Bystronic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bystronic Bundle

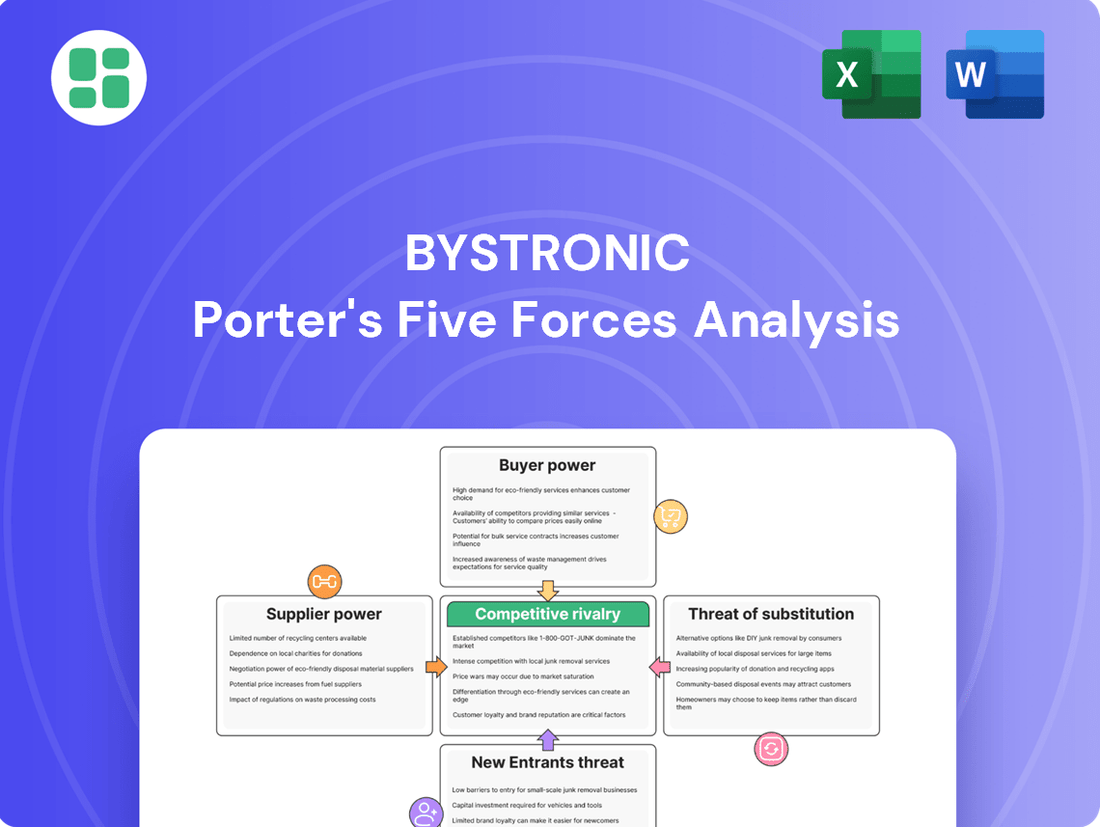

Bystronic's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for any stakeholder in the sheet metal processing industry.

The full Porter's Five Forces Analysis delves into the intricate interplay of these forces, revealing the underlying pressures and opportunities that define Bystronic's market position. Unlock actionable insights to navigate this complex environment and drive strategic success.

Suppliers Bargaining Power

Bystronic's reliance on highly specialized components, like advanced laser sources and precision optics, from a select group of global suppliers significantly amplifies supplier bargaining power. These niche suppliers, often holding patents or requiring substantial R&D, can dictate terms. For instance, a key supplier of a critical laser resonator, with only a few alternatives globally, could command higher prices, impacting Bystronic's cost structure.

The market for critical, advanced technological components, like specialized laser sources or high-precision control systems, vital for Bystronic's advanced machinery, is often characterized by significant supplier concentration. This means a small number of manufacturers control the supply of these essential parts.

When suppliers are few and dominant, they naturally hold considerable bargaining power. Bystronic, like other companies in similar situations, faces limited choices for sourcing these components, which can directly influence their ability to negotiate favorable pricing and terms.

For instance, if a key supplier of optical components for laser cutting systems experiences production issues or decides to increase prices, Bystronic's cost structure and production schedules could be significantly impacted. In 2023, the semiconductor industry, a key component supplier for many advanced manufacturing technologies, saw price increases for certain specialized chips due to high demand and limited production capacity, illustrating this dynamic.

Switching suppliers for critical, integrated components in Bystronic's advanced laser cutting systems presents substantial hurdles. The costs associated with re-engineering machinery, re-tooling production lines, and conducting extensive compatibility and performance testing are considerable, creating a strong incentive to maintain existing supplier relationships.

Forward Integration Threat by Suppliers

Suppliers of critical technologies or advanced components could threaten Bystronic through forward integration, essentially entering the sheet metal processing equipment market themselves. This is a real concern if these suppliers have proprietary technology, substantial financial backing, and strong connections across manufacturing industries.

Such a strategic shift by suppliers would directly intensify competition for Bystronic. For instance, a leading supplier of high-precision laser sources or advanced robotic automation systems might see an opportunity to capture more value by offering complete solutions rather than just components.

- Potential for Supplier Forward Integration: Suppliers with unique technological capabilities and significant capital resources could directly enter Bystronic's market.

- Increased Competitive Landscape: This move would introduce new competitors, potentially impacting Bystronic's market share and pricing power.

- Strategic Importance of Key Components: Suppliers of essential, high-value components are more likely to consider such a strategic pivot.

Importance of Supplier's Input to Bystronic's Product

The quality, innovation, and reliability of Bystronic's high-precision industrial machines are directly tied to the components its suppliers provide. If a supplier's input is crucial for Bystronic's competitive edge and how its products function, that supplier holds significant influence.

This dependence means Bystronic must cultivate strong supplier relationships, but it also inherently increases the bargaining power of those suppliers. For instance, in 2023, Bystronic reported that its cost of materials and components represented a significant portion of its total operating expenses, highlighting the financial impact of supplier relationships.

- Critical Components: Suppliers of specialized electronic components or advanced materials essential for Bystronic's cutting-edge laser and bending technologies wield considerable power.

- Innovation Dependence: If suppliers are the source of unique technological advancements integrated into Bystronic's machines, their bargaining position is strengthened.

- Reliability Factor: The consistent performance and timely delivery of parts from key suppliers directly affect Bystronic's production schedules and customer satisfaction, giving reliable suppliers leverage.

Bystronic's reliance on a concentrated number of suppliers for highly specialized components, such as advanced laser sources and precision optics, grants these suppliers significant bargaining power. The high switching costs for Bystronic, involving re-engineering and re-tooling, further solidify this leverage. Suppliers of critical, innovative parts also hold sway, as their contributions directly impact Bystronic's product quality and competitive edge.

For example, a supplier of a crucial laser resonator, with few global alternatives, can command higher prices, impacting Bystronic's cost structure. In 2023, the semiconductor industry, a key supplier for advanced manufacturing technologies, experienced price increases for certain specialized chips due to high demand and limited capacity, demonstrating this dynamic.

| Supplier Characteristic | Impact on Bystronic | Example Scenario |

|---|---|---|

| Supplier Concentration | Limited sourcing options, increased negotiation leverage for suppliers. | A single dominant supplier for high-precision control systems. |

| Switching Costs | High costs for Bystronic to change suppliers (re-engineering, testing). | Re-tooling production lines for new component integration. |

| Component Criticality & Innovation | Suppliers of unique or essential technologies hold significant power. | A supplier providing proprietary laser beam shaping technology. |

What is included in the product

This analysis dissects the competitive landscape for Bystronic by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the sheet metal processing industry.

Effortlessly visualize competitive intensity across all five forces with a dynamic, interactive dashboard.

Gain immediate clarity on market threats and opportunities, enabling faster, more informed strategic responses.

Customers Bargaining Power

Customer concentration, particularly with large industrial clients or multi-site corporations, can significantly influence Bystronic's bargaining power. These major buyers, often requiring extensive automation solutions, can leverage their substantial purchase volumes to negotiate more favorable pricing, demand tailored features, or secure comprehensive after-sales support. For instance, a single major automotive manufacturer placing a large order for multiple automated cutting and bending systems could represent a considerable portion of Bystronic's quarterly revenue, giving them considerable leverage.

While Bystronic excels in specialized, integrated solutions for sheet metal processing, the basic functionalities of some equipment can be perceived as standardized. This means if customers don't see enough unique value in Bystronic's offerings for their specific applications, their ability to negotiate prices or terms goes up.

Bystronic counters this by emphasizing its integrated software and complete workflow optimization. This strategy aims to create a distinct value proposition that reduces the perception of standardization and, consequently, lessens customer bargaining power. For instance, their investment in digital services and smart factory solutions aims to lock in customers with unique, hard-to-replicate benefits.

Customers investing in Bystronic's high-value machinery, integrated software, and automation solutions face substantial switching costs. These costs include the significant capital outlay for new equipment, the expense of re-training personnel on different systems, and the operational disruption involved in integrating new machinery into existing production workflows. For instance, a company deeply embedded in Bystronic's software ecosystem for laser cutting and bending might find it prohibitively expensive and time-consuming to migrate to a competitor's platform.

The loss of sunk costs in their current Bystronic setup also plays a crucial role. This includes investments in specialized tooling, maintenance contracts, and established operational procedures that are optimized for Bystronic equipment. These high switching costs effectively reduce customer bargaining power once they are committed to Bystronic, as the financial and operational penalties for switching are considerable.

Customer's Ability to Backward Integrate

For most of Bystronic's clientele, the idea of backward integrating to manufacture their own sophisticated sheet metal processing machinery is largely out of reach. This is primarily due to the highly specialized nature of the technology, substantial research and development expenses, and the intricate manufacturing processes required.

While a few exceptionally large corporations might possess the theoretical capacity, the practical hurdles make it an unlikely scenario, thereby significantly diminishing this particular avenue of customer leverage.

- High R&D Investment: Developing advanced laser cutting and bending technologies demands billions in research and development, a barrier most customers cannot overcome.

- Manufacturing Complexity: Producing precision machinery involves highly specialized tooling, skilled labor, and rigorous quality control, making in-house production impractical for most.

- Economies of Scale: Bystronic benefits from economies of scale in production, offering competitive pricing that is difficult for individual customers to match if they were to produce their own equipment.

Price Sensitivity of Customers

Customers in the sheet metal processing sector, especially smaller and medium-sized businesses, often exhibit price sensitivity. This is largely due to the substantial upfront investment needed for Bystronic's sophisticated machinery. For instance, in 2024, many SMEs faced tighter credit conditions, making the significant capital outlay for advanced laser cutting or bending systems a critical consideration.

While Bystronic highlights the long-term operational benefits and efficiency gains their systems offer, the initial purchase price remains a key decision driver. This inherent price sensitivity can translate into direct pressure on Bystronic to offer competitive pricing, particularly when economic conditions are less favorable or when customers are evaluating multiple equipment suppliers.

- Price Sensitivity: SMEs, a significant customer base for Bystronic, are often price-sensitive regarding large capital expenditures.

- Economic Impact: Economic downturns and restricted credit access in 2024 amplified customer focus on initial investment costs.

- Value Proposition: Bystronic's emphasis on long-term efficiency must be weighed against the immediate financial burden for customers.

- Competitive Pressure: The need to secure sales in a competitive market can lead customers to negotiate harder on price.

Bystronic's customers possess moderate bargaining power, largely influenced by their concentration and price sensitivity. Large industrial clients, representing significant purchase volumes, can negotiate favorable terms, while smaller businesses often prioritize initial cost due to the substantial investment required for Bystronic's advanced machinery. For example, in 2024, many SMEs faced tighter credit conditions, increasing their focus on upfront pricing.

The bargaining power of Bystronic's customers is tempered by high switching costs associated with their integrated software and automation solutions. These costs, encompassing capital outlay, retraining, and operational disruption, make migration to competitors difficult. Furthermore, backward integration by customers to produce their own machinery is impractical due to Bystronic's high R&D investment and manufacturing complexity.

| Factor | Impact on Bargaining Power | Bystronic's Mitigation Strategy |

|---|---|---|

| Customer Concentration | High for large clients | Emphasize integrated solutions and workflow optimization |

| Price Sensitivity | Moderate to High for SMEs | Highlight long-term efficiency and operational benefits |

| Switching Costs | Lowers bargaining power | Develop proprietary software and digital services |

| Threat of Backward Integration | Very Low | Focus on R&D and manufacturing complexity |

Preview the Actual Deliverable

Bystronic Porter's Five Forces Analysis

This preview showcases the complete Bystronic Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the sheet metal processing industry. You are looking at the actual document; once your purchase is complete, you’ll receive instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The global sheet metal processing equipment market is a crowded arena, featuring numerous established global giants and nimble regional specialists. Bystronic contends with a diverse set of rivals, each vying for market share across its key product lines like laser cutting, press brakes, and automation solutions.

This intense rivalry means competitors often differentiate through technological innovation, service offerings, and pricing strategies. For instance, in 2024, the market saw continued investment in advanced automation and smart factory integration, with companies like TRUMPF and Amada investing heavily in R&D to capture these emerging trends.

The intensity of competitive rivalry within the sheet metal processing industry is directly tied to its growth rate. When the market expands rapidly, like the projected 6.5% CAGR for global metal fabrication from 2024 to 2030, companies can often grow by simply increasing their output to meet rising demand. This generally reduces the need for aggressive competition as there's enough business for everyone.

However, if the industry experiences slower growth or enters a mature phase, competition tends to heat up considerably. In such scenarios, companies like Bystronic may face increased pressure to differentiate themselves through price reductions, enhanced marketing efforts, or quicker development of new technologies to steal market share from rivals. For instance, if the sheet metal processing market were to only grow at 2% in a given year, expect more aggressive pricing strategies.

Bystronic stands out by constantly innovating, offering integrated software, and optimizing the entire customer workflow, from material handling to data management. This deep level of differentiation makes it harder for rivals to directly compete on features or price.

In 2024, the capital equipment sector, including Bystronic's market, saw continued investment in automation and digital solutions. Companies that can offer truly integrated systems, like Bystronic's approach to the entire sheet metal processing chain, gain a significant edge, reducing the impact of direct price wars and fostering a focus on value-added services.

Exit Barriers for Competitors

High exit barriers in the industrial machinery sector, including Bystronic's focus on specialized laser cutting and press brake systems, can trap less profitable competitors. These barriers are often rooted in substantial investments in unique manufacturing equipment and dedicated production facilities, making it economically unfeasible for firms to simply shut down operations. For instance, the capital expenditure for a high-precision CNC machine can run into hundreds of thousands or even millions of dollars, creating a significant sunk cost.

These substantial fixed costs mean that even if a competitor is not generating profits, they might continue operating to recover some of their investment, leading to prolonged market presence. This persistence can result in persistent overcapacity within the industry, as these firms continue to produce goods even at reduced margins. Such a scenario directly intensifies competitive rivalry for Bystronic, as it contributes to downward pressure on pricing and limits opportunities for market share gains.

The financial implications are clear: in 2023, the global industrial machinery market saw significant investment, with companies like Bystronic investing heavily in R&D and production capabilities. This capital intensity means that exiting the market is not a simple decision but often involves substantial write-offs and financial penalties, effectively keeping even struggling players in the game and intensifying competition.

- High Capital Investment: Specialized manufacturing assets in the industrial machinery sector represent significant sunk costs, deterring easy exit.

- Contractual Obligations: Long-term supply agreements and customer contracts can bind companies to operations, even when unprofitable.

- Workforce Reduction Costs: Severance packages and retraining programs for a skilled workforce add to the expense of exiting the market.

- Industry Overcapacity: The presence of firms unable to exit due to these barriers contributes to market oversupply and price erosion.

Strategic Stakes and Commitments

Competitors like Amada and TRUMPF are deeply invested in achieving global market leadership in the sheet metal processing industry. Their commitment is evident in substantial R&D expenditures, aiming for technological breakthroughs in areas like automation and laser cutting. For instance, TRUMPF reported sales of €4.2 billion in fiscal year 2022/23, underscoring their significant investment capacity.

These rivals often accept lower profit margins to gain market share, particularly in emerging economies or for advanced product segments. This aggressive pricing and investment strategy directly impacts Bystronic's competitive landscape, requiring continuous innovation and efficient operations to maintain its own market position.

- Global Market Share Pursuit: Competitors actively seek to expand their global footprint, intensifying rivalry.

- Technological Investment: Significant R&D spending by rivals drives innovation and competitive pressure.

- Margin Sacrifice for Growth: Competitors may accept lower margins to capture market share, forcing strategic responses.

- Product Segment Dominance: Focus on dominating specific product niches leads to concentrated competitive efforts.

The sheet metal processing equipment market is highly competitive, with major players like TRUMPF and Amada actively investing in R&D and automation. This intense rivalry means companies often compete on innovation and integrated solutions rather than solely on price, especially as the market for advanced automation and smart factory integration grows. For example, TRUMPF's significant sales of €4.2 billion in fiscal year 2022/23 highlight their substantial investment capacity driving this competition.

Competitors frequently accept lower profit margins to gain market share, particularly in developing regions or for cutting-edge technologies. This aggressive strategy necessitates continuous innovation and operational efficiency from Bystronic to maintain its standing. The pursuit of global market leadership and dominance in specific product niches by rivals further intensifies these competitive pressures.

The high capital investment required for specialized manufacturing equipment, coupled with contractual obligations and workforce costs, creates significant exit barriers. These barriers ensure that even struggling competitors remain in the market, potentially leading to overcapacity and downward pressure on pricing, which directly impacts Bystronic.

| Key Competitor | 2022/23 Sales (Approx.) | Strategic Focus |

|---|---|---|

| TRUMPF | €4.2 billion | Automation, Digitalization, R&D |

| Amada | (Data not publicly available for 2022/23 in this context) | Innovation, Global Market Share |

| Bystronic | CHF 1,023.7 million (2023) | Integrated Solutions, Workflow Optimization |

SSubstitutes Threaten

While Bystronic is a leader in sheet metal processing, the threat of substitutes looms from alternative manufacturing processes. Advanced additive manufacturing, or 3D printing, is increasingly capable of producing complex parts that might otherwise require sheet metal fabrication. For instance, in 2024, the global 3D printing market was valued at over $20 billion and is projected to grow significantly, indicating a rising adoption rate for these technologies across various industries.

The threat of substitutes for sheet metal processing is growing as advanced materials gain traction. For instance, the aerospace industry, a significant user of sheet metal, is increasingly incorporating lightweight composites. Boeing, a key player, reported that composite materials accounted for approximately 50% of its 787 Dreamliner's primary structure by weight in 2023, a trend that continues to influence material choices across manufacturing sectors.

Specialized plastics and hybrid materials also present viable alternatives in applications where weight reduction and corrosion resistance are paramount. These materials can offer comparable or even superior performance to traditional sheet metal in certain contexts. For example, in the automotive sector, the drive for fuel efficiency has led to a greater adoption of high-strength plastics and aluminum alloys, which can directly compete with steel sheet metal in body panel applications.

If these alternative materials become more cost-effective and widely available, they could erode the demand for sheet metal processing equipment. This directly impacts companies like Bystronic, which specializes in laser cutting and bending machines for sheet metal. A significant shift towards substitute materials would mean a smaller addressable market for their core products, necessitating strategic adaptation.

The threat of substitutes for Bystronic's sheet metal fabrication machinery is significant as customers increasingly opt to outsource their production needs. Specialized service bureaus and contract manufacturers offer an alternative to in-house equipment investment, directly impacting the demand for Bystronic's capital-intensive solutions.

While Bystronic emphasizes the efficiency of its integrated systems for in-house fabrication, the availability of high-quality external fabrication services remains a potent substitute. The global contract manufacturing market, for instance, was valued at approximately $540 billion in 2023 and is projected to grow, indicating a strong existing and expanding alternative.

Manual or Less Automated Processes

For smaller production runs, highly specialized tasks, or businesses with tighter budgets, manual or less automated sheet metal processing remains a viable substitute. These methods, while inherently less efficient and precise than Bystronic's cutting-edge solutions, offer a compelling lower-cost alternative for specific market niches. Businesses not prioritizing high throughput or extensive automation can still achieve satisfactory results with these more traditional approaches.

The existence of these substitutes means that Bystronic cannot simply dictate pricing based on its technological superiority alone. Customers facing lower volume requirements or budget constraints will actively consider these less capital-intensive options. This competitive pressure from manual processes is a key factor in how Bystronic must position its offerings, particularly for small to medium-sized enterprises (SMEs).

Consider the impact on market segments:

- Cost Sensitivity: Businesses prioritizing upfront cost savings over long-term efficiency gains may opt for manual or semi-automated solutions.

- Niche Applications: Unique or low-volume production needs might not justify the investment in highly automated Bystronic systems, making manual methods more practical.

- Skill Availability: In regions where skilled labor for operating advanced machinery is scarce or expensive, manual processing might be the more accessible option.

Software-only or Service-only Solutions

Customers may opt for software-only or service-only solutions that enhance their current machinery or operational processes. These alternatives, offered by third-party providers, focus on efficiency improvements through consulting or smart factory services, potentially reducing the need for new physical equipment purchases from companies like Bystronic.

While Bystronic provides integrated software and services, the availability of competing standalone offerings presents a threat. These solutions aim to deliver efficiency gains without requiring substantial hardware investment, positioning them as potential substitutes for outright new machine acquisitions.

- Standalone Software: Companies might invest in advanced planning and scheduling (APS) software or simulation tools from independent vendors to optimize their existing production lines.

- Process Consulting: Specialized consulting firms can offer expertise to improve workflow and efficiency, reducing the perceived need for new, high-tech machinery.

- Smart Factory Services: Third-party providers specializing in IoT integration and data analytics can help manufacturers leverage their existing assets more effectively.

The threat of substitutes for Bystronic's sheet metal processing machinery is substantial, driven by advancements in additive manufacturing and alternative materials. For example, the global 3D printing market surpassed $20 billion in 2024, indicating a growing preference for complex part fabrication via this method. Similarly, the increasing use of lightweight composites, like those making up 50% of the Boeing 787's structure by weight in 2023, directly competes with traditional sheet metal applications.

Furthermore, the rise of outsourcing production to specialized service bureaus and contract manufacturers presents a significant substitute. The global contract manufacturing market, valued at approximately $540 billion in 2023, highlights a robust alternative to in-house capital investment in Bystronic's equipment. Even manual or less automated sheet metal processing methods offer a lower-cost substitute for niche applications or businesses with budget constraints.

| Substitute Type | Description | Impact on Bystronic | Example Data/Trend |

|---|---|---|---|

| Additive Manufacturing (3D Printing) | Fabrication of complex parts layer by layer. | Reduces demand for sheet metal fabrication equipment for certain applications. | Global 3D printing market exceeded $20 billion in 2024. |

| Advanced Materials | Composites, specialized plastics, and hybrid materials. | Displaces sheet metal in applications prioritizing weight reduction and corrosion resistance. | Composites comprised ~50% of Boeing 787 structure by weight (2023). |

| Outsourcing / Contract Manufacturing | Utilizing external service providers for production. | Decreases the need for in-house machinery investment. | Global contract manufacturing market valued at ~$540 billion (2023). |

| Manual/Semi-Automated Processing | Less sophisticated, lower-cost sheet metal fabrication methods. | Offers a viable alternative for low-volume or cost-sensitive production. | Remains a practical option for SMEs with specific budget or scale needs. |

Entrants Threaten

The advanced sheet metal processing equipment market, where Bystronic operates, is characterized by exceptionally high capital requirements. New entrants must be prepared to invest heavily in cutting-edge research and development to create competitive machinery. For instance, developing a new laser cutting system or a sophisticated bending machine can cost tens of millions of dollars.

Beyond R&D, establishing modern manufacturing facilities equipped with advanced automation and quality control systems represents another significant capital outlay. Companies entering this space often need to spend upwards of $100 million to build a competitive production infrastructure capable of meeting global demand and quality standards.

Furthermore, building a comprehensive global sales and service network is crucial for supporting complex machinery and ensuring customer satisfaction. This involves setting up regional offices, training technical staff, and stocking spare parts, which can easily add another $50 million to $100 million in initial investment, creating a formidable barrier for potential competitors.

Established players like Bystronic have a significant advantage due to their extensive proprietary technology and numerous patents in areas like laser cutting and automation. For instance, Bystronic's ongoing investment in R&D, which represented 6.6% of its revenue in 2023, fuels this technological moat.

Creating comparable advanced technology from the ground up is incredibly costly and time-consuming, often costing millions in research and development. Furthermore, navigating and circumventing existing intellectual property rights presents a substantial hurdle, effectively deterring many potential new entrants from entering the market.

Economies of scale present a significant barrier to new entrants in the laser cutting and automation industry. Established players like Bystronic leverage their substantial production volumes to achieve lower per-unit manufacturing costs. For instance, in 2024, Bystronic's global operations allow for optimized supply chain management and bulk purchasing of components, driving down input expenses.

These cost advantages are further amplified by significant investments in research and development, which are more feasible with larger revenue bases. New companies entering the market would find it exceedingly difficult to match these efficiencies without securing a considerable market share from the outset, making it challenging to compete on price against incumbents.

Access to Distribution Channels and Customer Relationships

Bystronic benefits from deeply entrenched global sales, service, and distribution networks. These aren't just physical locations; they represent years of investment in infrastructure and logistics, making it incredibly difficult for newcomers to replicate. For instance, in 2023, Bystronic reported a significant portion of its revenue derived from its established service and spare parts business, highlighting the ongoing value and reach of these channels.

Furthermore, Bystronic has cultivated long-standing customer relationships. This loyalty is built on a foundation of trust, a strong brand reputation, and a consistent track record of delivering high-performance machinery. New entrants struggle to break into this established trust, as customers often prioritize reliability and proven support over the unknown quantity of a new supplier. The cost and time required to build equivalent credibility are substantial deterrents.

- Global Reach: Bystronic operates in over 30 countries, a testament to its extensive distribution infrastructure.

- Customer Loyalty: Repeat purchase rates for Bystronic machinery are high, indicating strong customer retention.

- Service Network: The company's comprehensive service network ensures rapid response times, a critical factor for industrial clients.

- Brand Equity: Bystronic's brand is synonymous with quality and innovation in the sheet metal processing industry.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the industrial machinery sector, including for companies like Bystronic. The manufacturing and sale of such equipment are typically governed by a web of safety, environmental, and technical standards that vary considerably by region and country. For instance, in 2024, compliance with evolving emissions standards for manufacturing equipment, such as those being tightened in the European Union and North America, requires substantial investment in research and development and specialized engineering expertise.

New companies looking to enter this market must dedicate considerable resources to understanding and adhering to these diverse regulatory frameworks. This often involves lengthy and expensive certification processes, as well as ongoing monitoring and adaptation to new rules. For example, securing certifications for machinery sold into the United States under OSHA standards or into Europe under CE marking directives can take months and cost tens of thousands of dollars per product line, acting as a significant barrier.

- Navigating complex safety standards: New entrants must meet stringent safety regulations, such as those mandated by OSHA in the US, which can involve costly design modifications and testing.

- Adhering to environmental regulations: Compliance with global environmental standards, like emissions controls or material restrictions, adds significant R&D and manufacturing costs.

- Meeting technical and performance requirements: Industry-specific technical certifications and performance benchmarks, crucial for market acceptance, demand specialized engineering capabilities.

- Cost and time investment in compliance: The financial outlay and time required for regulatory approval across multiple jurisdictions deter many potential new entrants.

The threat of new entrants in Bystronic's market is significantly low due to immense capital requirements for R&D, manufacturing, and global service networks, often exceeding hundreds of millions of dollars. Proprietary technology and patents, coupled with economies of scale achieved by incumbents like Bystronic, further erect substantial barriers. For instance, Bystronic's 2023 R&D investment of 6.6% of revenue underscores its commitment to technological differentiation.

Established brand loyalty and extensive, deeply entrenched sales and service networks, built over years of investment, make it incredibly difficult for newcomers to gain traction. Bystronic's strong customer retention, evident in its 2023 service revenue, highlights this advantage. Navigating complex and varied global government policies, safety, environmental, and technical standards also demands significant resources and time, acting as a potent deterrent.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bystronic leverages data from company annual reports, industry-specific market research from firms like Statista and IBISWorld, and publicly available financial filings to provide a comprehensive view of the competitive landscape.