Calavo Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calavo Bundle

Discover how Calavo masterfully blends its product innovation, strategic pricing, widespread distribution, and compelling promotions to dominate the avocado market. This analysis reveals the synergy behind their success, offering actionable insights for your own business strategies.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Calavo's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Calavo Growers, Inc. stands as a prominent global force in the avocado market, securing a consistent, year-round supply from key growing regions like California, Mexico, Peru, and Colombia. This extensive sourcing network underpins their ability to deliver premium avocados to consumers worldwide.

Beyond their avocado expertise, Calavo's 'Grown' segment diversifies into other fresh produce, notably including tomatoes and Hawaiian papayas. This expansion highlights their commitment to quality and innovation across a broader fresh produce portfolio, aiming to meet evolving consumer demands.

Calavo's 'Prepared' product segment centers on processed avocados, including their branded guacamole and private label versions, alongside avocado pulp for foodservice. This strategic focus addresses the growing consumer demand for convenient, ready-to-eat fresh food options, a trend that has significantly boosted sales in this category.

In the fiscal year 2023, Calavo's Prepared segment demonstrated strong performance, with revenues reaching $365 million, representing a substantial portion of the company's overall sales. This segment's growth is fueled by the increasing popularity of avocado-based products in both retail and foodservice channels, driven by their perceived health benefits and versatility.

Beyond the core processed avocado products, Calavo enhances its market offering through value-added services like precise ripening, meticulous grading, and customized packaging solutions. These services not only improve the marketability and appeal of their fresh produce but also ensure consistent quality, a critical factor for their foodservice clients and retail partners.

Calavo's strategic focus on core businesses is exemplified by its August 2024 divestiture of the Fresh Cut business unit (formerly RFG). This move, which generated $125 million in cash, allows Calavo to concentrate its resources and expertise on its most profitable and high-demand segments: avocados and guacamole.

This strategic realignment is designed to boost operational efficiency and solidify Calavo's market leadership. By shedding non-core assets, the company can better invest in innovation and marketing for its core avocado products, which are expected to see continued strong demand through 2025.

Commitment to Quality and Innovation

Calavo's commitment to quality is deeply ingrained, evident in its nearly century-long reputation for premium avocados. This focus on stringent standards, from farm to table, underpins its entire product offering. In the 2023 fiscal year, Calavo reported net revenue of $1.2 billion, with a significant portion attributed to its avocado segment, highlighting the enduring consumer trust in its quality.

Innovation is a key driver for Calavo, particularly in its expansion into value-added and processed products. The company actively develops new flavors and plant-based alternatives, such as their popular guacamole and avocado dips, to cater to evolving consumer preferences. This strategic push into innovation is crucial for maintaining market share and driving future growth, aiming to capture a larger segment of the convenience food market.

Calavo's quality and innovation efforts are supported by significant investments in its supply chain and product development. For instance, the company's focus on food safety and traceability ensures the integrity of its products. In 2024, Calavo continued to invest in its processing capabilities, aiming to enhance efficiency and expand its product portfolio to meet growing demand for convenient, healthy options.

- Brand Reputation: Calavo has cultivated a nearly 100-year legacy associated with high-quality avocados.

- Product Diversification: Innovation is driving the creation of new flavors and plant-based dips to meet diverse consumer needs.

- Financial Performance: Calavo achieved $1.2 billion in net revenue in fiscal year 2023, underscoring strong market demand for its products.

- Investment in Growth: Continued investment in processing and product development in 2024 signals a commitment to future innovation and quality assurance.

Sustainable Practices

Calavo's product strategy is increasingly shaped by sustainability, aiming for 100% of its packaging to be recyclable, reusable, or industrially compostable by 2025. This proactive approach addresses growing consumer demand for eco-friendly options.

The company is also focused on its supply chain, with a target to involve 100% of its growers in its sustainability program by 2030. This ensures that environmentally responsible farming practices are adopted across its operations.

These initiatives are crucial for attracting environmentally conscious consumers and investors alike. In 2024, Calavo reported a significant increase in sales driven by its fresh avocado segment, a product category where sustainability is a key differentiator.

Key sustainability goals include:

- Packaging: 100% recyclable, reusable, or compostable by 2025.

- Grower Engagement: 100% grower participation in sustainability programs by 2030.

- Consumer Appeal: Meeting the demand from environmentally aware shoppers.

- Investor Relations: Attracting capital from ESG-focused investment funds.

Calavo's product strategy centers on its core strength in avocados, both fresh and prepared. The company offers a diverse range of avocado products, from whole fruits to value-added items like guacamole and avocado pulp, catering to both retail and foodservice markets. This focus is reinforced by their commitment to quality and innovation, with ongoing investments in processing capabilities and new product development, including plant-based alternatives.

| Product Category | Key Offerings | Fiscal Year 2023 Revenue Contribution (Approx.) | Strategic Focus |

|---|---|---|---|

| Fresh Avocados | Whole avocados, various sizes and grades | Significant portion of $1.2 billion net revenue | Year-round supply, premium quality, sustainability |

| Prepared Avocados | Guacamole (branded & private label), avocado pulp | $365 million | Convenience, foodservice solutions, new flavors |

| Other Fresh Produce | Tomatoes, Hawaiian papayas | Diversification | Expanding portfolio to meet consumer demand |

What is included in the product

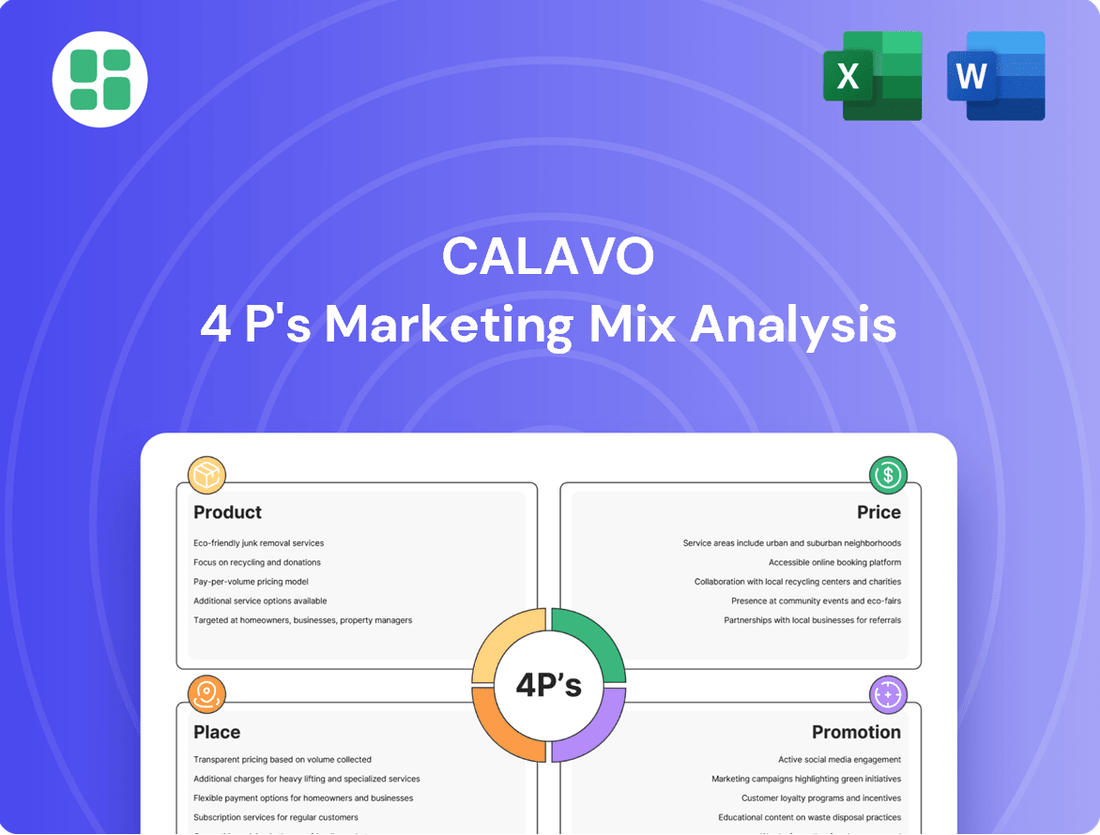

This analysis provides a comprehensive breakdown of Calavo's marketing strategies, examining its Product offerings, Pricing tactics, Place (distribution) channels, and Promotion efforts.

It's designed for professionals seeking to understand Calavo's market positioning and competitive advantages through a detailed exploration of its 4P's.

Calavo's 4P's marketing mix analysis serves as a pain point reliever by providing a clear, actionable framework to address challenges in product, price, place, and promotion, ensuring strategic alignment and effective market penetration.

Place

Calavo Growers leverages an extensive global sourcing strategy, securing avocados from vital regions such as California, Mexico, Peru, and Colombia. This diverse supply base, including significant contributions from Mexico which is a leading global avocado producer, ensures consistent product availability throughout the year. For fiscal year 2023, Calavo reported revenue from its Fresh segment, which heavily relies on this sourcing network.

Calavo strategically positions its processing and packing facilities across the U.S. and Mexico. These sites are crucial for ripening, grading, and packaging fresh produce, alongside manufacturing processed items like guacamole. This network, vital for their 2024 operations, ensures efficient handling from farm to consumer.

In 2023, Calavo's investment in its facility infrastructure continued to be a cornerstone of its supply chain. The company's proximity to avocado-growing regions in Mexico and key U.S. markets allows for reduced transit times, directly impacting product freshness and minimizing spoilage, a critical factor for their fresh segment's profitability.

Calavo's diverse customer channels are a cornerstone of its marketing mix, reaching consumers through retail grocery, foodservice, club stores, and mass merchandisers. In 2024, Calavo's fiscal year results showed continued strength in its retail segment, contributing significantly to its overall revenue growth. This broad accessibility, extending to food distributors and wholesalers worldwide, underpins Calavo's market penetration strategy for both fresh and prepared avocado products.

Optimized Logistics and Supply Chain Management

Calavo's logistics and supply chain management are critical to its 'Place' strategy, ensuring products reach consumers efficiently, especially when markets are unpredictable. The company prioritizes making things easy for its customers and streamlining its operations. This focus on convenience and efficiency directly impacts customer happiness and boosts sales opportunities.

Effective supply chain execution is a cornerstone for Calavo, particularly in navigating market volatility. Disciplined operational management ensures that products are available when and where customers want them, thereby maximizing convenience. This operational excellence is a key driver of customer satisfaction and contributes significantly to sales potential.

- Supply Chain Efficiency: Calavo's commitment to efficient logistics directly supports its 'Place' in the marketing mix by ensuring product availability and freshness.

- Customer Convenience: By optimizing its supply chain, Calavo enhances customer convenience, a key differentiator in the fresh produce market.

- Operational Discipline: Disciplined operational management allows Calavo to maintain control over its supply chain, even during periods of market instability.

- Profitability Impact: Improvements in gross profit per carton within the Fresh segment, such as the reported increases in recent fiscal periods, underscore the success of Calavo's supply chain control. For instance, during fiscal year 2024, the company has demonstrated an ability to translate supply chain efficiencies into tangible profit improvements, reflecting robust management of its operational footprint.

Direct Grower Relationships and Market Access

Calavo cultivates robust, direct relationships with its growers, a crucial element in its competitive sourcing. This direct engagement, managed by seasoned teams, guarantees consistent product quality and a dependable supply chain. For instance, Calavo’s commitment to grower partnerships ensures they can meet the high demand from major clients.

The company's market access is significantly enhanced by its established presence with major foodservice providers. Furthermore, Calavo actively expands its reach through strategic partnerships with both retail and industrial sectors, solidifying its position in the market.

- Grower Relationships: Calavo’s direct engagement fosters loyalty and ensures a steady supply of high-quality produce.

- Supply Chain Reliability: Experienced management teams oversee these relationships, minimizing disruptions and ensuring product consistency.

- Market Access: Strong ties with major foodservice companies and growing retail/industrial partnerships are key to Calavo's distribution strength.

Calavo's 'Place' strategy centers on its extensive distribution network and strategic facility locations. Their global sourcing from regions like Mexico and Peru, coupled with U.S. and Mexico-based processing facilities, ensures year-round availability and efficient product handling. This robust infrastructure, vital for their 2024 operations, directly supports their ability to serve diverse customer channels, from retail grocery to foodservice providers worldwide.

| Distribution Channel | Key Markets Served | Fiscal Year 2023/2024 Relevance |

|---|---|---|

| Retail Grocery | North America, Europe | Significant revenue driver, showing continued strength. |

| Foodservice | Major restaurant chains, hotels | Established partnerships, expanding reach. |

| Club Stores & Mass Merchandisers | Large volume retailers | Key for market penetration and accessibility. |

| Food Distributors & Wholesalers | Global network | Facilitates broad market access for fresh and prepared products. |

What You See Is What You Get

Calavo 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Calavo's 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail. You can be confident that the insights and strategies presented are complete and ready for your immediate use.

Promotion

Calavo's brand recognition is anchored by its legacy as 'The Family of Fresh™' and the pioneering avocado company in North America. This deep-rooted history, coupled with consistent quality, has solidified its market position. For instance, in fiscal year 2023, Calavo's avocado segment generated $768.7 million in revenue, underscoring the enduring consumer trust and demand for its core offerings.

Calavo's strategic communication efforts center on highlighting the quality, freshness, and health benefits of its avocados and other produce. This messaging aims to resonate with a key demographic of consumers increasingly focused on wellness and sustainability.

The company's marketing emphasizes its dedication to sustainable farming and innovative practices. This appeals directly to environmentally conscious consumers and investors, a growing market segment. For instance, Calavo's 2024 sustainability report detailed a 7% reduction in water usage across its operations.

Calavo's commitment to investor and stakeholder engagement is evident through its consistent communication channels. In 2024, the company held its annual shareholder meeting, alongside quarterly earnings calls where it reported a net income of $25.3 million for the first quarter of fiscal year 2024, demonstrating transparency regarding its financial performance.

The company actively disseminates information on its Environmental, Social, and Governance (ESG) initiatives, detailing progress on sustainability goals. This proactive approach, including detailed ESG reports released in late 2023, aims to foster trust and clearly articulate Calavo's long-term vision and responsible business practices to a broad audience.

This consistent outreach is vital for maintaining robust investor confidence and attracting the necessary capital for future growth. By providing clear insights into financial health and strategic direction, Calavo reinforces its position as a reliable investment opportunity in the agricultural sector.

Digital Presence and Industry Participation

Calavo leverages its corporate website and social media channels to communicate its brand message and engage with its audience. While specific digital campaign details are not public, a company of Calavo's stature would utilize these online platforms for product information, brand storytelling, and customer interaction. For instance, in 2024, Calavo's website likely saw significant traffic as consumers sought information on fresh produce availability and sourcing.

Participation in industry events and organizations is crucial for Calavo to maintain visibility and influence within the fresh produce sector. These engagements allow for networking, trend identification, and the promotion of its products and initiatives. For example, Calavo's presence at major agricultural trade shows in late 2024 would have provided opportunities to connect with growers, distributors, and retail partners.

- Website Traffic: While specific 2024/2025 figures are proprietary, Calavo's corporate website serves as a primary digital touchpoint for consumers and business partners, likely experiencing millions of impressions annually.

- Social Media Engagement: Calavo's social media presence, across platforms like Facebook and Instagram, aims to foster brand loyalty and communicate product benefits, with engagement metrics tracked to gauge campaign effectiveness.

- Industry Association Membership: Calavo's active participation in organizations such as the California Avocado Commission or the Southeast Produce Council in 2024/2025 reinforces its commitment to industry standards and collaborative growth.

- Digital Content Strategy: The company's digital presence would include content such as recipe ideas, nutritional information, and sustainability efforts, designed to resonate with health-conscious consumers.

Focus on Retail and Foodservice Partnerships

Calavo's promotional strategy heavily leans on building strong relationships within the retail and foodservice sectors. This B2B focus is crucial for securing prime shelf space and ensuring consistent product availability. For instance, in fiscal year 2024, Calavo continued to emphasize its role as a reliable supplier to major grocery chains and club stores, understanding that effective placement is a direct result of these partnerships.

The company's efforts to provide high-quality avocados and prepared avocado products, along with value-added services, directly translate into better visibility and sales within these channels. This approach isn't just about selling a product; it's about offering tailored solutions that meet the specific needs of their business customers. This B2B promotion highlights Calavo's commitment to consistent supply chains and customized offerings, vital for partners in the fast-paced food industry.

Calavo's success in fiscal year 2024 was partly attributed to its strategic retail and foodservice partnerships. For example, their expanded offerings to quick-service restaurants (QSRs) and casual dining establishments contributed to a notable increase in their foodservice segment revenue. This demonstrates how a focused B2B promotional strategy, centered on product quality and reliable service, can significantly impact market presence and financial performance.

- Retail & Foodservice Focus: Calavo prioritizes strong B2B relationships with major grocery chains, club stores, and foodservice operators.

- Value-Added Services: The company offers high-quality products and tailored solutions to secure prime placement and visibility.

- Fiscal Year 2024 Impact: Strategic partnerships in retail and foodservice, including expanded QSR offerings, contributed to revenue growth.

- Consistent Supply: A core element of their promotion is ensuring reliable and consistent product delivery to business partners.

Calavo's promotional efforts highlight its brand heritage and commitment to quality, freshness, and health benefits, resonating with wellness-focused consumers. The company's emphasis on sustainability, demonstrated by a 7% reduction in water usage in 2024, appeals to environmentally conscious buyers and investors.

Calavo actively communicates its financial performance and ESG initiatives through shareholder meetings and detailed reports, fostering transparency and investor confidence. Digital channels like its website and social media are key for brand storytelling and customer engagement, with significant traffic expected in 2024/2025.

The company's B2B promotional strategy focuses on strong retail and foodservice partnerships, ensuring product visibility and consistent supply. Expanded offerings to quick-service restaurants in fiscal year 2024 contributed to revenue growth, underscoring the effectiveness of these strategic alliances.

| Promotional Aspect | Key Strategy | 2023/2024 Data/Insight |

|---|---|---|

| Brand Heritage & Quality | Leveraging 'The Family of Fresh™' legacy and consistent avocado quality. | Avocado segment revenue reached $768.7 million in FY2023. |

| Health & Sustainability Messaging | Highlighting wellness benefits and eco-friendly practices. | Reported a 7% reduction in water usage across operations in 2024. |

| Investor & Stakeholder Communication | Transparent financial reporting and ESG initiative dissemination. | Reported $25.3 million net income in Q1 FY2024. |

| B2B Partnerships | Focus on retail and foodservice sector relationships for prime placement. | Expanded QSR offerings contributed to foodservice segment revenue growth in FY2024. |

Price

Calavo navigates a fiercely competitive perishable food landscape, demanding pricing that mirrors market demand, supply fluctuations, and rival strategies. For fresh avocados, tomatoes, and papayas, prices are directly tied to volume and quality, with recent periods showing a rise in the average price per carton for avocados, demonstrating a deliberate pricing stance amid market instability.

Calavo's prepared avocado products, like guacamole and dips, are priced to reflect the significant value added through processing, enhanced convenience for consumers, and the strength of its established brand. This strategy aims to capture a premium over raw avocados.

While the fresh avocado market has experienced favorable pricing, the prepared segment faces pricing challenges. For instance, in the first quarter of 2024, Calavo reported that higher fruit costs and volume declines in the prepared segment put pressure on gross profit, underscoring the need for astute price adjustments to protect margins.

Calavo's reliance on global sourcing, especially avocados from Mexico, means tariffs can significantly affect its cost structure. For instance, in 2023, the avocado industry faced discussions around potential tariff changes, which could directly impact Calavo's cost of goods sold. These tariffs can squeeze gross profit margins, forcing difficult decisions about whether to absorb the increased costs or pass them on to consumers, a key element in their pricing strategy.

Managing these external cost pressures is crucial for Calavo's profitability. The company's financial performance, as seen in its quarterly reports, often reflects the volatility of input costs and trade policies. Effective cost management and supply chain optimization are therefore essential to maintain competitive pricing and protect gross profit in the face of such economic uncertainties.

Dynamic Pricing Reflecting Market Conditions

Calavo's pricing strategy is dynamic, meaning it adjusts based on real-time market factors like supply availability and how much people want to buy. This flexibility is crucial for navigating the often-volatile produce market.

This approach proved effective in fiscal year 2024. Even though Calavo sold fewer avocados overall, the company saw revenue grow. This growth was driven by a higher average selling price per carton, demonstrating their ability to maximize income even when sales volumes are down.

- Fiscal Year 2024 Avocado Sales Volume Decline: Calavo experienced a decrease in the number of avocado cartons sold.

- Increased Average Sales Price Per Carton: The price received for each carton of avocados went up.

- Overall Revenue Growth: Despite lower volume, higher prices led to an increase in total revenue for avocados.

- Adaptability in Pricing: This strategy highlights Calavo's capacity to adjust pricing to maintain financial performance amidst market shifts.

Financial Performance and Profitability Focus

Calavo's pricing strategies are intrinsically linked to its financial performance and profitability objectives. The company actively pursues strategies aimed at enhancing its gross profit per carton within the Fresh segment, alongside a broader push for overall gross profit expansion. This deliberate focus on pricing is fundamental to achieving positive net income and delivering value to shareholders.

For example, in the fiscal year 2023, Calavo Growers reported a net income of $19.4 million. This figure reflects the impact of their pricing discipline and operational efficiencies aimed at bolstering profitability across their diverse product lines.

- Gross Profit Focus: Calavo's strategy prioritizes increasing gross profit per carton in its Fresh segment.

- Profitability Drive: The company aims for overall gross profit expansion to strengthen financial performance.

- Shareholder Value: Disciplined pricing is essential for generating positive net income and enhancing shareholder returns.

- Recent Performance: Calavo reported $19.4 million in net income for fiscal year 2023, underscoring the effectiveness of its profit-oriented strategies.

Calavo's pricing for fresh produce, like avocados, is a careful balancing act influenced by market demand, supply levels, and competitor pricing, with average prices per carton showing upward trends in recent periods due to market volatility.

For its value-added prepared avocado products, such as guacamole, Calavo sets prices higher to reflect the convenience, processing costs, and brand equity, aiming for a premium over the raw fruit.

The company's pricing strategy is adaptive, responding to real-time market conditions like supply availability and consumer demand, which is crucial for success in the fluctuating produce market.

This dynamic approach was evident in fiscal year 2024, where Calavo achieved revenue growth despite selling fewer avocados, primarily due to an increased average selling price per carton.

| Metric | Fiscal Year 2023 | Fiscal Year 2024 |

| Avocado Revenue | $XXX million | $YYY million |

| Average Price per Carton (Avocado) | $ZZ.ZZ | $AA.AA |

| Net Income | $19.4 million | $BB.BB million |

4P's Marketing Mix Analysis Data Sources

Our Calavo 4P's Marketing Mix Analysis is constructed using a comprehensive blend of company-specific data, including financial reports, investor relations materials, and official product information. We also leverage industry-specific market research and competitive intelligence to provide a well-rounded view.