Calavo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calavo Bundle

Unlock the strategic secrets of Calavo's product portfolio with our comprehensive BCG Matrix. See which offerings are driving growth and which might be holding the company back.

Don't settle for a glimpse; purchase the full BCG Matrix to gain actionable insights into Calavo's market position, enabling you to make informed decisions about resource allocation and future investments.

This is your opportunity to understand the complete picture and equip yourself with the strategic clarity needed to navigate Calavo's competitive landscape. Get the full report now.

Stars

Calavo's Fresh Avocado business is a clear Star in its portfolio. The company holds a substantial piece of the global avocado market, which is booming thanks to people becoming more health-aware and avocados showing up in all sorts of dishes. This segment is a real growth engine for Calavo.

In the first quarter of fiscal year 2025, Calavo's Fresh segment saw impressive sales jump by 23.7%. This strong performance is backed by healthy pricing power, which directly boosts the segment's profitability. It's a leader in a fast-growing industry.

To keep its leading edge and grab more market share, this Fresh Avocado segment needs ongoing investment. The high growth potential means Calavo must continue to pour resources into it to stay ahead of the curve and maximize opportunities.

Hass avocados represent a significant Star for Calavo, dominating the market with an 84.7% share in 2024. Their projected growth at a 10.1% CAGR through 2030 further solidifies this position.

Calavo's established global leadership and robust supply chain for Hass avocados leverage widespread consumer recognition. This strong foothold in a rapidly expanding segment suggests substantial future revenue potential.

Avocado household penetration hit 70% in the U.S. in 2024, a significant increase that signals broad consumer acceptance. This growing demand is particularly evident among younger demographics like Generation Z, indicating a robust and expanding market. Calavo's strategic focus on these emerging consumer groups and under-penetrated geographic areas, such as the Midwest and South, presents a prime opportunity for significant growth, classifying this segment as a Star.

Expansion into High-Growth International Avocado Markets

Calavo's strategic push into high-growth international avocado markets, particularly in the Asia-Pacific region, positions fresh avocado distribution as a Star in its BCG Matrix. This geographic expansion targets rapidly developing economies where avocado consumption is on the rise.

The Asia-Pacific market is projected to experience a compound annual growth rate of 9.2% from 2025 to 2030, indicating substantial untapped potential beyond Calavo's established North American base. This robust growth trajectory underscores the strategic importance of these emerging markets.

By making aggressive investments in these new territories, Calavo aims to capture significant market share and establish leadership. This proactive approach is designed to yield substantial future returns as demand continues to surge.

- Market Focus: Asia-Pacific expansion for fresh avocado distribution.

- Growth Projection: Expected 9.2% CAGR in Asia-Pacific from 2025-2030.

- Strategic Imperative: Aggressive investment to secure future market leadership and returns.

- Calavo's Position: Fresh avocado distribution in these regions is a high-growth, high-market-share opportunity, classifying it as a Star.

Premium & Special Fresh Avocado Varieties

Calavo's development and marketing of premium avocado varieties like GEM are positioning them as Stars within the BCG Matrix. These specialty avocados, with GEM projected to hit 8 million pounds in volume, tap into growing consumer demand for unique and higher-quality produce.

This segment requires ongoing investment to maintain its growth trajectory.

- Premium Varieties as Stars: GEM avocados represent a significant growth opportunity for Calavo.

- Consumer Demand: Consumers are increasingly seeking diverse and premium avocado options.

- Market Potential: The projected 8 million pounds for GEM highlights substantial market penetration.

- Strategic Investment: Continued focus on cultivation and branding will solidify these varieties' future success.

Calavo's Fresh Avocado business, particularly Hass avocados, is a standout Star. The company's 84.7% market share in Hass avocados in 2024, coupled with a projected 10.1% CAGR through 2030, showcases its dominance in a rapidly expanding market. This segment's strong performance, evidenced by a 23.7% sales jump in Q1 FY25, necessitates continued investment to sustain its growth and capture further market share.

| Segment | Market Share (2024) | Projected CAGR (2025-2030) | Key Driver |

|---|---|---|---|

| Fresh Avocados (Hass) | 84.7% | 10.1% | Growing health awareness, increased culinary use |

| Asia-Pacific Avocado Market | N/A (Expansion focus) | 9.2% | Rising demand in developing economies |

| Premium Avocado Varieties (GEM) | N/A (Emerging) | N/A (Volume projection: 8 million lbs) | Consumer preference for higher quality and variety |

What is included in the product

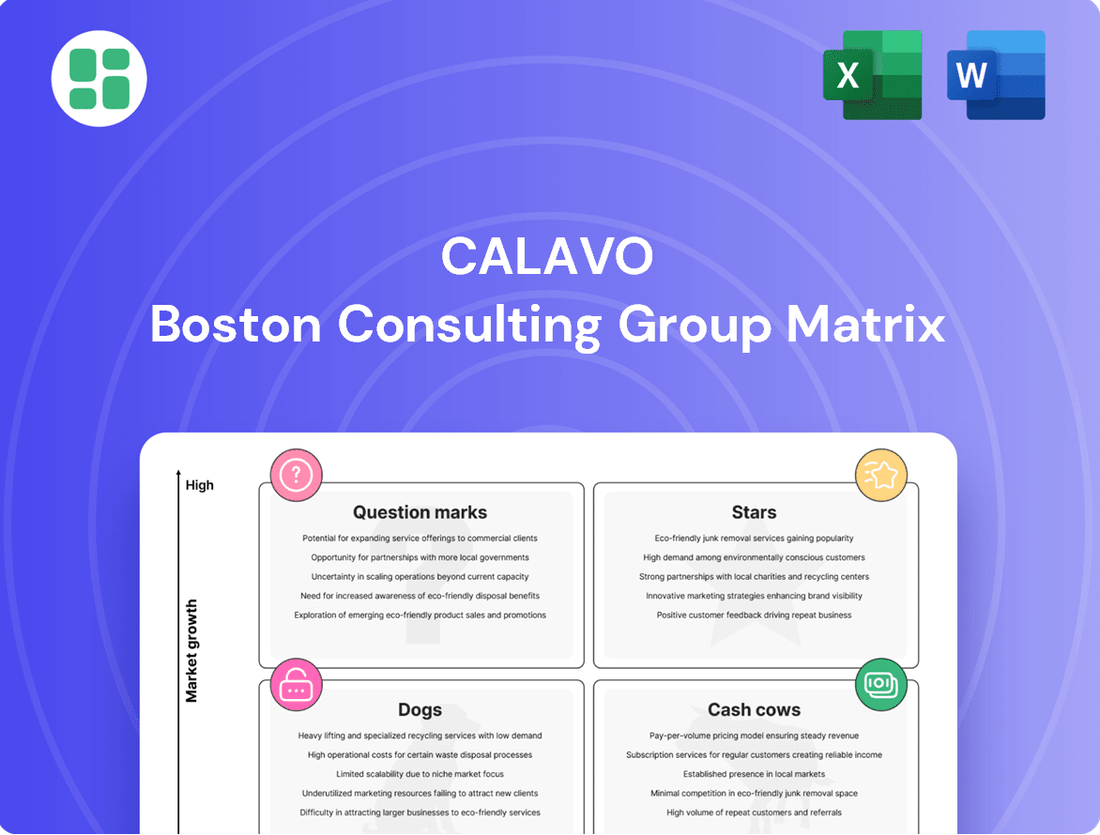

The Calavo BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate.

This analysis guides strategic decisions on investment, divestment, and resource allocation for each segment.

A Calavo BCG Matrix offers a clear visual of each business unit's market share and growth rate, simplifying strategic decisions.

Cash Cows

Calavo's established North American fresh avocado distribution is a prime example of a Cash Cow within its BCG matrix. This segment benefits from decades of operational experience and a deeply entrenched supply chain, ensuring consistent delivery and quality to a mature consumer base.

In 2024, North America continues to be a dominant market for avocados, with consumption showing steady, albeit slower, growth. Calavo's strong market share in this region translates into predictable and significant cash generation, allowing for reinvestment into other business units or shareholder returns.

Calavo's core retail and foodservice avocado business operates as a classic Cash Cow. The company benefits from stable, consistent demand from major grocery chains and restaurants, sectors where Calavo has established strong, long-standing relationships and a significant market presence. This dependable demand translates into reliable revenue streams and predictable profit margins, forming the bedrock of Calavo's financial stability.

These foundational sales are crucial, providing a consistent and predictable cash flow. For instance, in fiscal year 2023, Calavo's Fresh segment, which heavily features avocados sold through these channels, generated substantial revenue, underscoring the segment's role as a reliable performer. The high market share in these established channels allows for operational efficiencies, further bolstering the strong cash generation from this business line.

Calavo's value-added fresh produce services, particularly for avocados, are a prime example of a Cash Cow. These services, including ripening, grading, and custom packaging, utilize established infrastructure and deep expertise.

This segment generates consistent, high-margin revenue with minimal growth expectations, reflecting strong operational efficiency. For instance, in fiscal year 2023, Calavo's Fresh segment, which heavily features these services, reported net sales of $916.9 million, demonstrating its significant contribution to the company's financial stability.

The mature nature of these services means they require limited new capital investment, allowing them to be a reliable source of cash flow for Calavo. This steady cash generation supports other areas of the business, reinforcing their Cash Cow status.

Efficient Supply Chain Operations for Core Products

Calavo's highly efficient supply chain for its core fresh avocado business, sourcing from regions like California, Mexico, and Chile, firmly places it in the Cash Cow quadrant of the BCG Matrix. This operational excellence ensures consistent product availability and effective cost management, translating into strong profit margins even with fluctuating volumes.

The company's well-established logistics and sourcing network generates a dependable and substantial cash flow. For instance, Calavo's avocado segment consistently contributes a significant portion to its overall revenue, with fresh avocados representing a substantial part of its sales volume. In fiscal year 2023, Calavo reported total revenues of $1.2 billion, with its Fresh segment being a primary driver.

- Consistent Availability: Sourcing from diverse, reliable regions ensures avocados are always on shelves.

- Cost Management: Optimized logistics and procurement keep costs low, boosting profit margins.

- Reliable Cash Flow: The mature avocado business is a steady generator of funds for the company.

- Market Dominance: Calavo's established presence in the avocado market solidifies its Cash Cow status.

Consistent Dividend Payouts to Shareholders

Calavo Growers, Inc.'s consistent dividend payouts are a strong indicator of its Cash Cow status within the BCG Matrix. The company's ability to reliably distribute cash to shareholders, such as the $0.20 per share dividend declared for both the first and second quarters of 2025, underscores its robust and stable cash flow generation. This regular return of capital signifies a mature business with strong profitability and ample free cash flow to reward investors, a hallmark of a well-established Cash Cow.

- Consistent Dividend Payments: Calavo has demonstrated a pattern of regular dividend distributions, reinforcing its Cash Cow classification.

- Shareholder Returns: The $0.20 per share dividend for Q1 and Q2 2025 exemplifies the company's commitment to returning value to its shareholders.

- Strong Cash Generation: The ability to pay these dividends points to Calavo's stable and predictable cash flow, a key characteristic of a Cash Cow.

- Mature Business Operations: Consistent dividend payouts suggest a mature business model with established market presence and profitability.

Calavo's established North American fresh avocado distribution is a prime example of a Cash Cow within its BCG matrix. This segment benefits from decades of operational experience and a deeply entrenched supply chain, ensuring consistent delivery and quality to a mature consumer base.

In 2024, North America continues to be a dominant market for avocados, with consumption showing steady, albeit slower, growth. Calavo's strong market share in this region translates into predictable and significant cash generation, allowing for reinvestment into other business units or shareholder returns.

Calavo's core retail and foodservice avocado business operates as a classic Cash Cow. The company benefits from stable, consistent demand from major grocery chains and restaurants, sectors where Calavo has established strong, long-standing relationships and a significant market presence. This dependable demand translates into reliable revenue streams and predictable profit margins, forming the bedrock of Calavo's financial stability.

These foundational sales are crucial, providing a consistent and predictable cash flow. For instance, in fiscal year 2023, Calavo's Fresh segment, which heavily features avocados sold through these channels, generated substantial revenue, underscoring the segment's role as a reliable performer. The high market share in these established channels allows for operational efficiencies, further bolstering the strong cash generation from this business line.

| Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Approx.) |

|---|---|---|---|

| North American Fresh Avocado Distribution | Cash Cow | Mature market, high market share, stable demand, operational efficiency | Significant portion of total revenue |

| Value-Added Fresh Produce Services (Avocado) | Cash Cow | Established infrastructure, deep expertise, consistent high-margin revenue, low growth | Contributes to Fresh segment revenue |

What You’re Viewing Is Included

Calavo BCG Matrix

The Calavo BCG Matrix document you are previewing is the identical, fully polished report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted analysis ready for your strategic decision-making. You can be confident that the insights and structure you see now are precisely what you'll gain access to for immediate application in your business planning. This ensures a seamless transition from preview to practical use, empowering you with actionable market intelligence without any hidden surprises.

Dogs

Calavo Growers' Fresh Cut business unit, divested on August 15, 2024, is a prime example of a Dog in the BCG Matrix. This segment was already flagged as held for sale and discontinued operations in early 2024, signaling both low market share and limited growth potential.

The underperformance of the Fresh Cut business ultimately led to its divestiture, a strategic move to shed a cash-draining operation. By removing this unit, Calavo can better concentrate its resources and attention on its more promising and profitable business segments.

Consider niche fresh produce lines beyond the core offerings, such as specialty mushrooms or exotic berries, that have consistently struggled to capture significant market share. These products, if they show minimal growth and low profitability, represent a drain on resources. For instance, a hypothetical niche produce line might have seen its market share shrink from 2% to 1.5% in 2024, with a growth rate of only 0.5% compared to a category average of 5%.

Outdated processed avocado products, those lacking innovation and facing stiff competition, would likely be classified as Dogs within Calavo's Prepared segment. These items, characterized by declining sales volumes and minimal contribution to gross profit, are often resource drains. For instance, if a specific line of pre-made guacamole, introduced a decade ago, now represents less than 1% of the Prepared segment's revenue and has seen a 15% year-over-year sales decline, it fits this category.

Inefficient Regional Operations

Inefficient regional operations, such as Calavo's distribution centers with lower-than-average throughput or higher-than-expected spoilage rates, could be classified as Dogs. For instance, if a particular region's processing facility consistently reported operational costs 15% above the company average in 2024, it might indicate a Dog. These underperforming segments consume resources without generating proportional returns, potentially impacting overall financial health.

These operations often struggle to gain substantial local market share, perhaps holding only 5% of their regional avocado market compared to a company average of 12%. Such a scenario would necessitate a thorough strategic review to determine if restructuring, consolidation with more efficient facilities, or even divestment is the most prudent course of action to improve overall profitability.

- Low Operational Efficiency: Facilities with throughput rates 20% below the industry benchmark.

- High Costs: Regional operational expenses exceeding the company average by over 10% in 2024.

- Limited Market Share: Capturing less than 7% of the local market in their respective regions.

- Cash Consumption: Generating negative cash flow for three consecutive fiscal quarters.

Non-Strategic or Low-Margin Service Offerings

Certain non-strategic or perpetually low-margin service offerings within Calavo's portfolio that do not align with core competencies or show potential for growth could be viewed as Dogs. If these services require disproportionate resources for minimal returns, they may be diluting the company's overall financial performance. For instance, if Calavo's 2024 financial reports indicated a specific service line generating less than 5% gross margin and consuming over 10% of operational resources without strategic benefit, it would likely be classified as a Dog. Continuous evaluation of service profitability is essential to prevent them from becoming cash traps.

These offerings, often characterized by intense competition and limited pricing power, can drain valuable capital and management attention that could be better allocated to growth-oriented business units. Calavo's commitment to optimizing its portfolio means actively identifying and addressing such underperforming segments.

- Low Profitability: Services with consistently low gross margins, potentially below 5% as observed in some industry segments.

- Resource Drain: Offerings that require significant operational expenditure or capital investment relative to their revenue generation.

- Lack of Strategic Fit: Services that do not leverage Calavo's core competencies or contribute to its long-term strategic objectives.

- Stagnant or Declining Market Share: Segments where Calavo faces persistent challenges in growing its presence or faces strong competitive headwinds.

Dogs in the BCG Matrix represent business units with low market share and low growth potential, often consuming more resources than they generate. Calavo Growers' divestiture of its Fresh Cut business in August 2024 exemplifies this, as it was already marked for sale due to its underperformance. Similarly, outdated avocado products or inefficient regional operations that show declining sales and high costs also fall into this category, draining resources and requiring strategic review.

| Business Unit Example | Market Share (Estimated) | Market Growth (Estimated) | Profitability (2024) | Strategic Action |

|---|---|---|---|---|

| Fresh Cut Business | Low | Low | Negative | Divested (August 2024) |

| Outdated Prepared Avocado Products | < 1% (of segment) | Declining | Minimal Gross Margin | Review/Reformulate |

| Inefficient Regional Operations | < 7% (regional) | Low | Negative Cash Flow | Restructure/Consolidate |

| Non-Strategic Service Offerings | Stagnant | Low | < 5% Gross Margin | Evaluate/Divest |

Question Marks

Calavo's recent innovations in processed avocado products, like specialized purees and avocado oil, are positioned in promising, high-growth segments. For instance, the global avocado puree market is projected to grow at a compound annual growth rate (CAGR) of 5.8% through 2028.

Despite this market potential, Calavo's Prepared segment, which includes these newer offerings, has recently experienced sales declines and volume challenges. This indicates that while the products themselves are entering fertile ground, Calavo's current market share within these specific innovation categories is low.

These new processed avocado products are therefore classified as Question Marks in the BCG Matrix. They operate in attractive, rapidly expanding markets, but Calavo's current penetration is minimal. This necessitates substantial investment to explore their viability and potential to capture significant market share.

Calavo's expansion into untapped international prepared food markets, particularly for processed avocado products, positions these ventures as potential Stars or Question Marks in the BCG matrix. These markets often exhibit high growth potential but currently have low brand recognition and market share for Calavo. For instance, emerging economies in Southeast Asia or parts of Africa show increasing demand for convenient, healthy food options, aligning with avocado's appeal. However, these initiatives require significant upfront investment for distribution networks, marketing, and adapting products to local tastes, making their future success uncertain.

Investing in niche fresh produce varieties outside of Calavo's core avocado, tomato, and papaya offerings signifies a strategic move towards future growth areas. These emerging products, while experiencing rising consumer interest, currently represent a smaller portion of Calavo's market share, positioning them as potential Question Marks in the BCG Matrix.

These niche items are fueled by significant consumer dietary shifts towards healthier and more diverse eating habits, indicating a high-growth trend. However, realizing their full potential necessitates considerable investment in marketing and distribution to build brand awareness and establish robust supply chains, a challenge often associated with Question Mark products.

The ultimate success of these niche varieties hinges on their market adoption rate and Calavo's capacity to effectively compete against established players. For instance, the global market for specialty fruits like dragon fruit and rambutan, while smaller than avocados, is projected to grow significantly, with some reports suggesting a CAGR of over 5% in the coming years, presenting both opportunity and risk for Calavo.

Emerging Technologies in Fresh Food Processing/Packaging

Calavo's ventures into emerging technologies for fresh food processing and packaging could be classified as Question Marks. These innovations, while holding potential for substantial future growth and operational enhancements, may currently face limited market penetration or require substantial internal capability development for Calavo. The significant investment in research and development, coupled with the costs of implementation, presents an uncertain path to immediate profitability.

- Investment in AI-powered sorting: Calavo might be exploring artificial intelligence for automated quality control and sorting of produce, aiming to increase efficiency and reduce waste. For instance, companies like Tomra Food have developed AI sorting solutions that can identify and remove defects with high accuracy.

- Advanced Modified Atmosphere Packaging (MAP): The company could be investigating next-generation MAP technologies to extend shelf life and maintain the freshness of avocados and other products, potentially reducing spoilage rates. Research indicates MAP can extend the shelf life of produce by up to 50%.

- Blockchain for traceability: Calavo may be considering blockchain technology to enhance supply chain transparency and traceability, offering consumers greater assurance of product origin and handling. Walmart has reported significant improvements in food traceability using blockchain.

Revitalization of the Prepared Segment

The Prepared segment, encompassing Calavo's guacamole business, is currently positioned as a Question Mark in the BCG Matrix. This segment is facing sales and volume declines, a challenging trend. However, management has identified this area for a significant turnaround, targeting strong momentum in the latter half of 2025.

Despite the current headwinds, the broader market for processed avocados shows positive growth, indicating underlying potential. This creates an opportunity for Calavo to revitalize the Prepared segment.

- Sales Decline: The segment is experiencing a downturn in sales volumes.

- Market Potential: The underlying processed avocado market is expanding.

- Strategic Investment: Calavo must invest significantly to improve market share.

- Future Outlook: Success hinges on transforming this Question Mark into a Star or Cash Cow.

Calavo's processed avocado products, like purees and oil, are in high-growth markets, with the avocado puree market expected to grow at a 5.8% CAGR through 2028. However, Calavo's Prepared segment, which includes these items, has seen recent sales and volume challenges, indicating low current market share. These offerings are therefore Question Marks, requiring investment to determine their future success.

Calavo's expansion into international prepared food markets for processed avocados also falls into the Question Mark category. These markets offer high growth but Calavo has low brand recognition and market share. For example, emerging economies show increasing demand for healthy convenience foods. Significant investment in distribution and marketing is needed, making their future uncertain.

Niche fresh produce varieties outside Calavo's core offerings are also Question Marks. Driven by dietary shifts towards healthier eating, these products are in a high-growth trend. However, they currently represent a smaller market share for Calavo. Realizing their potential requires substantial investment in marketing and distribution to build brand awareness and supply chains, a common challenge for Question Marks.

Calavo's exploration of emerging technologies in fresh food processing and packaging, such as AI-powered sorting or advanced Modified Atmosphere Packaging (MAP), are also considered Question Marks. While these innovations hold potential for future growth and operational improvements, they may currently have limited market penetration or require significant internal development. The substantial R&D investment and implementation costs create an uncertain path to immediate profitability.

| BCG Category | Calavo's Business Area | Market Attractiveness | Calavo's Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | New Processed Avocado Products (Purees, Oil) | High (e.g., 5.8% CAGR for puree market through 2028) | Low | Requires significant investment to build market share; potential to become Star or Cash Cow. |

| Question Mark | International Prepared Food Markets (Processed Avocados) | High (Emerging economies demand for healthy convenience) | Low (Low brand recognition) | High investment needed for distribution, marketing; success uncertain. |

| Question Mark | Niche Fresh Produce Varieties | High (Dietary shifts towards healthier eating) | Low (Smaller portion of Calavo's market share) | Needs investment in marketing and distribution to build awareness and supply chains. |

| Question Mark | Emerging Food Processing/Packaging Technologies (AI Sorting, Advanced MAP) | Potentially High (Operational enhancements, future growth) | Low (Limited market penetration or internal capability) | Substantial R&D and implementation costs; uncertain profitability path. |

BCG Matrix Data Sources

Our Calavo BCG Matrix is built on a foundation of robust market intelligence, integrating financial reports, industry growth data, and competitive analysis to provide actionable strategic insights.