Canon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canon Bundle

Canon's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the constant threat of new entrants disrupting the market. Understanding these dynamics is crucial for any business operating within or looking to enter this sector.

The complete report reveals the real forces shaping Canon’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Canon's reliance on highly specialized components, like advanced optical lenses and image sensors crucial for its high-end cameras and sophisticated medical systems, creates a significant dependency. The limited number of suppliers capable of producing these critical, high-precision parts means these vendors often hold substantial bargaining power.

This specialized component dependency is a key factor in Canon's supplier power. For instance, in 2024, the global market for advanced semiconductor image sensors, a core component for Canon's digital imaging products, is dominated by a few key players. This concentration allows these suppliers to dictate terms, potentially impacting Canon's cost of goods sold and product development timelines.

The bargaining power of suppliers for Canon is significantly influenced by whether the components are commodities or highly differentiated. For standard, readily available parts like basic plastics or common electronic chips, Canon benefits from a wide array of potential suppliers, giving it considerable leverage to negotiate favorable terms. In 2023, the global market for electronic components saw continued price stability for many commodity items due to robust supply chains, benefiting large buyers like Canon.

Conversely, when Canon relies on specialized or proprietary technologies, the supplier's bargaining power intensifies. High switching costs, the lack of alternative suppliers for unique innovations, or the need for specialized technical support can shift the power balance considerably. For instance, in advanced imaging sensors or custom-designed optical elements, a single or limited number of suppliers may hold a near-monopoly, allowing them to command higher prices and dictate terms.

Canon's strategic approach to vertical integration, particularly its in-house production of key components as detailed in its annual reports, significantly dampens the bargaining power of suppliers. By manufacturing critical parts internally, Canon lessens its dependence on external vendors, thereby securing greater command over product quality, cost structures, and the overall stability of its supply chain. This deliberate strategy of bringing production in-house is a core tactic for managing vital inputs effectively.

Supplier Engagement and Sustainability Initiatives

Canon actively collaborates with its suppliers, a strategy that can mitigate their bargaining power by fostering long-term, mutually beneficial relationships. For instance, Canon's recognition as a Supplier Engagement Leader by CDP in 2023 highlights its commitment to driving sustainability throughout its supply chain. This engagement often involves setting shared goals, such as reducing CO2 emissions, which can align supplier interests with Canon's own, thereby lessening their ability to dictate terms.

These sustainability initiatives, including responsible sourcing and emissions reduction targets, can transform suppliers from purely transactional partners into strategic allies. By working together on these critical issues, Canon builds loyalty and interdependence, which can temper a supplier's inclination to leverage their position for higher prices or less favorable contract terms. This collaborative approach is a key element in managing the bargaining power of suppliers.

- Canon's CDP Supplier Engagement Leader recognition in 2023 underscores its proactive approach to supply chain sustainability.

- Collaborative efforts to reduce CO2 emissions and ensure responsible sourcing are central to Canon's supplier engagement strategy.

- These initiatives aim to build long-term partnerships, potentially reducing suppliers' ability to exert significant bargaining power.

- Shared objectives in sustainability can create a more balanced relationship, influencing supplier behavior and terms.

Global Supply Chain Dynamics

Canon's intricate global supply chain, while designed for diversification, faces inherent vulnerabilities. Specialized components, crucial for its advanced imaging and printing technologies, often originate from a limited number of suppliers. This concentration grants these suppliers significant leverage, potentially increasing costs or impacting production timelines. For instance, in 2023, the semiconductor shortage, a critical input for many electronic devices, demonstrated how reliance on a few key chip manufacturers could disrupt production schedules for companies like Canon.

The bargaining power of suppliers in Canon's ecosystem is influenced by several factors:

- Supplier Concentration: For highly specialized electronic components or rare earth materials, a small number of global suppliers can dictate terms.

- Switching Costs: The cost and time involved for Canon to find and qualify alternative suppliers for critical inputs can be substantial, reinforcing supplier power.

- Importance of the Component: If a component is vital to Canon's product differentiation or performance, suppliers of that specific part hold more sway.

- Industry Trends: Broader market conditions, such as raw material price volatility or geopolitical tensions affecting key manufacturing regions, can amplify supplier influence.

Canon's ongoing investments in supply chain management and IT reforms are strategically aimed at mitigating these supplier-driven risks. By enhancing visibility and agility across its network, the company seeks to strengthen its negotiating position and ensure a more resilient flow of essential materials and components.

Canon's bargaining power with suppliers is diminished when dealing with essential, highly specialized components where supplier concentration is high. For example, the market for advanced image sensors, critical for Canon's camera division, is dominated by a few firms. In 2024, this limited supplier base allows them to command higher prices and dictate terms, impacting Canon's cost of goods sold and product innovation cycles.

Conversely, for more commoditized parts, Canon leverages its scale to negotiate favorable terms. The company's robust supply chain management, including its 2023 CDP Supplier Engagement Leader recognition, demonstrates a strategic effort to build collaborative, long-term relationships that can temper supplier leverage.

Canon's vertical integration, producing key components in-house, also serves to reduce its reliance on external suppliers for critical inputs. This strategy strengthens its negotiating position and ensures greater control over quality and cost for vital elements of its product lines.

The bargaining power of suppliers is a key consideration for Canon, particularly for specialized components. Here's a look at some influential factors:

| Factor | Impact on Canon's Supplier Bargaining Power | Example/Data Point (as of 2023/2024) |

|---|---|---|

| Supplier Concentration | High for specialized components | Limited number of suppliers for advanced image sensors; a few dominant players in semiconductor manufacturing. |

| Switching Costs | High for critical, proprietary components | Significant time and investment required to re-qualify alternative suppliers for custom optical elements or specialized chipsets. |

| Component Differentiation | High for unique, performance-driving parts | Suppliers of unique lens coatings or proprietary sensor technologies have greater leverage due to their contribution to Canon's product performance. |

| Industry Trends | Can amplify supplier influence | Global shortages of specific electronic components in 2023 highlighted how supply chain disruptions can empower suppliers. |

What is included in the product

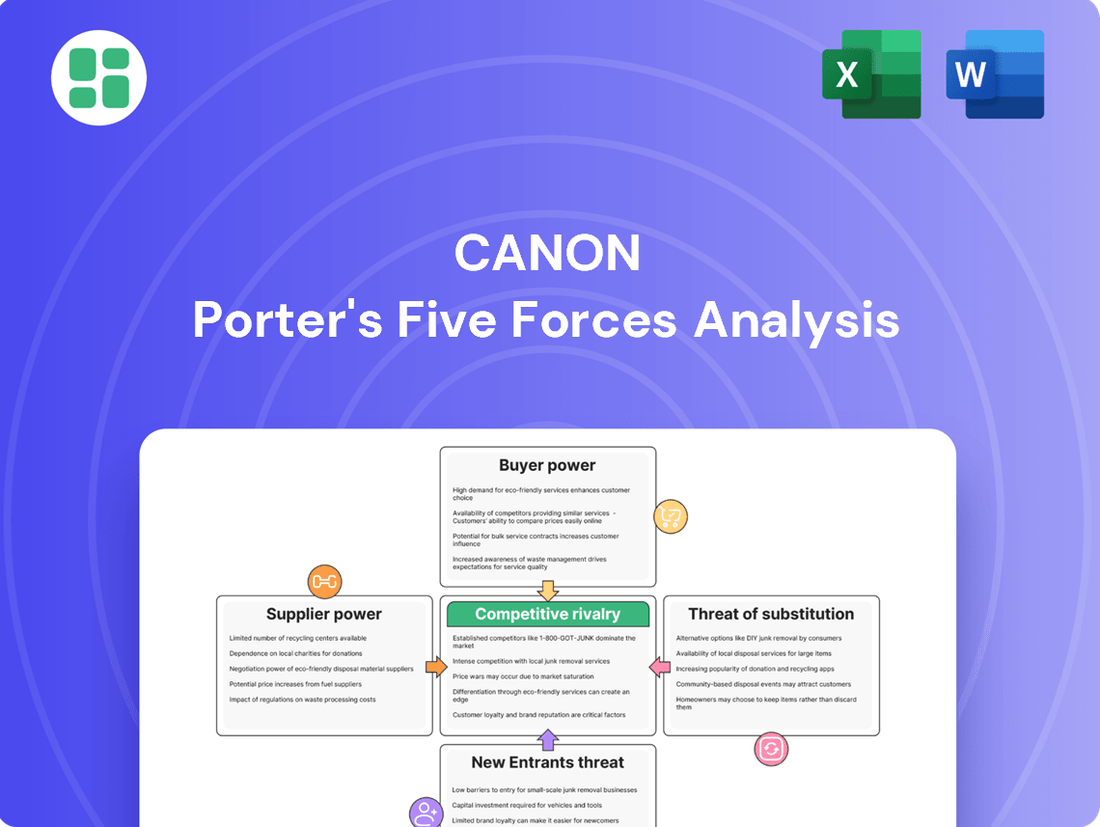

Analyzes the five competitive forces—rivalry, new entrants, buyer power, supplier power, and substitutes—to understand Canon's industry structure and profitability.

Quickly identify and address competitive pressures by visualizing the intensity of each Porter's Five Forces with an intuitive, interactive dashboard.

Customers Bargaining Power

In the consumer camera and printer sectors, buyers are quite sensitive to price. This is because there are many other brands and models available, giving them a strong say in what they pay. For instance, in 2024, the global digital camera market saw numerous competitors offering a wide range of products, making it easy for consumers to switch if prices aren't right.

The ability to easily check prices and product details online really boosts customer power. This means Canon has to keep its prices competitive and its features attractive to stay in the game. In 2024, online retail platforms continued to be a major channel for camera and printer sales, facilitating this price comparison and intensifying competition.

While price is a big factor, customer loyalty can offer some protection. However, with so many choices readily available, even loyal customers might be tempted by a better deal. Canon’s efforts in 2024 to build brand loyalty through innovative products and customer service are crucial in managing this aspect of consumer power.

For Canon's professional camera, semiconductor lithography, and medical imaging divisions, customers face significant switching costs. These include the need for specialized training, intricate integration with existing operational workflows, and substantial upfront capital expenditures, all of which tend to diminish their bargaining leverage.

Canon's strategy of offering comprehensive solutions and ongoing service further solidifies customer loyalty. For instance, in the semiconductor industry, the average cost for a semiconductor fabrication plant to switch lithography equipment suppliers can run into hundreds of millions of dollars, reflecting the deep integration and specialized nature of these tools.

Canon's robust brand image, especially in the imaging sector, coupled with ongoing advancements in products like mirrorless cameras, fosters significant customer loyalty. This loyalty directly diminishes the bargaining power of buyers, as they are less likely to switch to competitors. For instance, Canon's EOS R series cameras have seen strong adoption, indicating a preference for their differentiated technology.

Influence of Distribution Channels

The way Canon reaches its customers, through retail stores, online platforms, or even direct sales, significantly impacts how much say customers have. When online sales dominate, like the projected 20% year-over-year growth in e-commerce for electronics in 2024, customers can easily compare prices and gather information, which naturally boosts their bargaining power.

However, for more complex business solutions, Canon can regain some leverage. By utilizing direct sales teams and establishing long-term contracts, the company can foster stronger relationships and potentially lock in customers, thereby mitigating some of the customer's ability to dictate terms.

- Distribution Channel Impact: Retail, online, and direct sales all affect customer leverage.

- Online Prevalence: Increased online sales in 2024 provide customers with greater access to information and competitive pricing, enhancing their bargaining power.

- Direct Sales Strategy: For business solutions, direct sales and long-term contracts can shift power back towards Canon.

Large Enterprise and Healthcare Procurement

Large enterprise and healthcare procurement significantly impacts Canon's bargaining power with customers. These entities, such as major corporations and hospital networks, place substantial orders for printers, multifunction devices, and critical medical imaging equipment. Their volume purchasing capacity grants them considerable leverage in negotiations.

These powerful clients frequently secure advantageous terms from Canon. This often involves demanding competitive pricing structures, comprehensive bundled service packages, and tailored solutions to meet their specific operational needs. Winning these major contracts requires Canon to demonstrate significant value and flexibility.

- Significant Order Volumes: Large enterprises and healthcare organizations account for a substantial portion of Canon's device sales due to their bulk purchasing requirements.

- Negotiation Leverage: Their size and purchasing power enable them to negotiate favorable pricing and contract terms, putting pressure on Canon's profit margins.

- Demand for Customization: These clients often require customized solutions and bundled services, increasing the complexity and cost of meeting their demands.

- Competitive Bidding: Major contracts are often subject to competitive bidding processes, further intensifying the bargaining power of these customers.

In the consumer camera and printer markets, buyers possess considerable bargaining power. This is driven by the availability of numerous alternatives and a high degree of price sensitivity. For instance, in 2024, the global digital camera market was characterized by intense competition, with a wide array of brands and models readily accessible, making it easy for consumers to compare and switch based on price. The proliferation of online retail platforms in 2024 further amplified this power, allowing for effortless price and feature comparisons, thus compelling Canon to maintain competitive pricing and compelling product offerings.

| Factor | Impact on Canon | 2024 Data/Trend |

| Price Sensitivity | High | Consumers readily compare prices online for cameras and printers. |

| Availability of Substitutes | High | Numerous competing brands and models exist in consumer electronics. |

| Switching Costs (Consumer) | Low | Minimal costs for consumers to switch between camera or printer brands. |

| Information Availability | High | Online reviews and price comparison sites empower consumers. |

Same Document Delivered

Canon Porter's Five Forces Analysis

This preview showcases the complete Canon Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase, ensuring you get precisely what you need for strategic decision-making.

Rivalry Among Competitors

The consumer imaging sector is a battlefield where Canon faces formidable rivals such as Sony, Nikon, and Fujifilm. This intense rivalry necessitates constant product development and robust marketing campaigns to capture and retain consumer attention in a rapidly changing market.

The growing sophistication of smartphone cameras presents a significant competitive threat, forcing traditional camera manufacturers to innovate rapidly. For instance, in 2024, the global smartphone market continued its dominance, with shipments reaching hundreds of millions of units, many featuring advanced imaging capabilities that directly compete with entry-level and even mid-range dedicated cameras.

Canon operates in a fiercely competitive printing and office solutions market, contending with giants like HP, Epson, Brother, Xerox, and Ricoh. This intense rivalry is fueled by a constant battle over cost-per-page, innovative device features, the growing demand for managed print services, and increasingly important sustainability initiatives, pushing Canon to continuously innovate and carve out its unique value proposition.

Even in niche markets like semiconductor lithography or advanced medical imaging, the competition is fierce. Companies like ASML, a dominant player in lithography, face intense rivalry from established giants such as Siemens Healthineers, GE Healthcare, and Philips in the medical imaging sector. These companies heavily invest in research and development, making technological innovation the primary battleground.

Innovation and R&D as Key Differentiators

Innovation and substantial R&D investment are crucial for competitive advantage across all of Canon's business units. The company's consistent ranking in U.S. patents, often placing among the top patent assignees, underscores its commitment to technological advancement. For instance, in 2023, Canon was recognized for its significant patent filings, reflecting ongoing research into areas like advanced imaging and semiconductor manufacturing equipment.

Canon's focus on developing new products, such as its EOS R series mirrorless cameras and cutting-edge lithography technologies for semiconductor production, is vital for staying ahead. These advancements directly address evolving market demands and technological shifts. The company's investment in R&D, which historically represents a significant portion of its revenue, allows it to maintain a competitive edge by offering differentiated products and solutions.

- Canon's U.S. Patent Rankings: Consistently ranks among the top patent assignees, demonstrating a strong commitment to innovation.

- R&D Investment: Significant annual investment in research and development fuels the creation of new products and technologies.

- Product Differentiation: Focus on areas like mirrorless cameras and advanced lithography technologies provides a competitive edge.

Global Market Presence and Diversified Portfolio

Canon's extensive global reach and a remarkably diverse product lineup, encompassing everything from consumer cameras and printers to sophisticated industrial equipment and medical imaging systems, act as a significant buffer against the fierce rivalry in any one market. This broad operational scope allows Canon to absorb pressures in individual segments by drawing strength from its performance across various sectors.

The company's diversified portfolio, which includes imaging solutions, printing, and medical equipment, enables it to capitalize on technological overlaps and to offer integrated solutions to its customers. For instance, advancements in its camera sensor technology can find applications in its medical imaging devices, creating internal synergies that bolster its competitive edge.

In 2024, Canon reported total revenue of approximately ¥3.7 trillion (around $25 billion USD based on average exchange rates), showcasing the scale of its operations across these varied business areas. This financial strength, derived from its diversified business model, positions Canon favorably to withstand and compete effectively against rivals who may be more concentrated in specific product categories.

- Global Revenue: Canon's consolidated net sales for the fiscal year ending December 31, 2024, reached ¥3,734.4 billion.

- Segment Diversity: The company operates across key segments including Printing, Imaging Systems, Medical Systems, and Industrial Products.

- Cross-Selling Opportunities: Synergies between its imaging and printing divisions, for example, allow for bundled offerings and integrated solutions.

- Market Resilience: Diversification helps mitigate the impact of downturns or intense competition in any single market segment, contributing to overall stability.

Canon faces intense competition across all its business segments, from consumer imaging to industrial solutions. Rivals like Sony and Nikon in cameras, and HP and Epson in printing, constantly push innovation and pricing. Even in specialized fields like semiconductor lithography, ASML presents a significant challenge, while Siemens Healthineers and GE Healthcare compete fiercely in medical imaging.

This rivalry necessitates substantial investment in research and development, a core strength for Canon, which consistently ranks high in U.S. patent filings. For example, in 2023, Canon's commitment to R&D was evident in its significant patent activity, particularly in advanced imaging and semiconductor manufacturing technologies.

Canon's diversified business model, spanning printing, imaging systems, medical, and industrial products, provides a degree of resilience. In 2024, the company reported consolidated net sales of ¥3,734.4 billion, demonstrating its broad market presence and financial capacity to navigate competitive pressures across its varied portfolio.

| Key Competitors | Primary Market Segment | Competitive Pressure Example |

| Sony, Nikon | Consumer Imaging | Rapid innovation in mirrorless camera technology |

| HP, Epson, Brother | Printing & Office Solutions | Competition on cost-per-page and managed print services |

| ASML | Semiconductor Lithography | Dominance in EUV lithography market |

| Siemens Healthineers, GE Healthcare | Medical Imaging | Heavy R&D investment in advanced diagnostic equipment |

SSubstitutes Threaten

Smartphones have become the dominant substitute for traditional cameras, especially for casual users. Their all-in-one convenience, coupled with features like instant sharing and in-app editing, makes them incredibly appealing. For instance, in 2024, the global smartphone market shipped over 1.2 billion units, with camera capabilities being a key purchasing driver for many consumers.

While professional photographers and serious enthusiasts still rely on dedicated cameras for superior image quality, advanced controls, and specialized lenses, the gap is narrowing. The continuous improvement in smartphone sensor technology, computational photography, and AI-driven image processing means that for a vast segment of the market, the smartphone camera is more than adequate. This trend directly challenges Canon's market share, particularly in its entry-level and mid-range camera segments, as consumers increasingly opt for the device they already carry.

The growing wave of digital transformation and the increasing adoption of paperless office solutions present a significant threat of substitutes for Canon's traditional printing and scanning hardware. Cloud-based document management systems, for example, reduce the need for physical document creation and storage, directly impacting the demand for printers and multifunction devices. By mid-2024, reports indicated that over 70% of businesses were actively engaged in digital transformation projects, with a substantial portion focusing on digitizing workflows and reducing paper consumption.

The threat of substitutes in medical imaging is evolving, with artificial intelligence emerging as a significant factor. AI-driven diagnostic tools can analyze medical images with remarkable speed and accuracy, sometimes even surpassing human capabilities in detecting subtle anomalies. For example, by mid-2024, AI algorithms were demonstrating high sensitivity in identifying early signs of diabetic retinopathy from retinal scans, potentially reducing the reliance on ophthalmologists for initial screenings.

Furthermore, advancements in non-imaging diagnostic techniques also pose a threat. For instance, sophisticated blood tests and genetic sequencing are becoming more precise and accessible, offering alternative pathways for diagnosing certain conditions that might traditionally have required imaging. The increasing accuracy and cost-effectiveness of these methods can divert patients and healthcare providers away from traditional imaging modalities.

Content Creation and Video Platforms

The threat of substitutes for professional camcorders and broadcast equipment is significant, particularly from the rapidly advancing capabilities of mirrorless cameras and high-end smartphones. These devices offer increasingly sophisticated video features, making them viable alternatives for independent content creators and even some professional applications. For instance, many mirrorless cameras released in 2024 boast 8K recording capabilities and advanced autofocus systems, directly challenging the need for dedicated camcorders in certain production workflows.

Online video platforms, such as YouTube, TikTok, and Instagram, also play a crucial role in shaping the demand for content capture tools. The sheer volume of user-generated content on these platforms, often produced with more accessible equipment, normalizes the use of non-traditional video cameras. This trend encourages a wider range of creators to enter the market, further increasing the demand for versatile and often more affordable substitute technologies.

- Mirrorless Camera Market Growth: The global mirrorless camera market was valued at approximately $11.5 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, indicating a strong shift towards these versatile devices.

- Smartphone Video Capabilities: Leading smartphone manufacturers in 2024 are equipping their flagship models with advanced computational photography and videography features, including cinematic modes and improved low-light performance, directly competing with entry-level professional video gear.

- Content Creator Adoption: A significant portion of independent content creators, estimated to be over 60% by industry surveys conducted in late 2023 and early 2024, rely on mirrorless cameras or smartphones for their primary video production needs.

Software-based Solutions and Cloud Services

The increasing availability of software-based solutions and cloud services presents a significant threat of substitution for hardware-focused offerings. For instance, mobile scanning apps and online document sharing platforms can diminish the demand for traditional scanners and printers. In 2023, the global cloud computing market was valued at over $600 billion, indicating a strong shift towards digital and service-based solutions.

This trend forces companies like Canon to adapt by integrating their hardware with robust software and service components. For example, Canon's own cloud-based document management systems and integrated printing solutions aim to counter this by offering value beyond just the physical device. The continued growth in Software as a Service (SaaS) adoption, which saw an estimated 18% year-over-year increase in 2024, underscores the competitive pressure from these digital alternatives.

- Mobile scanning apps offer a low-cost alternative to dedicated scanners.

- Cloud-based collaboration tools reduce reliance on physical document sharing and printing.

- The growing SaaS market, projected to reach $326 billion in 2024, highlights the shift away from hardware dependency.

- Canon's strategy involves bundling hardware with cloud services to maintain relevance.

The threat of substitutes for traditional cameras is intensifying as smartphones offer increasingly sophisticated photographic capabilities. For many consumers, the convenience and integrated sharing features of smartphones make them a compelling alternative to dedicated cameras. By 2024, smartphone shipments exceeded 1.2 billion units, with camera performance being a key purchase driver, directly impacting entry-level and mid-range camera markets.

Similarly, the printing and scanning hardware sectors face substitution threats from digital transformation and paperless office initiatives. Cloud-based document management systems reduce the need for physical documents, impacting printer demand. Over 70% of businesses were engaged in digital transformation projects by mid-2024, focusing on digitizing workflows and reducing paper consumption.

The medical imaging field is also seeing substitutes emerge, notably through AI-driven diagnostic tools that can analyze images with high accuracy, sometimes surpassing human capabilities. Furthermore, advancements in non-imaging diagnostic techniques, like precise blood tests and genetic sequencing, offer alternative pathways for diagnosis, potentially diverting demand from traditional imaging modalities.

| Substitute Technology | Impacted Industry | Key Data Point (as of mid-2024) |

|---|---|---|

| Smartphones | Digital Cameras | Over 1.2 billion units shipped globally; camera features are a primary purchase driver. |

| Cloud Document Management & Scanning Apps | Printers & Scanners | Over 70% of businesses pursuing digital transformation to reduce paper use. |

| AI Diagnostic Tools & Advanced Blood Tests | Medical Imaging | AI algorithms showing high sensitivity in detecting early disease signs; increasing accessibility of genetic sequencing. |

Entrants Threaten

The threat of new entrants for Canon is significantly mitigated by the exceptionally high capital investment and R&D barriers present in its core markets. For instance, developing cutting-edge semiconductor lithography equipment, a key area for Canon, demands billions in research and development, alongside the construction of highly specialized manufacturing plants. In 2023, the semiconductor equipment market alone saw significant investment, with companies pouring substantial resources into innovation to stay competitive.

Canon benefits from a long-standing brand reputation and strong customer loyalty, built over decades of delivering quality and innovation. This deep-seated trust makes it difficult for newcomers to gain traction.

New entrants would face an uphill battle to build similar trust and market acceptance, especially in professional and industrial segments where reliability and performance are paramount. For instance, in 2023, Canon's imaging and printing segments continued to demonstrate robust performance, reflecting sustained customer preference.

Canon's deeply entrenched global distribution networks present a formidable hurdle for any new company aiming to enter the market. These established channels, built over decades, ensure efficient product reach and customer access, something a newcomer would struggle to replicate swiftly.

Furthermore, Canon's robust supply chain relationships, often secured through long-term contracts and integrated production sites, create a complex and costly ecosystem to penetrate. For instance, in 2023, Canon reported a consolidated revenue of approximately 3.8 trillion Japanese Yen, underscoring the scale of operations that new entrants must contend with in terms of logistics and procurement.

Intellectual Property and Proprietary Technology

Canon's extensive patent portfolio, encompassing over 50,000 active patents as of early 2024, significantly deters new entrants. These patents cover critical areas like advanced lens design, sensor technology, and printing mechanisms. Developing comparable technology would require substantial investment in research and development, potentially costing hundreds of millions of dollars, to either circumvent existing intellectual property or create truly novel solutions.

The threat of new entrants is further amplified by the sheer complexity and cost associated with replicating Canon's proprietary technologies. For instance, their advancements in optical coatings and image processing algorithms are the result of decades of focused innovation. A new player would face immense hurdles in matching this established technological depth, making market entry financially prohibitive and strategically risky without a significant technological leap.

- Canon's patent portfolio exceeds 50,000 active patents (as of early 2024).

- R&D investment to match Canon's technology could reach hundreds of millions of dollars.

- Proprietary technologies in optics, imaging, and precision engineering create high entry barriers.

- Infringement risk necessitates costly legal battles or significant R&D to develop alternatives.

Regulatory Hurdles and Industry Standards

Canon, particularly in its medical imaging and industrial equipment segments, faces significant barriers to entry due to rigorous regulatory requirements. New companies must navigate a complex web of compliance, including obtaining certifications and adhering to strict industry standards, a process that is both time-consuming and expensive.

For instance, the medical device industry, a key area for Canon, requires extensive testing and approval from bodies like the U.S. Food and Drug Administration (FDA). In 2024, the FDA continued to emphasize rigorous premarket review processes for new medical technologies, with approval timelines often extending over several years and incurring substantial costs for manufacturers.

- Regulatory Compliance Costs: Companies entering Canon's key markets must invest heavily in meeting regulatory standards, which can range from hundreds of thousands to millions of dollars depending on the product's complexity and intended use.

- Industry Standards Adherence: Meeting established industry benchmarks for quality, safety, and performance, such as ISO certifications, adds another layer of complexity and cost for potential new entrants.

- Time to Market: The lengthy approval processes for regulated products, like advanced medical imaging systems, significantly delay market entry, acting as a strong deterrent for new competitors.

The threat of new entrants for Canon is considerably low due to the massive capital requirements for research, development, and manufacturing in its core technology sectors. For example, the semiconductor equipment market demands billions in investment, and Canon's own 2023 revenue of approximately 3.8 trillion Japanese Yen highlights the immense scale new players must contend with.

Canon's established brand loyalty, extensive patent portfolio exceeding 50,000 active patents as of early 2024, and complex global distribution networks create significant barriers. Replicating their proprietary technologies in optics and imaging could cost hundreds of millions, while navigating stringent regulatory approvals, as seen with FDA processes in 2024, adds years and substantial costs to market entry.

| Barrier Type | Description | Estimated Cost/Time for New Entrant |

|---|---|---|

| Capital Investment | High R&D and manufacturing costs in areas like semiconductor lithography. | Billions of dollars. |

| Brand Loyalty & Reputation | Decades of trust in quality and performance. | Years to build comparable market acceptance. |

| Intellectual Property | Over 50,000 active patents as of early 2024. | Hundreds of millions to develop alternatives or license. |

| Distribution Networks | Established global reach and customer access. | Costly and time-consuming to replicate. |

| Regulatory Compliance | Rigorous approvals for medical and industrial equipment. | Hundreds of thousands to millions of dollars and several years. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic data. This comprehensive approach ensures a thorough understanding of the competitive landscape.