 3.5%, reaching an estimated $195 billion. This trend suggests a generally positive environment for entertainment spending heading into 2025, which bodes well for companies like Capcom.

Capcom, being a Japanese company with substantial global sales, is significantly affected by exchange rate volatility. For instance, the yen's performance against major currencies like the US dollar and the Euro directly influences its reported financial results.

A weaker yen, as seen at various points in 2024 and projected into 2025, generally benefits Capcom by increasing the yen value of its foreign earnings. Conversely, a strengthening yen can diminish these overseas profits when translated back into its home currency, impacting overall profitability.

For example, in fiscal year 2024, a weaker yen provided a tailwind to Capcom's overseas sales, contributing positively to its consolidated net sales, which reached ¥650.9 billion. This trend is expected to continue influencing financial reporting throughout 2025, making currency hedging strategies crucial for risk management.

Rising inflation presents a significant challenge for game development, directly impacting Capcom's operational costs. For instance, in 2024, the average salary for game developers in major markets saw an increase, driven partly by inflation, potentially pushing up personnel expenses. This inflationary pressure extends to other crucial areas like marketing campaigns and the acquisition of advanced technology infrastructure, essential for producing high-fidelity AAA titles.

Managing these escalating development budgets is paramount for Capcom to preserve its profit margins. The continuous upward trend in the cost of creating blockbuster games means that efficient cost management strategies are more critical than ever. As of early 2025, industry reports indicate that the average budget for AAA game development has continued its ascent, making cost control a key strategic imperative for sustained profitability.

Market Competition and Saturation

The video game industry is intensely competitive and has reached a mature stage, featuring numerous established companies alongside a constant influx of new developers. This high level of competition often results in price wars, escalating marketing expenditures, and significant pressure on game quality and the pace of innovation, all of which can impact Capcom's market share and overall profitability.

For instance, the global video game market was valued at approximately $184.3 billion in 2023 and is projected to grow, but this growth is occurring within a crowded landscape. Capcom faces direct competition from major players like Sony, Microsoft, Nintendo, and Activision Blizzard, as well as a multitude of independent studios releasing titles across various platforms. The need to stand out often drives up development and marketing costs, with major game launches frequently accompanied by multi-million dollar advertising campaigns.

- Intense Competition: The video game market is characterized by a high number of competitors, including both large, established companies and smaller, agile new entrants.

- Market Saturation: Many game genres are saturated, making it challenging for new titles to gain significant traction and market share without substantial marketing investment or unique selling propositions.

- Pressure on Pricing and Innovation: Fierce competition can lead to price wars, impacting profit margins, and necessitates continuous innovation to capture and retain player interest, increasing development costs.

- Impact on Profitability: Increased marketing spend and the need for constant innovation to combat competitive pressures can directly affect Capcom's bottom line and return on investment for new game titles.

Digital Distribution and Subscription Models

Capcom is navigating a significant industry shift towards digital distribution and subscription services, which directly impacts its traditional revenue from physical game sales. This transition presents both challenges and opportunities, requiring a strategic adaptation of its business model to capitalize on recurring revenue streams and potentially lower distribution costs.

The digital marketplace offers new avenues for engagement, but it also necessitates different monetization approaches compared to the one-time purchase of physical copies. For instance, Capcom's digital sales have been growing, with titles like Resident Evil Village and Monster Hunter Rise achieving substantial digital attach rates, indicating player preference for digital acquisition.

- Digital sales growth: Capcom reported that digital sales accounted for a significant portion of its revenue in recent fiscal years, exceeding 80% for some major titles.

- Subscription service integration: The company is exploring ways to integrate its games into subscription platforms, aiming to broaden its player base and secure consistent income.

- Reduced physical distribution costs: A greater emphasis on digital channels can lead to savings on manufacturing, shipping, and retail channel management.

- Evolving monetization strategies: Capcom is experimenting with in-game purchases, downloadable content (DLC), and season passes to complement digital game sales and foster ongoing player engagement.

Capcom's financial performance is significantly influenced by global economic conditions, with strong economies boosting discretionary spending on games. The company is also heavily impacted by currency fluctuations, particularly the yen's exchange rate against major currencies like the US dollar and Euro. A weaker yen generally benefits Capcom's reported earnings from overseas sales, a trend observed in fiscal year 2024 and expected to continue into 2025, with ¥650.9 billion in consolidated net sales reported for FY24.

Full Version Awaits

Capcom PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Capcom PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the gaming giant. Understand the external forces shaping Capcom's strategy and future success.

Sociological factors

The gaming landscape is rapidly evolving, with a significant shift occurring in who plays games. Gone are the days when gaming was solely the domain of young males; today, the audience is incredibly diverse, spanning all ages, genders, and even geographic regions. This broadening appeal means that companies like Capcom need to be more adaptable than ever.

In 2024, data indicates that over half of all gamers are women, a stark contrast to earlier perceptions. Furthermore, the average age of a gamer continues to rise, with significant growth in older demographics. For instance, in the US, the 35-44 age bracket saw a notable increase in gaming participation in recent years. This demographic diversification necessitates that Capcom develops a wider array of game genres and themes, alongside marketing campaigns that resonate with these varied groups, to maintain and expand its market share.

Societal views on gaming, including worries about addiction, violence, and excessive screen time, significantly shape public perception and can lead to increased regulatory attention. For instance, a 2024 Pew Research Center study indicated that while 70% of parents believe video games can be beneficial for learning, a substantial portion still express concerns about the amount of time their children spend gaming.

Capcom actively participates in social initiatives to cultivate a positive brand image and mitigate these societal anxieties. Their efforts include educational outreach programs designed to foster a healthier, more balanced approach to gaming, recognizing the importance of responsible engagement in the digital age.

Social media and live streaming platforms like Twitch and YouTube are now central to how games are discovered and how fan communities form. Capcom can tap into this by collaborating with popular streamers, who in 2024 continue to be a major driver of game sales, often reaching millions of viewers. This direct engagement allows for immediate feedback and buzz generation, crucial for titles like the Resident Evil series.

However, these platforms also present risks. Capcom, like other major game developers, must navigate the potential for negative feedback, online harassment, and the need for constant content moderation. The sheer volume of user-generated content means that while opportunities for grassroots marketing are immense, managing brand perception in such a dynamic environment is a significant challenge.

Esports Growth and Fan Engagement

The global esports market is experiencing significant growth, with projections indicating a continued upward trajectory. For instance, the market was valued at approximately $1.5 billion in 2023 and is anticipated to reach over $2.5 billion by 2027, demonstrating a strong compound annual growth rate. This expansion offers Capcom a substantial opportunity to leverage its popular fighting game franchises, such as Street Fighter, to tap into this burgeoning spectator and participation base.

Capcom can further solidify its brand presence and extend the lifespan of its intellectual property by cultivating robust esports ecosystems. This involves supporting professional tournaments, fostering community engagement, and creating accessible pathways for aspiring players. Such initiatives not only drive revenue through sponsorships, media rights, and merchandise but also deepen player loyalty and attract new audiences to its titles.

- Esports Market Growth: The global esports market is projected to exceed $2.5 billion by 2027, up from around $1.5 billion in 2023.

- Fan Engagement: Esports fosters deep fan engagement, creating communities around games like Street Fighter.

- Revenue Streams: Opportunities include sponsorships, media rights, and merchandise sales tied to competitive gaming.

- IP Longevity: Strong esports ecosystems enhance the long-term value and relevance of game franchises.

Cultural Sensitivities and Localization

Capcom's global reach necessitates careful consideration of cultural sensitivities. For instance, in 2024, the success of titles like Street Fighter 6, which features diverse characters and global settings, hinges on how well its themes and character portrayals are received across different markets. Localization efforts are paramount, extending beyond simple language translation to adapting storylines and visual elements to align with local norms and values, thereby preventing potential backlash and fostering broader appeal.

Effective localization ensures that Capcom's games resonate with a wider audience, avoiding cultural missteps that could damage its brand reputation. This involves a deep understanding of regional preferences and sensitivities. For example, character designs or narrative elements that might be acceptable in one culture could be offensive in another, requiring meticulous review and adjustment during the development and marketing phases. This proactive approach is crucial for maintaining positive brand perception worldwide.

The company's commitment to localization is evident in its ongoing efforts to adapt its popular franchises for various markets. By investing in culturally appropriate content creation and marketing, Capcom aims to maximize engagement and sales. This strategy is particularly important in emerging markets where cultural nuances can significantly impact consumer reception. For instance, in 2023, Capcom reported strong growth in its Asian markets, partly attributed to its localized content strategies.

- Cultural Nuance: Adapting game narratives and character portrayals to avoid offense in diverse global markets.

- Localization Investment: Allocating resources to translate and culturally adapt game content and marketing materials.

- Brand Reputation: Mitigating risks associated with cultural insensitivity to maintain a positive global brand image.

- Market Resonance: Ensuring game themes and designs connect with local audiences for increased player engagement and sales.

Societal views on gaming continue to evolve, with a growing acceptance of gaming as a legitimate form of entertainment and even a skill. However, concerns regarding addiction and excessive screen time persist, as highlighted by a 2024 Pew Research Center study where a significant portion of parents expressed worries about their children's gaming habits, despite acknowledging potential learning benefits.

The demographic of gamers has broadened considerably, with women now comprising over half of the gaming population in 2024, and the average gamer age increasing. This shift necessitates that Capcom caters to a more diverse audience with varied game genres and themes, supported by inclusive marketing efforts to resonate with these expanding player segments.

Social media and streaming platforms are critical for game discovery and community building, with popular streamers in 2024 significantly influencing game sales. Capcom can leverage these channels through collaborations, but must also manage the risks of negative feedback and online harassment inherent in these dynamic environments.

The global esports market is a significant growth area, projected to surpass $2.5 billion by 2027 from approximately $1.5 billion in 2023, presenting Capcom with opportunities to capitalize on franchises like Street Fighter through competitive gaming ecosystems, sponsorships, and media rights.

Technological factors

Capcom's commitment to its proprietary RE Engine, and its upcoming 'Codename REX,' is a significant technological advantage, enabling efficient development of visually stunning and immersive games. This internal technological prowess allows for greater control over game performance and unique graphical styles, a key differentiator in a competitive market.

Continued investment in these engines, integrating advanced features such as AI-driven image upscaling for sharper visuals and real-time ray tracing for more realistic lighting, is paramount. For instance, the RE Engine has been instrumental in titles like Resident Evil Village, lauded for its graphical fidelity, showcasing the tangible benefits of such technological investments.

These ongoing enhancements are crucial for maintaining Capcom's edge, allowing them to deliver next-generation gaming experiences that resonate with players and critics alike. By pushing the boundaries of what's possible with their internal tools, Capcom aims to solidify its position as a leader in interactive entertainment.

Capcom is actively exploring generative AI to revolutionize game development, aiming to generate vast quantities of unique in-game assets and concepts, potentially millions of ideas for environments and objects. This technological advancement promises to significantly cut down development expenses and speed up the creation process for their titles.

The expansion of cloud gaming platforms like Xbox Cloud Gaming and PlayStation Plus Premium is significantly broadening the accessibility of high-fidelity gaming experiences. This trend means players can enjoy graphically intensive titles, such as Capcom's popular Resident Evil and Monster Hunter series, on less powerful devices, directly via streaming. This shift is projected to grow the cloud gaming market substantially, with some estimates suggesting it could reach over $100 billion by 2027, according to various market research firms.

Capcom's strategic imperative is to ensure its titles are not only compatible but optimized for seamless cloud streaming, delivering a smooth and immersive player experience. Furthermore, exploring and expanding its presence in subscription-based gaming models, where players pay a recurring fee for access to a library of games, presents a significant revenue opportunity. This approach aligns with evolving consumer preferences for on-demand entertainment and could unlock new avenues for recurring income streams for the company's diverse game portfolio.

Virtual Reality (VR) and Augmented Reality (AR)

Virtual Reality (VR) and Augmented Reality (AR) are rapidly advancing, offering more immersive and sophisticated gaming experiences. These technologies are becoming increasingly accessible to a wider consumer base, presenting new avenues for content creation and engagement. For instance, the global VR/AR market was valued at approximately $28.2 billion in 2023 and is projected to reach $217.4 billion by 2030, indicating substantial growth potential.

Capcom can strategically leverage these evolving technologies by developing new game titles specifically for VR/AR platforms. Furthermore, adapting existing intellectual property (IP) to these immersive environments could unlock novel gameplay mechanics and appeal to emerging markets. This approach could lead to unique player interactions and differentiate Capcom's offerings in a competitive landscape.

- Market Growth: The VR/AR market is experiencing significant expansion, with projections indicating a compound annual growth rate (CAGR) of over 33% from 2024 to 2030.

- New Experiences: VR and AR offer opportunities for innovative gameplay, potentially enhancing player immersion and engagement beyond traditional gaming formats.

- IP Adaptation: Capcom's strong portfolio of established franchises can be reimagined for VR/AR, creating fresh experiences for both existing fans and new audiences.

Cybersecurity and Data Protection Technologies

Cybersecurity and data protection are increasingly critical for Capcom as its games become more interconnected and rely heavily on online services. Protecting player data, preventing in-game cheating, and safeguarding valuable intellectual property are paramount. For instance, the gaming industry experienced a significant rise in cyberattacks targeting user accounts and game servers. In 2024, reports indicated a substantial increase in Distributed Denial of Service (DDoS) attacks against gaming platforms, impacting millions of players globally.

Capcom's investment in advanced security technologies is therefore crucial not only for maintaining player trust but also for ensuring compliance with evolving data privacy regulations like GDPR and CCPA. The company's commitment to security directly impacts its brand reputation and its ability to operate seamlessly in the digital marketplace. Failure to adapt could lead to costly data breaches and significant financial penalties, as seen with other major tech companies facing fines in the hundreds of millions for privacy violations.

The technological landscape demands continuous innovation in cybersecurity. Capcom must focus on:

- Implementing advanced encryption methods to secure player data and financial transactions.

- Developing robust anti-cheat systems to ensure fair play and maintain the integrity of online multiplayer experiences.

- Investing in threat detection and response technologies to proactively identify and mitigate cyber threats against its servers and intellectual property.

- Ensuring compliance with global data privacy laws through secure data handling and storage practices.

Capcom's proprietary RE Engine continues to be a cornerstone of its technological strategy, powering visually impressive titles and streamlining development. This engine's ongoing enhancements, including AI upscaling and ray tracing, are key to delivering next-gen experiences, as seen in games like Resident Evil Village. The company is also actively exploring generative AI to accelerate asset creation and reduce development costs.

The rise of cloud gaming and subscription services presents new distribution avenues, requiring Capcom to optimize its titles for seamless streaming. The VR/AR market is also expanding rapidly, with projections suggesting significant growth, offering opportunities for Capcom to develop new content or adapt existing intellectual property for these immersive platforms. The global VR/AR market was valued at approximately $28.2 billion in 2023 and is expected to reach $217.4 billion by 2030.

Cybersecurity remains a critical focus, with increased online connectivity and data privacy regulations demanding robust protection measures. Capcom's investment in advanced security technologies, including encryption and anti-cheat systems, is essential for maintaining player trust and complying with laws like GDPR. The gaming industry faced a notable increase in cyberattacks in 2024, impacting millions of players globally.

Legal factors

Capcom must navigate a complex web of global data privacy laws, including Japan's Act on the Protection of Personal Information (APPI) and Europe's General Data Protection Regulation (GDPR). These regulations mandate stringent protocols for how Capcom handles user data, from collection to storage and processing. For instance, upcoming amendments to the APPI in 2025 are expected to further tighten protections for sensitive data like biometrics and information pertaining to minors, necessitating continuous adaptation of Capcom's privacy frameworks.

Copyright and intellectual property laws are the bedrock of Capcom's operations, safeguarding its valuable game titles, iconic characters like Ryu and Mega Man, and all its creative assets. These protections are crucial to prevent unauthorized use and maintain the integrity of its brands.

In the current digital landscape, where content is easily shared and distributed, Capcom must remain vigilant in monitoring and actively enforcing its intellectual property rights across all major global markets. This proactive stance is essential to combat piracy and protect its revenue streams.

For instance, in 2023, Capcom reported that its intellectual property portfolio contributed significantly to its record-high operating income of ¥106.1 billion (approximately $715 million USD), underscoring the financial importance of robust IP protection.

Consumer protection laws significantly shape how video games like Capcom's are marketed and sold, mandating clear age-appropriateness ratings through bodies such as the ESRB in North America and CERO in Japan. Adherence to these regulations is crucial for Capcom to prevent legal repercussions stemming from deceptive advertising or the promotion of mature content to younger audiences. For instance, in 2024, the ESRB rated over 10,000 titles, highlighting the extensive regulatory landscape game developers navigate.

Anti-Trust and Competition Law

Anti-trust and competition laws are crucial for companies like Capcom, especially in digital markets. For instance, Japan's Act on Promotion of Competition for Specified Smartphone Software, enacted to curb monopolistic practices, directly influences how software is distributed and how companies engage with platform providers. This regulatory environment necessitates careful consideration of distribution agreements and potential exclusivity arrangements.

These regulations can significantly shape Capcom's strategies regarding its presence on major digital storefronts and its relationships with app stores. Concerns about fair competition and preventing dominance could lead to scrutiny of Capcom's market share and its practices in selling games and in-game content. For example, ongoing discussions and potential regulatory actions concerning app store fees and developer terms by major tech companies could impact Capcom's revenue streams and its ability to negotiate favorable terms.

- Regulatory Scrutiny: Increased focus on digital marketplaces may lead to investigations into Capcom's market power and distribution methods.

- Platform Dependence: Reliance on dominant app stores could be challenged by regulations promoting interoperability or limiting platform control.

- Fair Competition Mandates: Laws designed to ensure fair competition could influence pricing strategies and promotional activities.

- Global Harmonization: Evolving anti-trust frameworks across different regions require Capcom to navigate a complex and sometimes inconsistent legal landscape.

Employment and Labor Laws

Capcom, like any major global employer, navigates a complex web of employment and labor laws. These regulations dictate everything from minimum wages and working hours to workplace safety and employee benefits across its operational regions. For instance, in Japan, where Capcom is headquartered, there's been a continued focus on improving working conditions and compensation within the creative industries, including gaming. This reflects a broader trend of increased scrutiny on labor practices in the sector.

The company must adhere to these varying legal frameworks to ensure fair treatment of its workforce. This includes compliance with Japan's Labor Standards Act, which sets standards for working hours, overtime pay, and leave, as well as similar legislation in countries where it has development studios or offices, such as the United States and the United Kingdom. Failure to comply can result in significant penalties and reputational damage.

Recent discussions in Japan concerning the "karoshi" (death from overwork) phenomenon and calls for better work-life balance in the entertainment sector underscore the importance of these legal considerations. Capcom's commitment to these standards directly impacts its ability to attract and retain talent in a competitive industry. For example, reports from 2024 indicate a growing awareness and push for more regulated working hours in Japanese tech and creative fields.

Key aspects of employment and labor law compliance for Capcom include:

- Wage and Hour Laws: Ensuring compliance with minimum wage requirements and overtime pay regulations in all operating jurisdictions.

- Workplace Safety and Health: Adhering to standards that protect employees from hazards and promote a healthy work environment.

- Employee Rights and Protections: Upholding rights related to unionization, anti-discrimination, and fair dismissal procedures.

- International Labor Standards: Navigating and aligning with international best practices and conventions where applicable.

Capcom operates under a robust framework of intellectual property laws, essential for protecting its valuable game franchises and characters. These laws prevent unauthorized use, safeguarding brand integrity and revenue. For instance, Capcom's strong IP portfolio was a key driver in its record operating income of ¥106.1 billion in 2023.

Consumer protection laws mandate clear age ratings, like those from the ESRB in North America, ensuring responsible marketing of games. Adherence is vital to avoid legal issues related to advertising or content suitability. In 2024, the ESRB rated over 10,000 titles, indicating the extensive regulatory environment.

Data privacy regulations, such as GDPR and Japan's APPI, require strict handling of user information. Upcoming APPI amendments in 2025 will further enhance protections, necessitating continuous adaptation of Capcom's data management practices.

Anti-trust laws influence Capcom's distribution strategies, particularly in digital marketplaces. Regulations like Japan's Act on Promotion of Competition for Specified Smartphone Software impact agreements with platform providers and could affect revenue streams from app store fees.

Environmental factors

The escalating demand for graphically intense games and cloud-based gaming services directly translates to increased energy consumption by gaming hardware and the data centers that power them. This trend puts companies like Capcom under scrutiny to mitigate their environmental impact within the gaming industry.

For instance, a single gaming session can consume a significant amount of electricity, and the proliferation of data centers supporting online multiplayer and streaming services exacerbates this issue. As of 2024, the global data center energy consumption is a substantial portion of overall electricity usage, and the gaming sector is a growing contributor.

The production and disposal of gaming hardware, along with physical game copies, contribute significantly to electronic waste, a growing environmental concern. Capcom, while increasingly focused on digital distribution, still faces environmental responsibilities tied to its physical products and the broader supply chain.

In 2023, the global e-waste generated reached an estimated 62 million tonnes, highlighting the scale of the issue. Capcom's strategic shift towards digital sales, which saw its digital sales ratio climb to 88.7% for the fiscal year ending March 31, 2024, directly addresses this by aiming to reduce resource consumption and waste associated with physical manufacturing and distribution.

Investor and public pressure for environmental responsibility and transparent ESG practices is intensifying. Capcom's commitment is evident in its proactive sustainability reports and initiatives such as adopting renewable energy sources and prioritizing digital sales, aligning with global ESG benchmarks.

Supply Chain Environmental Impact

Capcom's supply chain, while focused on digital distribution for many games, still carries environmental implications through physical merchandise and game disc production. Logistics for these physical goods, including transportation and warehousing, contribute to carbon emissions. For instance, the shipping industry, a key component of global supply chains, accounted for approximately 2.89% of global greenhouse gas emissions in 2023, according to the International Maritime Organization.

Packaging materials used for physical products also present an environmental challenge. Capcom, like many in the industry, faces the ongoing task of sourcing sustainable packaging and minimizing waste. The global packaging market, valued at over $1 trillion in 2024, is increasingly scrutinized for its environmental footprint, with a growing emphasis on recycled and biodegradable materials.

Minimizing the environmental impact across Capcom's entire supply chain is a complex and continuous effort. This involves optimizing shipping routes, exploring eco-friendly packaging alternatives, and potentially increasing the proportion of digital sales to reduce the reliance on physical distribution channels. For example, a shift towards more energy-efficient data centers for digital delivery can also indirectly lessen the environmental burden associated with gaming.

- Logistics Emissions: Transportation of physical goods contributes to carbon footprint, with global shipping being a significant source of greenhouse gases.

- Packaging Waste: The use of packaging materials for merchandise and physical games necessitates sustainable sourcing and waste reduction strategies.

- Digital Shift: Increasing digital game sales can mitigate some of the environmental impacts associated with physical production and distribution.

- Industry Trends: The broader packaging industry, valued in the trillions, is pushing for more sustainable practices, influencing choices for companies like Capcom.

Climate Change and Operational Resilience

Climate change poses a significant threat to Capcom's operational resilience. Extreme weather events, like the record-breaking heatwaves and intense rainfall observed globally in 2024, can disrupt manufacturing, logistics, and even consumer access to gaming hardware and software. These disruptions can impact the timely release of new titles and the availability of physical products, directly affecting revenue streams.

Capcom must proactively integrate climate risk into its strategic planning. This involves assessing vulnerabilities in its supply chain, particularly for components sourced from regions prone to climate-related disasters. For instance, increased frequency of typhoons in East Asia, a key manufacturing hub, could lead to production delays and increased shipping costs.

To mitigate these environmental risks, Capcom should consider:

- Diversifying supply chain partners to reduce reliance on single geographic locations susceptible to climate impacts.

- Investing in energy-efficient data centers and exploring renewable energy sources to power its online services and development studios, thereby reducing its carbon footprint and operational costs.

- Developing robust business continuity plans that account for potential disruptions from extreme weather, ensuring minimal impact on game development and release schedules.

- Enhancing cybersecurity measures to protect against climate-related infrastructure failures that could compromise digital distribution platforms.

The gaming industry's energy demands are rising, impacting companies like Capcom. As of 2024, data centers, crucial for cloud gaming, consume substantial electricity, a trend the gaming sector contributes to. Capcom's digital sales, reaching 88.7% in fiscal year 2024, help mitigate this by reducing the need for physical production and distribution, thereby lowering resource consumption and waste.

Environmental, Social, and Governance (ESG) pressures are mounting, with investors and the public demanding greater corporate responsibility. Capcom's sustainability reports and initiatives, such as adopting renewable energy, demonstrate its commitment to these standards. The company's supply chain, while leaning digital, still involves physical merchandise and game discs, contributing to carbon emissions through logistics, which in 2023 accounted for about 2.89% of global greenhouse gas emissions via shipping.

Packaging materials for physical products also present an environmental challenge. The global packaging market, exceeding $1 trillion in 2024, faces scrutiny for its environmental footprint, pushing for recycled and biodegradable options. Capcom's efforts to minimize its supply chain's impact include optimizing shipping and exploring eco-friendly packaging.

| Environmental Factor | Impact on Capcom | Mitigation Strategy/Data |

| Energy Consumption (Gaming & Data Centers) | Increased operational costs and environmental footprint. | Capcom's digital sales ratio was 88.7% for FY ending March 31, 2024. |

| E-Waste from Hardware/Physical Media | Reputational risk and resource depletion. | Global e-waste reached 62 million tonnes in 2023. |

| Supply Chain Emissions (Logistics) | Carbon footprint and potential disruption. | Global shipping accounted for 2.89% of global greenhouse gas emissions in 2023. |

| Packaging Materials | Waste generation and resource use. | Global packaging market valued over $1 trillion in 2024, with increasing focus on sustainability. |

PESTLE Analysis Data Sources

Our Capcom PESTLE analysis is built upon a robust foundation of data from official financial reports, industry-specific market research, and reputable gaming news outlets. We meticulously gather information on political stability, economic trends, technological advancements, and societal shifts affecting the gaming industry.