Capcom Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capcom Bundle

Capcom navigates a dynamic gaming landscape where intense competition, powerful buyers, and the looming threat of new entrants significantly shape its market position. Understanding these forces is crucial for any stakeholder in the video game industry.

The complete report reveals the real forces shaping Capcom’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Capcom's bargaining power of suppliers is significantly influenced by console manufacturers such as Sony, Microsoft, and Nintendo. These platform holders control access to the primary distribution channels for many of Capcom's games, granting them considerable leverage.

The reliance on these dominant ecosystems means that a game's success is often tied to its visibility and promotion on PlayStation, Xbox, and Nintendo Switch. This dynamic directly impacts Capcom's market reach and sales potential, underscoring the suppliers' power.

Looking ahead, while Nintendo is anticipated to be a strong performer in the next console generation, the ongoing competition between Sony and Microsoft's offerings will continue to shape the market and, consequently, the influence of these key suppliers on Capcom's business.

The bargaining power of suppliers in the game engine market is considerable, with Unity and Epic Games' Unreal Engine dominating. These providers can influence development costs through licensing fees and the availability of advanced features. Many developers, including major studios like Capcom, rely on these engines, making them susceptible to supplier-driven cost increases or changes in technology roadmaps.

Digital storefronts like Steam, PlayStation Store, and Xbox Store are essential for Capcom, with over 90% of its game sales occurring digitally. These platforms, however, impose substantial commission fees on each sale, directly affecting Capcom's profit margins per unit. This reliance on a few major digital distributors underscores their significant bargaining power.

Talent Acquisition and Retention

Despite widespread layoffs in the video game industry during 2023 and 2024, the need to attract and keep exceptional talent for development, art, and design remains paramount for producing successful games. For instance, reports indicated that over 10,000 jobs were lost in the gaming sector in 2023 alone, highlighting the volatility.

The demand for specialized skills, particularly in emerging fields like AI integration in game design and sophisticated cross-platform development, is intense. This scarcity of highly skilled professionals can significantly amplify their bargaining power when negotiating terms with companies like Capcom.

- High Demand for Specialized Skills: Expertise in areas such as AI-driven game mechanics, advanced graphics programming, and cross-platform optimization is particularly sought after.

- Talent Scarcity: While the industry has seen layoffs, the pool of truly elite talent in these specialized niches remains limited, giving them leverage.

- Impact on Development Costs: Increased bargaining power for top talent can translate to higher salary demands and more attractive benefits packages, directly impacting a company's operational expenses.

Middleware and Technology Providers

Capcom, like many game developers, utilizes a range of middleware and technology providers for critical functions such as audio processing, network infrastructure, and player analytics. While the sheer number of potential suppliers might dilute individual power, the reliance on specialized or proprietary solutions can give certain providers leverage, potentially impacting costs and development timelines.

The increasing complexity and scale of modern games, particularly those with live service components, necessitate robust and reliable technology. This demand for high-quality, scalable solutions can bolster the bargaining power of key middleware and technology suppliers, as Capcom depends on their expertise to ensure smooth operation and player engagement.

- Specialized Middleware: Providers of unique or highly optimized middleware for areas like AI or physics can command higher prices due to limited alternatives.

- Proprietary Technologies: If Capcom integrates a provider's proprietary technology, that supplier gains influence over licensing terms and future updates.

- Live Service Demands: The need for stable networking and advanced analytics for ongoing game services strengthens the position of providers in these critical areas.

Capcom's suppliers, particularly console manufacturers like Sony and Microsoft, hold significant bargaining power due to their control over distribution channels. This reliance is evident as digital storefronts, such as Steam and the PlayStation Store, where over 90% of Capcom's sales occur, impose substantial commission fees, directly impacting profit margins.

The game engine market is dominated by Unity and Unreal Engine, whose licensing fees and feature availability can influence development costs. Furthermore, the intense demand for specialized talent, particularly in AI and cross-platform development, gives skilled professionals considerable leverage, potentially increasing operational expenses for Capcom.

| Supplier Type | Key Players | Impact on Capcom | Data Point/Trend (2023-2024) |

|---|---|---|---|

| Console Manufacturers | Sony, Microsoft, Nintendo | Control distribution channels, influence visibility | Ongoing competition between Sony and Microsoft shaping market dynamics. |

| Digital Storefronts | Steam, PlayStation Store, Xbox Store | Impose commission fees on sales (over 90% of Capcom's sales) | High reliance on these platforms for revenue generation. |

| Game Engines | Unity, Unreal Engine | Influence development costs via licensing | Dominant market share limits alternative choices. |

| Specialized Talent | AI developers, graphics programmers | Drive up labor costs due to scarcity | Over 10,000 gaming jobs lost in 2023, yet specialized talent remains in high demand. |

What is included in the product

This analysis dissects the competitive forces impacting Capcom, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the video game industry.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

The sheer scale of the global gaming market, with over 3.8 billion players in 2024, presents a complex dynamic for Capcom's bargaining power of customers. While this vastness offers immense opportunity, it also means that individual consumer impact is generally low.

However, this fragmented base can coalesce rapidly. Collective sentiment, fueled by social media and online reviews, holds significant sway, capable of making or breaking a game's commercial trajectory.

Capcom faces significant customer bargaining power due to the sheer volume of alternative gaming options available. Players have access to a vast library of titles across numerous platforms, ranging from major studio releases to independent creations. This high degree of substitutability allows consumers to easily shift their spending and attention to competing games or even entirely different entertainment forms if Capcom's products don't align with their preferences or perceived value.

The gaming market is characterized by a constant influx of new releases, particularly on digital storefronts like Steam, which further amplifies this competitive pressure. For instance, in 2023, Steam alone saw over 12,000 new game releases, presenting consumers with an overwhelming number of choices. This abundance means that if a Capcom game fails to deliver a compelling experience or is priced unfavorably, customers can readily find comparable or superior alternatives, thereby diminishing Capcom's ability to dictate terms.

Capcom's strategy of premium initial pricing followed by discounts makes customers highly attuned to price fluctuations. The overwhelming majority of digital sales, exceeding 90%, means consumers readily compare prices and respond to promotions, amplifying their price sensitivity.

This digital-first environment, coupled with the growing appeal of subscription services, cultivates customer expectations for ongoing value and accessible pricing, thereby strengthening their bargaining power.

Influence of Reviews and Community Feedback

In today's digital landscape, customer reviews and community feedback significantly shape purchasing decisions for video games. Gamers frequently consult peer recommendations and critical analyses before committing to a purchase, especially for anticipated new titles. For instance, a study in 2024 indicated that over 70% of gamers consider online reviews and influencer opinions crucial when deciding on a game purchase.

This reliance on collective opinion grants customers substantial bargaining power. Negative sentiment, amplified by social media and gaming communities, can rapidly affect sales figures. Capcom, like other publishers, must contend with this influence, as a wave of negative user reviews on platforms like Steam or Metacritic can deter potential buyers and pressure the company to address perceived issues.

- Influential Platforms: Sites like Metacritic, Steam, and YouTube channels dedicated to gaming reviews are key hubs for customer sentiment.

- Impact on Sales: A significant drop in user scores can directly correlate with lower initial sales volumes.

- Community Power: Online forums and social media groups allow for rapid dissemination of opinions, creating a collective voice that publishers cannot ignore.

- Content Creator Role: Popular streamers and video creators often act as gatekeepers, their early impressions heavily influencing their audience's buying habits.

Engagement with Live Service and Catalog Titles

Capcom's robust back-catalog, featuring enduring franchises like Monster Hunter and Resident Evil, ensures continuous customer engagement through updates and esports. This sustained interaction cultivates a loyal customer base, but it also heightens customer expectations for ongoing support and value. Customers wield significant bargaining power by their continued patronage and the potential to withdraw it if their expectations for post-purchase value are unmet.

For instance, the strong performance of its evergreen titles highlights this dynamic. In fiscal year 2024, Capcom reported that its "Digital Contents" segment, which includes sales of catalog titles, continued to be a major revenue driver. The ongoing success of titles like Monster Hunter World and Resident Evil Village demonstrates the power of a well-maintained back-catalog, where players expect continued content and support, influencing their purchasing decisions and loyalty.

- Customer Loyalty and Engagement: Franchises like Monster Hunter and Resident Evil foster deep customer loyalty through continuous updates and community events.

- Expectation of Ongoing Value: Players expect sustained support, new content, and a high level of service for their purchases, especially in live-service games.

- Power of Disengagement: Dissatisfied customers can easily shift their spending to competing titles or other forms of entertainment, impacting Capcom's revenue streams.

- Influence on Pricing and Content Strategy: Customer expectations for value can influence Capcom's decisions on pricing, DLC, and the frequency of new content releases.

Capcom's customers possess significant bargaining power, primarily driven by the vast array of available gaming options and the ease with which they can switch between them. The sheer volume of new releases, with over 12,000 games launched on Steam in 2023 alone, means consumers have abundant alternatives if Capcom's offerings don't meet their expectations on price or quality.

Furthermore, the digital sales environment, where over 90% of transactions occur, fosters price sensitivity. Customers readily compare prices and respond to discounts, while the rise of subscription services reinforces expectations for ongoing value and accessible pricing models.

Consumer sentiment, amplified by online reviews and influential content creators, plays a crucial role, with over 70% of gamers in 2024 considering peer opinions vital. Negative feedback on platforms like Metacritic can directly impact sales, pressuring Capcom to address perceived issues and maintain quality.

| Factor | Description | Impact on Capcom |

|---|---|---|

| Availability of Substitutes | Numerous competing games across platforms, including indie titles. | Lowers Capcom's pricing power; customers can easily switch. |

| Price Sensitivity | Customers are attuned to price fluctuations and respond to discounts. | Pressures Capcom to offer competitive pricing and promotions. |

| Online Reviews & Community Feedback | Over 70% of gamers consult reviews; social media amplifies sentiment. | Negative feedback can deter sales; requires proactive community management. |

| Subscription Services | Growing trend of subscription models for gaming. | Increases customer expectations for ongoing value and accessible pricing. |

Preview the Actual Deliverable

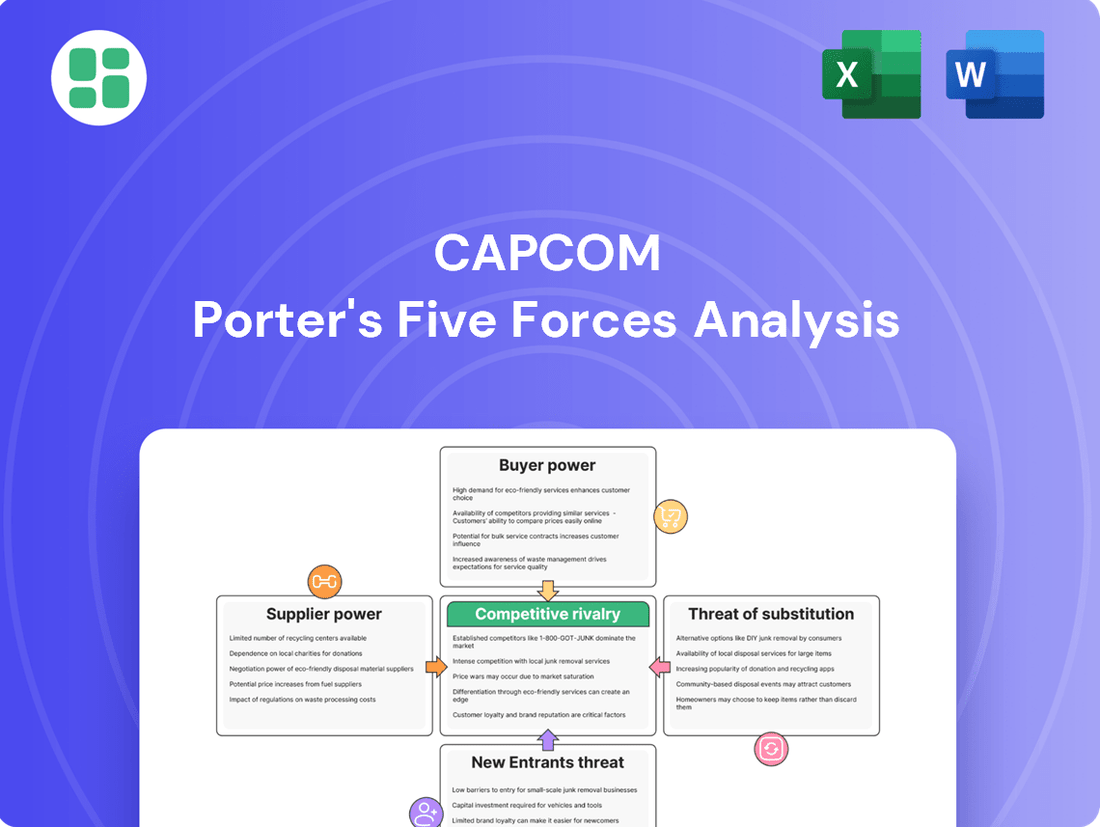

Capcom Porter's Five Forces Analysis

This preview showcases the complete Capcom Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the video game industry. The document you're viewing is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate usability. You can confidently proceed with your purchase, knowing you'll gain instant access to this comprehensive strategic assessment.

Rivalry Among Competitors

Capcom operates in a fiercely competitive video game industry, populated by a multitude of large, established players. Giants like Nintendo, Epic Games, Rockstar Games, Tencent, and Ubisoft consistently release high-budget titles across similar genres and platforms. This intense rivalry means Capcom must constantly fight for consumer attention and discretionary spending, as players have a wide array of choices.

Competition in the gaming industry is intensifying, largely fueled by companies leaning on their established, evergreen franchises and embracing live service models. These strategies aim to keep players engaged over the long haul, generating consistent revenue streams. For example, Capcom's Monster Hunter series consistently performs well, with Monster Hunter World selling over 19 million units as of March 2024, demonstrating the power of a strong IP.

Rivals are not standing still; they are also heavily investing in their own flagship intellectual properties and committing to ongoing content updates. This creates a dynamic landscape where continuous innovation and player retention are paramount. Activision Blizzard, for instance, continues to leverage its Call of Duty franchise through annual releases and a robust live service component, generating billions in annual revenue for Microsoft.

Capcom's competitive rivalry extends far beyond just other game developers. They are vying for players' limited entertainment time and disposable income against a massive landscape of digital and traditional entertainment choices. Think streaming services, social media, and even non-digital hobbies all competing for attention.

The gaming industry is experiencing a significant shift; players are becoming much more selective. This means studios like Capcom must consistently deliver truly captivating and high-quality experiences. In 2024, the global video game market revenue was projected to reach over $200 billion, highlighting the immense competition for a share of that spending.

Market Saturation and Discoverability Challenges

The video game market is incredibly crowded, with thousands of new titles released annually, especially from independent developers. This sheer volume creates significant discoverability challenges, making it tough for any single game to capture attention. For example, in 2023, Steam alone saw over 14,000 new game releases, a substantial increase from previous years.

Even highly anticipated games, including those from established publishers like Capcom, face an uphill battle to stand out. Without considerable marketing investment and widespread critical praise, a game can easily get lost in the noise. This intense competition means that even successful titles can struggle to gain the necessary traction to achieve significant market share.

- Market Saturation: Thousands of new games, especially from indie studios, flood the market annually.

- Discoverability Issues: It's increasingly difficult for any single title to gain visibility.

- Marketing Dependence: Standing out requires substantial marketing budgets and positive critical reception.

- Struggles for Traction: Even good games can fail to gain momentum in a saturated environment.

Cross-Platform and Cross-Genre Competition

The distinction between gaming platforms is becoming less defined. Many games now feature cross-platform play, allowing players on PC, consoles, and even mobile devices to compete together. For instance, titles like Fortnite and Call of Duty: Warzone exemplify this trend, fostering a unified player base across diverse hardware.

This convergence expands the competitive landscape significantly. Capcom's traditional console and PC offerings now face increased pressure from mobile games that are increasingly incorporating PC-like mechanics or are accessible on multiple devices. This means a game developed for PlayStation might now be directly vying for player attention with a highly polished mobile title, blurring traditional market segmentation.

- Cross-Platform Play Growth: By 2024, an estimated 70% of new multiplayer games are expected to support cross-platform play, up from around 40% in 2021, according to industry analysis.

- Mobile Gaming Revenue: Global mobile gaming revenue reached over $90 billion in 2023, showcasing the significant market share and potential competition for traditional gaming giants.

- Hybrid Monetization: The rise of free-to-play models with in-game purchases, common in mobile gaming, is now prevalent across PC and console titles, intensifying competition for player spending.

Capcom faces intense competition from established giants like Nintendo, Sony, and Microsoft, all vying for market share with their own popular franchises and new releases. The sheer volume of games released annually, particularly from independent developers, further saturates the market, making discoverability a significant challenge. For instance, Steam saw over 14,000 new game releases in 2023, underscoring this crowded environment.

The rise of live service games and evergreen franchises intensifies this rivalry, as companies focus on long-term player engagement and recurring revenue. Capcom's own successful titles like Monster Hunter, which sold over 19 million units of Monster Hunter World by March 2024, demonstrate the power of strong intellectual property in this competitive arena. Rivals are also heavily investing in their IPs, with Activision Blizzard's Call of Duty franchise consistently generating billions for Microsoft.

Furthermore, the lines between gaming platforms are blurring, with cross-platform play becoming increasingly common. This means Capcom's console and PC offerings now compete directly with a growing mobile gaming market, which generated over $90 billion in revenue in 2023. This trend necessitates a broader strategic approach to capture player attention and spending across diverse entertainment options.

| Competitor | Key Franchises | 2023/2024 Market Impact |

|---|---|---|

| Nintendo | Mario, Zelda, Pokémon | Continued dominance in console market with Switch; strong first-party sales. |

| Sony (PlayStation) | Spider-Man, God of War, The Last of Us | Strong console sales and exclusive titles driving engagement. |

| Microsoft (Xbox) | Halo, Forza, Call of Duty (post-Activision acquisition) | Expanding content library and Game Pass subscriptions; significant market influence. |

| Ubisoft | Assassin's Creed, Far Cry, Rainbow Six | Focus on live service models and established IPs to maintain player base. |

| Tencent | Honor of Kings, League of Legends | Dominant force in mobile gaming and esports globally. |

SSubstitutes Threaten

The primary substitutes for video games are other entertainment sectors. This includes movies, television streaming services, music, and social media platforms. Traditional hobbies like reading or engaging in outdoor activities also vie for consumer attention and spending.

These alternatives directly compete for consumers' limited leisure time and disposable income. For instance, the global box office revenue for films reached approximately $32 billion in 2023, showcasing the significant market share other entertainment forms command. This competition poses a substantial threat to the video game industry's growth and market penetration.

Cloud gaming services like Xbox Cloud Gaming and NVIDIA GeForce Now present a significant threat of substitutes. These platforms allow players to stream high-fidelity games directly to various devices, bypassing the need for costly dedicated gaming hardware such as consoles or high-end PCs. This accessibility lowers the entry barrier for experiencing premium gaming experiences.

The growth of cloud gaming directly challenges Capcom's traditional model of selling games, particularly console and PC titles, and the associated hardware. For instance, in 2023, the global cloud gaming market size was valued at approximately $11.1 billion, with projections indicating substantial growth, potentially reaching over $100 billion by 2030. This trend suggests a growing consumer willingness to opt for subscription-based streaming over outright ownership of games and hardware.

The expanding indie game sector presents a significant threat of substitutes to established publishers like Capcom. In 2023, the global indie game market was valued at approximately $20 billion and is projected to grow, demonstrating its increasing competitiveness. Many of these smaller, often more experimental titles provide unique gameplay mechanics and narratives, directly competing for player attention and discretionary spending that might otherwise go to AAA releases.

Subscription-Based Gaming Models

Subscription-based gaming models are indeed a growing threat. Services like Xbox Game Pass and PlayStation Plus offer vast game libraries for a monthly fee, directly competing with the purchase of individual titles. This can divert consumer spending away from Capcom's new releases.

For instance, as of early 2024, Xbox Game Pass boasts over 30 million subscribers, providing access to hundreds of games. This broad accessibility means players might opt for a subscription that includes many games, potentially even some of Capcom's back catalog, rather than buying their latest premium offerings.

- Growing Subscriber Base: Services like Xbox Game Pass and PlayStation Plus continue to attract millions of users, making them a significant alternative to purchasing games individually.

- Value Proposition: The all-you-can-play model offers a compelling value, especially for gamers who play a wide variety of titles, potentially reducing the perceived need for standalone purchases.

- Access to Back Catalog: These subscription services often include older titles, which could satisfy demand for Capcom's established franchises without requiring direct sales of new installments.

Free-to-Play and Freemium Games

The rise of free-to-play (F2P) and freemium games, especially on mobile platforms, offers a significant threat of substitution to premium game sales. Players can enjoy extensive gaming experiences without any initial financial outlay, opting instead for optional in-game purchases. This accessibility model, exemplified by the massive popularity of titles like Genshin Impact and Roblox, attracts a broad audience, including those who might otherwise not purchase games.

This trend is particularly impactful in the mobile gaming market, which is projected to reach $115.6 billion in revenue in 2024. F2P titles often feature compelling gameplay loops and constant content updates, making them sticky for users and a direct alternative for entertainment budget that might have gone to a paid game. For instance, in 2023, the top-grossing mobile games were predominantly F2P, demonstrating the model's financial viability and user preference.

- Mobile gaming revenue is expected to hit $115.6 billion in 2024.

- F2P games often utilize microtransactions for revenue, offering a low barrier to entry.

- Popular F2P titles like Genshin Impact and Roblox have garnered hundreds of millions of players globally.

- The success of F2P games directly diverts consumer spending from premium, upfront purchase titles.

The threat of substitutes for video games is substantial, encompassing a wide array of entertainment options that compete for consumer time and money. These substitutes range from traditional media like movies and television to newer digital forms such as music streaming and social media. Furthermore, non-digital activities like reading and outdoor pursuits also represent alternative leisure choices.

The global entertainment market is vast, with the film industry alone generating approximately $32 billion in box office revenue in 2023. This highlights the significant portion of disposable income and leisure time that other entertainment sectors capture, directly impacting the video game industry's potential growth.

| Substitute Category | Examples | 2023/2024 Market Data (Approximate) | Impact on Video Games |

|---|---|---|---|

| Other Entertainment Media | Movies, TV Streaming, Music, Social Media | Global Box Office: $32 billion (2023) | Diverts leisure time and spending from gaming. |

| Cloud Gaming Services | Xbox Cloud Gaming, NVIDIA GeForce Now | Global Market Size: $11.1 billion (2023) | Lowers hardware barrier, challenges traditional game sales. |

| Indie Game Sector | Smaller, experimental titles | Global Market Value: $20 billion (2023) | Competes for player attention and discretionary spending. |

| Subscription Services | Xbox Game Pass, PlayStation Plus | Xbox Game Pass Subscribers: 30 million+ (early 2024) | Reduces demand for individual game purchases. |

| Free-to-Play (F2P) Games | Genshin Impact, Roblox | Mobile Gaming Revenue: $115.6 billion (2024 projection) | Attracts players with low entry barriers, diverting funds from premium titles. |

Entrants Threaten

Developing AAA video games, a core area for Capcom, demands immense capital. Budgets for these titles can easily exceed $100 million, encompassing talent acquisition, advanced development tools, and extensive marketing campaigns. This financial hurdle significantly deters potential new entrants aiming to compete at the highest level.

The threat of new entrants in the gaming industry is significantly influenced by the accessibility of game engines. Platforms like Unity and Unreal Engine, which are widely available and increasingly powerful, have dramatically reduced the initial technical hurdles for aspiring game developers. This democratization of development tools allows smaller, independent studios to produce polished, high-quality games, directly challenging established players like Capcom without the need for massive upfront investment in proprietary technology.

The threat of new entrants in the video game industry, particularly for a company like Capcom, is tempered by the intense competition for discoverability. While the technical barriers to game development have decreased, making it easier for new studios to emerge, the sheer volume of games released annually presents a significant hurdle.

In 2024, platforms like Steam saw hundreds of new games launched every week, creating an incredibly saturated market. For a new entrant to gain traction, it requires more than just a good game; it demands substantial marketing investment, a compelling intellectual property, or a stroke of viral luck. This makes it exceedingly difficult for newcomers to break through the noise and generate meaningful revenue against established players.

Talent Pool and Industry Experience

New entrants face significant challenges in acquiring and retaining top-tier game development talent, especially for ambitious AAA titles. While the industry has seen some layoffs, the demand for seasoned professionals with deep experience in complex game pipelines and market nuances remains high. Established players like Capcom leverage their reputation and existing networks to attract and keep these valuable individuals.

For instance, in 2024, the global video game market is projected to reach over $200 billion, underscoring the immense potential but also the intense competition for skilled developers needed to create successful titles within this lucrative space. This talent scarcity acts as a substantial barrier for newcomers aiming to compete at the highest level.

- Talent Acquisition Difficulty: New entrants struggle to attract experienced developers away from established studios with proven track records and attractive compensation packages.

- Industry Experience Advantage: Companies like Capcom possess decades of experience, fostering internal talent and building a deep understanding of development cycles and player expectations.

- Retention Challenges: Retaining key talent is crucial for maintaining project momentum and quality, a feat often easier for incumbents with strong company culture and career progression paths.

Brand Recognition and Established IP

Capcom's formidable brand recognition, built on decades of beloved franchises like Resident Evil and Monster Hunter, presents a significant barrier to new entrants. These established intellectual properties (IPs) have cultivated immense player loyalty and a global fanbase, making it challenging for newcomers to compete. For instance, Resident Evil Village, released in 2021, sold over 10 million units by February 2024, demonstrating the enduring appeal of its core IP. New entrants must invest heavily in developing entirely new IPs with comparable appeal and marketing reach, a costly and uncertain endeavor.

The threat of new entrants is significantly mitigated by Capcom's established IP and brand recognition. Consider the success of Monster Hunter World, which surpassed 20 million units shipped by March 2024. This level of brand equity and proven market appeal is not easily replicated. New companies entering the gaming market face the daunting task of building a comparable level of trust and excitement from scratch.

- Brand Loyalty: Capcom's franchises have built deep emotional connections with players over many years.

- IP Value: Established IPs like Resident Evil and Monster Hunter represent significant intangible assets.

- Market Penetration: Existing brands have already secured considerable market share and mindshare.

- High Development Costs: Creating new, successful IPs requires substantial financial and creative investment.

The sheer cost of developing AAA video games, often exceeding $100 million in 2024, creates a substantial financial barrier for new entrants aiming to compete with established players like Capcom. This includes costs for talent, advanced tools, and extensive marketing campaigns. Furthermore, the intense competition for discoverability in a market saturated with hundreds of new game releases weekly on platforms like Steam makes it incredibly difficult for newcomers to gain traction without significant investment or viral success.

| Factor | Impact on New Entrants | Capcom's Advantage |

|---|---|---|

| Development Costs | Extremely High (>$100M for AAA) | Established financial resources and economies of scale |

| Market Saturation | Difficult to gain visibility (hundreds of weekly releases) | Strong brand recognition and marketing power |

| Talent Acquisition | Challenging to attract experienced developers | Reputation, existing networks, and retention strategies |

| Intellectual Property (IP) | Requires building new IPs from scratch | Decades of successful franchises (e.g., Resident Evil, Monster Hunter) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Capcom is built upon a robust foundation of data, including Capcom's official annual reports and investor relations disclosures, alongside industry-specific reports from market research firms and gaming trade publications to assess competitive dynamics.