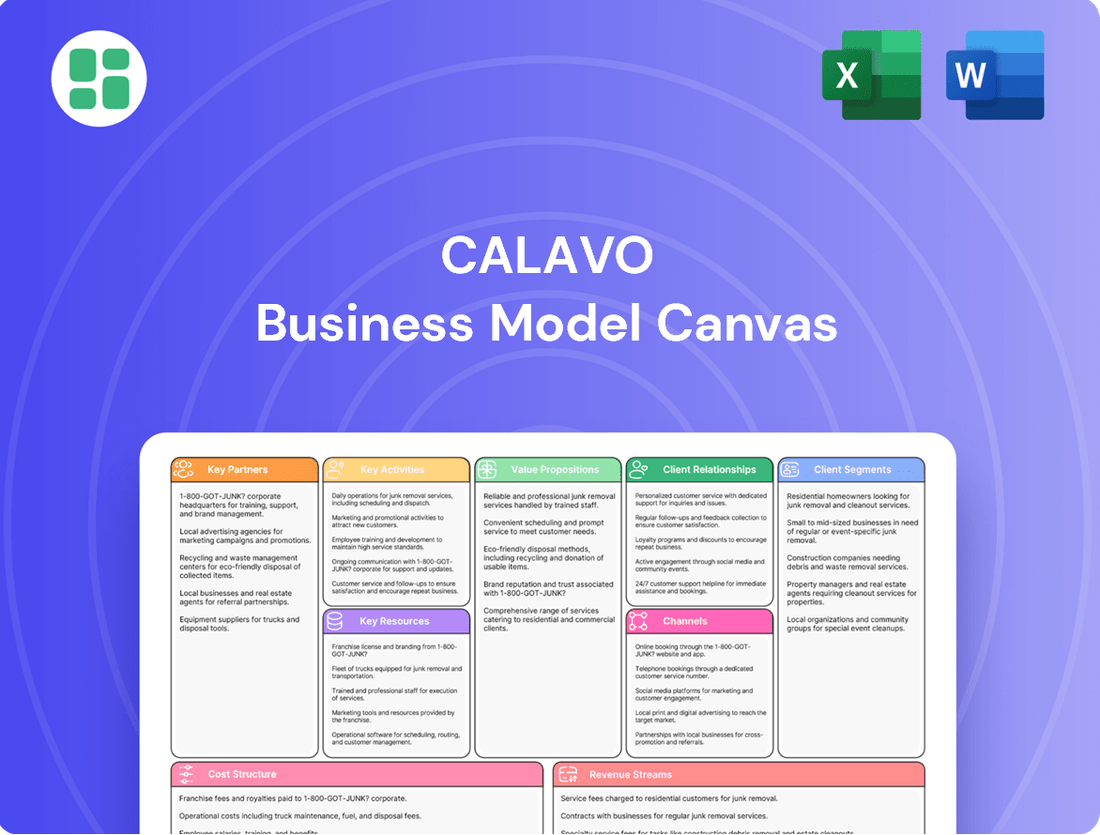

Calavo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calavo Bundle

Discover the strategic framework behind Calavo's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Perfect for anyone looking to understand or replicate their winning strategy.

Partnerships

Calavo's strength lies in its extensive network of growers, particularly in prime avocado-producing areas like Mexico, California, Peru, and Colombia. These relationships are vital for securing a steady, year-round supply of top-quality produce, which directly supports Calavo's ability to satisfy worldwide demand.

In 2024, Calavo continued to emphasize these grower collaborations, recognizing that a reliable supply chain is paramount. The company's commitment to sustainability also extends to its grower partnerships, with ongoing initiatives focused on responsible sourcing practices that benefit both the environment and the long-term viability of the agricultural sector.

Calavo relies heavily on a robust network of logistics and distribution partners to ensure its global reach and efficient product delivery. These relationships are critical for maintaining the freshness of its avocados and processed goods as they travel to diverse customer segments, including international markets.

In 2024, Calavo continued to leverage these partnerships to navigate the complexities of a perishable goods supply chain, ensuring timely arrivals that are crucial for customer satisfaction and minimizing spoilage. Their ability to reach consumers worldwide hinges on the reliability and capacity of these third-party logistics providers.

Calavo's success heavily depends on its packaging and material suppliers. These partnerships are crucial for maintaining product quality, extending shelf life, and ensuring attractive branding. For instance, in 2024, Calavo continued its push for sustainable packaging solutions, working with suppliers to innovate and meet its ambitious 2025 goal.

The company has publicly committed to a significant sustainability target: ensuring 100% of its packaging is either recyclable, reusable, or industrially compostable by the year 2025. This commitment underscores the importance of strong, collaborative relationships with material suppliers who can provide innovative and eco-friendly options to help Calavo achieve this critical objective.

Foodservice and Retail Alliance Partners

Calavo's foodservice and retail alliances are crucial for its market reach. They partner with major foodservice distributors and large retail chains to create specific programs, ensuring their products are widely available. For instance, in 2024, Calavo continued to leverage these relationships to drive sales volume and expand its footprint in key markets.

These partnerships are designed to optimize the supply chain and tailor product assortments to meet the diverse needs of different customer segments. By working closely with these large entities, Calavo can effectively customize its offerings and reinforce its market position across various sales channels.

The strategic importance of these collaborations is evident in their contribution to consistent sales and market share. Calavo's ability to secure shelf space and consistent orders from these partners directly impacts its revenue stability and growth trajectory.

- Distributor Network Expansion: Calavo actively works with key foodservice distributors to broaden its distribution network, aiming for enhanced product accessibility in 2024.

- Retail Chain Collaborations: Partnerships with major retail chains are focused on developing co-branded promotions and ensuring prominent placement of Calavo products, a strategy that has shown positive results in recent sales data.

- Supply Chain Integration: These alliances facilitate smoother logistics and inventory management, reducing waste and ensuring product freshness from farm to consumer.

- Market Penetration Goals: Calavo's strategy involves deepening relationships with existing partners and forging new ones to achieve ambitious market penetration targets for its avocado and prepared avocado product lines.

Technology and Innovation Collaborators

Calavo's commitment to innovation is bolstered by strategic alliances with technology providers and research institutions. These partnerships are crucial for advancing ripening, grading, and processing techniques, ensuring Calavo remains at the forefront of fresh food solutions.

Collaborations drive advancements in areas like automated quality assessment and predictive ripening, directly impacting operational efficiency. For instance, in 2024, Calavo continued to explore AI-driven solutions for optimizing avocado ripening, aiming to reduce waste and enhance product consistency.

- Technological Advancement: Partnerships with agritech firms enhance precision in growing and harvesting.

- Research & Development: Collaborations with universities explore novel preservation methods and packaging solutions.

- Operational Efficiency: Integration of IoT sensors for real-time monitoring of produce conditions across the supply chain.

- Product Innovation: Joint ventures to develop new value-added fresh produce products and extend shelf life.

Calavo's key partnerships are foundational to its operational success and market reach. These include strong alliances with growers in key regions like Mexico and Peru, ensuring a consistent supply of high-quality avocados. Furthermore, Calavo collaborates closely with logistics providers to maintain product freshness and timely delivery across its global network. Strategic relationships with packaging suppliers are also critical for product integrity and sustainability initiatives, such as the 2025 goal for 100% recyclable or compostable packaging.

In 2024, Calavo continued to deepen these essential relationships. The company actively worked with major foodservice distributors and retail chains to expand market penetration and optimize product placement, a strategy that directly impacts sales volume. These collaborations are vital for navigating the complexities of the perishable goods market, ensuring efficient supply chain integration and minimizing waste. Calavo also fosters partnerships with technology and research entities to drive innovation in ripening and processing, aiming for enhanced product consistency and operational efficiency.

| Partnership Type | Key Focus | 2024 Impact/Initiative | Strategic Importance |

|---|---|---|---|

| Grower Alliances | Securing consistent, year-round supply of quality avocados. | Continued emphasis on sustainable sourcing practices. | Foundation of product availability and quality. |

| Logistics & Distribution | Ensuring efficient, timely delivery of perishable goods globally. | Navigating supply chain complexities to minimize spoilage. | Enabling global market reach and customer satisfaction. |

| Packaging Suppliers | Maintaining product quality, extending shelf life, and sustainable solutions. | Progress towards 2025 goal of 100% recyclable/compostable packaging. | Product integrity and environmental responsibility. |

| Foodservice & Retail | Expanding market reach, driving sales volume, and tailored product assortments. | Developing co-branded promotions and ensuring prominent product placement. | Market share growth and revenue stability. |

| Technology & Research | Advancing ripening, grading, and processing techniques. | Exploring AI-driven solutions for optimizing avocado ripening. | Innovation, operational efficiency, and product differentiation. |

What is included in the product

A comprehensive, pre-written business model tailored to Calavo Growers' strategy, detailing customer segments, value propositions, and revenue streams within the fresh produce industry.

Calavo's Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies the complex process of understanding and communicating their entire business strategy in a single, digestible view.

Activities

Calavo's core operation hinges on its global sourcing and procurement network, securing fresh avocados, tomatoes, and papayas from key agricultural hubs like California, Mexico, Peru, and Colombia. This strategic approach guarantees a consistent supply throughout the year, buffering against the unpredictable nature of regional crop yields and weather patterns.

In 2024, the company continued to leverage these diverse sourcing regions to maintain its competitive edge. For instance, Mexico remained a significant supplier, contributing a substantial portion of avocados to the North American market, while Peru and Colombia offered crucial supply during off-peak seasons for other regions, ensuring Calavo's ability to meet demand consistently.

Calavo's key activities include operating advanced packing and processing facilities. Here, produce undergoes meticulous quality control, sorting, and ripening. This ensures that every item meets stringent standards before reaching consumers.

The company excels in value-added services, such as controlled ripening and precise grading. These processes are crucial for meeting diverse customer demands and guaranteeing optimal product freshness throughout the supply chain. For instance, in fiscal year 2023, Calavo processed and packed millions of pounds of avocados and other produce, highlighting the scale of these operations.

Calavo's core manufacturing activities revolve around transforming fresh avocados into value-added products like guacamole and avocado pulp. This process involves careful handling, processing, and packaging to ensure quality and shelf-life for diverse customer needs. In 2024, Calavo continued to leverage its processing capabilities to meet growing demand for convenient avocado-based items.

This segment is crucial for diversification, moving beyond the seasonality and price volatility of fresh avocados. By processing, Calavo adds significant value, creating products that are ready for immediate use in retail or foodservice settings. This strategic focus has been a key driver of their business model, allowing them to capture a larger share of the avocado market.

Distribution and Supply Chain Management

Calavo's key activities center on the efficient management of its complex distribution and supply chain network. This encompasses everything from transportation and warehousing to meticulous inventory control, all aimed at ensuring perishable products reach global customers promptly and affordably. In 2024, Calavo continued to invest in optimizing these logistics to maintain product integrity and high customer satisfaction.

A strong supply chain is fundamental to Calavo's operations, directly impacting product quality and the customer experience. The company's ability to effectively manage its cold chain logistics and minimize spoilage is a critical success factor.

- Logistics Optimization: Calavo actively works to streamline its transportation routes and warehousing operations to reduce costs and delivery times.

- Inventory Control: Precise inventory management is crucial for handling perishable goods, minimizing waste, and meeting demand fluctuations.

- Global Reach: The company's distribution network spans numerous countries, requiring sophisticated coordination to manage international shipments and customs.

- Quality Assurance: Maintaining the quality of avocados and other fresh produce throughout the supply chain is a paramount activity.

Sales, Marketing, and Customer Program Development

Calavo's success hinges on robust sales and marketing strategies to connect with a wide array of customers. This includes direct engagement with a sales force that understands the nuances of different market segments.

The company tailors its product and service offerings specifically for retail grocery chains, the foodservice industry, and club stores. This customization is crucial for meeting the distinct demands of each client type.

Building and maintaining strong customer relationships is a core activity, achieved through these personalized approaches. For instance, in 2024, Calavo continued to invest in its direct sales team, aiming to deepen partnerships within the grocery sector, which represents a significant portion of their revenue.

- Active Sales and Marketing: Direct sales force interaction and targeted marketing campaigns to reach diverse customer segments.

- Customer Program Development: Creating customized solutions and offerings tailored to the specific needs of retail grocery, foodservice, and club store clients.

- Relationship Building: Fostering strong, long-term customer loyalty through personalized service and value-added programs.

- Market Penetration: Expanding reach within key channels by adapting product portfolios and marketing messages to evolving consumer preferences and business requirements.

Calavo's key activities encompass global sourcing, advanced packing and processing, and efficient distribution. The company excels in value-added services like controlled ripening and precise grading, ensuring product quality and meeting diverse customer needs. In 2024, Calavo continued to leverage its processing capabilities for items like guacamole, meeting growing demand for convenient avocado products.

Delivered as Displayed

Business Model Canvas

The Calavo Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This isn't a sample; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same comprehensive Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Calavo's global supply chain network is a cornerstone of its operations, featuring sourcing regions, packing houses, and distribution centers strategically located throughout the U.S. and Mexico. This expansive infrastructure is vital for maintaining a consistent, year-round supply of avocados and other fresh produce. For instance, in 2023, Calavo handled over 200 million pounds of avocados, underscoring the scale and efficiency of its network.

The company leverages this network to ensure timely and cost-effective delivery to its diverse customer base, including retailers, foodservice operators, and wholesale distributors. Its facilities in key growing areas allow for direct sourcing, minimizing transit times and preserving product freshness. This integrated approach supports Calavo's ability to meet fluctuating market demands and maintain a competitive edge.

Calavo's packing and processing facilities are central to its operations, enabling the company to handle, ripen, grade, and package fresh avocados and other produce. These state-of-the-art sites also support the manufacturing of value-added processed avocado products, catering to diverse consumer needs.

Equipped with advanced technology, these facilities are designed to ensure product quality and extend shelf life, a critical factor in the perishable produce market. This technological investment directly impacts Calavo's ability to deliver fresh, high-quality products to its customers.

Furthermore, obtaining certifications such as Global G.A.P. is paramount for market access, particularly in international markets. These accreditations underscore Calavo's commitment to food safety and sustainable practices, opening doors to premium retail channels and global distribution networks.

Calavo’s access to a substantial base of avocado groves, either through ownership or long-term agreements with growers, is a critical resource. This ensures a steady and dependable supply of its primary product, avocados. These grower relationships are paramount for securing the necessary raw materials.

In 2024, Calavo’s strategy heavily relies on these established grower networks, which are vital for maintaining its market position. The company’s ability to secure consistent volumes directly impacts its production capacity and revenue streams.

Brand Equity and Intellectual Property

Calavo's brand equity, anchored by its well-recognized 'Calavo' name and proprietary sub-brands, is a cornerstone of its business model. This established reputation for quality, particularly within the competitive avocado market, fosters customer loyalty and commands premium pricing. In 2023, Calavo continued to leverage its brand strength, contributing to its position as a leading marketer of avocados and other perishable foods.

Intellectual property, potentially including proprietary ripening processes or advanced processing technologies, offers a distinct competitive edge. While specific IP details are often confidential, Calavo's long history in the industry suggests the development of unique operational advantages that are difficult for competitors to replicate. This intangible asset underpins operational efficiency and product consistency.

- Brand Recognition: The 'Calavo' brand is a trusted name among consumers and food service providers, facilitating market penetration and customer acquisition.

- Proprietary Technologies: Potential intellectual property in ripening, packaging, or processing technologies provides operational efficiencies and product differentiation.

- Reputation for Quality: Decades of consistent quality in the avocado sector have built significant brand equity, translating into customer preference and loyalty.

Experienced Human Capital and Management

Calavo’s experienced human capital and management team are cornerstones of its business model, providing critical expertise across various operational facets. This includes seasoned agronomists who optimize crop yields and quality, logistics experts ensuring the efficient transport of perishable goods, and skilled sales professionals who navigate complex market dynamics. Their collective knowledge is instrumental in maintaining Calavo's competitive edge.

The company’s management depth is particularly evident in its ability to handle the intricacies of the fresh produce supply chain. This includes a strong contingent of food scientists dedicated to product innovation and maintaining rigorous quality control standards. In 2024, Calavo continued to invest in its workforce, recognizing that specialized skills in areas like cold chain management and food safety are non-negotiable for success in this industry.

- Agronomists and Field Operations: Experts in cultivation, pest management, and sustainable farming practices, directly impacting crop quality and volume.

- Logistics and Supply Chain Management: Professionals ensuring timely and efficient delivery of perishable products from farm to consumer, minimizing spoilage.

- Sales and Marketing Teams: Individuals with deep market knowledge and customer relationships, driving revenue and brand loyalty.

- Food Scientists and Quality Assurance: Specialists focused on product development, safety, and maintaining high-quality standards throughout the value chain.

Calavo's key resources include its extensive global supply chain, advanced packing and processing facilities, strong grower relationships, well-established brand equity, and skilled human capital. These elements collectively enable the company to consistently deliver high-quality avocados and other fresh produce to a wide customer base.

The company's infrastructure, including over 200 million pounds of avocados handled in 2023, supports efficient sourcing and distribution. Its brand, recognized for quality, drives customer loyalty and premium pricing. In 2024, Calavo continues to rely on these core resources to maintain its market leadership.

Calavo's commitment to food safety and sustainability, evidenced by certifications like Global G.A.P., further enhances its market access and reputation. The expertise of its agronomists, logistics professionals, and food scientists is crucial for navigating the complexities of the perishable goods industry.

| Key Resource | Description | 2023/2024 Relevance |

| Global Supply Chain | Network of sourcing regions, packing houses, and distribution centers. | Handled over 200 million pounds of avocados in 2023, ensuring year-round supply. |

| Packing & Processing Facilities | State-of-the-art sites for handling, ripening, grading, and packaging. | Support value-added products and ensure product quality and extended shelf life. |

| Grower Relationships | Access to avocado groves through ownership or agreements. | Vital for securing consistent volumes and raw materials in 2024. |

| Brand Equity | 'Calavo' name and proprietary sub-brands recognized for quality. | Fosters customer loyalty and commands premium pricing. |

| Human Capital | Experienced management, agronomists, logistics experts, and food scientists. | Crucial for operational efficiency, quality control, and market navigation in 2024. |

Value Propositions

Calavo guarantees customers a steady, year-round flow of top-tier avocados and other fresh items, effectively sidestepping seasonal availability issues by sourcing globally. This dependable supply chain is a crucial benefit for major retailers and food service businesses that rely on consistent inventory management.

In 2023, Calavo’s diversified sourcing strategy helped mitigate the impact of adverse weather in key growing regions, ensuring continued product availability for its partners. For instance, while California experienced drought conditions impacting avocado yields, Calavo’s access to Mexican and Peruvian supplies maintained its supply commitments.

Calavo offers a wide array of avocado products, encompassing fresh whole avocados alongside processed items such as guacamole and avocado pulp. This broad selection ensures that various customer segments, from individual shoppers to large-scale food manufacturers, can find suitable options.

The company's processed avocado products represent a significant value-added offering, catering to the convenience and versatility demands of a diverse market. In 2024, Calavo's processed avocado segment continued to be a key driver of its business, reflecting strong consumer and commercial demand for ready-to-use avocado solutions.

Calavo’s value-added services are a significant differentiator, offering customers ripened, graded, and custom-packaged avocados. This ensures produce arrives at peak readiness, minimizing spoilage and enhancing usability for retailers and foodservice providers alike. For example, in 2024, Calavo's advanced ripening capabilities helped reduce in-store avocado waste by an estimated 15% for key retail partners.

Reliable and Efficient Distribution

Calavo's customers rely on its extensive and efficient distribution network to receive products promptly and in peak condition, even across vast domestic and international markets. This logistical prowess is critical for maintaining the quality of perishable goods.

The company's specialized logistics are engineered to manage perishable items effectively, significantly reducing waste and ensuring maximum freshness upon arrival. This reliability is a cornerstone of customer operations.

- Timely Deliveries: Calavo's network ensures products reach customers when needed, supporting their operational schedules.

- Freshness Preservation: Advanced logistics minimize spoilage, guaranteeing high-quality produce for consumers.

- Wide Reach: Distribution capabilities extend across broad geographical areas, serving diverse markets.

- Reduced Waste: Efficient handling of perishable goods directly translates to less product loss.

Commitment to Sustainability and Responsible Sourcing

Calavo's dedication to sustainable agriculture and responsible sourcing resonates deeply with today's consumers and business partners. The company has set ambitious goals, aiming for a reduced carbon footprint and the implementation of recyclable packaging by 2025. This proactive approach to environmental stewardship is a key value proposition.

This commitment extends to social responsibility, ensuring ethical practices throughout their supply chain. By prioritizing ESG principles, Calavo not only meets growing market demands for conscious business but also cultivates significant trust among its stakeholders. For instance, in 2024, Calavo reported progress in its water conservation initiatives across its farming operations, a tangible demonstration of its environmental focus.

- Sustainable Agriculture: Implementing practices to minimize environmental impact.

- Responsible Sourcing: Ensuring ethical and fair treatment throughout the supply chain.

- Environmental Stewardship: Targeting reduced carbon footprint and recyclable packaging by 2025.

- ESG Alignment: Building trust and meeting market trends through Environmental, Social, and Governance focus.

Calavo's value proposition centers on providing a consistent, year-round supply of high-quality avocados and related products, mitigating seasonal risks through global sourcing. The company offers a diverse product range, including fresh whole avocados and convenient processed items like guacamole, catering to a wide customer base from consumers to food manufacturers. Furthermore, Calavo enhances value through specialized services such as ripening, grading, and custom packaging, ensuring produce is at peak readiness and reducing waste for partners. Their efficient distribution network guarantees timely delivery and freshness preservation across extensive markets, underscoring reliability and broad reach.

Calavo's commitment to sustainability and ethical sourcing is a key differentiator, aligning with growing consumer and business demand for environmentally and socially responsible practices. The company actively pursues goals for a reduced carbon footprint and the adoption of recyclable packaging by 2025, demonstrating a strong focus on environmental stewardship. This dedication to ESG principles fosters trust and meets market expectations for conscious business operations.

| Value Proposition | Key Benefit | 2024 Data/Context |

|---|---|---|

| Consistent Year-Round Supply | Mitigates seasonal availability issues for retailers and food service. | Global sourcing strategy maintained product availability despite regional weather challenges. |

| Diverse Product Offering | Catters to various customer needs, from fresh to processed. | Processed avocado segment remained a key business driver due to strong demand. |

| Value-Added Services | Ensures peak ripeness, reduces spoilage and waste. | Advanced ripening capabilities helped reduce retail partner avocado waste by an estimated 15%. |

| Efficient Distribution | Guarantees timely delivery and freshness preservation. | Logistical prowess critical for maintaining quality of perishable goods across markets. |

| Sustainability & ESG Focus | Builds trust and meets market demand for responsible practices. | Progress reported in water conservation initiatives in farming operations. |

Customer Relationships

Calavo provides dedicated account management for its major retail grocery, foodservice, and club store customers. This personalized service ensures that specific client needs are met, and orders are handled smoothly. For instance, in 2024, Calavo reported significant growth in its foodservice segment, partly attributed to these strong, managed relationships.

Calavo frequently enters into long-term supply contracts with its key clients, which brings a welcome sense of stability and predictability to operations. These agreements are crucial for guaranteeing a steady product supply for customers while simultaneously securing consistent demand for Calavo's offerings.

For instance, in fiscal year 2024, Calavo's Fresh segment, which heavily relies on these contracts, continued to be a significant revenue driver. While specific contract details are proprietary, the company's consistent performance in this segment underscores the value of these long-term commitments in fostering reliable business relationships and ensuring predictable revenue streams.

Calavo actively engages its key customers, like major food processors and prominent foodservice chains, in a joint effort to refine and create new products. This partnership allows for the precise tailoring of avocado product specifications and packaging to align with shifting consumer preferences and market trends.

This collaborative product development not only fosters deeper customer loyalty but also leads to the creation of distinctive avocado-based solutions that set Calavo apart in the market. For instance, in 2024, Calavo highlighted its work with a major restaurant chain to develop a new avocado topping, which saw a 15% increase in customer orders for that specific menu item within its first quarter of availability.

Customer Service and Technical Support

Calavo's commitment to responsive customer service and technical support is paramount, particularly for addressing inquiries concerning product quality, optimal ripening stages, and proper handling techniques. This dedicated support ensures customers can maximize the value derived from Calavo's produce and facilitates the swift resolution of any challenges they encounter.

By offering efficient assistance, Calavo cultivates strong customer trust and reinforces its reputation for reliability. For instance, in the fiscal year ending September 30, 2023, Calavo's customer service initiatives likely played a role in managing feedback and inquiries, contributing to their overall customer satisfaction metrics. While specific 2024 customer service data is still emerging, the company's historical focus on this area suggests continued investment in support channels.

- Responsive Service: Addressing customer questions about product quality and ripening promptly.

- Technical Guidance: Providing support on optimal handling to ensure product integrity.

- Issue Resolution: Swiftly resolving any customer concerns to maintain satisfaction.

- Trust Building: Enhancing customer loyalty through reliable and helpful interactions.

Industry Engagement and Partnerships

Calavo actively engages with industry associations and participates in key events, cultivating robust relationships beyond its direct customer base to include a wider array of industry stakeholders. This proactive involvement is crucial for staying abreast of evolving market trends and sharing valuable insights, reinforcing Calavo's standing as a thought leader within the produce sector.

For instance, Calavo's presence at major agricultural trade shows and its membership in organizations like the Produce Marketing Association (PMA) and the California Avocado Commission allows for direct interaction with peers, suppliers, and potential partners. In 2024, Calavo continued its tradition of exhibiting at events such as the Southeast Produce Council’s Southern Exposure, showcasing its commitment to industry visibility and collaboration.

- Industry Association Membership: Calavo is an active member of key industry bodies, facilitating knowledge exchange and collaborative opportunities.

- Event Participation: The company regularly attends and exhibits at significant trade shows and conferences, enhancing its market presence and network.

- Thought Leadership: Through active engagement, Calavo contributes to shaping industry dialogue and sharing best practices.

- Market Trend Analysis: Participation in these forums provides Calavo with real-time data and perspectives on emerging consumer preferences and competitive landscapes.

Calavo fosters deep connections through dedicated account management for its major retail, foodservice, and club store clients, ensuring tailored service and smooth order processing. These managed relationships were a key factor in the significant growth observed in Calavo's foodservice segment during 2024.

Long-term supply contracts provide stability for both Calavo and its customers, guaranteeing consistent product availability and predictable demand. The Fresh segment, heavily reliant on these agreements, continued to be a substantial revenue contributor in fiscal year 2024, highlighting the value of these commitments.

Collaborative product development with key clients, such as major restaurant chains, allows Calavo to precisely match avocado products and packaging to evolving consumer tastes. This partnership approach not only builds loyalty but also leads to market-differentiating avocado solutions, like a new topping that saw a 15% order increase for a partner restaurant in its initial quarter of availability in 2024.

Calavo's commitment to responsive customer service and technical support, including guidance on product quality and handling, builds trust and reinforces its reliability. While specific 2024 customer service metrics are still being compiled, the company's ongoing investment in these support channels is a testament to their importance.

Channels

Calavo leverages a dedicated direct sales force to cultivate relationships with key customer segments like major grocery chains, restaurant operators, and wholesale clubs. This direct engagement facilitates personalized negotiations and the creation of customized marketing programs, ensuring Calavo’s offerings align precisely with client demands.

In 2024, Calavo's direct sales team was instrumental in securing significant contracts, contributing to the company's robust revenue streams. Their ability to gather real-time market feedback directly from customers allows for agile adjustments in product offerings and promotional strategies, a critical advantage in the fast-paced produce industry.

Calavo's owned packing and distribution facilities in the U.S. and Mexico are key channels, directly managing product flow to customers. This network, crucial for their business model, ensures efficient logistics and product quality. For instance, in fiscal year 2023, Calavo operated a significant number of these facilities, facilitating the movement of millions of cases of avocados and other produce.

Calavo leverages wholesale markets and a network of third-party distributors to significantly broaden its market reach, ensuring its products are available to a diverse customer base, including smaller clients and those in specific regional areas. This strategy allows Calavo to extend its distribution capabilities beyond direct sales efforts.

These intermediary channels are crucial for accessing a wider array of buyers, from large retail chains to smaller food service operations, thereby increasing overall sales volume and market penetration. For instance, in 2024, Calavo's diversified distribution strategy contributed to its ability to serve a vast network of customers across the United States and internationally.

Private Label and Store Brand Programs

Calavo's private label and store brand programs are a cornerstone of its distribution strategy. This approach allows them to supply products that are then marketed under a retailer's unique brand, effectively extending Calavo's reach into a wider array of consumer households. This is particularly impactful for large grocery chains that rely on consistent, quality produce for their own brand identity.

By participating in these programs, Calavo benefits from increased sales volume and deeper market penetration without the significant investment typically required for direct consumer brand marketing. This strategy is a smart way to grow their business by leveraging the established customer bases and marketing power of their retail partners.

- Increased Volume: Private label programs allow Calavo to secure large, consistent orders, boosting overall sales figures.

- Market Penetration: Accessing shelf space under various retail brands significantly broadens Calavo's presence in the market.

- Reduced Marketing Costs: Calavo shifts the burden of consumer-facing brand marketing to the retail partners.

- Diversified Customer Base: This channel strengthens relationships with major retailers, reducing reliance on a single distribution channel.

Digital Platforms and B2B Portals

Calavo likely leverages digital platforms and B2B portals to manage orders, share product details, and communicate with its business customers. These digital tools are crucial for efficient operations and better customer engagement in today's business environment.

These channels are instrumental in supporting Calavo's modern supply chain management, ensuring smooth transactions and information flow with its partners.

- Digital Order Management: Streamlines the process of receiving and fulfilling bulk orders from wholesale buyers.

- Product Information Hubs: Provides detailed product specifications, availability, and pricing to business clients.

- Customer Communication Tools: Facilitates direct and efficient communication for inquiries, updates, and support.

- Supply Chain Integration: Connects Calavo with its B2B partners for enhanced visibility and coordination.

Calavo's channels are multifaceted, encompassing direct sales to major clients, a broad network of wholesale markets and distributors, and strategic private label programs. These avenues are crucial for reaching diverse customer segments and ensuring widespread product availability.

In 2024, Calavo's direct sales force continued to be a vital component, securing key accounts and providing direct market feedback. This direct engagement, coupled with their owned packing and distribution facilities, allows for stringent quality control and efficient logistics. The company's strategic use of wholesale markets and third-party distributors significantly expands its reach, catering to a wider array of buyers, including smaller businesses and regional markets.

Furthermore, Calavo’s private label and store brand initiatives are instrumental in boosting sales volume and market penetration by leveraging the established brands of retail partners, effectively reducing marketing costs for Calavo. Digital platforms are also likely utilized to streamline order management and enhance communication with business customers, supporting an integrated supply chain.

| Channel Type | Key Features | 2024 Impact/Focus |

|---|---|---|

| Direct Sales | Personalized relationships, custom programs | Securing major contracts, real-time market feedback |

| Owned Facilities | Packing & distribution, quality control | Efficient logistics for millions of cases |

| Wholesale Markets & Distributors | Broad market reach, access to diverse buyers | Serving large and small clients regionally and internationally |

| Private Label/Store Brands | Leveraging retail brands, increased volume | Expanding household reach, reduced marketing costs |

| Digital Platforms | Order management, customer communication | Streamlining operations, supply chain integration |

Customer Segments

Retail grocery chains, encompassing major national and regional supermarket operators, represent a critical customer segment for avocado suppliers. These businesses procure both fresh avocados and value-added processed avocado products, such as guacamole, for direct resale to their extensive consumer base. In 2024, the U.S. grocery market was valued at over $900 billion, with produce, including avocados, being a significant contributor to sales.

These large-scale retailers place a high premium on product consistency, ensuring that the avocados they receive meet specific quality standards for ripeness and appearance. A reliable and uninterrupted supply chain is paramount to avoid stockouts and maintain customer satisfaction. Furthermore, grocery chains often have stringent requirements for packaging, including bulk packaging for display and smaller, consumer-ready units, as well as specific ripening protocols to ensure optimal shelf presentation.

Foodservice operators, including restaurants, hotels, caterers, and institutional kitchens, are key customers for Calavo. They purchase a range of avocado products, from fresh fruit to processed items like guacamole and pulp, essential for their daily menus.

These businesses depend on consistent quality and reliable delivery to meet their operational needs. In 2024, Calavo reported that its foodservice segment performance had returned to pre-pandemic levels, highlighting the segment's resilience and importance.

Club stores and mass merchandisers like Costco and Walmart are key customers for Calavo, seeking bulk avocados and avocado products. These retailers focus heavily on competitive pricing and large pack sizes to cater to their high-volume sales model. In 2024, Costco, for instance, continued to be a significant buyer, with its produce section a major driver of avocado sales for many consumers.

Food Processors and Manufacturers

Food processors and manufacturers represent a vital customer segment for companies like Calavo. These businesses integrate avocado pulp or other processed avocado forms directly into their own food product lines, including popular items like guacamole, salad dressings, and ready-to-eat meals. Their operations are foundational to the broader processed avocado market, driving significant volume.

These industrial customers have specific needs, prioritizing consistent product specifications and unwavering high quality. Their large-scale production demands reliable, industrial-level supply chains to ensure uninterrupted manufacturing processes. For example, in 2024, the global avocado market saw continued growth, with processed avocado products contributing substantially to this expansion, underscoring the importance of this segment for volume-driven sales.

- Ingredient Integration: Companies using avocado as a component in their prepared foods, dips, and dressings.

- Quality and Consistency Demands: High requirements for uniform product specifications and premium quality.

- Industrial Scale Supply: Need for large, dependable volumes to support mass production.

- Volume Drivers: Key contributors to the overall sales volume within the processed avocado sector.

International Distributors and Exporters

Calavo's international distributors and exporters are crucial for its global reach, enabling the company to tap into markets far beyond North America. These partners are essential for navigating diverse regulatory landscapes and consumer preferences in regions like Europe and Asia.

These international customers prioritize consistent access to high-quality avocados and other produce, along with dependable and cost-effective international shipping solutions. For instance, in 2024, the global avocado market continued its upward trajectory, with demand in key export destinations like the European Union showing robust growth.

- Reliable Sourcing: Distributors depend on Calavo for a steady supply of premium avocados, crucial for meeting their own market demand.

- Quality Assurance: International buyers expect produce that meets stringent quality and safety standards, often exceeding those in domestic markets.

- Logistics Expertise: Efficient cold chain management and timely delivery are paramount for preserving product integrity during long-haul shipments.

- Market Diversification: Calavo's engagement with international distributors helps reduce its dependence on any single geographic market, thereby lowering overall business risk.

Calavo serves a diverse customer base, including major retail grocery chains, foodservice operators, club stores, and food processors. These segments vary in their needs, from bulk purchases and competitive pricing to specific quality standards and integration into prepared foods. In 2024, the U.S. grocery market exceeded $900 billion, with produce sales being a significant driver.

Food processors and manufacturers are crucial, requiring consistent product specifications for large-scale production, contributing substantially to the processed avocado market's growth in 2024. International distributors are also key, demanding reliable sourcing and efficient logistics to serve global markets, where demand in regions like the EU showed robust growth in 2024.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Retail Grocery Chains | Consistency, reliable supply, specific packaging | Major contributor to produce sales in a >$900B market |

| Foodservice Operators | Consistent quality, reliable delivery | Returned to pre-pandemic levels, indicating strong demand |

| Club Stores/Mass Merchandisers | Competitive pricing, large pack sizes | Significant buyers driving high-volume avocado sales |

| Food Processors | Uniform specs, high quality, industrial scale | Substantial contributors to processed avocado market growth |

| International Distributors | Reliable sourcing, logistics expertise | Essential for global reach, tapping into growing EU demand |

Cost Structure

The direct cost of acquiring fresh avocados and other produce from growers represents Calavo's most substantial expense within its Cost of Goods Sold. This outlay is directly tied to the price paid for these raw materials, which are inherently volatile. For instance, in fiscal year 2023, Calavo's total cost of goods sold was $1.3 billion, with a significant portion dedicated to fresh produce procurement.

Fluctuations in these commodity costs are driven by a variety of factors, including the size of harvests, prevailing weather patterns, and overall market demand for avocados. Effective management of these agricultural input costs is therefore paramount to maintaining Calavo's profitability and competitive pricing strategies.

Calavo's business model heavily relies on managing significant logistics and transportation costs. Given the perishable nature of its avocados and other produce, moving these items from farms to packing houses, then to distribution centers, and finally to customers is a major expense. These costs encompass freight, fuel, and crucially, cold chain management to maintain product quality.

In 2024, the global supply chain continued to present challenges, with fuel prices fluctuating and impacting transportation budgets. For companies like Calavo, optimizing these routes and ensuring the integrity of the cold chain are paramount, even though these efficiencies come with substantial investment and ongoing operational expenditure.

Calavo's cost structure is heavily influenced by expenses related to its packing houses and processing facilities. These operational costs are essential for sorting, grading, ripening, and packaging fresh produce, as well as for manufacturing value-added processed products. For example, in fiscal year 2023, Calavo reported that its cost of goods sold, which includes these direct operational expenses, was $1.1 billion.

Labor constitutes a significant portion of these packing, processing, and labor costs. This includes wages for employees involved in every stage of preparation, from initial sorting and grading to the final packaging and manufacturing of processed items. These labor expenses are critical for ensuring product quality and readiness for market distribution, directly impacting Calavo's overall profitability.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses are a significant part of Calavo's operational costs. These include the salaries and benefits for their sales teams, marketing departments, and corporate administrative staff. Think of it as the cost of running the business beyond direct production.

Calavo has been actively working to manage these costs. Following strategic divestitures, the company has emphasized operational efficiency to bring down SG&A. For instance, in the first quarter of fiscal year 2024, Calavo reported SG&A expenses of $44.2 million.

- Salaries and Wages: Compensation for administrative, sales, and marketing employees.

- Marketing and Advertising: Costs associated with promoting Calavo's products.

- Professional Fees: Expenses for legal, accounting, and other consulting services.

- Corporate Overhead: Costs related to running the company's headquarters and general operations.

Research and Development (R&D) and Quality Assurance

Calavo's cost structure includes significant investments in Research and Development (R&D) and Quality Assurance (QA). These costs are essential for developing new avocado-based products, refining processing techniques for better yield and shelf-life, and implementing robust QA programs to ensure food safety and regulatory compliance.

These expenditures, while perhaps not the largest line items, are critical for maintaining Calavo's competitive edge and brand reputation. In 2024, companies in the food processing sector often allocate between 1-3% of revenue to R&D, with a focus on innovation and sustainability.

- R&D Investment: Funds dedicated to exploring new product formulations, packaging innovations, and advanced agricultural practices for avocado cultivation.

- Quality Assurance Programs: Costs associated with rigorous testing, certifications (e.g., HACCP, SQF), and personnel for maintaining high product standards and food safety.

- Process Improvement: Expenses related to optimizing harvesting, ripening, processing, and distribution methods to enhance efficiency and reduce waste.

- Competitive Advantage: These investments directly support Calavo's ability to differentiate itself through product quality, safety, and innovation in a dynamic market.

Calavo's cost structure is dominated by the procurement of fresh produce, which is subject to market volatility. Logistics and transportation, especially cold chain management, represent a substantial ongoing expense. Furthermore, operational costs at packing and processing facilities, including labor, are critical components of their cost base.

Selling, General, and Administrative (SG&A) expenses, covering sales, marketing, and corporate functions, are also significant. For example, SG&A was $44.2 million in Q1 fiscal year 2024. Investments in R&D and Quality Assurance, though smaller, are vital for innovation and maintaining brand trust.

| Cost Category | Description | Fiscal Year 2023 Impact | Fiscal Year 2024 Outlook |

|---|---|---|---|

| Cost of Goods Sold (COGS) | Fresh produce procurement | $1.1 billion (significant portion) | Continued volatility in commodity prices |

| Logistics & Transportation | Freight, fuel, cold chain management | Major operational expense | Impacted by fluctuating fuel prices |

| Packing & Processing Operations | Facility costs, labor for sorting, grading, packaging | Included in COGS | Essential for product quality and market readiness |

| SG&A | Salaries, marketing, professional fees, overhead | $44.2 million (Q1 FY24) | Focus on operational efficiency |

| R&D and Quality Assurance | New product development, process improvement, safety compliance | 1-3% of revenue (industry average) | Key for competitive advantage and brand reputation |

Revenue Streams

Calavo's core revenue originates from selling fresh, whole avocados. This is a significant driver, supplying grocery stores, restaurants, and bulk buyers. The avocado market, like many agricultural products, sees its prices and sales volumes shift due to factors like weather, harvest cycles, and consumer demand throughout the year.

The company's 'Grown' segment, which is heavily weighted towards avocados, demonstrated robust performance. For instance, Calavo reported substantial sales growth in this category during 2024, continuing into the first quarter of 2025, indicating strong market reception and successful supply chain management for their fresh produce.

Calavo generates revenue not only from its flagship avocados but also through the distribution of other fresh produce, including items like tomatoes and papayas. This strategy diversifies its product portfolio beyond avocados, effectively utilizing its established distribution network. These complementary produce sales contribute to the overall financial performance of Calavo's 'Grown' segment.

Calavo generates substantial revenue from its processed avocado products, encompassing guacamole, avocado pulp, and various other avocado-based food items. This segment serves both the retail market, through its own brands like Calavo and private labels, and the foodservice industry.

While the 'Prepared' segment experienced some volume decreases, it continues to be a vital revenue contributor. For instance, in the fiscal year 2023, Calavo's Prepared segment reported revenues of $206.7 million, demonstrating its ongoing importance to the company's overall financial performance.

Value-Added Services Fees

Calavo earns revenue by offering specialized services that go beyond basic produce handling. These include ripening avocados to perfection, meticulously grading produce for quality, and providing custom packaging solutions tailored to specific client needs.

These value-added services allow Calavo to command a premium, as they significantly boost the marketability and consumer appeal of the fresh produce. This focus on enhanced quality control and convenience directly translates into higher revenue streams.

For instance, in the fiscal year 2023, Calavo reported that its Fresh segment, which heavily relies on these value-added services, saw significant contributions to its overall performance, demonstrating the financial impact of these offerings.

Key value-added services contributing to revenue include:

- Ripening Services: Ensuring produce reaches optimal readiness for sale.

- Grading and Quality Control: Sorting produce based on size, color, and blemish-free standards.

- Custom Packaging: Offering branded or specialized packaging for retailers and food service clients.

- Private Label Programs: Developing and packaging produce under customer-specific brands.

International Sales

International sales represent a significant revenue stream for Calavo, extending its reach beyond the traditional U.S. and Mexican markets. This global expansion taps into the increasing worldwide demand for avocados, offering a crucial avenue for revenue diversification and sustained growth.

Calavo's international distribution network effectively utilizes its robust global sourcing capabilities, enabling it to serve a wider customer base. For instance, in fiscal year 2023, Calavo reported that its Fresh segment, which includes international sales, generated substantial revenue, demonstrating the importance of these markets.

- Global Reach: Revenue is generated from selling avocados and related products to customers in various countries, broadening Calavo's market presence.

- Demand Leverage: Capitalizes on the growing international appetite for avocados, a key driver for revenue expansion.

- Sourcing Synergy: Integrates global sourcing operations to efficiently supply international markets, optimizing logistics and product availability.

Calavo's revenue streams are diverse, encompassing fresh produce sales, processed avocado products, and value-added services. The company's 'Grown' segment, primarily avocados, saw significant sales growth in 2024, continuing into early 2025. Beyond avocados, Calavo also distributes other fresh items like tomatoes and papayas, leveraging its established network.

The 'Prepared' segment, focusing on guacamole and other avocado-based foods, is a vital contributor, generating $206.7 million in revenue in fiscal year 2023. Value-added services such as ripening, grading, and custom packaging further enhance revenue by increasing product marketability and allowing for premium pricing. International sales also play a crucial role, tapping into global demand for avocados.

| Revenue Stream | Primary Products/Services | Fiscal Year 2023 Contribution (Approx.) |

|---|---|---|

| Fresh Produce Sales | Avocados, Tomatoes, Papayas | Significant portion of overall revenue (Fresh segment contribution) |

| Processed Avocado Products | Guacamole, Avocado Pulp | $206.7 million (Prepared segment revenue) |

| Value-Added Services | Ripening, Grading, Custom Packaging | Enhances Fresh segment performance |

| International Sales | Avocados and related products globally | Key driver for diversification and growth |

Business Model Canvas Data Sources

The Calavo Business Model Canvas is built upon a foundation of comprehensive market research, internal financial disclosures, and operational data. These diverse sources ensure each component of the canvas accurately reflects the company's current strategic positioning and market realities.