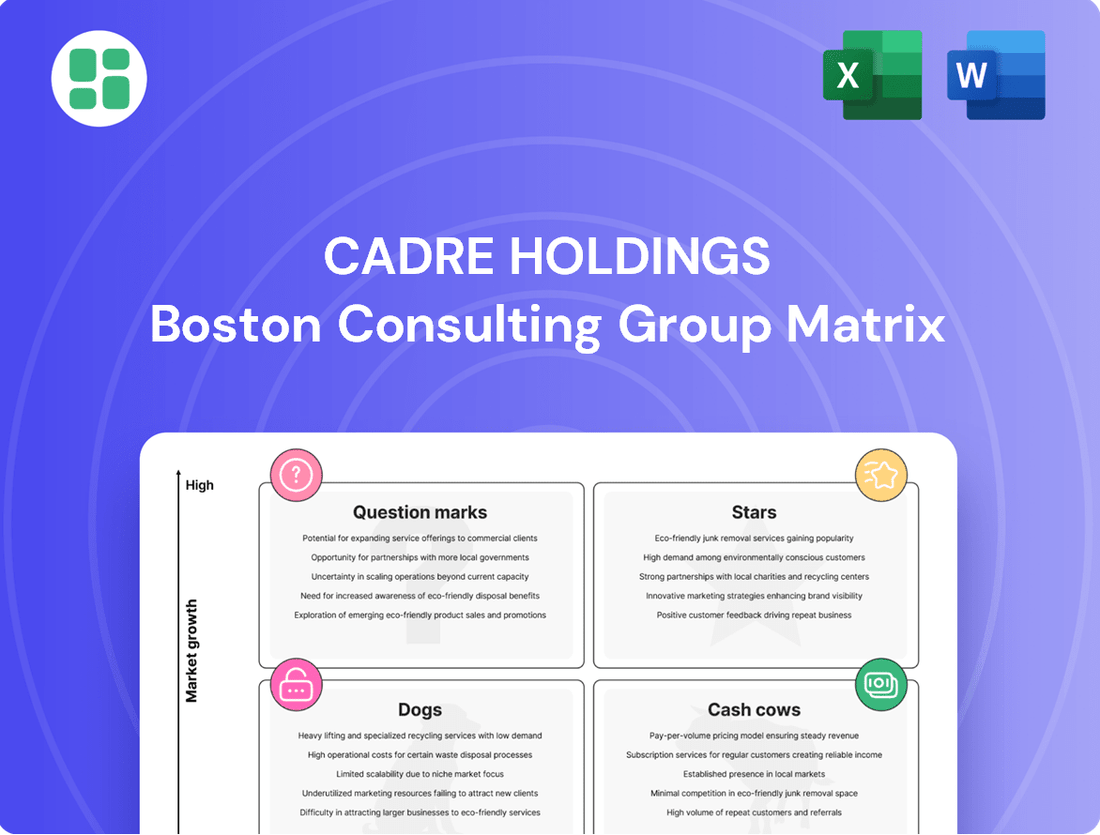

Cadre Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadre Holdings Bundle

Curious about Cadre Holdings' strategic product positioning? This BCG Matrix preview offers a glimpse into their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the actionable insights that will drive your investment decisions.

Unlock the full potential of Cadre Holdings' strategic landscape by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions and optimize your portfolio.

Elevate your strategic planning with the detailed Cadre Holdings BCG Matrix. This essential tool provides quadrant-specific analysis and expert recommendations, giving you a clear roadmap to capitalize on opportunities and mitigate risks in a dynamic market.

Stars

Cadre Holdings' acquisition of Carr's Engineering Division bolsters its position in the nuclear safety automation and robotics sector, a key growth area. This strategic move aligns with rising global energy and defense needs, as well as the critical requirement for nuclear waste management solutions. The nuclear sector is increasingly adopting automation and robotics to enhance safety and efficiency, with the global nuclear power market projected to reach $161.2 billion by 2028, growing at a CAGR of 2.6%.

Cadre Holdings' Med-Eng brand is a standout in the explosive ordnance disposal (EOD) sector, consistently innovating with next-generation equipment. The company's commitment to developing advanced EOD solutions is evident, catering to a market shaped by evolving global threats and offering a substantial addressable market.

The EOD segment within Cadre Holdings is experiencing robust demand, as evidenced by a growing order backlog. This increase, though influenced by shipment schedules, points to a strong market appetite for sophisticated EOD tools. For instance, in the first quarter of 2024, Cadre Holdings reported a backlog of $350 million, with a significant portion attributable to its EOD and bomb disposal solutions.

High-Threat Tactical Body Armor is a star in Cadre Holdings' portfolio, driven by a significant rise in active shooter incidents. This escalating threat landscape directly fuels demand for advanced protection solutions for law enforcement and military.

Cadre Holdings is well-positioned to capitalize on this, offering a comprehensive suite of cutting-edge armor. Their commitment to continuous technological innovation in this vital sector is a key differentiator.

The market for high-threat tactical body armor represents a substantial growth opportunity. Evolving security challenges and the non-negotiable need for enhanced personnel safety are the primary drivers.

International Market Expansion Initiatives

Cadre Holdings is strategically pursuing international market expansion, aiming to replicate its strong domestic market share by introducing its high-quality safety equipment globally. The company is focused on building robust local teams and exploring adjacent product categories to cater to diverse international needs.

This initiative is driven by the significant global demand for safety and protective gear, with particular attention on regions that currently show lower penetration rates but substantial growth potential. For instance, in 2024, the global market for personal protective equipment (PPE) was valued at approximately $60.5 billion, with projections indicating continued strong growth, especially in emerging economies.

- Global PPE Market Growth: The worldwide market for personal protective equipment is projected to expand significantly, offering substantial opportunities for Cadre Holdings.

- Targeting Under-penetrated Regions: Cadre Holdings is identifying and prioritizing international markets where its products can gain traction due to unmet demand for safety solutions.

- Strategic Expansion Tactics: The company's strategy involves establishing local operational capabilities and expanding its product portfolio to better serve diverse international customer bases.

- Leveraging Domestic Success: Cadre Holdings aims to capitalize on its established reputation and product excellence from its domestic market to build credibility and market share abroad.

Advanced Communication & Integrated Safety Systems

As public safety and defense roles become increasingly complex, the demand for innovative and integrated communication solutions within safety equipment is rapidly expanding. Cadre Holdings' portfolio directly addresses this need, featuring advanced communication gear specifically designed for law enforcement, military, and broader public safety applications.

This strategic focus on technologically sophisticated systems places Cadre in a high-growth market segment. The company is investing in solutions that are crucial for enhancing operational capabilities and ensuring seamless information flow in critical situations. For example, the global market for public safety communication systems was valued at approximately $25 billion in 2023 and is projected to grow significantly in the coming years.

- Demand Driver: Increasing complexity of public safety and defense operations necessitates integrated communication.

- Cadre's Offering: Advanced communication gear for law enforcement, military, and public safety personnel.

- Market Position: High-growth segment focused on enhancing operational capabilities and information flow.

- Market Size: The global public safety communication systems market was valued around $25 billion in 2023.

High-Threat Tactical Body Armor and advanced EOD solutions are clearly Stars in Cadre Holdings' portfolio, exhibiting strong market growth and high relative market share. These segments benefit from increasing global security concerns and technological advancements, driving consistent demand and positioning Cadre for continued leadership. Their robust performance underscores the company's ability to cater to critical safety needs in volatile environments.

What is included in the product

The Cadre Holdings BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment decisions.

Cadre Holdings BCG Matrix offers a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Cadre Holdings, through its prominent brands such as Safariland and Protech Tactical, commands a leading position in the essential market for core law enforcement body armor. This segment is vital, offering critical protection to officers and benefiting from a stable demand. This demand is fueled by ongoing modernization efforts and regular equipment replacement schedules, ensuring a predictable revenue stream.

The body armor sector for law enforcement represents a mature but indispensable market, consistently generating substantial cash flow for Cadre Holdings. In 2024, the demand for advanced ballistic protection remained robust. For instance, the U.S. Department of Justice reported that approximately 82% of local law enforcement agencies issued body armor to their officers, underscoring the consistent need for these products.

Standard Duty Gear & Holsters represent a significant Cash Cow for Cadre Holdings, built on decades of leadership in providing essential equipment to global law enforcement and military sectors. This segment benefits from predictable demand and consistent refresh cycles, ensuring stable sales volume year after year.

In 2024, the duty gear market continued to demonstrate resilience, with law enforcement agencies maintaining steady procurement of safety holsters and related equipment. Cadre's established brand reputation and extensive distribution network allow these foundational products to generate reliable cash flow with minimal need for aggressive promotional spending, underscoring their Cash Cow status.

Cadre Holdings' Med-Eng blast protection products, particularly its bomb suits, are a prime example of a Cash Cow. Med-Eng is a recognized global leader, serving over 100 countries with a substantial installed base.

This widespread adoption translates into predictable, recurring revenue streams from replacement cycles and high profit margins. The established reputation and market dominance solidify its position as a consistent cash generator for Cadre Holdings.

Forensic and Evidence Collection Products

Cadre Holdings' forensic and evidence collection products, including fingerprinting supplies and narcotics field identification kits, are firmly positioned as cash cows. This segment benefits from a consistent and non-discretionary demand from law enforcement agencies, ensuring stable revenue streams. The recurring need for these essential items means they require minimal additional investment to maintain their market position.

The predictable nature of this market allows Cadre to generate reliable cash flow. For instance, in 2024, the public safety sector, which heavily relies on such products, saw continued robust government spending, underscoring the stable demand. This stability allows Cadre to allocate resources effectively across its broader portfolio.

- Consistent Demand: Law enforcement agencies have an ongoing, essential need for forensic and evidence collection tools, regardless of economic fluctuations.

- Low Investment Needs: As established products in a stable market, these offerings typically require minimal capital expenditure for growth or maintenance.

- Reliable Cash Generation: The predictable sales cycle of these products contributes significantly to Cadre Holdings' overall financial stability.

- Market Stability: The non-discretionary nature of public safety spending ensures a consistent revenue base for these offerings.

Chemical Light and Illumination Products

Cadre Holdings' chemical light and illumination products are a classic example of a Cash Cow within the BCG Matrix. The company's position as the world leader in supplying these products to US and NATO military forces signifies a substantial and stable market share in a well-established sector. This dominance translates into predictable revenue streams, as these specialized items have a consistent demand from defense and law enforcement agencies.

The mature nature of this market, coupled with Cadre's established distribution networks, ensures efficient operations and reliable cash flow generation. For instance, in 2024, the defense sector continued to invest heavily in essential equipment, with global military spending reaching an estimated $2.44 trillion, according to the Stockholm International Peace Research Institute (SIPRI). This sustained demand underpins the Cash Cow status of Cadre's illumination products.

- Dominant Market Share: Cadre Holdings holds a leading position in the chemical light market, particularly for military applications.

- Mature Market: The demand for these illumination products is consistent and predictable within the defense and law enforcement sectors.

- Steady Cash Flow: Established distribution channels and consistent demand contribute to reliable revenue generation.

- Strategic Importance: These products are essential for military and law enforcement operations, ensuring ongoing sales.

Cadre Holdings' established brands in body armor, duty gear, and blast protection are prime examples of Cash Cows. These segments benefit from consistent, non-discretionary demand from law enforcement and military sectors, requiring minimal new investment to maintain their market position. In 2024, the global law enforcement equipment market continued its steady growth, driven by modernization and safety mandates, ensuring predictable revenue streams for these mature product lines.

| Cadre Holdings Segment | BCG Matrix Category | Key Characteristics | 2024 Market Context |

|---|---|---|---|

| Body Armor (Safariland, Protech) | Cash Cow | Essential, stable demand, mature market, predictable refresh cycles. | 82% of US local agencies issue body armor. |

| Duty Gear & Holsters | Cash Cow | Decades of leadership, predictable demand, consistent refresh cycles, minimal promotional need. | Steady procurement by law enforcement globally. |

| Blast Protection (Med-Eng) | Cash Cow | Global leadership, substantial installed base, recurring revenue from replacements, high margins. | Serves over 100 countries with established products. |

What You’re Viewing Is Included

Cadre Holdings BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just the complete, analysis-ready strategic tool for Cadre Holdings.

Dogs

Cadre Holdings' distribution of undifferentiated third-party products, such as uniforms, optics, and general firearms, represents a segment with potential challenges. These items often exist in crowded markets where achieving significant market share and robust growth can be difficult.

The low margins typically associated with these broadly available products may not align with Cadre's strategic emphasis on high-engineered, mission-critical offerings. For instance, the tactical apparel market, a key area for such distribution, saw growth but also intense competition in 2024, with many players offering similar items.

Within Cadre Holdings' portfolio, older body armor models that no longer meet current technical standards or offer reduced protection levels compared to advanced alternatives are becoming obsolete. These products are likely experiencing a decline in market demand and share, making them a low-growth, low-profit segment that requires significant effort to move.

For instance, while specific 2024 sales figures for individual older armor models within Cadre Holdings are not publicly detailed, the broader trend in the body armor industry shows a shift towards higher-performance materials like Dyneema and advanced ceramic composites. This evolution means that older, less protective designs are increasingly being phased out by law enforcement and military agencies prioritizing enhanced safety and compliance with updated National Institute of Justice (NIJ) standards.

Within Cadre Holdings' portfolio, niche, low-volume specialized tools represent products catering to very specific, often infrequent, market demands. These items, while potentially valuable to a select clientele, typically exhibit low sales volumes. For instance, a specialized diagnostic tool for a rare industrial application might only sell a few units annually, contributing minimally to overall revenue.

The challenge with these specialized tools lies in their limited growth potential and the resources they might consume. A tool designed for a market segment with only a few hundred potential users globally, even if it achieves a high penetration rate, will inherently have capped sales. This can lead to a situation where capital and operational efforts are tied up in products with modest return on investment, as is common for many specialized equipment manufacturers.

Products with High Regulatory Burden & Low Demand

Certain safety products, while critical, can fall into the Dogs category within the Cadre Holdings BCG Matrix. These are items that face a high regulatory burden, meaning compliance with safety standards, certifications, and evolving legal frameworks demands significant and ongoing investment. For instance, specialized personal protective equipment (PPE) might require extensive testing and re-certification, driving up operational costs.

The challenge is compounded when market demand for these specific regulatory-heavy products is low. This lack of robust consumer or industrial uptake means that the revenue generated doesn't justify the substantial resources poured into maintaining compliance. Consequently, these products can become cash traps, draining capital without offering a path to significant market share or growth.

Consider the scenario where a company produces a niche safety harness designed for a specific, declining industrial application. In 2024, the market for such harnesses might have shrunk by an estimated 5-10% year-over-year due to technological obsolescence. Yet, the regulatory requirements for fall protection equipment remain stringent, necessitating continuous updates to materials and design to meet evolving OSHA or equivalent international standards, leading to disproportionately high compliance costs relative to sales.

- High Compliance Costs: Ongoing expenses for certifications, testing, and adherence to evolving safety regulations.

- Low Market Demand: Limited sales volume due to niche applications or declining industry relevance.

- Cash Trap Potential: Investments in compliance yield insufficient returns, hindering overall portfolio profitability.

- Strategic Re-evaluation: These products often require a decision on divestment or significant operational restructuring.

Underperforming Acquired Brands/Product Lines

Within Cadre Holdings' strategic acquisition framework, underperforming acquired brands or product lines represent potential 'Dogs' in a BCG-like analysis. These are assets that, despite initial strategic intent, fail to gain traction or integrate effectively post-acquisition. For instance, if an acquired company's key product line experiences declining sales, as seen in some niche security technology sectors where innovation outpaces adoption, it could fall into this category.

These underperforming units can drain valuable resources without contributing significantly to Cadre's overall market share or growth objectives. A prime example could be an acquired software solution that struggles to integrate with Cadre's existing platforms or faces intense competition from newer, more agile competitors. In 2023, the cybersecurity market saw significant consolidation, but not all acquisitions immediately yielded positive results, with some integration challenges reported by industry players.

Cadre Holdings must continually monitor the performance of its acquired assets. If an acquired brand or product line consistently misses revenue targets and fails to achieve projected market share, it necessitates a thorough evaluation. This evaluation would consider factors like:

- Market Share Decline: A significant drop in market share for an acquired product line, perhaps falling below 10% in its specific segment, would signal underperformance.

- Profitability Issues: Persistent negative net income or a declining profit margin for the acquired unit, indicating it's a drain on resources.

- Integration Challenges: Difficulties in merging operations, technology, or sales channels, leading to operational inefficiencies and missed synergies.

- Strategic Misalignment: The acquired brand no longer fitting Cadre's evolving strategic direction or core competencies.

The ultimate decision for such 'Dog' assets often involves considering divestiture to reallocate capital and management focus to more promising ventures within Cadre's portfolio.

Products in the 'Dogs' category for Cadre Holdings, such as undifferentiated third-party items or obsolete safety gear, are characterized by low market share and minimal growth potential. These segments often suffer from low margins and high operational costs, particularly when regulatory compliance is a significant factor.

For example, older body armor models that don't meet current NIJ standards face declining demand, while niche safety tools for shrinking industries tie up capital without substantial returns. The market for tactical apparel, while growing, is highly competitive, making it difficult for broadly distributed products to gain significant traction and profitability.

Underperforming acquired brands also fall into this category, draining resources due to integration challenges or strategic misalignment. In 2023, some cybersecurity acquisitions struggled with integration, highlighting this risk. These 'Dog' assets often require divestiture or significant restructuring to improve the overall portfolio's performance.

Consider the following simplified illustration of potential 'Dog' characteristics within a portfolio:

| Product Category | Market Growth Rate | Market Share | Profit Margin | Key Challenge |

| Undifferentiated Apparel | Low (e.g., 2-4%) | Low (e.g., <5%) | Low (e.g., 5-10%) | Intense Competition |

| Obsolete Safety Gear | Declining (e.g., -3% to -7%) | Very Low (e.g., <2%) | Negative or Very Low | Obsolescence, High Compliance Costs |

| Niche Specialized Tools | Low (e.g., 1-3%) | Low (e.g., <10%) | Moderate to Low | Limited Market Size |

| Underperforming Acquired Brand | Varies (could be high or low) | Declining or Low | Negative or Declining | Integration Issues, Market Misalignment |

Question Marks

Following the acquisition of Carr's Engineering Division, Cadre Holdings is now exploring newly integrated nuclear safety sub-verticals. These areas, like specialized remote handling and niche robotics for nuclear environments, represent emerging markets where Cadre is in the initial phases of establishing its presence.

While the broader nuclear sector shows promising growth, Cadre's penetration in these specific, nascent sub-verticals is still developing. This means they are likely positioned as Question Marks in the BCG Matrix, requiring significant investment to scale and capture market share.

For instance, the global nuclear power market was valued at approximately $300 billion in 2023 and is projected to grow, but Cadre's specific share in these new, specialized segments is minimal. The company needs to strategically invest in R&D and market development to transform these Question Marks into Stars.

Cadre Holdings' investment in emerging technologies like AI for public safety aligns with a Stars quadrant strategy. The global public safety market, projected to reach $239.9 billion by 2027, is experiencing significant AI integration, creating high-growth opportunities. Cadre's focus here suggests a move into a rapidly expanding segment, aiming to capture future market share.

Cadre Holdings is strategically targeting international expansion, aiming to enter new geographies where its presence is currently minimal. This move is driven by the potential for significant growth in these markets, even though it necessitates substantial initial investment in building local infrastructure, brand awareness, and crucial partnerships.

These nascent international markets are classified as question marks due to their high growth potential coupled with low current market share. Cadre's approach involves significant capital allocation to establish a foothold, mirroring the typical investment required for such ventures. For instance, similar market entry strategies in 2024 for companies in the security and services sector often saw initial outlays ranging from $5 million to $20 million depending on the target region's regulatory environment and competitive landscape.

Unproven Product Innovations from R&D Pipeline

Cadre Holdings dedicates substantial resources to its research and development pipeline, aiming to introduce novel solutions. Products in this category are entirely new or represent groundbreaking technologies that have yet to gain significant market acceptance. These innovations carry high potential rewards but also face considerable uncertainty regarding market reception and often necessitate substantial marketing expenditure to build traction.

For instance, if Cadre were to launch a new AI-driven threat detection system for public safety, it would likely fall into this quadrant. While the technology might be cutting-edge, its adoption rate would depend on factors like integration ease, cost-effectiveness for municipalities, and proven efficacy in real-world scenarios. Such an innovation, before demonstrating consistent sales and market share growth, would be considered an unproven product innovation.

- High Potential, High Risk: These are nascent products with the possibility of significant future growth but currently lack established market share.

- Significant R&D Investment: Cadre's commitment to innovation means these products are backed by considerable research and development funding.

- Market Uncertainty: The success of these innovations hinges on market acceptance, competitive responses, and the ability to scale production and distribution effectively.

- Strategic Marketing Focus: To move these products out of the R&D pipeline and into stronger market positions, Cadre would need to allocate significant marketing and sales resources.

Specialized Crowd Control Products for New Applications

Cadre Holdings' specialized crowd control products could tap into emerging public safety needs, creating a niche market. Think about applications for large-scale event security beyond traditional policing, or even specialized containment for industrial emergencies. This segment, while currently representing a smaller portion of their market share, holds significant growth potential.

To capitalize on this, Cadre would need targeted marketing and product development. The focus would be on demonstrating the unique value proposition of their specialized solutions to specific user groups. For instance, introducing advanced containment barriers for biological hazard response or enhanced perimeter security for critical infrastructure protection.

- Emerging Markets: Potential growth in specialized applications like critical infrastructure protection and response to unique public safety events.

- Market Share: Currently a low market share segment, suggesting ample room for expansion.

- Growth Potential: High growth prospects due to the evolving nature of public safety challenges.

- Strategic Focus: Requires dedicated marketing and adoption strategies to gain traction beyond conventional crowd control.

Cadre Holdings' ventures into new nuclear safety sub-verticals, such as specialized remote handling and niche robotics, represent areas with high growth potential but currently low market share. These segments are characterized by significant investment requirements for research, development, and market penetration, typical of Question Marks in the BCG matrix. The company's strategic allocation of resources to these nascent markets underscores a commitment to future expansion, aiming to convert these initial investments into dominant market positions.

Cadre's international expansion efforts into new geographies also fall under the Question Mark category. These markets offer substantial growth prospects but demand considerable upfront investment in establishing infrastructure, building brand recognition, and forging strategic alliances. The success of these ventures hinges on Cadre's ability to navigate diverse regulatory landscapes and competitive environments, mirroring the high-risk, high-reward profile of Question Marks.

The company's investment in novel, unproven product innovations, like AI-driven threat detection systems, further exemplifies its Question Mark strategy. While these innovations hold the promise of significant future returns, their market acceptance and scalability remain uncertain. Cadre's approach involves substantial R&D and marketing expenditures to drive adoption and establish market presence, a hallmark of managing Question Mark business units.

Cadre Holdings' specialized crowd control products for emerging public safety needs also represent a Question Mark. While these niche applications offer high growth potential, they currently hold a low market share. The company must focus on targeted marketing and product development to demonstrate their unique value proposition and gain traction in these specialized segments.

| Business Unit | Market Growth | Relative Market Share | BCG Classification | Strategic Implication |

| Nuclear Safety Sub-verticals | High | Low | Question Mark | Increase investment, develop market share |

| International Expansion | High | Low | Question Mark | Significant investment, market development |

| Unproven Product Innovations (e.g., AI Threat Detection) | High | Low | Question Mark | R&D, marketing investment, market acceptance |

| Specialized Crowd Control | High | Low | Question Mark | Targeted marketing, product refinement |

BCG Matrix Data Sources

Our Cadre Holdings BCG Matrix leverages a robust data foundation, incorporating internal financial performance metrics, comprehensive market share analysis, and industry growth projections.