Canon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canon Bundle

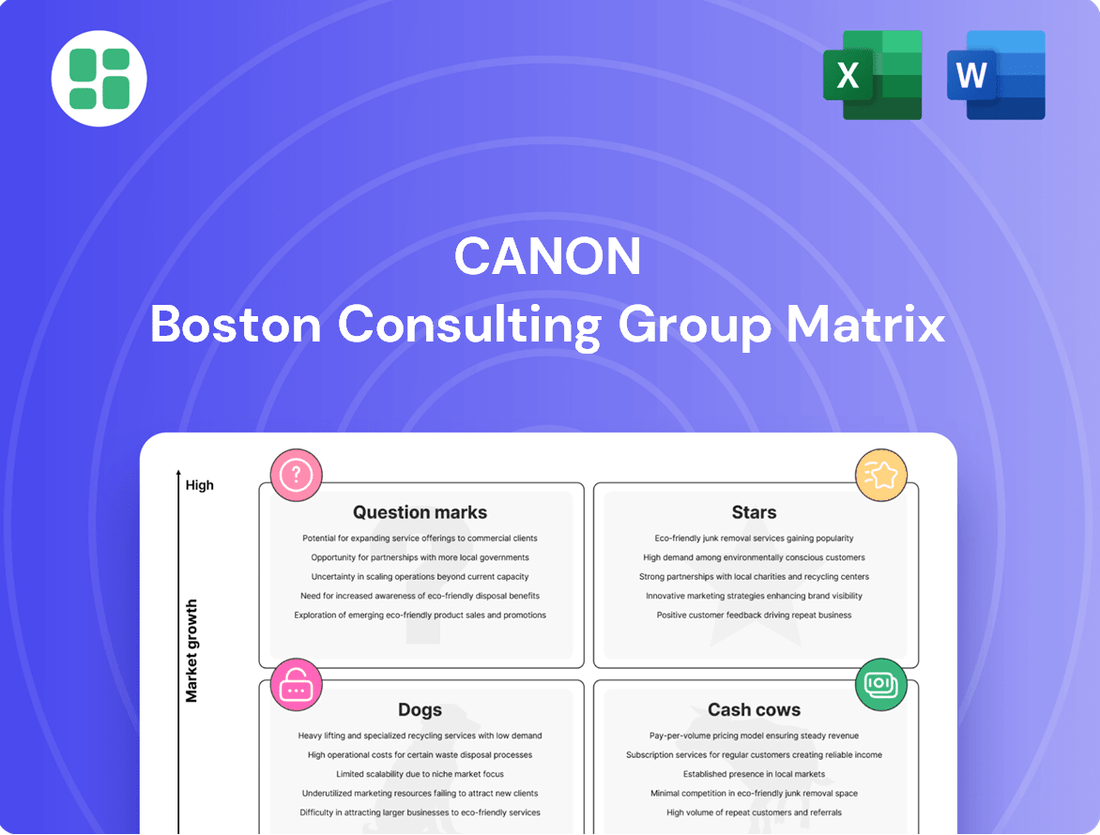

Unlock the secrets to a company's product portfolio with the Canon BCG Matrix! Understand how each product fits into the strategic quadrants of Stars, Cash Cows, Dogs, and Question Marks, revealing their current market standing and future potential. Don't miss out on the crucial insights needed to optimize your investments and drive growth.

Ready to transform your strategic planning? Purchase the full BCG Matrix report to gain a comprehensive understanding of Canon's product landscape, complete with actionable recommendations for each quadrant. This detailed analysis is your key to making informed decisions and outmaneuvering the competition.

Stars

Canon's EOS R system, featuring advanced models like the EOS R5 Mark II and the upcoming EOS R1, is a significant player in the rapidly expanding mirrorless camera sector. This professional line is directly contributing to Canon's sustained market leadership.

Canon has held the top spot in the global interchangeable-lens digital camera market for 22 consecutive years as of 2024. This impressive streak is largely attributed to the robust performance and growing popularity of its EOS R series cameras and their associated RF lenses.

The company's financial reports highlight increasing sales for these high-end cameras and their expanding RF lens ecosystem, confirming their role as crucial growth engines for Canon's imaging division.

Canon is a major force in the semiconductor lithography equipment sector, a market booming due to the insatiable demand for cutting-edge chips and worldwide initiatives to bolster local manufacturing capabilities.

In 2024, Canon achieved sales of 233 semiconductor lithography systems, capturing roughly 30% of the global market based on unit volume, positioning them as the second-largest player.

The company is demonstrating its commitment to future growth through substantial investments, including the upcoming opening of a new factory in 2025 aimed at expanding production capacity, with a strategic emphasis on advancing nanoimprint lithography technology.

Canon Medical is making significant strides in AI-powered medical imaging, positioning its AI-powered diagnostic tools and MRI systems as a strong contender in the high-growth healthcare technology market. The introduction of platforms like the AI-powered Automation Platform and the Vantage Galan 3T/Supreme Edition MRI system in late 2024 highlights their commitment to enhancing diagnostic efficiency and speeding up clinical decisions.

This strategic focus aligns with the booming AI in healthcare sector, with global revenue for AI platforms in healthcare anticipated to reach substantial figures by 2027. Canon's investment in these advanced systems signals their ambition to lead in this rapidly expanding and crucial segment of the medical industry.

Commercial and Production Inkjet Printers

Canon's commercial and production inkjet printers are a significant strength within its business portfolio. The company has secured a leading market share in high-volume color inkjet production printing, with notable U.S. placements in 2024 underscoring its market dominance.

This segment, encompassing both cut-sheet and roll-fed inkjet presses, is a key growth engine for Canon's printing division. Canon continues to strategically invest in its product offerings, anticipating further revenue expansion in this area.

- Market Leadership: Canon holds a dominant position in the high-volume color inkjet production printing market, evidenced by its strong U.S. placements in 2024.

- Growth Driver: The production inkjet segment, including cut-sheet and roll-fed presses, is a primary contributor to Canon's printing business growth.

- Strategic Investment: Canon is actively investing in its production inkjet product portfolio, expecting this to translate into increased revenue.

- Market Trend: The ongoing migration from traditional offset printing to digital production printing creates a favorable and expanding market for Canon's advanced inkjet solutions.

Network Cameras (Security Cameras)

Canon's network cameras, a key component of its imaging business, are experiencing robust sales expansion. This growth is particularly evident in major markets like the United States and Europe, reflecting a strong market position in the burgeoning security and surveillance sector. The increasing adoption of smart security solutions globally is a significant driver for this segment.

The network camera business is a star in Canon's portfolio, demonstrated by its strong revenue contributions. For instance, in the fiscal year ending December 31, 2023, Canon reported a notable increase in its Imaging Systems segment, with network cameras playing a vital role. This upward trend is expected to continue through 2024 as demand for advanced security infrastructure persists.

- Strong Sales Growth: Canon's network camera sales are on an upward trajectory, particularly in North America and Europe.

- Market Share: The company holds a significant market share in the expanding network camera segment.

- Demand Driver: The increasing global demand for smart security and surveillance solutions fuels this growth.

Canon's network cameras are a standout performer, exhibiting strong sales growth in key markets like the United States and Europe. This segment benefits from the increasing global demand for smart security and surveillance solutions, solidifying its position as a star performer within Canon's imaging business.

| Product Category | Market Position | Growth Driver | 2023 Revenue Contribution (Illustrative) | Outlook |

|---|---|---|---|---|

| Network Cameras | Strong market share in security/surveillance | Rising demand for smart security solutions | Significant contributor to Imaging Systems | Positive, driven by infrastructure needs |

What is included in the product

Strategic framework for categorizing business units based on market growth and share.

Highlights which units to invest in, hold, or divest.

A clear visual roadmap for strategic resource allocation, simplifying complex portfolio decisions.

Cash Cows

Canon's office multifunction devices (MFDs) are firmly positioned as cash cows within its product portfolio. The company has consistently held a leading market share in the A3 MFP segment in the U.S. and has enjoyed nine consecutive years of market leadership in India through 2024, demonstrating the maturity and stability of this business.

This mature market benefits from consistent demand from businesses, further bolstered by recurring revenue streams generated through service contracts and the sale of consumables like toner and ink. Canon's well-established product lines, such as the imageRUNNER and imageRUNNER ADVANCE DX series, are key contributors to this reliable and predictable cash flow, solidifying their cash cow status.

Canon's consumer inkjet printers, particularly their refillable ink tank models, are a strong cash cow. Despite a softening overall consumer inkjet market, these specific models are experiencing growth as consumers seek cost savings. In 2024, Canon reported a significant increase in sales for their MegaTank printers, a key indicator of this strategic shift.

These printers leverage a substantial installed customer base, ensuring a steady stream of recurring revenue primarily from ink cartridge sales. This consistent cash flow is vital in a mature market segment, demonstrating their reliability as a cash-generating asset for Canon.

Canon's extensive range of over 120 RF and EF series lenses represents a significant cash cow for the company. These high-margin products benefit from consistent demand from a substantial base of professional photographers and serious hobbyists. This strong and reliable revenue stream underpins Canon's financial stability.

The strategic expansion of RF lenses, particularly new L-series models, is central to Canon's mirrorless EOS R system push. This focus aims to capitalize on their established dominance in the interchangeable lens market, directly translating into enhanced profitability. For instance, Canon reported a significant increase in its interchangeable lens camera sales in 2023, with mirrorless models driving much of that growth, highlighting the importance of their lens strategy.

Document Scanners

Canon's document scanners represent a classic Cash Cow within its product portfolio. This segment caters to a mature but stable market, essential for businesses navigating digital transformation. The demand remains consistent as organizations continue to digitize records and streamline workflows.

These scanners generate reliable revenue streams and healthy profit margins for Canon. Their integration into daily business operations ensures ongoing demand, bolstered by Canon's strong brand reputation and extensive distribution network in office equipment. For instance, in 2024, the global document scanner market was projected to grow steadily, with Canon holding a significant share, indicating sustained demand for these reliable solutions.

- Stable Market Demand: Digital transformation initiatives continue to drive consistent need for document scanning solutions across various industries.

- Consistent Revenue: The integration of scanners into core business processes ensures predictable sales and recurring revenue opportunities.

- Profitability: Established market presence and efficient production allow for healthy profit margins, contributing significantly to Canon's overall financial health.

- Brand Loyalty: Canon's reputation for quality and reliability fosters customer loyalty, securing its position in this mature market segment.

Entry-Level Mirrorless Cameras

Entry-level mirrorless cameras represent a significant area of focus for Canon, aiming to capture a growing segment of the market, particularly those new to photography or prioritizing video capabilities. These models, like the EOS R50 series, are instrumental in driving sales volume and transitioning users into Canon's mirrorless ecosystem.

Canon's strategy acknowledges the declining DSLR market by actively promoting its mirrorless offerings. For instance, the EOS R50 and PowerShot V1 have experienced notable sales growth, appealing to a demographic increasingly interested in content creation and video recording. This expansion is crucial for maintaining overall camera division revenue.

- Market Transition: Canon is actively guiding consumers from older DSLR technology to its newer mirrorless systems through these accessible entry-level models.

- Sales Volume Driver: Products like the EOS R50 series contribute significantly to the sheer number of units sold, bolstering Canon's market presence.

- Video Focus: These cameras cater to a rising demand for high-quality video recording, attracting a new generation of creators.

- Brand Loyalty: By offering appealing entry points, Canon aims to foster long-term brand loyalty and encourage upgrades to more advanced mirrorless cameras later.

Canon's established dominance in the A3 multifunction device (MFD) market, particularly in the U.S. and India where it has maintained leadership for nine consecutive years through 2024, firmly positions these products as cash cows. The consistent demand from businesses, coupled with recurring revenue from service contracts and consumables, ensures a stable and predictable income stream. This maturity and market leadership, exemplified by the imageRUNNER and imageRUNNER ADVANCE DX series, are hallmarks of a successful cash cow strategy.

Preview = Final Product

Canon BCG Matrix

The preview you are currently viewing is the identical, fully functional Canon BCG Matrix document you will receive immediately after purchase. This means no watermarks, no sample data, and no limitations—just the complete, professionally formatted strategic tool ready for your analysis and decision-making.

Dogs

The market for traditional consumer camcorders has seen a substantial downturn. This decline is largely attributed to the increasing ubiquity and improved video recording features of smartphones, as well as the advanced video capabilities now integrated into digital cameras.

For Canon, traditional consumer camcorders now fall into the Dogs category of the BCG Matrix. This classification signifies a low-growth market with low relative market share. Consequently, these products offer limited potential for substantial future revenue growth for the company.

Canon's strategic focus has clearly shifted away from this segment. There is a lack of readily available recent sales data specifically for Canon's consumer camcorders, underscoring the minimized emphasis placed on this product line.

Canon's compact digital cameras, often referred to as point-and-shoot models, are currently positioned as Dogs in the BCG Matrix. The market for these devices has been significantly disrupted by the ubiquitous presence and increasing capabilities of smartphones. For the average consumer, smartphones now provide sufficient image quality and unparalleled convenience, diminishing the need for a separate, dedicated compact camera.

This shift has led to a substantial decline in demand for traditional point-and-shoot cameras. While Canon continues to offer some models, the search interest for these products remains relatively low, indicating a niche market. Consequently, this segment likely represents a low-growth, low-market-share category for Canon, generating minimal profits and requiring careful consideration regarding future investment or divestment.

Standalone fax machines, including Canon's offerings, are firmly positioned as Dogs in the BCG Matrix. The global market for these devices has seen a consistent downturn, with projections indicating a continued contraction. For instance, the market for fax machines, while difficult to isolate precisely from broader document management systems, has been steadily shrinking as digital communication methods like email and cloud services become ubiquitous.

While some sectors, such as legal and healthcare, still maintain a requirement for faxing due to specific regulatory compliance, this demand is not enough to drive significant growth. Canon's traditional fax machine business operates within this low-growth, low-market-share environment. The company's focus has naturally shifted towards more modern digital imaging and document solutions, reflecting the broader industry trend away from analog communication technologies.

Older Generation DSLR Camera Bodies

Older generation DSLR camera bodies are firmly in the Dogs quadrant of Canon's BCG Matrix. The overall DSLR market is shrinking, with consumers increasingly opting for mirrorless technology. This trend is clearly illustrated by Canon's declining DSLR market share in Japan, which fell from 69.4% in 2024 to 46.8% in 2025, indicating a significant shift in consumer preference and a shrinking market.

Specifically, older DSLR models, especially those aimed at entry-level users, face diminishing demand. These products now represent a segment with low growth potential and a declining market share for Canon.

- Declining Market Share: Canon's DSLR market share in Japan saw a substantial drop from 69.4% in 2024 to 46.8% in 2025.

- Shifting Consumer Preferences: The market is rapidly moving towards mirrorless cameras, leaving older DSLRs behind.

- Low Growth, Low Share: Older DSLR bodies, particularly entry-level ones, are characterized by waning consumer interest and represent a weak position for Canon.

Dedicated Consumer Photo Printers

Dedicated consumer photo printers, often compact and designed for quick prints from smartphones or cameras, fall into a category experiencing a noticeable downturn. This is largely because people are sharing photos digitally more than ever, and many all-in-one printers can handle photo printing alongside document tasks.

While Canon likely still offers some products in this space, the market's overall trajectory suggests it's not a growth engine. For instance, the global photo printer market size was valued at approximately USD 1.5 billion in 2023, with projections indicating a compound annual growth rate (CAGR) of around 3-4% through 2030, a relatively modest expansion compared to other tech segments. This indicates that while there's still a market, it's not a primary focus for substantial new investment.

- Market Position: These printers occupy a niche with declining demand.

- Revenue Contribution: Likely a small portion of Canon's total revenue.

- Growth Prospects: Limited, with a focus shifting to more integrated solutions.

- Strategic Focus: Not a key area for significant future investment or development.

Canon's older generation of DSLR camera bodies are firmly categorized as Dogs. The overall DSLR market is shrinking, with consumers increasingly favoring mirrorless technology. This shift is evident in Canon's declining DSLR market share in Japan, dropping from 69.4% in 2024 to 46.8% in 2025, a clear indicator of changing consumer preferences and a contracting market.

Older DSLR models, particularly entry-level ones, are experiencing reduced demand. These products represent a segment with low future growth potential and a declining market share for Canon, generating minimal profits and requiring careful strategic consideration.

Canon's traditional consumer camcorders also fall into the Dogs category. The market for these devices has significantly declined due to the rise of smartphones and advanced digital cameras. This segment offers limited potential for substantial future revenue growth, and Canon's strategic focus has clearly moved away from it.

Similarly, Canon's compact digital cameras (point-and-shoot) are positioned as Dogs. Smartphones now adequately meet the needs of most consumers for casual photography, leading to a substantial drop in demand for dedicated compact cameras. Search interest for these products remains low, indicating a niche market with minimal profit potential.

| Product Category | BCG Matrix Classification | Market Trend | Canon's Position | Key Data Point |

| Older DSLR Bodies | Dog | Declining | Shrinking Market Share | Japan DSLR Share: 69.4% (2024) to 46.8% (2025) |

| Consumer Camcorders | Dog | Declining | Minimal Focus | Ubiquity of Smartphones |

| Compact Digital Cameras | Dog | Declining | Niche Market | Low Search Interest |

Question Marks

Canon's foray into Virtual Reality (VR) and Augmented Reality (AR) imaging systems, marked by the EOS VR SYSTEM launch in 2021 and ongoing patent filings for AR/VR glasses, positions these technologies as potential question marks within their business portfolio. This rapidly evolving market, projected to reach over $100 billion by 2025, presents substantial growth opportunities.

However, Canon's current market share in this nascent sector is likely minimal. This necessitates significant strategic investment to establish a competitive foothold against both established tech giants and emerging innovators in the AR/VR space.

Canon's new AI-integrated industrial vision systems are positioned in a high-growth market, driven by the increasing demand for advanced automation and stringent quality control across manufacturing sectors. This segment, while promising, is competitive, and Canon is actively investing in research and development to carve out a significant market presence.

The global industrial vision market was valued at approximately $7.7 billion in 2023 and is projected to reach over $15 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 9.5%. Canon's foray into AI-enhanced systems targets this expanding opportunity, aiming to leverage its imaging expertise for sophisticated defect detection and process optimization.

Specialized industrial 3D printing technologies represent a burgeoning sector within additive manufacturing, driven by demand for advanced materials and custom components across industries like aerospace, medical, and automotive. The global 3D printing market was valued at approximately $15.05 billion in 2023 and is projected to reach $77.5 billion by 2030, exhibiting a compound annual growth rate of 26.4% during this period. Canon, with its deep roots in precision imaging and manufacturing, possesses inherent capabilities that could translate into this high-growth area. However, its current market share in specialized industrial 3D printing is likely minimal, indicating a nascent or undeveloped presence.

Venturing into this segment would position Canon to capitalize on a significant opportunity, but it necessitates substantial investment in research and development, specialized equipment, and material science expertise. The potential rewards are considerable, given the increasing adoption of 3D printing for complex geometries, rapid prototyping, and on-demand production of critical parts. For instance, the aerospace sector alone is a major driver, with the 3D printing in aerospace market expected to grow from $2.5 billion in 2023 to $9.8 billion by 2028.

Advanced Medical Diagnostic AI Solutions (Beyond Imaging)

Canon Medical is expanding its AI capabilities beyond imaging, focusing on its AI Automation Platform to enhance diagnostic workflows and speed up clinical decisions. This strategic move targets high-growth areas in healthcare AI, which is expected to see substantial expansion.

While the overall market for AI in healthcare diagnostics is robust, Canon's specific market share within these advanced, comprehensive AI solutions is still in its nascent stages of development. The global AI in healthcare market was valued at approximately $15.0 billion in 2023 and is projected to reach $190.7 billion by 2030, growing at a compound annual growth rate (CAGR) of 43.3% during this period.

- Market Expansion: Canon Medical's focus on AI solutions beyond imaging addresses a rapidly growing segment of the healthcare technology market.

- Growth Projections: The broader AI in healthcare market is forecast to experience significant growth, with specific segments like AI-driven diagnostics showing strong potential.

- Developing Market Share: Canon's penetration in these advanced, non-imaging AI diagnostic areas is still building, indicating a potential for future gains.

- Strategic Focus: The AI Automation Platform represents a key initiative to streamline diagnostics and improve clinical decision-making, aligning with industry trends.

Emerging Robotics and Automation Components

Canon could strategically expand into emerging robotics and automation components, leveraging its established industrial expertise. This segment is a prime candidate for a Question Mark in the BCG Matrix due to its significant growth potential, projected to reach over $200 billion globally by 2027, fueled by increasing demand for smart manufacturing and AI integration.

Canon's entry into highly specialized robotics components would likely begin with a low market share. This necessitates substantial investment in research and development, as well as market penetration strategies, to compete with established players in this rapidly evolving sector.

- Market Growth: The global robotics market is expected to grow at a CAGR of around 12% from 2023 to 2030.

- Investment Needs: Significant R&D funding is required for advanced sensor technology, AI integration, and specialized robotic arm development.

- Strategic Focus: Canon could focus on niche areas like collaborative robots (cobots) or automated inspection systems, where its imaging and precision engineering strengths are advantageous.

- Potential Returns: Successful penetration could yield high returns as the market matures and demand for sophisticated automation solutions escalates.

Canon's ventures into AR/VR, AI-integrated industrial vision, specialized 3D printing, AI in healthcare diagnostics, and robotics components all represent potential Question Marks. These areas exhibit strong market growth potential but currently have minimal market share for Canon, requiring significant investment to establish a competitive position.

The AR/VR market is projected to exceed $100 billion by 2025. Industrial vision systems, with AI integration, saw a global valuation of approximately $7.7 billion in 2023 and are expected to surpass $15 billion by 2030. Specialized industrial 3D printing, a market valued at $15.05 billion in 2023, is anticipated to reach $77.5 billion by 2030. The AI in healthcare market was valued at $15.0 billion in 2023 and is projected to reach $190.7 billion by 2030. The broader robotics market is expected to grow at a CAGR of around 12% from 2023 to 2030, with projections suggesting it could exceed $200 billion globally by 2027.

| Business Area | Market Size (2023/2025 Est.) | Projected Growth (CAGR) | Canon's Current Position | Strategic Implication |

|---|---|---|---|---|

| AR/VR Imaging | >$100 Billion (by 2025) | High | Minimal Market Share | Requires significant R&D and market entry investment. |

| AI Industrial Vision | ~$7.7 Billion (2023) | ~9.5% | Developing | Focus on R&D to gain competitive edge. |

| Specialized 3D Printing | ~$15.05 Billion (2023) | ~26.4% | Nascent | Needs investment in materials and specialized equipment. |

| AI in Healthcare Diagnostics | ~$15.0 Billion (2023) | ~43.3% | Nascent | Strategic focus on AI Automation Platform. |

| Robotics & Automation Components | >$200 Billion (by 2027) | ~12% | Low Market Share | Investment in advanced sensors and AI integration needed. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide a comprehensive strategic overview.