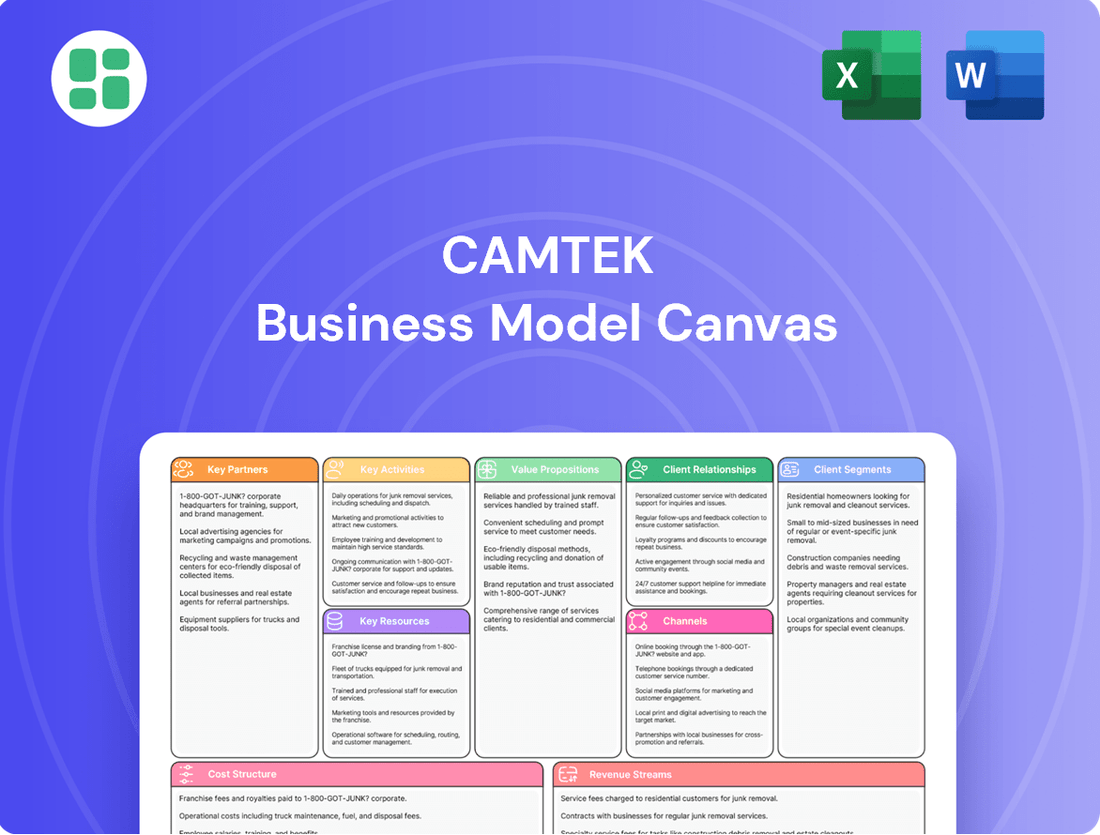

Camtek Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camtek Bundle

Unlock the strategic blueprint behind Camtek's success with our comprehensive Business Model Canvas. This detailed document breaks down how Camtek delivers value, engages customers, and manages its resources for sustained growth. Perfect for anyone seeking to understand the core mechanics of a leading tech company.

Dive deeper into Camtek's operational strategy with the full Business Model Canvas. This professionally crafted analysis reveals their key partners, revenue streams, and cost structure, offering invaluable insights for strategic planning and competitive analysis. Get the complete picture to inform your own business decisions.

See how Camtek builds and delivers value with our complete Business Model Canvas. This downloadable resource provides a clear, actionable overview of their customer relationships, key activities, and competitive advantages. Ideal for entrepreneurs and strategists looking to learn from industry leaders.

Partnerships

Camtek cultivates strategic alliances with premier global Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSAT) firms, and foundries. These collaborations are fundamental to grasping the dynamic demands of the industry, especially within advanced packaging and High-Performance Computing (HPC) sectors. For instance, in 2024, Camtek's engagement with major players in these fields directly influenced the development roadmap for their inspection and metrology tools, ensuring alignment with future technological advancements and customer requirements.

Camtek’s commitment to innovation is heavily reliant on its strategic partnerships with leading technology firms and esteemed research institutions. These collaborations are instrumental in the co-development of next-generation inspection and metrology solutions, crucial for addressing the evolving complexities of semiconductor manufacturing.

These alliances enable Camtek to push boundaries in critical areas such as hybrid bonding, micro-bump inspection, and the intricate challenges of heterogeneous integration. For instance, by working with key players in advanced packaging, Camtek ensures its offerings remain cutting-edge, directly supporting the industry's drive towards more sophisticated chip designs.

Camtek relies on specialized suppliers for critical components like high-precision optics and advanced sensors, ensuring the quality and technological edge of its inspection and metrology systems. These partnerships are vital for maintaining the performance and reliability of their offerings.

In 2023, Camtek's cost of revenue was $154.4 million, reflecting the significant investment in sourcing these high-quality components. The availability and innovation from these key software and hardware suppliers directly impact Camtek's ability to deliver cutting-edge solutions to the semiconductor industry.

Distribution and Service Network Partners

Camtek relies on a robust global network of distribution and service partners, augmented by its eight international offices, to achieve broad market penetration and deliver exceptional post-sales support. These collaborations are crucial for establishing a local footprint, fostering direct customer relationships, and ensuring prompt service delivery in vital semiconductor manufacturing hubs worldwide.

These partnerships are instrumental in reaching diverse customer segments and providing specialized technical assistance. For instance, in 2023, Camtek reported that a significant portion of its revenue was generated through its extensive partner network, underscoring their importance in market access and customer satisfaction.

- Global Reach: Eight international offices and numerous local partners ensure presence in key semiconductor manufacturing regions.

- Customer Engagement: Partners facilitate direct interaction and understanding of local market needs.

- Timely Support: Localized service networks guarantee efficient post-sales support and issue resolution.

- Market Access: Distribution partners are vital for introducing Camtek's advanced inspection and metrology solutions to new and existing customers.

Industry Consortia and Standards Bodies

Camtek actively engages with key industry consortia and standards bodies, a crucial element of its business model. This participation is vital for staying ahead of the curve in the rapidly evolving semiconductor industry. By contributing to the development of new standards, Camtek ensures its inspection and metrology solutions remain relevant and compatible with future manufacturing advancements. For instance, their involvement in organizations that define advanced packaging standards directly impacts the development of inspection tools for these complex structures.

This collaborative approach offers significant benefits. It allows Camtek to influence the direction of industry standards, ensuring their technologies are well-positioned for adoption. Furthermore, it provides early insights into emerging trends and customer needs, enabling proactive product development. In 2024, participation in such forums is more critical than ever as the industry pushes boundaries in areas like heterogeneous integration and advanced materials, where precise metrology is paramount.

- Influence on Standards: Camtek's engagement allows it to shape emerging industry standards, ensuring its technologies align with future semiconductor manufacturing needs.

- Compatibility Assurance: Participation guarantees Camtek's products remain compatible with evolving semiconductor processes and technologies, reducing integration friction for customers.

- Market Insight: Collaboration provides early access to market trends and customer requirements, driving innovation and product relevance.

- Industry Best Practices: Adherence to and contribution to best practices through these bodies reinforces Camtek's position as a leader in advanced inspection and metrology.

Camtek's key partnerships are essential for its innovation and market reach. Collaborating with IDMs, OSATs, and foundries, particularly in advanced packaging and HPC, ensures its inspection and metrology tools meet evolving industry demands. For example, in 2024, these engagements directly shaped Camtek's product development for emerging technologies.

Strategic alliances with technology leaders and research institutions facilitate the co-development of next-generation solutions, crucial for tackling complex semiconductor manufacturing challenges like micro-bump inspection. These partnerships are vital for maintaining Camtek's technological edge.

Camtek also relies on specialized suppliers for high-precision optics and advanced sensors, critical for the performance of its systems. In 2023, Camtek's cost of revenue was $154.4 million, reflecting the investment in these vital components from its suppliers.

A robust global network of distribution and service partners, supported by eight international offices, is key to Camtek's market penetration and post-sales support. These collaborations are instrumental in understanding local market needs and providing timely, specialized technical assistance, as evidenced by significant revenue generated through this network in 2023.

| Partnership Type | Key Activities | Impact on Camtek | Example/Data Point |

|---|---|---|---|

| Industry Customers (IDMs, OSATs, Foundries) | Co-development, understanding future demands | Product roadmap alignment, market relevance | Influence on tools for advanced packaging and HPC sectors (2024) |

| Technology Firms & Research Institutions | Co-development of next-gen solutions | Innovation in inspection and metrology | Pushing boundaries in hybrid bonding and heterogeneous integration |

| Specialized Component Suppliers | Supply of high-precision optics, advanced sensors | Ensuring quality and technological edge of systems | Reflected in $154.4M cost of revenue (2023) |

| Distribution & Service Partners | Market access, post-sales support | Broad market penetration, customer satisfaction | Significant revenue contribution (2023), facilitated by 8 international offices |

What is included in the product

A detailed Business Model Canvas for Camtek, outlining its core customer segments, value propositions, and channels, all grounded in its real-world operations and strategic plans.

This canvas provides a clear, structured overview of Camtek's business, ideal for internal strategy discussions and external presentations to stakeholders.

Camtek's Business Model Canvas offers a clear, structured approach to visualize and refine strategies, alleviating the pain of complex planning and communication.

It provides a single-page, easily digestible overview, removing the frustration of scattered information and enabling rapid strategic alignment.

Activities

Camtek's key activity revolves around continuous investment in Research and Development, a critical engine for its innovation in inspection and metrology systems. This dedication fuels the creation of cutting-edge platforms like the Eagle G5 and Hawk, designed to meet the evolving demands of the semiconductor industry.

The R&D focus extends to developing sophisticated algorithms, advanced optics, and physics-based solutions. These advancements are crucial for tackling the intricate challenges presented by emerging technologies such as advanced packaging, High Bandwidth Memory (HBM), and hybrid bonding, ensuring Camtek remains at the forefront of semiconductor manufacturing technology.

Camtek's manufacturing and assembly operations are central to its business, focusing on producing sophisticated inspection and metrology equipment. These high-end systems are built in specialized facilities located in Israel and Germany, underscoring the company's commitment to precision engineering and advanced manufacturing capabilities.

The process demands meticulous attention to detail, from sourcing high-quality components to the final assembly and calibration of complex machinery. This ensures that each unit meets Camtek's stringent performance and reliability standards, crucial for the demanding semiconductor and electronics industries.

In 2023, Camtek reported that its advanced manufacturing processes contributed to its revenue, which reached $277.4 million, demonstrating the commercial success of its production activities. The company's ability to consistently deliver cutting-edge equipment relies heavily on the efficiency and quality embedded within its manufacturing and assembly workflows.

Camtek actively sells and promotes its inspection and metrology solutions to key customers like Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSAT) providers, and foundries globally. This direct sales approach is vital for reaching their target markets.

Participation in major industry events such as SEMICON is a core activity, allowing Camtek to showcase its technology and connect with potential clients. These events are critical for brand visibility and lead generation in the semiconductor sector.

Strategic market positioning, especially in high-growth areas like Artificial Intelligence (AI) and High-Performance Computing (HPC), drives demand for Camtek's advanced solutions. For example, in 2023, the semiconductor industry saw significant investment in AI, creating a strong market for metrology tools that ensure wafer quality.

Customer Support and Service

Camtek's commitment to customer support is a cornerstone of its business. This involves providing comprehensive after-sales services such as installation, ongoing maintenance, crucial software upgrades, and readily available technical assistance to ensure optimal system performance.

Their robust global support network is designed to foster high levels of customer satisfaction. By ensuring maximum uptime and peak performance from their sophisticated deployed systems, Camtek builds lasting customer relationships and reinforces its market position.

- After-Sales Support: Installation, maintenance, and technical assistance are key.

- Software Upgrades: Ensuring customers benefit from the latest technological advancements.

- Global Infrastructure: A worldwide network to provide timely and effective support.

- Customer Satisfaction: Aiming for high satisfaction through reliable service and system uptime.

Software Development and Integration

Camtek's core activities revolve around the development of advanced software crucial for defect classification, data processing, metrology analysis, and the precise control of their inspection systems. This software is the intelligent engine that drives their hardware, transforming raw data into actionable insights for semiconductor manufacturers.

The company invests heavily in creating sophisticated algorithms and machine learning models to accurately identify and categorize defects, a critical step in ensuring yield and quality in semiconductor production. In 2023, Camtek reported that its software solutions contributed significantly to the value proposition of its inspection platforms, enabling customers to achieve higher throughput and better defect detection rates.

- Software Development: Creating proprietary algorithms for defect classification and metrology analysis.

- Data Processing: Building robust systems to handle and interpret vast amounts of inspection data.

- System Integration: Ensuring seamless integration of software with Camtek's hardware inspection platforms.

- AI/ML Enhancement: Continuously improving software capabilities through artificial intelligence and machine learning for smarter defect detection.

Camtek’s key activities encompass the entire lifecycle of its advanced inspection and metrology solutions. This includes significant investment in research and development to create cutting-edge hardware and software, ensuring they meet the evolving needs of the semiconductor industry, particularly in areas like advanced packaging and AI. The company also focuses on precision manufacturing and assembly, delivering high-quality, reliable systems. Furthermore, Camtek actively engages in sales and marketing, participating in industry events to showcase its technological prowess and build strong customer relationships through comprehensive after-sales support and software upgrades.

| Key Activity | Description | 2023 Relevance |

|---|---|---|

| Research & Development | Innovation in inspection and metrology systems, algorithms, optics, and physics-based solutions. | Drove the development of platforms for advanced packaging, HBM, and hybrid bonding. |

| Manufacturing & Assembly | Production of sophisticated inspection and metrology equipment in specialized facilities. | Contributed to $277.4 million in revenue, emphasizing precision and quality. |

| Sales & Marketing | Direct sales to IDMs, OSATs, and foundries; participation in industry events. | Showcased technology and generated leads in high-growth markets like AI and HPC. |

| Customer Support | After-sales services including installation, maintenance, software upgrades, and technical assistance. | Ensured customer satisfaction and system uptime, fostering long-term relationships. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered to you, ensuring complete transparency. Once your order is confirmed, you'll gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Camtek's business model relies heavily on its robust intellectual property portfolio, encompassing a significant number of patents and trade secrets. This IP covers core technologies in inspection and metrology, crucial for its semiconductor and electronics manufacturing customers. For instance, as of late 2023, Camtek held over 200 patents globally, with a substantial portion focused on advanced optical systems and sophisticated algorithms for defect detection and 3D measurement.

These proprietary technologies act as a significant competitive advantage, enabling Camtek to offer differentiated solutions in a highly technical market. Innovations in areas like advanced optical imaging and AI-driven analysis are key to maintaining product superiority. This strong IP foundation directly supports their value proposition by ensuring high-performance, reliable inspection tools that are difficult for competitors to replicate.

Camtek's highly skilled R&D and engineering talent is its bedrock. This specialized workforce, comprising engineers, scientists, and software developers, is crucial for driving the innovation behind their advanced inspection and metrology solutions. Their deep expertise spans critical areas like optics, algorithmics, physics, and semiconductor processes, enabling the development of cutting-edge technologies that meet the evolving demands of the semiconductor industry.

Camtek's advanced manufacturing facilities, strategically located in Israel and Germany, are foundational to its business model. These state-of-the-art sites are equipped for the precision manufacturing and rigorous testing of sophisticated semiconductor inspection and metrology equipment. In 2024, these facilities continued to be central to delivering the high-quality, reliable tools demanded by the semiconductor industry.

Global Sales and Service Infrastructure

Camtek’s global sales and service infrastructure, featuring eight international offices and a dedicated customer support team, is a cornerstone of its business model. This extensive network ensures direct engagement with a worldwide clientele, offering tailored support and service. For instance, in 2023, Camtek reported a significant portion of its revenue originating from international markets, underscoring the importance of this global reach.

This robust infrastructure facilitates localized service and support, crucial for maintaining strong customer relationships in diverse geographical regions. By having a physical presence and expert teams in key markets, Camtek can quickly address customer needs and provide efficient technical assistance.

- Global Presence: Eight international offices strategically located to serve key markets.

- Customer Engagement: Direct interaction with a diverse customer base, fostering strong relationships.

- Localized Support: Providing region-specific service and technical assistance.

- Revenue Contribution: International sales formed a substantial part of Camtek's overall revenue in 2023.

Financial Capital and Cash Reserves

Camtek's substantial financial capital, notably its robust cash and equivalents position, serves as a critical resource. As of the second quarter of 2025, the company reported over $540 million in cash and equivalents.

- Financial Strength: Over $540 million in cash and equivalents as of Q2 2025 provides significant financial flexibility.

- Investment Support: This capital underpins ongoing research and development initiatives, crucial for technological advancement.

- Strategic Growth: It also facilitates potential strategic acquisitions and supports operational expansion plans.

- Stability and Future: Ultimately, this financial bedrock ensures Camtek's stability and fuels its future growth trajectory.

Camtek's key resources include its substantial intellectual property portfolio, a highly skilled R&D team, advanced manufacturing facilities, a global sales and service network, and strong financial capital. These elements collectively enable the company to deliver high-performance inspection and metrology solutions to the semiconductor and electronics industries.

The company's intellectual property, comprising over 200 global patents as of late 2023, is central to its competitive edge. This IP, coupled with the expertise of its engineering talent and the capabilities of its manufacturing sites in Israel and Germany, ensures the development and production of cutting-edge technologies. Furthermore, Camtek's global infrastructure and over $540 million in cash and equivalents as of Q2 2025 provide the necessary reach and financial stability for continued innovation and market leadership.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Intellectual Property | Patents, Trade Secrets | Differentiates solutions, creates barriers to entry. Over 200 patents globally (late 2023). |

| Human Capital | Skilled R&D and Engineering Talent | Drives innovation in optics, algorithms, and semiconductor processes. |

| Physical Assets | Advanced Manufacturing Facilities (Israel, Germany) | Enables precision manufacturing and rigorous testing of sophisticated equipment. |

| Infrastructure | Global Sales and Service Network (8 international offices) | Facilitates direct customer engagement and localized support, crucial for international revenue. |

| Financial Capital | Cash and Equivalents (>$540 million as of Q2 2025) | Supports R&D, strategic growth, and operational stability. |

Value Propositions

Camtek's advanced inspection and metrology solutions are designed to boost production yields. By pinpointing defects and measuring critical dimensions with exceptional accuracy, manufacturers can significantly reduce scrap rates and improve overall output quality. This precision directly translates to more efficient production lines, as less time is spent on rework or dealing with faulty components.

For semiconductor manufacturers, this means a tangible increase in the number of good chips produced per wafer. In 2024, the demand for higher yields remains a paramount concern, and Camtek's technology addresses this by providing the detailed data needed to optimize processes. For instance, their systems can identify subtle anomalies that might otherwise go unnoticed, preventing larger losses down the line.

Camtek's value proposition centers on delivering exceptional accuracy and unwavering reliability for inspecting and measuring critical features on wafers. This precision is paramount for advanced microelectronic fabrication processes.

For demanding applications such as advanced packaging, High Bandwidth Memory (HBM), and hybrid bonding, their systems consistently perform, meeting the rigorous standards required for next-generation semiconductor manufacturing. This ensures that manufacturers can push the boundaries of microchip technology with confidence.

In 2024, the semiconductor industry continued its rapid evolution, with advanced packaging and HBM technologies seeing significant investment and development. Camtek's commitment to precision directly supports these growth areas, enabling the production of more powerful and efficient electronic devices.

Camtek's inspection and metrology solutions are crucial for the advanced packaging demands of the burgeoning AI and HPC markets. These sectors rely on highly intricate semiconductor components where precision is paramount.

By providing the necessary quality control, Camtek directly supports the production of chips powering these transformative technologies. This focus on critical segments like AI and HPC is a significant driver of Camtek's revenue growth, with the AI chip market alone projected to reach hundreds of billions by 2030.

Reduced Cost of Ownership

Camtek's value proposition centers on significantly lowering the total cost of ownership for its customers. By providing highly reliable inspection systems that boost throughput and precision, they enable clients to maximize their capital expenditure. This directly translates into reduced operational expenses through minimized scrap, less rework, and less downtime, ultimately enhancing overall efficiency.

The impact of these efficiencies is substantial. For instance, in the semiconductor industry, where precision is paramount, reducing even a fraction of a percent in scrap can lead to millions in savings. Camtek's systems are designed to achieve this by offering superior detection capabilities, which in turn lowers the need for manual intervention and costly re-inspections.

- Enhanced System Reliability: Camtek's robust engineering minimizes unexpected failures, reducing costly emergency repairs and service calls.

- Increased Throughput: Faster inspection cycles mean more units processed per hour, directly improving labor efficiency and output volume.

- Reduced Material Waste: Higher precision in defect detection leads to a significant decrease in scrap and rework, saving on raw material costs.

- Minimized Downtime: Reliable operation and proactive maintenance support keep production lines running, avoiding lost revenue due to unexpected stoppages.

Future-Proofing Through Continuous Innovation

Camtek's value proposition centers on future-proofing its customers through relentless innovation. By consistently releasing advanced systems like the Eagle G5 and Hawk, Camtek ensures clients have access to cutting-edge technology that meets immediate market needs and aligns with future industry trajectories. This proactive approach allows customers to navigate evolving technological landscapes with confidence, maintaining a competitive edge.

This dedication to advancement translates into tangible benefits for users. For instance, Camtek's commitment to R&D, which represented a significant portion of its operating expenses in recent years, directly fuels the development of solutions that enhance efficiency and yield in semiconductor manufacturing. In 2023, Camtek reported robust revenue growth, underscoring the market's positive reception to its innovative product pipeline.

- Continuous Product Development: Introduction of new inspection and metrology platforms.

- Adaptability to Market Needs: Systems designed to address evolving semiconductor manufacturing challenges.

- Future-Ready Solutions: Enabling customers to stay ahead of technological roadmaps and industry standards.

- Investment in R&D: A core strategy to maintain technological leadership and customer value.

Camtek's core value lies in its ability to significantly enhance production yields and reduce manufacturing costs for its clients, particularly in the demanding semiconductor industry. By providing highly accurate inspection and metrology solutions, Camtek helps customers minimize scrap, improve throughput, and ultimately lower their total cost of ownership.

Their advanced systems are critical for manufacturers aiming to increase the number of good chips produced per wafer, a key metric in 2024. This precision directly supports the production of complex components for high-growth sectors like AI and High Bandwidth Memory (HBM), ensuring quality and efficiency in next-generation electronics.

Camtek's commitment to continuous innovation ensures customers receive cutting-edge technology that addresses current needs and anticipates future industry trends. This proactive approach allows clients to maintain a competitive edge and confidently navigate the rapidly evolving technological landscape.

| Value Proposition | Key Benefit | Customer Impact | 2024 Relevance |

|---|---|---|---|

| Boost Production Yields | Reduced scrap rates, higher output quality | Increased profitability, efficient resource utilization | Crucial for meeting demand in AI, HPC, and advanced packaging |

| Lower Total Cost of Ownership | Minimized rework, less downtime, maximized CAPEX | Significant operational savings, improved ROI | Essential for cost-sensitive manufacturing environments |

| Future-Proofing through Innovation | Access to cutting-edge technology, adaptability | Maintained competitive edge, readiness for future tech | Supports adoption of new standards like advanced packaging and HBM |

Customer Relationships

Camtek offers dedicated, professional technical support and service teams worldwide. These experts assist customers with equipment installation, troubleshooting, and performance optimization, ensuring their complex systems operate at peak efficiency and minimize downtime.

Camtek actively partners with its customers, diving deep into their unique production hurdles. This close engagement allows for the creation of highly specific inspection solutions, ensuring optimal performance for each client's manufacturing process.

A prime example of this collaborative approach is evident in Camtek's work with leading semiconductor manufacturers. In 2023, the company reported that a significant portion of its revenue stemmed from customized solutions developed in direct response to customer feedback and evolving industry needs, highlighting the success of this strategy.

Camtek prioritizes cultivating deep, long-term partnerships over fleeting transactions. This strategy is clearly reflected in their consistent repeat order rates and ongoing customer engagement, demonstrating a commitment to mutual growth within the semiconductor industry.

This focus on enduring relationships builds significant trust, a cornerstone for sustained collaboration. For instance, in 2023, Camtek reported a substantial portion of its revenue stemming from existing customers, highlighting the success of its partnership-driven model.

Training and Knowledge Transfer

Camtek invests significantly in comprehensive training programs designed to equip customer personnel with the skills needed for optimal system operation, routine maintenance, and advanced application techniques. This focus on knowledge transfer ensures customers can maximize the value derived from their Camtek equipment.

For instance, in 2023, Camtek reported that its customer support and training initiatives contributed to a higher percentage of repeat business and expanded service contracts, reflecting the tangible benefits customers experienced. This commitment aims to foster a deeper understanding and proficiency, leading to greater customer success and loyalty.

- System Operation Proficiency: Detailed training ensures customers can efficiently operate Camtek's inspection and metrology solutions.

- Maintenance Expertise: Empowering customers with maintenance knowledge reduces downtime and prolongs equipment lifespan.

- Advanced Application Techniques: Training on advanced features allows customers to unlock the full potential of their systems for complex challenges.

- Customer Success: This knowledge transfer directly translates to improved process yields and enhanced product quality for our clients.

Regular Communication and Updates

Camtek prioritizes keeping its customers and stakeholders in the loop. This involves direct communication channels, a dedicated investor relations team, and regular news updates. For instance, in 2024, Camtek actively engaged with investors through quarterly earnings calls and investor conferences.

This consistent flow of information ensures everyone is aware of new product launches, significant technological advancements, and the company's overall financial performance. Transparency is key to fostering trust and long-term loyalty.

- Direct Communication: Maintaining open dialogue through various channels.

- Investor Relations: Providing timely information to shareholders and the financial community.

- News Updates: Announcing product developments, technological breakthroughs, and company performance.

- Transparency: Building confidence and loyalty through open and honest communication.

Camtek fosters deep, collaborative relationships by offering dedicated technical support and customized solutions tailored to specific customer production challenges. This partnership approach, evident in their work with semiconductor manufacturers, emphasizes long-term engagement and mutual growth, leading to significant repeat business. For example, in 2023, a substantial portion of Camtek's revenue was driven by these customized solutions and ongoing customer partnerships.

Camtek invests in comprehensive customer training programs, equipping clients with the skills for optimal system operation, maintenance, and advanced applications. This knowledge transfer directly enhances customer success by improving process yields and product quality, as seen in their 2023 results where training initiatives contributed to higher repeat business and expanded service contracts.

The company maintains transparency through direct communication channels and a dedicated investor relations team, ensuring stakeholders are informed about product launches and technological advancements. This commitment to open communication builds trust and loyalty, as demonstrated by Camtek's active engagement with investors through quarterly calls and conferences in 2024.

Channels

Camtek leverages a dedicated direct sales force, operating from its worldwide offices, to directly connect with leading semiconductor manufacturers. This approach facilitates in-depth technical conversations and the delivery of customized solutions.

In 2024, this direct engagement model was crucial as Camtek continued to innovate in inspection and metrology solutions for advanced chip production. Their sales teams are equipped to handle complex customer needs, fostering strong relationships within the industry.

Camtek's global network of eight offices, strategically located in key semiconductor hubs across Asia, Europe, and the United States, ensures a robust local presence. This extensive reach facilitates direct sales, provides responsive customer support, and enables deeper strategic engagement within critical markets.

These regional offices act as vital conduits, connecting Camtek directly with its customer base and partners. In 2024, this localized approach was instrumental in navigating diverse market dynamics and fostering strong client relationships, contributing to the company's continued growth in the semiconductor inspection and metrology sector.

Industry trade shows and conferences are vital touchpoints for Camtek. Participating in events like SEMICON Taiwan and SEMICON Korea allows for direct engagement with the semiconductor community. These platforms are ideal for unveiling new technologies and demonstrating the capabilities of their inspection and metrology solutions.

These gatherings provide Camtek with invaluable opportunities to connect with both prospective and established clients, fostering relationships and gathering market intelligence. For instance, SEMICON West 2024 saw significant industry attendance, highlighting the importance of these events for showcasing advancements in semiconductor manufacturing equipment.

Online Presence and Digital Platforms

Camtek utilizes its corporate website and dedicated investor relations portals as primary channels for communication. These digital platforms serve as central hubs for sharing crucial company information, detailed product specifications, financial reports, and timely news updates. They ensure that customers, investors, and industry analysts have readily available access to essential resources.

These online presences are vital for transparency and engagement. For instance, in 2024, Camtek's investor relations website would have provided access to their latest quarterly earnings reports, analyst calls, and corporate governance documents, facilitating informed decision-making for stakeholders. The website also showcases their advanced inspection and metrology solutions, offering detailed insights into their technological capabilities.

- Corporate Website: Primary source for product information, company news, and career opportunities.

- Investor Relations Portal: Dedicated section for financial filings, shareholder information, and investor presentations.

- Digital Reach: Facilitates global access to information for customers, investors, and analysts alike.

Strategic Customer Engagements

Camtek's strategic customer engagements are crucial for securing significant business. These aren't just about standard sales; they involve deep dives with top-tier manufacturers and major clients. This direct interaction is key to landing large orders and establishing partnerships for extended projects.

These high-level discussions often include detailed technical exchanges and hands-on demonstrations at the customer's site. For instance, in 2024, Camtek reported that a substantial portion of its revenue was driven by these key account relationships, highlighting the impact of such strategic outreach.

- Direct Engagement: Facilitates understanding of specific customer needs and technical requirements.

- Large Orders: These engagements are designed to secure high-value, multi-unit sales.

- Long-Term Collaboration: Builds trust and opens doors for ongoing project partnerships and R&D alignment.

- Technical Expertise: Showcases Camtek's advanced solutions through on-site demonstrations and tailored discussions.

Camtek's channels primarily consist of its direct sales force, global offices, industry events, and digital platforms. This multi-faceted approach ensures broad market reach and deep customer engagement.

The direct sales force, supported by a network of eight global offices in key semiconductor hubs, allows for personalized technical discussions and the delivery of tailored inspection and metrology solutions. In 2024, this direct engagement was vital for addressing the evolving needs of semiconductor manufacturers.

Participation in industry trade shows and conferences, such as SEMICON events, provides platforms for showcasing new technologies and connecting with clients, while the corporate website and investor relations portal offer accessible information for all stakeholders.

These channels collectively enable Camtek to build strong relationships, secure significant orders through strategic customer engagements, and maintain a transparent flow of information, all contributing to its position in the advanced chip production market.

Customer Segments

Camtek’s primary customer base consists of leading Integrated Device Manufacturers (IDMs) that handle the entire semiconductor lifecycle from design to sales. These giants in the industry, such as Intel and Samsung, rely heavily on Camtek’s advanced solutions.

These IDMs operate highly complex, vertically integrated manufacturing facilities. They demand meticulous, high-precision inspection and metrology tools to ensure quality and yield at every stage of their intricate production lines. For instance, in 2024, the semiconductor industry saw significant investment in advanced manufacturing, with IDMs at the forefront, driving the need for Camtek's specialized equipment.

Outsourced Semiconductor Assembly and Test (OSAT) companies represent a crucial customer segment for Camtek. These firms are the backbone of the semiconductor supply chain, handling the intricate processes of packaging and testing chips after they are manufactured.

The demand from OSATs is particularly robust due to the escalating complexity of advanced packaging techniques. This is especially true for chips designed for high-performance computing (HPC) and artificial intelligence (AI), which require more sophisticated and precise assembly and testing solutions.

In 2024, the global OSAT market was projected to reach approximately $45 billion, highlighting the significant scale of this segment. Camtek's inspection and metrology solutions are vital for OSATs to ensure the quality and reliability of these advanced packages, directly contributing to their ability to meet the stringent demands of leading-edge semiconductor applications.

Semiconductor foundries are a core customer segment for Camtek, relying on its advanced inspection and metrology equipment to maintain high quality and yield in the complex process of integrated circuit manufacturing. These foundries produce chips for a vast array of clients, necessitating versatile solutions that can handle diverse chip designs and manufacturing processes.

In 2024, the global semiconductor foundry market continued its robust growth, projected to reach over $130 billion, highlighting the critical need for the precision and reliability Camtek's systems provide. Foundries must ensure every wafer meets stringent specifications, directly impacting the performance and reliability of the final electronic devices.

Advanced Packaging Applications

This customer segment is crucial for manufacturers pushing the boundaries of semiconductor packaging. We're talking about companies deep into advanced technologies like chiplets, 3D integrated circuits (ICs), heterogeneous integration, and the increasingly important hybrid bonding. These are the innovators creating the next generation of powerful chips.

This area represents a significant growth engine for the semiconductor industry, especially as demand for AI and High-Performance Computing (HPC) components continues to surge. For instance, the global advanced packaging market was projected to reach approximately $50 billion in 2024, with a compound annual growth rate (CAGR) of over 7% expected through 2030. This growth is directly fueled by the need for more sophisticated packaging solutions to handle the increasing complexity and performance requirements of these advanced applications.

- Target Market Focus: Manufacturers specializing in chiplets, 3D ICs, heterogeneous integration, and hybrid bonding.

- Key Growth Driver: Essential for enabling advanced AI and HPC components.

- Market Trend: The advanced packaging market is a primary growth avenue, with significant investment and innovation occurring within this space.

- Industry Impact: These manufacturers are at the forefront of semiconductor innovation, driving the demand for cutting-edge inspection and metrology solutions.

High-Performance Computing (HPC) and Memory (HBM) Manufacturers

Camtek’s High-Performance Computing (HPC) and Memory (HBM) Manufacturers customer segment is vital. These clients produce chips essential for demanding applications like artificial intelligence (AI) and advanced data processing. The complexity and density of these chips necessitate extremely precise inspection and metrology solutions.

This segment is driven by the exponential growth in AI and data center infrastructure. For instance, the global AI chip market was valued at approximately $20 billion in 2023 and is projected to reach over $200 billion by 2030, highlighting the immense demand for HPC components. HBM, in particular, is critical for AI accelerators, with demand surging as models become more complex.

- Critical Performance Needs: HPC and AI chips demand sub-micron accuracy in inspection to ensure optimal functionality and prevent costly failures.

- High Density Requirements: HBM stacks multiple DRAM dies, creating intricate 3D structures that require advanced metrology to verify layer alignment and integrity.

- Market Growth Drivers: The insatiable appetite for AI training and inference, coupled with the expansion of cloud computing and edge AI, directly fuels the demand for these advanced semiconductor products.

- Quality Assurance Imperative: Given the high stakes of performance and the cost of chip failure in HPC applications, manufacturers prioritize cutting-edge inspection technologies to guarantee yield and reliability.

Camtek serves a diverse range of semiconductor manufacturers, including Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSAT) companies, and foundries. These customers require advanced inspection and metrology solutions to ensure quality and yield across complex production processes.

The company also targets manufacturers specializing in cutting-edge areas like chiplets, 3D ICs, and heterogeneous integration, crucial for the booming AI and High-Performance Computing (HPC) markets. This segment is driven by the increasing complexity of semiconductor packaging and the demand for higher performance chips.

Camtek's solutions are also vital for High-Performance Computing (HPC) and Memory (HBM) manufacturers, who produce chips essential for AI and advanced data processing. The sub-micron accuracy required for these high-density, high-performance components underscores the critical role of Camtek's technology.

| Customer Segment | Key Needs | 2024 Market Relevance |

| IDMs | High-precision inspection for entire lifecycle | Leading investment in advanced manufacturing |

| OSATs | Quality assurance for complex packaging | Global OSAT market projected ~$45 billion |

| Foundries | Maintaining quality and yield in IC manufacturing | Global foundry market projected >$130 billion |

| Advanced Packaging Specialists | Enabling chiplets, 3D ICs, hybrid bonding | Advanced packaging market projected ~$50 billion |

| HPC & HBM Manufacturers | Sub-micron accuracy for AI/data processing chips | Global AI chip market projected >$200 billion by 2030 |

Cost Structure

Camtek's cost structure heavily features Research and Development Expenses, reflecting a significant commitment to innovation. In 2023, R&D spending represented a substantial portion of their operational costs, crucial for developing advanced inspection and metrology solutions.

These expenses encompass salaries for highly skilled engineers and scientists, the procurement of materials for creating and testing prototypes, and the ongoing costs associated with protecting intellectual property. This investment is fundamental to Camtek's strategy of staying at the forefront of technological advancements in the semiconductor and electronics industries, enabling them to introduce new and improved products to the market.

Camtek's Cost of Goods Sold (COGS) is primarily driven by manufacturing expenses. This includes the cost of essential raw materials and components needed for their inspection and measurement solutions. Labor involved in the production process and factory overhead, such as utilities and facility maintenance, also contribute significantly to COGS.

Depreciation of their specialized manufacturing equipment forms another key component of COGS. Historically, inventory write-ups stemming from past acquisitions have also impacted this cost category, reflecting the accounting treatment of acquired assets.

For instance, in the first quarter of 2024, Camtek reported COGS of $36.8 million. This figure represents a notable portion of their overall expenses, underscoring the importance of efficient manufacturing operations.

Camtek's sales and marketing expenses are substantial, reflecting its global reach and competitive industry. These costs encompass a worldwide sales force, extensive marketing campaigns, and participation in key industry trade shows. Maintaining a presence in regional offices also adds to this significant operational expenditure.

The financial outlay includes salaries, performance-based commissions for the sales team, and considerable travel expenses incurred by personnel covering international markets. For instance, in 2023, Camtek reported sales and marketing expenses of approximately $53.1 million, a notable increase from $43.6 million in 2022, indicating continued investment in market penetration and customer engagement.

General and Administrative Expenses

General and Administrative (G&A) expenses are the backbone of Camtek's operational support, encompassing costs essential for the company's overall functioning. These include executive compensation, salaries for administrative personnel, legal and accounting services, and the maintenance of IT infrastructure. These are the costs that keep the business running smoothly behind the scenes.

For Camtek, these overhead costs are critical for maintaining corporate governance and supporting its global operations. In 2023, G&A expenses represented a portion of their overall operating costs, reflecting investments in talent and essential corporate services. These expenditures are vital for ensuring compliance, managing risk, and facilitating strategic decision-making across the organization.

- Executive and Management Salaries: Compensation for leadership driving Camtek's strategy.

- Administrative Staff Costs: Salaries for HR, finance, and support personnel.

- Legal and Professional Fees: Costs associated with legal counsel, audits, and consulting.

- IT Infrastructure and Support: Expenses for software, hardware, and network maintenance.

Shipping and Logistics Costs

Shipping and logistics represent a significant expense for Camtek, especially given its worldwide operations and customer reach. The cost of transporting its advanced inspection and metrology solutions globally, from manufacturing facilities to diverse client sites, is a direct reflection of its international footprint.

Geopolitical shifts and global supply chain disruptions, which have been prevalent in recent years, can directly influence these costs. For instance, increased fuel prices or trade barriers can add to the overall expense of moving goods. Camtek's ability to manage these fluctuating costs is crucial for maintaining profitability.

- Global Shipping Network: Camtek ships its sophisticated equipment to customers across North America, Europe, and Asia, necessitating a robust and cost-efficient logistics network.

- Supply Chain Volatility: Recent years have seen increased shipping rates and transit times due to global events, impacting the predictability and cost of logistics.

- Inventory Management: Efficient inventory management and strategic warehousing are vital to mitigate the impact of these shipping costs and ensure timely delivery to customers.

Camtek's cost structure is dominated by Research and Development (R&D) and Cost of Goods Sold (COGS), reflecting its focus on innovation and manufacturing. In 2023, R&D was a significant investment, while COGS, driven by materials and labor, also represented a substantial expense. Sales, marketing, and general administrative costs further contribute to the overall operational expenditure.

| Cost Category | 2023 Expense (Millions USD) | Key Drivers |

|---|---|---|

| Research & Development | Not explicitly detailed as a standalone figure, but a significant portion of operating expenses. | Salaries for engineers, prototype materials, IP protection. |

| Cost of Goods Sold (COGS) | $151.3 (approximate, based on reported gross profit) | Raw materials, components, manufacturing labor, factory overhead, depreciation. |

| Sales & Marketing | $53.1 | Global sales force, marketing campaigns, trade shows, travel. |

| General & Administrative (G&A) | Not explicitly detailed as a standalone figure, but essential for operations. | Executive compensation, administrative staff, legal, IT infrastructure. |

| Shipping & Logistics | Variable, influenced by global supply chain conditions. | Global transportation, warehousing, supply chain volatility. |

Revenue Streams

Camtek's main income source is the direct sale of its advanced inspection and metrology systems, including popular models like the Eagle and Hawk. These sophisticated machines are crucial for semiconductor makers who need to ensure the quality and boost the output of their chips.

In 2023, Camtek reported that its inspection and metrology equipment sales generated a significant portion of its revenue, reflecting the ongoing need for precision in semiconductor manufacturing. For instance, the company's strong performance in the semiconductor equipment market in 2024 is a testament to the demand for its quality control solutions.

Camtek generates revenue through a robust after-sales service model. This includes offering maintenance contracts, supplying spare parts, performing necessary repairs, and providing ongoing technical support for their inspection and metrology solutions.

These services are vital for ensuring customer satisfaction and maximizing the operational uptime of Camtek's sophisticated equipment. For instance, in 2023, Camtek reported that its Software and Services segment, which encompasses these offerings, contributed significantly to its overall financial performance.

This recurring revenue stream is a cornerstone of Camtek's business, fostering customer loyalty and providing a predictable income base that helps offset the cyclical nature of capital equipment sales.

Camtek generates revenue through the sale of software upgrades and new modules, which enhance the capabilities of its inspection and metrology solutions. This also includes recurring revenue from software licenses for advanced analytical tools, ensuring customers can leverage the full potential of their installed equipment base and access ongoing innovation.

System Upgrades and Retrofits

Camtek generates revenue through system upgrades and retrofits, enabling customers to improve the performance of their existing equipment or adapt to evolving technological needs. This approach offers a cost-effective alternative to purchasing entirely new systems, extending the lifecycle of their investments.

These services are crucial for maintaining a competitive edge in rapidly advancing industries. For instance, in the semiconductor inspection market, where technology evolves quickly, such upgrades ensure that manufacturing processes remain efficient and compliant with the latest standards.

- Enhanced Performance: Customers can boost processing speeds or improve accuracy.

- Technological Adaptation: Systems can be modified to support new materials or inspection requirements.

- Cost Savings: Upgrades are typically less expensive than acquiring new machinery.

- Extended Equipment Lifespan: Retrofits prolong the operational life of installed assets.

High-Performance Computing (HPC) and AI-Driven Sales

Camtek's revenue is increasingly powered by High-Performance Computing (HPC) and Artificial Intelligence (AI) applications. This burgeoning sector, which includes specialized inspection solutions for High Bandwidth Memory (HBM), is a primary driver of the company's growth. The demand for advanced semiconductor technologies in these fields directly translates into significant sales for Camtek's sophisticated metrology and inspection systems.

- HPC & AI Revenue Growth: A substantial and accelerating segment of Camtek's income originates from systems deployed in HPC and AI workloads.

- HBM Inspection Focus: The inspection of High Bandwidth Memory (HBM), critical for AI accelerators, represents a key area of revenue generation.

- Market Demand: The escalating need for advanced computing power fuels the demand for Camtek's specialized inspection and metrology solutions.

- Strategic Importance: This segment is identified as a critical growth engine, underscoring its strategic importance to Camtek's business model.

Camtek's revenue streams are diversified, with the core business centered on the sale of advanced inspection and metrology systems. These systems are vital for quality control in semiconductor manufacturing. The company also benefits from recurring revenue through software upgrades, licenses, and crucial after-sales services like maintenance and spare parts, ensuring sustained customer engagement and predictable income.

The growing demand for High-Performance Computing (HPC) and Artificial Intelligence (AI) applications, particularly for High Bandwidth Memory (HBM) inspection, represents a significant and accelerating revenue driver for Camtek. This strategic focus on cutting-edge technologies positions the company for continued growth in these rapidly expanding markets.

| Revenue Stream | Description | 2024 Projections/Trends |

| Equipment Sales | Direct sales of inspection and metrology systems. | Strong demand driven by semiconductor industry expansion and technological advancements. |

| Software & Services | Maintenance contracts, spare parts, technical support, software upgrades, and licenses. | Provides recurring revenue, enhancing customer loyalty and operational uptime. Expected to contribute a growing percentage of total revenue. |

| HPC & AI Solutions | Specialized inspection systems for advanced computing, including HBM. | Key growth engine, fueled by the increasing adoption of AI and HPC technologies. |

Business Model Canvas Data Sources

The Camtek Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and strategic insights derived from industry analysis. These diverse sources ensure each component of the canvas is grounded in factual information and current market realities.