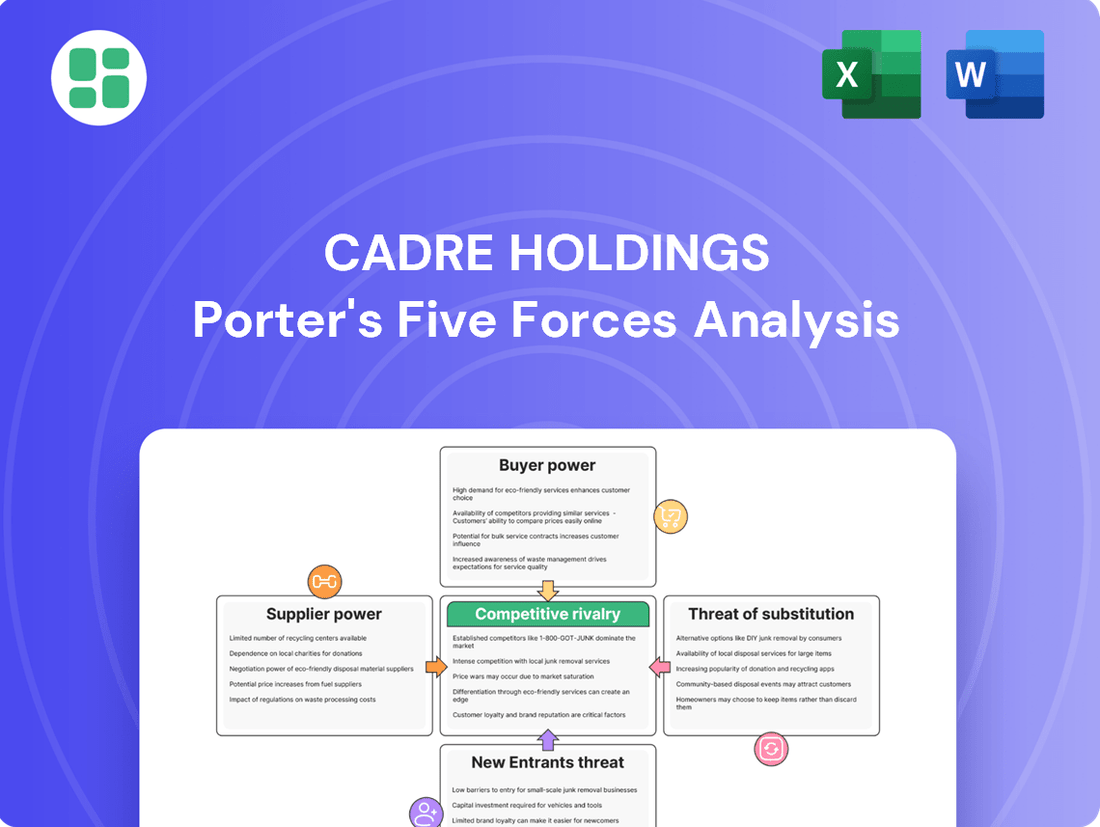

Cadre Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadre Holdings Bundle

Cadre Holdings operates within a competitive landscape shaped by several key forces. Understanding the intensity of rivalry among existing competitors and the bargaining power of buyers is crucial for its strategic positioning.

The threat of new entrants and the availability of substitute products also significantly influence Cadre Holdings's market dynamics. Furthermore, the bargaining power of suppliers can impact its operational costs and profitability.

Ready to move beyond the basics? Get a full strategic breakdown of Cadre Holdings’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The market for highly specialized materials, like advanced ballistic fabrics and sophisticated electronic components for EOD tools, is often dominated by a limited number of suppliers. This concentration grants these suppliers significant bargaining power, particularly when these inputs are crucial for Cadre Holdings' product performance and adherence to safety standards.

In 2024, the demand for advanced protective materials continues to rise, driven by global security concerns. For instance, the market for high-performance fibers used in body armor, a key input for companies like Cadre, is projected to see steady growth. Suppliers of these critical materials, such as DuPont (Kevlar) and DSM (Dyneema), hold considerable leverage due to their proprietary technologies and the high barriers to entry in this niche sector.

Cadre Holdings faces significant switching costs when changing suppliers for critical components. These costs aren't just monetary; they involve extensive re-qualification, potential product redesigns, and rigorous re-testing to ensure compliance with the demanding safety and regulatory standards inherent in serving law enforcement, first responders, and military clients. For instance, a shift in a key material for their ballistic protection products could necessitate entirely new certification processes, which can take months and incur substantial engineering and testing expenses.

While not a frequent occurrence, major suppliers of essential raw materials or specific components could potentially integrate forward into producing safety and survivability products. This theoretical capability, even if unlikely, grants suppliers a degree of influence, prompting companies like Cadre Holdings to nurture robust supplier relationships and potentially negotiate better terms.

However, the intricate nature and stringent regulations of the end-product market present significant obstacles to such forward integration. For instance, the defense and security sector, where Cadre operates, requires specialized knowledge, certifications, and extensive testing, making it a challenging arena for raw material suppliers to enter effectively.

Uniqueness of Supplier Inputs

Suppliers offering unique or proprietary technologies and materials, crucial for Cadre Holdings' advanced protective gear and specialized solutions, possess significant bargaining power. This is particularly true when these inputs are difficult to substitute and directly contribute to Cadre's product differentiation and performance edge. For instance, suppliers of advanced composite materials or specialized ballistic protection technologies can leverage their exclusivity to negotiate favorable pricing and terms, impacting Cadre's cost structure.

The lack of readily available alternatives for these specialized inputs means Cadre may face higher costs or limited access, directly influencing its profit margins. This reliance on a few key suppliers for critical components underscores the importance of managing these relationships effectively. The company’s strategic acquisitions, such as integrating Carr’s Engineering Division, aim to bring specialized capabilities in-house, potentially reducing reliance on external suppliers for certain critical components and thereby mitigating this supplier power.

- Proprietary Technology Dependence: Suppliers of unique technologies, like those used in advanced body armor or specialized vehicle protection, can exert considerable influence due to the difficulty in finding comparable alternatives.

- Input Significance: When these specialized inputs are vital for Cadre's product performance and market differentiation, suppliers gain leverage to dictate terms and pricing.

- Acquisition Strategy Impact: Cadre's move to acquire specialized engineering firms, such as Carr's Engineering Division, signals an effort to internalize critical capabilities, thereby reducing dependence on external, powerful suppliers.

- Cost Implications: High supplier power can translate to increased input costs for Cadre, potentially impacting overall profitability if not managed through strong supplier relationships or alternative sourcing strategies.

Impact of Input Costs on Cadre's Profitability

Fluctuations in the cost of essential raw materials, like ballistic fibers and specialized metals, directly affect Cadre's production expenses and, consequently, its gross profit margins. For instance, a 10% increase in ballistic fiber prices could significantly squeeze profitability if not passed on.

Recent market analyses in early 2024 highlight potential upward pressure on input costs due to anticipated tariffs on imported ballistic fibers and advanced ceramic inserts. This could lead to a substantial rise in material expenses for Cadre.

Cadre's ability to pass these increased costs onto its clientele, particularly government agencies with often fixed budgets, is a critical factor in mitigating supplier power. The negotiation leverage of suppliers is amplified if Cadre faces resistance in price adjustments.

- Input Cost Sensitivity: Cadre's profitability is directly tied to the price volatility of key components.

- Tariff Impact: Potential tariffs on imported ballistic fibers and ceramics pose a direct threat to input cost stability in 2024.

- Pricing Power: The capacity to pass on rising costs to government clients is a crucial determinant of supplier influence.

Suppliers of highly specialized materials, like advanced ballistic fabrics and sophisticated electronic components for EOD tools, often hold significant bargaining power due to market concentration and proprietary technologies. This leverage is amplified when these inputs are critical for Cadre Holdings' product performance and safety compliance, as seen with suppliers of high-performance fibers like DuPont (Kevlar). The company's strategic acquisitions, such as integrating Carr’s Engineering Division, aim to reduce this dependence.

The bargaining power of suppliers is further influenced by Cadre's substantial switching costs, which include extensive re-qualification and potential product redesigns for regulatory compliance. In 2024, rising global security concerns continue to drive demand for advanced protective materials, potentially increasing supplier leverage. For instance, anticipated tariffs on imported ballistic fibers and advanced ceramic inserts in early 2024 could lead to substantial material expense increases for Cadre, impacting profitability if these costs cannot be passed on to government clients.

| Supplier Characteristic | Impact on Cadre Holdings | Example Input |

|---|---|---|

| Market Concentration | Increased leverage for few dominant suppliers | Advanced ballistic fabrics |

| Proprietary Technology | Difficulty in finding alternatives, higher pricing | Specialized EOD electronic components |

| Input Significance | Direct impact on product performance and differentiation | High-performance fibers for body armor |

| Switching Costs | Deters easy supplier changes, locks in relationships | Custom-engineered protective materials |

| Potential Tariffs (2024) | Upward pressure on raw material costs | Imported ballistic fibers, ceramic inserts |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Cadre Holdings' security and safety solutions market.

Easily identify and address competitive pressures by visualizing the intensity of each of Porter's Five Forces for Cadre Holdings.

Customers Bargaining Power

Cadre Holdings' customer base includes significant government entities like law enforcement and military branches. These large clients often engage in competitive bidding processes and secure equipment through extended contracts, giving them considerable leverage.

The substantial volume and strategic nature of these government orders empower these customers to negotiate aggressively on pricing and contract terms. For instance, in 2024, the U.S. Department of Defense budget was projected at over $886 billion, highlighting the scale of potential government procurement.

While government procurement can be subject to shifts, there's a discernible trend towards longer-term agreements in certain defense sectors. This can provide Cadre Holdings with more predictable revenue streams but also locks in pricing and terms for extended periods, amplifying customer bargaining power.

While Cadre Holdings offers innovative, engineered products, certain safety equipment categories may have standardized specifications. This allows customers to readily compare options from various manufacturers, potentially increasing their bargaining power. For instance, in the body armor market, there are established ballistic protection standards like NIJ levels that provide a baseline for comparison.

However, Cadre's strong brand reputation for exceptional quality and rigorous adherence to critical safety standards, exemplified by brands like Safariland and Med-Eng, serves to diminish customer leverage. These differentiated product portfolios, often featuring proprietary technologies and specialized applications, make direct price-based comparisons more challenging and highlight value beyond mere standardization.

Customer price sensitivity for Cadre Holdings is a nuanced factor. While government entities, a significant customer base, often operate with strict budgets, making them price-conscious, the critical nature of Cadre's offerings like body armor and explosive ordnance disposal (EOD) equipment shifts the focus. For instance, in 2023, the U.S. Department of Defense's budget for protective equipment remained substantial, underscoring a willingness to invest in quality and reliability.

The decision-making process for these essential safety products balances cost-effectiveness with the paramount need for performance and life-saving capabilities. This means that while price is considered, it's often secondary to the assurance of superior protection and operational effectiveness, especially when lives are on the line.

Threat of Backward Integration by Customers

The threat of backward integration by customers for Cadre Holdings is generally low. Government agencies and large commercial clients typically lack the specialized manufacturing expertise, significant capital investment, and the extensive research and development capabilities necessary to produce complex safety and survivability products in-house.

These products often require highly specialized processes and adherence to stringent certification standards, which act as substantial barriers to entry for potential customer manufacturers. For instance, the development and production of advanced ballistic protection or specialized tactical gear involve proprietary technologies and rigorous testing protocols that are difficult and costly for typical customers to replicate.

This limited capability for backward integration means customers have less leverage to demand lower prices or more favorable terms by threatening to produce these goods themselves.

- Low Threat: Government and commercial clients generally do not possess the technical expertise or resources to manufacture Cadre's specialized products.

- High Barriers: Specialized manufacturing, R&D investment, and certification requirements deter customers from backward integration.

- Reduced Leverage: The inability of customers to produce these goods themselves limits their bargaining power.

Customer Access to Information and Multiple Suppliers

Customers today have an unprecedented amount of information at their fingertips. They can easily research product specifications, compare pricing across various providers, and identify alternative suppliers. This transparency significantly shifts the balance of power towards the buyer.

The ease with which customers can solicit bids from multiple qualified suppliers, particularly for substantial contracts, directly amplifies their bargaining leverage. This forces companies like Cadre Holdings to maintain a competitive edge, not just on price but also on the quality and features of their offerings. For instance, in 2024, the global average for business-to-business (B2B) purchasing decisions involved an average of 7.4 information sources, highlighting the depth of customer research.

- Increased Information Availability: Customers can readily access detailed product information and pricing data online.

- Supplier Comparison: Buyers can easily compare offerings from numerous qualified suppliers.

- Competitive Bidding: The practice of soliciting bids from multiple sources, common in large tenders, strengthens customer negotiation power.

- Pressure on Pricing and Features: This competitive environment compels suppliers to offer attractive pricing and superior product attributes.

Cadre Holdings faces moderate bargaining power from its customers, particularly government entities. These large buyers, often operating with significant budgets like the projected $886 billion U.S. Department of Defense budget for 2024, can leverage their purchasing volume and the competitive bidding process to negotiate favorable terms and pricing.

While some product categories may have standardized specifications, allowing for easier comparison and increasing customer leverage, Cadre's strong brand reputation and proprietary technologies in areas like body armor and EOD equipment help mitigate this. The critical nature of these life-saving products means customers prioritize performance and reliability, often making price secondary to quality, a trend supported by substantial 2023 protective equipment budgets within defense sectors.

The threat of backward integration by customers is generally low due to the specialized manufacturing, R&D, and certification requirements inherent in Cadre's product lines, limiting customers' ability to produce these goods internally and thus reducing their bargaining power.

| Factor | Impact on Cadre Holdings | Supporting Data/Observation |

|---|---|---|

| Customer Volume & Bidding | Moderate to High Leverage | U.S. DoD budget projected over $886 billion in 2024; extensive competitive bidding processes. |

| Product Standardization vs. Differentiation | Varies by Product Line | Standardized safety equipment allows comparison; proprietary tech (Safariland, Med-Eng) reduces direct price competition. |

| Price Sensitivity vs. Criticality | Price considered, but secondary to performance | Substantial 2023 protective equipment budgets indicate willingness to invest in quality and reliability for life-saving gear. |

| Backward Integration Threat | Low | High barriers in specialized manufacturing, R&D, and certifications deter customer in-house production. |

| Information Transparency | Increased Leverage for Customers | Average of 7.4 information sources used in B2B purchasing decisions in 2024 highlights deep customer research capabilities. |

Same Document Delivered

Cadre Holdings Porter's Five Forces Analysis

This preview showcases the complete Cadre Holdings Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within its industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The safety and survivability products market is quite crowded, featuring both big, well-known companies and smaller, niche businesses. This means Cadre Holdings faces competition from many sides, especially in areas like body armor and general law enforcement gear where numerous players vie for market share.

The military and law enforcement equipment sectors are seeing robust expansion. Specifically, the military personal protective equipment market is anticipated to expand at a compound annual growth rate of 8.2%, reaching $29.0 billion by 2029. Similarly, the body armor market is projected to grow at 5.86% annually, hitting $5.83 billion by 2034.

This healthy industry growth can temper direct rivalry by creating ample opportunities for all participants. However, the underlying competition for market share remains intense, as companies vie for dominance within these expanding segments.

Cadre Holdings focuses on differentiating its offerings through innovation and high quality, particularly in safety-critical products. Brands like Safariland and Med-Eng exemplify this, creating unique value that lessens direct competition based on price. For instance, Safariland’s advanced body armor solutions often command premium pricing due to their proven performance and adherence to stringent standards.

Exit Barriers

Cadre Holdings faces substantial exit barriers, primarily driven by significant capital investments in its manufacturing facilities and specialized equipment. These high fixed costs make it financially challenging for companies to simply shut down operations and leave the market.

The need to recoup these large investments often forces firms to continue operating, even when market conditions are unfavorable. This can lead to prolonged periods of aggressive competition as companies fight to stay afloat, intensifying the rivalry among existing players.

For instance, in the broader industrial manufacturing sector where Cadre Holdings operates, companies often have millions, if not billions, invested in their production lines. A report from Deloitte in 2024 highlighted that for many industrial firms, the average capital expenditure on plant and machinery can easily exceed $50 million, creating a strong incentive to remain operational rather than absorb such losses.

- High Capital Investment: Significant upfront costs in manufacturing plants and specialized machinery act as a major deterrent to exiting the market.

- Specialized Assets: The unique nature of much of this equipment means it has limited resale value outside the specific industry, increasing the cost of exit.

- Intellectual Property: Investments in proprietary technology and patents also represent sunk costs that are difficult to recover upon departure.

- Operational Continuity: The pressure to continue operations to amortize these large investments can lead to sustained, intense competition among existing firms.

Market Concentration and Acquisitions

The competitive rivalry within Cadre Holdings' operating environment is intensified by ongoing industry consolidation. This trend is characterized by strategic acquisitions that actively reshape the market. For instance, Cadre itself has engaged in acquisitions, such as that of Carr's Engineering Division, which directly alters its competitive positioning and capabilities.

These consolidation efforts can lead to a reduction in the number of direct competitors within specific market segments. Simultaneously, they bolster the market share and operational capacity of acquiring entities. This dynamic creates a landscape where larger, more integrated players can exert greater influence, potentially increasing the pressure on smaller or more specialized rivals.

- Industry Consolidation: Ongoing mergers and acquisitions are a hallmark of the sector.

- Strategic Acquisitions: Companies like Cadre are actively participating in M&A to expand.

- Reshaping Landscape: Acquisitions can reduce direct rivals in niche markets.

- Increased Market Share: Larger players gain enhanced capabilities and market dominance.

Cadre Holdings operates in a competitive landscape with numerous players, ranging from large corporations to specialized niche firms, particularly in body armor and law enforcement equipment. While industry growth offers opportunities, intense competition for market share persists. Cadre differentiates itself through quality and innovation, as seen with Safariland's premium body armor, aiming to reduce price-based rivalry.

The market for safety and survivability products is dynamic. In 2024, the global body armor market was valued at approximately $5.0 billion, with projections indicating steady growth. Similarly, the military personal protective equipment market is robust, with significant investment flowing into advanced materials and technologies.

| Market Segment | 2024 Estimated Value (USD Billion) | Projected CAGR (approx.) | Key Growth Drivers |

|---|---|---|---|

| Body Armor | 5.0 | 5.9% | Increased defense spending, law enforcement upgrades |

| Military PPE | 26.0 | 8.2% | Geopolitical tensions, technological advancements |

SSubstitutes Threaten

The threat of substitutes for Cadre Holdings' protective gear arises from innovative materials and technologies that could offer comparable or better performance at a potentially lower cost. For example, the development of advanced, ultra-lightweight composite materials or novel liquid body armor technologies could provide viable alternatives to traditional ballistic vests and helmets. These emerging solutions might disrupt Cadre's existing product lines by offering enhanced comfort, mobility, or cost-effectiveness, thereby diverting customer demand.

Non-product solutions, like refined training or updated operational tactics, can diminish the demand for specialized equipment that Cadre Holdings provides. For instance, if law enforcement agencies invest heavily in advanced de-escalation training, the need for certain less-lethal equipment might decrease.

These strategic shifts, while not direct product replacements, represent a significant threat by altering the fundamental need for Cadre's core offerings. Consider the potential impact if a major client, such as a large federal agency, were to implement new procedural guidelines that reduce their reliance on specialized protective gear.

The threat of lower-cost, general-purpose equipment is a significant concern for Cadre Holdings, particularly in segments where extreme specialization isn't a primary requirement. For instance, in certain commercial applications or less critical public safety roles, organizations might prioritize budget savings over the advanced protective features found in Cadre's specialized offerings. This dynamic is amplified by the availability of broadly applicable tools that can perform basic functions at a fraction of the cost.

In-house Development by Large Agencies

The threat of in-house development by large government defense agencies for protective equipment is generally low for companies like Cadre Holdings. While theoretically possible, the immense specialization, advanced manufacturing capabilities, and significant capital investment required to replicate the quality and scale of established suppliers present a formidable barrier. For instance, the defense sector's reliance on highly engineered materials and rigorous testing protocols means that developing comparable in-house solutions would be prohibitively expensive and time-consuming, especially when compared to leveraging the expertise of dedicated manufacturers.

This limited threat is underscored by the fact that specialized protective gear often involves proprietary technologies and decades of accumulated know-how. Companies in this space, such as those within Cadre's portfolio, benefit from established supply chains and efficient production processes that are difficult for even large government entities to replicate cost-effectively. The ongoing innovation in materials science and design within the defense industry further solidifies the advantage of specialized commercial providers.

- Limited In-House Capabilities: Large government agencies typically lack the specialized manufacturing infrastructure and deep technical expertise required for producing advanced protective equipment.

- High Development Costs: The significant investment in research, development, specialized machinery, and skilled labor makes in-house production economically unfeasible compared to sourcing from specialized firms.

- Focus on Core Competencies: Government agencies prioritize their core mission functions, such as defense strategy and operations, rather than diverting resources to manufacturing specialized equipment.

- Economies of Scale Advantage: Companies like Cadre Holdings benefit from economies of scale in procurement and production, allowing them to offer specialized gear at competitive prices that are difficult for individual agencies to match.

Evolving Threat Landscape

The threat of substitutes for Cadre Holdings' products is significant due to the dynamic nature of threats faced by law enforcement and military personnel. A shift from traditional ballistic threats to chemical, biological, or cyber warfare necessitates entirely new protective solutions.

For instance, the increasing reliance on cyber operations in modern conflict means that traditional physical armor might become less critical compared to advanced cyber defense systems. This evolving threat landscape means that companies offering non-traditional security solutions could emerge as potent substitutes.

- Cybersecurity Solutions: As digital threats grow, cybersecurity firms offering advanced protection against data breaches and cyber-attacks pose a growing substitute threat, particularly for government and defense contracts focused on information security.

- Advanced Chemical and Biological Protection: The potential for WMD use means that specialized suits, detection equipment, and decontamination systems developed by niche manufacturers could substitute for some existing personal protective equipment.

- Drones and Robotics: In certain scenarios, unmanned aerial vehicles (UAVs) or ground robots equipped with sensors and non-lethal deterrents could substitute for human personnel in high-risk surveillance or intervention operations, impacting demand for certain types of protective gear.

- Emerging Materials Science: Breakthroughs in materials science could lead to lighter, stronger, or more versatile protective materials that render current offerings obsolete, creating opportunities for new market entrants.

The threat of substitutes for Cadre Holdings' protective gear is moderate, primarily driven by advancements in materials science and evolving operational tactics. While direct product substitutes offering similar ballistic protection are limited due to specialized engineering and testing, alternative solutions like enhanced training or shifts in threat focus can indirectly reduce demand for certain equipment.

For instance, innovations in lighter composite materials could offer comparable protection with improved user comfort, potentially drawing customers away from heavier, traditional gear. Furthermore, as the nature of security threats evolves, for example, with an increased focus on cyber warfare, the relative importance of physical protective equipment might diminish, opening the door for different types of security solutions to emerge as substitutes.

The availability of lower-cost, general-purpose protective items in less demanding commercial applications also presents a threat, as budget-conscious buyers may opt for these alternatives when extreme specialization is not critical.

In 2024, the global body armor market was valued at approximately $10.5 billion, with projections indicating continued growth, suggesting that while substitutes exist, the core demand for specialized protective gear remains robust. However, the increasing adoption of advanced materials like Dyneema and Kevlar continues to push the boundaries of what is considered a viable substitute for traditional ballistic protection.

Entrants Threaten

Entering the safety and survivability sector, particularly for sophisticated items like body armor and explosive ordnance disposal (EOD) gear, demands significant capital. Companies must invest heavily in research and development to innovate and meet stringent performance standards. For instance, the development of advanced ballistic materials can cost millions of dollars before a single product is manufactured.

Beyond R&D, establishing state-of-the-art manufacturing facilities equipped with specialized machinery is crucial. These facilities often require certifications and adherence to rigorous quality control processes. Cadre Holdings, for example, operates in a market where product reliability is paramount, necessitating substantial upfront investment in production capabilities to ensure consistent quality and compliance with government and military specifications.

Stringent regulatory requirements and certifications present a significant threat of new entrants for companies like Cadre Holdings. Products designed for law enforcement, first responders, and military personnel must meet rigorous safety standards and undergo extensive testing, such as NIJ standards for body armor.

The process of navigating these complex regulatory landscapes is both time-consuming and costly, acting as a substantial barrier for new companies seeking to enter the market. For instance, obtaining NIJ certification for body armor can take many months and involve significant upfront investment in testing and compliance, deterring many potential competitors.

Cadre Holdings enjoys a significant advantage due to its established brand reputation and deep-rooted customer relationships, particularly within the public safety and defense sectors. Brands like Safariland and Med-Eng have cultivated trust over many years, making it difficult for newcomers to replicate this loyalty.

New entrants face a formidable challenge in overcoming the ingrained trust and long-term partnerships Cadre Holdings has built with government agencies and commercial entities. These relationships are often cemented through rigorous testing, proven performance, and a history of reliability, which are not easily or quickly established by emerging companies.

Proprietary Technology and Intellectual Property

The threat of new entrants for Cadre Holdings, particularly concerning proprietary technology and intellectual property, is significantly mitigated by the substantial barriers to entry already established by incumbents. Cadre, like other established players in its sector, has invested heavily in research and development, resulting in a portfolio of patents and unique manufacturing processes. For instance, advancements in materials science for ballistic protection, a core area for companies like Cadre, often involve years of specialized research and testing, creating a knowledge moat.

The high cost associated with replicating this level of technological sophistication acts as a formidable deterrent. New companies would need to either undertake their own extensive and expensive R&D initiatives, potentially taking years to reach competitive performance levels, or secure licensing agreements for existing technologies, which can be prohibitively costly.

- High R&D Investment: Developing advanced protective materials requires significant capital outlay, often in the tens of millions of dollars, for specialized laboratories and expert personnel.

- Patent Protection: Cadre Holdings possesses numerous patents covering aspects of material composition, product design, and manufacturing techniques, shielding its innovations from direct imitation.

- Licensing Costs: Acquiring licenses for cutting-edge technologies can involve substantial upfront fees and ongoing royalties, making it difficult for new entrants to achieve competitive pricing.

- Manufacturing Expertise: The specialized knowledge and infrastructure required for high-volume production of advanced protective gear are not easily replicated, adding another layer of entry barrier.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in accessing established distribution channels and securing reliable supply chains, particularly for specialized materials. Cadre Holdings has invested heavily in building a robust global manufacturing and distribution network, which acts as a considerable barrier to entry. This existing infrastructure, coupled with strong relationships with distributors and direct sales channels, makes it difficult for new companies to effectively reach Cadre's diverse customer base.

Consider the following points regarding access to distribution channels and supply chains:

- Established Infrastructure: Cadre's global manufacturing and distribution networks represent a substantial upfront investment that new entrants would need to replicate, a costly and time-consuming endeavor.

- Supplier Relationships: Securing reliable supply chains for specialized materials often depends on long-standing relationships with suppliers, which are hard for newcomers to forge quickly.

- Channel Access: Existing relationships with distributors and direct sales channels provide Cadre with immediate market reach, a privilege that new entrants must painstakingly build from scratch.

- Market Penetration Costs: The cost and complexity of establishing comparable market penetration for specialized equipment and services are high, deterring many potential new competitors.

The threat of new entrants into the safety and survivability sector, where Cadre Holdings operates, is generally moderate to low. This is primarily due to the substantial capital requirements for research and development, establishing advanced manufacturing facilities, and navigating stringent regulatory approvals. For example, achieving NIJ certification for body armor can cost tens of thousands of dollars and take many months, creating a significant barrier.

Furthermore, established brand loyalty and deep customer relationships, particularly with government agencies, present a formidable challenge for newcomers. Cadre's brands, like Safariland, have built decades of trust through proven performance. New entrants must overcome the high cost of replicating this established reputation and the extensive time needed to build similar trust and partnerships.

Proprietary technology and intellectual property also act as significant deterrents. Cadre Holdings invests heavily in R&D, securing numerous patents for materials and manufacturing processes. The expense and time required to develop comparable technologies make it difficult for new companies to compete effectively on innovation.

Lastly, access to established distribution channels and reliable supply chains is a critical barrier. Cadre's global infrastructure and long-standing supplier relationships are not easily replicated, requiring substantial investment and time for new entrants to achieve comparable market reach and operational efficiency.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cadre Holdings leverages a diverse range of data, including Cadre Holdings' SEC filings, investor presentations, and publicly available financial statements. We also incorporate industry-specific market research reports and insights from trade publications to provide a comprehensive view of the competitive landscape.