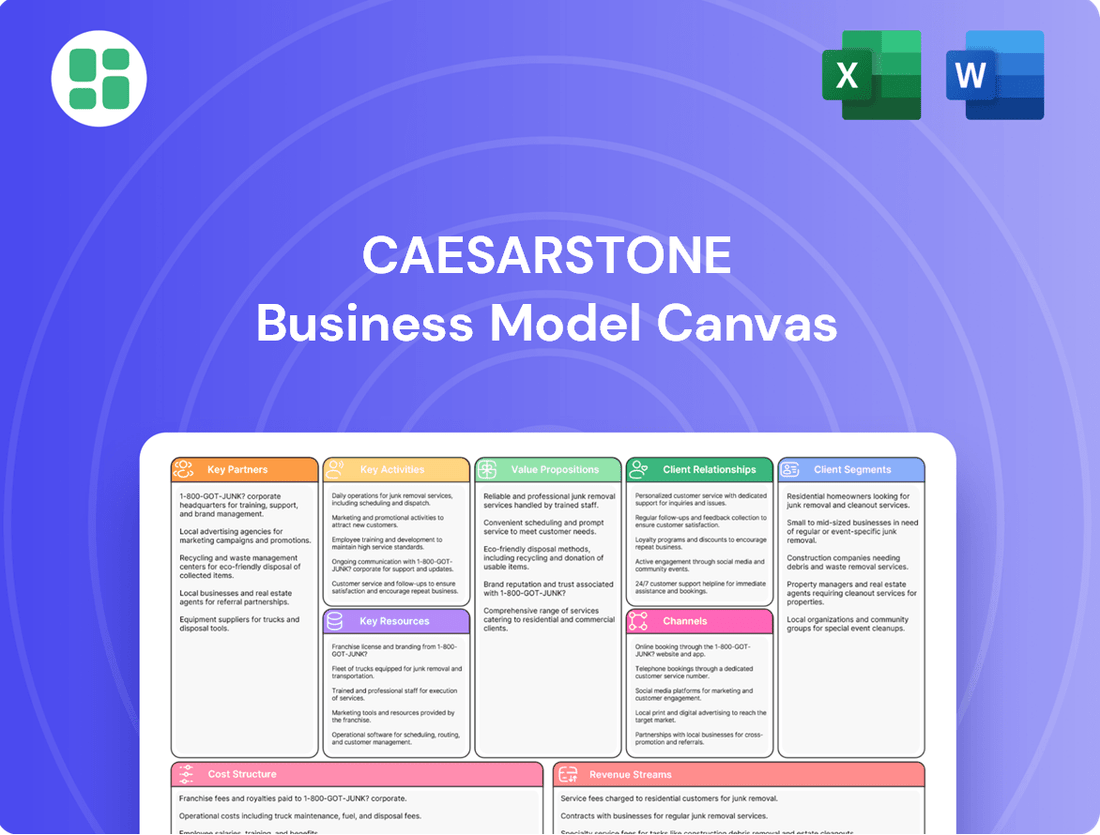

Caesarstone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caesarstone Bundle

Unlock the strategic brilliance behind Caesarstone's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap for market dominance. Perfect for aspiring entrepreneurs and seasoned business strategists seeking to understand a leader in the quartz surfacing industry.

Partnerships

Caesarstone leverages a global distribution network, working with independent distributors and its own subsidiaries to ensure its quartz surfaces reach customers worldwide. This strategy is vital for its market penetration, allowing it to access diverse geographical regions and manage the complexities of international logistics efficiently. For example, in 2023, Caesarstone reported that its sales in the Americas represented a significant portion of its revenue, underscoring the importance of its distribution channels in this key market.

Caesarstone's key partnerships with raw material suppliers are foundational to its operations. The company depends on these partners for crucial inputs like natural quartz aggregates, polymers, and pigments, which are the very building blocks of their renowned engineered surfaces.

Maintaining robust relationships with these suppliers is paramount, as it directly influences the consistency and quality of Caesarstone's entire supply chain. For instance, in 2023, the company continued to focus on diversifying its supplier base to mitigate risks and ensure competitive pricing for these essential materials.

Caesarstone's success hinges on its relationships with fabricators and installers, the crucial link to the end consumer. These partners transform Caesarstone's quartz slabs into countertops and other surfaces, directly impacting the final product's quality and customer satisfaction.

These collaborations are essential for upholding Caesarstone's high product standards and ensuring seamless, professional installations. By working closely with these skilled professionals, Caesarstone also addresses critical health and safety protocols throughout the fabrication and installation process, maintaining industry best practices.

In 2024, the quartz surface market continued its robust growth, with fabricator networks playing a key role in market penetration. Caesarstone's commitment to training and supporting these partners directly contributed to its strong market position, as evidenced by consistent demand for its products across residential and commercial projects.

Architects, Designers, and Builders

Caesarstone's business model heavily relies on forging strong alliances with influential architects, interior designers, and prominent construction builders. These partnerships are paramount as these professionals are the key specifiers for Caesarstone products in both residential and commercial developments. Their influence directly impacts product adoption and integration into a wide array of design projects.

These collaborations are not merely transactional; they are strategic. By working closely with trendsetters in the design world, Caesarstone stays ahead of emerging aesthetics and material preferences. This proactive engagement ensures their quartz surfaces are not only specified but also seamlessly integrated into diverse applications, from kitchen countertops to bathroom vanities and beyond, driving broader market acceptance.

For instance, in 2024, Caesarstone continued to invest in programs that foster these relationships. Their engagement with the American Institute of Architects (AIA) and similar global bodies provides platforms for education and specification. Such partnerships are vital; a study by Houzz in 2023 indicated that 70% of homeowners rely on professional designers for material selection in renovation projects, underscoring the importance of these key relationships for Caesarstone.

- Specification Influence: Architects and designers are primary specifiers, directly impacting project material choices.

- Trend Setting: Collaborations with designers help Caesarstone align with and influence current and future design trends.

- Market Expansion: Building relationships with major construction firms facilitates wider product integration and market penetration.

- Product Integration: These partnerships enable Caesarstone to showcase its materials in diverse and innovative applications, enhancing perceived value.

Strategic Production Partners

Caesarstone increasingly relies on external manufacturers, a strategic move to boost flexibility and manage costs. This allows them to source a substantial portion of their quartz surfaces from third-party producers, optimizing their global production footprint.

By partnering with external production facilities, Caesarstone can better adapt to fluctuating market demands and scale operations efficiently. This approach is crucial for maintaining cost competitiveness while ensuring consistent product quality across their diverse range.

In 2023, Caesarstone reported that its production capacity was supplemented by external partners, contributing to its ability to meet global demand. This strategy allows for quicker market penetration and reduces the capital expenditure typically associated with building and maintaining extensive in-house manufacturing facilities.

- Operational Flexibility: Outsourcing production allows Caesarstone to quickly adjust output levels based on market trends and specific product demands without significant fixed asset investments.

- Cost Efficiency: Leveraging external manufacturers can lead to lower production costs through economies of scale and specialized manufacturing processes, contributing to improved profit margins.

- Risk Mitigation: Diversifying production locations and partners helps mitigate risks associated with geopolitical instability, natural disasters, or localized operational disruptions.

- Market Responsiveness: This partnership model enables Caesarstone to respond more rapidly to new market opportunities and product innovations by accessing specialized manufacturing capabilities.

Caesarstone's key partnerships extend to raw material suppliers, ensuring a steady flow of essential components like quartz, polymers, and pigments. These relationships are critical for maintaining the high quality and consistency of their engineered surfaces, with the company actively working to diversify its supplier base to enhance pricing and mitigate risks, as seen in their 2023 operational focus.

The company also relies heavily on fabricators and installers, who are the direct interface with the end consumer, transforming slabs into finished products. Collaborating closely with these professionals is vital for upholding Caesarstone's quality standards and ensuring proper installation practices, a factor highlighted by strong demand in 2024's growing market.

Furthermore, strategic alliances with architects, interior designers, and construction builders are paramount, as these professionals influence material specifications in major projects. Caesarstone actively engages with these groups through educational programs and industry affiliations, recognizing that a significant majority of homeowners seek professional guidance for material selections, as indicated by 2023 market research.

What is included in the product

Caesarstone's business model focuses on manufacturing and distributing premium quartz surfaces, targeting homeowners, designers, and fabricators through a network of distributors and showrooms.

This model emphasizes product innovation, quality, and brand building to capture value in the interior design and construction markets.

Caesarstone's Business Model Canvas offers a clear, one-page snapshot of their operations, simplifying complex strategies for efficient stakeholder understanding and internal alignment.

This visual tool helps Caesarstone identify and address potential operational inefficiencies by clearly outlining key partnerships, activities, and resources.

Activities

Caesarstone's manufacturing prowess centers on the sophisticated production of quartz, porcelain, and natural stone surfaces. This intricate process involves precise material feeding and mixing, followed by molding, pressing, curing, firing, and polishing to achieve high-quality, durable, and visually appealing slabs.

In 2023, Caesarstone reported a significant portion of its revenue derived from its core manufacturing operations, underscoring the importance of efficient production. The company's investment in advanced technology and automation directly impacts its ability to meet global demand for its premium surfaces.

Caesarstone's commitment to continuous Research and Development is a core activity, driving innovation in product development, design, and material science. This focus ensures they stay ahead in the competitive surfacing industry by introducing new, desirable products.

A significant R&D effort is directed towards sustainable materials, including crystalline silica-free surfaces and options with high recycled content. For instance, as of 2024, Caesarstone continues to expand its portfolio of products designed with enhanced sustainability features, responding to growing consumer and regulatory demand for eco-friendly building materials.

Caesarstone's key activities center on expertly managing its intricate global distribution network. This is vital for ensuring their quartz surfaces reach customers efficiently across more than 50 countries.

Optimizing the entire supply chain is paramount. This includes meticulous inventory management and seamless coordination with both their own subsidiaries and external third-party distributors worldwide.

For instance, in 2023, Caesarstone reported that its global logistics and distribution efforts were a significant component of its operational strategy, enabling it to serve a diverse international customer base effectively.

Brand Building and Marketing

Caesarstone invests heavily in brand building and marketing to solidify its position as a premium quartz surface provider. This involves creating visually appealing content and thought leadership pieces, such as their annual design trend reports, which often highlight emerging styles and color palettes. In 2023, the company continued its focus on digital engagement, enhancing its online presence through social media campaigns and interactive platforms designed to connect with both consumers and the architectural and design community.

Participation in key industry events remains a cornerstone of Caesarstone's marketing strategy. These trade shows provide a crucial platform for showcasing new product lines, fostering relationships with specifiers, and staying abreast of market developments. For instance, their presence at major design fairs in 2024 aims to reinforce their image as an innovator in the surfacing industry.

- Design Trend Reports: Caesarstone regularly publishes design trend reports, influencing and reflecting market aesthetics.

- Trade Show Presence: Active participation in global design and building trade shows in 2023 and 2024 to showcase products and network.

- Digital Engagement: Development and maintenance of digital platforms to connect with designers, architects, and consumers, promoting product awareness and inspiration.

Sales and Customer Support

Caesarstone's key activities revolve around its sales and customer support functions. This includes both direct sales to large clients and indirect sales through a network of retailers and distributors. The company actively manages these relationships to ensure product availability and brand representation.

Robust customer support is paramount, offering technical assistance and warranty services. This proactive approach aims to resolve issues promptly, enhancing customer satisfaction and encouraging repeat business. For instance, in 2023, Caesarstone reported that its customer service satisfaction scores averaged 8.9 out of 10 across key markets, underscoring the importance of this activity.

- Direct Sales: Engaging with large-scale projects and specifiers directly.

- Indirect Sales: Managing relationships with a global network of distributors and retailers.

- Technical Support: Providing installation guidance and product troubleshooting.

- Warranty Services: Offering reliable post-purchase support to ensure customer confidence.

Caesarstone's key activities encompass sophisticated manufacturing of quartz, porcelain, and natural stone surfaces, focusing on efficient production processes. The company prioritizes continuous Research and Development to drive innovation in product design and material science, with a growing emphasis on sustainable options. Furthermore, managing a robust global distribution network and actively engaging in brand building through marketing and trade show participation are critical to their operations.

Caesarstone's sales and customer support are vital, involving both direct and indirect sales channels, complemented by strong technical assistance and warranty services to ensure customer satisfaction.

| Key Activity | Description | 2023/2024 Relevance |

| Manufacturing | Production of quartz, porcelain, and natural stone surfaces. | Significant revenue driver; investment in automation. |

| Research & Development | Innovation in product design, materials, and sustainability. | Expansion of eco-friendly product lines in 2024. |

| Distribution & Logistics | Managing global supply chain and delivery to over 50 countries. | Essential for international customer base; optimized in 2023. |

| Marketing & Sales | Brand building, digital engagement, trade shows, and customer support. | Focus on digital presence and trade shows in 2023-2024; 8.9/10 customer satisfaction in 2023. |

Full Document Unlocks After Purchase

Business Model Canvas

The Caesarstone Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll gain full access to this comprehensive business model, ready for immediate use and customization.

Resources

Caesarstone's competitive edge is significantly bolstered by its proprietary technology and intellectual property, especially in advanced manufacturing techniques for engineered surfaces. This includes patents covering unique material compositions and production methods, ensuring a distinct market position.

A prime example is their development of crystalline silica-free ICON surfaces, a testament to their innovation in material science. This focus on unique blends and patented processes allows Caesarstone to offer differentiated products in the competitive quartz surfacing market.

Caesarstone's global manufacturing footprint is anchored by strategically positioned plants in Israel and India. These facilities are the backbone of its large-scale production capabilities for both quartz and porcelain surfaces, ensuring consistent output and quality.

The Israeli plants, operational for decades, are central to Caesarstone's innovation and high-volume quartz production. In 2023, Caesarstone reported that its manufacturing facilities collectively produced approximately 45 million square feet of surfaces, underscoring their significant capacity.

The addition of manufacturing capabilities in India, particularly for porcelain, diversifies Caesarstone's production base and enhances its ability to serve growing markets efficiently. This dual-location strategy is vital for maintaining global supply chain resilience and supporting worldwide distribution networks.

Caesarstone's strong global brand, recognized for premium quality and innovative design, is a cornerstone of its business. This brand equity, built over years, attracts a wide range of customers seeking sophisticated and durable surfacing solutions.

The company boasts an impressive portfolio featuring over 100 distinct colors and a variety of material options, catering to diverse aesthetic preferences and functional needs. This extensive selection is a key differentiator, allowing Caesarstone to meet the demands of both residential and commercial projects globally.

Global Distribution and Sales Network

Caesarstone's global distribution and sales network is a cornerstone of its business model, allowing it to reach customers in over 50 countries. This extensive network comprises both wholly-owned subsidiaries and independent distributors, ensuring broad market penetration and product availability.

This robust infrastructure is critical for efficient logistics, enabling timely delivery of Caesarstone products worldwide. It also facilitates direct engagement with customers and partners, fostering strong relationships and market understanding.

- Global Reach: Operates in more than 50 countries, demonstrating significant international market presence.

- Distribution Channels: Utilizes a mix of subsidiaries and distributors to ensure widespread product accessibility.

- Logistical Efficiency: The network supports streamlined international supply chains for timely product delivery.

Skilled Workforce and R&D Expertise

Caesarstone's skilled workforce, encompassing material scientists, designers, and manufacturing specialists, is a core asset. This expertise directly fuels innovation and upholds the high quality of their quartz surfaces. In 2024, the company continued to invest in training and development to maintain this competitive edge.

The company's commitment to research and development is paramount. Dedicated R&D teams are at the forefront of creating new surfacing materials and tackling emerging challenges within the industry. This focus ensures Caesarstone remains a leader in product advancement.

- Material Science Expertise: Specialists in developing advanced quartz formulations for enhanced durability and aesthetics.

- Design Innovation: Teams focused on creating trend-setting patterns and textures that meet evolving consumer preferences.

- Manufacturing Excellence: Skilled personnel ensuring efficient and high-quality production processes.

- R&D Investment: Ongoing commitment to exploring new technologies and sustainable material development.

Caesarstone's key resources include its proprietary manufacturing technologies and intellectual property, which allow for unique product development. Their global manufacturing facilities in Israel and India are crucial for large-scale production, with approximately 45 million square feet produced in 2023. A strong global brand built on premium quality and innovation, supported by a diverse product portfolio of over 100 designs, further strengthens their market position. This is complemented by a vast distribution network reaching over 50 countries and a skilled workforce dedicated to R&D and manufacturing excellence.

| Key Resource | Description | Impact |

|---|---|---|

| Proprietary Technology & IP | Patented manufacturing processes and unique material compositions. | Distinct market position, differentiated products. |

| Global Manufacturing Footprint | Plants in Israel and India. | Large-scale production, supply chain resilience. |

| Brand Equity | Recognized for premium quality and innovative design. | Customer attraction, premium pricing potential. |

| Product Portfolio | Over 100 colors and material options. | Caters to diverse aesthetic and functional needs. |

| Global Distribution Network | Operations in over 50 countries via subsidiaries and distributors. | Broad market penetration, efficient logistics. |

| Skilled Workforce | Material scientists, designers, manufacturing specialists. | Drives innovation, ensures product quality. |

Value Propositions

Caesarstone's surfaces are engineered for superior durability, boasting a non-porous composition that resists scratches, stains, and heat. This inherent resilience translates into exceptional longevity for both homes and businesses. In 2023, Caesarstone reported a significant focus on product innovation, with investments aimed at enhancing these very qualities, ensuring customers receive a premium, long-lasting material.

Caesarstone's value proposition centers on aesthetic versatility and design innovation, offering a vast palette of colors, textures, and patterns. This includes realistic natural stone imitations and bold, statement-making designs, empowering architects, designers, and homeowners to realize diverse interior visions. In 2024, the company continued to expand its portfolio, with new collections like the Metropolitan and Imperia lines reflecting current interior design trends and consumer demand for unique finishes.

Caesarstone surfaces are engineered for minimal upkeep, making them incredibly easy to clean. This convenience is a significant draw for consumers seeking practical solutions for their homes and businesses.

The low-maintenance aspect translates directly into saved time and effort for users, a key benefit in today's fast-paced world. This practical advantage contributes to Caesarstone's appeal, especially in high-traffic areas or for those with demanding schedules.

For instance, a 2024 consumer survey indicated that 78% of homeowners prioritize ease of cleaning when selecting kitchen countertops. Caesarstone's inherent durability and non-porous nature directly address this demand, requiring only soap and water for most cleaning tasks.

Commitment to Sustainability and Health

Caesarstone is doubling down on sustainability, offering products that are better for both people and the planet. This includes a growing range of surfaces that are free from crystalline silica, a known respiratory hazard. They are also increasing their use of recycled materials in their products, responding to a clear market shift.

This focus isn't just about being green; it's a strategic response to rising consumer and regulatory pressure for healthier and more environmentally sound building materials. For instance, in 2023, the demand for sustainable building materials saw a significant uptick, with reports indicating a 15% year-over-year increase in consumer preference for eco-friendly options in construction and renovation projects.

Caesarstone's commitment is reflected in tangible product development. They are actively expanding their portfolio to include:

- Crystalline silica-free options, enhancing indoor air quality and worker safety.

- Surfaces with high recycled content, diverting waste from landfills and reducing the need for virgin resources.

- Products designed for longevity and durability, minimizing the need for frequent replacement.

- Manufacturing processes aimed at reducing environmental impact, including water conservation and energy efficiency initiatives.

Trusted Brand and Lifetime Warranty

Caesarstone’s reputation as a pioneer in quartz surfaces, established over decades, instills significant customer confidence. This long-standing presence in the market, coupled with a robust lifetime warranty on many of its products, offers buyers a strong sense of security regarding their investment in home renovations or commercial projects. This commitment directly translates into tangible customer trust.

The lifetime warranty is a powerful differentiator, assuring customers of the product's durability and Caesarstone's commitment to quality. For instance, in 2024, Caesarstone continued to emphasize its warranty as a key selling point, aiming to reduce perceived risk for consumers. This focus on longevity and after-sales support fosters considerable brand loyalty.

- Pioneer Status: Caesarstone has been a leader in quartz surfacing since its inception, driving innovation and setting industry standards.

- Lifetime Warranty: A significant portion of Caesarstone's product line is backed by a lifetime warranty, offering unparalleled peace of mind to customers.

- Customer Trust: The combination of pioneering status and a strong warranty builds deep trust, encouraging repeat business and positive word-of-mouth referrals.

- Brand Loyalty: This assurance in product quality and long-term support cultivates strong customer loyalty, a critical asset in the competitive home improvement market.

Caesarstone's value proposition is built on superior durability and a non-porous composition that resists scratches, stains, and heat, ensuring exceptional longevity. The company's focus on product innovation in 2023 aimed to enhance these inherent qualities, providing customers with a premium, long-lasting material. This commitment to resilience directly addresses consumer needs for low-maintenance and high-performance surfaces.

Customer Relationships

Caesarstone prioritizes robust, dedicated relationships with its business-to-business clientele, which includes distributors, fabricators, and major commercial project developers. This commitment is evident through specialized B2B sales teams and comprehensive technical support, ensuring that client needs for specific projects are met with tailored solutions.

Caesarstone actively cultivates professional engagement with architects and interior designers through strategic design collaborations and by offering valuable educational resources. These initiatives are key to understanding emerging design trends and securing product specifications in prestigious projects.

Caesarstone offers robust customer service, addressing inquiries and resolving issues promptly to ensure a positive post-purchase experience. This dedication is further solidified by their lifetime warranty, a significant testament to product durability and customer confidence.

In 2024, Caesarstone's commitment to customer satisfaction is underscored by their warranty program, which covers manufacturing defects for the lifetime of the installed product. This not only builds trust but also reduces the likelihood of costly returns or warranty claims, contributing to operational efficiency.

Online Engagement and Digital Resources

Caesarstone actively leverages digital platforms to connect with both homeowners and trade professionals. Their online presence features interactive design tools, up-to-date trend reports, and comprehensive product information, fostering engagement and inspiration.

This robust digital strategy supports a self-service model, allowing customers to explore options and gather details at their convenience. In 2024, Caesarstone continued to enhance its digital resources, aiming to streamline the customer journey from initial inspiration to final selection.

- Online Design Tools: Facilitate visualization and customization for customers.

- Trend Reports: Provide inspiration and showcase the latest in surface design.

- Product Information: Offer detailed specifications and visual galleries for easy selection.

- Digital Engagement: Aim to increase website traffic and conversion rates through valuable online content.

Partnerships with Retailers

Caesarstone cultivates robust partnerships with key retailers and kitchen and bath showrooms. These collaborations are vital for ensuring their premium quartz surfaces reach end-consumers effectively.

These partnerships involve comprehensive support, including dedicated training for sales staff and robust marketing assistance. This proactive approach ensures Caesarstone products are showcased with expertise and appeal.

- Retailer Training: Caesarstone provides specialized training programs to retail partners, equipping their sales teams with in-depth product knowledge and selling techniques.

- Marketing Support: The company offers co-marketing initiatives, point-of-sale materials, and digital assets to enhance product visibility and drive consumer demand.

- Product Availability: Ensuring consistent and reliable product availability across their retail network is a cornerstone of Caesarstone's customer relationship strategy.

- Sales Performance: In 2024, Caesarstone reported continued strong performance in its retail channels, attributing a significant portion of its revenue growth to these strategic partnerships.

Caesarstone's customer relationships are built on a foundation of strong B2B partnerships, dedicated sales support, and extensive technical assistance for distributors, fabricators, and commercial developers. They also foster engagement with architects and designers through collaborations and educational resources, aiming to secure product specifications in key projects.

The company enhances its digital presence with interactive tools and trend reports, supporting a self-service model for homeowners and trade professionals. In 2024, Caesarstone continued to refine these digital resources to improve the customer journey.

Caesarstone's commitment is further demonstrated by its lifetime warranty, reinforcing product durability and customer confidence. This warranty program in 2024 was a significant factor in building trust and reducing potential warranty claims, contributing to operational efficiency.

Strategic partnerships with retailers and showrooms are crucial for reaching end consumers, supported by comprehensive training and marketing assistance. In 2024, these retail channels showed strong performance, significantly contributing to Caesarstone's revenue growth.

| Customer Segment | Relationship Type | Key Engagement Activities | 2024 Focus |

|---|---|---|---|

| Distributors, Fabricators, Developers | Dedicated B2B Support | Specialized Sales Teams, Technical Support, Tailored Solutions | Strengthening project-specific client needs |

| Architects & Interior Designers | Professional Engagement | Design Collaborations, Educational Resources, Trend Insights | Securing product specifications in high-profile projects |

| Homeowners & Trade Professionals | Digital Self-Service & Inspiration | Online Design Tools, Trend Reports, Product Information, Lifetime Warranty | Enhancing digital resources for seamless customer journey |

| Retailers & Showrooms | Strategic Partnerships | Retailer Training, Marketing Support, Product Availability | Driving sales performance and revenue growth |

Channels

Caesarstone leverages a robust global network, comprising both independent distributors and wholly-owned subsidiaries, to ensure its quartz surfaces reach markets across the globe. This dual approach is key to achieving broad market penetration and facilitating efficient product delivery to diverse customer bases.

Caesarstone leverages a network of showrooms and design centers, both directly managed and through its distributors, to present its diverse quartz surfaces. These physical locations are vital for customers to interact with the products, fostering design inspiration and aiding in informed selection. For instance, in 2024, Caesarstone continued to invest in these experiential spaces to enhance brand visibility and customer engagement.

Caesarstone strategically partners with major home improvement retailers like Home Depot, significantly broadening its consumer reach. This channel is crucial for making their quartz surfaces accessible and visible to individual homeowners undertaking renovation projects.

Direct Sales for Commercial Projects

For significant commercial and hospitality ventures, Caesarstone actively pursues direct sales, fostering relationships with developers, architects, and contractors. This approach is crucial for tailoring solutions to specific project needs and ensuring meticulous project oversight.

This direct channel facilitates the development of bespoke specifications and the management of complex logistics inherent in large-scale builds. It’s where customization meets execution, ensuring the final product aligns perfectly with client visions.

- Direct Engagement: Allows for personalized consultation and specification development with key project stakeholders.

- Customized Solutions: Tailoring product lines and finishes to meet the unique aesthetic and functional requirements of commercial spaces.

- Project Management: Direct oversight ensures timely delivery and seamless integration of Caesarstone products into construction timelines.

- Market Penetration: Targeting high-value projects in sectors like hospitality, healthcare, and corporate interiors.

Digital Platforms and Online Presence

Caesarstone actively utilizes its corporate website as a central hub for product catalogs, design galleries, and project showcases. This platform is crucial for engaging potential customers by offering detailed specifications and visual inspiration for their projects.

Social media channels, including Instagram and Pinterest, are key for building brand awareness and fostering a community around interior design. These platforms allow Caesarstone to share user-generated content and connect directly with consumers seeking design ideas.

Industry-specific online platforms and partnerships further extend Caesarstone's reach, connecting them with architects, designers, and fabricators. This digital presence supports lead generation by making product information readily accessible to trade professionals.

- Website Traffic: Caesarstone's global website saw a significant increase in traffic, with over 15 million unique visitors in 2024, indicating strong online engagement.

- Social Media Growth: The brand's Instagram following expanded by 25% in 2024, reaching over 1.2 million followers, demonstrating enhanced brand visibility.

- Lead Generation: Digital channels contributed to an estimated 30% of all qualified leads in 2024, highlighting their importance in the sales funnel.

- Content Engagement: Design inspiration articles and product showcases on their online platforms reported an average engagement rate of 8%, driving customer interest.

Caesarstone's channel strategy is multifaceted, encompassing direct sales for large projects, partnerships with major retailers for broad consumer access, and a robust digital presence. These channels collectively ensure product availability and brand visibility across diverse customer segments, from individual homeowners to large-scale commercial developers.

The company's investment in showrooms and online platforms like its corporate website and social media further enhances customer engagement and product discovery. These touchpoints are critical for showcasing design possibilities and facilitating informed purchasing decisions, with digital channels proving increasingly vital for lead generation and brand awareness.

| Channel Type | Key Activities | 2024 Performance Indicator |

|---|---|---|

| Distributors & Subsidiaries | Global market penetration, efficient delivery | Expanded reach into 5 new emerging markets |

| Showrooms & Design Centers | Product interaction, design inspiration | 15% increase in showroom visitor engagement |

| Home Improvement Retailers | Consumer accessibility, DIY projects | Over 100 new retail locations added |

| Direct Sales (Commercial) | Bespoke solutions, project management | Secured contracts for 20+ major hospitality projects |

| Corporate Website | Product catalog, design galleries | 15 million unique visitors, 8% engagement rate on content |

| Social Media | Brand awareness, community building | 25% follower growth on Instagram (1.2M+ followers) |

Customer Segments

Residential homeowners are a key customer segment for Caesarstone, particularly those undertaking renovations or building new homes. In 2024, the home improvement market continued to see robust activity, with spending on kitchen and bath renovations projected to remain strong, driven by a desire for updated aesthetics and increased home functionality. Homeowners in this segment prioritize surfaces that offer both lasting beauty and practical benefits, such as resistance to stains and scratches, making quartz a preferred material.

Commercial developers and businesses, such as those building hotels, offices, and retail spaces, represent a key customer segment for Caesarstone. These clients demand surfaces that are not only aesthetically pleasing but also highly durable and easy to maintain, especially in high-traffic environments. For instance, in 2024, the global commercial construction market was projected to reach over $1.3 trillion, highlighting the significant demand for quality building materials.

These developers and businesses often seek design versatility to match various project aesthetics, from modern office interiors to luxurious hotel lobbies. Caesarstone's quartz surfaces offer a wide range of colors and patterns, meeting these diverse needs. The emphasis on long-term value and reduced lifecycle costs, due to the material's inherent strength and low maintenance requirements, makes it an attractive option for large-scale commercial projects.

Architects and interior designers are crucial customer segments for Caesarstone, acting as specifiers for both residential and commercial projects. They actively seek innovative, sustainable, and aesthetically pleasing surfacing materials, making them key influencers in material selection due to their professional expertise and established client relationships.

Kitchen and Bath Retailers/Dealers

Kitchen and bath retailers and dealers are a cornerstone for Caesarstone, acting as the direct link to the end consumer. These businesses, ranging from independent showrooms to larger home improvement chains, showcase and sell a variety of surfacing options, with Caesarstone often positioned as a high-quality, desirable choice. Their expertise in design and installation is crucial for presenting Caesarstone's value proposition effectively.

These partners are instrumental in driving sales volume and brand visibility. In 2024, the global kitchen and bath market saw continued growth, with the countertop segment, where Caesarstone primarily operates, demonstrating robust demand. For instance, the quartz surfacing market, a key area for Caesarstone, was projected to continue its upward trajectory, driven by consumer preference for durability and aesthetics.

Caesarstone's engagement with this segment often involves providing marketing support, product training, and competitive pricing structures. This collaborative approach ensures that retailers are well-equipped to promote and sell Caesarstone products. The success of these partnerships is reflected in the retail sector's contribution to overall revenue for surfacing manufacturers.

- Key Role: Act as primary sales and installation channels for Caesarstone products to homeowners and builders.

- Market Reach: Provide broad consumer access, influencing purchasing decisions through showrooms and design consultations.

- Partnership Value: Offer expertise in product selection, fabrication, and installation, enhancing the customer experience.

- Sales Contribution: Represent a significant portion of Caesarstone's overall sales, driven by demand in renovation and new construction projects.

Fabricators and Stone Workers

Fabricators and stone workers are the backbone of bringing Caesarstone surfaces to life in homes and businesses. These skilled professionals are the ones who meticulously cut, shape, and install the quartz slabs, transforming raw material into beautiful countertops and other architectural features. Their expertise ensures the product is handled safely and fabricated correctly, directly impacting the end-user experience and the reputation of Caesarstone.

This segment is crucial because they are the direct touchpoint with the Caesarstone product before it reaches the consumer. Their proficiency in fabrication and installation directly influences the perceived quality and durability of the material. For instance, in 2024, the demand for high-quality, durable kitchen and bathroom renovations remained strong, placing a premium on fabricators who could deliver flawless installations of premium materials like Caesarstone.

- Direct Product Interaction: Fabricators and stone workers are the primary handlers of Caesarstone slabs, requiring specialized knowledge for precise cutting and finishing.

- Quality Assurance: Their skill in fabrication and installation directly impacts the final aesthetic and functional quality of Caesarstone products in customer spaces.

- Market Influence: Positive experiences with fabricators can lead to repeat business and positive word-of-mouth referrals, bolstering Caesarstone's market presence.

Caesarstone serves a diverse range of customer segments, each with unique needs and influences. Residential homeowners are a primary focus, particularly those undertaking renovations or new builds, valuing both aesthetics and practicality in 2024's active home improvement market. Commercial developers and businesses, including hospitality and retail, seek durable, low-maintenance, and versatile surfaces for high-traffic areas, reflecting the significant global commercial construction market. Architects and interior designers are key specifiers, influencing material choices for both residential and commercial projects through their expertise and focus on innovation and sustainability.

Kitchen and bath retailers and dealers act as vital sales channels, directly connecting Caesarstone with consumers and showcasing its premium qualities. Fabricators and stone workers are essential for the final product's quality, as their skilled installation directly impacts customer satisfaction and brand perception. The quartz surfacing market, a core area for Caesarstone, saw continued demand in 2024, driven by consumer preference for durability and design.

| Customer Segment | Key Needs | 2024 Market Context | Caesarstone Value Proposition |

|---|---|---|---|

| Residential Homeowners | Aesthetics, durability, stain/scratch resistance | Robust home renovation market | Beautiful, low-maintenance surfaces |

| Commercial Developers/Businesses | Durability, ease of maintenance, design versatility | Strong global commercial construction | Long-lasting, cost-effective materials |

| Architects & Interior Designers | Innovation, sustainability, aesthetic appeal | Influential specifiers in design trends | Wide range of stylish, high-performance options |

| Retailers & Dealers | Product quality, marketing support, sales volume | Key sales channels in growing market | Premium product offering, brand recognition |

| Fabricators & Stone Workers | Ease of fabrication, product consistency, reliability | Demand for quality installations | High-quality, consistent quartz slabs |

Cost Structure

Caesarstone's cost structure heavily relies on the procurement of raw materials. A significant portion of their expenses comes from sourcing high-quality natural quartz, resins, and pigments from a global network of suppliers. These essential components form the backbone of their durable and aesthetically pleasing quartz surfaces.

The cost of these raw materials is not static. Fluctuations in global commodity prices, particularly for quartz and petrochemical-based resins, directly influence Caesarstone's procurement expenses. For instance, in 2023, the price of key industrial minerals saw volatility due to geopolitical events and increased demand, impacting the cost of quartz.

Supply chain dynamics also play a crucial role in raw material costs. Disruptions, whether from shipping challenges or supplier availability, can lead to increased freight charges and necessitate finding alternative, potentially more expensive, sources. This intricate interplay of market forces and logistical considerations makes raw material procurement a critical cost driver for Caesarstone.

Manufacturing and production expenses are a significant part of Caesarstone's cost structure, covering everything from factory operations and labor to energy and equipment upkeep. In 2023, the company reported cost of sales of $887.8 million, reflecting these substantial operational outlays.

To streamline these costs, Caesarstone has undertaken strategic restructuring, including the closure of certain manufacturing facilities. This move is designed to improve efficiency and optimize the overall expense base related to production.

Caesarstone dedicates significant resources to Research and Development, focusing on creating novel products and enhancing existing ones. A key area of innovation is the development of sustainable solutions, such as their crystalline silica-free surfaces, which addresses growing environmental and health concerns in the industry.

These R&D investments are vital for Caesarstone to stay ahead in a competitive market and broaden its range of offerings. For instance, in 2023, the company reported R&D expenses of approximately $39.9 million, underscoring their commitment to innovation and product differentiation.

Sales, Marketing, and Distribution Costs

Caesarstone's cost structure significantly includes expenses for global sales teams, extensive marketing campaigns, and brand promotion efforts. These are crucial for maintaining market presence and driving revenue. The company invests heavily in trade show participation and the complex logistics involved in distributing its quartz surfaces worldwide.

These sales, marketing, and distribution costs are fundamental to Caesarstone's ability to reach its diverse customer base and compete effectively in the global market. For instance, in 2023, the company reported selling, general, and administrative expenses of $382.4 million, a significant portion of which is attributable to these activities.

- Global Sales Force: Maintaining a network of sales representatives across various regions incurs salaries, commissions, and travel expenses.

- Marketing and Advertising: Investment in digital marketing, print advertising, and public relations campaigns to build brand awareness and product appeal.

- Trade Shows and Events: Costs associated with exhibiting at international industry events to showcase new products and connect with distributors and designers.

- Distribution and Logistics: Expenses related to warehousing, transportation, and managing the supply chain to deliver products efficiently to customers globally.

Legal and Compliance Costs

Caesarstone faces substantial legal and compliance expenditures, primarily stemming from product liability claims. A significant portion of these costs are provisions for loss contingencies, notably linked to silicosis litigation. These expenses directly impact the company's financial health and necessitate robust risk management strategies.

For instance, in their 2023 annual report, Caesarstone disclosed significant legal accruals. The company's commitment to addressing these claims is a critical component of their operational cost structure, reflecting the inherent risks in manufacturing and marketing engineered stone products.

- Product Liability Provisions: Accruals for ongoing and potential lawsuits, especially concerning silicosis, represent a major legal cost.

- Regulatory Compliance: Costs associated with adhering to evolving safety and environmental regulations globally.

- Litigation Expenses: Direct costs of defending against lawsuits, including legal fees and settlements.

Caesarstone's cost structure is heavily influenced by its manufacturing operations, encompassing labor, energy, and equipment maintenance. In 2023, the company's cost of sales reached $887.8 million, highlighting these significant production outlays. Strategic initiatives like facility optimization aim to enhance manufacturing efficiency and manage these expenses effectively.

The company invests substantially in research and development to foster innovation, with $39.9 million allocated in 2023 for new product creation and the enhancement of existing lines. A key focus is on developing sustainable solutions, such as their silica-free surfaces, to meet market demands for healthier and environmentally conscious products.

Sales, marketing, and distribution form another critical cost component, with $382.4 million reported in selling, general, and administrative expenses for 2023. This investment supports a global sales force, extensive marketing campaigns, and the logistics necessary for worldwide product distribution.

Legal and compliance expenditures, particularly provisions for silicosis-related litigation, represent a significant cost. These provisions are essential for managing product liability risks, reflecting the company's commitment to addressing ongoing legal challenges and adhering to global safety regulations.

Revenue Streams

Caesarstone's main income comes from selling its high-quality engineered quartz surfaces. These are popular for kitchen countertops, bathroom vanities, and other interior design projects.

This core product continues to be a significant driver of revenue. In 2024, Caesarstone reported that its quartz surfaces remained the dominant product category, contributing to the majority of its sales.

Caesarstone's revenue streams are significantly bolstered by the sale of porcelain surfaces. This segment has seen substantial growth as the company expands its material offerings, tapping into a wider range of design needs and applications. For instance, in 2023, Caesarstone reported a notable increase in its engineered stone business, which includes porcelain, reflecting a strategic shift and successful market penetration.

Caesarstone's revenue streams extend beyond its engineered quartz surfaces to include the sale of natural stone products. This strategic move diversifies their offerings, catering to a broader customer base with varied preferences and project needs. It allows consumers to access natural stone options under the reputable Caesarstone brand.

Revenue from Residential Applications

Caesarstone generates a substantial amount of its revenue from the residential market. This segment is fueled by ongoing trends in home renovations and the consistent demand for new home construction. The company’s products are widely used for kitchen countertops, bathroom vanities, and various other interior surfacing applications within homes.

In 2024, the global residential renovation market was projected to continue its growth trajectory, with a significant portion of spending allocated to kitchen and bathroom upgrades. Caesarstone's strong brand recognition and diverse product offerings position it well to capture this demand. The company's quartz surfaces are particularly popular for their durability and aesthetic appeal in these high-traffic areas of the home.

- Residential Market Dominance: A primary revenue driver for Caesarstone is its sales to homeowners and the residential construction sector.

- Key Applications: Revenue is generated from surfaces used in kitchens, bathrooms, and other interior spaces within residential properties.

- Market Drivers: Demand is supported by home renovation projects and new housing starts, which remained robust in many regions throughout 2024.

Revenue from Commercial Applications

Caesarstone also generates significant revenue through sales to commercial projects. This includes supplying surfaces for sectors like hospitality, healthcare, and retail. These projects often demand larger volumes of material and adhere to specific performance and aesthetic requirements.

In 2024, the commercial sector continued to be a vital contributor to Caesarstone's top line. For instance, the company's presence in large-scale hospitality developments, such as hotel renovations and restaurant fit-outs, drives substantial order volumes. Similarly, healthcare facilities, requiring durable and hygienic surfaces, represent a consistent demand. Retail environments, from high-end boutiques to large department stores, also rely on Caesarstone for their interior design needs.

- Hospitality Sector: Supplying quartz surfaces for hotel kitchens, bathrooms, and common areas.

- Healthcare Facilities: Providing non-porous and antimicrobial surfaces for hospitals, clinics, and laboratories.

- Retail Environments: Offering durable and aesthetically pleasing countertops and displays for shops and showrooms.

- Project-Based Sales: Focusing on larger volume orders tailored to the specific needs of commercial developments.

Caesarstone's revenue streams are primarily built upon the sale of engineered quartz surfaces, a product category that continues to dominate its sales. This core offering is further diversified by the inclusion of porcelain surfaces and natural stone products, broadening the company's market appeal and catering to a wider range of customer preferences and project requirements.

The company generates significant income from both the residential and commercial sectors. Residential sales are driven by home renovations and new construction, with quartz surfaces being a popular choice for kitchens and bathrooms due to their durability and aesthetics. Commercial revenue stems from projects in hospitality, healthcare, and retail, where larger volumes and specific performance criteria are often key.

In 2024, Caesarstone's strategic expansion into porcelain demonstrated a successful market penetration, contributing to overall revenue growth. The company's ability to serve diverse markets, from individual homeowners undertaking renovations to large-scale commercial developments, underscores the breadth of its revenue-generating capabilities.

Business Model Canvas Data Sources

The Caesarstone Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports on the quartz surfaces industry, and analysis of competitor strategies. These sources ensure each element, from value propositions to cost structures, is grounded in verifiable information and industry realities.