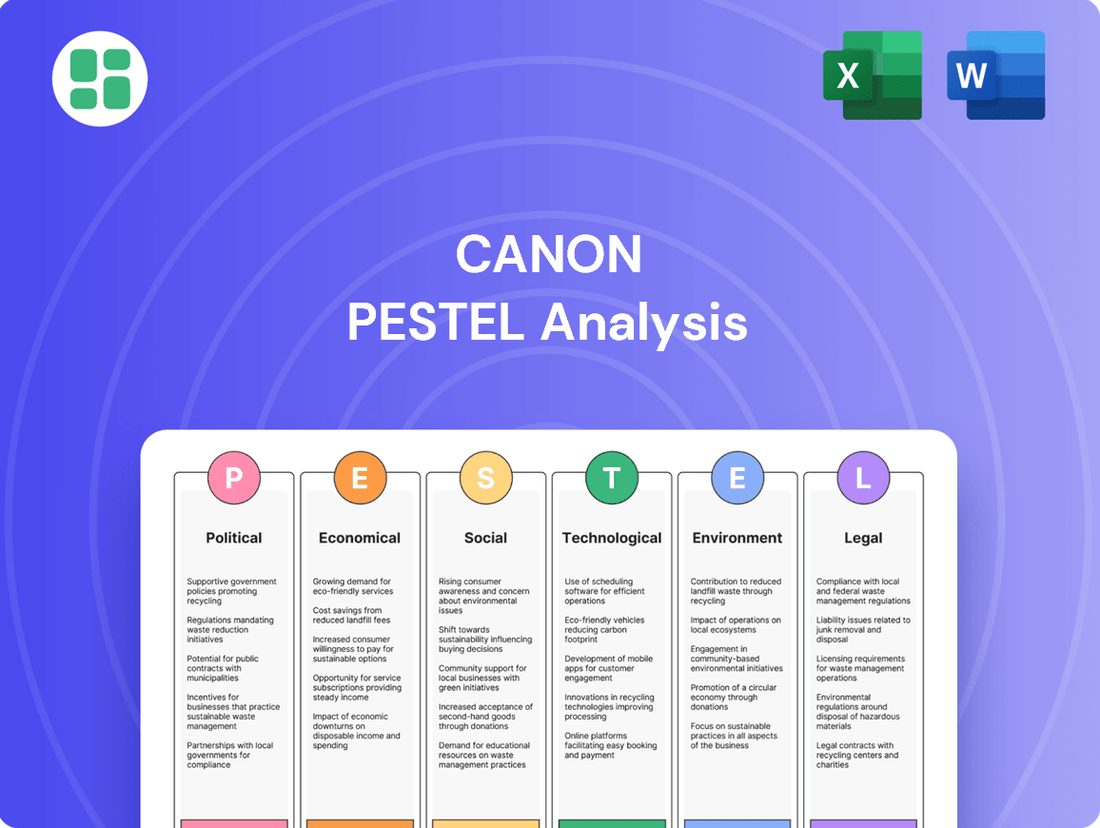

Canon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canon Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping Canon's trajectory. Our meticulously researched PESTLE analysis provides the critical intelligence you need to anticipate market shifts and identify strategic opportunities. Equip yourself with actionable insights to navigate the complexities of Canon's operating environment. Download the full PESTLE analysis now and gain a decisive advantage.

Political factors

Global trade policies and tariffs present a significant political factor for Canon. Ongoing trade tensions, notably between the United States and China, can disrupt Canon's intricate supply chains and affect the cost of manufacturing its products. For instance, increased tariffs on key electronic components, which Canon heavily relies on, could force price adjustments or shifts in production strategies to remain competitive in the global market.

Canon's operational stability is significantly tied to the geopolitical climate in its key markets. For instance, ongoing global economic uncertainties, including regional conflicts and trade tensions, can directly impact government and corporate spending on imaging solutions, affecting Canon's sales cycles and investment plans in areas like healthcare and enterprise technology.

The company's strategy to maintain a diversified global manufacturing and sales presence, spanning Asia, Europe, and the Americas, is crucial for mitigating the risks posed by localized political instability. This approach allows Canon to shift production or sales focus if one region experiences significant unrest or policy changes, thereby ensuring business continuity and protecting revenue streams.

Government agencies and public sector organizations represent a substantial customer base for Canon, purchasing everything from office equipment and printers to advanced medical imaging technology. These entities often have specific procurement policies that can significantly influence sales. For instance, in 2024, many governments continued to emphasize sustainability in their purchasing decisions, potentially favoring Canon's eco-friendly product lines.

Shifts in government spending priorities also play a crucial role. A government's decision to increase investment in digital transformation initiatives, as seen in several European nations throughout 2024, could boost demand for Canon's document management and IT solutions. Conversely, a reduction in healthcare budgets, a trend observed in some regions during the same period, might impact sales of Canon's medical imaging equipment.

Data Privacy Regulations

Canon's operations are significantly influenced by increasingly stringent data privacy regulations worldwide. Laws like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) in the US dictate how Canon must manage sensitive information collected by its multifunction devices, business solutions, and medical imaging systems. These regulations necessitate robust data security measures and transparent data handling policies.

Compliance with these evolving privacy laws requires substantial investment. Canon must allocate resources to enhance data protection, ensure localized data storage where mandated, and adapt its product development and service offerings to meet these requirements. For instance, the GDPR, implemented in 2018, has set a precedent for data protection globally, impacting how companies like Canon process personal data, with potential fines for non-compliance reaching up to 4% of annual global turnover.

- GDPR Fines: Non-compliance can result in fines up to €20 million or 4% of global annual revenue.

- CCPA Impact: California's CCPA grants consumers rights over their personal information, affecting data collection and usage practices.

- Data Localization: Some regulations may require data to be stored within specific geographic regions, impacting Canon's IT infrastructure.

- Increased Security Costs: Adhering to privacy standards often leads to higher spending on cybersecurity and data management systems.

Intellectual Property Protection

Canon's reliance on its extensive patent portfolio, covering imaging, optics, and industrial technologies, makes intellectual property protection a critical political factor. Strong IP laws and their enforcement are vital for safeguarding its innovations and ensuring returns on significant research and development spending. For instance, in 2023, Canon continued to actively pursue patent litigation globally to defend its technological edge, particularly in areas like inkjet printing and camera sensor technology.

The varying strength of intellectual property rights across different markets directly impacts Canon's ability to prevent counterfeiting and unauthorized use of its patented technologies. Countries with robust IP enforcement, such as the United States and Germany, provide a more secure environment for Canon's innovations. Conversely, regions with weaker IP protections can pose a greater risk of infringement, potentially eroding Canon's competitive advantage and profitability.

- Global Patent Filings: Canon consistently ranks among the top patent filers worldwide, with a significant portion of its filings in 2023 and early 2024 focused on AI-driven imaging solutions and advanced semiconductor lithography equipment.

- IP Enforcement Actions: In 2024, Canon reported successfully resolving several patent infringement cases, recovering damages and securing injunctions against unauthorized manufacturers of printer consumables in key Asian markets.

- R&D Investment: Canon's commitment to innovation is underscored by its substantial R&D budget, which in fiscal year 2023 exceeded $3.2 billion, with a substantial portion allocated to developing and protecting new technologies.

Government procurement policies and regulations significantly shape Canon's market access and sales strategies. Many governments, particularly in 2024, prioritized sustainability and digital transformation in their purchasing decisions, influencing demand for Canon's eco-friendly products and document management solutions. Shifts in public sector spending, such as increased investment in healthcare technology or digital infrastructure, directly impact Canon's revenue streams and require adaptive business planning.

Canon's global operations are subject to a complex web of international trade agreements and geopolitical stability. Trade tensions and tariffs, such as those impacting electronic components in 2024, can disrupt supply chains and increase manufacturing costs, necessitating strategic adjustments in production and pricing. Regional conflicts and economic uncertainties also influence government and corporate spending on imaging and technology solutions, affecting Canon's sales cycles.

Intellectual property (IP) protection is a critical political factor for Canon, given its substantial investment in research and development. Strong IP laws and their enforcement are vital for safeguarding innovations in areas like imaging, optics, and semiconductor lithography. For instance, in 2023, Canon actively pursued patent litigation to defend its technological edge, with global patent filings in early 2024 continuing to focus on AI-driven imaging and advanced equipment.

Data privacy regulations, such as GDPR and CCPA, impose significant compliance burdens on Canon, requiring robust data security and transparent data handling. These laws necessitate substantial investment in IT infrastructure and product development to meet evolving standards. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching up to 4% of global annual revenue.

| Political Factor | Impact on Canon | 2023-2024 Relevance |

|---|---|---|

| Government Procurement Policies | Influences sales channels and product demand, especially for eco-friendly and digital solutions. | Increased focus on sustainability and digital transformation in government purchasing. |

| Trade Tensions & Tariffs | Disrupts supply chains, increases costs, and necessitates strategic production shifts. | Ongoing global trade disputes affecting component costs and market access. |

| Intellectual Property Rights | Protects R&D investments and competitive advantage against counterfeiting. | Active patent litigation and focus on AI and advanced technology filings. |

| Data Privacy Regulations | Requires investment in data security, compliance, and impacts product development. | Stringent enforcement of GDPR and CCPA, with potential for significant fines. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Canon's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a strategic framework for understanding market dynamics and identifying opportunities and threats relevant to Canon's global business.

Provides a clear, actionable framework for understanding external factors, simplifying complex market dynamics and reducing the anxiety of unforeseen challenges.

Economic factors

Global economic growth is a significant driver for Canon's diverse product lines. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a stable rate that supports consumer spending on cameras and printers, as well as business investment in office solutions. This growth trend, while moderate, generally translates to increased demand for Canon's offerings.

Looking ahead to 2025, forecasts suggest a similar economic environment, with the IMF anticipating 3.2% global growth. This continued stability is crucial for Canon, as robust economies encourage consumers to upgrade electronics and businesses to invest in productivity tools like printers and advanced business solutions, directly impacting Canon's revenue streams.

Rising inflation presents a significant challenge for Canon. For instance, the US Consumer Price Index (CPI) saw a notable increase in 2023, with annual inflation rates fluctuating. This trend directly impacts Canon's procurement of essential components, manufacturing expenses, and overall operating costs, potentially squeezing profit margins on its diverse product lines, from cameras to printers.

Furthermore, the prevailing interest rate environment, as influenced by central bank policies aiming to curb inflation, affects Canon's financial strategy. Higher borrowing costs can deter Canon from undertaking ambitious capital expenditures or expanding its market reach through acquisitions. For consumers, elevated interest rates can also dampen demand for big-ticket items like high-end cameras and office equipment, impacting sales volumes.

Canon's global operations mean currency exchange rates are a constant factor. For instance, in early 2024, the Japanese Yen experienced volatility, trading around 150 JPY to the USD. A stronger Yen makes Canon's cameras and printers pricier for overseas buyers, potentially dampening sales volumes.

Conversely, a weaker Yen, as seen at times in late 2023 when it dipped towards 140 JPY to the USD, can significantly boost Canon's international competitiveness. This makes their products more attractive abroad and increases the JPY value of profits earned in foreign currencies, positively impacting Canon's reported net sales and overall profitability for the fiscal year ending December 31, 2024.

Disposable Income Levels

Disposable income levels are a critical economic factor influencing consumer demand for Canon's products, from digital cameras to home printers. When households have more discretionary funds, they are more likely to invest in non-essential items like photography equipment and printing solutions. For instance, in the United States, the personal saving rate, a proxy for disposable income available for spending or saving, stood at approximately 3.9% in April 2024, indicating a moderate level of consumer purchasing power.

Conversely, economic downturns impacting wage growth or leading to higher unemployment can significantly dampen sales of these imaging products. A decline in disposable income directly translates to reduced consumer spending on discretionary goods. For example, if inflation outpaces wage increases, consumers may prioritize essential purchases, leading to a slowdown in sales for companies like Canon. The U.S. Bureau of Labor Statistics reported that real average hourly earnings saw a modest increase of 0.5% over the year ending April 2024, suggesting that while wages are growing, the pace might not always outstrip inflation for all consumers.

- Consumer Spending Power: Directly correlates with demand for non-essential imaging products.

- Wage Stagnation Impact: Can reduce discretionary funds, leading to lower sales.

- Unemployment Rates: Higher unemployment diminishes overall consumer purchasing power.

- Personal Saving Rate (US, April 2024): Approximately 3.9%, reflecting available funds for discretionary spending.

Supply Chain Disruptions and Raw Material Costs

Global supply chain vulnerabilities continue to impact manufacturing, with semiconductor shortages directly affecting Canon's production. For example, the persistent global chip shortage, which saw significant disruptions throughout 2022 and 2023, directly constrained output for Canon's diverse product lines, from high-end cameras to advanced industrial printing equipment. This constraint not only extended delivery times for consumers and businesses but also drove up manufacturing expenses due to increased component sourcing costs.

Fluctuations in raw material prices also present a significant challenge. The cost of key materials used in Canon's products, such as plastics, metals, and specialized optical components, has seen volatility. For instance, the price of rare earth metals, crucial for certain electronic components, experienced upward pressure in early 2024, adding to Canon's cost of goods sold and potentially impacting profit margins if these increases cannot be fully passed on to consumers.

- Semiconductor Shortages: Continued challenges in securing sufficient semiconductor components impact production volumes for key Canon product lines.

- Raw Material Price Volatility: Fluctuations in the cost of essential materials like plastics, metals, and rare earth elements directly affect manufacturing expenses.

- Logistics Costs: Increased global shipping and freight costs contribute to higher overall production and distribution expenses for Canon.

- Supply Chain Resilience: Canon's ongoing efforts to diversify its supplier base and build more resilient supply chains are critical for mitigating future disruptions.

Canon's performance is closely tied to global economic health, with projected stable growth in 2024 and 2025 supporting consumer and business spending. However, rising inflation, as evidenced by fluctuating US CPI rates in 2023, increases Canon's operational costs and can squeeze profit margins.

Interest rate hikes aimed at controlling inflation can deter Canon's capital investments and dampen consumer demand for higher-priced items. Currency fluctuations, such as the Yen's volatility against the USD in early 2024 (around 150 JPY/USD), directly impact the international pricing and profitability of Canon's products.

Disposable income, reflected in the US personal saving rate of 3.9% in April 2024, directly influences sales of discretionary items like cameras. Conversely, wage stagnation or rising unemployment can reduce consumer purchasing power, negatively impacting sales volumes.

Supply chain issues, including semiconductor shortages and volatile raw material prices (e.g., rare earth metals in early 2024), continue to challenge Canon's production efficiency and increase manufacturing expenses.

| Economic Factor | 2024/2025 Outlook | Impact on Canon | Supporting Data |

|---|---|---|---|

| Global Growth | Stable (IMF projected 3.2% for 2024 & 2025) | Supports demand for electronics and business solutions. | IMF Global Growth Forecast: 3.2% (2024 & 2025) |

| Inflation | Elevated, with central bank efforts to curb it. | Increases procurement and manufacturing costs. | US CPI fluctuations in 2023. |

| Interest Rates | Higher, influenced by anti-inflationary policies. | Deters capital expenditure; reduces consumer spending on big-ticket items. | Central bank policy trends. |

| Currency Exchange Rates | Volatile (e.g., JPY vs. USD) | Affects international pricing and repatriated profits. | JPY around 150/USD in early 2024. |

| Disposable Income | Moderate, influenced by wage growth and inflation. | Drives demand for discretionary imaging products. | US Personal Saving Rate: 3.9% (April 2024). |

| Supply Chain Stability | Vulnerable to shortages and price volatility. | Constrains production and increases component costs. | Ongoing semiconductor shortages; rare earth metal price pressure (early 2024). |

What You See Is What You Get

Canon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Canon PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the detailed insights and strategic overview presented are precisely what you'll get.

Sociological factors

The ubiquity of smartphones has fundamentally altered consumer behavior, leading to a decline in demand for traditional point-and-shoot cameras. Canon has responded by heavily investing in its mirrorless camera technology, aiming to capture a market segment that values advanced features and portability. The company's strategic pivot also includes a focus on high-value-added systems and the burgeoning content creation market, recognizing the shift towards visual storytelling and immediate sharing.

The enduring rise of hybrid and remote work, accelerated by events in recent years, significantly impacts Canon's printing business. By late 2024, a substantial portion of the workforce, estimated to be over 30% in many developed economies, continues to operate under flexible arrangements, a notable increase from pre-pandemic levels. This shift directly influences demand for office printing hardware, potentially reducing the need for large, centralized multifunction devices in corporate settings.

Conversely, this trend fuels a growing market for compact, reliable home-office printing solutions and associated document management software. Canon's strategic response needs to prioritize products and services tailored for individual users and smaller, distributed teams. For instance, the demand for personal all-in-one printers and cloud-based document sharing platforms is expected to see continued growth through 2025.

Demographic shifts, especially the aging populations in developed markets, are significantly boosting the demand for advanced medical imaging systems. As people live longer, the prevalence of chronic diseases naturally increases, creating a greater need for diagnostic tools.

Canon's Medical Group is strategically positioned to benefit from this trend. For instance, in 2024, the global medical imaging market was valued at approximately $100 billion and is projected to grow, with a substantial portion of this growth driven by the needs of an aging global population, estimated to reach over 1.6 billion people aged 65 and over by 2050.

Environmental Consciousness Among Consumers

Consumer awareness regarding environmental impact is a significant sociological factor shaping purchasing behavior. Globally, a growing number of consumers are actively seeking out products and services from companies that demonstrate a genuine commitment to sustainability. This trend is particularly pronounced among younger demographics, who are increasingly prioritizing eco-friendly options. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, a figure that has steadily climbed over the past few years.

Canon's proactive approach to environmental responsibility directly addresses this evolving consumer sentiment. By offering remanufactured products, robust recycling programs, and designing energy-efficient imaging and printing solutions, Canon is aligning its operations with consumer values. This not only strengthens its brand image but also creates a competitive advantage, as evidenced by increased customer loyalty in markets where sustainability is a key differentiator. Canon's 2024 sustainability report highlighted a 15% year-over-year increase in the adoption of its remanufactured products.

- Growing Demand: Over 60% of consumers consider sustainability in purchasing decisions (2024 data).

- Brand Enhancement: Eco-friendly practices improve brand reputation and customer appeal.

- Product Innovation: Canon's remanufactured products saw a 15% adoption increase in 2024.

- Market Advantage: Sustainability is becoming a key differentiator in the imaging and printing industry.

Digital Literacy and Adoption Rates

Global digital literacy is on the rise, with an estimated 73% of the world’s population expected to be online by the end of 2024, according to Statista. This growing proficiency directly influences demand for Canon's advanced imaging and business solutions, as more users are comfortable adopting sophisticated technologies. Higher digital skillsets can translate into increased adoption of complex multifunction devices and integrated software systems.

The increasing comfort with digital tools is a significant driver for Canon. For instance, the adoption of cloud-based services for document management and printing solutions is accelerating. By 2025, the global cloud computing market is projected to reach over $1 trillion, indicating a strong societal shift towards digital infrastructure that Canon can leverage.

- Rising Digital Proficiency: An increasing percentage of the global population possesses the skills to operate advanced digital devices and software.

- Demand for Sophistication: Higher digital literacy fuels the demand for Canon's complex multifunction devices, software, and integrated business solutions.

- Cloud Adoption: The growing reliance on cloud services for business operations creates opportunities for Canon's digital workflow and document management offerings.

- Market Growth: The expanding digital economy, projected to exceed $20 trillion by 2025, provides a fertile ground for Canon's technology-driven products and services.

Sociological factors highlight shifts in consumer behavior and societal needs that directly impact Canon's market. The growing preference for sustainability, with over 60% of consumers considering it in 2024, pushes Canon towards eco-friendly product lines and recycling programs, which saw a 15% increase in remanufactured product adoption in 2024. Simultaneously, rising global digital literacy, with an estimated 73% of the world online by late 2024, increases demand for sophisticated digital imaging and business solutions, including cloud-based services.

| Sociological Factor | Impact on Canon | Supporting Data (2024/2025) |

|---|---|---|

| Sustainability Awareness | Increased demand for eco-friendly products and services; drives adoption of remanufactured goods. | Over 60% of consumers consider sustainability in purchasing (2024). Canon's remanufactured products adoption up 15% (2024). |

| Digital Literacy Growth | Greater acceptance and demand for advanced digital imaging and business solutions, including cloud integration. | Estimated 73% of global population online by end of 2024. Global cloud computing market projected to exceed $1 trillion by 2025. |

| Aging Population | Boosts demand for advanced medical imaging systems due to increased healthcare needs. | Global medical imaging market valued around $100 billion (2024). Over 1.6 billion people aged 65+ projected by 2050. |

Technological factors

Advancements in AI and machine learning are significantly reshaping industries where Canon has a presence. These technologies are boosting image processing in cameras, improving medical imaging accuracy, and streamlining business workflows.

Canon is actively embedding AI into its offerings, aiming to provide smarter and more efficient solutions for its customers across its diverse product lines.

Canon's camera division thrives on miniaturization, with sensor technology advancements directly impacting image quality in increasingly portable devices. For instance, the development of smaller, more sensitive CMOS sensors allows for higher resolution and better low-light performance in their EOS R series mirrorless cameras, a key segment for them.

In medical imaging, sensor innovation is paramount for Canon Medical Systems. The push for higher resolution and faster readout speeds in diagnostic imaging equipment, like CT scanners and MRI machines, directly translates to more detailed patient scans and improved diagnostic accuracy, a critical factor in healthcare.

Canon can leverage the widespread adoption of cloud computing, with global public cloud spending projected to reach $679 billion in 2024, an increase of 20.4% from 2023. This trend allows for enhanced printer functionalities and document management systems through cloud-based services, offering greater flexibility and accessibility for users.

The integration of the Internet of Things (IoT) presents significant opportunities for Canon. By 2025, the number of connected IoT devices is expected to surpass 27 billion, enabling Canon to develop smarter network cameras and printers. These devices can offer features like remote monitoring, predictive maintenance, and streamlined data solutions, improving operational efficiency and customer experience.

Competitor Innovation

Canon operates in intensely competitive sectors such as imaging, printing, medical, and industrial equipment, where rivals consistently roll out cutting-edge technologies and products. Staying ahead requires Canon to sustain a robust research and development pipeline and expedite innovation, especially in burgeoning fields like mirrorless cameras and semiconductor lithography, to preserve its market dominance and competitive edge.

In 2024, the digital camera market saw continued growth in mirrorless models, with Canon’s EOS R series actively competing against Sony and Fujifilm, both known for rapid product cycles. The semiconductor lithography market, critical for Canon's industrial segment, is dominated by ASML, but Canon's ongoing investment in advanced lithography systems aims to capture a larger share by offering competitive solutions for next-generation chip manufacturing.

- Mirrorless Camera Market Share: Canon's mirrorless camera shipments in 2024 are projected to increase, challenging established leaders by leveraging its extensive lens ecosystem and advanced sensor technology.

- Semiconductor Lithography R&D: Canon has allocated significant capital for R&D into EUV and other advanced lithography technologies, aiming to provide viable alternatives to dominant players by 2025.

- Printing Technology Advancements: Competitors like HP and Epson continue to innovate in inkjet and laser printing, pushing Canon to invest in more sustainable and efficient printing solutions, including advancements in its proprietary MAXIFY and PIXMA lines.

- Medical Imaging Competition: The medical imaging sector sees constant innovation from GE Healthcare, Siemens Healthineers, and Philips, compelling Canon Medical Systems to accelerate the development of AI-integrated diagnostic imaging equipment.

Cybersecurity Threats

The increasing interconnectedness of Canon's products, from printers to advanced medical imaging systems, significantly elevates the risk of cyberattacks. As more data flows through these devices, safeguarding that information becomes paramount. For instance, in 2023, the global cost of cybercrime was estimated to reach $8 trillion, highlighting the substantial financial and reputational damage that a breach can inflict. Canon's reliance on data for its solutions means robust cybersecurity is not just a technical requirement but a fundamental pillar for maintaining operational integrity and customer confidence.

Protecting user data and ensuring the security of business solutions are critical. This is especially true for Canon's offerings in sensitive sectors like healthcare, where medical imaging systems handle patient data. A breach in such systems could have severe consequences, impacting patient privacy and trust. The growth of the cybersecurity market itself underscores this importance, with global spending on cybersecurity solutions projected to exceed $200 billion in 2024. This trend suggests a continuous need for Canon to invest in and evolve its security protocols to counter sophisticated and ever-changing cyber threats.

Maintaining customer trust is intrinsically linked to effective cybersecurity. Canon's reputation hinges on its ability to secure the data processed by its diverse product portfolio.

- Increased Attack Surface: As Canon integrates IoT capabilities into more devices, the number of potential entry points for cyber threats expands.

- Data Integrity: Ensuring the accuracy and reliability of data processed by Canon's solutions, particularly in critical applications like medical diagnostics, is vital.

- Reputational Risk: A significant cyber incident could severely damage Canon's brand image and customer loyalty, impacting future sales and partnerships.

- Regulatory Compliance: Evolving data protection regulations worldwide necessitate stringent cybersecurity measures to avoid penalties and legal repercussions.

Technological advancements are a core driver for Canon, particularly in AI and IoT integration, enhancing product capabilities across imaging, printing, and medical sectors. The company is actively investing in R&D for next-generation technologies like advanced semiconductor lithography, aiming to solidify its competitive position in rapidly evolving markets.

Canon's strategic focus on miniaturization, especially in sensor technology for its mirrorless cameras, directly impacts image quality and device portability. Similarly, innovations in medical imaging sensors are crucial for improving diagnostic accuracy, a key differentiator in the healthcare industry.

The increasing adoption of cloud computing and the expansion of IoT devices present significant opportunities for Canon to develop smarter, more connected solutions. These trends allow for enhanced functionalities like remote monitoring and predictive maintenance, improving operational efficiency and customer experience.

| Technology Area | Canon's Focus/Investment | Market Trend/Data | Impact on Canon |

| Artificial Intelligence (AI) | Embedding AI in cameras, medical imaging, business workflows | AI market projected to reach $200 billion in 2024 | Enhanced product intelligence and efficiency |

| Internet of Things (IoT) | Developing smart network cameras and printers | Over 27 billion connected IoT devices expected by 2025 | New service opportunities, remote capabilities |

| Sensor Technology | Miniaturization and improved sensitivity in cameras | Continued demand for higher resolution in imaging | Superior image quality in compact devices |

| Semiconductor Lithography | R&D in advanced lithography (e.g., EUV) | Critical for next-gen chip manufacturing | Potential to capture market share in industrial segment |

Legal factors

Canon must navigate a complex web of international and national product safety and quality standards. For instance, in 2024, the European Union's General Product Safety Regulation (GPSR) continues to emphasize manufacturer responsibility for product safety across all consumer goods, impacting Canon's camera and printer lines sold in the EU.

Failure to comply with these evolving regulations, which differ significantly by region, can lead to substantial legal penalties, costly product recalls, and severe damage to Canon's brand reputation. In 2023, fines for non-compliant electronics in the US market alone reached millions of dollars for various companies, highlighting the financial risks involved.

Canon, as a global leader in imaging and optical products, navigates a complex web of antitrust and competition laws across its operating regions. For instance, in 2023, the European Commission continued its rigorous enforcement of competition rules, impacting various technology sectors. Canon's significant market share in areas like digital cameras and printers necessitates careful consideration of these regulations for any strategic moves, ensuring practices do not stifle competition.

The company must proactively ensure its mergers, acquisitions, and day-to-day market activities align with global antitrust frameworks, such as those enforced by the U.S. Federal Trade Commission (FTC) or the UK's Competition and Markets Authority (CMA). Failure to comply can result in substantial fines and operational disruptions, underscoring the critical importance of ongoing legal diligence in maintaining Canon's competitive standing.

Canon's reliance on innovation means patent and copyright infringement laws are critical. The company invests heavily in research and development, securing patents for its imaging technologies, camera designs, and printing mechanisms. For instance, Canon reported spending approximately ¥340 billion (around $2.3 billion USD based on a 2024 exchange rate) on R&D in 2023, underscoring the importance of protecting these innovations.

Navigating these laws involves both safeguarding Canon's own intellectual property and meticulously avoiding infringement of competitors' patents. Failure to do so can result in costly litigation, such as the ongoing patent disputes in the printer ink cartridge market, or necessitate expensive licensing agreements, impacting profitability and market access.

Labor Laws and Regulations

Canon's global operations necessitate strict adherence to a mosaic of labor laws. These regulations cover everything from minimum wage requirements and working hour limits to employee rights and anti-discrimination statutes. For instance, in 2024, many European nations continued to strengthen worker protections, with Germany's Works Constitution Act influencing employee representation in corporate decision-making.

Failure to comply can lead to significant legal repercussions and reputational damage. Canon's commitment to ethical operations means navigating these complex legal landscapes at each of its manufacturing and sales locations.

- Compliance with minimum wage laws: As of early 2024, the UK's National Living Wage increased by 9.8%, impacting labor costs for Canon's UK operations.

- Working condition standards: Regulations concerning workplace safety and health, like those enforced by OSHA in the United States, are critical for Canon's facilities.

- Employee rights and non-discrimination: Laws such as the Equality Act 2010 in the UK prohibit discrimination based on protected characteristics, a key area for Canon's HR policies.

- Unionization and collective bargaining: Canon must also navigate varying levels of union influence and collective bargaining agreements across different countries, affecting wage negotiations and employment terms.

Import/Export Regulations and Customs Duties

Canon's global operations mean it must navigate a labyrinth of import/export regulations and customs duties. These rules directly influence the cost of goods and the speed at which components and finished products can move across international borders. For instance, a shift in tariffs on camera lenses or printer ink could significantly alter Canon's cost structure and competitive pricing strategies in key markets.

Trade sanctions also pose a considerable risk, potentially disrupting supply chains and limiting market access. As of early 2024, ongoing geopolitical tensions continue to create uncertainty around trade flows, necessitating robust compliance and risk management for companies like Canon.

- Tariff Rates: Fluctuations in import duties on electronic components and finished goods can impact Canon's cost of production and final product pricing.

- Export Controls: Restrictions on exporting certain technologies or products to specific countries can limit market reach and revenue opportunities.

- Trade Agreements: Favorable trade agreements can reduce costs and streamline logistics, while their absence or renegotiation can create challenges.

- Customs Procedures: Inefficient or complex customs clearance processes can lead to delays, increasing inventory holding costs and impacting delivery times.

Canon must meticulously adhere to evolving data privacy and cybersecurity laws globally. Regulations like the EU's GDPR and California's CCPA, which continue to be enforced and updated, mandate strict handling of customer data, impacting Canon's online services and product data collection. Failure to comply, as seen with significant fines levied against tech companies in 2023 for data breaches, can lead to substantial financial penalties and severe reputational harm.

Ensuring robust cybersecurity measures is paramount, especially with increasing sophistication of cyber threats. Canon's commitment to protecting user information is directly tied to its legal obligations and customer trust.

Environmental factors

Canon faces increasing global pressure from climate change regulations, including stricter emissions targets and energy efficiency standards. These evolving rules directly influence manufacturing processes and product development, pushing the company to innovate for sustainability.

For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in for many sectors by 2026, could impact the cost of imported components if their production involves high carbon emissions, necessitating a focus on supply chain decarbonization.

Canon's commitment to reducing its carbon footprint is crucial for compliance and market competitiveness. The company's initiatives, such as investing in renewable energy for its operations, directly address these regulatory demands and align with global decarbonization goals.

Canon must navigate increasingly stringent waste electrical and electronic equipment (WEEE) directives and recycling laws, particularly within the European Union. These regulations place the onus on manufacturers to manage their products' end-of-life, impacting design and operational costs. For instance, the EU's Circular Economy Action Plan, updated in 2020, emphasizes extended producer responsibility and aims to boost recycling rates for electronics.

In response, Canon has proactively implemented robust recycling programs. These initiatives, such as their toner cartridge recycling schemes, not only ensure compliance with global environmental standards but also foster a more sustainable, circular economy model. This commitment is crucial for maintaining brand reputation and market access in environmentally conscious regions.

Resource scarcity directly affects Canon's supply chain, particularly for components like rare earth minerals vital for its imaging and printing technologies. Global demand for these materials continues to rise, pushing prices higher. For instance, the price of neodymium, a key rare earth element, saw significant fluctuations in 2024, impacting manufacturing costs for electronic components.

Canon's strategy must therefore emphasize sustainable sourcing and the exploration of alternative materials to navigate potential shortages and price volatility. By investing in research and development for recycled materials and more readily available substitutes, Canon can build resilience against supply chain disruptions and maintain competitive pricing for its products.

Consumer Demand for Eco-Friendly Products

A significant and growing segment of consumers now actively seeks out products that are environmentally sustainable. This societal shift directly influences Canon, compelling the company to prioritize innovation in areas like sustainable product design, enhanced energy efficiency, and eco-conscious packaging. This isn't just about meeting regulations; it's increasingly becoming a key way Canon can stand out in the marketplace.

For instance, a 2024 report indicated that over 60% of consumers are willing to pay a premium for products from brands committed to sustainability. This demand directly impacts Canon's product development lifecycle, pushing for greener materials and reduced environmental footprint throughout manufacturing and distribution.

- Growing Consumer Preference: Surveys in late 2024 and early 2025 show a consistent upward trend in consumer preference for eco-friendly electronics.

- Market Differentiation: Canon's investment in sustainable technologies, such as its recycled plastics initiatives and energy-saving printer modes, is a direct response to this demand, aiming to capture market share from less environmentally conscious competitors.

- Regulatory and Brand Image: Beyond consumer demand, evolving environmental regulations globally further necessitate Canon's focus on sustainability, reinforcing its brand image as a responsible corporate citizen.

Supply Chain Environmental Standards

Canon faces growing pressure to ensure its global supply chain meets stringent environmental standards, covering everything from greenhouse gas emissions to waste management and responsible material sourcing. This means actively working with suppliers to reduce their environmental footprint, a critical aspect of corporate sustainability in the 2024-2025 period.

Canon's commitment to environmental stewardship extends beyond its own manufacturing. For instance, in its 2023 sustainability report, the company highlighted efforts to reduce CO2 emissions across its value chain, aiming for a 30% reduction by 2030 compared to 2019 levels. This includes engaging suppliers on energy efficiency and the adoption of renewable energy sources.

- Emissions Reduction: Canon aims to cut CO2 emissions from its entire supply chain by 30% by 2030, building on progress made in 2023.

- Waste Management: The company is implementing stricter waste reduction and recycling programs with its suppliers, targeting a circular economy approach.

- Ethical Sourcing: Canon conducts rigorous due diligence to ensure raw materials are sourced ethically and with minimal environmental impact, a key focus for 2024-2025.

Environmental factors significantly shape Canon's operational and strategic landscape, driven by escalating climate change regulations and a growing consumer demand for sustainability. These pressures necessitate continuous innovation in product design, manufacturing processes, and supply chain management to ensure compliance and maintain market competitiveness.

Canon is actively addressing these challenges by investing in renewable energy, enhancing product energy efficiency, and implementing robust recycling programs, aligning with global decarbonization goals and circular economy principles.

The company's commitment to reducing its environmental footprint, including a 30% CO2 emission reduction target across its value chain by 2030, reflects a proactive approach to environmental stewardship and brand image enhancement.

| Environmental Factor | Impact on Canon | Canon's Response/Initiatives | Relevant Data/Period |

|---|---|---|---|

| Climate Change Regulations | Increased compliance costs, need for process innovation | Investing in renewable energy, stricter emissions targets | EU CBAM (phased in by 2026) |

| Waste Management Directives | Extended producer responsibility, impact on product design | Toner cartridge recycling programs, circular economy focus | EU Circular Economy Action Plan (2020 update) |

| Resource Scarcity | Supply chain volatility, rising component costs | Sustainable sourcing, R&D for recycled/alternative materials | Neodymium price fluctuations (2024) |

| Consumer Demand for Sustainability | Market differentiation, product development focus | Eco-friendly product design, energy-saving features | 60% consumers willing to pay premium (2024 report) |

PESTLE Analysis Data Sources

Our Canon PESTLE analysis is grounded in a comprehensive review of official government publications, reputable market research firms, and leading economic indicators. We meticulously gather data on political stability, economic forecasts, technological advancements, environmental regulations, social trends, and legal frameworks.