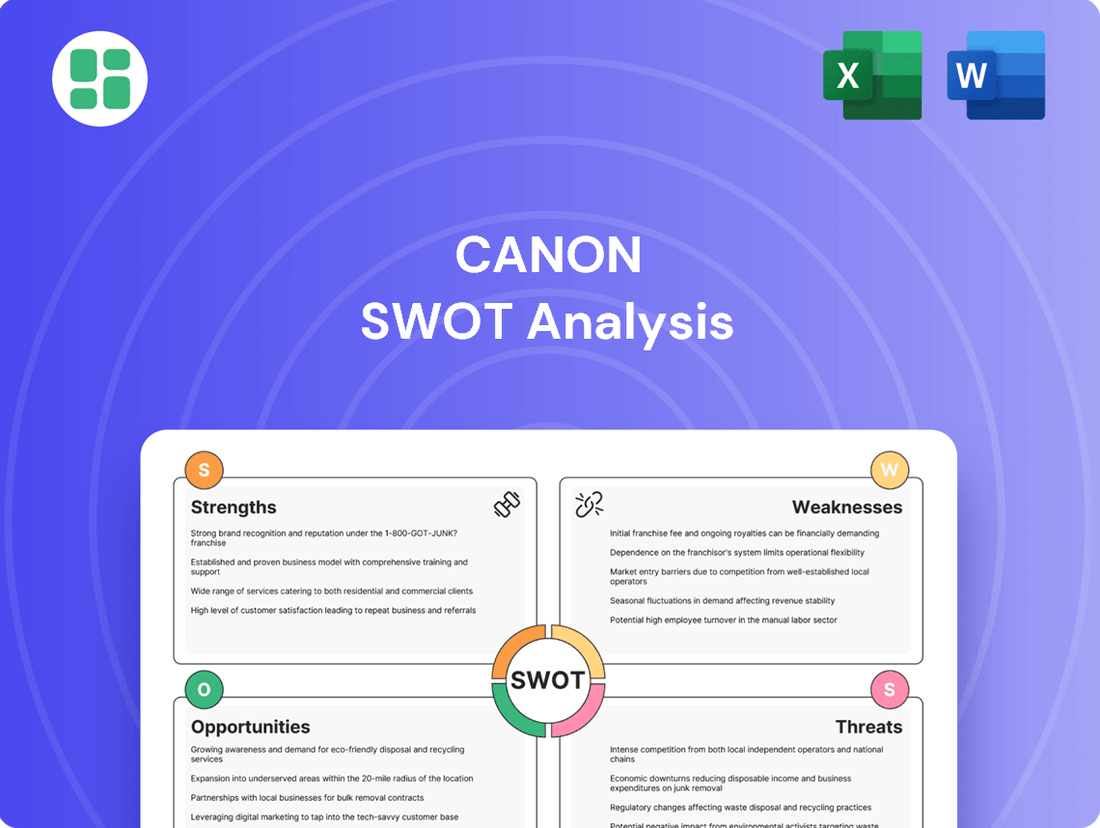

Canon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canon Bundle

Canon's strong brand recognition and extensive product portfolio are significant strengths, but the company faces challenges in the rapidly evolving digital imaging market. Understanding these dynamics is crucial for strategic planning.

Want to dive deeper into Canon's competitive edge and potential vulnerabilities? Purchase our comprehensive SWOT analysis to unlock actionable insights, detailed market trends, and strategic recommendations.

Strengths

Canon's global brand recognition is a significant strength, built on a legacy of quality imaging and optical products that spans many decades. This established trust resonates across consumer, professional, and business markets, cultivating strong customer loyalty and providing a distinct edge against competitors.

The company's reputation for innovation is further underscored by its consistent achievement of being among the top patent recipients in the U.S. for over 40 years straight. This sustained innovative output directly supports its brand strength and market position.

Canon's strength lies in its diversified business portfolio, strategically extending beyond its core camera and printer markets. This includes significant presence in medical imaging systems, crucial industrial equipment like semiconductor lithography tools, and comprehensive business solutions.

The company's structure into four key industry groups—Printing, Medical, Imaging, and Industrial—effectively mitigates risks by reducing dependence on any single market segment. This broad operational base offers a more resilient and stable foundation for management and growth.

For instance, Canon's Medical Systems segment is a major contributor, with sales in this area consistently showing robust performance. In the fiscal year ending December 31, 2023, Canon reported overall net sales of ¥3,737.3 billion, with its Medical segment playing a vital role in this revenue stream, demonstrating the financial impact of this diversification.

Canon consistently demonstrates robust research and development capabilities, evident in its substantial annual investment in R&D. This dedication has led to the company securing a significant number of U.S. patents each year, underscoring its innovative output.

This strong R&D foundation enables Canon to develop proprietary technologies such as advanced CMOS image sensors and DIGIC image processors. Furthermore, their pioneering work in areas like nanoimprint lithography positions them at the forefront of technological advancement, allowing for the introduction of groundbreaking products.

Market Leadership in Key Segments

Canon's market leadership is a significant strength, particularly evident in its sustained dominance in the global interchangeable-lens digital camera sector. The company has maintained the number one market share for an impressive 22 consecutive years, from 2003 through 2024. This enduring position highlights deep customer loyalty and consistent product innovation in its foundational imaging business.

Beyond consumer imaging, Canon also commands a strong presence in crucial industrial markets. It holds a substantial market share in semiconductor lithography systems, a technically demanding and high-value sector. Furthermore, Canon is recognized as a leader in hardcopy remanufacturing, showcasing its competitive edge in specialized business-to-business segments.

- Sustained Global Camera Market Dominance: No. 1 market share in interchangeable-lens digital cameras for 22 consecutive years (2003-2024).

- Semiconductor Lithography Leadership: Significant market share in advanced semiconductor manufacturing equipment.

- Industrial Hardcopy Expertise: Recognized leader in hardcopy remanufacturing services.

Commitment to Sustainability and Circular Economy

Canon demonstrates a robust commitment to sustainability and the circular economy, a significant strength in today's market. The company actively champions environmental performance through initiatives such as remanufactured products, the utilization of renewable energy sources, and comprehensive closed-loop recycling programs for items like toner cartridges.

This dedication is underscored by ambitious targets to reduce greenhouse gas emissions. For instance, Canon aims to achieve a 50% reduction in CO2 emissions across its entire value chain by 2030 compared to 2008 levels. Their efforts have garnered recognition, with the company consistently receiving high ratings from sustainability assessment organizations, reflecting growing global consumer and investor preference for environmentally responsible businesses.

- Visionary Sustainability: Canon's strong sustainability vision drives its operational and product development strategies.

- Circular Economy Practices: Active promotion of remanufactured products and closed-loop recycling programs for consumables like toner cartridges.

- Emission Reduction Targets: Bold goals to cut greenhouse gas emissions, with a 2030 target for a 50% reduction in CO2 across the value chain.

- Industry Recognition: Consistent top ratings for sustainability efforts, aligning with increasing global demand for eco-conscious companies.

Canon's diversified business model is a core strength, extending beyond its well-known imaging products into lucrative sectors like medical equipment and industrial solutions. This strategic breadth ensures resilience against market fluctuations in any single area. The company's commitment to research and development fuels its innovation pipeline, consistently yielding advanced technologies and a strong patent portfolio. For example, in 2023, Canon's net sales reached ¥3,737.3 billion, with its Medical Systems segment contributing significantly to this overall financial performance.

| Business Segment | 2023 Net Sales (¥ billion) | Key Strengths |

|---|---|---|

| Imaging | 1,567.8 | Global brand recognition, 22-year camera market leadership |

| Printing | 1,459.5 | Strong presence in office equipment, hardcopy remanufacturing |

| Medical | 509.0 | Advanced imaging technology, significant market share |

| Industrial | 201.0 | Semiconductor lithography leadership, robust R&D |

What is included in the product

Analyzes Canon’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address weaknesses, turning potential threats into actionable strategies.

Weaknesses

Canon's continued reliance on mature markets, particularly traditional cameras and office printing, presents a significant weakness. These sectors are experiencing long-term stagnation, even decline, as technology evolves and consumer habits shift away from physical media and towards digital alternatives. For instance, while digital camera sales have stabilized somewhat, they remain a shadow of their peak, and the office printing market faces ongoing pressure from digitization and cloud-based solutions.

This dependence on established but shrinking markets could hinder Canon's overall growth trajectory. If the company's newer ventures, such as medical equipment or industrial inkjet, do not expand at a sufficiently rapid pace to compensate for potential contractions in its legacy businesses, overall revenue and profitability could be negatively impacted. This was evident in fiscal year 2023, where while the medical segment showed promise, the imaging and industrial products segments, though performing adequately, are still within more mature landscapes.

Canon faces significant challenges in the digital imaging and printing sectors due to fierce competition. In the camera market, rivals like Sony and Nikon consistently introduce innovative products, forcing Canon to invest heavily in research and development to stay relevant. This dynamic environment can put downward pressure on pricing and profit margins.

The printing industry is similarly crowded, with numerous manufacturers vying for market share. This intense rivalry often translates into aggressive pricing strategies and necessitates ongoing product development to meet evolving customer demands for efficiency and sustainability. For instance, the global printer market was valued at approximately $48.5 billion in 2023 and is projected to grow, but this growth is shared among many players, intensifying competition.

Canon's adaptation to the mirrorless camera market, while improving, has been a point of concern. Despite holding the top spot in interchangeable-lens cameras overall, the company was perceived as slower to fully commit to and lead the burgeoning mirrorless sector compared to some rivals. This earlier hesitancy may have ceded valuable market share to competitors who moved more aggressively into mirrorless technology.

Challenges in Advanced Semiconductor Lithography

Canon's nanoimprint lithography (NIL) faces a significant hurdle in its competition with ASML's established extreme ultraviolet (EUV) lithography. While NIL offers potential cost and power efficiency benefits, its market penetration in the advanced semiconductor sector remains limited. For instance, ASML's EUV systems are the de facto standard for cutting-edge chip manufacturing, with the company having shipped 63 EUV systems by the end of 2023, generating substantial revenue. Canon's success hinges on convincing foundries to adopt its newer technology, a challenging proposition given the massive investments already made in EUV infrastructure.

The path to mass adoption for Canon's NIL technology is steep. The semiconductor industry, particularly at the leading edge, prioritizes proven reliability and performance, areas where ASML's EUV has a considerable head start. Building the necessary ecosystem, including mask suppliers and process integration expertise for NIL, will be critical. Without widespread market acceptance and a robust supply chain, Canon's NIL may struggle to gain significant traction in the high-value segment of advanced chip production.

Potential Impact of Geopolitical and Economic Factors

Canon recognizes that geopolitical and economic instability poses a significant weakness. For instance, the company anticipates a softening of demand in the United States. This is partly due to price increases stemming from anticipated additional tariffs, which directly impact consumer purchasing power and Canon's pricing strategies.

These external forces can disrupt Canon's intricate supply chains and hinder efforts to optimize production. Furthermore, regional sales performance is vulnerable to fluctuations in global economic conditions and political developments, creating an unpredictable operating environment.

- Trade Tariffs: Expected demand softening in the US due to price increases from potential tariffs.

- Supply Chain Disruption: Vulnerability of global supply chains to political and economic instability.

- Production Optimization: Challenges in maintaining efficient production due to external uncertainties.

- Regional Sales Performance: Susceptibility of sales in various markets to geopolitical and economic shocks.

Canon's reliance on mature markets like traditional cameras and office printing remains a key weakness, as these sectors face long-term decline due to digital shifts. While newer ventures show promise, their growth must outpace contractions in legacy businesses to avoid impacting overall profitability, a dynamic observed in fiscal year 2023 results.

Intense competition in both the camera and printing markets forces significant R&D investment and can pressure pricing and margins. For example, the global printer market, valued around $48.5 billion in 2023, is highly fragmented, intensifying rivalry among numerous players.

Canon's earlier hesitation in fully embracing the mirrorless camera market may have ceded ground to more agile competitors. Furthermore, its nanoimprint lithography (NIL) faces a significant challenge from ASML's dominant EUV lithography, with ASML having shipped 63 EUV systems by the end of 2023, highlighting the established infrastructure Canon needs to overcome.

Geopolitical and economic instability, including anticipated demand softening in the US due to potential tariffs, presents another weakness. These external factors can disrupt supply chains, hinder production optimization, and make regional sales performance vulnerable to global economic and political shifts.

Same Document Delivered

Canon SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

Canon is well-positioned to capitalize on the burgeoning global medical imaging market, which is projected to reach approximately $50 billion by 2025, a substantial increase driven by an aging population and rising healthcare expenditures. The company's deep-rooted expertise in sensor technology and high-resolution imaging directly aligns with the increasing demand for more sophisticated diagnostic tools, offering a clear pathway for innovation in areas like AI-powered image analysis and portable imaging devices.

Furthermore, Canon's expansion into healthcare IT presents a significant opportunity to integrate its imaging hardware with advanced software solutions, creating comprehensive, high-value service packages for hospitals and clinics. This synergy allows Canon to offer end-to-end solutions, from image acquisition to data management and analysis, thereby enhancing operational efficiency and patient care for healthcare providers.

Canon has a substantial opportunity to grow its industrial solutions segment, especially in semiconductor lithography equipment. The global semiconductor market is anticipated to reach approximately $700 billion by 2025, presenting a robust demand for advanced manufacturing tools like those Canon offers.

Furthermore, the increasing adoption of network cameras across various sectors fuels growth in Canon's business solutions. This includes applications in enhanced security surveillance, data-driven in-store marketing analytics, and the critical area of factory automation, where visual monitoring and control are paramount.

Canon can capitalize on the surging demand for artificial intelligence and digital transformation by embedding AI into its diverse product range. This includes enhancing video content analysis capabilities, advancing robotic vision systems for industrial applications, and offering AI-driven tools for automating business processes. Such integration not only boosts the functionality of existing products but also opens avenues for novel service offerings and significant operational improvements for Canon's clientele.

Circular Economy and Sustainability Services

Canon's established expertise in remanufacturing and recycling aligns perfectly with the growing global demand for circular economy solutions. This presents a significant opportunity for Canon to expand its service offerings, helping businesses achieve their sustainability targets.

By leveraging its existing infrastructure and knowledge, Canon can develop and market new services focused on reducing waste, extending product lifecycles, and enabling resource efficiency for its clients. This directly addresses the increasing pressure on corporations to improve their environmental, social, and governance (ESG) performance.

For instance, the global market for circular economy services is projected to grow substantially. Reports from 2024 indicate a rising trend in corporate investment in sustainable practices, with many companies actively seeking partners to help them implement circular models. Canon's ability to offer end-to-end solutions, from product design for disassembly to collection and remanufacturing, positions it favorably.

- Expanding remanufacturing capabilities: Canon can further enhance its remanufacturing processes for imaging and office equipment, offering cost-effective and environmentally friendly alternatives to new products.

- Developing carbon footprint reduction services: The company can create consulting and implementation services to help clients measure, manage, and reduce their carbon emissions through optimized product usage and lifecycle management.

- Investing in new recycling technologies: Continued investment in advanced recycling technologies can allow Canon to recover more valuable materials from end-of-life products, creating new revenue streams and reinforcing its sustainability credentials.

- Partnering for broader impact: Collaborating with other industry players and waste management specialists can extend Canon's reach and impact in the circular economy space, creating a more comprehensive ecosystem of sustainable solutions.

Emerging Markets and New User Segments

Canon can capitalize on the robust growth projected for emerging markets, particularly in Asia. For instance, the Asia-Pacific digital camera market is anticipated to experience significant expansion, with some projections indicating a compound annual growth rate (CAGR) of over 5% through 2028. This presents a substantial opportunity for Canon to increase its market share in these dynamic regions.

Furthermore, Canon has a clear avenue for growth by targeting burgeoning segments of new camera users. This includes social media influencers and content creators who increasingly rely on video for their platforms. These users often seek capabilities beyond what smartphones offer, creating a demand for specialized, user-friendly video-centric cameras.

- Targeting Asia's Growth: The Asia-Pacific region is a key focus, with its digital camera market showing strong upward trends.

- Cultivating Video Creators: There's a growing demand from social media users and content creators for cameras that enhance video production quality.

- Differentiating from Smartphones: Canon can offer products that provide a distinct value proposition compared to the video capabilities of modern smartphones.

Canon's strategic focus on expanding its medical imaging solutions presents a significant growth opportunity, tapping into a global market projected to reach approximately $50 billion by 2025. This expansion is fueled by an aging global population and increased healthcare spending, driving demand for advanced diagnostic tools where Canon's imaging expertise is a key advantage.

The company can leverage its strong position in semiconductor lithography equipment to capitalize on the robust growth of the global semiconductor market, which is expected to reach around $700 billion by 2025, indicating sustained demand for advanced manufacturing technologies.

Canon is well-positioned to integrate artificial intelligence across its product lines, enhancing video analysis, robotic vision, and business process automation, thereby creating new service offerings and improving client operational efficiency.

The company can also capitalize on the growing demand for circular economy solutions by expanding its remanufacturing and recycling services, aligning with corporate ESG goals and increasing pressure for sustainable business practices.

Canon's growth prospects are further bolstered by targeting emerging markets, particularly in Asia, where the digital camera market is projected for significant expansion, and by catering to the increasing demand from content creators for specialized video equipment.

Threats

Canon is experiencing intensified competition not just from established camera and printer brands, but also from highly specialized companies. For instance, in the critical semiconductor lithography sector, ASML has become a dominant force, a segment where Canon also competes. This specialization allows ASML to focus its innovation and resources, potentially outmaneuvering broader players.

Similarly, in the medical equipment market, dedicated manufacturers often possess deep expertise and can develop highly advanced, niche products that challenge Canon's offerings. This trend highlights the challenge of competing across diverse markets when specialized firms can concentrate on specific, high-value segments, potentially impacting Canon's market share in those areas.

The relentless pace of technological advancement, particularly within digital imaging and electronics, presents a significant threat of rapid product obsolescence for Canon. This means that what is cutting-edge today could be outdated tomorrow, impacting sales of existing product lines.

To counter this, Canon faces the ongoing necessity of substantial investment in research and development. For instance, in 2023, Canon reported R&D expenses of approximately ¥386.8 billion (roughly $2.6 billion USD at the time), a crucial allocation to maintain competitiveness and avoid disruption from emerging technologies.

Canon, like many global corporations, faces significant headwinds from potential economic downturns. In 2024, the International Monetary Fund projected global growth to slow, with advanced economies facing particular challenges. This economic instability can directly translate to reduced consumer spending on discretionary items like cameras and printers, and dampen business investment in office equipment and industrial imaging solutions, directly impacting Canon's revenue streams.

Furthermore, Canon's extensive reliance on a complex global supply chain presents a persistent threat. Geopolitical tensions and unforeseen events, such as the ongoing semiconductor shortages experienced in late 2023 and early 2024, can severely disrupt manufacturing operations. These disruptions can lead to production delays, increased costs, and an inability to meet customer demand, tarnishing brand reputation and market share.

Shifting Consumer Preferences and Smartphone Integration

The ever-improving cameras on smartphones are directly eating into the market for entry-level and compact digital cameras. This trend puts pressure on Canon's consumer imaging segment, as consumers increasingly find their smartphone sufficient for everyday photography. For instance, by early 2024, it's estimated that over 90% of all photos taken globally were captured on smartphones, a stark reminder of this shift.

Canon must continuously innovate and highlight what makes its dedicated cameras stand out from the ubiquitous smartphone. This means offering superior image quality, advanced features, and unique shooting experiences that smartphones simply cannot replicate. The challenge lies in communicating this added value effectively to a broad consumer base.

- Smartphone camera quality continues to improve, blurring the lines with dedicated devices.

- Demand for compact digital cameras has seen a significant decline in recent years.

- Canon needs to emphasize distinct advantages like optical zoom, sensor size, and manual controls to counter smartphone dominance.

Regulatory Changes and Trade Policies

Changes in international trade policies, such as the imposition of tariffs, can directly impact Canon's profitability and pricing strategy in key markets. For instance, ongoing trade tensions between major economies could lead to increased import duties on Canon's products, affecting its competitive pricing and sales volumes.

Evolving environmental regulations and data privacy laws across different regions could necessitate significant operational adjustments and compliance costs for Canon. For example, stricter emissions standards or new data protection mandates in the EU or North America might require substantial investment in product redesign or data management infrastructure.

- Tariff Impact: Potential for increased costs on imported components or finished goods, affecting profit margins.

- Environmental Regulations: Need for compliance with evolving standards for product lifecycle management and manufacturing processes.

- Data Privacy Laws: Requirements to adapt data handling practices for customer information, potentially increasing IT and legal expenses.

- Trade Policy Volatility: Uncertainty in global trade can disrupt supply chains and market access, impacting revenue forecasts.

Canon faces threats from highly specialized competitors, like ASML in semiconductor lithography, who can outmaneuver broader players by focusing innovation. The rapid pace of technological advancement also risks making Canon's products obsolete quickly, necessitating continuous, significant R&D investment, as evidenced by their ¥386.8 billion R&D spend in 2023.

SWOT Analysis Data Sources

This Canon SWOT analysis is built upon a robust foundation of data, drawing from official financial reports, comprehensive market research studies, and expert industry analyses to ensure a thorough and accurate strategic evaluation.