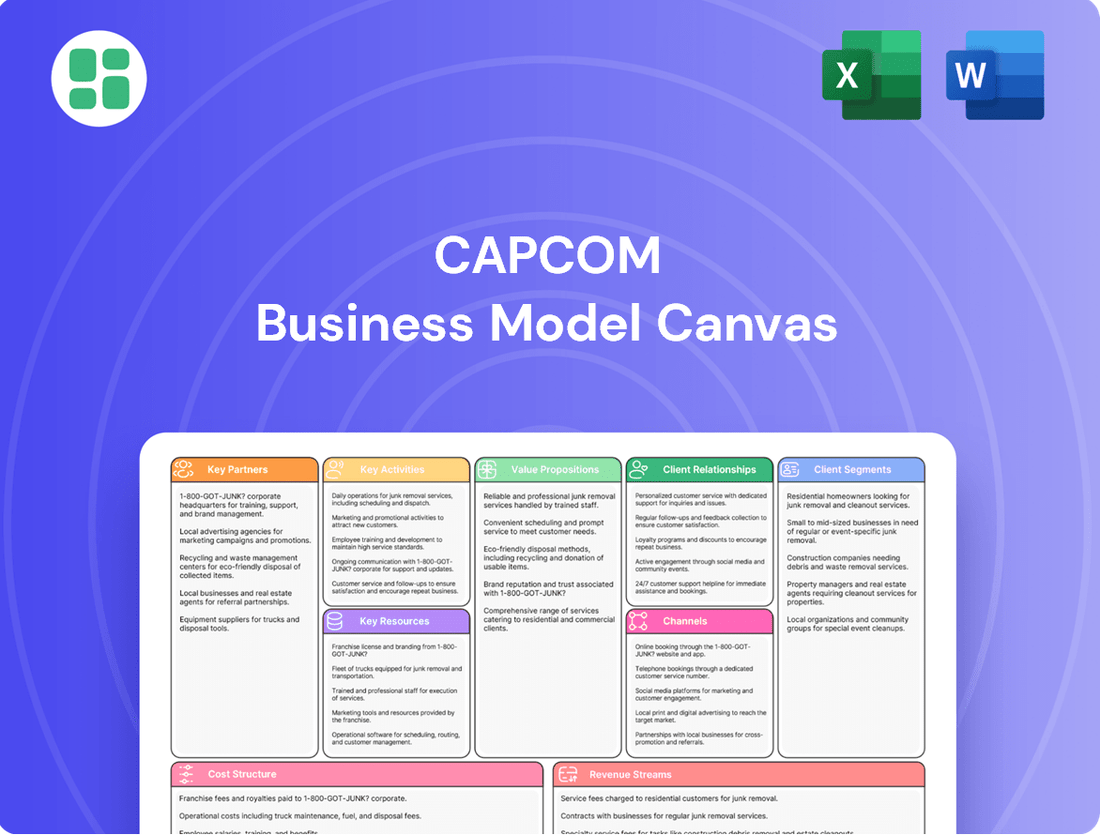

Capcom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capcom Bundle

Unlock the strategic blueprint behind Capcom's gaming empire. This detailed Business Model Canvas reveals how they create value through beloved franchises, engage a massive player base, and generate revenue streams from diverse sources. Discover the key partnerships and cost structures that fuel their success.

Ready to dissect Capcom's winning formula? Our full Business Model Canvas provides an in-depth, section-by-section breakdown of their operations, from customer relationships to revenue streams. Download the complete, editable version to gain actionable insights for your own business strategy.

Partnerships

Capcom's strategic alliances with console manufacturers like Sony, Microsoft, and Nintendo are foundational to its business. These partnerships are vital for ensuring their diverse game portfolio, from the Resident Evil series to Monster Hunter, reaches the widest possible player base across all major gaming ecosystems.

These collaborations go beyond simple distribution. They often include deep technical support, enabling Capcom to optimize game performance for specific hardware, and joint marketing initiatives. For instance, in 2023, Capcom's Street Fighter 6 saw significant cross-promotional efforts with PlayStation, highlighting the symbiotic relationship that drives sales and brand visibility.

Capcom's key partnerships with digital distribution platforms like Steam, PlayStation Store, Xbox Games Store, Nintendo eShop, Apple App Store, and Google Play Store are fundamental to its business model. These collaborations grant direct access to a massive global customer base, facilitating the widespread distribution of Capcom's video game titles.

This digital-first approach is a significant driver of Capcom's revenue. In fiscal year 2024, digital sales accounted for an impressive 77.3% of Capcom's consolidated net sales, highlighting the critical reliance on these platform partnerships for reaching consumers and generating revenue.

Capcom actively collaborates with esports organizations and event organizers, such as the Esports World Cup Foundation, to elevate its intellectual properties like Street Fighter 6 on the global esports stage. These strategic alliances are crucial for enhancing brand visibility, drawing in substantial viewership, and fostering the expansion of their esports ventures.

These partnerships directly translate into increased engagement and reach. For example, Capcom's own events like Capcom Cup 11 and the Street Fighter League: World Championship 2024 garnered an impressive combined online viewership exceeding 10 million, underscoring the power of these key collaborations in driving audience numbers and solidifying their presence in the competitive gaming landscape.

Merchandising and Licensing Partners

Capcom actively engages in character merchandising and licensing, collaborating with numerous partners to produce and distribute a wide array of products. This strategy significantly broadens the brand's presence beyond the gaming realm, creating vital additional revenue streams and bolstering overall brand equity. The company strategically prioritizes merchandise development for its most beloved franchises, such as the Monster Hunter and Street Fighter series, ensuring alignment with fan favorites.

These partnerships are crucial for extending the lifecycle and reach of Capcom's intellectual properties. For instance, in 2023, the Monster Hunter franchise alone saw substantial growth in its merchandise segment, contributing to the overall robust performance of Capcom's Consumer Products segment, which reported significant year-over-year increases. This focus on tangible goods allows fans to connect with their favorite characters and worlds in new ways.

- Brand Extension: Merchandising partners help extend the visibility and appeal of Capcom's IP across diverse consumer categories.

- Revenue Diversification: Licensing agreements provide a consistent and growing revenue stream independent of direct game sales.

- Fan Engagement: High-quality merchandise fosters deeper connections with the fanbase, enhancing brand loyalty.

- Strategic Focus: Key franchises like Monster Hunter and Street Fighter are central to the merchandise strategy, maximizing impact.

Technology and Development Partners

Capcom actively partners with external technology providers and other game development studios to sharpen its game creation capabilities. This strategic approach involves tapping into specialized expertise and advanced tools to elevate game engines, visual fidelity, and overall development efficiency. For instance, in 2023, Capcom continued to invest in its proprietary RE Engine, a key element in its development ecosystem, aiming to integrate cutting-edge technologies and streamline production workflows for titles like the highly anticipated Dragon's Dogma 2.

The company's commitment to innovation is underscored by its continuous development and updating of the RE Engine. This in-house engine is crucial for supporting new technological advancements and boosting work efficiency across its development teams. By refining the RE Engine, Capcom ensures it remains at the forefront of graphical capabilities and performance optimization, directly impacting the quality and marketability of its flagship titles. This focus on internal technology development, augmented by external collaborations, is a cornerstone of Capcom's strategy to deliver high-quality gaming experiences.

- RE Engine Enhancements: Continued investment in the proprietary RE Engine to support next-generation graphics and improved development workflows.

- External Studio Collaborations: Partnerships with specialized studios to leverage unique technical skills or creative assets.

- Technology Provider Integration: Adoption of cutting-edge middleware and tools from external technology firms to enhance game performance and features.

- Cross-Platform Development Expertise: Collaborations to ensure seamless development and optimization across various gaming platforms.

Capcom's key partnerships extend to third-party publishers and developers for co-branded titles or content sharing, broadening its market reach and IP appeal. These collaborations are crucial for accessing new player demographics and leveraging complementary strengths in game development and marketing.

For instance, Capcom's collaboration with Bandai Namco for the Monster Hunter and Tekken crossover content in Street Fighter 6 in 2023 exemplifies how such alliances can drive engagement and introduce franchises to new audiences. This strategic approach not only enhances existing titles but also opens avenues for future joint ventures and IP cross-pollination.

These partnerships are vital for expanding Capcom's intellectual property (IP) portfolio and accessing new markets. By collaborating with other studios, Capcom can tap into diverse creative talent and development expertise, leading to innovative game experiences and a wider audience reach.

Capcom's strategic alliances with content creators, streamers, and influencers are instrumental in amplifying its marketing efforts and engaging with its global fanbase. These partnerships are crucial for driving awareness and fostering community around its popular franchises like Resident Evil and Monster Hunter.

In 2023, Capcom leveraged influencer marketing extensively, with top streamers showcasing gameplay for titles like Resident Evil 4 Remake, generating millions of views and significant pre-launch buzz. This digital-first approach ensures that Capcom's games resonate with contemporary gaming culture and reach a broad spectrum of potential players.

These collaborations are essential for building brand loyalty and driving sales. By working with key influencers, Capcom can effectively communicate the appeal of its games, fostering a sense of community and encouraging player engagement, which directly translates into stronger sales performance.

What is included in the product

A detailed breakdown of Capcom's strategy, focusing on its core customer segments, diverse distribution channels, and unique value propositions in the gaming industry.

This model offers a clear, actionable blueprint of Capcom's operational framework, perfect for strategic planning and investor communication.

The Capcom Business Model Canvas offers a visual framework to pinpoint and address inefficiencies in game development and publishing, streamlining operations.

Activities

Capcom's core activity revolves around the meticulous planning, design, and development of video games. This encompasses everything from initial concept to final testing, ensuring each title offers an engaging experience.

The company focuses on creating globally appealing content, whether it's new installments in beloved franchises, reimagined classics, or entirely original intellectual properties.

In fiscal year 2024, Capcom's Digital Content segment, which includes video game sales, generated ¥471,331 million in net sales, demonstrating the significant revenue driven by these development efforts.

Capcom orchestrates extensive global marketing and promotional campaigns to build anticipation and boost sales for both new game launches and its established library. This multi-faceted approach includes widespread advertising across diverse media channels, active engagement with online gaming communities, and strategic collaborations with popular influencers.

In 2024, Capcom continued to emphasize digital sales, a trend that has seen significant growth, and actively works to extend the commercial life of its catalog titles through ongoing support and re-releases. For instance, the Resident Evil franchise, a cornerstone of their catalog, consistently sees renewed interest and sales through various digital storefronts and platform expansions.

Capcom's key activity involves expertly managing the global distribution and sales of its interactive entertainment software. This crucial function spans both digital storefronts and traditional physical retail, ensuring its games reach a vast audience.

The company's strategic objective is to make its titles accessible in more than 230 countries and regions globally. This expansive reach is heavily supported by a strong emphasis on digital sales, which have become the dominant revenue stream.

In fact, digital sales accounted for over 70% of Capcom's consolidated net sales for the fiscal year ending March 2024, highlighting the effectiveness of their digital distribution and sales management strategies.

Intellectual Property (IP) Management and Expansion

Capcom's intellectual property management is central to its business, actively nurturing its renowned franchises such as Resident Evil, Monster Hunter, and Street Fighter. This strategic approach involves carefully planning new installments, remakes, and related content to keep these beloved series fresh and engaging for a global audience.

Expansion beyond video games is a key pillar, with Capcom leveraging its IP across various media. This includes producing successful film and television adaptations, as well as engaging in lucrative licensing agreements that extend brand reach and revenue streams.

- Franchise Focus: Capcom prioritizes its core IPs like Resident Evil, Monster Hunter, and Street Fighter for continued development and expansion.

- Media Diversification: IP is actively translated into film, TV series, and merchandise to broaden audience engagement and revenue.

- Licensing Revenue: Strategic licensing partnerships contribute significantly to overall financial performance, as seen in the continued success of merchandise and collaborations.

- New IP Exploration: While focusing on established brands, Capcom also explores opportunities for new intellectual property creation and development.

Esports and Live Service Operations

Capcom actively operates and supports esports tournaments for its competitive titles, like Street Fighter. This engagement builds strong communities and keeps players invested long-term. For instance, Capcom's partnership with the Esports World Cup Foundation in 2024 aims to significantly boost its esports visibility and participation.

Ongoing post-launch support and content updates are crucial for Capcom's live service games. This strategy maintains player interest and provides continuous monetization opportunities. Capcom's commitment to live services is evident in the consistent updates for popular titles, ensuring sustained revenue streams.

- Esports Tournament Operations: Facilitating and managing competitive events for titles such as Street Fighter.

- Community Engagement: Fostering player interaction and loyalty through esports initiatives.

- Live Service Support: Providing continuous content updates and maintenance for ongoing game services.

- Monetization Strategy: Leveraging live services for sustained revenue through player retention and engagement.

Capcom's key activities are centered on creating and delivering high-quality video games, managing their intellectual property across various media, and fostering player communities through services like esports and live updates.

The company's development efforts are strongly focused on its established franchises, such as Resident Evil and Monster Hunter, ensuring continued engagement and revenue from these core assets. This is complemented by strategic marketing and global distribution, with a significant emphasis on digital sales, which accounted for over 70% of net sales in fiscal year 2024.

Furthermore, Capcom actively diversifies its revenue streams by extending its intellectual property into film, television, and merchandise, alongside robust support for esports and live service games to maintain long-term player investment and monetization.

| Key Activity | Description | Fiscal Year 2024 Impact |

| Game Development & Design | Creating engaging video game content, from new IPs to franchise installments. | Digital Content net sales reached ¥471,331 million. |

| Intellectual Property Management | Nurturing and expanding core franchises across games and other media. | IP leveraged in film, TV, and licensing deals for extended revenue. |

| Global Distribution & Sales | Ensuring worldwide accessibility of titles through digital and physical channels. | Digital sales exceeded 70% of consolidated net sales. |

| Community & Live Service Operations | Supporting esports and providing ongoing content for live service games. | Partnerships like the Esports World Cup Foundation enhance visibility. |

Full Document Unlocks After Purchase

Business Model Canvas

The Capcom Business Model Canvas you are previewing is the actual document you will receive upon purchase, offering a transparent look at the complete strategic framework. This isn't a sample or a mockup; it's a direct representation of the detailed analysis that will be yours to utilize. Upon completing your order, you will gain full access to this comprehensive and ready-to-use Business Model Canvas, ensuring you receive exactly what you see.

Resources

Capcom's strong intellectual property portfolio is a critical key resource, featuring globally acclaimed franchises like Resident Evil, Monster Hunter, and Street Fighter. These established brands are the bedrock of their success.

The enduring appeal of these intellectual properties ensures a dedicated global fanbase, creating a stable platform for ongoing game development and diverse revenue streams through merchandising and licensing.

As of early 2024, Resident Evil has achieved over 170 million units sold worldwide, while Monster Hunter has surpassed 120 million units sold globally, underscoring the immense commercial power of these IPs.

Capcom's talented game development teams are the bedrock of its success, a fusion of creative minds and technical wizards. This highly skilled workforce, encompassing developers, designers, artists, and engineers, is essential for crafting the innovative and high-quality interactive entertainment that defines the Capcom brand.

The company recognizes the paramount importance of this human capital, actively investing in its growth. Capcom's strategic plan includes expanding its development division by onboarding approximately 100 new employees each year. Furthermore, to accommodate this expansion and foster continued innovation, a new development building is slated for construction by 2027.

Capcom's proprietary game engines, most notably the RE Engine, are a cornerstone of their business model. This advanced technology allows for efficient development and consistently high-quality graphics and performance, evident in titles like Resident Evil Village and Monster Hunter Rise. The RE Engine's ongoing development ensures it remains at the forefront of gaming technology.

Global Distribution Network and Digital Infrastructure

Capcom leverages a comprehensive global distribution network, encompassing both digital storefronts and traditional retail partnerships, to ensure its titles reach a worldwide audience. This expansive reach is a cornerstone of its operational strategy.

The company's digital sales channels are particularly vital to its business model. In fiscal year 2024, digital sales represented a significant portion of Capcom's revenue, accounting for over 70% of its consolidated net sales. This highlights the critical role of online platforms in delivering games and generating income.

- Digital Dominance: Over 70% of Capcom's consolidated net sales in FY2024 were driven by digital sales.

- Global Reach: The network includes major digital storefronts like Steam, PlayStation Store, and Xbox Games Store, alongside physical retail partners.

- Infrastructure Investment: Continued investment in robust digital infrastructure supports efficient game delivery and customer engagement.

- Sales Growth: The digital distribution model has been a key driver of Capcom's consistent sales growth in recent years.

Financial Capital and Investment Capacity

Capcom's substantial financial capital is a cornerstone of its business model, fueling significant investments in R&D, large-scale game development, and broad marketing initiatives. This financial strength is directly linked to the company's ability to innovate and maintain a competitive edge in the dynamic gaming industry.

The company's robust financial performance, evidenced by consistent operating income growth and record profits, provides the necessary resources to consistently fund the creation of new, high-quality titles and the adoption of cutting-edge technologies. For instance, in fiscal year 2024, Capcom reported net sales of ¥634.7 billion, a 14.7% increase year-on-year, demonstrating its strong revenue-generating capacity.

This financial capacity translates into tangible advantages:

- Investment in High-Quality Content: Capcom can allocate substantial budgets to develop visually stunning and engaging games, such as the Resident Evil and Monster Hunter franchises, which are critical to its success.

- Technological Advancement: Financial resources allow for investment in proprietary game engines and advanced development tools, enhancing production efficiency and game quality.

- Global Marketing Reach: Significant capital enables widespread marketing campaigns across various platforms, ensuring maximum visibility and consumer engagement for new releases.

- Strategic Acquisitions and Partnerships: Financial flexibility permits exploration of strategic opportunities that can expand its intellectual property portfolio or market presence.

Capcom's strong intellectual property portfolio, featuring globally acclaimed franchises like Resident Evil and Monster Hunter, forms the bedrock of its business. These established brands ensure a dedicated global fanbase, creating a stable platform for ongoing game development and diverse revenue streams through merchandising and licensing. As of early 2024, Resident Evil had sold over 170 million units worldwide, and Monster Hunter surpassed 120 million units globally, showcasing the immense commercial power of these IPs.

Value Propositions

Capcom is renowned for delivering meticulously crafted, high-quality video games that immerse players with deep gameplay and engaging narratives. Their commitment to impressive visual fidelity across diverse genres ensures a consistently captivating experience. In fiscal year 2024, Capcom reported net sales of ¥170.1 billion, a testament to the global appeal and recognized excellence of their game development.

Capcom offers players the chance to dive into beloved, globally recognized game franchises through new releases, remakes, and updates. This strong brand recognition and the powerful pull of nostalgia are key attractions for a broad player base. For instance, in the fiscal year ending March 2024, Capcom reported net sales of ¥177.1 billion, with its major intellectual properties like Resident Evil and Monster Hunter consistently driving significant revenue.

Capcom's commitment to consistent content updates and live service support for its major titles, particularly online-focused ones, is a cornerstone of its business strategy. This includes regular downloadable content (DLC) and ongoing game enhancements, which significantly boost player engagement and extend the overall lifespan of their games. For instance, the continued success of titles like Monster Hunter: World and its expansion Iceborne, which received substantial post-launch support, demonstrates how this approach drives sustained revenue and customer loyalty.

Cross-Platform Availability

Capcom's commitment to cross-platform availability significantly broadens its market reach. By releasing titles on multiple gaming consoles, personal computers, and mobile devices, the company ensures its games can be enjoyed by a vast and diverse audience, thereby maximizing its potential customer base.

This strategic approach is evident in Capcom's recent performance, with PC sales demonstrating substantial strength. For the first half of fiscal year 2025, PC accounted for a significant 54% of Capcom's total unit sales, highlighting the importance of this platform in their overall success.

- Broad Accessibility: Games are available on consoles, PC, and mobile, reaching a wider audience.

- Market Penetration: Multi-platform releases tap into different gaming ecosystems and player preferences.

- Revenue Diversification: Relying on multiple platforms reduces dependence on any single hardware manufacturer.

- PC Dominance: PC sales represented 54% of Capcom's unit sales in H1 FY2025, underscoring its critical role.

Engaging Esports and Community Events

Capcom cultivates a lively competitive scene through its esports, building a dedicated community around its fighting games. This provides entertainment beyond solo play, allowing fans to connect with titles and each other. For instance, Capcom's Street Fighter League: Pro-JP 2023 saw significant viewership, demonstrating the strong community engagement.

These events offer players a chance to test their skills and connect with the broader fighting game community, enhancing the overall value of their gaming experience. This deepens player loyalty and provides recurring engagement opportunities, crucial for long-term franchise health.

Capcom actively promotes these events and hosts fan gatherings, such as the Capcom Showcase, which often feature esports highlights and community spotlights. In 2024, Capcom continued to invest in its esports infrastructure, with plans for expanded regional leagues and major international tournaments for titles like Street Fighter 6.

Key aspects of Capcom's esports and community engagement include:

- Fostering Competitive Play: Providing platforms and tournaments for players to compete in titles like Street Fighter 6.

- Building Community: Creating spaces for fans to interact, share their passion, and engage with the brand.

- Enhancing Player Experience: Offering entertainment and engagement beyond the core game, increasing player retention.

- Brand Promotion: Utilizing esports and events to generate excitement and awareness for their game franchises.

Capcom's value proposition centers on delivering high-quality, immersive gaming experiences powered by its renowned intellectual properties. The company leverages its strong brand recognition and a commitment to continuous content updates to foster deep player engagement and loyalty across multiple platforms. This strategic focus on quality, brand strength, and sustained engagement drives significant revenue, as evidenced by their fiscal year 2024 net sales of ¥177.1 billion.

Customer Relationships

Capcom actively cultivates its player relationships by engaging directly on social media and community forums. This approach facilitates immediate dialogue, gathers valuable player feedback, and strengthens the bond with fans around their popular game franchises.

With over 20 million followers across its official social media channels, Capcom effectively leverages these platforms to foster a sense of community and stay connected with its global audience.

Capcom prioritizes responsive customer support and readily available feedback channels. This commitment ensures player concerns are swiftly addressed and their valuable opinions are integrated into future game development, fostering high customer satisfaction.

Capcom cultivates customer relationships through robust loyalty and reward systems. In 2024, the company continued to leverage in-game rewards and special content to foster repeat engagement, a strategy that has proven effective in retaining players across its popular franchises like Monster Hunter and Resident Evil. These programs are designed to incentivize continued play and spending, building a dedicated player base.

Direct Communication through Official Channels

Capcom prioritizes direct engagement with its player base through official channels. This includes their comprehensive website, regular newsletters, and timely in-game announcements, ensuring players are consistently updated on new game releases, software patches, special events, and other pertinent information. This direct line of communication fosters a strong sense of community and keeps players actively connected to the Capcom brand.

This strategy proved effective in 2024, with Capcom reporting significant player engagement across its major titles. For instance, the Resident Evil franchise continued to see strong player retention, with titles like Resident Evil 4 Remake maintaining high player counts throughout the year. Capcom's direct communication efforts were instrumental in driving participation in in-game events and promoting upcoming content, directly impacting sales and player loyalty.

- Official Websites: Central hubs for product information, news, and community interaction.

- Newsletters: Direct email campaigns delivering exclusive content and updates to subscribers.

- In-Game Announcements: Real-time notifications within games about events, updates, and new content.

- Social Media Integration: Leveraging platforms like X (formerly Twitter) and YouTube for broader reach and community building.

Fan Events and Esports Spectatorship

Capcom actively engages its community through fan events and esports, fostering deep connections. Hosting and participating in events like Capcom Showcase, alongside major esports tournaments, allows for direct interaction with dedicated fans, significantly boosting brand loyalty and emotional investment. In 2023, Capcom saw substantial viewership for its esports titles, with Street Fighter 6’s Capcom Cup X in early 2024 awarding a record-breaking $1 million prize, highlighting the growing spectator interest.

- Fan Conventions: Capcom regularly attends and hosts events like the Capcom Showcase, offering exclusive reveals and direct fan engagement.

- Esports Spectatorship: Major tournaments for titles like Street Fighter 6 draw significant online viewership, with Capcom Cup X in 2024 being a prime example of large-scale esports engagement.

- Brand Loyalty: These interactive experiences cultivate strong emotional bonds, reinforcing player dedication to Capcom's franchises.

- Community Building: Events serve as crucial hubs for community interaction, strengthening the overall player base and its connection to the brand.

Capcom's customer relationship strategy centers on direct engagement and community building. They leverage social media, with over 20 million followers across platforms, and direct communication channels like newsletters and in-game announcements to keep players informed and involved. This commitment to responsiveness and feedback integration fosters high player satisfaction and loyalty.

In 2024, Capcom continued to enhance player retention through loyalty programs and in-game rewards, particularly for franchises like Monster Hunter and Resident Evil. Their active participation in fan events and esports, such as the Capcom Cup X for Street Fighter 6 in early 2024, which featured a $1 million prize, further strengthens brand loyalty and community bonds.

| Engagement Channel | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Social Media | Direct interaction, feedback gathering | Over 20 million followers, community building |

| Direct Communication | Newsletters, in-game announcements | Player updates, event promotion |

| Loyalty Programs | In-game rewards, exclusive content | Player retention, repeat engagement |

| Events & Esports | Fan showcases, tournaments (e.g., Capcom Cup X) | Brand loyalty, community investment |

Channels

Digital distribution platforms are the lifeblood of Capcom's game sales, encompassing PC powerhouses like Steam, and essential console marketplaces such as the PlayStation Store, Xbox Games Store, and Nintendo eShop.

These digital storefronts are critical for reaching a global audience, with mobile app stores like the Apple App Store and Google Play Store also playing a significant role in distributing Capcom's mobile titles.

In fiscal year 2024, digital sales represented a substantial portion of Capcom's overall revenue, underscoring the importance of these channels for the company's financial performance and market reach.

Capcom actively partners with physical retailers worldwide to distribute its game titles. This strategy ensures a tangible presence for its products, reaching consumers who still prefer purchasing physical media. In 2023, physical game sales in the US accounted for approximately 17% of total game spending, demonstrating the continued relevance of this channel.

Capcom's official website acts as a primary information gateway, offering detailed product descriptions, company news, and investor relations updates. It's a crucial touchpoint for all stakeholders, from gamers to financial analysts.

Dedicated game portals, like the Resident Evil or Monster Hunter sites, provide specific community engagement and direct access to game-related content, fostering brand loyalty. These often link to e-commerce platforms for direct sales, a key revenue stream.

In 2023, Capcom reported net sales of ¥146.1 billion, with digital sales accounting for a significant portion, highlighting the importance of their online presence and direct-to-consumer channels.

Esports Broadcasting and Streaming Platforms

Esports broadcasting and streaming platforms like Twitch and YouTube are crucial for reaching Capcom's vast audience. These channels are where fans engage with competitive gaming, directly impacting game visibility and community growth. For instance, Capcom Cup 11, a major esports event for Street Fighter, drew an impressive viewership of over 10 million online viewers, highlighting the power of these platforms.

- Platform Reach: Twitch and YouTube are the primary conduits for broadcasting competitive gaming content.

- Audience Engagement: These platforms connect Capcom with millions of esports enthusiasts globally.

- Visibility Driver: Streaming tournaments significantly boosts the profile and appeal of Capcom's fighting game titles.

- Key Event Success: Capcom Cup 11's viewership exceeding 10 million demonstrates the immense reach of live esports broadcasts.

Gaming Media Outlets and Influencer Networks

Capcom leverages gaming media outlets and influencer networks as a crucial channel for marketing and community engagement. These partnerships ensure broad reach and credibility by tapping into established platforms and trusted voices within the gaming community.

By collaborating with gaming news websites and magazines, Capcom can effectively announce new titles, share gameplay updates, and generate buzz. For instance, in 2024, major gaming publications continued to be a primary source for in-depth reviews and previews, significantly influencing purchasing decisions for titles like the highly anticipated Resident Evil Village DLC.

Influencer marketing plays a vital role, with Capcom partnering with prominent streamers and content creators on platforms like Twitch and YouTube. These influencers, who command millions of followers, provide authentic gameplay experiences and recommendations. In 2024, Capcom saw substantial engagement from influencer campaigns promoting titles such as Street Fighter 6, with many creators showcasing high-level play and tutorials.

- Partnerships with gaming news sites and magazines: Ensures broad dissemination of official announcements and reviews.

- Collaboration with content creators and influencers: Leverages trusted voices for authentic game promotion and community building.

- Targeted reach: Accesses dedicated gaming audiences through established media and popular personalities.

- Increased visibility and credibility: Builds anticipation and trust for new game releases and ongoing titles.

Capcom's channel strategy extends to its own digital properties, including its official website and dedicated game portals. These platforms serve as central hubs for information, community interaction, and direct sales, reinforcing brand presence and customer relationships. In fiscal year 2024, Capcom's direct-to-consumer initiatives, including sales through its own channels, contributed significantly to its digital revenue streams.

Capcom's diverse channel mix is crucial for maximizing reach and engagement across its global player base. From digital storefronts to physical retail and influential online communities, each channel plays a distinct role in driving sales and fostering brand loyalty. The company's strategic use of these varied avenues ensures its titles are accessible and appealing to a wide spectrum of gamers.

| Channel Type | Key Platforms/Examples | Fiscal Year 2024 Relevance |

|---|---|---|

| Digital Distribution | Steam, PlayStation Store, Xbox Games Store, Nintendo eShop, Apple App Store, Google Play Store | Primary driver of game sales, significant revenue contributor. |

| Physical Retail | Global brick-and-mortar stores | Maintains a tangible presence, catering to consumers preferring physical media. |

| Owned Digital Properties | Capcom Official Website, Dedicated Game Portals (e.g., Resident Evil, Monster Hunter) | Information hub, community engagement, direct sales, brand reinforcement. |

| Esports & Streaming | Twitch, YouTube | Broad audience reach for competitive gaming, community growth, title visibility. Capcom Cup 11 viewership exceeded 10 million. |

| Media & Influencers | Gaming News Websites, Magazines, YouTube/Twitch Creators | Marketing, community engagement, credibility building, driving purchasing decisions. Street Fighter 6 influencer campaigns saw substantial engagement in 2024. |

Customer Segments

Core gamers and franchise enthusiasts represent a vital customer segment for Capcom, particularly those deeply invested in series like Resident Evil, Monster Hunter, and Street Fighter. These dedicated players are the bedrock of Capcom's sales, consistently purchasing new releases, remakes, and downloadable content. For instance, Monster Hunter: World, released in 2018, achieved over 20 million units shipped as of September 2023, demonstrating the immense commercial power of a beloved franchise within this segment.

Capcom's business model effectively caters to this group by prioritizing the development of new installments and high-quality remakes within its established franchises. This strategy ensures a continuous stream of content that resonates with the established fanbase, fostering loyalty and repeat purchases. The success of Resident Evil 4 Remake, which shipped over 5 million units by March 2024, highlights the segment's strong appetite for updated versions of their favorite games.

Casual and mobile gamers represent a vast and growing audience looking for easily accessible and fun gaming experiences, often on their smartphones. Capcom recognizes this significant market and is actively developing mobile titles to capture this segment. For instance, the company is set to launch Resident Evil Survival Unit, a new mobile strategy game in 2025, signaling a commitment to this platform.

Esports players and spectators, especially fans of Street Fighter, represent a core customer segment for Capcom. This group fuels the competitive gaming ecosystem through active participation and consistent viewership, directly impacting sponsorship opportunities and overall engagement. Capcom's dedication to revitalizing the global esports market is clearly demonstrated by their investment in and promotion of these communities.

In 2024, the esports industry continued its robust growth, with global revenues projected to reach over $1.5 billion. Street Fighter, in particular, saw significant engagement, with Capcom Pro Tour events drawing substantial online viewership. For instance, the 2023 Capcom Cup X garnered millions of hours watched, highlighting the passionate and dedicated nature of this segment.

Collectors and Merchandise Buyers

Collectors and merchandise buyers are a key customer segment for Capcom, representing a deep brand loyalty that extends beyond gameplay. This group actively seeks out physical game editions, apparel, collectibles, and other licensed products tied to Capcom's popular intellectual properties like Resident Evil and Monster Hunter. Their purchases demonstrate a strong emotional connection and a desire to own tangible pieces of these franchises.

Capcom strategically caters to this segment by developing and marketing a wide array of merchandise. This includes everything from high-quality action figures and art books to limited-edition vinyl soundtracks and themed clothing lines. The company’s focus on these offerings taps into the collector's market, driving additional revenue streams and reinforcing brand presence.

- Brand Affinity: This segment exhibits a strong connection to Capcom's IPs, purchasing physical goods as a testament to their fandom.

- Merchandise Focus: Capcom actively develops and promotes merchandise for its most popular franchises, such as Resident Evil and Monster Hunter.

- Revenue Diversification: Sales of collectibles, apparel, and other licensed products provide a significant revenue stream separate from game sales.

- Market Engagement: By offering diverse merchandise, Capcom keeps its brands relevant and engages with fans on multiple levels, fostering long-term loyalty.

New Console Owners and PC Gamers

This segment comprises individuals who have recently invested in new gaming hardware, whether it be the latest consoles or upgraded PCs, and are actively seeking compelling software experiences to match their new capabilities. Capcom's robust multi-platform releases, alongside consistent sales from its established game library, effectively capture this eager audience. For instance, in the first half of fiscal year 2025, PC sales represented a significant 54% of Capcom's total unit sales, underscoring the importance of this platform for new hardware owners.

Key aspects for this customer segment include:

- Hardware Acquisition: Consumers are actively looking for high-quality games to enjoy on their new consoles or powerful PCs.

- Software Discovery: They are open to exploring new titles and revisiting popular franchises that leverage their recent hardware investments.

- Platform Diversity: Capcom's presence across multiple platforms ensures that new hardware owners on PlayStation, Xbox, and PC can access their offerings.

- Catalog Engagement: Strong back catalog sales indicate that new owners are also interested in Capcom's established hits, providing immediate value.

Capcom's customer base is diverse, encompassing dedicated core gamers who drive sales of new releases and remakes, as seen with titles like Resident Evil 4 Remake. This segment also includes a growing casual and mobile audience, for whom Capcom is developing accessible titles like Resident Evil Survival Unit. Furthermore, esports enthusiasts, particularly those following Street Fighter, represent a key demographic fueling competitive gaming and viewership.

The company also targets collectors and merchandise buyers who demonstrate deep brand loyalty through purchases of physical goods and licensed products. Finally, individuals who have recently acquired new gaming hardware represent a significant segment actively seeking high-quality software experiences, with PC gaming showing strong performance, accounting for 54% of Capcom's unit sales in the first half of fiscal year 2025.

| Customer Segment | Key Characteristics | Capcom's Strategy | Supporting Data (2024/2025) |

|---|---|---|---|

| Core Gamers & Franchise Enthusiasts | Invested in series (RE, MH, SF), purchase new releases, remakes, DLC. | Develop new installments, high-quality remakes. | Monster Hunter: World >20M units shipped (as of Sep 2023); RE4 Remake >5M units shipped (as of Mar 2024). |

| Casual & Mobile Gamers | Seek accessible, fun experiences, primarily on smartphones. | Develop mobile-specific titles. | Planned launch of Resident Evil Survival Unit (2025). |

| Esports Players & Spectators | Active participants and viewers in competitive gaming (SF). | Invest in and promote esports communities. | Street Fighter Pro Tour events garnered millions of hours watched (2023). |

| Collectors & Merchandise Buyers | Deep brand loyalty, seek physical editions, apparel, collectibles. | Develop and market diverse merchandise. | Strong sales of branded merchandise across IPs. |

| New Hardware Owners | Recently acquired new consoles/PCs, seek compelling software. | Multi-platform releases, strong back catalog sales. | PC sales were 54% of total unit sales (H1 FY2025). |

Cost Structure

Capcom's cost structure heavily leans on game development and research & development (R&D). A substantial part of these expenses goes towards compensating their talented teams of developers, artists, and engineers. For instance, in fiscal year 2024, Capcom reported significant investments in content creation and R&D, reflecting the ongoing need to produce high-quality titles and explore new gaming technologies.

These R&D costs also encompass investments in proprietary game engines and the pursuit of innovative gaming experiences. The lengthy development cycles inherent in creating major game titles necessitate considerable resource allocation, impacting the overall cost base. This commitment to cutting-edge technology and creative talent is central to maintaining their competitive edge in the dynamic gaming industry.

Capcom dedicates significant resources to marketing, advertising, and promotion for its game titles. These expenses are crucial for global launches and maintaining player engagement with existing franchises.

For fiscal year 2024, Capcom reported advertising and sales promotion expenses of approximately ¥25.9 billion. This substantial investment reflects their strategy of promoting titles with the expectation of generating long-term sales growth.

The company utilizes a multi-channel approach, including digital advertising, social media campaigns, and traditional media, to reach a broad audience. Promotional activities often coincide with new game releases and major content updates to maximize impact.

Capcom incurs significant costs through platform licensing fees and royalties. These are essential payments to console manufacturers like Sony and Microsoft, as well as digital storefronts such as Steam and the Nintendo eShop, for the privilege of distributing their games. For instance, platform holders typically take a percentage of each sale, often around 30%, which directly impacts Capcom's revenue from digital game purchases.

Server Infrastructure and Online Service Maintenance

Capcom invests significantly in maintaining robust server infrastructure to support its online multiplayer titles and live service games. This includes costs for cloud hosting, bandwidth, and dedicated network engineers to ensure smooth gameplay and minimal latency for millions of players worldwide.

For games like Monster Hunter: World and Street Fighter 6, which feature extensive online components, these infrastructure costs are ongoing. In fiscal year 2024, Capcom reported that its Digital Contents segment, which includes online service costs, saw continued strong performance, reflecting the necessity of these investments for player engagement and revenue generation.

- Server Hosting & Cloud Services: Essential for online multiplayer functionality and data management.

- Network Maintenance: Ensuring reliable connectivity and low latency for a seamless player experience.

- Content Updates & Patches: Ongoing development and deployment of new content and bug fixes to retain player interest.

- Security Measures: Protecting player data and preventing unauthorized access to game servers.

General, Administrative, and Operational Overheads

Capcom's General, Administrative, and Operational Overheads encompass the essential costs of running a global gaming enterprise. These include expenses for corporate functions like human resources, legal services, and managing its extensive facilities. For fiscal year 2024, Capcom reported significant investments in these areas to support its worldwide operations and talent acquisition.

These overheads are crucial for maintaining Capcom's infrastructure and supporting its diverse workforce across development studios and publishing offices. The company's commitment to its employees and operational efficiency directly impacts its ability to deliver high-quality gaming experiences.

- Corporate Administration: Costs associated with executive management, finance, and accounting.

- Human Resources: Expenses for recruitment, employee benefits, and talent development.

- Legal and Compliance: Fees for legal counsel, intellectual property protection, and regulatory adherence.

- Facilities and IT: Costs for office spaces, data centers, and technology infrastructure.

Capcom's cost structure is dominated by game development and R&D, with significant investments in talent and technology. Marketing and advertising are also major expenses, crucial for global game launches and player engagement. Platform licensing fees and ongoing server infrastructure costs for online services represent substantial operational expenditures.

| Cost Category | Description | Fiscal Year 2024 (Approximate) |

|---|---|---|

| Game Development & R&D | Salaries for developers, artists, engineers; engine development; new technology exploration. | Primary driver of expenses, reflecting commitment to high-quality content. |

| Marketing & Advertising | Digital ads, social media, traditional media campaigns for game promotion. | ¥25.9 billion (Advertising and Sales Promotion) |

| Platform Licensing & Royalties | Fees paid to console manufacturers and digital storefronts for game distribution. | Typically a percentage of digital sales (e.g., 30%). |

| Server Infrastructure & Online Services | Cloud hosting, bandwidth, network maintenance for online multiplayer and live services. | Ongoing costs supporting popular titles like Monster Hunter and Street Fighter. |

| General & Administrative | Corporate functions, HR, legal, facilities, and IT support. | Essential for global operations and talent management. |

Revenue Streams

Capcom's core revenue engine is fueled by the sale of its full video game titles, encompassing both digital downloads and traditional physical copies. This direct sales model represents the initial purchase of a complete gaming experience.

Digital sales have become increasingly dominant, contributing significantly to Capcom's overall financial performance. For instance, in the fiscal year ending March 31, 2024, digital sales accounted for a substantial portion of the company's net sales, reflecting the industry's shift towards online distribution.

Capcom significantly boosts its profitability through in-game purchases and downloadable content (DLC). This strategy involves selling post-launch additions like new characters, story expansions, cosmetic items, and season passes for titles such as Monster Hunter and Street Fighter. For instance, Capcom reported that digital contents, which includes DLC, accounted for a substantial portion of its revenue in fiscal year 2023, demonstrating the ongoing value derived from extending the life and engagement of its popular game franchises.

Capcom generates significant income by licensing its beloved game franchises for a wide array of merchandise. This includes everything from action figures and clothing to trading cards and home goods, effectively turning its popular intellectual properties into tangible consumer products.

This strategy diversifies Capcom's revenue streams, making it less reliant solely on video game sales. For example, the success of franchises like Monster Hunter and Resident Evil fuels demand for related merchandise, contributing to overall profitability.

In fiscal year 2024, Capcom reported robust growth in its Consumer Products segment, which encompasses merchandise and licensing. This segment consistently performs well, demonstrating the enduring appeal of its brands and the effectiveness of its merchandising strategy.

Esports Sponsorships and Event Revenue

Capcom generates significant revenue through esports sponsorships and event-related income. This includes partnerships with major esports organizations and the sale of media rights for broadcasting competitive gaming events.

For instance, Capcom's involvement with the Esports World Cup Foundation highlights their strategic approach to leveraging popular titles like Street Fighter for broader audience engagement and revenue generation. Such collaborations can lead to substantial sponsorship deals.

The financial impact of these streams is growing, with the global esports market projected to reach over $2.5 billion by 2027, according to Newzoo. Capcom's ability to tap into this market through its popular franchises is a key component of its business model.

- Sponsorships: Revenue from brand partnerships for esports tournaments and leagues.

- Media Rights: Income from broadcasting rights sold to streaming platforms and television networks.

- Event Revenue: Potential earnings from ticket sales, merchandise, and other on-site activities at live esports events.

Amusement Equipment and Arcade Operations

Capcom’s amusement equipment and arcade operations represent a significant, albeit secondary, revenue stream. While best known for its video game development and publishing, the company also profits from the manufacturing and operation of pachinko and pachislot machines, as well as running its own arcades.

This segment demonstrated its financial resilience, contributing positively to Capcom's overall profitability in fiscal year 2025. For instance, in FY2025, the Amusement segment reported operating income, underscoring its ongoing value to the company's diversified business model.

- Amusement Equipment: Revenue generated from the sale and licensing of pachinko and pachislot machines.

- Arcade Operations: Income derived from the operation of physical arcade locations.

- FY2025 Contribution: This segment was a profitable contributor to Capcom's financial results in the fiscal year ending March 31, 2025.

Capcom's revenue streams are diverse, extending beyond initial game sales to include ongoing monetization and brand extensions.

Digital content, such as downloadable content (DLC) and in-game purchases, significantly bolsters revenue, extending the lifecycle and profitability of popular titles. For the fiscal year ending March 31, 2024, Capcom saw a substantial portion of its net sales derived from digital channels, highlighting this trend's continued importance.

Licensing its intellectual property for merchandise and leveraging its brands in esports also contribute meaningfully. The Consumer Products segment, for example, demonstrated robust growth in fiscal year 2024, reflecting strong brand recognition and consumer demand for related goods.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

| Digital Sales & Content | Sales of full game downloads, DLC, and in-game purchases. | A significant driver of net sales, reflecting industry shift to digital. |

| Merchandise & Licensing | Revenue from selling branded products and licensing IP for various goods. | Consumer Products segment showed robust growth, indicating strong brand appeal. |

| Esports & Sponsorships | Income from brand partnerships and media rights for competitive gaming. | Strategic collaborations like the Esports World Cup Foundation tap into growing esports market. |

| Amusement Equipment & Arcades | Profits from pachinko/pachislot machines and arcade operations. | Remained a profitable contributor in FY2025, adding to diversified income. |

Business Model Canvas Data Sources

The Capcom Business Model Canvas is constructed using a blend of financial disclosures, market research reports, and internal operational data. These sources provide a comprehensive view of Capcom's revenue streams, cost structures, and customer relationships, ensuring a data-driven strategic framework.