Camtek Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camtek Bundle

Camtek's competitive landscape is shaped by several key forces, including the bargaining power of its buyers and the intensity of rivalry within the semiconductor inspection market. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping Camtek’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Camtek's reliance on suppliers for highly specialized components, often proprietary or requiring unique manufacturing, significantly amplifies supplier bargaining power. These critical parts are essential for Camtek's advanced inspection and metrology systems, meaning few alternatives exist. For instance, in 2023, Camtek reported that its cost of revenue was $104.8 million, highlighting the substantial expenditure on components and materials, which are largely sourced from these specialized suppliers.

Camtek's reliance on highly specialized technological components for its advanced inspection and metrology solutions, particularly for demanding sectors like AI and advanced packaging, means suppliers of these critical sub-systems hold considerable bargaining power. For instance, the semiconductor industry, a key market for Camtek, often sees specialized equipment suppliers with proprietary technology commanding strong positions.

The difficulty and cost associated with sourcing alternative, equally advanced technological inputs for Camtek's sophisticated equipment amplify this supplier leverage. Companies that provide unique, high-performance sensors, advanced optics, or specialized software essential for Camtek's competitive edge can dictate terms, especially if their intellectual property is difficult to replicate or substitute.

The semiconductor equipment sector, where Camtek operates, frequently features a limited supplier base for specialized, high-tech components. This concentration means that if only a handful of companies can produce the advanced parts Camtek needs, those suppliers gain significant leverage. For instance, in 2024, the global market for advanced semiconductor manufacturing equipment saw key component suppliers experiencing robust demand, potentially strengthening their pricing power.

Geopolitical and Trade Restrictions

Geopolitical shifts and trade policies significantly impact the bargaining power of suppliers within the semiconductor industry, a sector where Camtek operates. The highly interconnected global supply chain is particularly vulnerable to international tensions. For instance, export controls implemented by nations can restrict the availability of critical technologies or components, thereby limiting Camtek's choices and potentially driving up costs.

These restrictions can create a more favorable environment for suppliers who are not subject to such limitations. For example, disruptions stemming from trade disputes or national security concerns can lead to shortages of specialized equipment or raw materials. This scarcity allows unaffected suppliers to command higher prices, as demand outstrips supply.

- Global Interdependence: The semiconductor supply chain's reliance on international collaboration means geopolitical events can have widespread ripple effects.

- Export Controls: Restrictions on the sale of advanced technologies or manufacturing equipment can limit supplier options for companies like Camtek.

- Increased Costs: When fewer suppliers can provide necessary components due to trade barriers, the remaining suppliers often have increased pricing power.

- Supply Chain Vulnerability: Trade wars or sanctions can disrupt the flow of goods, creating uncertainty and empowering suppliers who can navigate these complexities.

Supplier's R&D Investment

Suppliers in the advanced semiconductor inspection and metrology sector, crucial for companies like Camtek, often channel significant resources into research and development. This investment is vital for creating cutting-edge materials and components that drive technological advancements.

These R&D investments directly translate into supplier power. By developing proprietary technologies and specialized components, suppliers provide innovations that are indispensable for Camtek to sustain its competitive advantage and adapt to the rapidly changing requirements of the semiconductor industry.

- High R&D Spending: Leading suppliers in the semiconductor equipment supply chain can invest upwards of 10-15% of their revenue back into R&D, aiming to stay ahead in a fast-paced market.

- Proprietary Technology: Suppliers with unique, patented technologies for critical components gain substantial leverage, as finding alternative sources can be difficult and costly for customers like Camtek.

- Innovation as a Differentiator: The ability of suppliers to consistently deliver innovative solutions, such as novel sensor technologies or advanced processing materials, makes them indispensable partners, strengthening their bargaining position.

Suppliers of highly specialized components for Camtek's advanced inspection and metrology systems possess significant bargaining power. This is due to the proprietary nature of their technology and the limited availability of comparable alternatives, essential for Camtek's competitive edge. For instance, in 2023, Camtek's cost of revenue reached $104.8 million, underscoring the substantial investment in these critical, often single-sourced, inputs.

The semiconductor industry, a key market for Camtek, is characterized by a concentrated supplier base for advanced technological inputs. Suppliers with unique, high-performance sensors, optics, or software crucial for Camtek's systems can dictate terms, especially when their intellectual property is difficult to replicate. In 2024, leading suppliers in this niche reported strong demand, reinforcing their pricing leverage.

Geopolitical factors and trade policies further bolster supplier power by creating supply chain vulnerabilities. Export controls and trade disputes can limit Camtek's sourcing options, driving up costs and empowering unaffected suppliers. This situation is exacerbated by the high R&D investments, often 10-15% of revenue, made by these key suppliers to maintain their technological lead.

What is included in the product

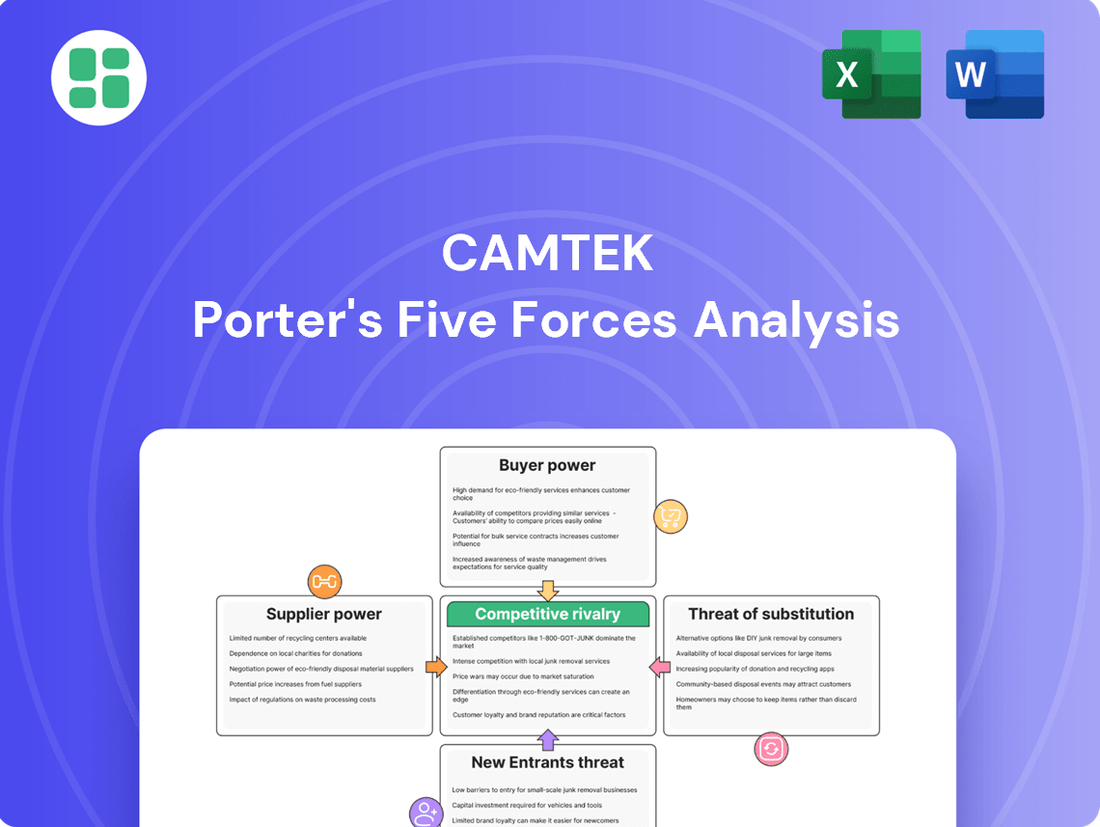

Analyzes the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and threat of substitutes specific to Camtek's semiconductor inspection and metrology market.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, allowing for rapid assessment and strategic adjustment.

Customers Bargaining Power

Camtek's reliance on a concentrated customer base, with roughly 70% of its revenue generated from Tier-1 clients like leading IDMs, OSATs, and foundries, significantly amplifies customer bargaining power. These major players wield considerable influence due to their substantial order volumes and critical role in Camtek's financial performance. This concentration means that any dissatisfaction or demand from these key customers can have a disproportionate impact on Camtek's pricing and terms.

Camtek's inspection and metrology equipment plays a vital role in the semiconductor industry, directly impacting customer production efficiency and yield. For instance, their systems are crucial for identifying defects early in the manufacturing process, which can significantly reduce waste and improve the overall output of chips. This criticality gives customers a degree of leverage.

Customers understand that acquiring this advanced equipment involves substantial capital outlay and often extended delivery schedules. This reality can empower them to negotiate for better pricing, more favorable payment terms, or enhanced service agreements when making significant investments in Camtek's technology.

Camtek's customers, primarily semiconductor manufacturers, possess significant technical expertise. This deep understanding allows them to thoroughly assess equipment performance and articulate precise feature requirements.

Their technical acumen empowers them to negotiate aggressively on specifications and pricing, as they can readily identify areas for cost reduction or performance enhancement. For instance, in 2024, the average semiconductor fabrication plant invested billions in advanced equipment, underscoring the high stakes and sophisticated evaluation processes involved.

High Switching Costs

High switching costs significantly diminish the bargaining power of Camtek's customers. Once a customer has invested in integrating Camtek's specialized inspection and metrology systems into their intricate fabrication processes, the expense and disruption associated with migrating to a competitor become substantial. These costs can encompass re-tooling machinery, rigorous re-qualification of new equipment and processes, and the inevitable, often costly, production downtime that accompanies such a transition.

This integration lock-in effectively reduces customer leverage, particularly after the initial purchase and implementation phases. For instance, a semiconductor manufacturer relying on Camtek's advanced defect detection for wafer inspection faces considerable hurdles in switching. The learning curve for new systems, the validation of their performance against established standards, and the potential for yield impacts all weigh heavily against a quick change. This makes customers less likely to demand price concessions or favorable terms once they are deeply embedded with Camtek's technology.

- Significant Re-tooling Expenses: Replacing specialized inspection equipment can cost millions of dollars, impacting a customer's capital expenditure plans.

- Re-qualification Time and Cost: Ensuring new systems meet stringent quality and performance benchmarks can take months and require dedicated engineering resources.

- Production Downtime Impact: Even a short period of reduced output during a transition can result in substantial lost revenue for fabrication plants.

- Camtek's Market Position: As of early 2024, Camtek holds a notable position in the semiconductor inspection market, further solidifying customer reliance on their established solutions.

Demand Driven by End-Markets

The bargaining power of Camtek's customers is significantly shaped by the demand originating from key end-markets for semiconductors. Growth in sectors such as artificial intelligence (AI), high-performance computing (HPC), and the increasing complexity of advanced packaging directly fuels the need for Camtek's inspection and metrology solutions.

These market dynamics influence how much leverage customers possess. For instance, if demand in these crucial end-markets experiences a downturn, customers might become more price-sensitive and seek better terms from suppliers like Camtek. Conversely, robust demand can reduce their immediate need to negotiate aggressively.

- Semiconductor End-Market Demand: Growth in AI and HPC drives demand for advanced semiconductor inspection.

- Customer Investment Cycles: Fluctuations in end-market demand can alter customer spending patterns and negotiation leverage.

- Advanced Packaging Importance: The need for sophisticated inspection in advanced packaging techniques strengthens the customer's position when demand is high.

Camtek's customers, primarily large semiconductor manufacturers, possess considerable bargaining power due to their substantial order volumes and the critical nature of Camtek's inspection equipment in their production lines. This leverage is amplified by the fact that roughly 70% of Camtek's revenue comes from a concentrated base of Tier-1 clients, making these relationships paramount.

The technical expertise of these customers also empowers them to negotiate effectively on specifications and pricing, as they can readily assess equipment performance and identify potential cost savings. For example, in 2024, semiconductor fabrication plants continued to invest billions in advanced equipment, highlighting the sophisticated evaluation processes involved in these high-value purchases.

While high switching costs generally reduce customer leverage, the concentrated customer base and the essential role of Camtek's technology in ensuring chip quality and yield mean that these customers still wield significant influence. Their ability to impact Camtek's revenue through order volumes and their technical understanding of the equipment's value proposition are key drivers of their bargaining power.

| Factor | Impact on Camtek's Customer Bargaining Power | Supporting Data/Context (as of early 2024) |

|---|---|---|

| Customer Concentration | High | ~70% of revenue from Tier-1 clients (IDMs, OSATs, foundries) |

| Criticality of Product | Moderate to High | Inspection and metrology systems are vital for yield and defect detection in chip manufacturing. |

| Customer Technical Expertise | High | Customers possess deep understanding to negotiate specifications and pricing. |

| Switching Costs | Lowers Customer Power | Significant investment in integration and re-qualification for new systems. |

| End-Market Demand | Variable | Strong demand in AI/HPC can reduce customer price sensitivity, but downturns increase it. |

Full Version Awaits

Camtek Porter's Five Forces Analysis

This preview displays the complete Camtek Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

The semiconductor metrology and inspection arena is a battlefield of giants. Camtek faces formidable competition from global leaders like KLA Corporation, Applied Materials, and ASML, companies with vast resources and established market share. These players consistently invest heavily in research and development, pushing the boundaries of what's possible in defect detection and process control.

Beyond these behemoths, specialized firms such as Onto Innovation, Lasertec, and Hitachi also vie for market dominance, each bringing unique technological strengths and niche expertise. This crowded landscape means Camtek must constantly innovate and clearly differentiate its offerings to stand out and capture market attention. For instance, KLA Corporation reported revenues of approximately $10.5 billion for its fiscal year ending June 2023, highlighting the scale of investment and revenue potential in this sector.

Competitive rivalry in the semiconductor inspection and metrology sector is fierce, largely fueled by the relentless pace of technological innovation. Companies must constantly push the boundaries of precision, speed, and functionality to meet the demands of increasingly intricate semiconductor designs. This technological arms race means that significant investment in research and development is not just an advantage, but a necessity for survival and growth.

Leading players such as Camtek, KLA Corporation, and Applied Materials are prime examples of this R&D intensity. For instance, KLA Corporation, a major competitor, reported R&D expenses of approximately $1.4 billion for its fiscal year ending June 30, 2024. This substantial spending underscores the industry's commitment to developing next-generation solutions and maintaining a competitive edge through superior technology.

The semiconductor inspection market is booming, with growth particularly strong in advanced packaging, artificial intelligence (AI), and high-performance computing (HPC). This robust expansion naturally intensifies competition among established companies vying for dominance in these lucrative, rapidly evolving sectors. For instance, the global semiconductor market was projected to reach $677.7 billion in 2024, according to the Semiconductor Industry Association (SIA), highlighting the significant revenue opportunities driving this rivalry.

Product Specialization and Niche Leadership

Camtek's strategic focus on inspection and metrology for advanced packaging has solidified its position as a leader in this high-value segment. This specialization offers a distinct competitive edge, allowing them to cater to specific industry needs with tailored solutions. However, the very success of this niche can attract competitors who may seek to replicate or acquire similar expertise, intensifying rivalry.

The advanced packaging market, crucial for semiconductors, saw significant growth. For instance, the global advanced packaging market size was valued at approximately USD 45 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 6% through 2030. This robust expansion signals a lucrative opportunity, drawing in players who can develop or acquire the necessary technological capabilities to challenge Camtek's dominance.

- Market Specialization: Camtek leads in inspection and metrology for advanced semiconductor packaging.

- Competitive Threat: Rivals can enter this niche by developing or acquiring similar advanced capabilities.

- Market Growth: The advanced packaging market is expanding, making it attractive for new entrants and intensified competition.

Customer Relationships and Installed Base

Camtek's competitive rivalry is significantly influenced by its strong customer relationships and the substantial installed base of its inspection and metrology equipment. These deep-rooted connections create a considerable competitive barrier for rivals seeking to enter or expand within the semiconductor manufacturing sector.

Building and maintaining these relationships is crucial. Camtek's success in this area is evident, boasting over 3,000 tools currently installed across the globe. This widespread deployment not only signifies market acceptance but also fosters a high degree of customer loyalty and reliance.

The company serves a broad customer base, with more than 250 distinct clients. This diversification across numerous semiconductor manufacturers reduces dependency on any single customer and highlights the broad applicability and trust placed in Camtek's solutions. The stickiness associated with this installed base means that switching costs for customers are often high, further solidifying Camtek's market position and intensifying rivalry for new business.

- Installed Base: Over 3,000 Camtek tools are operational in semiconductor fabrication plants worldwide.

- Customer Reach: The company serves more than 250 unique customers within the semiconductor industry.

- Competitive Barrier: A large installed base and strong customer relationships make it difficult for competitors to gain market share.

- Customer Loyalty: The reliance on existing equipment and integrated workflows encourages long-term customer retention.

The semiconductor metrology and inspection market is characterized by intense rivalry, driven by significant R&D investments and the rapid pace of technological advancement. Major players like KLA Corporation, with fiscal 2024 R&D expenses around $1.4 billion, and Applied Materials are constantly innovating to meet the demands of complex chip designs.

Camtek's specialization in advanced packaging inspection, a segment valued at approximately $45 billion in 2023, provides a competitive edge but also attracts rivals seeking to replicate its success. The overall semiconductor market's projected $677.7 billion valuation for 2024 further fuels this competition.

Camtek's substantial installed base of over 3,000 tools and a diverse customer portfolio exceeding 250 clients creates high switching costs, acting as a barrier to entry for competitors and fostering customer loyalty.

| Competitor | Approximate Fiscal Year End | Approximate R&D Expenses | Key Market Focus |

|---|---|---|---|

| KLA Corporation | June 2024 | $1.4 billion | Metrology and Inspection |

| Applied Materials | October 2023 | $1.6 billion | Semiconductor Equipment Manufacturing |

| ASML | December 2023 | $2.6 billion | Lithography Systems |

| Camtek | December 2023 | $74.9 million | Advanced Packaging Inspection |

SSubstitutes Threaten

For high-end semiconductor manufacturing, especially in advanced packaging and crucial production stages, there are very few direct substitutes that can replicate the precise, high-resolution inspection and metrology capabilities offered by specialized equipment. These alternative methods often fall short of meeting the demanding quality and yield expectations essential in this sector.

While dedicated inspection tools remain crucial for quality assurance, the rise of sophisticated in-line process control systems poses a significant threat of substitution. These advanced systems, leveraging AI and machine learning, are increasingly capable of predicting and mitigating defects in real-time, potentially diminishing the need for separate, post-process inspection steps. For instance, in the semiconductor industry, where Camtek operates, the adoption of Industry 4.0 principles is accelerating, with companies investing heavily in smart manufacturing solutions that integrate process monitoring and predictive analytics directly into the production line. This shift could reduce the demand for standalone inspection equipment if these in-line solutions prove equally or more effective at a lower overall cost.

The threat of substitutes for Camtek's inspection technologies is present, as the market encompasses various inspection methods like optical, E-beam, acoustic, and X-ray. While Camtek has a strong foothold in certain areas, a significant industry shift towards a fundamentally different core inspection technology could challenge its market position if it fails to adapt its offerings.

Customer Internal Development

Large semiconductor manufacturers, often referred to as Integrated Device Manufacturers (IDMs), sometimes choose to develop their own inspection solutions internally. This strategy can be driven by a desire to reduce dependence on external equipment suppliers, especially for tasks that are not core to their competitive advantage. For instance, some IDMs might invest in developing proprietary in-house inspection tools for less critical process steps.

This internal development can significantly impact companies like Camtek. By creating their own solutions, IDMs can potentially bypass the need for specialized third-party equipment, thereby reducing the threat of substitution. While the exact figures for internal development spending by major IDMs are often not publicly disclosed, the trend towards greater vertical integration in advanced manufacturing suggests a continued focus on in-house capabilities. For example, in 2024, the semiconductor industry continued to see significant investment in advanced manufacturing technologies, with many leading firms prioritizing control over their production processes.

- Reduced Reliance: IDMs developing internal inspection capabilities lessen their need for external vendors.

- Cost Efficiency: For specific, high-volume, or proprietary processes, in-house solutions can sometimes be more cost-effective in the long run.

- Control and Customization: Internal development allows for greater control over technology roadmaps and customization to specific manufacturing needs.

- Strategic Advantage: Securing unique or highly efficient inspection processes internally can provide a competitive edge.

Cost-Benefit Trade-offs

For less critical or mature process nodes, customers might consider lower-cost inspection methods or tolerate higher defect rates if the expense of advanced equipment is not justified by the benefits. This is particularly relevant in segments where the cost of sophisticated inspection tools outweighs the value of marginal defect reduction. For instance, in some older semiconductor manufacturing processes, a simpler optical inspection might suffice compared to the advanced AOI and SPI systems Camtek specializes in, especially if the end-product's value or performance tolerance is lower.

Camtek's focus on high-end segments, such as advanced semiconductor packaging and printed circuit board (PCB) inspection, inherently limits the threat of substitutes. In these demanding applications, the precision and defect detection capabilities offered by Camtek's solutions are often non-negotiable. The cost of rework or product failure due to undetected defects in these high-value markets typically far exceeds the investment in advanced inspection equipment. For example, the cost of a single failure in advanced semiconductor packaging can run into thousands of dollars, making sophisticated inspection a clear cost-benefit win.

- Cost-Benefit Trade-offs: While lower-cost, less sophisticated inspection methods exist for less critical applications, the high-end segments Camtek serves have a low tolerance for defects, making advanced inspection a necessity rather than a luxury.

- Market Segmentation: The threat of substitutes is significantly reduced in Camtek's target markets of advanced semiconductor packaging and PCB inspection, where precision and defect detection are paramount.

- Risk of Failure: In these advanced manufacturing sectors, the cost of product failure due to undetected defects often dwarfs the investment in high-end inspection equipment, diminishing the appeal of cheaper alternatives.

The threat of substitutes for Camtek's advanced inspection solutions is relatively low in its core high-end markets. While simpler inspection methods exist, they often lack the precision required for advanced semiconductor packaging and PCB manufacturing, where even minor defects can lead to significant financial losses. The cost of failure in these sectors, potentially reaching thousands of dollars per unit, makes investing in specialized inspection equipment a clear economic imperative.

However, the increasing sophistication of in-line process control systems, powered by AI and machine learning, presents a growing substitution threat. These integrated solutions aim to predict and prevent defects during manufacturing, potentially reducing the reliance on standalone post-process inspection. For instance, advancements in Industry 4.0 are driving significant investment in smart manufacturing, with companies like Camtek needing to adapt to these evolving technological landscapes.

Furthermore, some large Integrated Device Manufacturers (IDMs) may opt for developing proprietary in-house inspection capabilities to reduce vendor dependency and gain greater control. While not always publicly detailed, this trend towards vertical integration in 2024 suggests a strategic move by some players to bypass third-party solutions for specific, less critical process steps, potentially impacting demand for external inspection equipment.

| Threat of Substitutes | Description | Impact on Camtek |

|---|---|---|

| In-line Process Control Systems | AI-driven systems that predict and mitigate defects during manufacturing, reducing the need for post-process inspection. | Moderate to High, as these systems can reduce demand for standalone inspection tools if proven effective and cost-efficient. |

| Internal Development by IDMs | Large manufacturers creating their own inspection solutions to reduce reliance on external suppliers. | Low to Moderate, primarily affecting less critical process steps or specific niche requirements. |

| Lower-Cost Inspection Methods | Simpler optical or less sophisticated techniques for less critical applications or mature process nodes. | Low for Camtek's target markets due to the high precision requirements and cost of failure in advanced segments. |

Entrants Threaten

Developing and manufacturing advanced inspection and metrology equipment, like Camtek's offerings, demands immense capital. We're talking about significant investments in research and development to stay ahead of technological curves, coupled with the need for highly specialized manufacturing facilities. For instance, the semiconductor equipment industry, where Camtek operates, saw R&D spending by major players reach billions in 2023, highlighting the financial muscle required.

The semiconductor inspection and metrology sector, where Camtek operates, is characterized by an intense need for cutting-edge technology. Developing the sophisticated systems required for inspecting and measuring microscopic features on semiconductor wafers demands significant investment in research and development. New entrants would face a steep uphill battle, needing years, if not decades, to accumulate the deep scientific and engineering expertise necessary to compete with established players who have already invested heavily in this area.

Long customer qualification cycles represent a significant barrier to entry in the semiconductor equipment market, particularly for companies like Camtek. Semiconductor manufacturers, due to the immense cost of production downtime and potential yield losses, subject new equipment to extremely rigorous and lengthy qualification processes.

For new entrants, navigating these protracted qualification periods, which can often extend for many months or even years, demands substantial upfront investment in time and resources. Building the necessary trust and securing initial customer adoption is a major hurdle, as proven reliability and performance are paramount for buyers in this industry.

Intellectual Property and Patents

Established companies like Camtek hold significant intellectual property, including patents for their advanced inspection and metrology solutions. This robust patent portfolio acts as a substantial barrier, making it challenging for new entrants to operate without risking infringement or needing to develop groundbreaking, non-infringing technologies.

For instance, the semiconductor inspection market, where Camtek operates, is heavily reliant on proprietary algorithms and hardware designs. Developing comparable capabilities often requires substantial R&D investment, a hurdle that deters many potential new competitors.

- Proprietary Technology: Camtek's patents cover key aspects of its automated optical inspection (AOI) and metrology systems, crucial for semiconductor manufacturing.

- R&D Investment: The high cost and time required to develop novel, patentable technologies in this specialized field are significant deterrents to new market entrants.

- Legal Barriers: The threat of litigation for patent infringement further discourages new companies from entering the market without substantial legal and technological groundwork.

Strong Established Customer Relationships and Installed Base

Camtek and its competitors have cultivated deep, enduring relationships with major global semiconductor manufacturers. This loyalty is a significant barrier to entry, as new entrants must overcome established trust and proven performance.

The substantial installed base of Camtek's inspection and metrology solutions represents another hurdle. Customers are often reluctant to switch from systems they are familiar with and that are integrated into their existing workflows, especially in a high-stakes industry like semiconductor manufacturing where reliability is paramount.

For instance, in 2023, the semiconductor industry continued to emphasize supply chain stability and proven technology. Companies like Camtek, with their long track records and extensive customer support networks, are favored by manufacturers seeking to minimize production risks. This makes it incredibly difficult for newcomers to penetrate the market without offering a demonstrably superior and equally reliable alternative.

- Established Trust: Leading semiconductor firms often prioritize long-term partnerships with proven vendors like Camtek.

- Installed Base Inertia: High switching costs associated with integrating new equipment into existing manufacturing lines deter new entrants.

- Reliability Demand: The critical nature of semiconductor production demands proven reliability, a trait new players struggle to establish quickly.

The threat of new entrants for Camtek is relatively low due to the immense capital requirements for R&D and specialized manufacturing, estimated in the billions for semiconductor equipment. Furthermore, the extensive patent portfolios held by incumbents, like Camtek's proprietary AOI and metrology technologies, create significant legal and technological barriers. The industry's demand for proven reliability and the high switching costs associated with established customer relationships and installed bases further solidify this advantage.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D and manufacturing investment (billions in semiconductor equipment sector). | Significant financial hurdle for new players. |

| Proprietary Technology & Patents | Extensive patent protection on advanced inspection and metrology solutions. | Discourages entry due to infringement risk and need for novel development. |

| Customer Relationships & Installed Base | Established trust and integration into existing manufacturing workflows. | High switching costs and preference for proven reliability deter new entrants. |

Porter's Five Forces Analysis Data Sources

Our Camtek Porter's Five Forces analysis is built upon a robust foundation of data, including Camtek's official investor relations materials, detailed financial statements, and industry-specific market research reports. We also incorporate insights from competitor announcements and publicly available trade publications to ensure a comprehensive understanding of the competitive landscape.