Camtek PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camtek Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Camtek's landscape. This meticulously researched PESTLE analysis provides the strategic foresight you need to anticipate market shifts and capitalize on emerging opportunities. Don't guess your next move—download the full version for actionable intelligence.

Political factors

Geopolitical trade tensions, especially between the United States and China, continue to cast a shadow over the semiconductor industry. These disputes, characterized by tariffs and export controls, directly affect companies like Camtek by potentially disrupting the flow of critical components and limiting access to key markets. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has implemented various export control measures targeting advanced semiconductor technologies, impacting global supply chains.

Such restrictions can create significant hurdles for Camtek, affecting both the import of necessary materials and the export of its inspection and metrology solutions to certain regions. This necessitates a proactive approach, pushing Camtek to explore market diversification and potentially re-evaluate its manufacturing and supply chain footprints to mitigate these risks. The ongoing nature of these trade disputes underscores the importance of strategic agility in navigating the complexities of the global semiconductor landscape.

Government subsidies and incentives are a significant political factor influencing Camtek. For instance, the US CHIPS and Science Act of 2022 allocated over $52 billion to boost domestic semiconductor manufacturing, a move mirrored by similar large-scale investments in Europe and Asia. These programs directly stimulate demand for advanced inspection and metrology solutions like those offered by Camtek, as new and expanded fabrication plants require cutting-edge equipment to ensure quality and yield.

Export control regulations, particularly for dual-use technologies, significantly shape Camtek's global sales of advanced inspection and metrology systems. These complex international laws demand strict adherence to prevent penalties and ensure continuous operations. For instance, the US Bureau of Industry and Security (BIS) regularly updates its Entity List and Commerce Control List, impacting the flow of sophisticated semiconductor manufacturing equipment. In 2024, ongoing geopolitical tensions continue to influence these regulations, requiring proactive monitoring for effective market planning.

Political Stability in Key Manufacturing Regions

Political stability in key semiconductor manufacturing regions like Taiwan, South Korea, and China directly influences Camtek's operational landscape. Instability or sudden policy changes in these hubs can disrupt supply chains and affect the demand for inspection and metrology solutions. For instance, heightened cross-strait tensions involving Taiwan, a critical semiconductor producer, present a persistent geopolitical risk.

Camtek's reliance on these manufacturing centers means that geopolitical events can directly impact its customer base and the flow of goods. Continuous assessment of geopolitical risks is therefore crucial for forecasting and strategic planning. The semiconductor industry's concentration in East Asia underscores the importance of monitoring political developments in countries like Vietnam, which is increasingly becoming a significant player in electronics assembly.

- Taiwan's semiconductor industry, led by TSMC, accounts for a substantial portion of global advanced chip manufacturing.

- South Korea, home to Samsung and SK Hynix, is another cornerstone of global semiconductor production.

- China's ambitious semiconductor development plans and its role in electronics manufacturing present both opportunities and potential political challenges.

- Southeast Asian nations, including Vietnam and Malaysia, are experiencing growth in electronics manufacturing, diversifying the geographical risk profile.

International Standards and Alliances

Camtek's operations are significantly shaped by international standards in semiconductor manufacturing. For instance, adherence to standards like those set by the International Electrotechnical Commission (IEC) ensures product quality and interoperability, which is crucial for global market access. The company's commitment to these benchmarks, which are constantly evolving with advancements in areas like advanced packaging and metrology, allows for smoother integration into global supply chains.

Technological alliances between nations, particularly in the semiconductor sector, can create both opportunities and challenges. For example, the CHIPS and Science Act in the United States, enacted in 2022, aims to bolster domestic semiconductor manufacturing through significant investment and international collaboration. Camtek, as a provider of inspection and metrology solutions, can benefit from increased R&D spending and manufacturing expansion driven by such alliances, potentially leading to higher demand for its advanced systems.

A stable and predictable international regulatory landscape is vital for Camtek. Predictability fosters investment and allows companies to plan long-term strategies. For example, trade agreements that reduce tariffs on specialized equipment, like those Camtek produces, directly impact its cost structure and competitive pricing. The company's ability to navigate and align with these international frameworks underpins its capacity for broader market acceptance and effective technological integration across different regions.

- International Standards: Camtek benefits from alignment with evolving IEC standards for semiconductor inspection and metrology, ensuring global product compatibility.

- Technological Alliances: Initiatives like the US CHIPS Act foster R&D and manufacturing growth, potentially increasing demand for Camtek's advanced inspection solutions.

- Regulatory Stability: Predictable international trade policies and reduced tariffs on specialized equipment enhance Camtek's cost competitiveness and market reach.

- Market Acceptance: Adherence to international frameworks facilitates broader adoption of Camtek's technologies, supporting seamless integration into global semiconductor production lines.

Government initiatives like the US CHIPS and Science Act of 2022, allocating over $52 billion to domestic semiconductor manufacturing, directly stimulate demand for advanced inspection and metrology solutions. This trend is mirrored globally, with significant investments in Europe and Asia, creating a favorable environment for companies like Camtek. These subsidies encourage the expansion of fabrication plants, all of which require cutting-edge equipment to ensure quality and yield.

Geopolitical trade tensions, particularly between the US and China, continue to impact the semiconductor supply chain through tariffs and export controls, potentially disrupting component flow and market access. Camtek must navigate these restrictions, which affect both material imports and equipment exports, necessitating market diversification and strategic supply chain adjustments. The ongoing nature of these disputes highlights the need for agility in the global semiconductor market.

Political stability in key semiconductor manufacturing regions, such as Taiwan and South Korea, is crucial for Camtek's operational landscape and customer base. Instability or sudden policy shifts in these hubs can disrupt supply chains and affect demand for inspection and metrology solutions, underscoring the importance of continuous geopolitical risk assessment for strategic planning.

What is included in the product

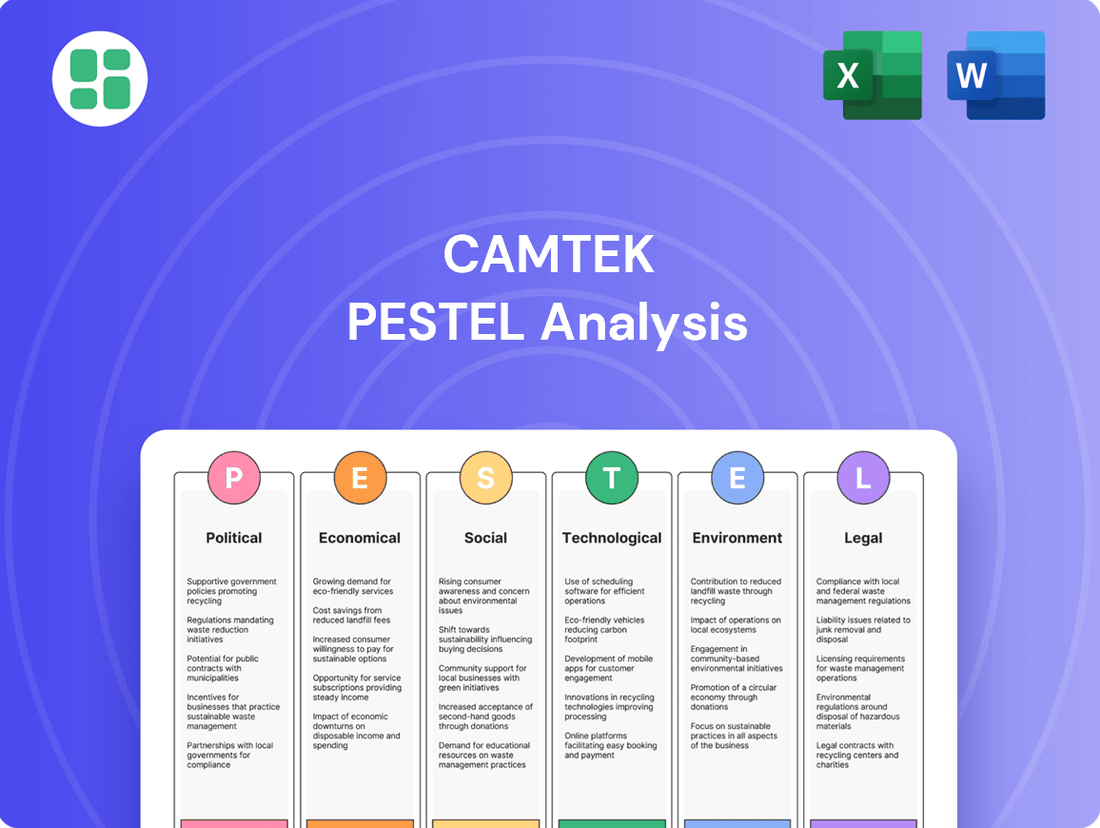

This Camtek PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making external factor analysis efficient.

Helps support discussions on external risk and market positioning during planning sessions by offering a structured overview of relevant PESTLE factors.

Economic factors

The global semiconductor market is inherently cyclical, experiencing booms and busts that directly impact companies like Camtek. For instance, the industry saw robust growth in 2021, with worldwide semiconductor revenue reaching an all-time high of $595 billion, according to the Semiconductor Industry Association (SIA).

However, this was followed by a slowdown in 2023, with the SIA reporting a 10.9% decline in revenue to $520 billion, driven by weaker demand for consumer electronics and PCs. This volatility means Camtek's sales of inspection and metrology tools, crucial for chip production, are closely tied to the capital expenditure plans of its semiconductor manufacturing clients, which tend to contract during downturns.

Forecasting these market swings is paramount for Camtek's strategic planning, influencing everything from R&D investment to inventory management. The industry is expected to rebound, with projections indicating a return to growth in 2024, potentially reaching $600 billion, though the precise timing and strength of this recovery remain subject to economic conditions and geopolitical factors.

Camtek's revenue is closely tied to the capital expenditure plans of its clients in the semiconductor, PCB, and IC substrate sectors. When these industries are optimistic about future demand, they tend to increase their spending on new equipment and capacity expansion, directly benefiting Camtek.

For instance, in 2024, the semiconductor industry is projected to see a rebound in capital spending after a dip in 2023, with some estimates suggesting a growth of over 10% driven by demand for AI chips and advanced packaging. This trend bodes well for Camtek as its inspection and metrology solutions are crucial for these advanced manufacturing processes.

Rising inflation presents a significant challenge for Camtek, as it directly impacts operational costs. For instance, the Producer Price Index (PPI) in the US, a key indicator of inflation, saw a notable increase throughout 2024, reaching 2.2% year-over-year in May 2024, up from 0.9% in January 2024. This escalation in raw material, labor, and energy prices can erode Camtek's profit margins if not effectively passed on to customers.

Concurrently, fluctuating interest rates pose another hurdle. Central banks globally, including the US Federal Reserve, have maintained elevated interest rates into 2025 to combat persistent inflation. With the Federal Funds Rate holding steady at 5.25%-5.50% as of mid-2024, borrowing becomes more expensive. This increased cost of capital can deter Camtek's customers from investing in new inspection and metrology equipment, potentially dampening demand for its products and services.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for Camtek, a global enterprise operating across multiple markets. Fluctuations in exchange rates can directly impact the cost of its products for international buyers and the repatriated value of its earnings. For example, a stronger Israeli Shekel (ILS) against currencies like the US Dollar (USD) or Euro (EUR) could make Camtek's advanced inspection solutions less competitive in those regions or diminish the Shekel-equivalent value of revenue generated abroad.

Camtek's financial reporting, as of its latest disclosures, reflects operations in various currencies, underscoring its exposure to these movements. For instance, in the first quarter of 2024, Camtek reported a significant portion of its revenue originating from international markets. A hypothetical scenario where the ILS strengthens by 5% against the USD could reduce the dollar value of sales made in ILS and decrease the ILS value of dollar-denominated profits.

To manage this inherent risk, Camtek may implement hedging strategies, such as forward contracts or currency options, to lock in exchange rates for anticipated transactions.

- Global Operations Exposure: Camtek's international sales, particularly in major markets like Asia and North America, expose it to currency fluctuations.

- Shekel Strength Impact: A stronger ILS can make Camtek's semiconductor inspection and metrology equipment more expensive for overseas customers, potentially affecting sales volume.

- Repatriation of Earnings: Currency appreciation also reduces the local currency value of profits earned in foreign markets when converted back to ILS.

- Hedging as Mitigation: The company likely employs financial instruments to hedge against adverse currency movements, aiming to stabilize its financial performance.

Global Economic Growth and Consumer Spending

Global economic expansion and consumer spending habits are pivotal for Camtek, as they directly impact the demand for its semiconductor testing and inspection solutions. A robust global economy typically translates to higher consumer spending on electronic devices, from smartphones to advanced automotive systems and data center components. This increased demand for electronics fuels the need for more semiconductor manufacturing, and consequently, for Camtek's advanced metrology and inspection equipment.

In 2024, while global economic growth is projected to moderate from previous years, the underlying demand for semiconductors remains strong, driven by AI, automotive, and IoT applications. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a figure that supports continued investment in technology. This environment is favorable for Camtek, as semiconductor manufacturers invest in advanced equipment to meet quality standards for these growing sectors.

- Global economic growth: Projected at 3.2% for 2024 by the IMF, indicating a stable, albeit moderate, environment for capital expenditure in the semiconductor industry.

- Consumer spending on electronics: Remains a key driver, with continued demand for smartphones, wearables, and smart home devices supporting semiconductor volumes.

- Automotive sector: Increased semiconductor content per vehicle, driven by electrification and advanced driver-assistance systems (ADAS), boosts demand for high-quality chips and inspection solutions.

- Data center and AI infrastructure: Significant investments in AI accelerators and cloud computing infrastructure are creating substantial demand for advanced semiconductors, benefiting inspection equipment providers like Camtek.

Global economic expansion and consumer spending habits are pivotal for Camtek, as they directly impact the demand for its semiconductor testing and inspection solutions. A robust global economy typically translates to higher consumer spending on electronic devices, from smartphones to advanced automotive systems and data center components. This increased demand for electronics fuels the need for more semiconductor manufacturing, and consequently, for Camtek's advanced metrology and inspection equipment.

In 2024, while global economic growth is projected to moderate from previous years, the underlying demand for semiconductors remains strong, driven by AI, automotive, and IoT applications. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a figure that supports continued investment in technology. This environment is favorable for Camtek, as semiconductor manufacturers invest in advanced equipment to meet quality standards for these growing sectors.

The automotive sector, in particular, is seeing increased semiconductor content per vehicle due to electrification and advanced driver-assistance systems (ADAS), which boosts demand for high-quality chips and, by extension, inspection solutions. Similarly, significant investments in AI accelerators and cloud computing infrastructure are creating substantial demand for advanced semiconductors, benefiting inspection equipment providers like Camtek.

| Economic Factor | 2024 Projection/Data | Impact on Camtek |

|---|---|---|

| Global Economic Growth | IMF: 3.2% (2024) | Supports capital expenditure in semiconductor manufacturing. |

| Consumer Spending on Electronics | Steady demand for smartphones, wearables, smart home devices. | Drives semiconductor volumes, necessitating advanced inspection. |

| Automotive Sector Growth | Increased semiconductor content per vehicle (EVs, ADAS). | Boosts demand for high-quality chips and related inspection. |

| AI and Data Center Investment | Significant investment in AI accelerators and cloud infrastructure. | Creates substantial demand for advanced semiconductors and testing. |

Full Version Awaits

Camtek PESTLE Analysis

The preview you see here is the exact Camtek PESTLE Analysis document you'll receive after purchase, offering a comprehensive overview of the factors influencing the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing you with a fully formatted and professionally structured analysis.

The content and structure shown in the preview is the same document you’ll download after payment, allowing you to immediately leverage this detailed PESTLE analysis for Camtek.

Sociological factors

The insatiable global appetite for advanced electronics, from the latest smartphones and AI hardware to the burgeoning IoT and electric vehicle markets, directly translates into a heightened demand for sophisticated semiconductor components. This surge in complexity for chips is precisely where Camtek's expertise in advanced inspection and metrology becomes critical for ensuring manufacturing quality and maximizing yield.

Consumers' ongoing desire for sleeker, more powerful, and exceptionally reliable electronic gadgets creates a powerful tailwind for companies like Camtek. For instance, the global semiconductor market is projected to reach $600 billion in 2024, with advanced nodes and specialized chips driving a significant portion of this growth, underscoring the need for precision manufacturing solutions.

The semiconductor industry, including companies like Camtek, relies heavily on a highly skilled workforce, especially in fields such as electrical engineering, software development, and advanced manufacturing. The availability of talent in specialized areas like optical engineering, artificial intelligence, and data science is paramount for Camtek's ability to innovate and maintain its operational edge. For instance, the U.S. Bureau of Labor Statistics projects a 7% growth in software developers from 2022 to 2032, indicating strong demand.

A scarcity of these specialized professionals can significantly impede Camtek's product development cycles and its capacity for expansion. This reality underscores the ongoing need for strategic investments in robust training programs and proactive recruitment initiatives to secure a competitive talent pipeline.

The societal embrace of remote work, amplified by the COVID-19 pandemic, has fundamentally reshaped how businesses operate and individuals connect. This seismic shift has dramatically accelerated digital transformation initiatives across virtually every sector, leading to an unprecedented demand for sophisticated IT infrastructure. By 2024, it's estimated that over 30% of the global workforce will be working remotely at least part-time, a significant increase from pre-pandemic levels.

This increased reliance on digital connectivity directly translates into a higher need for the components that power it. More data centers are being built, network equipment is being upgraded, and personal devices for work and communication are in constant demand. Global semiconductor sales reached a record $600 billion in 2022, a testament to this growing digital dependency, with projections indicating continued robust growth through 2025.

Camtek's role in this evolving landscape is crucial. Their advanced inspection and metrology solutions are vital for ensuring the quality and reliability of semiconductors used in these expanding digital ecosystems. As industries continue to digitize and remote work solidifies its place, the demand for high-performance, defect-free chips, which Camtek helps produce, will remain a strong driver.

Consumer Awareness of Product Quality

Consumers today are far more informed about the quality and dependability of their electronic gadgets. This means manufacturers face mounting pressure to ensure every component is perfect. For instance, a 2024 report indicated that 75% of consumers consider product reliability a top factor when purchasing electronics, up from 60% in 2022.

This increased consumer scrutiny directly benefits companies like Camtek, whose advanced inspection and metrology solutions are crucial for identifying and preventing defects. High yields and the elimination of flaws in sensitive applications are paramount, as even minor issues can lead to significant product failures and costly recalls. The demand for such precision is expected to grow by an estimated 12% annually through 2025.

Brand image is now intrinsically linked to how well a product performs over time. A reputation for quality can drive significant sales, while a single defect can severely damage consumer trust. Surveys from late 2024 revealed that 85% of consumers would switch brands after experiencing a single product defect, highlighting the critical role of quality assurance.

- Consumer demand for high-quality electronics continues to rise, with reliability being a key purchasing driver.

- Manufacturers are investing more in advanced quality control to meet these expectations and protect brand reputation.

- Camtek's inspection and metrology solutions are vital for ensuring component integrity in an increasingly demanding market.

- Product defects can have a substantial negative impact on brand loyalty and future sales.

Globalization of Talent and R&D

Camtek's ability to leverage the globalization of talent and R&D is a significant sociological factor. By attracting and retaining a diverse global workforce and establishing research and development centers in various regions, the company gains access to a wider pool of specialized skills and innovative ideas. This international approach allows Camtek to tap into varied cultural perspectives and local market insights, which are crucial for fostering innovation and maintaining a competitive edge in the global semiconductor industry.

This global strategy, however, necessitates careful navigation of differing labor laws, compensation structures, and cultural norms across its international operations. For instance, as of late 2024, companies operating in multiple countries often face complexities in harmonizing HR policies to ensure compliance and employee satisfaction. Camtek's success hinges on its capacity to effectively manage these diverse human capital elements.

- Global Talent Acquisition: Access to a broader spectrum of specialized engineering and technical expertise.

- R&D Hubs: Establishing research centers in regions with strong technological ecosystems and talent pools.

- Cultural Integration: Managing diverse workforces requires sensitivity to different cultural backgrounds and communication styles.

- Regulatory Navigation: Adhering to varying international labor laws and employment regulations.

Societal shifts towards greater environmental awareness and sustainability are increasingly influencing consumer purchasing decisions and regulatory landscapes. This growing demand for eco-friendly products and manufacturing processes puts pressure on companies like Camtek to adopt greener practices and develop solutions that minimize environmental impact. For example, by 2024, over 60% of consumers reported actively seeking out sustainable brands, a trend that extends to the supply chains of the electronics they purchase.

The semiconductor industry, in particular, faces scrutiny regarding its energy consumption and waste generation. As a result, there's a growing expectation for manufacturers to implement energy-efficient technologies and responsible waste management throughout their operations. This societal push for sustainability directly impacts the demand for advanced metrology and inspection tools that can help identify and reduce manufacturing inefficiencies, thereby contributing to a more sustainable production cycle.

Camtek's role in this evolving landscape is to provide solutions that not only ensure the quality of semiconductors but also contribute to more efficient and less wasteful manufacturing. By enabling higher yields and reducing the need for rework or scrapped components, Camtek's technology indirectly supports the industry's sustainability goals. The global market for green technology and sustainability solutions is projected to grow significantly, reaching an estimated $1.5 trillion by 2025, indicating a clear market direction.

The increasing emphasis on corporate social responsibility (CSR) means that companies are evaluated not just on their financial performance but also on their ethical and social impact. This includes fair labor practices, community engagement, and transparent operations. Camtek, like its peers, must demonstrate a commitment to CSR to maintain a positive brand image and attract investors and talent who prioritize these values. A 2024 survey indicated that 70% of investors consider CSR performance when making investment decisions.

| Sociological Factor | Impact on Camtek | Supporting Data (2024/2025) |

|---|---|---|

| Environmental Consciousness | Increased demand for sustainable manufacturing solutions; pressure to reduce waste and energy consumption. | Over 60% of consumers seek sustainable brands; green tech market projected to reach $1.5 trillion by 2025. |

| Corporate Social Responsibility (CSR) | Need for ethical operations, fair labor, and community engagement to maintain brand reputation and attract investment. | 70% of investors consider CSR performance in investment decisions. |

| Consumer Demand for Quality & Reliability | Heightened need for advanced inspection to meet consumer expectations, reducing product defects and recalls. | 75% of consumers consider reliability a top purchase factor; demand for precision expected to grow 12% annually through 2025. |

Technological factors

The relentless march of semiconductor manufacturing towards smaller feature sizes, such as 2nm and beyond, alongside innovations like 3D stacking and advanced packaging, demands exceptionally precise inspection and metrology. Camtek's success hinges on its capacity to develop solutions that can accurately identify defects and measure critical parameters in these increasingly complex structures.

The industry's move towards wafer-level packaging and heterogeneous integration, where different chip technologies are combined, introduces novel challenges for quality control. This evolution offers significant growth avenues for companies like Camtek that can provide the necessary inspection tools to ensure the reliability and performance of these integrated systems.

The manufacturing sector's embrace of AI and machine learning for defect detection, yield enhancement, and predictive maintenance is a pivotal technological shift. Camtek can integrate these advanced capabilities into its inspection systems, delivering quicker, more precise, and smarter analysis of production data.

This strategic integration allows Camtek to offer a distinct competitive advantage and boost customer operational efficiency. For instance, the global AI in manufacturing market was valued at approximately $1.5 billion in 2023 and is projected to reach over $15 billion by 2030, indicating substantial growth and adoption.

The semiconductor industry's shift towards advanced packaging like fan-out wafer-level packaging (FOWLP) and 3D ICs is a significant technological driver. These methods are essential for boosting performance and shrinking device sizes. For instance, the market for advanced packaging solutions was projected to reach $40 billion by 2024, highlighting its growing importance.

Camtek's inspection and metrology tools are crucial for enabling these sophisticated packaging techniques. The intricate nature of chiplets and 3D stacking demands extremely precise quality control, a niche where Camtek excels. This specialization positions Camtek as a vital partner for manufacturers pushing the boundaries of microelectronics.

Automation and Industry 4.0

The manufacturing sector's accelerating embrace of automation and Industry 4.0 principles, focusing on interconnected systems and real-time data, directly shapes the engineering and capabilities of Camtek's inspection solutions. Camtek's equipment is increasingly designed to integrate smoothly within highly automated production environments, delivering crucial data for the operational efficiency of smart factories.

This technological evolution highlights the growing importance of sophisticated software, data analytics, and robust connectivity within Camtek's product portfolio. For instance, the demand for predictive maintenance and yield optimization in semiconductor manufacturing, a key market for Camtek, necessitates advanced software features that leverage the data generated by their inspection systems.

- Industry 4.0 adoption: Global manufacturing investment in automation and smart factory technologies is projected to reach hundreds of billions of dollars annually by 2025, creating a significant market for integrated inspection solutions.

- Data integration: Camtek's systems must provide seamless data exchange with MES (Manufacturing Execution Systems) and other factory management software to support real-time decision-making.

- Software-centric solutions: The value proposition of inspection equipment is shifting towards the intelligence and analytical capabilities embedded in the software, rather than just the hardware.

Data Analytics and Metrology Software

Camtek's technological edge extends significantly into its data analytics and metrology software. This software is crucial for processing the vast amounts of inspection data generated, allowing customers to pinpoint issues and enhance their manufacturing yields. For instance, advanced algorithms can identify subtle trends that might otherwise go unnoticed, directly impacting process control and product quality.

The company's commitment to developing these software capabilities is a key driver of value. By focusing on areas like big data processing and sophisticated visualization tools, Camtek empowers its clients with actionable insights. This continuous innovation in software is vital for maintaining a competitive advantage in the increasingly data-driven semiconductor inspection market, especially as manufacturing complexity grows.

- Enhanced Yield Improvement: Camtek's software analyzes inspection data to identify root causes of defects, leading to tangible improvements in customer production yields.

- Process Control Sophistication: Advanced analytics enable finer control over manufacturing processes by detecting anomalies and trends in real-time.

- Big Data Integration: The ability to process and interpret large datasets is critical for uncovering complex patterns in semiconductor manufacturing.

- Visualization Tools: Intuitive data visualization helps engineers quickly understand inspection results and make informed decisions.

The ongoing miniaturization in semiconductor manufacturing, pushing towards 2nm and beyond, alongside advancements in 3D stacking and advanced packaging, necessitates incredibly precise inspection and metrology. Camtek's ability to innovate solutions for these complex structures is paramount for its success.

The industry's trend towards wafer-level packaging and heterogeneous integration, combining different chip technologies, presents new quality control challenges. This evolution creates significant growth opportunities for companies like Camtek that can provide essential inspection tools to ensure the reliability of these integrated systems.

The increasing adoption of AI and machine learning in manufacturing for defect detection and yield enhancement is a key technological shift. Camtek can integrate these advanced capabilities into its systems, offering faster, more accurate, and intelligent data analysis.

This technological integration provides Camtek with a competitive edge and improves customer efficiency. For example, the global AI in manufacturing market was valued at approximately $1.5 billion in 2023 and is projected to exceed $15 billion by 2030, indicating substantial growth.

| Technological Factor | Impact on Camtek | Supporting Data/Trend (2024/2025 Focus) |

| Miniaturization & Advanced Packaging | Requires higher precision inspection tools. | Semiconductor nodes continue to shrink; advanced packaging market projected to reach $40 billion by 2024. |

| AI & Machine Learning | Enables smarter defect detection and yield optimization. | AI in manufacturing market expected to grow significantly, reaching over $15 billion by 2030 from $1.5 billion in 2023. |

| Industry 4.0 & Automation | Drives demand for integrated, data-driven inspection solutions. | Global automation investment in manufacturing is substantial, creating a large market for smart factory technologies. |

| Data Analytics & Software | Enhances value through actionable insights and process control. | Sophisticated software is crucial for processing vast inspection data, improving yield by identifying subtle trends. |

Legal factors

Protecting Camtek's intellectual property (IP), encompassing its patents, trade secrets, and proprietary software, is absolutely critical in the fast-paced, innovation-driven semiconductor inspection industry. Strong legal frameworks are essential for safeguarding these assets, enforcing rights, and defending against any potential infringement, thereby preserving Camtek's technological edge and market standing.

In 2023, the global IP market saw significant activity, with patent filings continuing to rise, underscoring the importance of robust IP strategies. For companies like Camtek, navigating international IP laws and treaties is paramount, as these agreements dictate how patents and other proprietary information are recognized and protected across different jurisdictions, directly impacting global market access and competitive advantage.

Camtek must navigate a complex web of international trade laws and customs regulations for its high-tech inspection and metrology equipment. For instance, the imposition of tariffs, such as those seen in recent US-China trade disputes impacting electronics, can significantly alter pricing strategies and market competitiveness. Staying compliant with varying import/export requirements across its global customer base is crucial for maintaining efficient supply chains and market access.

Camtek's advanced inspection and metrology solutions must rigorously adhere to product liability and safety regulations across its global markets. This necessitates compliance with stringent electrical safety standards, machinery directives like the EU Machinery Directive, and various international certifications to guarantee the safe operation of its sophisticated equipment for all users.

Failure to meet these critical safety benchmarks can trigger severe consequences for Camtek, including expensive product recalls, significant legal liabilities from potential lawsuits, and substantial damage to its hard-earned reputation within the semiconductor industry.

Data Privacy and Cybersecurity Laws

Camtek's operations, particularly its handling of sensitive manufacturing data, are significantly impacted by evolving data privacy and cybersecurity laws. Compliance with regulations like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is paramount, requiring robust data protection frameworks. For instance, as of early 2025, global data protection fines have reached billions, underscoring the financial risks of non-compliance.

Protecting customer data and Camtek's proprietary operational information from cyber threats presents a critical legal and operational challenge. The increasing sophistication of cyberattacks means that cybersecurity measures must be continuously updated and rigorously tested to maintain compliance and safeguard sensitive information. Reports from 2024 indicate a substantial rise in manufacturing sector cyber incidents, highlighting the persistent threat landscape.

- GDPR and CCPA Compliance: Ensuring adherence to global data privacy standards for collected manufacturing data.

- Cybersecurity Investment: Maintaining and updating robust defenses against increasing cyber threats.

- Data Breach Penalties: Mitigating significant financial and reputational risks associated with data breaches.

- Regulatory Scrutiny: Navigating an environment of heightened governmental oversight on data handling practices.

Employment and Labor Laws

Operating globally, Camtek must navigate a complex web of employment and labor laws across its various international locations. This involves adhering to regulations concerning recruitment practices, employee termination procedures, workplace safety standards, minimum wage requirements, and collective bargaining agreements. For instance, in 2024, countries like Germany have stringent works council regulations that impact how companies manage workforce changes, while the US continues to see evolving state-level labor laws affecting overtime and benefits.

Compliance with these diverse legal frameworks is critical for Camtek to prevent costly disputes, foster a positive and productive work environment, and ensure uninterrupted operations. Failure to comply can lead to significant fines, legal challenges, and reputational damage, impacting the company's ability to attract and retain talent. For example, in 2023, several multinational corporations faced substantial penalties for non-compliance with local labor laws in Asia, highlighting the risks involved.

Key areas of focus for Camtek’s legal compliance in 2024-2025 include:

- Fair Hiring Practices: Ensuring recruitment processes are free from discrimination and comply with local equal opportunity laws.

- Working Conditions: Adhering to regulations on working hours, breaks, health, and safety standards, which vary significantly by region.

- Compensation and Benefits: Meeting statutory requirements for minimum wages, overtime pay, and legally mandated employee benefits.

- Employee Relations: Managing relationships with unions or works councils where applicable, and ensuring fair termination processes.

Camtek's global operations necessitate strict adherence to international trade laws and customs regulations for its advanced metrology and inspection equipment. Tariffs and import/export restrictions, such as those impacting semiconductor supply chains in 2024, can directly influence pricing and market access. Compliance with these diverse international requirements is essential for maintaining efficient global logistics and competitive positioning.

The company must also navigate product liability and safety regulations across all operating regions, ensuring its sophisticated equipment meets stringent electrical safety standards and international certifications. Failure to comply, as evidenced by significant product recall costs incurred by other tech firms in 2023, can lead to severe financial penalties and reputational damage.

Furthermore, Camtek faces increasing scrutiny under data privacy and cybersecurity laws, with global fines for breaches reaching billions by early 2025. Protecting sensitive manufacturing data and proprietary information from sophisticated cyber threats, which saw a notable increase in the manufacturing sector in 2024, requires continuous investment in robust data protection frameworks.

Employment and labor laws also present a complex legal landscape, with varying regulations on hiring, working conditions, and employee relations across different countries. In 2024, countries like Germany have particularly stringent works council regulations, impacting workforce management and highlighting the need for localized compliance strategies to avoid disputes and maintain operational stability.

Environmental factors

The semiconductor industry, including companies like Camtek, faces growing pressure to adopt sustainable manufacturing practices. This translates to designing equipment that consumes less energy and minimizes waste. For instance, by 2025, many leading semiconductor manufacturers aim to reduce their energy intensity by 10% compared to 2020 levels, directly impacting the demand for energy-efficient inspection and metrology solutions.

Camtek's operations and its customers face increasingly stringent regulations concerning electronic waste (e-waste) and manufacturing byproducts. These rules directly influence how both Camtek and its clients must handle the disposal and recycling of materials, impacting production costs and supply chain logistics.

For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive, which sets targets for collection and recycling rates, requires manufacturers like Camtek to design products with recyclability in mind and to contribute to the management of e-waste. As of 2024, WEEE compliance remains a significant operational consideration for companies selling into the EU market.

Camtek must therefore proactively address the recyclability of its inspection and measurement solutions and provide support to its customers in managing the waste streams generated from their semiconductor manufacturing processes. This includes ensuring compliance with global e-waste regulations, which are becoming more harmonized and comprehensive, with many countries updating their legislation in 2024 and 2025.

The energy consumption of semiconductor manufacturing equipment is a major environmental consideration due to the highly energy-intensive nature of chip fabrication processes. This is a critical factor for companies like Camtek, which operates within this sector.

Camtek's focus on developing and promoting energy-efficient inspection and metrology systems presents a significant competitive edge. By offering solutions that help their clients lower operational expenses and reduce their environmental footprint, Camtek can attract customers who are increasingly prioritizing sustainability.

Recent industry trends, particularly in 2024 and leading into 2025, highlight a strong demand for innovations in power management within manufacturing equipment. For instance, advancements in smart power distribution and reduced idle power draw are key areas of focus for semiconductor foundries aiming to meet their ESG (Environmental, Social, and Governance) targets.

Climate Change and Supply Chain Resilience

Climate change poses increasing risks to global supply chains, with extreme weather events like floods and droughts directly impacting the availability of critical components for manufacturing. For Camtek, this means potential disruptions to the flow of materials necessary for producing its advanced inspection and metrology solutions.

Companies are now intensely scrutinizing their supply chains for environmental vulnerabilities, a trend that will likely intensify. This heightened awareness means Camtek faces growing pressure to demonstrate the robustness of its own supply network against climate-related disruptions.

Camtek must proactively assess and build resilience into its supply chain. This involves identifying key chokepoints and developing contingency plans. For instance, a 2024 report indicated that over 60% of businesses experienced supply chain disruptions due to climate-related events in the preceding year, highlighting the urgency.

- Increased frequency of extreme weather events impacting raw material sourcing.

- Growing investor and customer demand for environmentally resilient supply chains.

- Potential for higher logistics costs due to climate-induced transportation disruptions.

- Need for diversification of suppliers and geographic sourcing to mitigate risks.

Resource Scarcity and Material Sourcing

The increasing demand for advanced electronics, a sector Camtek serves, heightens the risk of resource scarcity, especially for rare earth metals and other critical materials vital for semiconductor manufacturing. This scarcity presents both an environmental and economic hurdle, potentially impacting production costs and supply chain stability. For instance, cobalt, a key component in many batteries and electronic devices, saw prices surge by over 50% in early 2024 due to supply chain disruptions and rising demand.

Camtek must proactively address this by prioritizing responsible and sustainable material sourcing. This involves rigorous vetting of suppliers to ensure ethical and environmentally sound practices. Exploring alternative materials with more readily available supply chains or investing in recycling technologies for electronic components could significantly mitigate risks associated with material availability and reduce the overall environmental footprint.

Camtek's commitment to sustainability in material sourcing is crucial for long-term resilience.

- Supply Chain Vulnerability: Dependence on specific rare earth minerals, often sourced from limited geographic regions, creates inherent supply chain vulnerabilities.

- Price Volatility: Fluctuations in the market prices of critical raw materials directly impact manufacturing costs and profitability.

- Regulatory Pressures: Growing environmental regulations globally are likely to increase scrutiny on material sourcing and waste management.

- Innovation in Materials: The drive for sustainable sourcing may spur innovation in developing alternative, more abundant, or recycled materials for electronic components.

The semiconductor industry's environmental footprint is under increasing scrutiny, with a focus on energy efficiency and waste reduction. Camtek's solutions contribute by enabling more precise manufacturing, which can lead to fewer rejected parts and thus less material waste. For example, by 2025, many semiconductor fabs are targeting a 10% reduction in energy consumption per wafer produced, directly influencing demand for optimized equipment.

Stringent e-waste regulations, such as the EU's WEEE directive, are compelling manufacturers like Camtek to design for recyclability. This means considering the entire lifecycle of their inspection and metrology equipment, from production to end-of-life management. Compliance with these evolving global standards, which saw updates in many regions during 2024, is critical for market access.

Climate change presents tangible risks to global supply chains, impacting the availability of raw materials essential for semiconductor manufacturing. Camtek must build resilience against potential disruptions caused by extreme weather events, a trend highlighted by a 2024 report showing over 60% of businesses experienced climate-related supply chain issues in the prior year. Diversifying suppliers and geographic sourcing is becoming a necessity.

Resource scarcity, particularly for rare earth metals, poses a significant challenge for the electronics sector. The surging price of materials like cobalt, which saw over a 50% increase in early 2024, underscores the need for responsible sourcing and exploration of alternative or recycled materials. Camtek's commitment to sustainable practices in material procurement is vital for long-term operational stability.

| Environmental Factor | Impact on Camtek | Industry Trend/Data (2024-2025) |

|---|---|---|

| Energy Consumption | Demand for energy-efficient inspection tools; reduced operational costs for customers. | 10% energy intensity reduction target for semiconductor manufacturing by 2025. |

| Waste Management (E-waste) | Need for product recyclability; compliance with global regulations like WEEE. | Increased harmonization of e-waste legislation globally; ongoing updates in 2024. |

| Climate Change & Supply Chain | Risk of material sourcing disruptions; need for supply chain resilience. | Over 60% of businesses faced climate-related supply chain disruptions in 2023. |

| Resource Scarcity | Potential for increased raw material costs; need for sustainable sourcing. | Cobalt prices increased >50% in early 2024 due to supply chain issues. |

PESTLE Analysis Data Sources

Our Camtek PESTLE Analysis is built on a robust foundation of data sourced from leading market research firms, government economic reports, and reputable technology trend publications. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social shifts to provide a comprehensive view.