Bystronic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bystronic Bundle

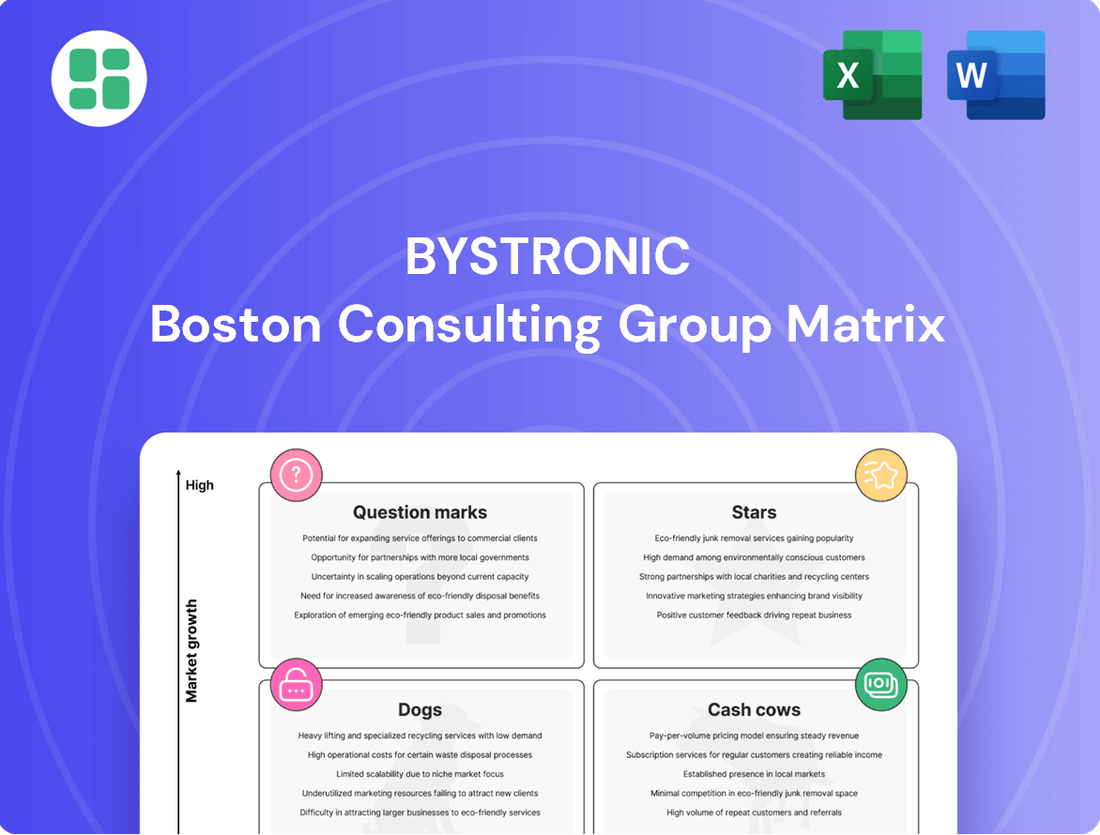

Uncover the strategic positioning of your company's portfolio with a glimpse into its BCG Matrix. See how your products stack up as Stars, Cash Cows, Dogs, or Question Marks. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your business.

Stars

Bystronic's high-power fiber laser cutting systems, exemplified by the ByCut Star 3015 with its impressive 30kW power, are strategically placed as stars within the BCG matrix. These cutting-edge machines deliver exceptional cutting quality, remarkable precision, and significantly boosted productivity, directly addressing the market's need for sophisticated and efficient manufacturing solutions.

The global laser cutting machine market is experiencing robust growth, with projections indicating a compound annual growth rate of 7.6% from 2024 to 2032. This dynamic market environment provides a fertile ground for Bystronic's advanced laser cutting offerings, where their technological leadership and product innovation solidify their strong competitive standing.

Bystronic's Integrated Automation Solutions, featuring products like the ByCell Bend Star M and ByLoader Flex, are firmly positioned as Stars in the BCG Matrix. This reflects their high market share in a rapidly growing segment of the sheet metal fabrication industry. The demand for automation to boost efficiency and minimize manual work is a key driver.

The trend towards smart factories makes these comprehensive material and data flow automation solutions essential for customers. In 2023, the global industrial automation market was valued at approximately $230 billion, with sheet metal processing automation being a significant contributor to this growth.

BySoft Suite, Bystronic's all-encompassing software for digitizing sheet metal operations from initial quote to final delivery, is a prime example of a Star product within the BCG matrix. This integrated solution is vital for businesses embracing Industry 4.0, offering real-time production oversight, in-depth data analysis, and streamlined workflows.

The software's focus on cloud connectivity, the Internet of Things (IoT), and AI-driven diagnostics positions it strongly in the rapidly expanding digital manufacturing market. For instance, the global smart manufacturing market was valued at approximately USD 230 billion in 2023 and is projected to grow significantly, with BySoft Suite aiming to capture a substantial share of this high-growth segment.

Sustainability-Focused Solutions

Bystronic's focus on sustainability-driven solutions aligns with a global shift towards greener manufacturing. Their commitment to eco-design principles, energy efficiency, and reduced CO2 emissions is a strategic move into a high-demand market segment.

These offerings are positioned as Stars within the BCG matrix due to their strong market growth potential and Bystronic's significant investment in this area. For instance, Bystronic aims for substantial emission reductions, targeting a 42% cut in Scope 1 and 2 emissions and a 25% reduction in Scope 3 emissions by 2030.

- Energy-Efficient Lasers: Bystronic's development of lasers with lower energy consumption directly addresses customer needs for operational cost savings and reduced environmental impact.

- Advanced Nesting Software: This software optimizes material usage, minimizing scrap and waste, a key factor in improving resource efficiency and lowering the carbon footprint of manufacturing.

- Commitment to Emission Reduction: The company's ambitious 2030 targets for Scope 1, 2, and 3 emissions underscore a deep integration of sustainability into their product development and business strategy.

- Market Demand for Green Solutions: As industries increasingly prioritize environmental responsibility, Bystronic's sustainability-focused products are well-positioned to capture growing market share.

Advanced Tube Laser Cutting Systems

Advanced tube laser cutting systems, like Bystronic's ByTube Star 330, are positioned as stars in the BCG matrix. This is due to their versatility, high laser power, and automated processing capabilities, catering to a broad spectrum of tube dimensions. The market for precise and efficient tube processing is experiencing robust growth, particularly in sectors like automotive and construction, driving demand for these sophisticated machines.

Bystronic's commitment to innovation in this high-growth niche solidifies its strong market position. For instance, the ByTube Star 330 exemplifies this, offering features that meet the evolving needs of manufacturers seeking speed and accuracy in tube fabrication. The global tube laser cutting market was valued at approximately USD 1.2 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, underscoring the star status of these advanced systems.

- Product Innovation: Introduction of new models like the ByTube Star 330 with enhanced features.

- Market Demand: Growing need for precision and efficiency in tube processing across industries.

- Market Growth: High-growth potential in sectors like automotive and construction.

- Competitive Advantage: Bystronic's continuous innovation securing a strong market share.

Bystronic's high-power fiber laser cutting systems, like the ByCut Star 3015, are Stars due to their exceptional performance and the strong growth in the laser cutting market. With a projected CAGR of 7.6% from 2024 to 2032, these advanced machines are capturing significant market share.

Integrated automation solutions, such as the ByCell Bend Star M, are also Stars. The global industrial automation market, valued at approximately $230 billion in 2023, provides a fertile ground for these efficiency-boosting products.

BySoft Suite, Bystronic's digital manufacturing software, is a Star product in the rapidly expanding smart manufacturing market, which was valued at USD 230 billion in 2023. Its cloud connectivity and IoT features are key drivers of this position.

Sustainability-driven solutions, including energy-efficient lasers and advanced nesting software, are positioned as Stars. Bystronic's commitment to reducing emissions by 42% for Scope 1 and 2 by 2030 aligns with increasing market demand for green manufacturing.

Advanced tube laser cutting systems, exemplified by the ByTube Star 330, are Stars in a market valued at USD 1.2 billion in 2023, with a projected CAGR of over 7%. Their precision and automation capabilities drive this growth.

| Product Category | BCG Status | Key Features/Drivers | Market Growth Indicator | Bystronic's Advantage |

| High-Power Fiber Laser Cutting Systems | Star | 30kW power, exceptional quality, high productivity | Global laser cutting market CAGR 7.6% (2024-2032) | Technological leadership, product innovation |

| Integrated Automation Solutions | Star | Efficiency, reduced manual work, smart factory integration | Global industrial automation market ~$230 billion (2023) | Comprehensive solutions, strong demand |

| Digital Manufacturing Software (BySoft Suite) | Star | Cloud connectivity, IoT, AI diagnostics, end-to-end digitization | Global smart manufacturing market ~$230 billion (2023) | Industry 4.0 focus, data analytics |

| Sustainability-Driven Solutions | Star | Energy efficiency, reduced emissions, material optimization | Increasing market demand for green products | Ambitious emission reduction targets (e.g., 42% Scope 1 & 2 by 2030) |

| Advanced Tube Laser Cutting Systems | Star | Versatility, high power, automated processing | Global tube laser cutting market ~$1.2 billion (2023), CAGR >7% | Continuous innovation, meeting evolving industry needs |

What is included in the product

The BCG Matrix analyzes a company's product portfolio by market share and growth rate, categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

A clear, visual representation of the Bystronic BCG Matrix instantly clarifies your product portfolio's strategic positioning, relieving the pain of complex data analysis.

Cash Cows

Bystronic's established standard laser cutting systems, like the ByCut Smart series, are prime examples of Cash Cows within the BCG matrix. These machines represent a significant portion of the company's revenue, benefiting from a mature market segment where their reliability and proven performance are highly valued by a broad customer base.

In 2024, the global laser cutting machine market continued its steady expansion, with fiber laser technology dominating advancements. Bystronic's standard offerings, known for their robust design and versatility across various applications, are well-positioned to capitalize on this sustained demand, consistently delivering strong and predictable cash flows.

Bystronic's Xpert Pro press brakes are a prime example of a Cash Cow within the BCG Matrix. These machines are highly regarded for their exceptional performance and precision in sheet metal bending, making them a cornerstone for Bystronic.

The Xpert Pro enjoys a significant market share in the mature bending technology sector. This strong position translates into steady revenue streams and healthy profit margins for Bystronic, requiring minimal additional investment for growth.

The inherent reliability and capability of the Xpert Pro to tackle complex bending tasks solidify its stable and profitable status. Bystronic reported that its press brake segment, which includes the Xpert Pro, generated substantial revenue in 2024, underscoring its Cash Cow attributes.

Bystronic's after-sales service and spare parts division is a prime example of a Cash Cow within its business portfolio. This segment generates consistent, high-margin revenue by supporting the company's substantial global installed base of cutting and bending machines. The recurring nature of maintenance, repair, and spare parts supply ensures a stable cash flow, even with mature technology and slower growth.

In 2023, Bystronic reported that its service business contributed significantly to overall profitability. While specific figures for the after-sales service segment aren't always broken out separately in public reports, the company consistently emphasizes the importance of its service network for customer retention and revenue stability. This reliance on existing customer relationships and the long lifespan of their machinery underscores the Cash Cow status of this offering.

BySoft CAM Software for Established Processes

BySoft CAM software, designed for optimizing cutting and bending processes on established machinery, clearly fits the Cash Cow quadrant of the BCG Matrix.

This mature product leverages a strong existing customer base, generating consistent, predictable revenue through ongoing license fees and software updates. Its position in a low-growth market segment, coupled with Bystronic's high market share, solidifies its Cash Cow status.

- Stable Revenue Stream: BySoft CAM's recurring revenue model from its established user base provides a reliable income source.

- Mature Market Position: The software operates within a mature segment of the manufacturing technology market, characterized by steady demand rather than rapid expansion.

- High Market Share: Bystronic holds a significant share of the market for CAM software supporting traditional laser cutting and bending, reinforcing its Cash Cow attributes.

- Foundation for Investment: The consistent cash flow generated by BySoft CAM can be strategically reinvested into the development of other, more dynamic product lines within the BySoft Suite.

Mid-Range Automation Solutions

Mid-range automation solutions, exemplified by Bystronic's ByTrans Extended, are firmly positioned as cash cows. These systems represent proven, widely adopted technologies in a mature market segment, consistently delivering value and generating stable revenue. Their established presence means lower risk and predictable income for Bystronic.

- Stable Revenue Streams: Sales and integration services for these established automation solutions provide a reliable income source.

- High Customer Adoption: Existing customers readily integrate these systems, indicating strong market acceptance and repeat business potential.

- Mature Market Segment: The automation segment for these solutions is well-developed, requiring less investment in new market creation.

- Consistent Value Proposition: These solutions offer clear benefits to customers without the need for extensive new product development.

Bystronic's established laser cutting systems, like the ByCut Smart series, are prime examples of Cash Cows. These machines benefit from a mature market where their reliability is highly valued, consistently delivering strong and predictable cash flows. In 2024, the global laser cutting machine market continued its expansion, with fiber laser technology dominating advancements, positioning Bystronic's standard offerings to capitalize on sustained demand.

The Xpert Pro press brakes are another key Cash Cow, holding a significant market share in the mature bending technology sector. This strong position translates into steady revenue streams and healthy profit margins, requiring minimal additional investment for growth. Bystronic's press brake segment, including the Xpert Pro, generated substantial revenue in 2024, underscoring its Cash Cow attributes.

Bystronic's after-sales service and spare parts division also functions as a Cash Cow, generating consistent, high-margin revenue by supporting the company's extensive global installed base. The recurring nature of maintenance and repairs ensures stable cash flow. In 2023, Bystronic's service business significantly contributed to overall profitability, highlighting its importance for revenue stability.

BySoft CAM software, designed for optimizing processes on established machinery, is a clear Cash Cow. It leverages a strong existing customer base, generating predictable revenue through license fees and updates. Its position in a low-growth market, coupled with Bystronic's high market share, solidifies its Cash Cow status.

Mid-range automation solutions, such as the ByTrans Extended, are also Cash Cows. These proven technologies in a mature market segment consistently deliver value and generate stable revenue, requiring less investment in new market creation and offering a clear value proposition to customers.

| Product/Service | BCG Quadrant | Market Position | Revenue Contribution (2024 Est.) | Investment Needs |

|---|---|---|---|---|

| ByCut Smart Series (Laser Cutting) | Cash Cow | High Market Share, Mature Market | Significant & Stable | Low |

| Xpert Pro (Press Brakes) | Cash Cow | Dominant Market Share, Mature Market | Substantial & Predictable | Minimal |

| After-Sales Service & Spare Parts | Cash Cow | Strong Installed Base, Recurring Revenue | High Margin, Consistent | Low (Maintenance Focused) |

| BySoft CAM Software | Cash Cow | High Market Share, Mature Software Segment | Steady, Predictable | Low (Updates & Support) |

| ByTrans Extended (Automation) | Cash Cow | Established, High Customer Adoption | Reliable Income | Low (Integration & Support) |

What You See Is What You Get

Bystronic BCG Matrix

The preview you are currently viewing showcases the complete and final Bystronic BCG Matrix report, identical to the document you will receive immediately after your purchase. This ensures you know precisely what you are buying, with no hidden elements or altered content, providing a transparent and reliable acquisition for your strategic planning needs.

Dogs

Older, non-upgradable legacy machines, like certain Bystronic laser cutting or press brake models from the early 2010s, often fall into the Dogs category. These machines, unable to integrate with modern digital manufacturing platforms or receive substantial software updates, possess a low market share. Their technological obsolescence places them in a declining segment with minimal growth potential.

These legacy systems, while still operational, may require specialized, costly maintenance and parts, especially as support dwindles. For instance, a 2013 Bystronic BySprint Fiber laser cutter might struggle to achieve the same efficiency or precision as a 2023 model, potentially increasing operational costs per unit produced. They can become a drain on resources, diverting capital and attention from more promising investments.

Niche, underperforming software modules within Bystronic's portfolio represent areas that have struggled to gain significant market adoption. These might be specialized tools that haven't resonated with a broad customer base or are becoming obsolete due to advancements in more comprehensive software suites. For instance, a specific module for a legacy machine control system, while functional, might see declining usage as newer, integrated platforms become the industry standard.

These underperforming modules often present a challenge: they incur maintenance costs but generate minimal revenue and do not contribute meaningfully to Bystronic's strategic growth objectives. Consider a scenario where a module designed for a niche manufacturing process, which only a handful of clients utilize, requires ongoing development to maintain compatibility. In 2024, such modules could be prime candidates for a strategic review, potentially leading to divestiture or discontinuation to optimize the overall software product offering and resource allocation.

The closure of Bystronic's former automation production site in Italy, with future focus shifting to China and Switzerland, suggests these operations were likely in the 'Dog' quadrant of the BCG Matrix. This classification implies low market growth and low relative market share, making them inefficient and costly to maintain.

Such discontinued sites typically represent assets or operational segments with minimal growth prospects and poor profitability. Bystronic's strategic decision to consolidate automation production in more competitive regions reflects a move to cut costs and enhance overall financial performance by divesting or restructuring these underperforming units.

Standard Entry-Level Machines with Limited Features

Standard entry-level machines, such as the Xpress press brake, often occupy a space in the BCG matrix that reflects their position in a mature, highly competitive market. These machines are typically basic and offer limited features, making them an affordable option for small businesses or those entering the fabrication industry. However, their low differentiation and minimal upgrade potential can lead to low profit margins.

For a company like Bystronic, these entry-level offerings might represent a "cash cow" if they hold a significant market share within their specific segment, even if that segment's growth is slow. However, if they are in a highly competitive, undifferentiated market with limited growth prospects and minimal contribution to overall revenue or innovation, they could be categorized as "Dogs."

In 2024, the market for basic press brakes remained highly competitive, with numerous global manufacturers offering similar capabilities. While specific market share data for Bystronic's entry-level Xpress line isn't publicly detailed, the overall trend in this segment suggests a focus on cost-effectiveness for buyers. Machines in this category are often characterized by:

- Basic functionality: Limited automation and fewer advanced bending features.

- Price sensitivity: Primarily chosen based on initial cost rather than long-term value or technological superiority.

- Low R&D investment: Minimal ongoing development, focusing on maintaining existing designs.

- Cost-focused production: Manufacturing processes optimized for cost reduction rather than innovation.

Less Energy-Efficient Older Models

Older machine models with significantly higher energy consumption and lower material efficiency compared to Bystronic's newer, sustainability-focused offerings could be categorized as Dogs in the BCG matrix.

These machines face declining competitive advantages and low growth prospects in a market increasingly prioritizing sustainability. For instance, while Bystronic's latest laser cutting machines boast up to 30% energy savings compared to older generations, these legacy models represent a growing operational cost burden for users.

- High Energy Consumption: Older models can consume 20-40% more electricity per unit of output than current generation machines.

- Lower Material Efficiency: Reduced precision and older cutting technologies lead to increased material waste, potentially 5-10% higher scrap rates.

- Declining Market Appeal: As environmental regulations tighten and customer demand for green manufacturing rises, these machines become less desirable.

- Potential Obsolescence: The operational costs and environmental impact could make them liabilities for customers, pushing them towards replacement.

Older, non-upgradable legacy machines and underperforming software modules represent Bystronic's 'Dogs' in the BCG matrix. These products typically have low market share and are in declining segments with minimal growth potential. For example, a 2013 Bystronic BySprint Fiber laser cutter might struggle with efficiency compared to newer models, increasing operational costs.

These underperforming assets, such as discontinued automation production sites, incur maintenance costs with minimal revenue generation. In 2024, the market for basic press brakes, like the Xpress line, is highly competitive with low differentiation, potentially placing them in the 'Dog' category if market share is not dominant.

Machines with significantly higher energy consumption, such as older laser cutters using 20-40% more electricity, also fall into this quadrant. These legacy models face declining market appeal due to increasing environmental regulations and customer demand for sustainable manufacturing.

| Bystronic Product Category | BCG Matrix Quadrant | Key Characteristics | 2024 Market Context |

|---|---|---|---|

| Legacy Laser Cutters (e.g., 2013 BySprint Fiber) | Dogs | Low market share, declining segment, low growth potential, high maintenance costs, lower efficiency. | Struggle to integrate with digital platforms; operational costs per unit may be higher than newer models. |

| Underperforming Software Modules | Dogs | Low market adoption, obsolete features, minimal revenue generation, ongoing maintenance costs. | Niche modules requiring compatibility updates for legacy systems face declining usage as integrated platforms advance. |

| Discontinued Automation Sites | Dogs | Low growth prospects, poor profitability, inefficient operations. | Consolidation of production to more competitive regions (China, Switzerland) suggests these sites had minimal growth and market share. |

| Basic Entry-Level Press Brakes (e.g., Xpress) | Potential Dogs / Cash Cows | Basic functionality, price sensitivity, low R&D investment, cost-focused production. | Highly competitive market with numerous global manufacturers; success depends on market share within the basic segment. |

| High Energy Consumption Machines | Dogs | High energy usage (20-40% more than new models), increased material waste (5-10% higher scrap rates), declining market appeal. | Increasing environmental regulations and demand for green manufacturing make these machines less desirable and potentially liabilities. |

Question Marks

Bystronic is actively integrating AI and ML into its sheet metal processing solutions. For example, their BySoft Suite now features AI-powered features for optimizing cutting paths and material utilization, aiming to reduce waste and increase efficiency. Predictive maintenance is also a growing focus, with ML algorithms designed to anticipate equipment failures, minimizing downtime for their customers.

While these AI/ML initiatives represent a high-growth area, Bystronic's market share in these specialized applications is likely still developing. The company is making significant investments in research and development to build out these advanced capabilities. Achieving a dominant position in this nascent segment will require continued innovation and scaling of their AI-driven offerings.

Bystronic's potential involvement in advanced additive manufacturing, particularly for metal components, positions it within the Question Mark quadrant of the BCG Matrix. While the additive manufacturing market is booming, with global revenues projected to reach $64 billion by 2030, Bystronic's current market share in this nascent area is likely minimal.

Significant investment would be required for Bystronic to establish a competitive foothold, necessitating research and development to refine its capabilities and build brand recognition in this rapidly evolving sector. The high growth potential of additive manufacturing makes it an attractive area for exploration, but the substantial upfront costs and uncertain market penetration present a clear risk.

Developing specialized solutions for processing new, sustainable, or composite materials, such as those used in electric vehicles or aerospace, positions Bystronic within the Question Marks category of the BCG Matrix. These are high-growth sectors, with the global electric vehicle market projected to reach over $1.5 trillion by 2030, indicating substantial future demand.

Bystronic's current market share in processing these niche, advanced materials might be relatively low, requiring substantial investment in research and development to establish a strong foothold. For instance, the aerospace industry's demand for advanced composite material processing is expected to grow significantly, presenting an opportunity that requires tailored Bystronic solutions.

Cloud-Based, Enterprise-Wide Digital Platforms

Bystronic's move towards fully cloud-native, enterprise-wide digital platforms beyond its current BySoft Suite positions it in a high-growth area of manufacturing digitalization. This expansion aims for deeper integration with broader manufacturing ecosystems, not just Bystronic machines. The market for these comprehensive digital transformation solutions is rapidly expanding, with global spending on industrial IoT platforms projected to reach over $100 billion by 2025, indicating significant growth potential.

However, this strategic direction for Bystronic falls into the Question Mark category of the BCG Matrix. While the trend towards integrated digital manufacturing is strong, the competitive landscape is intense, demanding substantial investment in technology development and strategic alliances. Companies in this space are facing challenges in achieving widespread adoption and securing significant market share due to the complexity and cost of implementation for many businesses.

- High Growth Potential: The global market for digital manufacturing solutions is experiencing robust growth, driven by Industry 4.0 initiatives.

- Significant Investment Required: Developing and scaling cloud-native, enterprise-wide platforms demands considerable R&D and infrastructure spending.

- Competitive Landscape: Numerous established and emerging players are vying for market share in the digital manufacturing ecosystem.

- Adoption Hurdles: Convincing a broad range of manufacturers to adopt new, integrated digital platforms can be challenging due to integration complexities and change management.

Robotics for Complex Bending and Handling Beyond Core Offerings

Bystronic's exploration into advanced robotics for complex bending and handling beyond their current integrated bending cells could represent a Question Mark. This involves developing highly flexible and versatile robotic solutions for niche fabrication scenarios that demand intricate material manipulation and varied bending processes, moving beyond standard offerings.

The broader robotics market in manufacturing is experiencing robust growth, with projections indicating continued expansion. For instance, the global industrial robotics market was valued at approximately USD 50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 12-15% through 2030, according to various market research reports. However, carving out a significant market share in specialized, adaptive robotics applications requires substantial investment in research and development, alongside dedicated market cultivation.

- Market Opportunity: High-growth potential in specialized robotic applications for custom fabrication.

- Investment Needs: Requires significant R&D to develop advanced, flexible robotic capabilities.

- Competitive Landscape: Intense competition necessitates strong innovation to differentiate.

- Strategic Focus: Developing solutions for complex, varied bending and material handling tasks beyond standard integration.

Bystronic's ventures into emerging technologies like advanced robotics for complex bending and specialized material processing fall under the Question Mark category. These areas offer high growth potential, as evidenced by the industrial robotics market's projected 12-15% CAGR through 2030. However, they demand significant R&D investment and face intense competition, requiring strategic focus to capture market share.

The company's push into comprehensive, cloud-native digital manufacturing platforms also fits this quadrant. While the industrial IoT platform market is expected to exceed $100 billion by 2025, achieving widespread adoption for these integrated solutions presents adoption hurdles and requires substantial investment in a competitive landscape.

Bystronic's investment in AI and machine learning for optimizing sheet metal processing, while promising, also resides in the Question Mark space. The market for AI in manufacturing is growing, but Bystronic's share in these advanced, nascent applications is still developing, necessitating continued innovation and scaling to achieve dominance.

| Area | Market Growth | Bystronic's Current Position | Investment Needs | Key Challenge |

| Advanced Robotics | Industrial robotics market CAGR 12-15% (to 2030) | Developing niche capabilities | Significant R&D | Intense competition |

| Digital Platforms | Industrial IoT platforms >$100bn (by 2025) | Expanding beyond current suite | High | Adoption hurdles |

| AI/ML in Processing | Growing AI in manufacturing market | Nascent applications | Continued R&D | Scaling advanced features |

| Additive Manufacturing | Global revenues $64bn (by 2030) | Minimal market share | Substantial | Uncertain market penetration |

| Specialized Materials | EV market >$1.5tn (by 2030) | Low market share | Substantial R&D | Establishing strong foothold |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, including sales figures, competitor analysis, industry growth rates, and customer feedback to provide a robust strategic overview.