Caesarstone SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caesarstone Bundle

Caesarstone's strengths lie in its premium brand recognition and extensive product range, while its opportunities include expanding into emerging markets and capitalizing on sustainable design trends. However, it faces threats from intense competition and fluctuating raw material costs.

Want the full story behind Caesarstone's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Caesarstone boasts formidable global brand recognition, a key strength in the competitive premium surfaces market. Its products are distributed worldwide via a robust network of distributors and wholly-owned subsidiaries, a testament to its extensive reach.

This expansive global footprint is crucial, allowing Caesarstone to tap into diverse markets and mitigate risks associated with economic downturns in any single region. For instance, in 2023, Caesarstone reported net sales of $560.9 million, with a significant portion derived from international markets, underscoring the benefit of this widespread presence.

The company's established brand equity cultivates strong customer loyalty and trust across varied geographies. This recognized name acts as a powerful differentiator, enabling premium pricing and sustained demand even amidst intense competition.

Caesarstone's strength lies in its premium product quality and continuous innovation in quartz surfaces. These surfaces are highly valued for their exceptional durability, minimal upkeep, and attractive designs, achieved by blending natural quartz with cutting-edge technology.

The company's dedication to high-quality and forward-thinking product development, including research into new materials like porcelain and silica-free formulations, firmly establishes Caesarstone as a leader in surface design and performance. This innovative drive keeps their product offerings appealing and competitive as market preferences shift.

Caesarstone has significantly optimized its production by closing underperforming plants and increasing outsourcing. This strategic move resulted in substantial cost savings and improved gross margins, with the company reporting these gains in Q1 and Q4 of 2024. This focus on efficiency allows for greater agility in matching production to market needs.

Strong Financial Position

Caesarstone boasts a robust financial position, underscored by its solid net cash status. For instance, the company reported a healthy net cash balance in its Q1 2024 and Q4 2024 filings, demonstrating strong liquidity. This financial strength is crucial for funding strategic growth plans and weathering economic uncertainties.

This financial resilience equips Caesarstone with the capital needed for key activities. The company can readily invest in research and development to foster innovation, pursue strategic acquisitions, and maintain operational stability even during market downturns.

The company's strong balance sheet translates into several key advantages:

- Solid Net Cash Position: Caesarstone consistently maintains a healthy net cash balance, providing ample liquidity.

- Capital for Growth: The financial strength allows for dedicated investment in strategic growth initiatives and R&D.

- Market Resilience: A robust financial standing enhances the company's ability to navigate challenging market conditions effectively.

- Capacity for Future Investment: The company is well-positioned to make future investments, supporting long-term value creation.

Versatile Product Applications

Caesarstone's quartz surfaces are highly versatile, finding application in numerous residential and commercial settings such as kitchen countertops, bathroom vanity tops, and interior wall cladding. This broad utility significantly expands the company's potential customer base and diversifies its revenue sources, reducing dependence on any single market segment. For instance, in 2024, the global quartz surface market was valued at approximately $12.5 billion, a figure expected to grow, highlighting the substantial opportunity for companies like Caesarstone with adaptable product lines.

The inherent qualities of Caesarstone products, including their exceptional durability, non-porous nature, and resistance to scratches and stains, further enhance their appeal across these varied applications. These attributes translate into long-term value for consumers and businesses alike, solidifying Caesarstone's position in a competitive market. The company's focus on these performance characteristics supports its market penetration in sectors like hospitality and healthcare, where hygiene and longevity are paramount.

- Broad Market Reach: Applications span kitchens, bathrooms, and commercial spaces.

- Revenue Diversification: Reduced reliance on any single application segment.

- Product Attributes: Longevity, non-porousness, and resistance to wear are key selling points.

- Market Growth: The global quartz surface market is expanding, offering significant opportunities.

Caesarstone's global brand recognition is a significant asset, allowing it to command premium pricing and foster customer loyalty in the competitive premium surfaces market. Its extensive distribution network, encompassing both distributors and wholly-owned subsidiaries, ensures a wide geographic reach, which was evident in its 2023 net sales of $560.9 million, with substantial international contributions.

The company's commitment to product quality and innovation, particularly in quartz surfaces known for durability and low maintenance, positions it as a market leader. This focus extends to exploring new materials and formulations, ensuring its offerings remain relevant and competitive. Furthermore, strategic operational optimizations, including plant consolidation and increased outsourcing, have demonstrably improved gross margins, as reported in Q1 and Q4 of 2024, enhancing efficiency and cost-effectiveness.

Caesarstone maintains a robust financial position, characterized by a solid net cash status, as consistently reported in its 2024 filings. This financial strength provides the liquidity necessary to fund research and development, pursue strategic growth opportunities, and maintain stability through economic fluctuations.

The versatility of Caesarstone's quartz surfaces, suitable for diverse residential and commercial applications from kitchen countertops to wall cladding, broadens its market appeal and diversifies revenue streams. This adaptability is crucial in a global quartz surface market valued at approximately $12.5 billion in 2024 and projected to grow, offering significant potential for companies with flexible product lines.

| Strength Category | Key Attributes | Supporting Data/Examples |

|---|---|---|

| Brand & Market Reach | Global Brand Recognition, Extensive Distribution Network | 2023 Net Sales: $560.9 million (significant international component) |

| Product Innovation & Quality | Premium Quartz Surfaces, Durability, Low Maintenance, R&D Focus | Development of new materials and formulations |

| Operational Efficiency | Optimized Production, Cost Savings | Reported gross margin improvements in Q1 & Q4 2024 |

| Financial Strength | Solid Net Cash Position, Liquidity for Growth | Consistent healthy net cash balances in 2024 filings |

| Product Versatility | Wide Range of Applications, Revenue Diversification | Global Quartz Surface Market valued at ~$12.5 billion in 2024 |

What is included in the product

Delivers a strategic overview of Caesarstone’s internal and external business factors, examining its brand strength and market position against competitive threats and growth opportunities.

Offers a clear, organized framework to identify and address Caesarstone's market challenges and competitive threats.

Weaknesses

Caesarstone's financial performance is closely tied to the health of the global construction and renovation markets. When economic conditions worsen, leading to factors like high interest rates or decreased consumer spending on home improvements, the company's sales volumes and overall revenue often take a hit. This vulnerability was evident in Q1 2024 and Q4 2024, where challenging market conditions negatively impacted the company's top line.

The engineered stone market is incredibly crowded, with many companies, both big and small, offering very similar products. This means there's constant pressure to lower prices, which can really squeeze Caesarstone's profits and make it tough to keep its premium image without losing customers.

In fact, Caesarstone itself mentioned that these intense competitive pressures were already affecting their sales volumes in the first quarter of 2024, highlighting the immediate impact of this challenging market dynamic.

Caesarstone's reliance on natural quartz and other components makes it vulnerable to price swings in these raw materials. These fluctuations can directly affect the company's profitability by squeezing gross margins. For instance, while Q1 2024 saw some relief from lower raw material costs, a reversal of this trend due to commodity price increases or supply chain disruptions poses a significant risk.

Operational Restructuring Challenges

Caesarstone's operational restructuring, while intended to boost efficiency, inherently creates transitional hurdles. The company is navigating challenges like managing existing inventory levels and reconfiguring its supply chain as it closes some factories and increases outsourcing. These adjustments are a necessary part of the process but can temporarily impact operations.

The full financial benefits of these restructuring initiatives are anticipated to materialize in 2025. This timeline suggests that the current period, including late 2024 and early 2025, will be characterized by ongoing implementation and integration of these changes. As of Caesarstone's Q1 2024 earnings report, the company noted that restructuring costs were impacting profitability in the short term.

- Transitional Disruptions: Factory closures and increased outsourcing can lead to temporary disruptions in production and distribution.

- Inventory Management: Managing excess inventory from consolidated operations presents a short-term challenge.

- Supply Chain Realignment: Adjusting to new supplier relationships and logistics networks requires careful management.

- Delayed Savings Realization: The full impact of cost savings from restructuring is not expected until 2025, meaning the current period involves investment and adjustment rather than immediate returns.

Silica-Related Regulatory and Legal Risks

The engineered stone industry, including Caesarstone, is confronting growing regulatory headwinds concerning respirable crystalline silica dust. Australia, a significant market, has implemented outright bans on engineered stone due to health concerns, impacting sales and requiring adaptation of product offerings or market focus.

Caesarstone is entangled in a substantial number of lawsuits alleging silicosis claims. These legal battles represent a considerable financial risk, with potential for significant liabilities that could negatively affect earnings and cash flow. For instance, by early 2024, the number of silicosis claims filed against various engineered stone manufacturers, including Caesarstone, had reached thousands, underscoring the gravity of this legal exposure.

- Regulatory Bans: Australia's complete ban on engineered stone from July 1, 2024, directly impacts market access and revenue streams.

- Silicosis Litigation: Thousands of ongoing lawsuits related to silicosis present a significant and unpredictable financial liability.

- Increased Compliance Costs: Stricter workplace safety regulations and potential legal defense expenses add to operational costs.

- Reputational Damage: Persistent legal and regulatory issues can erode consumer and investor confidence.

Caesarstone faces significant challenges due to intense competition in the engineered stone market, leading to pricing pressures that can erode profit margins and complicate efforts to maintain a premium brand image. This competitive landscape directly affects sales volumes, as noted by the company in early 2024.

The company's profitability is susceptible to fluctuations in the cost of raw materials like quartz, with potential supply chain disruptions posing a risk to gross margins. While Q1 2024 saw some relief, a reversal in commodity prices could negatively impact earnings.

Operational restructuring, including factory closures and increased outsourcing, introduces temporary disruptions and inventory management hurdles. The full financial benefits of these changes are not expected until 2025, meaning short-term profitability may be affected by restructuring costs, as reported in Q1 2024.

Regulatory actions, such as Australia's ban on engineered stone from July 1, 2024, due to silicosis concerns, directly limit market access. Furthermore, thousands of ongoing silicosis-related lawsuits represent a substantial and unpredictable financial liability, potentially impacting cash flow and earnings.

Preview Before You Purchase

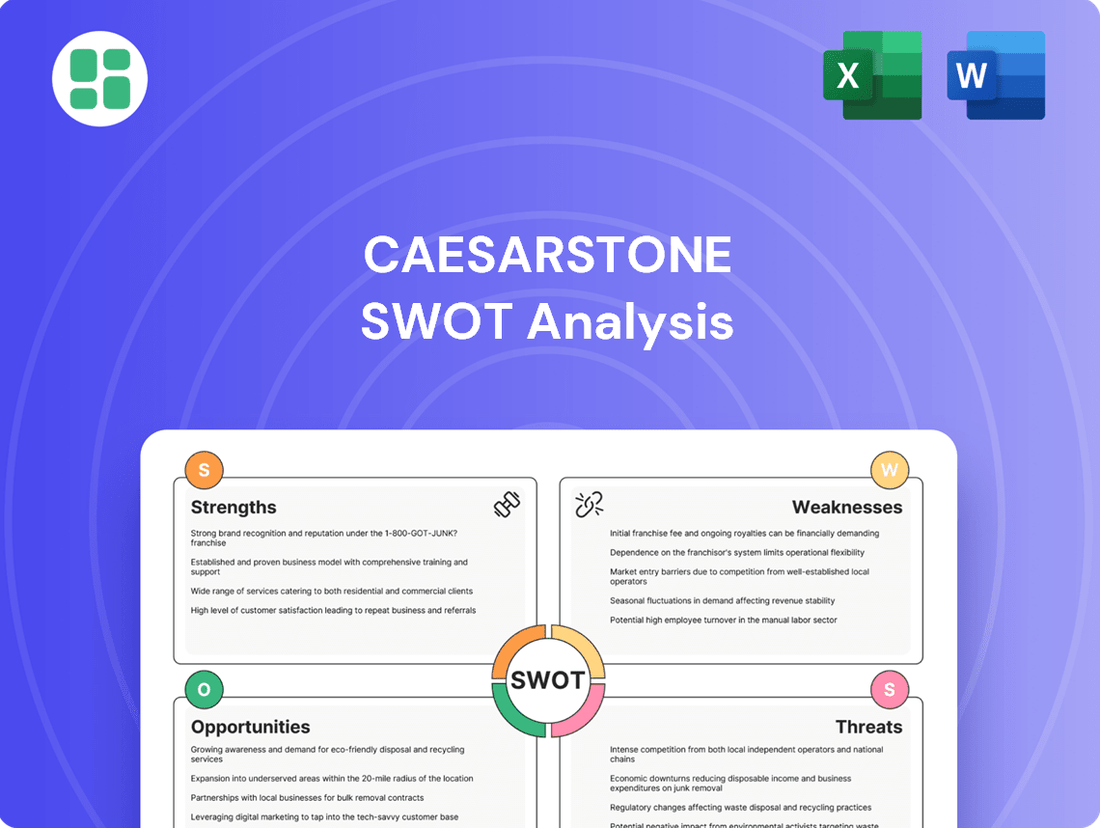

Caesarstone SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, showcasing Caesarstone's strategic positioning.

This is the same SWOT analysis document included in your download, offering a comprehensive look at Caesarstone's Strengths, Weaknesses, Opportunities, and Threats. The full content is unlocked after payment.

You’re previewing the actual analysis document, providing a clear understanding of Caesarstone's current market standing. Buy now to access the full, detailed report and leverage this valuable insight.

Opportunities

The home renovation and remodeling sector is showing robust growth, with projections indicating a continued upward trend. This is particularly beneficial for companies like Caesarstone, as kitchens and bathrooms, key areas for their quartz surfaces, remain focal points for homeowner investment.

A significant driver of this opportunity is the shift towards upgrading existing homes. Many homeowners are opting to enhance their current living spaces rather than purchasing new properties, leading to increased spending on renovations. This trend is expected to persist, offering a strong market for Caesarstone's aesthetically pleasing and durable products.

Caesarstone can capitalize on the growing demand for safer building materials by expanding its zero crystalline silica and porcelain product lines. This move addresses increasing regulatory scrutiny and health concerns associated with crystalline silica, positioning the company favorably in markets with existing or anticipated bans. For instance, California's silica dust regulations are becoming more stringent, creating a significant opportunity for silica-free alternatives.

Consumer demand for sustainable home renovation materials is significantly increasing. A 2024 Houzz survey indicated that 71% of homeowners considered environmental impact when choosing building materials. Caesarstone can leverage this by highlighting its use of recycled content, which reached 40% in some product lines by early 2025, and promoting its energy-efficient manufacturing, which reduced carbon emissions by 15% in 2024.

Increased Penetration in Commercial and Outdoor Applications

Caesarstone can significantly grow by targeting commercial spaces like hotels, restaurants, and healthcare facilities, where its durability and hygienic qualities are highly valued. This expansion offers a pathway to new revenue streams beyond the traditional residential market.

The burgeoning outdoor living trend presents another substantial opportunity. Engineered stone's weather resistance and low maintenance make it an ideal material for outdoor kitchens, patios, and furniture, areas previously dominated by natural stone or less durable alternatives.

- Commercial Expansion: Focus on hospitality and healthcare sectors, leveraging Caesarstone's hygienic and durable properties.

- Outdoor Applications: Capitalize on the growing demand for outdoor living spaces, offering weather-resistant and low-maintenance solutions.

- Diversified Revenue: Tapping into these segments can reduce reliance on the residential market and create more stable income.

- Market Share Growth: By addressing these less saturated markets, Caesarstone can capture new customer bases and increase overall market penetration.

Strategic Partnerships and Acquisitions

Caesarstone's willingness to leverage external manufacturing partners opens doors for strategic collaborations. These partnerships could be leveraged to bolster research and development, broaden the company's product offerings, and gain better traction in rapidly expanding markets.

The company's strategic move to acquire the remaining stake in Lioli Ceramica underscores its dedication to growing its porcelain segment. This acquisition, finalized in early 2024, is expected to strengthen Caesarstone's position in the premium quartz and porcelain market, a segment that has shown robust growth.

- Strategic Alignment: Caesarstone's external manufacturing strategy aligns with a broader industry trend of seeking agility and specialized expertise through partnerships.

- Growth Potential: Future acquisitions or deeper partnerships could unlock access to new technologies or customer bases, particularly in emerging markets where porcelain demand is increasing.

- Porcelain Focus: The Lioli Ceramica acquisition is a concrete step, signaling a commitment to expanding its footprint in the high-value porcelain category, which saw global market growth projected at over 6% annually leading into 2025.

The increasing demand for sustainable and healthier building materials presents a significant opportunity. Caesarstone can expand its lines of zero crystalline silica and porcelain products, catering to growing consumer and regulatory preferences for safer alternatives, especially as regions like California tighten silica dust regulations.

Caesarstone is well-positioned to benefit from the ongoing home renovation boom, particularly in kitchens and bathrooms, which remain key areas for homeowner investment. Furthermore, the burgeoning trend of outdoor living offers new avenues for growth, as engineered stone's durability and low maintenance are ideal for outdoor kitchens and patios.

Expanding into commercial sectors such as hospitality and healthcare, where hygiene and durability are paramount, can unlock substantial new revenue streams. Strategic partnerships and potential acquisitions in high-growth segments like porcelain, as evidenced by the Lioli Ceramica stake acquisition in early 2024, further bolster its market position and product diversification.

| Opportunity Area | Key Driver | Caesarstone's Advantage |

|---|---|---|

| Sustainable & Healthy Materials | Consumer preference for safety, regulatory shifts | Zero silica products, porcelain expansion |

| Home Renovation & Outdoor Living | Increased home improvement spending, outdoor lifestyle trend | Durable, low-maintenance surfaces for interior and exterior use |

| Commercial Sector Expansion | Demand for hygienic, durable surfaces in hospitality/healthcare | Leveraging product qualities for new market segments |

| Porcelain Market Growth | Acquisition of Lioli Ceramica stake (early 2024) | Strengthening position in a high-growth premium segment |

Threats

A significant threat to Caesarstone is the increasing regulatory scrutiny and potential bans on engineered stone, particularly concerning silica content. Australia's outright ban on the manufacture, supply, processing, and installation of engineered stone, effective July 1, 2024, exemplifies this trend, directly impacting sales in a key market.

This global push for stronger regulations on silica-containing materials necessitates costly adaptation for manufacturers like Caesarstone, potentially requiring shifts in product composition and production methods to comply with new standards or to develop alternative materials.

Caesarstone is confronting a rising tide of silicosis lawsuits, primarily from fabricators exposed to silica dust during their work. This legal challenge represents a significant threat, with the potential for substantial financial repercussions.

The company has already faced adverse jury verdicts, and the ongoing legal battles are proving costly. These proceedings not only incur significant legal expenses but also generate negative publicity, both of which can severely impact Caesarstone's profitability and damage its hard-earned reputation in the market.

While specific figures for ongoing litigation are often confidential, the industry has seen settlements and judgments in the tens of millions of dollars for similar cases. For instance, in early 2024, several large quartz surface manufacturers were reported to be involved in extensive litigation concerning silicosis claims, highlighting the scale of this potential financial burden.

A general global economic slowdown, coupled with persistent high interest rates, is a significant threat. This economic climate often leads to reduced consumer confidence, which directly impacts discretionary spending. For Caesarstone, this means a potential decrease in demand for home renovations and new construction projects, as consumers tighten their budgets.

This slowdown directly affects Caesarstone's core business by lowering demand for its premium surfaces. Consequently, the company could experience lower sales volumes and revenue declines. For example, in the first quarter of 2024, many companies in the home improvement sector reported softer sales trends compared to previous periods due to these macroeconomic pressures.

Intensified Competition from Alternative Materials and Technologies

Caesarstone faces significant pressure from a widening array of competing surface materials. Beyond traditional rivals like granite and marble, the market is seeing rapid advancements in porcelain and sintered stone technologies. These alternatives are increasingly matching engineered quartz in aesthetics and durability, often at competitive price points, posing a direct threat to Caesarstone's market position.

Innovations in these alternative materials are a key concern. For instance, advancements in large-format porcelain slabs allow for seamless installations, a feature previously a strong selling point for engineered quartz. Furthermore, the development of ultra-thin yet highly durable sintered stone products offers new design possibilities and performance characteristics that directly challenge engineered quartz's established advantages.

The competitive landscape is dynamic, with new entrants and technological breakthroughs constantly emerging. This intensified competition could lead to price erosion and a reduction in Caesarstone's market share if the company cannot effectively differentiate its offerings or adapt to these evolving material trends. For example, the global quartz surfaces market, while growing, is also becoming more fragmented, with increased competition impacting pricing power.

- Intensified Competition: Engineered quartz faces rivals like natural stone, solid surfaces, porcelain, and sintered stone.

- Porcelain and Sintered Stone Advancements: These materials offer competitive aesthetics, durability, and pricing.

- Market Share Erosion Risk: Innovations in alternatives could reduce Caesarstone's dominance.

- Evolving Material Landscape: The need for Caesarstone to innovate and differentiate is critical in a dynamic market.

Supply Chain Disruptions and Trade Tariffs

Geopolitical tensions and ongoing global logistics challenges continue to pose a significant threat to Caesarstone's operations. These disruptions can directly impact the availability and cost of essential raw materials, such as quartz, and also affect the timely delivery of finished products to key markets. For instance, in 2024, shipping costs saw fluctuations due to Red Sea disruptions, directly impacting global trade routes.

The imposition of new trade tariffs, particularly on imported goods, presents a direct financial risk. A substantial portion of Caesarstone's revenue is generated in the U.S. market, making it vulnerable to any new tariffs levied on products entering the country. Such measures can increase the cost of goods sold and potentially reduce profit margins, forcing price adjustments that could affect consumer demand.

- Supply Chain Volatility: Continued geopolitical instability in regions supplying key raw materials can lead to price spikes and shortages.

- Logistics Bottlenecks: Port congestion and shipping container shortages, which were prevalent in 2023 and continued into early 2024, can delay shipments and increase transportation expenses.

- Tariff Impact: New U.S. tariffs could directly increase the cost of Caesarstone's imported products, potentially impacting its competitive pricing strategy in a key market.

- Increased Operational Costs: The combined effect of supply chain disruptions and tariffs can lead to a significant rise in overall operational expenditures for the company.

The increasing regulatory pressure, exemplified by Australia's July 2024 ban on engineered stone due to silica content, poses a direct threat to Caesarstone's sales in key markets and necessitates costly product adaptation.

The company is also facing substantial financial and reputational risks from ongoing silicosis lawsuits, with industry precedents involving multi-million dollar settlements and judgments, as seen in early 2024 litigation against other major quartz manufacturers.

A global economic slowdown and high interest rates, evident in softer Q1 2024 sales trends across the home improvement sector, reduce consumer spending on renovations and new construction, directly impacting Caesarstone's demand and revenue.

Intensified competition from porcelain and sintered stone, which are advancing in aesthetics, durability, and pricing, threatens to erode Caesarstone's market share as these alternatives offer compelling features like seamless installations.

SWOT Analysis Data Sources

This Caesarstone SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a well-rounded perspective on Caesarstone's internal capabilities and external market positioning.