Cadre Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadre Holdings Bundle

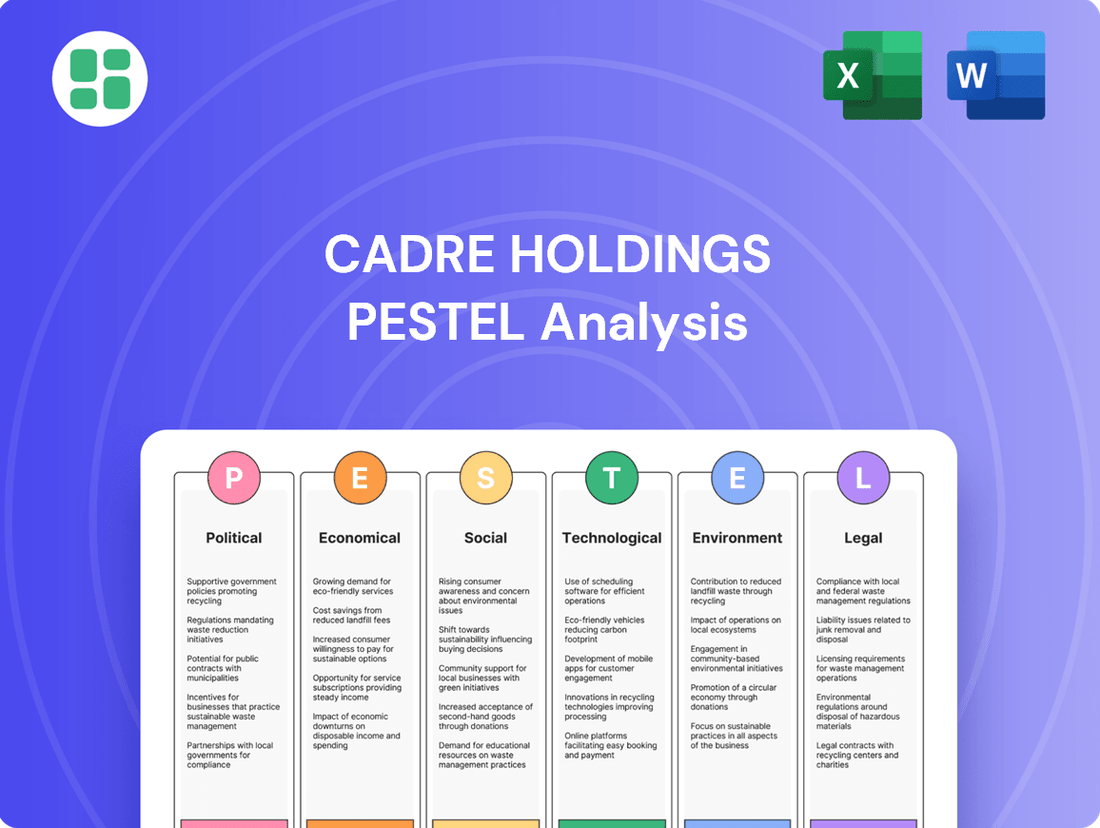

Cadre Holdings operates within a dynamic environment shaped by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights.

Gain a competitive advantage by leveraging our expert-crafted PESTLE analysis for Cadre Holdings. Discover how political stability, economic growth, social trends, technological innovation, environmental regulations, and legal frameworks are impacting its operations and future trajectory. Equip yourself with the knowledge to make informed decisions.

Unlock the full potential of your market strategy with our detailed PESTLE analysis of Cadre Holdings. This report provides a deep dive into the external factors that matter most, empowering you to anticipate challenges and capitalize on opportunities. Download the complete version now for immediate strategic clarity.

Political factors

Cadre Holdings' performance is closely tied to government expenditure on defense and public safety. Increased government spending in these sectors directly translates into greater demand for Cadre's specialized equipment and services.

Global defense spending saw a notable increase of 8.1% in 2024, reaching $2.3 trillion, and projections indicate a further rise to $2.68 trillion in 2025. This upward trend presents a robust market opportunity for Cadre Holdings.

The U.S. Department of Defense's proposed budget for fiscal year 2025, amounting to $849.8 billion, highlights a strategic focus on modernizing military capabilities. This investment directly supports companies like Cadre Holdings that supply essential equipment for these upgrades.

Ongoing geopolitical tensions, including the Russia-Ukraine war and the Israel-Hamas conflict, are significantly boosting global defense spending. This increased investment directly translates into higher demand for safety and survivability solutions, a core area for Cadre Holdings. Nations are prioritizing military modernization, leading to greater procurement of advanced equipment.

Cadre Holdings' historical performance demonstrates a strong resilience across diverse geopolitical landscapes. This suggests the company is well-positioned to capitalize on the current environment, which necessitates enhanced military capabilities and advanced protective gear for armed forces globally.

Changes in international trade policies, such as new tariffs or export controls, directly influence Cadre Holdings' global manufacturing and distribution networks. For instance, China's January 2025 decision to add 28 U.S. companies to its dual-use export control list highlights potential disruptions for defense contractors and their intricate supply chains.

These types of governmental actions can significantly increase operational costs for Cadre by making it more expensive to source necessary materials or by imposing restrictions on where they can distribute their finished products internationally.

Government Contracts and Procurement Processes

Cadre Holdings' revenue is significantly influenced by government contracts, necessitating careful navigation of evolving procurement procedures. The National Defense Authorization Act for Fiscal Year 2025, for instance, introduces measures to expedite acquisitions and bolster the defense industrial base. This legislation favors companies offering commercial off-the-shelf solutions and adhering to stringent compliance requirements.

The Department of Defense's emphasis on utilizing authorities to accelerate the procurement of commercial products and solutions presents both opportunities and challenges for Cadre Holdings. Companies demonstrating agility and alignment with these priorities are better positioned to secure contracts. For example, the DoD's stated intent to leverage existing commercial item acquisition authorities more broadly could streamline the process for suppliers like Cadre, provided they meet the defined criteria.

- Legislative Impact: The NDAA FY2025 aims to streamline defense acquisitions, potentially benefiting companies like Cadre Holdings that can adapt to new procurement pathways.

- Department of Defense Priorities: The DoD's focus on expediting acquisitions through commercial product authorities signals a shift that Cadre must align with to maintain competitiveness.

- Compliance and Standards: Meeting specific compliance standards and offering commercial solutions are increasingly critical for securing government contracts in the current environment.

International Relations and Defense Alliances

Strong defense alliances, particularly with U.S. and NATO partners, directly impact Cadre Holdings by driving demand for interoperable safety and survivability equipment. This is evident in the first quarter of FY 2025, where 64% of proposed direct commercial sales of defense equipment involved NATO 5+ partners, signaling sustained investment in allied defense capabilities.

Furthermore, the ongoing emphasis by administrations, such as the Trump administration's call for increased defense investments from allies, acts as a significant stimulus for the defense products market. This geopolitical push encourages greater spending on military hardware and protective gear, benefiting companies like Cadre Holdings that supply these essential items.

- Interoperability Demand: Alliances necessitate equipment that works seamlessly across different national forces, boosting demand for Cadre's specialized gear.

- FY25 Q1 Sales Trends: 64% of proposed defense sales involved NATO 5+ partners, highlighting the importance of this bloc for growth.

- Ally Investment Push: Calls for increased defense spending by key allies create a more favorable market environment for defense contractors.

Government spending remains a critical driver for Cadre Holdings, especially within defense and public safety sectors. The global defense market continues its upward trajectory, with projected spending reaching $2.68 trillion in 2025, up from $2.3 trillion in 2024, presenting significant opportunities for Cadre.

Geopolitical instability, such as the ongoing conflicts in Eastern Europe and the Middle East, is fueling increased defense budgets worldwide, directly benefiting companies like Cadre that provide essential safety and survivability equipment. The U.S. Department of Defense's fiscal year 2025 budget of $849.8 billion underscores a commitment to modernizing military capabilities, aligning with Cadre's product offerings.

Changes in international trade policies and export controls can impact Cadre's supply chain and market access. For instance, China's export control measures in early 2025 highlight the need for companies to navigate complex global trade regulations to maintain operational efficiency and market reach.

| Factor | Impact on Cadre Holdings | Supporting Data (2024/2025) |

|---|---|---|

| Government Defense Spending | Directly drives demand for Cadre's equipment and services. | Global defense spending to reach $2.68 trillion in 2025. U.S. DoD FY25 budget: $849.8 billion. |

| Geopolitical Tensions | Increases global defense expenditure, boosting demand for protective gear. | Ongoing conflicts spurring significant investment in military modernization. |

| Trade Policies & Export Controls | Can disrupt supply chains and affect international distribution. | Example: China's 2025 export control list impacting dual-use technologies. |

| Defense Procurement Reforms | Streamlining acquisition processes favors agile companies. | NDAA FY2025 aims to expedite defense acquisitions, favoring commercial solutions. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Cadre Holdings across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape opportunities and threats, aiding strategic decision-making for Cadre Holdings.

Provides a clear, actionable overview of the external factors impacting Cadre Holdings, serving as a vital tool for strategic decision-making and risk mitigation.

Economic factors

Global economic stability is a crucial factor for Cadre Holdings, as government budgets for defense and public safety directly influence their sales. Even with some economic uncertainties, Cadre Holdings demonstrated resilience, posting robust Q1 2025 financial results that highlight ongoing demand for their essential safety equipment. However, a significant global economic slowdown could strain public sector finances, potentially leading to decreased spending on these vital products.

Rising inflation in 2024 and projected into 2025 presents a dual challenge for Cadre Holdings. Increased costs for raw materials and manufacturing could squeeze gross profit margins. While Cadre's Q1 2025 performance demonstrated resilience with improved gross profit margins, partly due to effective pricing strategies offsetting material inflation, persistent inflationary pressures remain a key concern for sustained profitability.

Higher interest rates, a common response to inflation, also impact Cadre Holdings. The cost of borrowing for the company itself may increase, affecting its ability to finance operations or expansion. Furthermore, elevated interest rates can dampen demand from Cadre's customers by making financing for their purchases more expensive, potentially slowing sales growth.

Government spending on police and law enforcement equipment is a key factor for Cadre Holdings. The market for these goods is projected to expand by $1.50 billion between 2024 and 2029, with an expected compound annual growth rate of 6.7%. This growth is fueled by an increasing emphasis on public safety and greater governmental investment in these areas.

Cadre's strategic moves, like entering the nuclear safety sector, highlight how the company capitalizes on government funding for critical infrastructure projects. This expansion directly aligns with opportunities arising from specific government budget allocations in sensitive and vital sectors.

Exchange Rate Fluctuations

Cadre Holdings, as a global entity, faces significant exposure to exchange rate fluctuations. These shifts directly affect the cost of raw materials and components sourced internationally, as well as the value of revenue earned from overseas sales when repatriated. For instance, a strengthening US dollar could make imported parts cheaper but reduce the dollar-equivalent earnings from sales in countries with weaker currencies.

The volatility of currency markets presents a challenge to consistent profitability. In 2024, major currency pairs like EUR/USD saw notable swings, with the euro experiencing periods of both appreciation and depreciation against the dollar. Similarly, emerging market currencies can exhibit even greater volatility, impacting Cadre's margins in those regions.

Effective management of currency risk is therefore paramount for Cadre Holdings. Strategies such as hedging through forward contracts or options can mitigate the impact of adverse currency movements. The company's ability to navigate these financial complexities is critical for maintaining its competitive edge and financial stability across its international operations.

- Impact on Costs: A 10% depreciation of the US dollar against the Euro could increase the cost of components sourced from the Eurozone by 10% in dollar terms.

- Impact on Revenue: Conversely, a 10% appreciation of the US dollar against the Japanese Yen could decrease the dollar value of sales made in Japan by 10%.

- Hedging Strategies: Cadre Holdings may utilize financial instruments to lock in exchange rates for future transactions, aiming to protect profit margins.

- 2024 Currency Trends: The US dollar showed resilience in early 2024, but forecasts suggest potential weakening later in the year due to interest rate differentials, impacting companies with significant international trade.

Supply Chain Costs and Raw Material Prices

The cost and availability of essential raw materials, like UHMWPE and ceramics for body armor, and components for EOD tools, are critical drivers of Cadre Holdings' production expenses. Fluctuations in these input prices directly impact the company's cost of goods sold and overall profitability.

The aerospace and defense sector faced significant supply chain volatility in 2024. Reports indicated a 35% year-over-year increase in disruptions, stemming from events such as factory fires, labor disputes, and severe weather patterns. This heightened instability translates to higher operational costs and potential lead time extensions for Cadre Holdings' product deliveries.

- Raw Material Volatility: Prices for key materials like UHMWPE and ceramics are subject to market forces, impacting Cadre's manufacturing budget.

- Supply Chain Disruptions: A 35% rise in aerospace and defense supply chain disruptions during 2024, driven by fires, labor issues, and weather, directly affects Cadre's operational efficiency.

- Increased Costs: These supply chain challenges lead to elevated input costs and can cause delays in fulfilling customer orders, potentially impacting revenue recognition.

The market for public safety and defense equipment, a core area for Cadre Holdings, is projected to grow significantly. Analysts forecast a $1.5 billion expansion between 2024 and 2029, with an anticipated compound annual growth rate of 6.7%. This upward trend is driven by increased government focus on national security and public safety initiatives, directly benefiting Cadre's sales pipeline.

Inflationary pressures in 2024 and continuing into 2025 pose a challenge, potentially increasing raw material and manufacturing costs. While Cadre Holdings reported improved gross profit margins in Q1 2025, partly due to strategic pricing, sustained inflation could still impact profitability. Higher interest rates, often accompanying inflation, also raise borrowing costs for Cadre and can make financing more expensive for its customers.

Cadre Holdings' global operations expose it to currency exchange rate fluctuations. A stronger US dollar, for instance, could reduce the dollar value of international earnings. The company's Q1 2025 results showed resilience, but ongoing currency volatility, as seen in major pairs like EUR/USD in 2024, necessitates robust risk management strategies to protect profit margins.

Full Version Awaits

Cadre Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cadre Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Cadre Holdings' market landscape, enabling informed strategic planning.

Sociological factors

Public sentiment towards law enforcement and military entities directly impacts their operational capacity and, consequently, the demand for their equipment. Positive public perception often translates to increased funding and support for these institutions, creating a more favorable market environment for companies like Cadre Holdings.

Heightened security concerns and a greater emphasis on protecting public spaces, particularly in 2024 and projected into 2025, are significant drivers for the law enforcement and security equipment market. This trend fuels demand for advanced protective gear, surveillance technology, and other solutions Cadre Holdings provides.

Conversely, negative public perception can lead to scrutiny, calls for budget reductions, or stricter regulations on law enforcement and military operations. Such shifts could dampen demand for specialized equipment, posing a potential challenge for Cadre Holdings' product sales and market penetration.

Societal shifts are significantly impacting the demand for personal protection. As awareness of evolving threats grows, so does the desire for enhanced safety, extending beyond official channels. This heightened safety consciousness is translating into increased demand for personal protective equipment (PPE) across various professional fields and even among the general public.

The market for bulletproof vests exemplifies this trend, with projections indicating substantial growth. This sector is expected to expand from an estimated $1.58 billion in 2025 to $2.69 billion by 2034. This upward trajectory is fueled by innovations in protective materials and a broadening demand base that now includes not only defense and law enforcement but also civilian applications.

The availability of a skilled workforce is paramount for Cadre Holdings, especially in manufacturing specialized safety and survivability products. The defense manufacturing sector, in particular, has grappled with a declining pool of skilled labor. For instance, a 2023 report by the National Association of Manufacturers highlighted that 77% of manufacturers reported difficulty finding skilled workers, a figure that has remained consistently high.

This scarcity directly impacts Cadre's ability to scale production and manage supply chain complexities. To counter this, Cadre must actively recruit and retain individuals with critical expertise in areas like materials science, advanced engineering, and modern manufacturing techniques. The U.S. Bureau of Labor Statistics projects a 4% growth in manufacturing jobs between 2022 and 2032, but the demand for specialized skills often outpaces this general growth.

Social Unrest and Crime Rates

Heightened social unrest and increasing crime rates directly translate to a greater demand for law enforcement and security equipment, benefiting companies like Cadre Holdings. As public safety concerns grow, agencies are compelled to invest more in critical gear. For instance, in 2023, the U.S. experienced a notable uptick in certain violent crime categories, prompting increased procurement of protective equipment.

This surge in demand is particularly evident in personal protective equipment (PPE) and non-lethal weaponry. Law enforcement agencies are prioritizing officer safety and the de-escalation of potentially volatile situations. This trend is supported by data showing a significant rise in the market for tactical gear and less-lethal options, reflecting a proactive approach to managing public order.

- Increased demand for PPE: Agencies are allocating more resources to ballistic vests and helmets to ensure officer safety amidst rising threats.

- Focus on non-lethal options: Investment in tasers and other incapacitation devices is growing as departments seek to minimize use-of-force incidents.

- Impact on security spending: Public perception of safety directly influences government and private sector security budgets, creating opportunities for companies like Cadre.

- 2024 projections: Analysts anticipate continued growth in the law enforcement equipment market, driven by ongoing security challenges and technological advancements in protective gear.

Evolving Societal Expectations for Ethical Sourcing and Manufacturing

Consumers and government bodies are intensifying their scrutiny of how companies source materials and conduct manufacturing, with a particular focus on ethical practices. This heightened awareness means that businesses, especially those in sensitive sectors like public safety and defense, must proactively showcase responsible supply chain management. For Cadre Holdings, this translates to a need to demonstrate compliance with labor standards and environmental regulations, as such factors increasingly influence procurement choices and overall brand perception.

The demand for ethical sourcing is not just a consumer trend; it's a significant driver in B2B relationships as well. For instance, in 2024, a survey indicated that over 60% of procurement professionals consider a supplier's ethical sourcing policies as a key factor in their decision-making process. This pressure extends to demonstrating fair labor practices throughout the entire production lifecycle, from raw material extraction to final assembly. Companies failing to meet these evolving expectations risk not only reputational damage but also exclusion from lucrative contracts, particularly within government and public sector supply chains.

Cadre Holdings, supplying critical equipment to public safety and defense sectors, faces direct implications from these societal shifts. Procurement mandates are increasingly incorporating clauses related to supply chain transparency and ethical conduct. Reports from late 2024 highlighted a growing number of government tenders requiring suppliers to provide detailed audits of their labor practices and environmental impact. Demonstrating a commitment to these principles is becoming a competitive necessity, directly impacting market access and long-term business viability.

- Increased Demand for Transparency: Stakeholders expect clear visibility into supply chains, from raw materials to finished goods, to verify ethical sourcing and manufacturing.

- Government Scrutiny and Regulation: Public sector procurement increasingly includes stringent requirements for ethical labor practices and environmental sustainability.

- Reputational Impact: Negative publicity surrounding unethical sourcing or manufacturing can severely damage brand image and consumer trust, affecting sales and partnerships.

- Supply Chain Risk Management: Companies must actively manage and mitigate risks associated with labor exploitation, environmental damage, and non-compliance within their extended supply networks.

Societal attitudes toward law enforcement and military operations significantly shape the market for Cadre Holdings' products. Positive public perception often correlates with increased funding and support for these agencies, thereby boosting demand. Conversely, negative sentiment can lead to budget cuts or stricter regulations, potentially hindering sales.

Heightened security concerns, particularly evident in 2024 and projected into 2025, are driving demand for advanced protective gear and surveillance technology. This trend is further amplified by a growing societal emphasis on personal safety, extending demand for personal protective equipment (PPE) beyond traditional sectors. The market for bulletproof vests alone is projected to grow from $1.58 billion in 2025 to $2.69 billion by 2034.

The availability of a skilled workforce is a critical sociological factor impacting Cadre Holdings. The defense manufacturing sector, for example, faces challenges with labor shortages; a 2023 report indicated 77% of manufacturers struggled to find skilled workers. This scarcity directly affects production capacity and necessitates strategic recruitment for specialized roles.

Societal shifts also emphasize ethical sourcing and transparency in manufacturing. In 2024, over 60% of procurement professionals considered a supplier's ethical policies crucial. Cadre Holdings must demonstrate compliance with labor standards and environmental regulations to maintain market access and positive brand perception, especially as government tenders increasingly require such disclosures.

| Sociological Factor | Impact on Cadre Holdings | Supporting Data/Trend |

|---|---|---|

| Public Sentiment towards Law Enforcement/Military | Influences demand for equipment; positive sentiment boosts sales. | Public perception directly affects agency budgets and procurement priorities. |

| Heightened Security Concerns & Personal Safety Awareness | Increases demand for PPE, surveillance, and protective gear. | Bulletproof vest market projected to reach $2.69 billion by 2034 from $1.58 billion in 2025. |

| Skilled Workforce Availability | Affects production capacity and scalability; labor shortages are a challenge. | 77% of manufacturers reported difficulty finding skilled workers in 2023. |

| Ethical Sourcing & Transparency Demands | Requires demonstrable compliance with labor and environmental standards. | Over 60% of procurement professionals prioritize ethical sourcing in 2024. |

Technological factors

Technological factors significantly impact Cadre Holdings, particularly through innovations in materials science for body armor. New polyethylene fibers such as Dyneema, alongside graphene and nanocomposites, are making armor lighter, more flexible, and more protective. For instance, DuPont's Kevlar® EXO™ introduced in 2024 provides a 30% weight reduction while upholding strong ballistic resistance.

Technological advancements in Explosive Ordnance Disposal (EOD) tools and robotics are significantly boosting safety and operational effectiveness. Cadre's Med-Eng® brand, a key player in this sector, benefits directly from continuous research and development in areas like advanced robotics and remote-controlled systems. These innovations are vital for Med-Eng® to maintain its leadership position and provide cutting-edge solutions for hazardous environments.

The increasing digital integration into duty gear and communication is a significant technological factor. Think of smart body cameras and advanced communication devices becoming standard issue. For instance, by the end of 2024, it's estimated that over 80% of major US police departments will have body-worn cameras in use, with many integrating them into real-time data streams.

This digital shift extends to AI-powered tools. These can analyze vast amounts of data to assist in predictive policing, helping agencies allocate resources more effectively. In 2024, investments in AI for public safety are projected to exceed $10 billion globally, indicating a strong industry focus on leveraging these technologies.

Research and Development Investments

Cadre Holdings' commitment to innovation is directly tied to its research and development (R&D) spending. For fiscal year 2023, Cadre Holdings reported R&D expenses of $12.5 million, a notable increase from $9.8 million in fiscal year 2022, signaling a strategic push towards developing advanced solutions. These investments are crucial for creating products that improve protection and operational effectiveness for their customers.

The company's R&D strategy emphasizes developing next-generation protective gear. For example, a key focus area is the exploration of hybrid materials for body armor. This initiative aims to achieve a superior balance of lightweight design and robust multi-hit protection, a critical requirement in modern defense and security applications.

- R&D Investment Growth: Cadre Holdings increased R&D spending to $12.5 million in FY2023, up from $9.8 million in FY2022.

- Product Enhancement Focus: Investments are directed towards developing products that boost protection, performance, and operational capabilities.

- Hybrid Material Exploration: A strategic priority is the development of hybrid materials for body armor, targeting lightweight design with enhanced durability.

Counterfeit Product Detection Technologies

Cadre Holdings, as a producer of vital safety gear, confronts the significant threat posed by counterfeit products. The market for counterfeit goods is substantial; for example, the OECD estimated in 2019 that global trade in counterfeit and pirated goods could reach $461 billion annually, representing about 2.5% of world trade. This highlights the pervasive nature of the problem across industries.

To safeguard its brand reputation, user safety, and product integrity, Cadre's adoption or development of advanced counterfeit detection technologies is paramount. These technologies are crucial for ensuring that only authentic, certified equipment reaches end-users, thereby maintaining trust in Cadre's mission-critical products.

Emerging technologies in this space include:

- Advanced Holography and Security Tagging: Incorporating sophisticated holographic labels or embedded security threads that are difficult to replicate.

- Serialization and Blockchain Tracking: Assigning unique serial numbers to each product and leveraging blockchain technology for immutable tracking from manufacturing to sale.

- Material Science and Chemical Signatures: Embedding unique, undetectable chemical markers or using specialized materials that can be verified through specific testing.

- Digital Watermarking and AI-powered Verification: Embedding invisible digital codes within product designs or packaging that can be authenticated by specialized software, often enhanced with AI for pattern recognition.

Technological advancements are reshaping the protective gear industry, directly benefiting Cadre Holdings. Innovations in materials science, such as advanced polyethylene fibers and composites, are enabling lighter, more flexible, and more protective body armor. For instance, new materials introduced in 2024 are offering significant weight reductions while maintaining ballistic resistance.

Furthermore, the integration of digital technologies into duty gear, including smart body cameras and enhanced communication systems, is becoming standard. By the end of 2024, a substantial majority of major US police departments are expected to utilize body-worn cameras, often linked to real-time data streams.

Cadre's strategic investments in research and development underscore its commitment to leveraging these technological shifts. The company's R&D spending saw a notable increase in FY2023, signaling a focus on developing next-generation protective solutions and exploring novel materials for enhanced performance.

Legal factors

Cadre Holdings operates in sectors where product liability and safety regulations are extremely stringent. For instance, body armor and related protective gear must meet rigorous standards set by bodies like the National Institute of Justice (NIJ). The NIJ's updated standard, NIJ 0101.07, introduced more demanding testing protocols for ballistic resistance, directly impacting manufacturers like Cadre.

Failure to comply with these evolving safety specifications can lead to significant product liability claims and potentially restrict market access. In 2024, the emphasis on enhanced performance and reliability in personal protective equipment means that companies must invest heavily in research, development, and quality control to ensure their products meet or exceed these critical benchmarks. This regulatory environment necessitates continuous adaptation and robust compliance strategies.

Cadre Holdings must meticulously adhere to export controls and international trade laws, critical for its worldwide product distribution. The U.S. Directorate of Defense Trade Controls (DDTC) oversees the commercial export of defense items and services designated on the U.S. Munitions List (USML), a key area for Cadre's operations.

Navigating these intricate regulations is paramount for Cadre to conduct lawful international sales and avert significant penalties. For instance, in 2023, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) reported over $1 billion in penalties for export control violations, highlighting the financial risks involved.

Cadre Holdings relies heavily on intellectual property rights, including patents, to protect its innovative solutions and specialized equipment. This legal shield is crucial for maintaining its competitive edge and preventing rivals from copying its proprietary technologies and designs. Safeguarding these assets directly supports its substantial investments in research and development, solidifying its market position.

Compliance with Defense Procurement Regulations

Cadre Holdings operates within a landscape heavily influenced by defense procurement regulations. Key among these are the stipulations within the National Defense Authorization Act (NDAA), which dictate crucial aspects of government contracting. These regulations encompass everything from the specific terms of contracts and allowable pricing structures to the critical requirement of robust supply chain security. Failure to comply can jeopardize a company's ability to secure and retain vital government contracts, which represent a substantial portion of Cadre's overall revenue.

Navigating these legal requirements is not merely a procedural hurdle; it's a fundamental pillar of Cadre's business model. For instance, the 2024 NDAA continued to emphasize cybersecurity measures for defense contractors, requiring enhanced protection of sensitive data and systems. This directly impacts Cadre's operational protocols and investment in compliance technologies. In 2023, the Department of Defense awarded over $600 billion in prime contracts, underscoring the immense market opportunity but also the high stakes associated with regulatory adherence.

- Contractual Adherence: Cadre must meticulously follow terms, conditions, and performance metrics stipulated in government contracts, often governed by the Federal Acquisition Regulation (FAR).

- Pricing and Cost Controls: Regulations dictate allowable costs and profit margins, requiring transparent accounting and rigorous cost management to ensure compliance and maintain profitability.

- Supply Chain Integrity: Ensuring the security and reliability of its entire supply chain, from raw materials to finished goods, is mandated by defense procurement laws to prevent counterfeiting and ensure national security.

- Cybersecurity Mandates: Compliance with evolving cybersecurity standards, such as those outlined in NIST SP 800-171, is increasingly critical for protecting sensitive government information.

Labor Laws and Employment Regulations

Cadre Holdings, as a global manufacturer, navigates a complex web of labor laws and employment regulations across its operational territories. Compliance with these diverse rules, covering worker safety, minimum wage standards, acceptable working conditions, and prohibitions against discrimination, is paramount to its global operations.

Labor disruptions were identified as a significant supply chain impediment within the aerospace and defense sector throughout 2024. This underscores the critical importance for companies like Cadre Holdings to cultivate strong labor relations and maintain rigorous adherence to all relevant employment legislation.

- Global Compliance Burden: Cadre Holdings must adhere to varying labor laws in each country of operation, impacting everything from hiring practices to termination procedures.

- Worker Safety Mandates: Regulations concerning workplace safety, including equipment standards and hazard protocols, are a constant focus, with significant penalties for non-compliance.

- Wage and Hour Laws: Adherence to minimum wage, overtime pay, and fair working hour regulations is essential, with potential for substantial financial penalties and reputational damage if violated.

- Non-Discrimination Policies: Employment practices must align with laws preventing discrimination based on race, gender, age, religion, and other protected characteristics.

Cadre Holdings must navigate stringent product safety regulations, such as the NIJ 0101.07 standard for body armor, impacting R&D and quality control investments. Failure to comply can lead to product liability claims and market access issues, a critical consideration given the 2024 emphasis on enhanced protective equipment performance. The company also faces significant legal hurdles in adhering to export controls and international trade laws, with U.S. BIS penalties for violations exceeding $1 billion in 2023, highlighting the financial risks of non-compliance.

Environmental factors

Cadre Holdings faces growing pressure to adopt sustainable manufacturing. This means actively reducing waste, cutting down on energy use, and incorporating greener materials into their safety and survivability gear. For instance, in 2024, many companies in the defense and safety sectors are exploring recycled polymers and low-emission manufacturing processes to align with global environmental goals.

By prioritizing sustainability, Cadre Holdings can significantly boost its brand image and appeal to a market increasingly concerned with environmental responsibility. Meeting stricter environmental regulations, which are becoming more common across various jurisdictions, and satisfying customer demand for eco-conscious products are key drivers for this shift.

Cadre Holdings' manufacturing of specialized equipment, such as explosive ordnance disposal (EOD) tools and advanced body armor, often involves materials that are classified as hazardous. This necessitates robust waste management protocols. For instance, the production of certain chemical compounds used in protective gear or the disposal of spent materials from manufacturing processes must comply with stringent environmental standards.

Failure to manage and dispose of these hazardous materials correctly can lead to significant environmental contamination and substantial legal penalties. In 2023, the U.S. Environmental Protection Agency (EPA) reported that improper disposal of industrial waste cost businesses billions in cleanup and fines, underscoring the financial risks associated with non-compliance. Cadre Holdings must ensure all disposal practices align with both domestic regulations, like the Resource Conservation and Recovery Act (RCRA), and international environmental agreements.

Cadre Holdings' manufacturing operations inherently involve energy consumption, creating an environmental footprint. Reducing this consumption offers dual benefits: it's good for the planet and can significantly lower operational costs. For instance, in 2023, the industrial sector globally saw energy efficiency measures contribute to an estimated 2-3% reduction in energy intensity, a trend Cadre can leverage.

By adopting energy-efficient technologies and optimizing production processes, Cadre aligns with the growing global emphasis on sustainability. This not only enhances its corporate image but also directly impacts the bottom line by cutting down on utility expenses. Companies that prioritize energy efficiency often see a tangible decrease in their operating expenditures, potentially freeing up capital for other strategic investments.

Compliance with Environmental Regulations

Cadre Holdings navigates a complex landscape of environmental regulations, which are increasingly stringent globally. These rules dictate everything from emissions standards to waste management practices, directly impacting operational costs and strategic planning. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and the Clean Water Act, with potential penalties for violations escalating.

Failure to adhere to these environmental mandates can lead to severe consequences. These include substantial financial penalties, costly litigation, and significant damage to Cadre Holdings' brand reputation. In 2023, companies across various sectors faced billions in environmental fines, underscoring the financial risks associated with non-compliance.

Key areas of environmental compliance for Cadre Holdings include:

- Air Emissions: Monitoring and controlling pollutants released into the atmosphere.

- Water Discharge: Managing wastewater quality and disposal methods to prevent water contamination.

- Chemical Management: Ensuring safe handling, storage, and disposal of hazardous chemicals.

- Waste Disposal: Complying with regulations for solid and hazardous waste management and recycling.

Climate Change Impact on Operational Environments

While Cadre Holdings doesn't directly manufacture goods impacted by climate change, the increasing frequency and intensity of extreme weather events globally can significantly disrupt its operational environment. These events can cause supply chain interruptions, affecting the delivery of critical equipment to first responders and military personnel. For instance, severe flooding or prolonged droughts can hinder transportation networks, delaying essential shipments.

The broader implications of climate change, such as more volatile weather patterns, can indirectly influence the demand for Cadre's survivability equipment. As operational environments become more challenging and unpredictable, there's a growing need for gear designed to withstand diverse and extreme conditions. This could translate into increased demand for products offering enhanced protection against environmental hazards.

- Supply Chain Disruption: Extreme weather events, like those experienced in 2024 with record-breaking heatwaves and severe storms in various regions, can disrupt logistics and manufacturing processes, impacting Cadre's ability to source components and deliver finished goods.

- Increased Demand for Resilient Gear: The need for equipment that can function reliably in harsh or rapidly changing environmental conditions is likely to grow, potentially boosting sales for specialized protective gear.

- Operational Challenges for End-Users: First responders and military personnel increasingly operate in environments affected by climate change, requiring robust and adaptable equipment to ensure mission success and personal safety.

Cadre Holdings must navigate evolving environmental regulations concerning emissions, waste, and chemical management. For example, in 2024, the EPA continued to enforce stringent standards like the Clean Air Act, with non-compliance risking significant fines. The company’s production of specialized safety gear, such as body armor, involves materials requiring careful hazardous waste disposal, a process governed by regulations like RCRA.

Energy efficiency presents a key opportunity for Cadre Holdings to reduce operational costs and enhance its environmental profile. By adopting greener technologies, the company can align with global sustainability trends, similar to how the industrial sector in 2023 saw energy intensity reductions of 2-3% through efficiency measures. This focus not only improves corporate image but also directly impacts the bottom line through lower utility expenses.

Extreme weather events, increasingly common due to climate change, pose risks to Cadre Holdings' supply chain and operations. Disruptions in 2024, such as severe storms impacting logistics, can delay critical equipment deliveries. Conversely, these challenging conditions may increase demand for the company's resilient protective gear, designed for harsh environments.

PESTLE Analysis Data Sources

Our Cadre Holdings PESTLE analysis is built on a comprehensive review of official government reports, reputable industry publications, and leading economic data providers. We integrate insights from regulatory bodies, market research firms, and technology trend analyses to ensure accuracy and relevance.