Cadre Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadre Holdings Bundle

Cadre Holdings demonstrates robust strengths in its diversified product portfolio and strong brand recognition, positioning it well in competitive markets. However, understanding the nuances of its potential weaknesses and the external threats it faces is crucial for informed decision-making.

Want the full story behind Cadre Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Cadre Holdings excels with a specialized product line, manufacturing and distributing essential safety and survivability gear like body armor, EOD tools, and duty equipment. This focus caters directly to the critical needs of law enforcement, first responders, and military forces, ensuring a consistent and robust demand for their offerings.

The mission-critical nature of Cadre's products creates a resilient business model, as their demand stems from the fundamental requirement for protection and operational effectiveness in high-stakes situations, making them less susceptible to general economic downturns.

Cadre Holdings boasts a significant global reach, operating in over 100 countries and catering to both government agencies and commercial clients. This extensive international presence, coupled with a diverse customer portfolio, effectively mitigates risks associated with dependence on any single market or government funding cycles. The company's ability to generate revenue from multiple sources worldwide is a key advantage.

Cadre Holdings demonstrates a strong commitment to innovation, consistently investing in research and development to integrate advanced technologies and materials into its product lines. This forward-thinking approach ensures their offerings remain competitive and at the leading edge of safety and survivability in their respective markets.

The company's dedication to R&D is underscored by its significant investment of $12.3 million in 2024. This financial commitment fuels the development of high-performance products that not only meet but often exceed evolving regulatory standards and the demanding requirements of their user base.

Strong Financial Performance and Liquidity

Cadre Holdings has showcased impressive financial strength, consistently exceeding analyst forecasts with rising net sales and gross profit. This robust performance is underpinned by a healthy balance sheet featuring substantial cash holdings and ample undrawn credit lines, enabling strategic investments and acquisitions.

Key financial highlights include:

- Q2 2025 Net Sales: $157.1 million, reflecting strong market demand and effective sales strategies.

- Q2 2025 Gross Profit Margin: 40.9%, indicating efficient cost management and pricing power.

- Liquidity Position: Significant cash reserves and available credit provide substantial financial flexibility for future growth initiatives.

Strategic Acquisitions and Market Expansion

Cadre Holdings demonstrates a robust strength in strategic acquisitions, exemplified by its acquisition of the engineering division from Carr's Group in early 2024. This move significantly bolstered its nuclear safety vertical and broadened its international presence, adding to its existing global operations.

These inorganic growth strategies are crucial for Cadre's expansion, enabling entry into new product categories and markets. The company is actively targeting areas like automation, robotics, and nuclear medicine, which are poised for significant growth. This diversification not only strengthens its revenue streams but also solidifies its market leadership in specialized sectors.

- Strategic Acquisitions: Acquired Carr's Group engineering division in early 2024, enhancing its nuclear safety capabilities and international reach.

- Market Expansion: Targeting new sectors such as automation, robotics, and nuclear medicine to diversify revenue.

- Revenue Diversification: Inorganic growth strategies are key to developing multiple income streams and reducing reliance on single markets.

- Market Leadership: Expansion efforts aim to reinforce and extend Cadre's position as a leader in its specialized industries.

Cadre Holdings' specialized product focus on safety and survivability gear for law enforcement, first responders, and military creates a stable demand base. Their mission-critical offerings are essential, insulating them from broader economic fluctuations. The company's significant global presence across over 100 countries, serving both government and commercial clients, effectively diversifies revenue and mitigates single-market risks.

Cadre's commitment to innovation is backed by substantial R&D investment, with $12.3 million allocated in 2024 to develop cutting-edge products. This forward-thinking approach ensures their gear remains competitive and meets evolving user needs.

Financially, Cadre Holdings has demonstrated strong performance, with Q2 2025 net sales reaching $157.1 million and a gross profit margin of 40.9%. Robust cash reserves and available credit provide significant financial flexibility for growth.

Strategic acquisitions, such as the early 2024 purchase of Carr's Group's engineering division, have bolstered Cadre's nuclear safety vertical and expanded its international footprint. The company is actively pursuing growth in automation, robotics, and nuclear medicine to further diversify its revenue streams and solidify market leadership.

| Financial Metric | Q2 2025 Value | Significance |

|---|---|---|

| Net Sales | $157.1 million | Indicates strong market demand and effective sales execution. |

| Gross Profit Margin | 40.9% | Demonstrates efficient cost management and pricing power. |

| R&D Investment (2024) | $12.3 million | Fuels product innovation and maintains competitive edge. |

What is included in the product

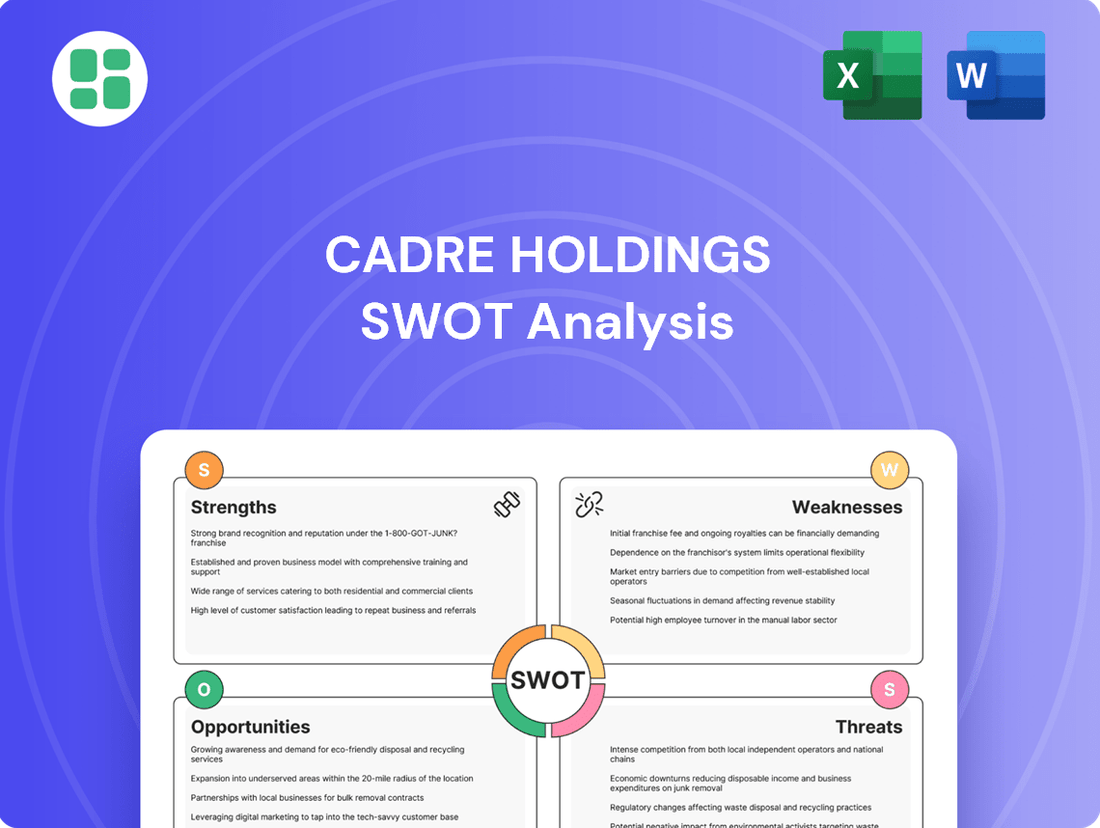

Analyzes Cadre Holdings’s competitive position through key internal and external factors, detailing its strengths in product innovation and market leadership, weaknesses in supply chain reliance, opportunities in emerging markets, and threats from intense competition and regulatory changes.

Offers a clear breakdown of Cadre Holdings' competitive landscape, highlighting areas for strategic advantage and potential threats.

Weaknesses

Cadre Holdings' significant reliance on government contracts, particularly from law enforcement and military sectors, presents a notable weakness. For instance, during fiscal year 2023, approximately 40% of Cadre's revenue was tied to government and institutional customers, highlighting this dependency. This exposure makes the company vulnerable to shifts in public spending priorities and the inherent unpredictability of government budget allocations and procurement timelines.

Fluctuations in government budgets, driven by political changes or economic downturns, can directly impact Cadre's sales volumes and overall profitability. Delays in the procurement process, a common occurrence in government sectors, can also disrupt revenue streams and create cash flow challenges for the company. This dependence means Cadre's financial performance is intrinsically linked to factors outside of its direct control, such as legislative decisions on defense spending or law enforcement funding.

Cadre Holdings' product mix can present a challenge to its overall profitability, with certain offerings potentially weighing down gross margins. While the company aims for strong financial performance, the nature of its diverse product lines means that some segments may not contribute as robustly to profitability as others.

For example, the strategic acquisition of the engineering division from Carr's Group in 2023, while enhancing Cadre's capabilities, introduced a product mix that may initially dilute gross margins. This necessitates a focus on post-acquisition integration and operational efficiencies to bring these new segments in line with corporate margin targets.

The safety and survivability products market is quite crowded, with numerous manufacturers and distributors actively competing for lucrative contracts. This intense rivalry means Cadre Holdings, despite its strong position in key areas, faces potential pressure on its pricing strategies and its overall market share.

For instance, in 2023, the global body armor market alone was valued at approximately $6.5 billion, and it's projected to grow significantly. This growth attracts new entrants and intensifies competition among established players, requiring Cadre to constantly adapt.

To stay ahead, Cadre Holdings must prioritize continuous innovation and find ways to differentiate its offerings from those of its competitors. This proactive approach is crucial for maintaining its leadership and ensuring long-term success in this dynamic sector.

Supply Chain Vulnerabilities

Cadre Holdings, as a global player in manufacturing and distribution, faces inherent weaknesses stemming from its reliance on complex supply chains. Disruptions in the availability of essential raw materials, unforeseen manufacturing slowdowns, and international shipping challenges can directly impact its operational efficiency and product availability. For instance, the global semiconductor shortage experienced in 2021-2023 significantly affected various manufacturing sectors, a risk Cadre Holdings is not immune to.

Further compounding these vulnerabilities are the unpredictable nature of macroeconomic conditions and geopolitical tensions. These external factors can lead to sudden spikes in input costs, currency fluctuations, and extended lead times for components, ultimately affecting Cadre Holdings' profitability and its ability to meet customer demand in a timely manner.

- Raw Material Dependency: Reliance on specific suppliers or regions for key components can create single points of failure.

- Logistical Bottlenecks: Global shipping disruptions, port congestion, and rising freight costs can delay deliveries and increase operational expenses.

- Geopolitical Risks: Trade wars, sanctions, or regional conflicts can disrupt international trade routes and supplier relationships.

- Demand Volatility: Sudden shifts in market demand can strain supply chains, leading to either shortages or excess inventory.

Potential for Acquisition-Related Costs and Integration Challenges

Acquisitions, while a path to expansion for Cadre Holdings, bring inherent risks. These include the significant costs associated with the acquisition process itself and the complexities of integrating new operations. For instance, Cadre's Q2 2025 results showed a dip in net income despite revenue growth, largely attributed to these acquisition-related expenses.

Successfully merging newly acquired entities into Cadre's existing framework is crucial. This involves ensuring smooth operational transitions and achieving the expected financial benefits, or synergies, from the deals. However, these integration efforts can be resource-intensive and may divert management attention from other core business activities.

- Acquisition Costs: Direct expenses related to deal structuring, legal fees, and due diligence can impact profitability.

- Integration Hurdles: Challenges in merging systems, cultures, and operational processes can lead to inefficiencies.

- Synergy Realization: Failure to achieve anticipated cost savings or revenue enhancements post-acquisition can negate the strategic benefits.

- Resource Diversion: Management focus and capital allocation may be shifted towards integration, potentially affecting other growth initiatives.

Cadre Holdings' reliance on government contracts, representing approximately 40% of its 2023 revenue, exposes it to the volatility of public spending and procurement delays. This dependency means its financial performance is significantly influenced by external legislative and budgetary decisions beyond its direct control.

The company's diverse product portfolio, while offering breadth, can lead to lower gross margins in certain segments, as seen with the integration of the Carr's Group engineering division in 2023. This necessitates careful management to ensure all product lines contribute effectively to overall profitability targets.

Intense competition within the safety and survivability market, valued at around $6.5 billion for body armor alone in 2023, pressures Cadre's pricing and market share. Continuous innovation and differentiation are vital to maintain its competitive edge against numerous established and emerging players.

Cadre's global operations are vulnerable to supply chain disruptions, including raw material shortages and logistical bottlenecks, as exemplified by the 2021-2023 semiconductor shortage affecting many manufacturers. Geopolitical risks and macroeconomic shifts further exacerbate these vulnerabilities by impacting input costs and lead times.

Full Version Awaits

Cadre Holdings SWOT Analysis

This is the actual Cadre Holdings SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

Opportunities

Global demand for safety and defense equipment is on the rise, with a growing emphasis on public safety, national defense, and emergency preparedness. This trend is fueled by evolving threats and a greater need for protective gear. For instance, the global defense market was valued at approximately $750 billion in 2023 and is projected to grow, indicating a robust environment for companies like Cadre Holdings.

This sustained global focus translates into consistent demand for Cadre Holdings' specialized products, creating significant opportunities for growth across its various market segments. Governments and industries worldwide are increasing their investments in worker protection and emergency readiness, signaling a lasting and expanding market for safety solutions.

Cadre Holdings' strategic push into the nuclear safety sector, bolstered by recent acquisitions, presents a substantial avenue for growth. This expansion taps into a rising global need across energy, defense, and nuclear waste management.

The company is well-positioned to leverage this trend, entering new product segments such as automation, robotics, and nuclear medicine. For instance, the global nuclear power market was valued at approximately $70 billion in 2023 and is projected to grow steadily, indicating a strong demand for specialized safety solutions.

Cadre Holdings can capitalize on ongoing technological advancements in materials science, smart technologies, and advanced manufacturing to create next-generation safety products. This focus on innovation allows for the development of highly differentiated offerings that can capture new market segments.

By investing in research and development, Cadre Holdings can introduce products that offer superior performance and protection, thereby solidifying its market leadership. For instance, the global body armor market is projected to reach approximately $10.5 billion by 2028, indicating substantial room for growth through technological innovation.

Leveraging Strong Financial Position for Further Inorganic Growth

Cadre Holdings' strong financial footing, marked by substantial cash reserves and readily accessible credit lines, provides a significant advantage for pursuing further inorganic growth through strategic acquisitions. This robust financial position allows the company to act decisively in a competitive M&A landscape.

The company's active M&A pipeline, spanning critical sectors such as law enforcement, first responders, military, and the nuclear industry, signals a clear intent to consolidate and expand its market presence. This strategic focus on acquiring complementary businesses can accelerate market share gains and diversify revenue streams.

For instance, as of the first quarter of 2024, Cadre Holdings reported approximately $130 million in cash and cash equivalents, coupled with an undrawn credit facility that further enhances its acquisition capacity. This financial flexibility is crucial for capitalizing on timely M&A opportunities that align with its growth objectives.

- Strong Balance Sheet: Significant cash and available credit empower strategic acquisitions.

- Active M&A Pipeline: Opportunities identified across law enforcement, first responders, military, and nuclear sectors.

- Market Consolidation: Potential to gain market share and expand reach through targeted acquisitions.

- Financial Flexibility: ~$130 million in cash and undrawn credit facilities as of Q1 2024 support decisive M&A activity.

Growing Demand for Personal Protective Equipment (PPE)

The global market for personal protective equipment (PPE) has seen significant expansion, driven by heightened awareness of workplace safety and evolving regulatory standards. This trend presents a notable opportunity for companies like Cadre Holdings, even beyond its core specialized offerings.

Cadre Holdings can explore avenues to capitalize on this growing demand by potentially extending its manufacturing and distribution expertise to broader commercial and industrial PPE segments. For instance, the global PPE market was valued at approximately $60 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7% through 2030, according to various market research reports.

- Expanding Product Lines: Cadre Holdings could investigate opportunities to develop or acquire capabilities in producing or distributing more common PPE items, such as safety glasses, gloves, or respiratory protection, to serve a wider array of industries.

- Leveraging Distribution Networks: The company's existing logistics and distribution infrastructure can be utilized to efficiently reach new customer bases requiring a broader range of safety equipment.

- Strategic Partnerships: Collaborating with established PPE manufacturers or distributors in complementary sectors could provide a faster entry into new market segments.

- Addressing Emerging Needs: Future public health or industrial safety concerns could create demand for novel or specialized PPE, an area where Cadre Holdings' focus on specialized equipment positions it well for innovation.

Cadre Holdings is well-positioned to benefit from increasing global demand for safety and defense equipment, with the global defense market projected to continue its growth trajectory from its 2023 valuation of around $750 billion. The company's strategic expansion into the nuclear safety sector, supported by acquisitions, taps into a growing need in energy and defense, with the nuclear power market valued at approximately $70 billion in 2023. Furthermore, Cadre Holdings can leverage technological advancements to innovate in areas like advanced materials and smart technologies, aiming to capture a larger share of the projected $10.5 billion global body armor market by 2028.

The company's robust financial position, including approximately $130 million in cash and cash equivalents as of Q1 2024, coupled with an undrawn credit facility, provides substantial capacity for strategic acquisitions. This financial flexibility supports an active M&A pipeline targeting law enforcement, first responders, military, and the nuclear industry, enabling market consolidation and revenue diversification. Cadre Holdings can also explore opportunities within the broader personal protective equipment (PPE) market, which was valued at approximately $60 billion in 2023 and is expected to grow at a CAGR of around 7% through 2030, by potentially expanding its product lines or leveraging existing distribution networks.

| Opportunity Area | Market Context (2023/2024 Data) | Growth Projection/Valuation | Cadre Holdings' Leverage |

|---|---|---|---|

| Global Defense & Safety Demand | Defense market ~$750 billion (2023) | Projected continued growth | Sustained demand for specialized products |

| Nuclear Safety Sector Expansion | Nuclear power market ~$70 billion (2023) | Steady projected growth | Acquisitions bolstering new market entry |

| Technological Innovation in PPE | Body armor market ~$10.5 billion by 2028 | Growth through differentiation | R&D for next-gen safety products |

| Strategic Acquisitions | Cash reserves ~$130 million (Q1 2024) | Enhanced M&A capacity | Active pipeline in key sectors |

| Broader PPE Market Entry | PPE market ~$60 billion (2023) | Projected ~7% CAGR through 2030 | Leveraging distribution, expanding product lines |

Threats

Cadre Holdings' reliance on government contracts presents a significant threat. Fluctuations in public spending, budget reductions, or alterations in defense and law enforcement policies directly impact the company's revenue streams and future growth. For example, new tariffs implemented in July 2025 could negatively affect Cadre Holdings' financial outlook, underscoring its vulnerability to government-driven economic shifts.

The safety and survivability product market is indeed a crowded space, with both seasoned companies and emerging innovators vying for market share. This intense competition naturally translates into significant pricing pressures. For Cadre Holdings, maintaining its premium brand positioning is crucial to avoid margin erosion, especially when competitors might offer comparable products at lower price points.

In 2023, the global body armor market alone was valued at approximately $4.5 billion and is projected to grow, indicating a robust demand but also a fertile ground for competition. Cadre Holdings' ability to differentiate through continuous innovation and strong brand loyalty will be key to navigating these pressures and preventing market share erosion from lower-cost alternatives or technologically advanced offerings.

Cadre Holdings faces significant headwinds from macroeconomic uncertainty and geopolitical instability, impacting its global operations. Economic downturns and rising inflation in key markets, such as the United States and Europe, can directly affect demand for its products and services, particularly from commercial clients. For instance, a projected slowdown in global GDP growth for 2024, estimated by the IMF to be around 2.9%, could dampen customer spending.

Geopolitical conflicts, like the ongoing tensions in Eastern Europe and the Middle East, create further unpredictability. These events can disrupt supply chains, leading to increased raw material costs and delivery delays, directly impacting Cadre's operational efficiency and profitability. The cost of key materials, such as steel, has seen volatility, with prices fluctuating based on global supply and demand dynamics influenced by these geopolitical events.

Product Liability and Regulatory Compliance Risks

Cadre Holdings faces significant product liability risks due to the critical nature of its safety equipment. A malfunction or failure in products designed for life-saving applications could result in severe injuries or fatalities, leading to substantial legal claims and reputational damage. For instance, in 2023, the personal protective equipment (PPE) market saw increased scrutiny following reports of certain equipment failing to meet advertised safety standards, highlighting the potential for costly litigation.

The company must also navigate a complex and evolving regulatory landscape. Adherence to rigorous safety certifications and standards, such as those set by NIJ (National Institute of Justice) for body armor, is paramount. This compliance requires ongoing investment in testing, quality control, and documentation. Failure to meet these stringent requirements, which are subject to change, could result in product recalls, fines, or even bans from government contracts, impacting revenue streams. For example, in early 2024, several suppliers faced investigations for non-compliance with ballistic protection standards, underscoring the financial and operational risks associated with regulatory missteps.

- Product Liability: Potential for costly lawsuits stemming from equipment malfunctions impacting user safety.

- Regulatory Compliance: Ongoing need to meet stringent and evolving safety standards (e.g., NIJ, OSHA).

- Cost of Compliance: Significant investment in testing, certification, and quality assurance processes.

- Market Restrictions: Risk of penalties, recalls, or exclusion from contracts due to non-compliance.

Technological Obsolescence and Rapid Innovation by Competitors

The rapid evolution of technology presents a significant threat to Cadre Holdings. Competitors are constantly developing new and improved solutions, meaning Cadre's current offerings could quickly become outdated. For instance, advancements in digital training platforms or new simulation technologies could challenge the relevance of traditional methods.

A failure to keep pace with these innovations risks eroding Cadre's market position. If competitors introduce more efficient or cost-effective technologies, customers may shift their preferences. This underscores the critical need for continuous investment in research and development to stay ahead of the curve and maintain a competitive edge in the security and public safety sectors.

- Technological Obsolescence: Cadre's reliance on existing technologies faces the risk of becoming outdated due to rapid advancements.

- Competitor Innovation: Breakthrough technologies from rivals could quickly diminish Cadre's market leadership and competitive advantage.

- Adaptation Imperative: A failure to continuously innovate and adapt swiftly could lead to a loss of market share and relevance.

Cadre Holdings faces intense competition in the safety and survivability product market, leading to pricing pressures and potential margin erosion. With the global body armor market valued at approximately $4.5 billion in 2023, differentiation through innovation and brand loyalty is crucial to counter lower-cost or technologically superior alternatives.

Macroeconomic instability and geopolitical conflicts pose significant threats, impacting demand and increasing operational costs. Economic downturns, as suggested by a projected 2.9% global GDP growth for 2024, and disruptions from events like those in Eastern Europe can lead to higher raw material costs and delivery delays.

Product liability risks are substantial, given the life-saving nature of Cadre's equipment. Malfunctions could trigger costly lawsuits and reputational damage, as evidenced by increased scrutiny in the PPE market in 2023 regarding safety standard compliance.

Navigating a complex regulatory landscape, including NIJ standards for body armor, requires continuous investment in compliance. Failure to meet evolving safety certifications, which saw some suppliers investigated in early 2024 for non-compliance, can result in penalties, recalls, and loss of government contracts.

SWOT Analysis Data Sources

This Cadre Holdings SWOT analysis is built upon a foundation of comprehensive data, including publicly available financial filings, detailed market research reports, and insights from industry experts. These sources collectively provide a robust understanding of the company's operational landscape and strategic positioning.