Camtek Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camtek Bundle

Unlock the strategic power of the Camtek BCG Matrix and see your product portfolio with newfound clarity. This insightful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, revealing their growth potential and market share. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your investments and drive business growth.

Stars

Camtek's advanced packaging inspection and metrology solutions for High-Performance Computing (HPC) and Artificial Intelligence (AI) are a clear Star in its BCG Matrix. This segment is the company's main growth engine, accounting for an impressive 65% of its revenue in 2024. The increasing complexity of chip designs, such as chiplets and High Bandwidth Memory (HBM) for AI accelerators, directly fuels the demand for these critical inspection tools.

The Eagle G5 System, introduced in September 2024, represents Camtek's latest advancement in inspection technology, specifically targeting the burgeoning advanced packaging sector. This fifth-generation system is engineered for critical applications like High-Performance Computing (HPC), CMOS Image Sensors (CIS), and Silicon Carbide (SiC), areas experiencing rapid growth and demanding higher precision.

With its enhanced wafer throughput and superior optical resolution, the Eagle G5 is positioned to address both immediate and future market needs in these high-demand segments. Camtek's strategic foresight is underscored by substantial orders already secured for 2025, indicating strong market reception and reinforcing its leadership in 2D inspection and 3D metrology for these advanced semiconductor processes.

The Hawk system, launched in February 2025, is a significant advancement for Camtek, targeting sophisticated packaging methods like hybrid bonding and chiplets, including High Bandwidth Memory (HBM).

This system excels at inspecting and conducting 3D measurements on wafers, even those featuring millions of micro bumps, a critical capability for next-generation semiconductor manufacturing.

With initial orders already surpassing $50 million for 2025, the Hawk is strategically positioned to become a leader in this high-growth, essential market segment.

HBM Inspection Solutions

HBM Inspection Solutions, a segment within Camtek's business, is capitalizing on the explosive growth of High Bandwidth Memory (HBM), largely driven by the insatiable demand from artificial intelligence applications. Camtek's advanced inspection systems are indispensable for the intricate manufacturing of HBM, especially as the industry gears up for HBM4 and HBM4e, which necessitate sophisticated hybrid bonding techniques. The company is poised for a significant increase in inspection tool orders as these technological advancements roll out, solidifying its market leadership.

The transition to next-generation HBM standards, such as HBM4, is expected to significantly boost the need for Camtek's specialized inspection solutions. This upcoming wave of innovation in memory technology directly translates into increased revenue potential for Camtek. For instance, the HBM market is projected to grow at a substantial compound annual growth rate (CAGR) in the coming years, with some estimates placing it well over 30% annually through 2027, directly benefiting companies like Camtek that provide essential manufacturing equipment.

- HBM Market Growth: The HBM market is experiencing rapid expansion, fueled by AI and high-performance computing.

- Technological Transitions: Upcoming HBM standards like HBM4 and HBM4e require advanced manufacturing processes, including hybrid bonding.

- Inspection Demand: These technological shifts are expected to drive a surge in demand for sophisticated inspection solutions.

- Camtek's Position: Camtek is strategically positioned to benefit from this increased demand, reinforcing its role as a key supplier.

Heterogeneous Integration Metrology

Camtek's solutions for Heterogeneous Integration (HI) are crucial for merging different semiconductor components into single, highly efficient packages, which is essential for advancements in AI and high-performance computing. Their capabilities in ensuring exact alignment and identifying defects within these intricate 3D structures are significantly enhanced by their acquisition of FormFactor's FRT metrology business. This strategic move positions Camtek favorably in the rapidly expanding HI market.

The demand for HI is driven by the need for more powerful and compact electronics. For instance, the global AI chip market is projected to reach hundreds of billions of dollars by the end of the decade, with HI being a key enabler. Camtek's metrology tools play a direct role in achieving the stringent quality and yield requirements for these advanced semiconductor applications.

- Market Growth: The HI market is experiencing rapid expansion, fueled by demand from AI, 5G, and advanced packaging technologies.

- Camtek's Advantage: Integration of FormFactor's FRT metrology business bolsters Camtek's offerings in precise alignment and defect detection for complex 3D structures.

- Enabling Technology: Camtek's metrology solutions are critical for ensuring the high yield and reliability needed for next-generation semiconductor devices that utilize HI.

- Competitive Edge: Their specialized metrology expertise provides a significant advantage in a market where precision and quality are paramount.

Camtek's advanced packaging inspection and metrology solutions, particularly for AI and HPC applications, are firmly positioned as Stars in its BCG Matrix. The company's revenue from these segments, reaching 65% in 2024, highlights its dominant growth trajectory. Innovations like the Eagle G5 and Hawk systems, launched in late 2024 and early 2025 respectively, are specifically designed to meet the escalating precision demands of next-generation chip technologies, including HBM and chiplets.

The Hawk system, for instance, has already secured over $50 million in orders for 2025, underscoring its strong market acceptance and future potential. Camtek's strategic focus on these high-growth areas, coupled with technological advancements, solidifies its leadership in providing essential metrology and inspection tools for the evolving semiconductor landscape.

| Product/Solution | Target Market | Launch Date | 2024 Revenue Contribution | Key Growth Driver |

|---|---|---|---|---|

| Eagle G5 System | Advanced Packaging (HPC, AI, CIS, SiC) | September 2024 | Significant contributor to 65% AI/HPC revenue | Increasing chip complexity, demand for higher precision |

| Hawk System | Advanced Packaging (Hybrid Bonding, Chiplets, HBM) | February 2025 | Projected strong growth from 2025 orders | Next-gen HBM standards (HBM4/HBM4e), hybrid bonding adoption |

| HBM Inspection Solutions | High Bandwidth Memory | Ongoing development | Integral to AI/HPC revenue | Explosive AI demand, transition to HBM4/HBM4e |

| Heterogeneous Integration (HI) Solutions | Advanced Packaging | Enhanced by FormFactor acquisition | Key enabler for AI/HPC | Need for compact, powerful electronics, stringent yield requirements |

What is included in the product

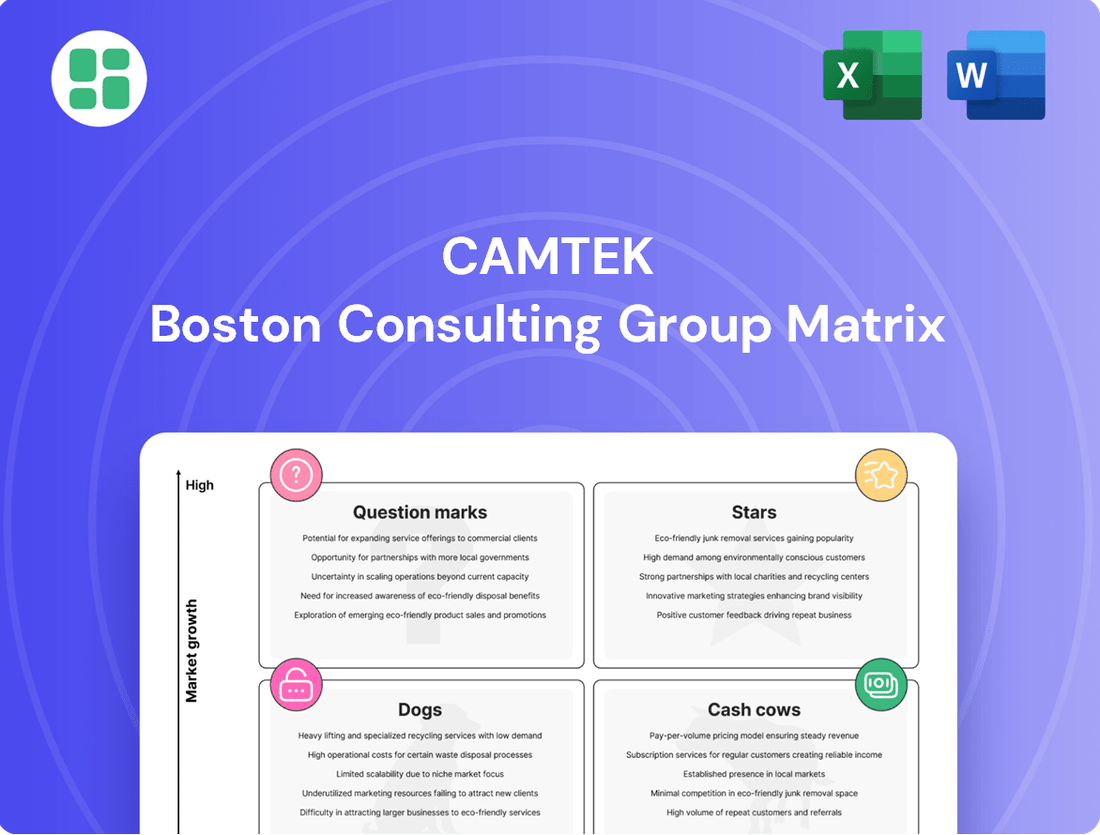

The Camtek BCG Matrix analyzes product portfolio performance by market share and growth rate.

It guides strategic decisions on investing, holding, or divesting based on Stars, Cash Cows, Question Marks, and Dogs.

Camtek's BCG Matrix offers a clear, visual snapshot of your portfolio's performance, easing the pain of complex strategic analysis.

Cash Cows

Camtek's established wafer inspection and metrology base acts as a significant cash cow within its business portfolio. The company boasts an impressive installed base exceeding 3,000 tools worldwide, supporting over 300 clients, with a substantial 70% comprised of Tier-1 manufacturers.

This vast network of deployed systems is a consistent revenue generator, driven by recurring income from service contracts, essential maintenance, and the uptake of incremental upgrades. These mature solutions, while perhaps not positioned in the most rapidly expanding market segments, reliably deliver stable and predictable cash flow for Camtek.

Camtek's General Semiconductor Inspection Equipment represents a significant cash cow, encompassing their broad range of inspection and metrology systems used in standard semiconductor manufacturing. These systems are vital for ensuring quality and efficiency across numerous established production lines, not just the most advanced ones.

This segment benefits from widespread adoption and its essential role in ongoing semiconductor production, providing a stable and reliable source of revenue and profit for Camtek. For instance, the global semiconductor equipment market was valued at approximately $100 billion in 2023, with a substantial portion dedicated to inspection and metrology tools for mature process nodes.

Camtek's CMOS Image Sensor (CIS) inspection solutions represent a significant Cash Cow within its portfolio. While the overall CIS market might be experiencing slower growth compared to emerging areas like advanced packaging for AI, Camtek has carved out a strong market share. This established presence ensures a steady and reliable revenue stream, primarily driven by the consistent demand from the mobile and automotive sectors, where CIS technology is a mature and integral component.

Automated Optical Inspection (AOI) Solutions

Camtek's Automated Optical Inspection (AOI) solutions represent a significant cash cow within their product portfolio. Their deep-rooted expertise in AOI, honed over years of operation, forms the bedrock of their market presence. These robust AOI systems are integral to semiconductor and PCB manufacturing, particularly in optimizing yield for established production lines.

These mature AOI systems consistently generate reliable revenue streams, bolstered by a strong history of performance and a loyal customer base. For instance, in 2023, Camtek reported that its AOI solutions continued to be a primary revenue driver, benefiting from the ongoing demand for quality control in high-volume manufacturing environments.

- Established Market Position: Camtek's AOI solutions have a long-standing presence in the semiconductor and PCB industries.

- Consistent Revenue Generation: These systems are critical for yield improvement, ensuring steady demand and cash flow from mature production facilities.

- Customer Loyalty: A proven track record and consistent performance foster strong customer retention for their AOI offerings.

- Focus on Mature Markets: AOI is particularly valuable in established manufacturing processes where incremental yield gains are highly prized.

Aftermarket Services and Support

Camtek's aftermarket services and support are a clear cash cow, generating substantial and consistent revenue. This segment includes essential offerings like spare parts, expert technical support, and crucial software upgrades for their wide range of installed equipment.

These services are characterized by high-profit margins and a recurring revenue model, which is vital for maintaining long-term customer relationships and maximizing the overall lifetime value of each piece of equipment sold. For instance, in 2024, the aftermarket segment is projected to contribute a significant portion of Camtek's total revenue, with estimates suggesting it could account for over 30% of their income, driven by a growing installed base.

- High Profit Margins: Aftermarket services typically boast higher profit margins compared to initial equipment sales, often ranging from 40-60%.

- Recurring Revenue: This segment provides a predictable and stable income stream, essential for financial planning and investment.

- Customer Loyalty: Excellent support and timely upgrades foster strong customer loyalty, reducing churn and increasing repeat business.

- R&D Funding: The consistent cash flow from aftermarket services directly fuels Camtek's research and development efforts, enabling innovation in their core product lines.

Camtek's established wafer inspection and metrology systems, particularly those serving mature semiconductor manufacturing processes, function as significant cash cows. These systems benefit from widespread adoption and their essential role in ongoing production, providing a stable and reliable revenue source.

The company's Automated Optical Inspection (AOI) solutions are a prime example, generating consistent revenue from their critical function in optimizing yield for established production lines. This segment is bolstered by a strong history of performance and a loyal customer base, with AOI solutions continuing to be a primary revenue driver in high-volume manufacturing environments.

Furthermore, Camtek's aftermarket services, including spare parts and technical support, represent a substantial and consistent revenue stream. This segment is characterized by high-profit margins and a recurring revenue model, projected to contribute significantly to Camtek's income in 2024.

| Segment | Role in BCG Matrix | Revenue Driver | Key Characteristics |

| Wafer Inspection & Metrology (Mature Processes) | Cash Cow | Recurring service contracts, maintenance, upgrades | Large installed base (>3,000 tools), >300 clients (70% Tier-1) |

| Automated Optical Inspection (AOI) | Cash Cow | Yield optimization in established lines, quality control | Long-standing market presence, loyal customer base |

| Aftermarket Services & Support | Cash Cow | Spare parts, technical support, software upgrades | High-profit margins (40-60%), recurring revenue model (projected >30% of 2024 income) |

Preview = Final Product

Camtek BCG Matrix

The Camtek BCG Matrix preview you are currently viewing is the identical, fully complete document you will receive immediately after your purchase. This means you can trust that the strategic insights and visual representations of Camtek's product portfolio are exactly as presented, ready for your immediate use in business planning and analysis.

Dogs

Legacy inspection systems, those older generations of Camtek's offerings that aren't easily updated for advanced packaging or high-performance computing needs, fall into the Dogs category. These systems typically cater to markets that are shrinking or barely growing, meaning they don't bring in much new business.

These older units likely contribute very little to new sales and demand a significant amount of support compared to the revenue they generate. This can tie up valuable resources that could be better used elsewhere. For instance, in the fast-paced semiconductor industry, products that can't keep up with technological advancements often become obsolete quickly.

Commoditized PCB inspection equipment, if present in Camtek's portfolio, would likely fall into the Dogs quadrant of the BCG Matrix. These are products with low market share and low growth potential, often characterized by intense price competition and minimal differentiation. For instance, basic optical inspection systems for less complex PCBs might fit this description, struggling to command premium pricing in a saturated market.

Within the semiconductor industry, certain mature or declining sub-segments, where technological progress has slowed and demand is stable or decreasing, might be considered 'Dogs' in a BCG matrix analysis. These areas typically see limited new research and development investment, primarily generating revenue through ongoing support for existing clients.

Camtek's strategic direction is firmly aimed at high-growth markets, meaning these stagnant segments are not a primary focus for expansion or significant capital allocation. For instance, while the overall semiconductor market is projected for robust growth, specific niches within older memory technologies or analog components might exhibit this 'Dog' characteristic, not aligning with Camtek's innovation-driven strategy.

Divested or Phased-Out Product Lines

Divested or phased-out product lines in Camtek's portfolio would fall into the Dogs category of the BCG Matrix. These are typically areas with low market share and minimal growth potential, often representing past investments that no longer align with the company's strategic direction. By divesting or phasing out these offerings, Camtek can free up capital and management attention for more lucrative ventures.

While specific recent divestitures aren't highlighted, Camtek's history includes managing its product lifecycle. For instance, the company has historically offered solutions for various inspection needs. As new technologies emerge and market demands shift, older product lines might become less competitive. This proactive portfolio management is crucial for maintaining financial health and reinvesting in areas like advanced semiconductor inspection, which saw significant demand in 2023 and is projected for continued growth.

- Low Market Share: Products with declining relevance or facing intense competition.

- Limited Growth Prospects: Technologies or segments where market expansion is minimal or negative.

- Resource Reallocation: Divestment allows resources to be channeled into Stars or Question Marks with higher potential returns.

- Portfolio Optimization: Eliminates cash drains and simplifies operations, enhancing overall company efficiency.

Non-Core, Low-Market Share Offerings

Non-core, low-market share offerings in Camtek's portfolio, outside of its primary semiconductor and advanced packaging segments, would fall into the 'Dogs' category of the BCG Matrix. These are typically niche applications that haven't achieved significant market penetration or growth. For instance, if Camtek explored peripheral inspection solutions for industries with very limited demand and minimal competitive advantage, these would be considered 'Dogs'.

The company's overall strong profitability, as evidenced by its robust financial performance in 2024, indicates effective resource management across its core business. This suggests that resources are not being unduly strained by these low-performing segments. Camtek's commitment to optimizing its product mix likely involves a strategic evaluation of these 'Dog' offerings to determine if they warrant continued investment or divestment.

- Peripheral Inspection: Offerings in areas like general electronics inspection that do not align with Camtek's core competencies.

- Low Market Share: Segments where Camtek holds a negligible percentage of the total addressable market.

- Stagnant Market Growth: Industries or applications experiencing minimal or no expansion, limiting potential for future gains.

- Resource Reallocation Potential: The opportunity to redirect capital and R&D efforts from these 'Dog' offerings to more promising 'Stars' or 'Cash Cows'.

Camtek's 'Dogs' represent product lines or market segments with low market share and minimal growth potential. These are typically older technologies or those in commoditized markets where competition is fierce and differentiation is difficult. For example, basic inspection systems for less advanced PCBs might fit this description, often requiring significant support relative to their revenue generation.

These offerings drain resources that could be better allocated to high-growth areas. Camtek's strategic focus on advanced semiconductor and packaging inspection means these 'Dog' segments are not a priority for expansion. The company's robust financial performance in 2024 underscores its ability to manage its portfolio effectively, likely involving a strategic evaluation of these lower-performing assets.

Divesting or phasing out these non-core, low-market share offerings is a key strategy for portfolio optimization. This allows Camtek to free up capital and management attention for more promising ventures, such as its 'Stars' or 'Question Marks' in advanced inspection technologies.

Camtek's commitment to innovation means that products unable to keep pace with technological advancements, particularly in the rapidly evolving semiconductor industry, are likely candidates for the 'Dogs' category. The company's proactive approach to product lifecycle management is crucial for maintaining competitiveness and reinvesting in areas with higher future returns.

| Camtek BCG Matrix Category | Characteristics | Example Scenario | Strategic Implication |

|---|---|---|---|

| Dogs | Low market share, low market growth | Legacy inspection systems for mature PCB markets | Divest, harvest, or minimize investment |

| High support costs relative to revenue | Commoditized inspection equipment with little differentiation | Reallocate resources to Stars or Question Marks | |

| Limited potential for future gains | Peripheral inspection solutions in niche, stagnant industries | Focus on portfolio optimization and efficiency |

Question Marks

Camtek's Hawk system currently serves the hybrid bonding market, but the transition to HBM4e and subsequent generations will necessitate more advanced inspection and metrology capabilities. The development of next-generation hybrid bonding metrology, especially for intricate wafer-to-wafer bonding and sub-micron void detection, positions these advancements as a Question Mark within Camtek's portfolio. These represent promising high-growth areas where Camtek's investment in R&D is crucial for establishing market leadership in future hybrid bonding technologies.

Camtek is actively embedding AI into its inspection systems, a move that positions it well for the future. However, the next frontier involves a much deeper integration of advanced AI and machine learning. This could encompass predictive maintenance to anticipate equipment failures, sophisticated intelligent defect classification for more nuanced quality control, and fully autonomous inspection processes that go beyond today's capabilities.

The potential for growth in this area is substantial, especially as semiconductor manufacturing processes become increasingly intricate. For instance, the global AI in manufacturing market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly. Yet, the widespread adoption of these highly advanced AI-driven solutions is still in its early stages, and Camtek's precise market share within these nascent, cutting-edge segments remains to be fully established, making it a classic Question Mark in the BCG matrix.

Glass Core Substrates (GCS) represent an emerging technology within the advanced IC substrate market, positioning them as a Question Mark in Camtek's BCG Matrix. This nascent sector holds considerable long-term growth prospects, particularly driven by the increasing demands of AI and data center applications. The market for GCS is still developing, but its potential to enable higher performance and density in integrated circuits is significant.

Camtek's strategic focus on developing specialized inspection and metrology solutions for GCS aligns with this emerging opportunity. This venture is characterized by high potential growth but currently low market share, necessitating substantial investment to establish a strong foothold and capitalize on future demand. By addressing the unique inspection challenges of GCS, Camtek aims to become a key enabler for this transformative technology.

Expansion into New Geographic Semiconductor Hubs

Camtek's expansion into new geographic semiconductor hubs, driven by global initiatives like the US CHIPS and Science Act of 2022, positions these markets as potential Question Marks within its BCG matrix. These regions, experiencing substantial government investment in local chip manufacturing, represent high-growth opportunities but necessitate considerable upfront investment in sales infrastructure, technical support, and tailored solutions to establish a significant market presence.

For instance, the European Union's European Chips Act, aiming to double its share in the global semiconductor market by 2030, signifies a major push into areas where Camtek might currently hold a limited footprint. Successfully navigating these emerging hubs requires strategic resource allocation to build local expertise and adapt offerings, mirroring the investment profile of a Question Mark seeking to capture future market share.

- Emerging Hubs: Countries like Germany, France, and Italy are actively attracting semiconductor investment, creating new geographic focal points for Camtek.

- Investment Needs: Establishing a strong presence in these new hubs demands significant capital for localized sales teams, application engineers, and potentially R&D adaptation.

- Growth Potential: The substantial government incentives and strategic importance placed on domestic chip production offer a high ceiling for market penetration and revenue growth for Camtek.

- Market Share Challenge: Camtek's current low market share in these nascent hubs underscores the Question Mark classification, highlighting the effort required to convert potential into tangible market dominance.

Early-Stage Material Characterization Technologies

Developing specialized inspection technologies for emerging materials like advanced compound semiconductors represents a high-risk, high-reward area for Camtek. These materials, crucial for next-generation electronics, require entirely new characterization methods. Camtek’s current market share in these niche, future-focused segments is likely minimal, positioning these ventures as potential Stars or Question Marks within a BCG matrix framework.

These early-stage material characterization technologies are characterized by significant R&D investment and uncertain market adoption. For instance, the market for Gallium Nitride (GaN) substrates, a key compound semiconductor, was projected to reach approximately $2.5 billion by 2027, indicating substantial growth potential but also the early stage of widespread adoption for many applications.

- High R&D Investment: Significant capital is required to develop and validate inspection tools for novel materials.

- Unproven Market Size: The ultimate demand for these specialized characterization solutions is still being established.

- Low Current Market Share: Camtek's penetration in these nascent markets is expected to be low initially.

- Potential for Disruption: Success in these areas could lead to dominant market positions in future semiconductor technologies.

Camtek's ventures into advanced AI-driven inspection and metrology for next-generation semiconductor manufacturing, such as hybrid bonding and emerging materials like Gallium Nitride (GaN), represent significant Question Marks. These areas offer high growth potential, mirroring the projected growth of the AI in manufacturing market, which was valued at approximately $1.5 billion in 2023. However, they require substantial R&D investment and face uncertain market adoption, meaning Camtek currently holds a low market share in these nascent segments.

| Area of Focus | Market Potential | Current Market Share | Investment Required | BCG Classification |

|---|---|---|---|---|

| Next-Gen Hybrid Bonding Metrology | High (driven by advanced packaging needs) | Low | High R&D | Question Mark |

| Advanced AI Integration (Predictive Maintenance, Autonomous Inspection) | High (global AI in manufacturing market projected for significant growth) | Low (in cutting-edge applications) | Significant R&D & Implementation | Question Mark |

| Glass Core Substrates (GCS) Inspection | High (driven by AI/data center demand) | Low | Moderate R&D & Market Development | Question Mark |

| Emerging Compound Semiconductor Inspection (e.g., GaN) | High (e.g., GaN substrate market projected ~$2.5B by 2027) | Very Low | Very High R&D | Question Mark |

BCG Matrix Data Sources

Our Camtek BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to accurately position each product.