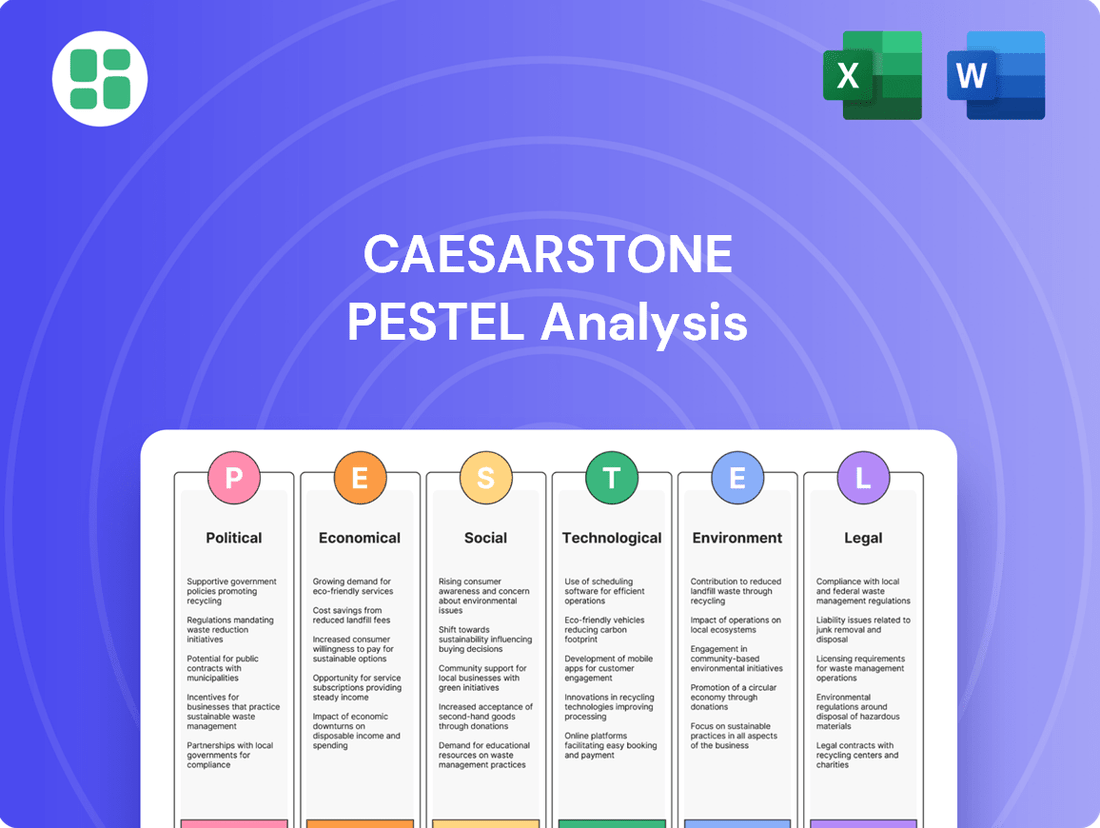

Caesarstone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caesarstone Bundle

Understand how political shifts and economic volatility are impacting Caesarstone's global operations. Our PESTLE analysis dives deep into technological advancements and environmental regulations affecting the quartz surfaces market. Download the full version to gain actionable intelligence and refine your strategic approach.

Political factors

Changes in international trade policies, such as new tariffs on quartz or finished quartz surfaces, directly affect Caesarstone's cost of goods. For instance, if the United States were to impose a 10% tariff on imported quartz slabs, this would increase raw material costs for Caesarstone's North American manufacturing facilities. Such shifts in import/export duties can alter the company's pricing strategies and its ability to compete with local manufacturers.

Protectionist measures enacted by governments in key markets, like the European Union or Australia, could also pose challenges. If these regions implement policies favoring domestic production or impose quotas on imported goods, Caesarstone's global distribution network could be restricted. This would likely impact sales volumes and overall profitability, especially in regions where imports form a significant portion of their market presence.

Political stability in key markets is paramount for Caesarstone's operations. For instance, in 2024, countries like Israel, where Caesarstone is headquartered and has significant manufacturing, maintained a stable political landscape, fostering a predictable business environment. Conversely, regions experiencing political upheaval, such as certain parts of Europe or the Middle East, could pose risks to supply chain continuity and demand, as seen in past instances where geopolitical tensions impacted raw material sourcing and export markets.

Government policies significantly shape the demand for Caesarstone's quartz surfaces. For instance, in 2024, many regions are seeing increased investment in infrastructure and affordable housing initiatives, which directly translates to higher construction volumes. Stricter building codes mandating specific material durability or fire resistance could favor engineered surfaces like quartz, while relaxed regulations might open doors for a wider range of materials.

Changes in housing development policies can have a direct impact on Caesarstone's sales. As of early 2025, several countries are reporting record housing starts, driven by government incentives and a post-pandemic demand surge. Conversely, if regulations become overly burdensome or costly for developers, it could slow down new construction projects, thereby reducing the market for countertops and other surfacing materials.

Material specifications within building codes are crucial. For example, a 2024 report indicated that a growing number of municipalities are updating their codes to include requirements for non-porous, hygienic surfaces in public buildings and healthcare facilities. This trend is beneficial for Caesarstone, as its quartz products meet these stringent criteria, potentially increasing their adoption in commercial projects.

Geopolitical Tensions and International Relations

Escalating geopolitical tensions, particularly in regions critical for raw material sourcing and shipping, can significantly impact Caesarstone's supply chain and operational costs. For instance, disruptions in the Red Sea shipping lanes, a key artery for global trade, have led to increased transit times and surcharges for many companies, including those in the building materials sector. These events directly translate to higher freight expenses and potential delays in product delivery to international markets.

Caesarstone's global footprint means it is inherently exposed to the economic consequences of strained international relations. Trade disputes or the imposition of tariffs between major economies could create barriers to market entry or expansion for Caesarstone's quartz surfaces. As of early 2024, ongoing trade friction between major economic blocs continues to create uncertainty for multinational corporations, influencing investment decisions and market access strategies.

The company's reliance on international markets for both sales and potentially raw material acquisition makes it vulnerable to shifts in global political stability. For example, political instability in countries that are significant suppliers of quartz or other necessary components could lead to supply shortages and price volatility. The ongoing conflicts and political realignments observed throughout 2023 and into 2024 underscore the persistent risks associated with global geopolitical dynamics for companies like Caesarstone.

These geopolitical factors can manifest in several ways for Caesarstone:

- Increased shipping and logistics costs: Disruptions to major trade routes can add significant percentages to freight expenses.

- Tariff and trade barriers: New trade policies can make it more expensive or difficult to export products to key markets.

- Supply chain disruptions: Political instability in sourcing regions can lead to shortages of essential raw materials.

- Reduced consumer and business confidence: Geopolitical uncertainty can dampen demand for discretionary spending on home renovations and commercial projects.

Government Incentives for Green Building

Government incentives for green building present a significant opportunity for Caesarstone. For instance, the Inflation Reduction Act of 2022 in the United States offers tax credits for energy-efficient home improvements, which can indirectly benefit companies supplying sustainable building materials. Many jurisdictions are also implementing or expanding subsidies for projects that utilize recycled content or low-VOC (volatile organic compound) materials, aligning with Caesarstone's product portfolio.

These initiatives can drive demand for Caesarstone's quartz surfaces, particularly in new construction and renovation projects seeking to meet environmental certifications like LEED. For example, in 2024, several European countries announced increased funding for energy-efficient building renovations, often prioritizing materials with a lower environmental footprint. Conversely, a lack of robust government support for sustainable building practices could decelerate the adoption of premium, eco-friendly materials, potentially impacting Caesarstone's market penetration in certain regions.

Key government support mechanisms include:

- Tax credits and rebates for energy-efficient construction and renovations.

- Grants for research and development of sustainable building materials.

- Preferential treatment or expedited permitting for green building projects.

- Mandates for recycled content or low-emission materials in public building projects.

Government policies on trade and tariffs directly influence Caesarstone's cost of goods and market competitiveness. For example, in 2024, the ongoing trade discussions between major economies create uncertainty regarding potential import duties on quartz slabs, impacting manufacturing costs. Protectionist measures in key markets could restrict global distribution, affecting sales volumes and profitability.

Political stability in operational regions is crucial for supply chain continuity and demand predictability. Caesarstone's headquarters in Israel experienced a stable political environment in 2024, fostering a predictable business climate. However, geopolitical tensions in other regions can pose risks to raw material sourcing and export markets, as observed in past supply chain disruptions.

Government initiatives, such as those promoting green building and energy efficiency, present opportunities for Caesarstone. For instance, in 2024, many regions are increasing funding for energy-efficient renovations, favoring materials with a lower environmental footprint. Tax credits and subsidies for sustainable building can drive demand for Caesarstone's quartz products in new construction and renovation projects.

Regulatory changes in building codes, particularly those mandating non-porous or hygienic materials, benefit Caesarstone. As of early 2025, a growing number of municipalities are updating codes to require such surfaces in public and healthcare facilities, aligning with the inherent properties of quartz. Conversely, relaxed regulations could allow for a wider range of materials, potentially increasing competition.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Caesarstone, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick understanding of how external factors impact Caesarstone's operations and strategic decisions.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the political, economic, social, technological, environmental, and legal landscapes affecting Caesarstone.

Economic factors

Global economic growth is a significant driver for Caesarstone, as consumer spending on home renovations and new construction directly correlates with overall economic health and disposable income. A strong global economy typically leads to increased demand for premium surfaces like those offered by Caesarstone. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicative of ongoing economic activity that supports consumer discretionary spending on home improvement projects.

Interest rate fluctuations directly influence mortgage affordability, a key driver for the housing market and new home construction. For instance, the Federal Reserve's benchmark interest rate, which impacts mortgage rates, saw increases throughout 2023 and into early 2024, reaching levels not seen in over two decades. This trend makes borrowing more expensive for potential homebuyers.

When interest rates rise, as they did significantly in 2023 and continued to be a concern in early 2024, the cost of mortgages increases. This directly reduces housing sales and can dampen enthusiasm for renovations, leading to a slowdown in demand for building materials like Caesarstone's quartz surfaces. For example, mortgage rates in the US climbed to over 7% in late 2023, impacting buyer purchasing power.

The cost of key inputs like quartz, resins, and polymers directly influences Caesarstone's manufacturing expenses. Fluctuations in these raw material prices, often driven by global demand and extraction costs, can significantly impact the company's profitability. For instance, the price of quartz, a primary component, has seen volatility in recent years due to mining capacity and geopolitical factors.

Energy costs, essential for the manufacturing process, and transportation expenses for both raw materials and finished goods add further layers of cost pressure. As of late 2024 and into 2025, global energy markets continue to experience price swings, directly affecting Caesarstone's operational overhead. Similarly, elevated shipping rates and fuel surcharges can erode profit margins if not effectively passed on to consumers.

Inflationary trends across the broader supply chain, from packaging materials to logistics, necessitate ongoing evaluation of pricing strategies. Caesarstone must balance the need to absorb some cost increases to maintain market share with the imperative to protect its profit margins. This dynamic can lead to adjustments in product pricing, potentially impacting consumer demand and competitive positioning within the countertop market.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for Caesarstone, a global company with operations spanning multiple countries. Fluctuations in exchange rates can directly impact its financial performance by altering the value of international sales and the cost of imported raw materials.

For instance, if the U.S. dollar strengthens against the Euro, Caesarstone's revenue generated in Euros would translate into fewer dollars, potentially reducing reported earnings. Conversely, a weaker dollar could make imported components more expensive. In 2023, the U.S. Dollar Index (DXY) experienced fluctuations, trading between approximately 100 and 107, highlighting the ongoing currency risks.

- Impact on Revenue: A stronger reporting currency (e.g., USD) can decrease the reported value of sales made in weaker foreign currencies.

- Impact on Costs: A weaker reporting currency can increase the cost of imported raw materials or components.

- Hedging Strategies: Companies like Caesarstone often employ financial instruments such as forward contracts or options to mitigate these currency risks.

- 2024/2025 Outlook: Continued geopolitical uncertainties and differing inflation rates across major economies are expected to maintain currency market volatility throughout 2024 and into 2025, requiring ongoing vigilance.

Competition and Pricing Pressures

The premium surfaces market is indeed a crowded space, with a variety of alternative materials like natural stone and porcelain, alongside a significant number of competing manufacturers. This intense competition means Caesarstone constantly faces pressure on its pricing strategies.

Economic downturns exacerbate these pressures. As consumers tighten their belts and become more budget-conscious, the demand for premium products can soften, leading to increased price sensitivity. This can trigger price wars among competitors, directly impacting Caesarstone's profit margins and potentially eroding its market share if it cannot effectively differentiate its offerings or manage costs.

- Market Share Dynamics: In 2024, the global quartz surface market, a key segment for Caesarstone, is estimated to be worth around $15 billion, with significant growth projected. However, this growth is accompanied by intense competition, with companies like Silestone (Cosentino) and Cambria being major rivals.

- Pricing Sensitivity: During periods of economic uncertainty, such as the inflation experienced in late 2023 and early 2024, consumer spending on discretionary items like kitchen countertops can decrease. This forces manufacturers to consider price adjustments to remain competitive, potentially impacting average selling prices.

- Raw Material Costs: Fluctuations in the cost of raw materials, particularly quartz, can also influence pricing. Increases in energy and transportation costs, as seen throughout 2023, add further pressure on manufacturers to either absorb these costs or pass them on, further complicating pricing strategies.

Global economic conditions significantly influence Caesarstone's performance, with consumer spending on home renovations and new construction being key. The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, indicating continued economic activity that supports discretionary spending on home improvement projects.

Interest rates directly affect housing affordability and, consequently, demand for building materials. For instance, U.S. mortgage rates exceeded 7% in late 2023, impacting buyer purchasing power and potentially slowing new home sales and renovations.

Raw material and energy costs are critical for Caesarstone's manufacturing expenses. Throughout 2023 and into early 2025, global energy markets and shipping costs have shown volatility, directly impacting operational overhead and profit margins.

Currency exchange rate fluctuations pose a risk for Caesarstone's global operations. For example, the U.S. Dollar Index (DXY) traded between 100 and 107 in 2023, illustrating the ongoing potential for revenue and cost impacts from currency shifts.

Full Version Awaits

Caesarstone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Caesarstone.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing insights into the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Caesarstone.

The content and structure shown in the preview is the same document you’ll download after payment, giving you a complete understanding of Caesarstone's strategic landscape.

Sociological factors

Consumer preferences are a significant sociological factor influencing Caesarstone's market. Evolving aesthetic tastes, such as a growing demand for natural stone looks with veining and matte finishes, directly impact the popularity of specific Caesarstone product lines. For instance, reports from 2024 indicate a strong consumer pull towards warmer neutral tones and textured surfaces in kitchen and bath design, a trend Caesarstone has actively addressed with new collections.

Staying ahead of these design trends is paramount for maintaining market relevance and consumer appeal. The interior design industry, heavily influenced by social media and design publications, rapidly disseminates new styles. Caesarstone's ability to innovate and offer surfaces that align with prevailing aesthetic preferences, such as introducing new color palettes and edge profiles in 2024, is critical for its competitive edge.

Consumers are increasingly prioritizing health and wellness, with a growing concern for indoor air quality and the safety of materials used in their homes. This trend directly impacts purchasing decisions for surfaces like countertops. Caesarstone's focus on low-VOC (volatile organic compound) emissions and hygienic properties positions it favorably to capture this expanding market segment.

Consumers increasingly seek products that align with their environmental values, driving demand for sustainable and eco-friendly options. This trend is not just a niche concern; a 2024 NielsenIQ report indicated that 60% of global consumers are willing to pay more for sustainable products. Caesarstone can capitalize on this by highlighting its sustainability efforts, such as reduced water usage in manufacturing and the use of recycled materials in some product lines. Achieving certifications like GREENGUARD Gold can further bolster its appeal to environmentally conscious buyers, potentially increasing market share and strengthening brand perception.

DIY and Home Improvement Culture

The growing DIY and home improvement culture significantly influences consumer behavior and market demand for home products. This trend, particularly strong in 2024 and projected to continue into 2025, sees more homeowners tackling projects themselves, driving overall engagement with the home sector.

While Caesarstone products generally necessitate professional installation due to their nature, the widespread enthusiasm for home upgrades indirectly benefits the brand. This heightened interest in renovations translates to increased awareness and a larger pool of potential customers seeking quality materials for their projects.

Data from 2024 highlights this phenomenon:

- Home improvement spending in the US was projected to reach over $500 billion in 2024.

- DIY projects accounted for a substantial portion of this spending, with many homeowners citing a desire for personalization and cost savings.

- Online platforms and social media continue to fuel this DIY movement, providing inspiration and tutorials that encourage more people to undertake home improvement tasks.

Demographic Shifts and Urbanization

Demographic shifts are significantly reshaping housing demands. An aging population, for instance, often leads to a preference for single-story living and accessibility features, influencing the types of renovations and material choices homeowners make. Globally, urbanization continues its upward trend, with projections suggesting that by 2050, 68% of the world's population will reside in urban areas, according to the UN. This concentration of people in cities drives demand for smaller, more efficient living spaces and can increase renovation activity as older urban housing stock is updated.

Caesarstone needs to monitor these trends closely. For example, the growing number of smaller households, often single-person or couples without children, may favor compact kitchen designs and durable, low-maintenance surfaces. Conversely, as more people age in place, there could be increased demand for materials that offer both aesthetic appeal and practical benefits like ease of cleaning and slip resistance. Adapting product lines and marketing messages to align with these evolving consumer needs is crucial for sustained growth.

Key demographic and urbanization impacts include:

- Aging Population: Increased demand for accessible and single-level living renovations.

- Smaller Household Sizes: Potential shift towards more compact kitchen and bathroom designs.

- Urbanization: Growth in renovation projects for urban housing stock and demand for space-saving solutions.

- Global Urban Growth: By 2050, an estimated 68% of the world's population is projected to live in urban areas, impacting housing needs.

Societal values are increasingly emphasizing health and wellness, leading consumers to seek out products that contribute to a healthier indoor environment. Caesarstone's commitment to low-VOC emissions and hygienic surfaces aligns with this growing demand, positioning the brand favorably in the market. Furthermore, a significant portion of consumers, as indicated by a 2024 NielsenIQ report showing 60% willingness to pay more for sustainable products, are prioritizing eco-friendly options. Caesarstone's efforts in water conservation and the incorporation of recycled materials in select product lines cater to this environmentally conscious demographic, enhancing brand appeal.

The burgeoning DIY and home improvement culture, particularly strong in 2024 and anticipated to continue into 2025, drives overall engagement with the home sector. While Caesarstone products typically require professional installation, the heightened interest in home renovations indirectly benefits the brand by increasing product awareness and expanding the potential customer base seeking quality materials for their projects. Home improvement spending in the US alone was projected to exceed $500 billion in 2024, underscoring the scale of this trend.

Demographic shifts, such as an aging population and increasing urbanization, are reshaping housing demands and renovation preferences. Projections indicate that by 2050, 68% of the global population will reside in urban areas, leading to a greater need for efficient living spaces and urban housing updates. Smaller households, a growing segment, may favor compact designs and durable, low-maintenance surfaces, necessitating product line adaptations to meet these evolving consumer needs.

| Sociological Factor | Impact on Caesarstone | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Health & Wellness | Demand for low-VOC, hygienic materials | Consumer preference for healthier indoor environments. |

| Sustainability | Preference for eco-friendly products | 60% of global consumers willing to pay more for sustainable products (NielsenIQ, 2024). |

| DIY & Home Improvement | Increased product awareness and potential customer base | US home improvement spending projected over $500 billion in 2024. |

| Demographics (Aging, Urbanization) | Demand for accessible, compact, and updated living spaces | 68% global urban population by 2050 (UN projection); smaller households favoring efficient designs. |

Technological factors

Caesarstone benefits from advancements in manufacturing, like enhanced pressing techniques and automated lines, boosting efficiency and product consistency. For instance, in 2023, the company reported investments in optimizing its production facilities, aiming to leverage these technological gains to maintain its competitive edge in quality and output.

Ongoing research into advanced composite materials and refinements in quartz formulations are key technological drivers for Caesarstone. These innovations aim to enhance product durability, improve aesthetic appeal, and boost sustainability credentials, allowing the company to carve out a distinct market position.

For instance, the development of self-healing surfaces or materials with embedded antimicrobial properties could significantly differentiate Caesarstone's product lines. While specific figures for R&D investment in new material development for 2024 are not publicly detailed, the broader engineered stone industry sees continuous investment in material science to meet evolving consumer and regulatory demands.

Digital design and visualization tools, including virtual reality (VR) and augmented reality (AR), are transforming how consumers interact with products like Caesarstone. These technologies allow potential buyers to see how quartz surfaces will look in their own kitchens or bathrooms before making a purchase, significantly enhancing the customer experience and potentially boosting sales conversion rates. For instance, by mid-2024, many leading home improvement retailers were integrating AR features into their mobile apps, enabling users to virtually place different countertop designs within their home environments.

Supply Chain Technology and Logistics

Caesarstone is increasingly leveraging advanced logistics software and IoT sensors to enhance its global supply chain operations. These technologies enable real-time tracking of inventory and shipments, providing greater visibility and control. For instance, many leading manufacturers are reporting significant improvements in on-time delivery rates, often exceeding 95%, after implementing integrated supply chain management systems.

The integration of AI-driven demand forecasting is another key technological factor. This allows Caesarstone to predict market needs more accurately, leading to optimized inventory levels and reduced carrying costs. Companies adopting AI for forecasting have seen reductions in excess inventory by as much as 15-20% in recent years, directly impacting profitability.

- Optimized Inventory: Reduced carrying costs by accurately predicting demand.

- Enhanced Visibility: Real-time tracking of goods through IoT sensors.

- Improved Efficiency: Streamlined logistics leading to lower operational expenses.

- Reduced Lead Times: Faster delivery cycles to meet customer expectations.

Automation and Robotics in Production

Caesarstone is increasingly leveraging automation and robotics within its production facilities. This technological shift directly impacts operational efficiency, enabling higher output volumes and enhanced product consistency. For instance, the adoption of advanced robotic arms for material handling and processing can significantly reduce cycle times and minimize human error, directly contributing to a more streamlined manufacturing process. By 2024, the global industrial robotics market was valued at approximately $51.2 billion, with a projected compound annual growth rate (CAGR) of 13.5% through 2030, indicating a strong industry trend towards greater automation.

The integration of these technologies offers several key advantages for Caesarstone. It leads to a reduction in direct labor costs associated with repetitive tasks, while simultaneously improving workplace safety by removing employees from potentially hazardous environments. This focus on operational excellence is crucial for maintaining a competitive edge in the quartz surfaces market. In 2023, companies investing in automation reported an average reduction in manufacturing costs by up to 15%, alongside a 10% increase in production speed.

- Increased production output and consistency through robotic integration.

- Reduced labor costs and improved workplace safety in manufacturing.

- Enhanced precision in fabrication and finishing processes.

- Contribution to overall operational excellence and competitive advantage.

Technological advancements in manufacturing, such as automated lines and enhanced pressing techniques, are boosting Caesarstone's efficiency and product consistency. Investments in optimizing production facilities in 2023 aimed to leverage these gains for a competitive edge. Ongoing research into advanced composite materials and refined quartz formulations are key drivers, enhancing durability and aesthetics, with the engineered stone industry seeing continuous material science investment.

Digital tools like VR and AR are transforming customer interaction, allowing visualization of products in homes, enhancing the buying experience. By mid-2024, many retailers integrated AR into apps for virtual product placement. Advanced logistics software and IoT sensors improve supply chain visibility and control, with leading manufacturers reporting over 95% on-time delivery after implementing integrated systems.

AI-driven demand forecasting optimizes inventory and reduces carrying costs, with adopting companies seeing up to 15-20% reductions in excess inventory. Automation and robotics in production increase output and consistency, reducing labor costs and improving safety. Companies investing in automation in 2023 reported up to 15% reduction in manufacturing costs and a 10% increase in production speed.

| Technology Area | Impact on Caesarstone | Relevant Data/Trend |

| Manufacturing Automation | Increased efficiency, product consistency, reduced labor costs, improved safety. | Global industrial robotics market valued at ~$51.2 billion in 2024, with a 13.5% CAGR projected through 2030. Companies reported up to 15% manufacturing cost reduction in 2023. |

| Advanced Materials R&D | Enhanced product durability, improved aesthetics, sustainability credentials. | Continuous investment in material science within the engineered stone industry to meet evolving demands. |

| Digital Customer Experience (VR/AR) | Transformed customer interaction, enhanced sales conversion. | Mid-2024 saw increased integration of AR in retail apps for virtual product placement. |

| Supply Chain & Logistics Tech (IoT, AI) | Improved supply chain visibility, optimized inventory, reduced lead times. | Over 95% on-time delivery rates reported by leading manufacturers using integrated systems. AI forecasting adoption led to 15-20% reduction in excess inventory. |

Legal factors

Caesarstone must navigate stringent regulations on crystalline silica dust exposure, a key component in its quartz surfaces. For instance, OSHA's permissible exposure limit (PEL) for respirable crystalline silica is 50 micrograms per cubic meter of air averaged over an 8-hour workday. Failure to adhere to these standards, which are being increasingly enforced globally, can result in significant fines and operational disruptions, impacting production and profitability.

Environmental protection laws, covering waste disposal, water usage, air emissions, and chemical handling, directly influence Caesarstone's manufacturing processes. For instance, stricter regulations on volatile organic compounds (VOCs) emissions, a common concern in quartz surface production, can necessitate costly upgrades to filtration systems. Failure to comply, as seen with other industrial manufacturers facing penalties, can lead to significant fines and operational disruptions.

Adherence to these environmental standards is not just about avoiding penalties; it's vital for maintaining operating licenses and reinforcing Caesarstone's commitment to corporate social responsibility. In 2024, for example, the European Union's updated Industrial Emissions Directive (IED) requires continuous improvement in pollution prevention technologies, impacting companies like Caesarstone that operate within its member states.

Protecting Caesarstone's unique quartz surface designs, advanced manufacturing techniques, and established brand through patents and trademarks is absolutely crucial for maintaining its competitive edge. These legal protections are the bedrock of their innovation, allowing them to differentiate themselves in a crowded market.

Effectively enforcing these intellectual property rights against any instances of infringement is paramount. This legal recourse safeguards Caesarstone's proprietary innovations and reinforces their hard-won market position, preventing unauthorized use of their valuable assets.

Consumer Protection and Product Liability Laws

Consumer protection laws, including those concerning product quality and warranties, are critical for Caesarstone. These regulations mandate that the company's quartz surfaces meet stringent performance and safety standards, ensuring they align with marketing claims. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continued to enforce standards that could impact material manufacturers, requiring adherence to safety protocols. Failure to comply can lead to significant legal repercussions and damage brand reputation.

Product liability laws expose Caesarstone to risks associated with defective products. Ensuring rigorous quality control and transparent communication about product capabilities is paramount to mitigating claims. In 2024, the average cost of product liability claims in the construction materials sector remained substantial, underscoring the financial implications of non-compliance. Caesarstone's commitment to product integrity directly influences its ability to avoid costly litigation and maintain consumer confidence.

- Adherence to Safety Standards: Caesarstone must comply with evolving national and international safety regulations for building materials, impacting product formulation and manufacturing processes.

- Warranty Compliance: Ensuring product warranties are transparent and honored is essential to prevent disputes and maintain customer satisfaction, especially as consumer rights legislation strengthens.

- Product Liability Mitigation: Proactive measures in quality assurance and risk management are crucial to defend against potential lawsuits arising from product defects, which can incur significant legal and financial penalties.

- Consumer Recourse Mechanisms: Understanding and facilitating clear processes for consumer complaints and returns is vital for maintaining trust and complying with consumer protection frameworks.

Labor Laws and Employment Regulations

Caesarstone must meticulously adhere to diverse labor laws across its global operations, covering everything from minimum wages and working conditions to employee benefits and collective bargaining agreements. For instance, in 2024, the International Labour Organization (ILO) reported that many countries are strengthening regulations around fair wages and safe working environments, impacting operational costs and compliance strategies.

Failure to comply with these intricate legal frameworks can result in significant financial penalties, costly litigation, and severe damage to Caesarstone's brand reputation. For example, a major manufacturing firm in 2023 faced substantial fines and a temporary shutdown due to violations of worker safety standards, highlighting the direct impact of non-compliance.

- Wage Compliance: Ensuring all employees receive at least the statutory minimum wage, which varies significantly by country and region, with some jurisdictions implementing regular increases.

- Working Conditions: Maintaining safe and healthy workplaces that meet or exceed local health and safety regulations, including provisions for ergonomic assessments and hazard mitigation.

- Employee Benefits: Providing legally mandated benefits such as paid time off, sick leave, health insurance contributions, and retirement plan participation as required by national laws.

- Union Relations: Navigating and respecting the rights of employees to organize and bargain collectively, adhering to specific protocols for union recognition and negotiation in different markets.

Caesarstone's operations are significantly shaped by legal frameworks governing product safety, intellectual property, and consumer rights. Adherence to regulations like OSHA's silica dust limits, which stood at 50 micrograms per cubic meter in 2024, is critical to avoid fines. Protecting unique designs through patents is essential, as is complying with consumer protection laws, such as those enforced by the CPSC, to maintain brand trust and avoid costly litigation stemming from product liability claims.

Environmental factors

The environmental impact of quarrying quartz and other minerals is a significant concern for Caesarstone. The company's commitment to responsible sourcing practices, including minimizing ecological disruption at extraction sites, directly influences its environmental footprint. For instance, in 2023, Caesarstone reported that 99% of its quartz raw material was sourced from quarries with environmental certifications, a crucial step in managing its ecological impact.

Caesarstone faces increasing pressure to manage manufacturing waste, including quartz scraps and process water, more effectively. By 2024, many global manufacturers are aiming for a 15% reduction in landfill waste, a target Caesarstone is likely pursuing.

Robust recycling initiatives are becoming essential, not just for regulatory compliance but also to meet consumer demand for sustainable products. In 2025, expect stricter emissions and waste disposal regulations, potentially increasing operational costs if not proactively addressed through advanced recycling technologies.

Manufacturing quartz surfaces is an energy-intensive process, directly impacting Caesarstone's carbon footprint. For instance, in 2023, the industrial sector was a significant contributor to global greenhouse gas emissions, underscoring the need for manufacturers like Caesarstone to address their energy consumption.

Caesarstone's commitment to environmental stewardship hinges on adopting renewable energy sources and enhancing energy efficiency across its operations. By investing in cleaner energy and optimizing production processes, the company can actively reduce its greenhouse gas emissions, aligning with global sustainability goals and potentially mitigating future regulatory risks.

Water Usage and Conservation

Water is a critical input for many manufacturing processes, including those used by Caesarstone. The company's operations, like many in the quartz surfaces industry, likely involve water for cooling, dust suppression, and cleaning. Minimizing water consumption and ensuring responsible management are therefore key environmental considerations.

Caesarstone's commitment to sustainability would involve implementing advanced water-saving technologies within its production facilities. This could include closed-loop water systems that recycle water, significantly reducing the need for fresh intake. Furthermore, responsible discharge practices, treating any wastewater to meet stringent environmental standards before release, are essential for regulatory compliance and minimizing ecological impact.

The global focus on water scarcity, particularly in regions where manufacturing is concentrated, underscores the importance of these practices. For instance, by 2025, projections suggest that over two-thirds of the world's population could face water shortages. Caesarstone's proactive approach to water conservation not only mitigates environmental risk but also enhances its operational resilience and reputation.

- Water Consumption: Manufacturing quartz surfaces often requires significant water for cooling and dust control.

- Recycling Initiatives: Implementing closed-loop systems and water recycling technologies can drastically reduce fresh water intake.

- Discharge Standards: Adhering to strict regulations for wastewater treatment and discharge is paramount to prevent environmental contamination.

- Resource Scarcity: Growing global water scarcity by 2025 necessitates efficient water management strategies for long-term operational viability.

Product Life Cycle Assessment and End-of-Life Solutions

The environmental impact of quartz surfaces is under increasing scrutiny, with a growing emphasis on product life cycle assessments. This involves evaluating everything from raw material extraction and manufacturing processes to the product's eventual disposal or recycling. For Caesarstone, understanding and mitigating these impacts is becoming a key differentiator.

Developing strategies for product longevity and effective end-of-life solutions, such as robust recycling programs or designing for disassembly, can significantly improve Caesarstone's environmental credentials. This proactive approach aligns with evolving consumer expectations and regulatory pressures for sustainable business practices.

Consider these points:

- Life Cycle Assessment (LCA) Importance: Growing regulatory and consumer demand for transparency regarding the environmental footprint of building materials. For instance, the construction sector's carbon emissions were estimated at 37% globally in 2022, highlighting the need for sustainable material choices.

- Product Longevity: Caesarstone's durable quartz surfaces inherently contribute to longevity, reducing the frequency of replacement and associated waste.

- End-of-Life Solutions: Initiatives like take-back programs or partnerships for recycling countertop waste are crucial. While specific industry-wide recycling rates for quartz countertops are still developing, the global waste management market is projected to reach $700 billion by 2027, indicating a significant opportunity for circular economy solutions.

- Environmental Profile Enhancement: Investing in and promoting these sustainable practices can lead to a stronger brand reputation and potentially access to green building certifications and markets.

Caesarstone's environmental strategy must address the energy-intensive nature of quartz manufacturing, a sector that contributed significantly to industrial greenhouse gas emissions in 2023. The company's investment in renewable energy sources and improved energy efficiency across its global operations is critical for reducing its carbon footprint and meeting evolving sustainability goals.

Water management is another key environmental factor, especially given that global water scarcity projections indicate over two-thirds of the world's population could face shortages by 2025. Caesarstone's implementation of advanced water-saving technologies, such as closed-loop systems, and adherence to strict wastewater discharge standards are vital for operational resilience and environmental compliance.

The company is also navigating increasing pressure for robust recycling initiatives and product life cycle assessments, driven by consumer demand for sustainable building materials. The global waste management market's projected growth to $700 billion by 2027 highlights the opportunity for circular economy solutions in countertop waste.

| Environmental Factor | 2023 Data/Projection | Caesarstone Relevance | Strategic Implication |

| Carbon Emissions (Industrial Sector) | Significant contributor to global emissions | Energy-intensive manufacturing | Invest in renewables, energy efficiency |

| Water Scarcity | Potential shortages for 2/3 of world by 2025 | Water use in manufacturing | Implement water recycling, conservation |

| Waste Management Market | Projected $700 billion by 2027 | Recycling of quartz waste | Develop end-of-life solutions, circular economy |

| Sustainable Building Materials Demand | Growing consumer and regulatory pressure | Product life cycle assessment | Enhance environmental profile, green certifications |

PESTLE Analysis Data Sources

Our Caesarstone PESTLE Analysis is informed by a robust blend of data from governmental bodies, international economic organizations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the quartz surfaces industry.