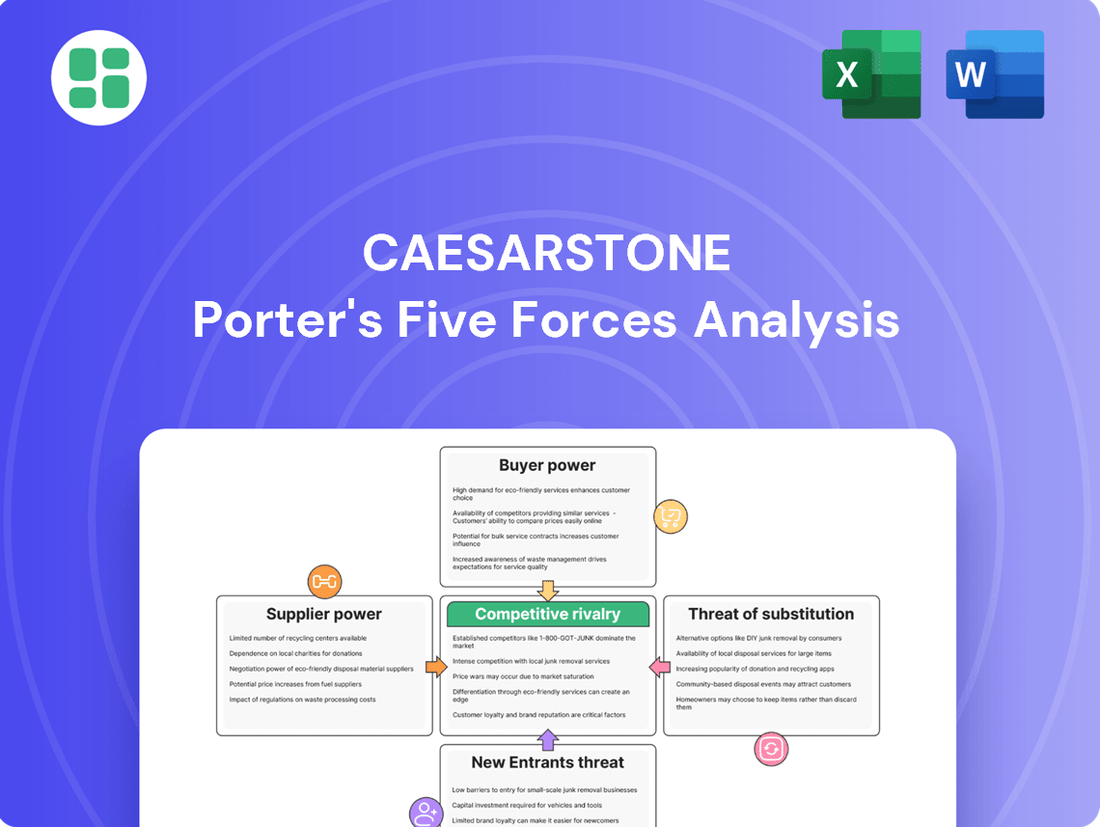

Caesarstone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caesarstone Bundle

Caesarstone faces moderate bargaining power from buyers who can easily switch to competitors offering similar quartz surfaces. The threat of substitutes, such as natural stone or laminate, also exerts pressure on pricing and differentiation.

The complete report reveals the real forces shaping Caesarstone’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Caesarstone's production is deeply tied to essential raw materials like natural quartz, resins, and pigments. Fluctuations in the availability and cost of these inputs directly affect the company's manufacturing expenses and bottom line.

The company's dependence on these specific materials means suppliers hold significant sway. For instance, in 2024, Caesarstone reported that elevated shipping and raw material expenses squeezed its gross profit margins, a clear indicator of supplier leverage.

Supplier concentration for specialized quartz and resins can significantly influence bargaining power. When only a limited number of suppliers can meet Caesarstone's stringent quality and volume demands, these suppliers gain considerable leverage, potentially driving up costs.

Caesarstone's proactive strategy to diversify its sourcing, with over 60% of its production now coming from a global network of manufacturing partners, directly addresses this concentration. This shift aims to reduce reliance on any single supplier and enhance its negotiating position.

While Caesarstone has diversified its manufacturing, the process of switching between its primary raw material suppliers can still incur substantial expenses. These costs often involve rigorous material re-qualification, fine-tuning production lines, and the administrative burden of forging new supply agreements.

These inherent switching costs grant key raw material providers a degree of bargaining power, influencing pricing and contract terms. For instance, in 2023, Caesarstone reported that its cost of goods sold was $759.5 million, highlighting the significant impact of raw material procurement on its overall financial performance.

Uniqueness and Quality of Inputs

While quartz itself is abundant, the specific purity and consistency needed for high-end engineered stone surfaces can make certain raw material suppliers stand out. This level of specialization allows these suppliers to potentially negotiate better terms. For instance, suppliers meeting rigorous environmental certifications, such as those for recycled content, may also hold stronger bargaining power.

Caesarstone's strategic focus on incorporating more recycled materials into its product lines, a trend gaining traction in the construction and design sectors, could shift its supplier dynamics. Companies that can reliably provide these sustainable inputs might find themselves in a more advantageous position when negotiating pricing and supply agreements.

- Specialized Material Requirements: High purity and consistent quality quartz are essential for premium engineered surfaces.

- Sustainability as a Differentiator: Suppliers meeting environmental standards, like those for recycled content, can command higher prices.

- Caesarstone's Sustainability Goals: The company's increasing use of recycled content influences supplier selection and negotiation power.

Threat of Forward Integration by Suppliers

The threat of raw material suppliers moving into engineered quartz surface manufacturing is typically low. This is because entering this market requires significant financial investment, sophisticated technology, and established distribution channels, creating high barriers to entry that protect companies like Caesarstone.

However, major chemical corporations that supply specialized resins used in quartz production might have the financial clout and technical know-how to consider forward integration. While this remains a limited threat, it does grant these specific suppliers a degree of bargaining power.

- High Capital Investment: The cost to establish a quartz surface manufacturing facility is substantial, deterring most raw material suppliers.

- Technological Sophistication: Producing high-quality engineered quartz requires advanced manufacturing processes and proprietary technology.

- Distribution Network Requirements: Accessing and serving the global market for quartz surfaces necessitates a well-developed and extensive distribution network.

- Limited Supplier Capability: Only a few large chemical companies possess the scale and expertise to realistically consider forward integration into this sector.

The bargaining power of Caesarstone's suppliers is moderate, primarily driven by the specialized nature of key raw materials like quartz and resins. While quartz is abundant, the required purity and consistency for engineered stone can limit supplier options.

In 2023, Caesarstone's cost of goods sold reached $759.5 million, underscoring the significant impact of raw material procurement costs. Suppliers who can meet stringent quality and sustainability certifications, such as those for recycled content, may hold enhanced leverage.

Caesarstone's diversification efforts, with over 60% of production from a global network, aim to mitigate supplier concentration. However, switching costs for re-qualifying materials and retooling production lines can still grant existing suppliers a degree of pricing influence.

| Factor | Impact on Caesarstone | 2023 Data Relevance |

|---|---|---|

| Raw Material Dependence | High for quartz, resins, pigments | Cost of Goods Sold: $759.5M |

| Supplier Concentration | Moderate for specialized inputs | N/A (Qualitative assessment) |

| Switching Costs | Moderate for material re-qualification | N/A (Qualitative assessment) |

| Sustainability Requirements | Increasingly important for sourcing | N/A (Qualitative assessment) |

What is included in the product

This analysis unpacks the competitive intensity, buyer and supplier power, threat of new entrants, and the risk of substitutes impacting Caesarstone's market position.

Effortlessly assess competitive threats and identify strategic opportunities with a visually intuitive Porter's Five Forces analysis, simplifying complex market dynamics for Caesarstone.

Customers Bargaining Power

Caesarstone's significant presence in both residential and commercial sectors, with products reaching consumers through a wide global distribution network, indicates a highly fragmented end-user market. This broad customer base, comprising numerous individual homeowners and a multitude of smaller commercial projects, inherently dilutes the bargaining power of any single customer. For instance, in 2023, Caesarstone reported net sales of $1.5 billion, reflecting the vast number of transactions across diverse geographic regions, which further supports the notion of a dispersed customer base.

Even though Caesarstone's customers are spread out, major players like Home Depot and large fabricators can wield considerable influence. These large-volume buyers, who directly access consumers, can negotiate better pricing and terms, impacting Caesarstone's profitability, particularly when the market is competitive.

Caesarstone differentiates its quartz surfaces by highlighting superior durability, minimal upkeep, and a vast array of over 100 colors and finishes. This premium positioning, reinforced by significant brand recognition and ongoing design advancements, such as new collections launched in 2024, cultivates strong customer loyalty. Consequently, customers become less sensitive to price fluctuations, thereby reducing their bargaining power.

Customer Price Sensitivity

Customer price sensitivity has significantly increased in 2024 due to global economic challenges and heightened competition within the renovation and remodeling markets. This environment has put pressure on demand, making buyers more inclined to seek lower prices or more budget-friendly options.

This amplified customer power directly impacts companies like Caesarstone, as evidenced by their financial performance. For instance, Caesarstone reported a net revenue of $170.5 million in the first quarter of 2024, a decrease from $191.7 million in the same period of 2023, reflecting the volume pressures and pricing challenges.

- Increased Price Sensitivity: Economic slowdowns and competitive pressures in 2024 have made consumers more price-conscious in the home improvement sector.

- Demand for Lower Prices: Customers are actively negotiating for better deals or switching to more affordable alternatives.

- Impact on Caesarstone: The company's first-quarter 2024 revenue declined year-over-year, indicating that lower volumes and pricing pressures are affecting sales.

- Market Conditions: The broader renovation and remodeling market is experiencing reduced demand, further empowering customers in their purchasing decisions.

Availability of Alternatives and Switching Costs

Customers possess considerable bargaining power due to the abundance of alternatives to Caesarstone. The market is populated with numerous other quartz manufacturers, such as Silestone, Cambria, and LG Hausys, offering comparable products. Furthermore, a growing number of substitute materials, including natural stone like granite and marble, and even durable laminates, present viable options for consumers.

Switching costs for customers are generally low. Consumers can easily transition from Caesarstone to a competitor's quartz product or a different material without incurring significant financial penalties or operational disruptions. This ease of switching directly amplifies their leverage, compelling Caesarstone to maintain competitive pricing and emphasize product differentiation and customer service to foster loyalty.

- Market Saturation: The quartz surfacing market is highly competitive, with numerous brands vying for market share.

- Substitute Materials: Natural stones (granite, marble) and engineered materials offer diverse price points and aesthetics.

- Low Switching Costs: Consumers can readily switch between brands or materials with minimal effort or expense.

- Price Sensitivity: The availability of alternatives makes customers more sensitive to price fluctuations and promotional offers.

Caesarstone's customers, particularly large distributors and fabricators, hold significant bargaining power. Their ability to purchase in bulk allows them to negotiate favorable pricing and terms, directly impacting Caesarstone's margins. This power is amplified by the availability of numerous competitors and substitute materials, making it easier for these buyers to switch suppliers if terms are not met.

The increased price sensitivity observed in 2024, driven by economic conditions and market competition, further empowers customers. Caesarstone's first-quarter 2024 revenue decrease to $170.5 million from $191.7 million in Q1 2023 highlights the pressure from customers seeking lower prices or more affordable alternatives, indicating a shift in market dynamics favoring buyers.

| Factor | Impact on Caesarstone | Supporting Data (2023-2024) |

|---|---|---|

| Customer Concentration | High bargaining power for large buyers | Net sales of $1.5 billion in 2023 across a broad base. |

| Price Sensitivity | Increased demand for lower prices | Q1 2024 revenue down to $170.5M from $191.7M (Q1 2023). |

| Availability of Alternatives | Reduced customer loyalty, increased switching | Numerous quartz competitors (Silestone, Cambria) and substitute materials (granite, marble). |

| Low Switching Costs | Amplifies customer leverage | Minimal financial or operational barriers for customers to change suppliers. |

Preview the Actual Deliverable

Caesarstone Porter's Five Forces Analysis

This preview showcases the complete Caesarstone Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the quartz surfaces industry. The document you see here is precisely what you'll receive immediately after purchase, ensuring full transparency and immediate access to actionable insights. You're looking at the actual, professionally formatted analysis, ready for your strategic planning needs without any placeholders or alterations.

Rivalry Among Competitors

The engineered quartz surface market is a crowded space, with a significant number of both global and regional companies vying for market share. This intense rivalry means companies like Caesarstone must constantly innovate and differentiate themselves to stand out. For instance, in 2024, the market continues to see strong competition from brands such as Silestone, a prominent player owned by Cosentino, and Cambria, known for its premium positioning.

Other significant competitors include Q Quartz, a brand from MSI, Vicostone, a major player in Asia, and LG Hausys with its Viatera line. This high number of competitors creates a dynamic and challenging environment where pricing pressures and the need for continuous product development are paramount. The presence of so many players ensures that customer loyalty is hard-won and that market shifts can occur rapidly.

The global engineered quartz surface market is expected to see growth, but Caesarstone faced declining volumes in 2024, indicating heightened competition. This suggests a fierce battle for market share among industry players, particularly as global economic conditions present challenges.

Aggressive competition for market share directly impacts sales volumes and profitability for companies like Caesarstone. In 2024, this intensified rivalry meant that firms were actively working to capture a larger portion of the market, often at the expense of others' performance.

Competitive rivalry in the quartz surfacing market is intense, fueled by constant product differentiation. Companies like Caesarstone offer a vast spectrum of colors, patterns, textures, and finishes, even replicating the look of natural stone. This drive for unique aesthetics is a primary battleground.

Caesarstone's commitment to research and development, including its strategic expansion into porcelain materials, is vital for maintaining its competitive advantage. Innovation isn't just about new looks; it's about developing superior materials and functionalities to capture market share and appeal to a sophisticated customer base.

Pricing Pressure and Cost Efficiency

The quartz surface industry is experiencing intense pricing pressure, driven by global economic headwinds and the influx of more affordable quartz slabs from diverse international markets. This competitive landscape demands a sharp focus on cost efficiency and streamlined production processes to maintain a competitive edge.

Companies that excel at managing their supply chains and optimizing operational expenditures are better positioned to thrive. For instance, Caesarstone, a leading player, has been actively working to improve its manufacturing efficiency and global sourcing strategies. In 2023, the company reported efforts to reduce its cost of goods sold through various initiatives, aiming to mitigate the impact of these market pressures.

- Intense Pricing Pressure: Global economic conditions and readily available lower-cost quartz slabs intensify competition.

- Cost Efficiency Imperative: Companies must prioritize optimizing production and supply chain costs to remain competitive.

- Strategic Advantage: Effective cost management provides a significant edge in the market.

- Caesarstone's Focus: The company actively pursues manufacturing efficiency and supply chain improvements to counter market pressures.

Strategic Responses to Rivalry

Caesarstone actively navigates intense competition through strategic restructuring. This includes optimizing its global production footprint to enhance efficiency and improve profit margins. For instance, in 2023, the company continued to refine its manufacturing operations, aiming for greater cost-effectiveness in response to market pressures.

Strengthening partnerships with external manufacturers is another key tactic. This allows Caesarstone to better align production with fluctuating demand and potentially reduce fixed costs. By leveraging these collaborations, the company seeks to maintain flexibility in a dynamic market environment.

The company's deliberate focus on cash flow generation and operational enhancements underscores its commitment to building a more agile and efficient organization. These efforts are designed to position Caesarstone to capitalize on emerging market opportunities and effectively counter competitive threats.

- Production Footprint Optimization: Caesarstone has been actively reviewing and adjusting its manufacturing sites to improve cost structures and responsiveness to market demand.

- External Manufacturing Partnerships: The company leverages strategic alliances with third-party manufacturers to supplement its production capabilities and manage capacity effectively.

- Focus on Cash Flow: A core strategic objective is to bolster cash flow generation, providing financial flexibility to invest in growth initiatives and navigate competitive challenges.

- Operational Enhancements: Continuous improvement in operational efficiency is pursued to drive better margins and maintain a competitive edge in the quartz surfaces market.

The engineered quartz surface market is highly competitive, with numerous global and regional players. This intense rivalry necessitates continuous innovation and differentiation for companies like Caesarstone. Competitors such as Silestone, Cambria, Q Quartz (MSI), Vicostone, and LG Hausys (Viatera) are all actively vying for market share.

In 2024, Caesarstone experienced declining volumes, a direct indicator of this heightened competition and a fierce battle for market share, particularly amid challenging global economic conditions. This environment puts significant pressure on pricing and demands constant product development to capture and retain customer loyalty.

| Competitor | Ownership/Parent | Key Market Presence |

|---|---|---|

| Silestone | Cosentino | Global |

| Cambria | Private | North America (Premium) |

| Q Quartz | MSI | North America |

| Vicostone | Phuc Khang Corporation | Asia |

| Viatera | LG Hausys | Global |

SSubstitutes Threaten

Traditional materials like granite and marble represent a significant threat of substitutes for engineered quartz countertops. These natural stones appeal to consumers prioritizing unique, organic patterns and a perceived sense of luxury, even with higher maintenance requirements.

Despite quartz's superior durability and lower upkeep, natural stone still commands a substantial portion of the countertop market. For instance, in 2023, the global natural stone market was valued at approximately $100 billion, indicating strong consumer preference and demand for these traditional options.

The decision between quartz and natural stone often hinges on a consumer's personal priorities regarding aesthetics, budget, and desired functionality. While quartz excels in consistency and stain resistance, the inherent variability and classic appeal of granite and marble ensure their continued relevance as competitive substitutes.

The rise of porcelain slabs presents a significant threat of substitution for Caesarstone. This material is rapidly gaining popularity, with projections indicating it will be the fastest-growing countertop option in the United States through 2028. Porcelain offers a compelling combination of visual appeal, often replicating the look of natural stone, and superior durability, boasting resistance to stains, heat, and frost.

Caesarstone's strategic response to this evolving market is evident in its own expansion into porcelain product lines. This move acknowledges the increasing demand for porcelain and aims to capture market share within this growing segment, mitigating the direct threat by becoming a provider of the substitute itself.

The threat of substitutes for Caesarstone, primarily from laminates and solid surface materials, is a significant consideration. Laminates, while often perceived as lower quality, remain a viable, lower-cost alternative for price-sensitive consumers. In 2023, the global laminate flooring market was valued at approximately $12.7 billion, indicating its continued presence, though growth has been modest compared to engineered surfaces.

Solid surface materials, such as acrylic or polyester-based composites, offer aesthetic advantages like seamless designs and a wide range of colors. However, they may not always match the superior hardness and scratch resistance that quartz surfaces, like those offered by Caesarstone, are known for. This difference in performance can be a key differentiator for consumers prioritizing durability.

Technological Advancements in Alternatives

Innovations in manufacturing, like advanced digital printing for porcelain, are making substitutes more appealing by mimicking natural stone with greater accuracy. This technological leap directly challenges quartz surfaces by offering a visually comparable product at potentially different price points or with unique aesthetic advantages. For instance, by 2024, the global digital printing market for ceramics was projected to reach over $3 billion, indicating significant investment and adoption of these mimicking technologies.

The emergence of new materials boasting superior performance or a reduced environmental footprint further amplifies the threat of substitutes. These advancements could offer benefits like enhanced durability, stain resistance, or a more sustainable lifecycle, directly competing with Caesarstone's core value propositions. Caesarstone's strategic emphasis on sustainability initiatives and the continuous development of innovative product lines are proactive measures designed to counter these evolving substitution threats.

- Technological Mimicry: Digital printing allows porcelain to closely replicate the appearance of natural stone, a direct substitute for quartz.

- Performance Enhancements: New materials with improved durability or environmental profiles pose a growing threat.

- Market Response: Caesarstone's investment in sustainability and new product development aims to mitigate these substitution risks.

Low Switching Costs for Consumers

The threat of substitutes for Caesarstone is significant, largely due to low switching costs for consumers. Homeowners and builders can easily opt for a wide array of alternative countertop materials like granite, quartz (from competitors), marble, laminate, or solid surface products. The availability of these options from numerous suppliers and fabricators means consumers face minimal hurdles when deciding to switch. For instance, in 2024, the global engineered quartz market, a direct substitute, was projected to reach over $15 billion, indicating robust competition and easy accessibility.

Consumer decisions to switch are often driven by factors such as changing interior design trends, budget considerations, or a desire for specific material characteristics, such as enhanced scratch resistance or a particular aesthetic. This ease of transition necessitates that Caesarstone consistently highlight its unique value proposition, whether through product innovation, brand reputation, or superior customer service, to retain its market share.

- Low Switching Costs: Consumers can readily choose from numerous alternative countertop materials like granite, marble, laminate, and competitor quartz brands.

- Driver of Choice: Decisions to switch are influenced by evolving design trends, budget constraints, and preferences for specific material properties.

- Competitive Landscape: The broad availability from various suppliers and fabricators intensifies competition, requiring Caesarstone to continually prove its value.

The threat of substitutes for Caesarstone is substantial, driven by the accessibility and diverse appeal of alternative materials. Consumers face minimal barriers when choosing between engineered quartz, natural stones like granite and marble, or more budget-friendly options such as laminates and solid surfaces. The ease with which consumers can switch, influenced by design trends, cost, and desired material properties, underscores the competitive pressure Caesarstone faces.

The market for countertop materials is dynamic, with innovations constantly enhancing the attractiveness of substitutes. For instance, advancements in digital printing technology have enabled porcelain slabs to closely mimic the aesthetics of natural stone, presenting a direct challenge to quartz. This technological evolution, coupled with the inherent appeal of traditional materials, means Caesarstone must continually innovate and emphasize its unique selling propositions to maintain market relevance.

Caesarstone's strategic response includes expanding its own product lines into porcelain, acknowledging the growing demand for this substitute material. This proactive approach aims to capture market share within the burgeoning porcelain segment, thereby mitigating the direct threat by becoming a provider of the substitute itself. Furthermore, ongoing investments in sustainability and product development are crucial for countering the evolving preferences and performance advantages offered by competing materials.

| Substitute Material | Key Appeal | 2023 Market Data/Projection |

|---|---|---|

| Granite & Marble | Unique patterns, perceived luxury | Global natural stone market valued at ~$100 billion (2023) |

| Porcelain Slabs | Mimics natural stone, superior durability | Projected fastest-growing US countertop option through 2028 |

| Laminates | Lower cost | Global laminate flooring market valued at ~$12.7 billion (2023) |

| Solid Surfaces | Seamless designs, color variety | Performance often lags quartz in hardness/scratch resistance |

| Competitor Quartz | Similar properties, brand choice | Global engineered quartz market projected over $15 billion (2024) |

Entrants Threaten

The engineered quartz surface manufacturing industry demands substantial capital, with new facilities requiring hundreds of millions of dollars for specialized machinery and advanced production technology. For instance, establishing a state-of-the-art quartz slab production line can easily exceed $100 million, creating a significant financial hurdle. This high upfront investment acts as a powerful deterrent, effectively limiting the number of new companies that can realistically enter the market and compete.

Established players like Caesarstone leverage significant economies of scale in production, raw material sourcing, and global distribution networks. These cost advantages create a substantial barrier for newcomers aiming to compete on price.

New entrants would find it challenging to match the cost efficiencies achieved by incumbents who have optimized their operations over many years, often decades.

Caesarstone benefits from significant brand loyalty and deeply entrenched distribution channels, making it tough for newcomers. Their global brand recognition, built through direct subsidiaries, showrooms, and a wide network of fabricators and retailers, creates a substantial barrier. For instance, in 2023, Caesarstone reported net sales of $1.7 billion, underscoring their market penetration and the scale of investment required to replicate such reach.

Regulatory and Health Challenges

The threat of new entrants in the engineered stone industry is significantly impacted by stringent regulatory and health challenges. Australia's ban on engineered stone, effective July 1, 2024, due to concerns over respirable crystalline silica dust, highlights the severe health risks and potential for widespread regulatory action. This ban, alongside ongoing litigation in other jurisdictions, creates substantial barriers for any new player looking to enter the market.

New entrants must contend with the escalating costs associated with compliance and the development of safer alternatives. Investing in advanced, low-silica or silica-free technologies is not just an option but a necessity to mitigate health risks and avoid future legal repercussions. For instance, the cost of implementing dust suppression systems and personal protective equipment can be substantial, adding to the initial capital expenditure and ongoing operational expenses, thereby increasing the overall risk profile for newcomers.

- Regulatory Hurdles: The Australian ban on engineered stone from July 2024 exemplifies the increasing regulatory pressure concerning silica dust.

- Litigation Risks: Ongoing lawsuits in various regions related to occupational health issues create significant legal and financial liabilities for companies.

- Technological Investment: New entrants must invest heavily in low-silica or silica-free manufacturing technologies, which are often more expensive to implement and operate.

- Compliance Costs: Navigating evolving health and safety standards requires continuous investment in safety protocols, training, and monitoring, increasing the cost of doing business.

Proprietary Technology and Expertise

The threat of new entrants into the engineered quartz surface market is significantly tempered by the proprietary technology and specialized expertise required. While quartz itself is abundant, transforming it into high-quality, aesthetically diverse countertops involves complex manufacturing processes and unique chemical formulations. Established players like Caesarstone, with over 30 years of pioneering experience, have invested heavily in research and development to refine these techniques, creating a substantial barrier for newcomers.

Replicating the quality, durability, and design innovation that market leaders offer demands considerable capital expenditure and a deep understanding of material science. New entrants would face the challenge of not only matching existing product standards but also developing the sophisticated supply chains and distribution networks that established companies have cultivated. For instance, the significant upfront investment in specialized machinery and ongoing R&D to maintain a competitive edge in design trends can deter potential competitors. In 2023, the global engineered quartz market was valued at approximately $13.2 billion, with significant portions attributed to established brands that have built their market position on technological differentiation.

- Proprietary Manufacturing Processes: Companies like Caesarstone have developed patented techniques for creating consistent, high-performance quartz surfaces, requiring substantial R&D investment to replicate.

- Formulation Expertise: The specific blend of quartz, resins, and pigments is crucial for durability and aesthetics, representing years of accumulated knowledge and trade secrets.

- Capital Investment: Setting up advanced manufacturing facilities capable of producing premium engineered quartz surfaces necessitates significant financial resources, estimated in the tens of millions of dollars for state-of-the-art operations.

- Brand Reputation and Design Innovation: Established players benefit from strong brand recognition and a track record of design leadership, which new entrants must overcome through substantial marketing and product development efforts.

The threat of new entrants in the engineered quartz market is considerably low due to massive capital requirements, estimated to be hundreds of millions of dollars for new manufacturing facilities. For example, a single advanced production line can cost over $100 million, creating a significant financial barrier. This high entry cost, combined with established players' economies of scale in sourcing and distribution, makes it difficult for new companies to compete on price.

Furthermore, stringent regulatory and health concerns, such as Australia's engineered stone ban effective July 2024 due to silica dust, pose substantial risks and require significant investment in safer technologies. Litigation risks and the need for continuous compliance with evolving safety standards add to the operational complexity and cost for any new entrant.

Proprietary technology and specialized expertise, honed over decades by companies like Caesarstone, represent another formidable barrier. Replicating the quality, durability, and design innovation demands considerable R&D investment and a deep understanding of material science, making it challenging for newcomers to gain market traction.

| Barrier Type | Description | Estimated Cost/Impact |

|---|---|---|

| Capital Requirements | Establishing advanced manufacturing facilities | >$100 million per production line |

| Economies of Scale | Cost advantages in production, sourcing, and distribution | Significant cost advantage for incumbents |

| Regulatory & Health Risks | Silica dust concerns, potential bans, litigation | Requires investment in new tech, high compliance costs |

| Proprietary Technology & Expertise | Patented processes, material science knowledge | Substantial R&D investment needed to replicate |

Porter's Five Forces Analysis Data Sources

Our Caesarstone Porter's Five Forces analysis leverages a comprehensive set of data, including Caesarstone's annual reports, investor presentations, and competitor financial filings. We also incorporate industry-specific market research reports and data from reputable financial databases to provide a robust assessment of the competitive landscape.