Capcom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capcom Bundle

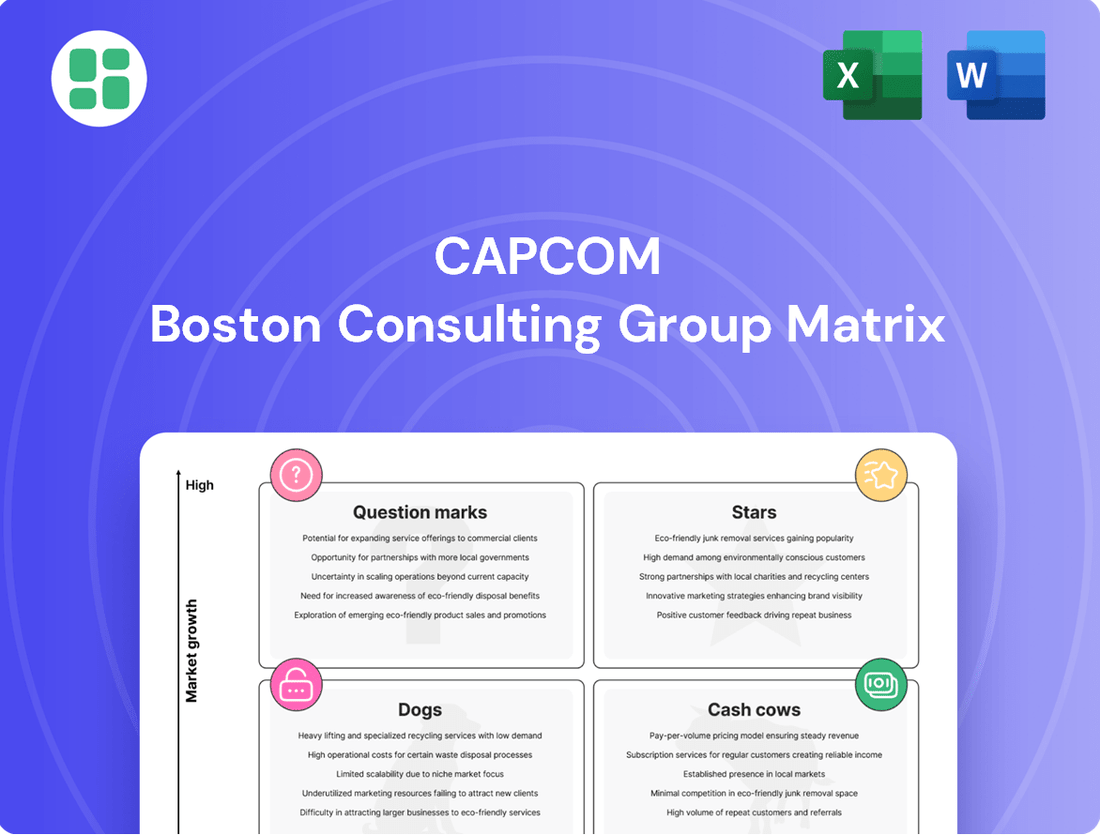

Explore the strategic positioning of Capcom's gaming portfolio with our insightful BCG Matrix analysis. Understand which titles are market leaders (Stars), which consistently generate revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This preview offers a glimpse into how Capcom's iconic franchises are performing. To unlock a comprehensive understanding of their market share and growth potential, and to develop actionable strategies for future investments, purchase the full BCG Matrix report.

Gain a competitive edge by understanding the full picture of Capcom's product lifecycle. The complete BCG Matrix provides detailed quadrant placements and strategic recommendations to optimize your own business decisions.

Stars

Monster Hunter Wilds, launched in February 2025, is a monumental addition to Capcom's celebrated franchise. It shattered expectations, becoming Capcom's fastest-selling game ever, with an impressive 10.1 million units sold within its initial fiscal year.

This remarkable performance signifies strong market penetration and robust growth within the action RPG segment, positioning Monster Hunter Wilds as a clear star in the BCG Matrix.

While requiring significant investment for ongoing development and marketing, its rapid sales trajectory suggests it will be a major revenue driver for Capcom, solidifying its status as a high-growth, high-market-share product.

Street Fighter 6, released in June 2023, is a shining example of a Star in Capcom's portfolio. By September 2024, it had already achieved 4 million sales, and this upward trajectory continued, surpassing 5 million units sold by June 2025. This strong performance is fueled by consistent content updates, new character releases, and a thriving eSports scene, notably through the Capcom Pro Tour, solidifying its dominant position in the fighting game genre.

Resident Evil 4 Remake, launched in March 2023, is a strong performer for Capcom. By December 2024, it had surpassed 10 million units sold, with sales reaching 9.91 million by March 2025. This indicates a high market share in the survival horror category.

The game's success, driven by both new and returning players, positions it as a potential cash cow for Capcom. Its robust sales trajectory suggests a bright future for revitalized classic titles within the company's offerings.

Dragon's Dogma 2

Dragon's Dogma 2, a significant action RPG released in 2024, has demonstrated impressive commercial success. By March 2025, it had already achieved 3.7 million unit sales, indicating a robust launch for the sequel.

Operating within the high-growth market of AAA action RPGs, Dragon's Dogma 2 benefits from substantial player interest and positive critical reception. This positions it as a potential long-term revenue generator for Capcom.

Capcom's strategy for Dragon's Dogma 2 includes continued investment in post-launch content. This commitment is crucial for maintaining player engagement and solidifying its status as a Star within the company's portfolio.

- Dragon's Dogma 2 Sales: 3.7 million units by March 2025.

- Genre: Action RPG (High Growth Market).

- Strategic Importance: Potential long-term Star for Capcom.

- Key Strategy: Investment in post-launch content.

Capcom's Digital Contents Business Expansion

Capcom's Digital Contents business is a clear Star in its portfolio, demonstrating robust expansion. In the first quarter of fiscal year 2025, net sales for this segment surged by an impressive 39.4% year-on-year. This growth is underpinned by a significant shift in consumer purchasing habits, with 90.1% of game copies sold digitally in fiscal year 2024.

This strategic emphasis on digital distribution, encompassing re-releases on new platforms and a strong focus on catalogue sales, fuels this high-growth segment. It allows Capcom to effectively leverage its diverse game library, maximizing reach and revenue streams.

- Digital sales dominance: 90.1% of game copies sold digitally in FY2024.

- Q1 FY2025 growth: Digital Contents net sales up 39.4% year-on-year.

- Strategic focus: Re-releases and catalogue sales drive expansion.

- Maximizing reach: Digital platform enhances revenue across the portfolio.

Stars represent Capcom's products with high market share in high-growth industries. These are typically new or recently released titles that are performing exceptionally well and are expected to continue growing. Monster Hunter Wilds, with 10.1 million units sold in its first fiscal year, and Street Fighter 6, surpassing 5 million units by June 2025, exemplify this category. Resident Evil 4 Remake, nearing 10 million units by March 2025, also shows strong potential for continued growth and market dominance.

| Product | Market Share | Industry Growth | Capcom's Status |

|---|---|---|---|

| Monster Hunter Wilds | High | High | Star |

| Street Fighter 6 | High | High | Star |

| Resident Evil 4 Remake | High | High | Potential Star/Cash Cow |

| Dragon's Dogma 2 | Growing | High | Developing Star |

| Digital Contents | High | High | Star |

What is included in the product

Capcom's BCG Matrix analyzes its game portfolio, identifying Stars like Monster Hunter, Cash Cows like Resident Evil, Question Marks with new IPs, and potential Dogs.

A clear, visual representation of Capcom's portfolio, identifying Stars and Cash Cows, alleviates the pain of strategic resource allocation.

Cash Cows

Monster Hunter: World and its expansion Iceborne continue to be significant cash cows for Capcom. By March 2025, Monster Hunter: World achieved 28.51 million lifetime sales, while Iceborne reached 15.20 million. These titles operate in a mature market, demanding little in terms of new development investment but consistently generating revenue from Capcom's back catalog.

Resident Evil Village stands as a strong Cash Cow for Capcom. In FY2024, it achieved sales of 1.50 million units, followed by 923,000 units in Q1 FY2025. By June 2025, its lifetime sales had impressively reached 12.2 million units.

This title maintains a significant market share within the survival horror genre, a segment where the Resident Evil brand already enjoys considerable strength. Its sustained sales performance indicates a mature product that continues to be a reliable revenue generator for Capcom.

The game's profitability is further enhanced by its ability to generate substantial revenue with comparatively lower marketing expenses than newer franchise entries. This characteristic is a hallmark of a Cash Cow, contributing steadily to the company's financial health.

Resident Evil 2 Remake, with 15.4 million lifetime sales by March 2025, and Resident Evil 7: Biohazard, at 14.78 million lifetime sales by the same date, exemplify Capcom's cash cows. These established titles have reached high market saturation, consistently generating revenue through digital sales and ongoing promotions.

Their profitability is driven by minimal ongoing investment, making them reliable sources of steady cash flow for Capcom. These games continue to be significant contributors to the company's financial performance, showcasing the enduring appeal of the Resident Evil franchise.

Devil May Cry 5

Devil May Cry 5 continues to be a significant revenue generator for Capcom, firmly establishing itself as a cash cow. Its impressive sales figures, reaching 10.5 million units by June 2025, are a testament to its enduring popularity and market presence.

The game's performance was further bolstered by a Netflix anime adaptation, which reignited interest and likely contributed to its strong showing of 1.78 million units sold in Q1 FY2025. This cross-media synergy highlights the title's ability to leverage its established brand across different platforms.

- Strong Lifetime Sales: Devil May Cry 5 achieved 10.5 million lifetime sales by June 2025.

- Recent Sales Momentum: The game sold 1.78 million units in Q1 FY2025.

- Brand Strength: It holds a significant market share in the action-adventure genre due to its established franchise.

- Cross-Media Synergies: A Netflix anime adaptation boosted sales and renewed player interest.

Overall Back-Catalogue Sales

Capcom's strategic emphasis on its extensive back-catalogue has yielded impressive results, with older titles contributing a substantial 13.36 million units to sales in the first quarter of fiscal year 2025. This consistent performance across its diverse portfolio of established franchises offers a reliable and significant revenue stream, underscoring the enduring appeal of its intellectual property.

These mature products represent classic Cash Cows within the BCG Matrix framework. Their high market share, coupled with significantly reduced new development costs, makes them instrumental in generating the robust cash flow necessary to fund future investments and innovation in new game development.

- Back-catalogue sales reached 13.36 million units in Q1 FY2025.

- These sales are from established and mature franchises.

- High market share and low development costs characterize these titles.

- They provide a stable revenue stream and essential cash flow for new investments.

Capcom's established franchises like Monster Hunter and Resident Evil continue to be powerful cash cows. Titles such as Monster Hunter: World, with 28.51 million sales by March 2025, and Resident Evil Village, at 12.2 million lifetime sales by June 2025, exemplify this. These games, operating in mature markets, require minimal new investment but consistently generate substantial revenue from Capcom's extensive back catalog.

| Game Title | Lifetime Sales (Millions) - by June 2025 (unless otherwise stated) | Q1 FY2025 Sales (Millions) | Category |

|---|---|---|---|

| Monster Hunter: World | 28.51 (by March 2025) | N/A | Cash Cow |

| Resident Evil Village | 12.2 | 0.923 | Cash Cow |

| Resident Evil 2 Remake | 15.4 (by March 2025) | N/A | Cash Cow |

| Resident Evil 7: Biohazard | 14.78 (by March 2025) | N/A | Cash Cow |

| Devil May Cry 5 | 10.5 | 1.78 | Cash Cow |

Delivered as Shown

Capcom BCG Matrix

The Capcom BCG Matrix preview you are currently viewing is the identical, complete document you will receive immediately after your purchase. This means the strategic insights, detailed analysis, and professional formatting are exactly as you see them now, ready for your immediate use without any alterations or watermarks. You can confidently use this preview as a direct representation of the high-quality, actionable BCG Matrix report that will be delivered to you, ensuring no surprises and immediate utility for your business planning.

Dogs

Capcom's extensive library includes older arcade and niche console compilations. These titles, while historically important, now occupy a very small market share and contribute very little to overall revenue. Many of these games are not updated for modern platforms or promoted, meaning their impact on sales is practically zero.

Capcom's older intellectual properties like Commando and 1942 represent dormant assets. These franchises, along with others such as Final Fight and Sengoku Basara, have historically low lifetime sales compared to Capcom's blockbuster titles.

Currently, these IPs hold a minimal market share within genres that are either stagnant or in decline. For instance, the arcade shooter genre, where Commando and 1942 originated, has seen limited mainstream resurgence in recent years.

Without substantial investment and a well-defined strategy to re-engage players or tap into niche markets, these dormant IPs are unlikely to become significant growth drivers for Capcom in the near future.

Mobile titles not linked to Capcom's big-name series, like Monster Hunter or Resident Evil, often find themselves in the 'Dog' quadrant of the BCG Matrix. These games typically struggle to attract and retain players, resulting in minimal revenue streams and a dwindling user base.

These underperforming mobile games represent a drain on resources without generating substantial returns. Their limited market penetration and low engagement metrics mean they are more likely to be cash traps, consuming development and marketing funds without contributing significantly to Capcom's overall financial performance.

Games with Low Sales Post-Launch Without Continued Support

Games that don't reach Capcom's platinum sales milestone of 1 million units and receive minimal post-launch support can quickly become dogs in the BCG matrix. These titles struggle to gain traction and, without further investment, become insignificant revenue contributors.

For instance, while specific sales figures for all non-platinum titles aren't publicly detailed, Capcom's financial reports often highlight the success of their major franchises. In fiscal year 2024, Capcom reported net sales of ¥171.7 billion, with their "Major Titles" segment, which includes blockbuster releases, driving a significant portion of this revenue. Titles that fall short of the 1 million unit mark often represent a smaller, less impactful segment of their overall portfolio.

- Low Sales Threshold: Games failing to exceed 1 million units sold post-launch are categorized as potential dogs.

- Limited Post-Launch Engagement: A lack of updates, new content, or marketing efforts exacerbates their underperformance.

- Market Share Neglect: These titles fail to capture substantial market share and become irrelevant revenue streams.

- Financial Impact: While specific figures are private, such titles contribute minimally to overall sales compared to successful franchises.

Un-remastered or Un-ported Titles from Less Popular Series

Capcom’s extensive game catalog includes many titles that haven't seen a modern re-release or remaster. These un-ported or un-remastered games from less popular series often struggle with very low current sales and minimal market relevance. They essentially sit as dormant assets, not actively generating significant revenue for the company.

These titles, often tied to older hardware or now-defunct digital storefronts, represent a category of games that are not contributing to Capcom's current financial performance. For instance, while specific sales figures for these niche un-remastered titles are not publicly detailed by Capcom, the overall market trend for games without modern accessibility is a steep decline in player engagement and purchasing power.

- Dormant Assets: Games from less popular series that are not remastered or ported to current platforms have minimal market presence.

- Low Revenue Contribution: These titles typically generate negligible sales, failing to contribute meaningfully to Capcom's income.

- Limited Market Relevance: Without updates or availability on modern systems, their appeal and reach are severely restricted.

- Potential for Re-evaluation: While currently underperforming, some of these titles might hold latent value if strategically re-released or remastered in the future.

Capcom's "Dogs" primarily include older, underperforming IPs and mobile titles not tied to major franchises. These games have low market share, minimal revenue generation, and often lack significant post-launch support. For example, titles that don't reach Capcom's platinum sales milestone of 1 million units can quickly become dogs, consuming resources without substantial returns.

These underperforming assets, such as older arcade compilations or less popular mobile games, contribute very little to Capcom's overall financial performance. Their limited market penetration and low engagement metrics mean they are more likely to be cash traps, consuming development and marketing funds without significant contribution.

Capcom's fiscal year 2024 saw net sales of ¥171.7 billion, with major titles driving this success. Games falling outside this blockbuster category, particularly those with low sales and minimal market relevance, represent the 'Dog' quadrant. Without strategic re-engagement or investment, these dormant IPs are unlikely to become significant growth drivers.

These titles often struggle to attract and retain players, resulting in minimal revenue streams and a dwindling user base. Their limited market penetration and low engagement metrics mean they are more likely to be cash traps, consuming development and marketing funds without contributing significantly to Capcom's overall financial performance.

Question Marks

Kunitsu-Gami: Path of the Goddess, a new intellectual property from Capcom, is slated for release in 2024/2025, including a day-one availability on Xbox Game Pass. This positions it within a high-growth market, leveraging its distinct Japanese folklore theme and the broad reach of Game Pass.

As a fresh IP, Kunitsu-Gami faces the challenge of establishing market share. Its future trajectory, whether it becomes a Star or a Dog in Capcom's portfolio, hinges on successful player adoption and effective marketing campaigns. For context, Capcom reported a 15.7% increase in net sales for the fiscal year ending March 31, 2024, reaching ¥627.6 billion ($4.0 billion USD), indicating a strong overall performance for the company.

Capcom is strategically revitalizing the Onimusha series, a move that positions it within the BCG Matrix. The upcoming Onimusha: Way of the Sword, slated for a 2026 release, and the remaster of Onimusha 2 in May 2025, signify a renewed commitment to this dormant intellectual property. This initiative aims to re-establish Onimusha in a market where its current share is minimal due to its extended absence.

The success of these new titles is critical for Onimusha's trajectory. If they resonate with players and achieve strong sales, the franchise could transition from a low-market-share position to a high-growth segment, effectively becoming a Star in Capcom's portfolio. For context, Capcom's overall revenue reached ¥155.5 billion in the fiscal year ending March 2024, demonstrating the company's capacity for significant IP investment.

The potential Okami sequel, with original director Hideki Kamiya's involvement announced at The Game Awards 2024, positions Okami as a Question Mark within Capcom's BCG Matrix. This revival of a dormant IP targets a passionate, albeit niche, fanbase, representing a low-market-share product in a potentially high-growth segment of nostalgic gamers and fans of unique art styles.

Upcoming, Unannounced Resident Evil Titles (e.g., Resident Evil 9)

Upcoming, unannounced Resident Evil titles, like the rumored Resident Evil 9, are positioned as potential Stars within Capcom's portfolio. The franchise consistently performs well, with Resident Evil Village selling over 8.4 million units by March 2024, indicating strong market demand for new installments.

These future games represent high-growth potential due to the series' established popularity and a massive, engaged fanbase eager for new experiences. The success of Resident Evil 4 Remake, which shipped over 6.48 million units as of March 31, 2024, further underscores the franchise's commercial viability.

However, as unreleased products, they currently have no market share and require substantial upfront investment in development and marketing. This investment is crucial to capitalize on the anticipated high demand and ensure these titles can achieve their potential.

- High Growth Potential: Franchise's proven sales record and dedicated fanbase.

- Significant Investment Required: Costs associated with AAA game development.

- No Current Market Share: As unreleased products.

- Strategic Importance: Key for future revenue streams and franchise longevity.

Capcom's Expanding eSports Initiatives

Capcom is making a significant push into eSports, highlighted by the global Capcom Pro Tour for Street Fighter 6, aiming to boost its brand's appeal. This strategic move taps into the rapidly expanding eSports market, which is projected to reach $2.4 billion in revenue by the end of 2024, according to Newzoo. While the growth potential is substantial, Capcom's direct revenue generation from these eSports ventures, beyond initial game sales, is still in its nascent stages and requires considerable investment.

The long-term impact of these eSports initiatives on creating new revenue streams and deepening player engagement is a key area to monitor. For instance, the Street Fighter League: Pro-JP 2024 season saw increased viewership and sponsor interest, indicating positive early traction. However, quantifying the precise return on investment and establishing a consistent revenue model from eSports remains an ongoing challenge for Capcom, placing these activities in a position that requires further development and strategic refinement.

- Strategic Investment: Capcom's commitment to eSports, exemplified by the Capcom Pro Tour, represents a strategic investment in brand building and market presence within a high-growth sector.

- Market Growth vs. Direct Revenue: While the eSports market is booming, Capcom's direct revenue from these activities is still developing, indicating a significant investment phase rather than immediate, substantial profit generation.

- Future Revenue Streams: The success of these eSports initiatives in establishing new, sustainable revenue streams and enhancing brand loyalty is a critical question mark for the company's future financial performance.

- Brand Amplification: The global reach and engagement of events like the Street Fighter 6 Capcom Pro Tour are designed to amplify brand value, potentially driving future game sales and merchandise revenue.

The potential Okami sequel, with original director Hideki Kamiya's involvement announced at The Game Awards 2024, positions Okami as a Question Mark within Capcom's BCG Matrix. This revival of a dormant IP targets a passionate, albeit niche, fanbase, representing a low-market-share product in a potentially high-growth segment of nostalgic gamers and fans of unique art styles.

Question Marks, like the potential Okami sequel, require significant investment to grow their market share. Their future success is uncertain, but if they capture a significant portion of their target market, they could become Stars. Capcom's overall revenue reached ¥155.5 billion in the fiscal year ending March 2024, demonstrating the company's capacity for such strategic investments.

The success of these new titles is critical for Okami's trajectory. If they resonate with players and achieve strong sales, the franchise could transition from a low-market-share position to a high-growth segment, effectively becoming a Star in Capcom's portfolio.

Capcom's investment in these Question Mark titles is a calculated risk, aiming to tap into underserved markets or revive beloved franchises. The company's strong financial performance, with a 15.7% increase in net sales for the fiscal year ending March 31, 2024, reaching ¥627.6 billion ($4.0 billion USD), provides a solid foundation for such ventures.

| Product | Market Share | Market Growth | BCG Category | Strategy |

|---|---|---|---|---|

| Okami Sequel (Potential) | Low | High | Question Mark | Invest to gain share or divest |

| Kunitsu-Gami: Path of the Goddess | Low | High | Question Mark | Invest to gain share or divest |

| Onimusha Series (Revitalized) | Low | Medium | Question Mark/Dog | Invest to gain share or divest |

BCG Matrix Data Sources

Our Capcom BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.