Calavo SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calavo Bundle

Calavo's strengths lie in its established brand and diversified product portfolio, but it faces challenges from intense competition and fluctuating avocado prices. Understanding these dynamics is crucial for navigating the fresh produce market.

Unlock the full story behind Calavo's market position and growth drivers. Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Calavo Growers, Inc. stands as a titan in the global avocado market, leveraging decades of experience to solidify its leadership. Their integrated approach, from cultivation partnerships to sophisticated distribution networks, ensures a consistent supply of high-quality avocados to consumers worldwide. This extensive reach and operational efficiency are key differentiators.

Calavo's strength lies in its diversified product portfolio, extending beyond fresh avocados to include items like tomatoes and papayas. This broad offering helps to mitigate risks associated with relying on a single commodity, ensuring greater financial stability.

The company also excels in its processed avocado segment, producing popular items such as guacamole and avocado pulp. This segment caters to a wider consumer base and varying demand patterns, further solidifying its market position.

In fiscal year 2023, Calavo's Fresh segment reported net sales of $934.5 million, while its Prepared segment generated $379.2 million. This demonstrates the significant contribution of its diversified offerings to overall revenue.

Calavo's extensive customer base is a significant strength, spanning retail grocery, foodservice, club stores, mass merchandisers, food distributors, and wholesalers worldwide. This broad reach across diverse channels, including major restaurant chains and independent eateries, diversifies revenue streams and reduces dependence on any single market segment. For instance, in fiscal year 2023, Calavo reported net sales of $1.2 billion, with its Fresh segment, heavily reliant on retail and foodservice, forming a substantial portion of this revenue.

Integrated Supply Chain and Grower Relationships

Calavo's integrated supply chain is a significant strength, managing everything from sourcing to distribution across key regions like California, Mexico, Peru, and Colombia. This end-to-end control is crucial for maintaining product quality and availability.

These operations are supported by deep, long-standing relationships with independent growers. This network is vital for securing a consistent and high-quality supply of produce, especially avocados, which are subject to market volatility.

The company's robust network provides a distinct competitive edge. For instance, in fiscal year 2023, Calavo's Fresh segment, heavily reliant on its supply chain, generated $725.7 million in revenue, showcasing the economic impact of these integrated operations.

- Integrated Operations: Sourcing, packing, and distribution managed across multiple countries.

- Grower Partnerships: Long-term relationships ensure consistent supply and quality.

- Market Resilience: A strong supply chain mitigates risks associated with agricultural markets.

- Revenue Contribution: The Fresh segment, leveraging this integration, is a significant revenue driver for Calavo.

Improved Financial Performance and Liquidity

Calavo's financial performance has significantly improved, showcasing a strong return to profitability. The company reported increased net sales and achieved net income in both the first and second quarters of 2025, a notable turnaround from prior periods of losses.

This enhanced financial standing is further supported by robust liquidity. Calavo maintains a healthy cash position and has actively reduced its debt burden, particularly after the strategic divestiture of its Fresh Cut business in 2024. This financial discipline creates a stable platform for pursuing new growth opportunities.

- Positive Net Income: Achieved in Q1 and Q2 2025, signaling a strong recovery.

- Increased Net Sales: Demonstrating revenue growth in the recent reporting periods.

- Strong Liquidity: Maintaining a solid cash position for operational needs.

- Reduced Debt: Following the 2024 divestiture, improving the balance sheet.

Calavo's integrated supply chain, spanning sourcing, packing, and distribution across key regions, is a significant competitive advantage. This end-to-end control ensures product quality and availability, crucial in the volatile agricultural market. Furthermore, deep, long-standing relationships with independent growers provide a consistent and high-quality supply of produce. The Fresh segment, a major revenue driver, directly benefits from these robust operations, as evidenced by its substantial revenue contribution.

| Segment | Fiscal Year 2023 Net Sales |

| Fresh | $934.5 million |

| Prepared | $379.2 million |

What is included in the product

Delivers a strategic overview of Calavo’s internal and external business factors, highlighting its strengths in brand recognition and distribution, weaknesses in operational efficiency, opportunities in expanding product lines and international markets, and threats from competition and supply chain volatility.

Calavo's SWOT analysis acts as a pain point reliever by offering a clear roadmap to navigate industry challenges and capitalize on emerging opportunities.

Weaknesses

Calavo's significant reliance on the avocado crop presents a notable weakness, exposing the company to the inherent volatility of this single commodity. Fluctuations in avocado volumes and market prices directly impact Calavo's operational stability and financial performance, creating a challenging environment for consistent supply and pricing strategies.

This deep-seated dependency can hinder Calavo's ability to maintain a steady, high-quality supply of avocados at predictable price points. Such challenges directly translate into increased per-pound handling costs and can significantly erode overall profitability, even with diversification efforts in place.

For instance, in fiscal year 2023, avocados represented a substantial portion of Calavo's total revenue, underscoring the critical nature of this crop to the company's core business operations and financial health.

Calavo's reliance on avocados and other fresh produce makes it highly susceptible to price swings in these commodities. This volatility directly impacts the company's financial results, creating an unpredictable operating environment.

For example, in the first quarter of 2025, despite elevated avocado prices, Calavo's Prepared segment experienced a gross profit decrease attributed to increased fruit acquisition costs. These fluctuations can significantly squeeze profit margins, particularly within the value-added processed food operations.

Calavo's Q2 2025 results revealed a concerning trend: a decline in gross profit despite overall revenue growth. This dip was largely attributed to reduced sales volumes within its Fresh and Prepared segments. Specifically, a significant drop in tomato sales acted as a major drag on the company's performance.

This downturn in key product lines suggests potential difficulties in navigating market fluctuations and managing a diverse product portfolio effectively. The underperformance in these segments points to challenges in maintaining consistent profitability across all business areas, raising questions about operational efficiencies and demand forecasting.

Ongoing Legal and Tax Disputes

Calavo Growers is currently navigating significant legal and tax complexities, particularly concerning its operations in Mexico. The company is facing substantial claims from Mexican tax authorities, adding a layer of financial uncertainty.

Furthermore, Calavo is addressing compliance issues related to potential Foreign Corrupt Practices Act (FCPA) violations within its Mexican business units. These ongoing legal and tax matters are likely to incur considerable professional fees and could lead to unforeseen fines, impacting the company's financial predictability.

- Tax Disputes: Calavo is engaged in significant disputes with Mexican tax authorities, potentially involving substantial financial liabilities.

- FCPA Compliance: The company is actively addressing compliance matters concerning potential Foreign Corrupt Practices Act violations in Mexico.

- Financial Uncertainty: These legal and tax challenges introduce unpredictability and can lead to increased professional expenses and potential penalties.

Missed Analyst Expectations and Revenue Decline Trends

Calavo Growers has recently faced challenges in meeting financial projections, missing analyst expectations for both revenue and earnings per share in the first two quarters of fiscal year 2025. This underperformance has understandably raised investor concerns about the company's short-term financial health.

Adding to these concerns, Calavo has experienced a consistent downward trend in sales, with annual revenue declining over the past three fiscal years. Projections from financial analysts indicate this revenue decline is expected to continue, signaling potential headwinds in the company's ability to capture market share and drive sustained top-line growth.

- Missed Q1 2025 EPS Estimate: Calavo reported earnings per share below analyst consensus.

- Missed Q2 2025 Revenue Estimate: The company's top-line performance in the second quarter also fell short of expectations.

- Three-Year Sales Decline: Fiscal years 2022, 2023, and 2024 all saw a reduction in annual sales.

- Projected Continued Revenue Drop: Analysts anticipate a further decrease in revenue for the upcoming fiscal year.

Calavo's heavy dependence on avocados makes it vulnerable to supply chain disruptions and price volatility, impacting its ability to ensure consistent product availability and manage costs effectively. This concentration risk limits its resilience against external shocks affecting this key commodity.

The company's recent financial performance, including missed earnings and revenue targets in early fiscal year 2025, highlights operational challenges. A three-year trend of declining sales, with projections indicating this will continue, points to difficulties in market penetration and growth.

Furthermore, Calavo faces significant legal and tax hurdles, particularly in Mexico, involving substantial claims and FCPA compliance issues. These ongoing matters introduce financial uncertainty and can lead to increased operational expenses and potential penalties.

Preview Before You Purchase

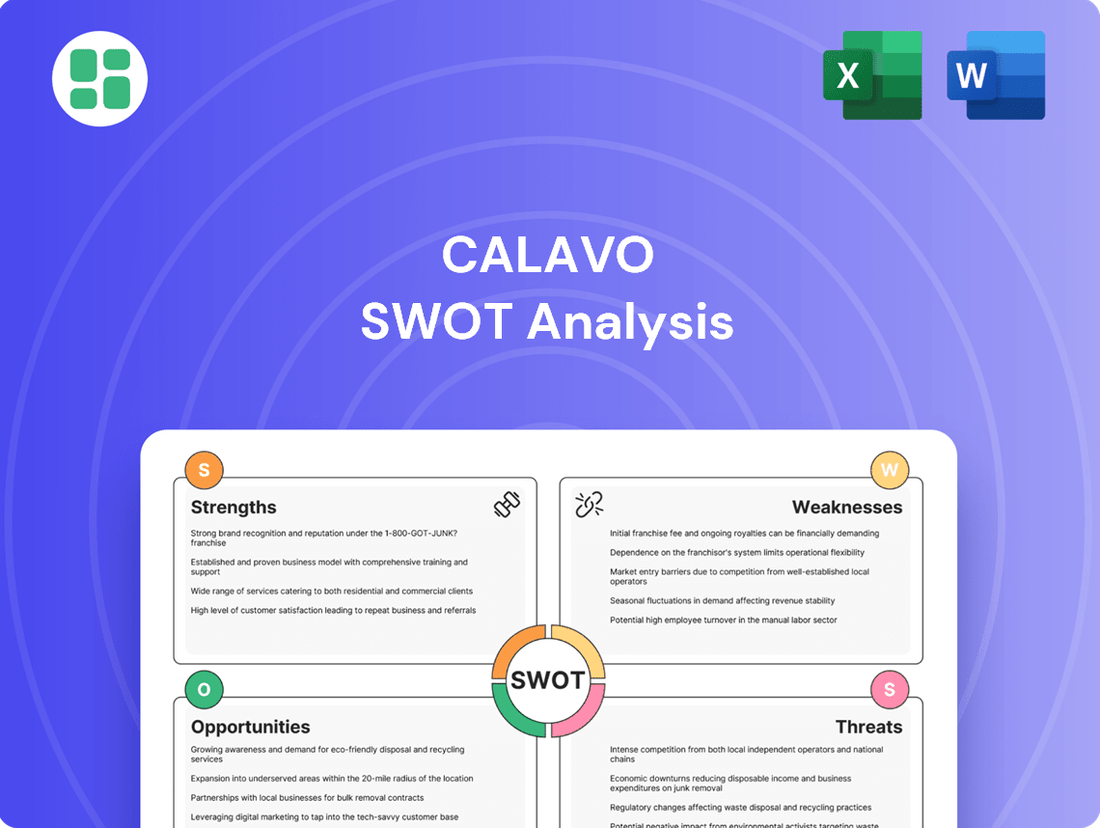

Calavo SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Calavo Growers' Strengths, Weaknesses, Opportunities, and Threats in a clear, actionable format.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Calavo's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Calavo SWOT analysis, ready for your strategic planning.

Opportunities

The global avocado market is booming, fueled by a growing awareness of healthy eating and evolving food trends. This surge in demand, with projections indicating a market value exceeding $20 billion by 2025, offers a substantial avenue for Calavo to expand its reach and leverage increasing consumer interest.

Calavo has a significant opportunity to grow by entering new international markets, especially in Asia and Latin America, where demand for avocados is on the rise. This geographic diversification helps mitigate risks tied to reliance on any single region and unlocks fresh avenues for income.

For instance, Calavo's ability to source from regions like Jalisco, Mexico, a major avocado-producing area, directly supports its capacity to serve these expanding international customer bases. This strategic move aligns with the global trend of increasing avocado consumption, projected to continue its upward trajectory through 2025.

Calavo can significantly boost growth by innovating within its Prepared segment, introducing novel avocado-based items and ready-to-eat meals. This strategy capitalizes on the growing consumer demand for convenient, healthy options. For example, expanding the line of guacamole and avocado dips with new flavor profiles or functional ingredients could capture a larger market share.

Beyond avocados, Calavo has a prime opportunity to diversify its fresh produce portfolio. Expanding into categories like tomatoes, papayas, and other tropical fruits allows the company to tap into different consumer preferences and seasonal demands. Furthermore, exploring the application of avocado's beneficial properties in the beauty and personal care sector aligns with a strong market trend towards natural ingredients.

Leveraging e-commerce channels is crucial for the success of these new product lines. By establishing a robust online presence and optimizing direct-to-consumer sales, Calavo can reach a wider audience and drive revenue for its innovative offerings. In 2023, online grocery sales in the U.S. continued to grow, indicating a receptive market for convenient, digitally-available food products.

Strategic Acquisitions and Partnerships

The global avocado market, characterized by ongoing consolidation, presents a fertile ground for Calavo to pursue strategic acquisitions and partnerships. Despite its recent divestiture of the Fresh Cut segment, the industry landscape remains conducive to targeted M&A. These moves could bolster Calavo's core avocado and guacamole operations, enhance its processing capabilities, or facilitate market share expansion. For instance, in 2024, the global avocado market was valued at an estimated $17.5 billion, with projections indicating continued growth, making strategic integration a key avenue for competitive advantage.

Calavo can leverage this consolidating environment to its advantage by seeking out synergistic opportunities. Potential targets could include smaller avocado growers with unique varietals, companies specializing in advanced processing technologies, or even distribution networks that complement Calavo's existing reach. Such actions align with industry trends where larger players are increasingly acquiring smaller, specialized entities to streamline operations and broaden their product portfolios.

- Industry Consolidation: The global food sector, including produce, is witnessing significant consolidation, creating opportunities for Calavo to acquire complementary businesses.

- Strengthening Core Business: Acquisitions can fortify Calavo's primary avocado and guacamole segments, potentially by integrating supply chains or enhancing product offerings.

- Market Share Growth: Strategic M&A can provide a faster route to increasing market share compared to organic growth alone, especially in a competitive landscape.

- Capability Expansion: Partnerships or acquisitions could introduce new technologies or operational efficiencies, such as improved cold chain logistics or value-added product development.

Leveraging Improved Financial Position for Growth

Calavo's financial standing has notably improved, creating significant opportunities for expansion. The company's sale of its Fresh Cut business has bolstered its liquidity and reduced outstanding debt, providing a stronger foundation for future investments and strategic moves. This enhanced financial flexibility is a key enabler for growth initiatives.

With this strengthened financial position, Calavo can now more effectively invest in several critical areas. These include enhancing operational efficiencies to streamline processes and reduce costs, actively recruiting new customers to broaden its market reach, and expanding its global sourcing capabilities to ensure a consistent and diverse supply of avocados. These strategic investments are designed to directly fuel anticipated increases in avocado sales volume.

- Enhanced Liquidity: Following the Fresh Cut business sale, Calavo benefits from increased cash reserves.

- Reduced Debt: Lowered debt levels improve the company's balance sheet and financial flexibility.

- Investment Capacity: The improved financial health allows for targeted investments in operational upgrades and market expansion.

- Projected Sales Growth: Calavo anticipates higher avocado sales volume in fiscal 2025, driven by these strategic initiatives.

Calavo can capitalize on the growing global demand for avocados, a market projected to reach over $20 billion by 2025, by expanding into new international markets, particularly in Asia and Latin America. The company's ability to source from key regions like Jalisco, Mexico, supports this expansion and aligns with increasing worldwide avocado consumption.

Threats

Climate change presents a substantial threat to avocado cultivation, with forecasts suggesting a significant reduction in optimal growing regions by 2050 due to increasingly extreme weather patterns. This vulnerability is amplified by avocados' high water requirements, making them susceptible to droughts and water shortages. These conditions can directly impact yields and escalate production expenses for growers in critical sourcing areas for companies like Calavo.

The global avocado and fresh produce markets are incredibly crowded, with new players constantly entering the scene. This influx can create seasonal gluts in certain regions, driving down prices. For Calavo, this means facing significant price pressures that can squeeze profit margins and make it harder to maintain its market share.

For instance, in 2024, the U.S. imported approximately 1.2 billion pounds of avocados, a testament to the market's scale but also its competitive nature. Companies like Calavo must continually innovate and optimize their operations to navigate these aggressive pricing dynamics and secure their position in a challenging supply chain environment.

Calavo's extensive operations are inherently vulnerable to supply chain disruptions. Factors like adverse weather patterns impacting avocado harvests, or pest infestations, can significantly reduce available volumes. These disruptions directly affect per-pound handling costs, as lower volumes often mean higher per-unit expenses for Calavo.

Geopolitical events add another layer of complexity and risk. For instance, trade policies and tariffs, such as those that have historically impacted US imports of avocados from Mexico, can directly increase costs for raw materials and disrupt established trade flows. Such tariffs can lead to higher consumer prices and complicate global sourcing strategies.

Regulatory and Compliance Risks

Calavo Growers faces significant regulatory hurdles, including those from federal and state agencies, exposing them to ongoing legal and compliance risks. These regulations can impact everything from food safety to labor practices, potentially leading to operational disruptions and increased costs.

The company is currently navigating a pending internal investigation concerning potential Foreign Corrupt Practices Act (FCPA) violations in Mexico. Such investigations can be lengthy and costly, with the potential for substantial financial penalties if violations are found.

Furthermore, Calavo is involved in disputes with Mexican tax authorities. These disagreements could result in significant financial liabilities and may affect the company's profitability and cash flow if adverse judgments are rendered.

- FCPA Investigation: Potential penalties and reputational damage.

- Tax Disputes: Risk of significant financial liabilities in Mexico.

- Broader Regulatory Compliance: Ongoing costs and operational adjustments to meet diverse agency requirements.

Shifting Consumer Preferences or Negative Perceptions

While the demand for avocados remains robust, Calavo Growers faces a significant threat from evolving consumer tastes or the emergence of negative public opinion. Concerns regarding the environmental footprint of avocado farming, especially its substantial water requirements, could dampen consumer enthusiasm. For instance, reports in 2024 highlighted that avocado production can require hundreds of liters of water per fruit, a figure that may increasingly influence purchasing decisions.

This shift could translate into reduced sales volumes or necessitate a pivot towards more sustainable, and potentially more expensive, sourcing strategies. Such a transition might involve investing in water-efficient farming techniques or exploring alternative origins, impacting Calavo's cost structure and competitive positioning in the 2024-2025 period. For example, a 2025 consumer survey might reveal a 15% increase in consumers prioritizing sustainability in their food choices.

- Environmental Concerns: Growing awareness of avocado farming's water intensity poses a risk to sustained demand.

- Shifting Consumer Tastes: A potential decline in avocado popularity due to perceived environmental impact or changing dietary trends.

- Increased Sourcing Costs: Pressure to adopt sustainable practices could lead to higher operational expenses for Calavo.

- Reputational Risk: Negative perceptions surrounding water usage or agricultural practices could damage brand image.

Calavo faces significant threats from climate change impacting avocado yields and increasing water scarcity, which could escalate production costs. The competitive market landscape, with new entrants and potential seasonal gluts, exerts downward pressure on prices, squeezing profit margins. Supply chain disruptions, whether from weather, pests, or geopolitical events like tariffs, can increase per-unit handling costs and complicate sourcing.

Furthermore, ongoing regulatory compliance and legal disputes, including an FCPA investigation and tax disagreements in Mexico, pose substantial financial and reputational risks. Evolving consumer preferences, driven by concerns over the environmental impact of avocado farming, could also dampen demand, necessitating costly shifts to more sustainable practices.

| Threat Category | Specific Risk | Potential Impact | Data Point/Example |

| Environmental | Climate Change & Water Scarcity | Reduced yields, increased production costs | Avocado cultivation may see a significant reduction in optimal growing regions by 2050. |

| Market Competition | Price Pressure & Market Share Erosion | Squeezed profit margins, difficulty maintaining position | U.S. avocado imports reached ~1.2 billion pounds in 2024, indicating a large but competitive market. |

| Supply Chain & Geopolitical | Disruptions & Trade Policies | Higher handling costs, disrupted sourcing | Tariffs on Mexican avocado imports can directly increase raw material costs. |

| Legal & Regulatory | FCPA Investigation & Tax Disputes | Financial penalties, reputational damage, operational disruption | Ongoing FCPA investigation in Mexico and disputes with Mexican tax authorities. |

| Consumer Sentiment | Environmental Concerns & Shifting Tastes | Reduced demand, increased sourcing costs | Avocado production can require hundreds of liters of water per fruit, a factor influencing consumer choice in 2024-2025. |

SWOT Analysis Data Sources

This Calavo SWOT analysis is meticulously constructed using a blend of official financial statements, comprehensive market research reports, and expert industry analyses to provide a robust and actionable strategic overview.